Bybit has established itself as a notable name in the cryptocurrency space.

Founded in 2018 in Singapore and now headquartered in Dubai, Bybit caters to a global market with a comprehensive array of crypto-centric financial services.

Whether you’re looking to engage in spot trading, explore the derivatives market, participate in copy trading, make instant purchases, delve into the NFT marketplace, or use Web3 products, Bybit is a robust platform that aims to meet various trading needs.

As a derivatives-focused exchange, Bybit provides tools that could potentially enhance profits and risks through leveraged trading.

Bybit promotes a high-security standard and claims a reported uptime of 99.99% and a no-downtime commitment.

Bybit Product Offerings

Bybit is a cryptocurrency trading platform offering services tailored to your trading needs. The platform provides these essential products:

- Spot Trading: Engage directly with the market by buying and selling cryptocurrencies at real-time prices.

- Derivatives Trading: Tap into more complex financial instruments:

- Perpetual Contracts: Speculate on the price movement of cryptocurrencies without an expiration date.

- Inverse Perpetual Contracts: A perpetual contract settled in the underlying cryptocurrency.

- USDT Perpetual Contracts: Trade contracts quoted and settled in USDT.

- Quarterly Futures Contracts: Settle on a specific future date, providing a way to hedge against market volatility.

- Copy Trading: Identify and mirror the strategies of experienced traders on the platform to enhance your trading decision-making.

- Instant Purchases: Acquire cryptocurrencies using fiat or other cryptos with the convenience of third-party payment solutions.

- Staking: Securely lock your assets to accrue rewards and influence decision-making within the platform’s governance structure.

- NFT Marketplace: Discover a space for unique digital collectibles, enabling you to buy, sell, or mint NFTs.

- Web3 Products: Explore decentralized applications and engage with the burgeoning blockchain ecosystem through Bybit’s interface.

These offerings are designed with versatility, allowing you to access a wide array of crypto-related activities from a single platform.

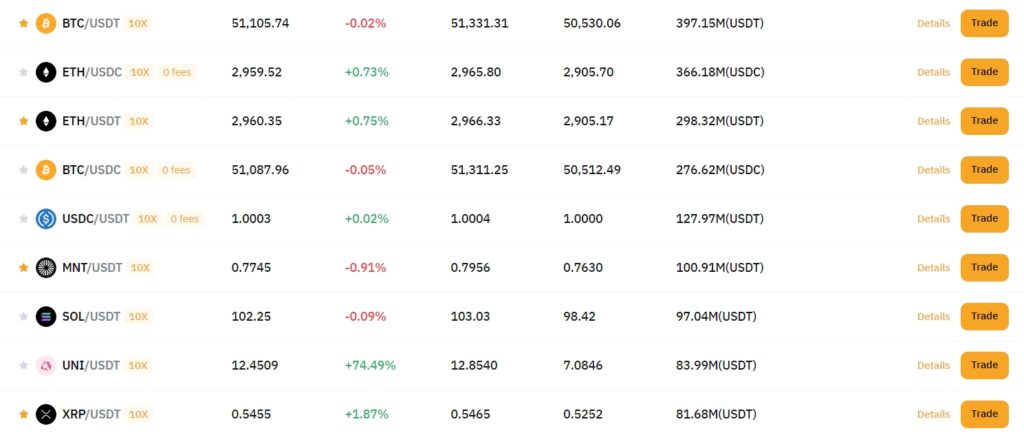

Bybit Supported Coin List

Bybit, as a cryptocurrency futures exchange, provides a wide variety of digital assets for your trading and investing needs.

Your options include a comprehensive selection of over 300 cryptocurrencies you’re likely familiar with. For a robust trading experience, Bybit ensures you have access to significant coins such as:

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether (USDT)

- Binance Coin (BNB)

- Cardano (ADA)

- Solana (SOL)

In addition to these cryptocurrencies, you can deposit and trade some of the prominent fiat currencies, which helps to facilitate seamless transactions. Here are a few fiat options made available to you:

- U.S. dollar (USD)

- Euro (EUR)

- British pound (GBP)

It’s worth mentioning that Bybit is attuned to the cryptocurrency market dynamics and your feedback. Consequently, it’s not uncommon to see the addition of new coins and trading pairs to meet market trends and user demand.

Keep an eye on their platform for the latest updates and offerings to ensure you don’t miss out on new opportunities.

Bybit Order Types

When trading on Bybit, you have access to various order types that cater to different trading strategies, ensuring you can take action on the market as efficiently as possible. Below is a brief overview of the other order types available on Bybit.

- Market Order: Executes your trade instantly at the current market price, offering the fastest entry or exit from the market.

- Limit Order: This lets you specify the price you’re willing to buy or sell at, giving you control over the execution price.

- Conditional Order: Activates only when conditions like a specified price or time have been met, adding precision to your trade entries or exits.

For more strategic actions, Bybit provides several specialized order types:

- Stop Order: Protects your trades by closing positions at a predefined price, helping you manage risk if the market moves against your position.

- Take Profit Order: Aims to secure profits by executing a sale when the asset reaches a target price.

- Trailing Stop Order: Adjusts the stop price at a fixed distance away from the market price as it moves so you can secure profits while cushioning against loss.

- Post-Only Order: Ensures your limit order adds liquidity to the book, helping avoid paying the taker fee.

- Reduce-Only Order: Useful for decreasing an existing position without increasing it, focusing solely on position reduction.

Bybit’s combination of market, limit, and conditional orders and these specialized types provides a comprehensive toolkit for enhancing your trading effectiveness.

Each order type has its application and can be used to fine-tune your trading strategy according to market conditions and your individual risk management preferences.

Bybit’s Liquidation Mechanism

When you engage in leveraged trading on Bybit, you must know the fundamental concept of liquidation.

This occurs forcefully when a position is closed because the margin level drops below a specific threshold. If this happens, you forfeit your initial margin plus any applicable liquidation fees.

Bybit employs a dual-price mechanism to set the liquidation price. This is used to protect traders from market manipulation and unintended liquidations.

Your liquidation price is pegged to the mark price, essentially the global spot price index, ensuring it’s a fair reflection of the market value.

Meanwhile, the execution price is based on the last traded price, the prevailing rate in Bybit’s marketplace.

In exceptional scenarios where the liquidation fund lacks sufficient capital to absorb the losses from liquidated positions, Bybit’s auto-deleveraging (ADL) system comes into effect. Here’s how it works:

- Analyzing Position and Leverage: The system reviews the profitable positions that utilize high leverage.

- Ranking Priority: It then ranks these positions based on profitability and leverage.

- Auto-Deleveraging: If necessary, the ADL system will reduce or close out positions, starting with those with high leverage and low priority.

Auto-deleveraging helps maintain the exchange’s integrity and protects the broader trading ecosystem. With this system, Bybit ensures that the liquidation process is handled relatively under extreme market conditions.

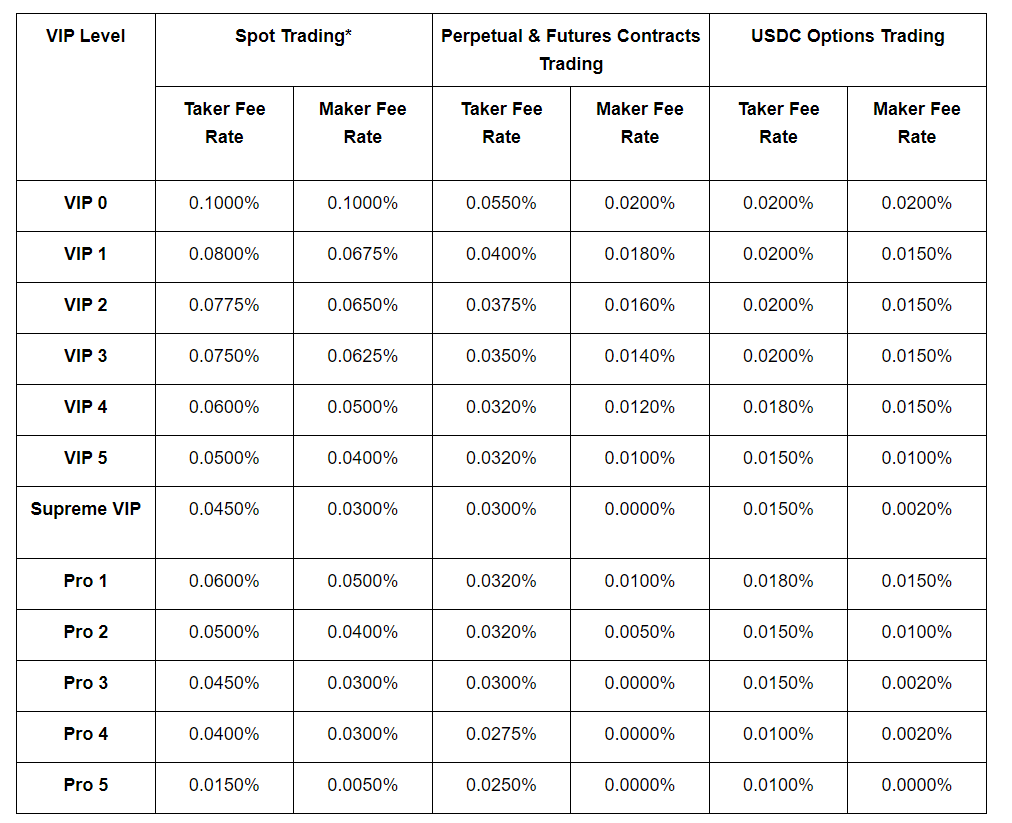

Bybit Trading Fees

When you trade on Bybit, understanding the fee structure is crucial. Your transactions will incur different fees, whether spot trading or derivatives.

Spot Trading Fees

Bybit simplifies spot trading costs, charging a fee of 0.1% for both maker and taker orders. This flat rate applies regardless of the trading pair.

Derivatives Trading Fees

Below is an easy-to-read table portraying the derivatives trading fees on Bybit:

| Trading Pair | Maker Fee | Taker Fee |

|---|---|---|

| BTC/USD | 0.01% | 0.06% |

| ETH/USD | 0.01% | 0.06% |

| XRP/USD | 0.01% | 0.06% |

| Other Pairs | Varies | Varies |

Taker fees are generally higher as they remove liquidity from the order book.

Bybit has a tiered fee structure for high-volume traders, offering rebates and lower fees. If you trade over $250,000 per month or hold a sufficient amount of Bybit’s native token, BYT, you may be eligible for these discounts.

Remember that fees are subject to change, so staying updated with the latest fee structure directly on Bybit’s platforms will ensure you have the most accurate information for your trading strategies.

Want to try your hands on Futures Trading? Lear How to Futures Trade Crypto with Bybit

Bybit Funding Rates/Fees

Bybit’s funding mechanism ensures that the trading price of perpetual contracts remains close to the underlying spot price.

This means that you will either pay or receive funding fees periodically. These fees are based on the divergence between the contract and mark prices.

Funding rates are calculated by Bybit every eight hours at 00:00 UTC, 08:00 UTC, and 16:00 UTC. The relevant funding rate will be applied to your account if you have a position open at these specific times. Here’s how it works:

- If the rate is positive, long position holders will pay the rate to those holding short positions.

- If the rate is negative, it’s the opposite; short position holders pay long position holders.

The Funding Rates/Accrual Times:

| Time (UTC) | Calculation |

|---|---|

| 00:00 | Applied to positions |

| 08:00 | Applied to positions |

| 16:00 | Applied to positions |

Remember, these fees do not go to Bybit but are exchanged between traders. It’s a pivotal component to consider when holding positions over the funding times, as it can affect your return on investment.

Additionally, Bybit’s fee structure includes different tiers for spot and derivatives trading.

For spot trades, a standard fee starts at 0.1% for both makers and takers, with potential rebates available for higher-volume trades. With derivatives, you can expect fees starting at 0.06% for takers and 0.01% for makers.

A Bybit VIP program also offers rewards for trading volumes exceeding $250,000 monthly. Remember that the exact fees may vary, so it’s advisable always to check the latest fee structure before trading.

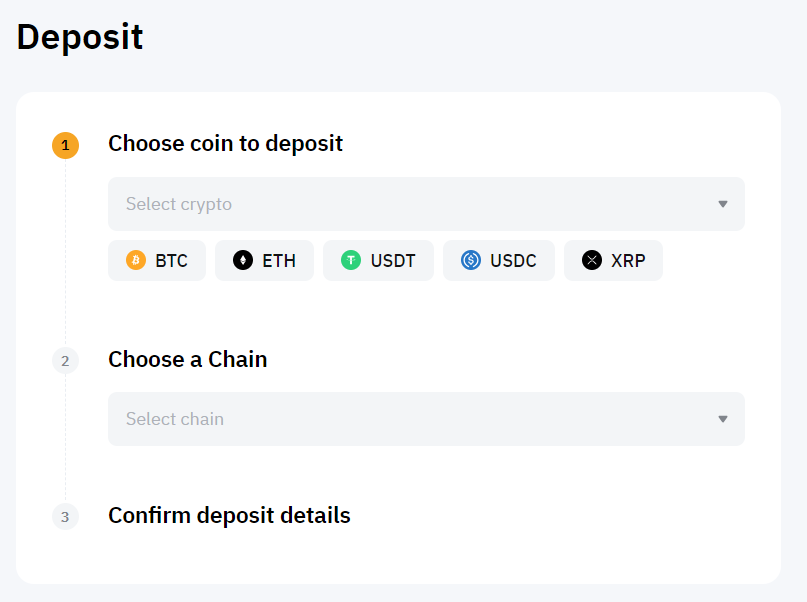

Bybit Deposit & Withdrawal Fees

When funding your Bybit account, you will not incur any deposit fees directly from Bybit. However, network fees apply, which are standard across blockchain transactions and vary depending on network congestion and the cryptocurrency chosen.

Cryptocurrency Transactions

Bybit supports a range of cryptocurrencies for both deposits and withdrawals, including but not limited to:

- BTC

- ETH

- USDT

- BNB

- ADA

- SOL

Each cryptocurrency has its minimum and maximum transaction limits, adjusted in response to the market’s current state. To find the exact limits, you should check directly on the Bybit platform, as they fluctuate with market conditions.

Fiat Currency Options

If dealing with fiat currencies, such as USD, EUR, or GBP, Bybit provides mechanisms for both depositing and withdrawing. For these transactions, the limits are set depending on:

- The currency in question

- The payment provider used

- Your verification level

- Your location

Review the specific requirements for the currency you intend to use, as the platform might have different partnerships and limits based on your jurisdiction.

Withdrawal Timings

Withdrawals are batch-processed by Bybit at specific daily intervals: 08:00 UTC, 16:00 UTC, and 00:00 UTC. To ensure your withdrawal is processed swiftly, submit your request before the cut-off time for the respective processing slot.

Remember that while Bybit strives to process your transactions efficiently, the speed depends on the blockchain network and the current load it is experiencing.

Bybit Account Types

Bybit provides differentiated account options tailored to meet various trading needs and comply with regulatory standards. Whether you are starting or seeking more advanced trading features, understanding the account types and associated KYC tiers is essential for maximizing your experience on the platform.

Bybit KYC Tiers

KYC 0

At this tier, only your email address and phone number are required.

- Daily Withdrawal Limit: Up to 2 BTC

- Trading Access: Available

- Fiat Services: Limited

KYC 1

This tier requires additional personal information.

- Daily Withdrawal Limit: Up to 100 BTC

- Trading Access: Available

- Fiat Services: Some services accessible

KYC 2

For full platform access, this tier necessitates official identity documents.

- Daily Withdrawal Limit: Unlimited

- Trading Access: Available

- Fiat Services: All services accessible

Limits

Depending on your account verification level and geographic location, Bybit enforces certain limits to align with regulatory requirements and enhance security.

- Standard Account: The default account with product access but restricted leverage levels and some fiat services.

- Professional Account: Designed for experienced users who qualify through criteria like trading activity and financial background, and provides additional perks like reduced fees and increased leverage options.

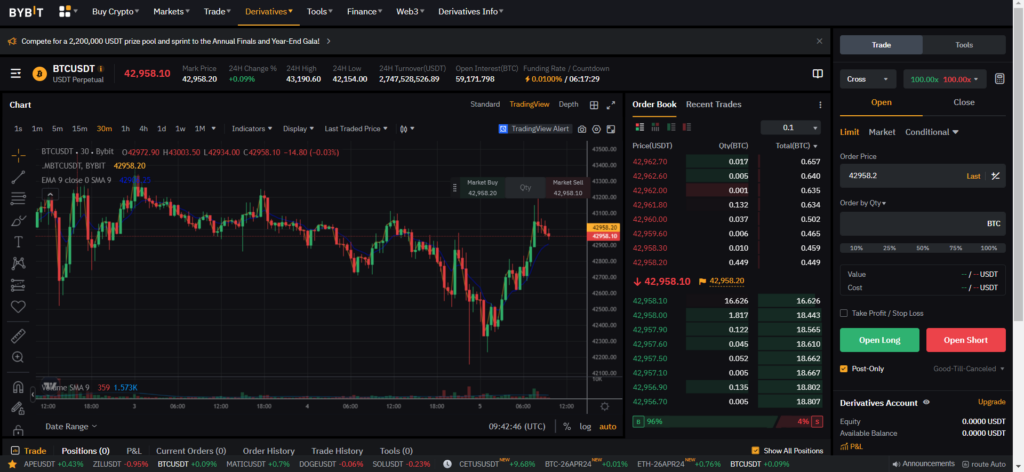

Bybit Trading Platform & Tools

Trading Interface

Bybit’s platform is designed to be accessible and efficient, allowing you to trade on web and mobile devices. The interface is clean, user-friendly, and meticulously designed to cater to novice and advanced traders.

Charting Tools

The Trading View tool is a standout feature, providing a highly customizable and interactive charting tool.

This enables you to closely monitor market trends and analyze various technical indicators to inform your trading decisions.

Market Depth and Transactions

The Order book displays a real-time stream of buy and sell orders, showing the market’s depth and liquidity.

Below the order book, you can observe the Recent trades section, giving you live updates on trades, including price, quantity, and whether they were buy or sell orders.

Portfolio Management

You can keep track of your trading positions through the Position panel, which includes crucial details like entry price, margin, unrealized P&L, liquidation price, and your chosen leverage.

Manage your trades with the Order panel, summarizing active, conditional, and filled orders, complete with details such as type, price, quantity, and fees.

The Asset panel provides a snapshot of your account’s financial status, including balance, equity, margin availability, and wallet.

Trading Calculations and Alerts

The Calculator is a practical tool that helps you estimate the profit/loss, margin requirements, and liquidation price for your trades, ensuring you are well-informed before you commit.

Stay up-to-date with market movements by using Alerts to receive notifications for significant events, like price changes and order executions.

Advanced Connectivity

For tech-savvy traders or those using automated strategies, Bybit offers an API for seamless integration with third-party services, including trading bots, portfolio management tools, or advanced analytical platforms, allowing for a more customized trading experience.

These tools collectively offer a comprehensive and dynamic trading environment, ensuring that you have the resources to refine and execute your trading strategies effectively.

ByBit Insurance Fund

Bybit’s Insurance Fund is crucial in protecting your interests as a trader. This fund is specifically designed to cover losses that might occur when a liquidated position exceeds its margin. Here’s how it operates and benefits you:

- Funding: The Insurance Fund obtains its resources mainly from liquidation fees and Auto-Deleveraging (ADL) fees collected from traders. This ensures the fund’s growth and sustainability without imposing additional costs on you.

- Impact on Auto-Deleveraging (ADL):

- The presence of the Insurance Fund reduces the necessity of ADL, limiting unexpected impacts on your profitable trades.

- By supporting cases where losses surpass the collateral, the Insurance Fund acts as a buffer, promoting a stable trading environment.

- Transparency and Auditability:

- Bybit values openness regarding the Insurance Fund’s status. The balance and transactions are regularly published on their website for you to audit and review.

- Segregation and Purpose:

- The assets in the Insurance Fund are segregated according to trading pairs and contract types.

- Bybit commits to not using the fund for purposes other than its intended role in loss coverage.

By using the Insurance Fund, Bybit underscores its commitment to securing a trustworthy trading experience for you. These elements can offer you peace of mind while trading on the platform.

Bybit Deposit Methods

Bybit offers multiple deposit options to cater to the diverse needs of its users. Understanding the deposit methods will enhance your experience as you fund your Bybit account.

- Crypto Deposits:

You can add funds to your account using cryptocurrencies. For a seamless deposit, Bybit provides a QR code and a wallet address specific to your account that you can use to transfer funds from an external wallet.

- Fiat Deposits:

If you prefer fiat currency, Bybit has partnered with third-party payment providers. These entities, including MoonPay, Banxa, and Simplex, facilitate deposits via credit cards, debit cards, and bank transfers, among other payment options.

- P2P Deposits:

Peer-to-peer (P2P) platforms offer another avenue for fiat deposits. Using services like LocalBitcoins and Paxful, you can directly engage with other buyers or sellers to deposit funds into your Bybit account.

- Exchange Deposits:

Transferring funds from other exchanges is also a convenient method. Platforms such as Binance, Coinbase, and Kraken enable you to deposit cryptocurrencies and fiat currencies into your Bybit account.

When choosing a deposit method, consider factors such as transaction speed, fees, and the convenience of the deposit mechanism to ensure a smooth and efficient funding process.

Bybit Security Features

Bybit is known for its robust security measures to safeguard your assets and personal information. Understanding these security features can give you confidence in the platform’s ability to protect against threats.

Cold Storage: A significant portion of your digital assets are securely stored in cold wallets. This offline storage strategy is enhanced by:

- Multi-signature technology: Requires multiple keys to authorize a transaction, increasing security.

- Geographic distribution: Wallets are spread across various locations to mitigate risks.

Hot Wallet: Bybit operates a minimal hot wallet system for operational efficiency:

- Limited assets online: Only a tiny percentage is held online to fulfill daily withdrawal requests.

- Continuous monitoring: These wallets are under 24/7 scrutiny for irregular activities.

SSL Encryption: To secure data exchange between you and the platform, Bybit enforces the following:

- Secure socket layer (SSL) encryption, ensuring your communication remains private and intact.

Two-factor Authentication (2FA): This crucial layer of security requires:

- A one-time password (OTP) or biometric verification is used to log in and execute sensitive account operations.

Email Verification: Your account’s protection is further strengthened through mandatory email validation, which assists in thwarting unauthorized access and phishing schemes.

Withdrawal Address Allowlist: You have the option to:

- Restrict where your funds can be sent by pre-approving withdrawal addresses, a practice that can prevent unintended transactions.

Anti-DDoS Protection: Bybit combats distributed denial-of-service attacks using:

- Advanced anti-DDoS measures to maintain platform stability and continuous operation.

These security protocols reflect Bybit’s commitment to maintaining a secure user trading environment.

Bybit Customer Support

Bybit ensures you receive assistance whenever you need it through its robust customer support system. Here’s what you should expect:

Live Chat: Access 24/7 live chat support through Bybit’s website or mobile app. The live chat provides real-time help from customer service representatives or automated responses from a chatbot.

Email Support: You can email Bybit at [email protected] for less urgent requests. Responses are typically provided within a day, catering to feedback or issue resolution.

Phone Support: Bybit has a dedicated line at +65 3158 8389 for immediate concerns or intricate matters. Reach out to speak directly with knowledgeable customer service agents.

Social Media Engagement: Keep up-to-date and find support on popular social media platforms, including Twitter, Facebook, Telegram, and Reddit. These channels offer the latest Bybit news, user interactions, and staff engagement.

Help Center: Bybit’s online help center encompasses a repository of FAQs, informative guides, detailed tutorials, and articles. This self-service hub addresses many topics pertinent to Bybit’s services and features.

Bybit’s various support options aims to ensure that your trading experience is seamless and supported at every step.

Is Bybit a Legal & Safe Platform?

Bybit has established itself within legal frameworks, and your safety on the platform is a priority reflected in its operational compliance. In regions such as Dubai, Singapore, Japan, and Canada, Bybit is registered and adheres strictly to these jurisdictions’ licensing requirements.

Licenses and Registrations:

- Dubai: Operates as Bybit Fintech FZE

- Singapore: Compliance with local regulations

- Japan & Canada: Registered with respective authorities

Participating in various global organizations guarantees that Bybit aligns with industry standards. Membership in entities like the Blockchain Association and CryptoUK indicates a commitment to industry best practices and ethical conduct.

Industry Associations:

- Blockchain Association

- CryptoUK

- Japan Cryptocurrency Business Association

Transparency is a core aspect, and Bybit fulfills this by publishing operational reports and security audits, ensuring accountability and providing you with peace of mind regarding the platform’s integrity.

Transparency Measures:

- Regular performance reports

- Security audits

Finally, Bybit is dedicated to maintaining a secure trading environment. Your experience on the platform is safeguarded by rigorous policies that prevent fraudulent activities and provide a fair trading experience.

Security Measures:

- Anti-fraud policies

- Trading manipulation prevention

- Abuse safeguards

Bybit’s legal compliance and dedicated safety measures establish it as a legitimate and secure choice for your crypto trading activities.

Conclusion

Bybit distinguishes itself as a comprehensive cryptocurrency exchange.

It caters to various levels of traders and investors, providing a robust and adaptable platform to multiple trading strategies. Notably, Bybit offers a seamless trading experience with a platform characterized by speed and stability.

- User-Friendly Interface: You benefit from an intuitive trading environment that simplifies complex financial transactions.

- Fee Structure: You will find the fees competitive, with a flexible structure, enabling cost-effective trading.

The platform prioritizes security and user satisfaction:

- Security Protocols: With top-notch security measures, your assets are safeguarded.

- Customer Support: Expect responsive support. We are ready to address your concerns.

Bybit rewards its users for engaging with the platform:

- Innovative Rewards: Enjoy various incentive programs that are both innovative and generous.

The platform is compliant and values market integrity:

- Trust and Compliance: Bybit operates within the legal framework, assuring you of its legitimacy and trustworthiness.

Bybit continues to innovate and expand its services to cater to your evolving crypto needs:

- Continuous Improvement: Benefit from a platform that adapts and grows, aiming to be your all-in-one crypto solution.

For those keen on derivatives and leverage trading, Bybit emerges as a viable and potentially rewarding option. Its commitment to providing a comprehensive trading experience makes it worth exploring as part of your cryptocurrency trading journey.

Explore how Bybit compares to its competitors:

- Bybit vs. BingX: Side-by-Side Comparison

- Bybit vs. MEXC: Side-by-Side Comparison

- Bybit vs Phemex: Side-by-Side Comparison

- Bybit vs Binance: Side-by-Side Comparison