Bybit and BingX have emerged as significant players: both platforms are known for their robust trading systems and have attracted a considerable user base with their competitive offerings.

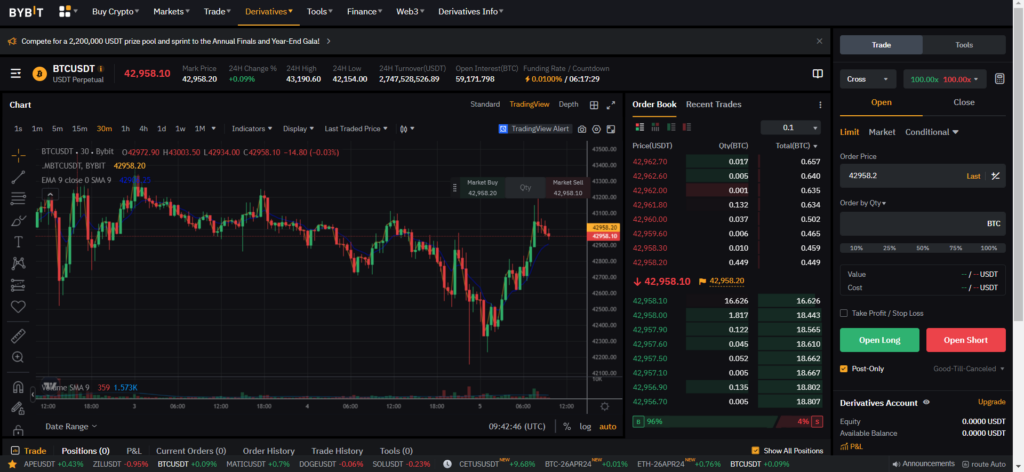

Bybit, established in 2018, has rapidly evolved into one of the leading exchanges, renowned for its advanced trading interface and diverse market offerings, including spot and derivatives trading.

Its commitment to providing a fair, transparent, and efficient trading environment has garnered attention from traders globally.

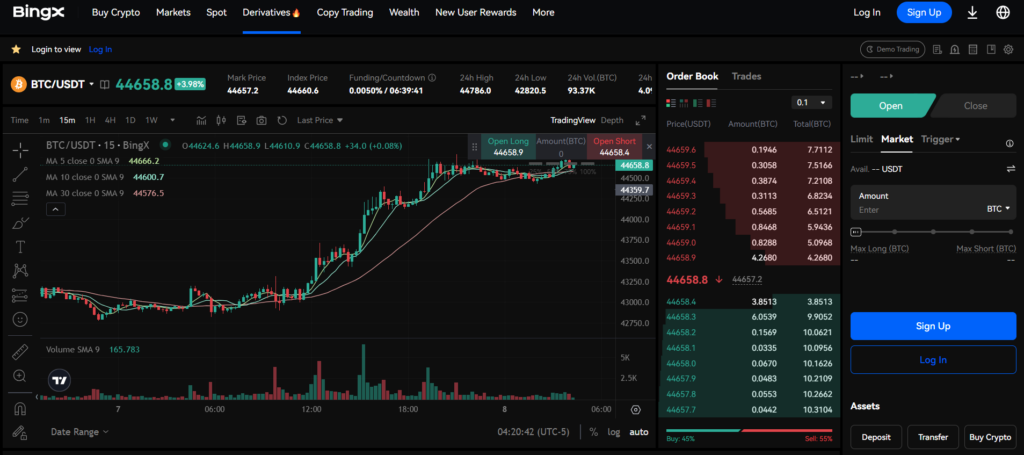

BingX, on the other hand, offers a unique social trading platform that allows users to follow and replicate the trades of experienced investors.

Starting in 2018, BingX has differentiated itself with this social feature and standard exchange functionalities.

Bybit vs BingX: Products and Services

Your usage of these platforms will likely hinge on comparing their features, such as trading fees, withdrawal processes, deposit methods, supported cryptocurrencies, and overall user experience.

Here’s a table summarizing their offerings:

| Feature | Bybit | BingX |

|---|---|---|

| Spot Trading | Available | Available |

| Futures Trading | High liquidity | Competitive options |

| Derivatives | Extensive range | Available |

| Leverage | Up to 100x | Lower compared to Bybit |

| Margin Trading | Yes | Yes |

| Copy Trading | Not primary focus | Offered |

| Trading Bots | Supported | Supported |

| Supported Cryptos | Wide range | Diverse but fewer than Bybit |

Bybit and BingX are prominent platforms in the crypto trading space, each offering products and services catered to their user base.

Bybit is known for its extensive range of trading products, including:

- Spot Trading: Purchase and sell cryptocurrencies at current market prices.

- Derivatives Trading: Engage in futures and options trading.

- Leverage: Offers high-leverage options for various trading pairs.

- Margin Trading: Trade cryptos by borrowing funds to increase buying power.

- Trading Bots: Automate trading strategies.

BingX, on the other hand, provides:

- Spot Trading: Access to trading multiple cryptocurrencies.

- Copy Trading: Follow and copy the strategies of experienced traders.

- Features & Services: BingX focuses on user experience with various tools for new and seasoned traders.

Both exchanges support an array of supported cryptos, with Bybit typically offering a more comprehensive range. Additionally, both platforms allow for automated trading, making them suitable for users interested in setting up trading bots.

Bybit and BingX have strengths and areas suited for different trader preferences.

The aim is to equip you with a comprehensive understanding of both exchanges, enabling you to make an informed decision that best serves your trading requirements.

Bybit vs. BingX: Contract Types

In cryptocurrency exchanges, contract types are crucial for traders looking to leverage different trading instruments. Bybit is recognized for providing an extensive array of contract types.

Bybit offers inverse perpetual contracts, which are favored for hedging existing positions or speculating on price movements using cryptocurrency as collateral. Additionally, you can access linear perpetual agreements, allowing you to trade with contracts quoted in USD while using crypto for margin.

On Bybit, you can also engage in inverse futures contracts, providing an alternative with fixed expiry dates for your trading strategies.

Leverage plays a key role here; Bybit enables high leverage with isolated and cross-margin options, leading to versatile money management during trading.

Alternatively, BingX focuses more on spot trading and supports derivatives trading, including futures contracts, though the variety may not match Bybit’s broad offerings.

However, BingX is known for its user-friendly platform, making navigating and trading various derivatives easier.

They offer USD-M futures, denominated and settled in USD, simplifying the process if you prefer to avoid direct cryptocurrency exposure for margin.

Regarding options trading, Bybit has the edge in selecting options for different cryptocurrencies. This gives you the tools to capitalize on market volatility and construct more complex trading strategies.

Here’s a quick overview:

| Feature | Bybit | BingX |

|---|---|---|

| Spot Trading | Available | Available |

| Derivatives Trading | Extensive Range | Available |

| Perpetual Contracts | Inverse and Linear | Not Specified |

| Futures Contracts | Inverse and Regular (COIN-M/USD-M) | USD-M Futures Available |

| Options Trading | Available | Not Specified |

| Leverage | High; Isolated and Cross Margin | Not Specified |

Bybit vs BingX: Leverage and Margin

Bybit Leverage and Margin

Bybit provides you with a maximum leverage of up to 100x on specific trading pairs, allowing you to open positions significantly larger than your initial margin.

This exchange employs an isolated margin system, enabling you to manage risk on individual positions without affecting your entire account balance.

However, take caution: high leverage increases potential returns while heightening your liquidation risk.

- Maximum Leverage: 100x

- Margin System: Isolated Margin

- Liquidation Risk: High with maximum leverage; depends on market conditions

- Funding Rates: Vary by trading pairs; displayed clearly on the trading interface

BingX Leverage and Margin

On BingX, you can utilize leverage as well, but the maximum provided is up to 150x on select contracts, which exceeds the offering from Bybit.

This can significantly enhance your buying power, but subsequently, it also escalates the liquidation risk.

Like Bybit, BingX offers an isolated margin system, safeguarding your positions individually and providing tools for adept risk management.

- Maximum Leverage: 150x

- Margin System: Isolated Margin

- Liquidation Risk: Extremely high at maximum leverage; careful monitoring required

- Funding Rates: Specific to contracts; transparently provided on the platform

Remember, with higher leverage comes the increased responsibility of monitoring positions closely. Both platforms have mechanisms like stop-loss to help you control potential losses.

Bybit vs BingX: Liquidity and Volume

When choosing between Bybit and BingX, liquidity and trading volume are critical factors you should consider.

Liquidity refers to buying or selling assets without causing a significant price change. High liquidity generally means tighter spreads and less slippage.

Bybit has a reputation for high liquidity, which is evident from its spot trading and derivatives trading volume.

The exchange consistently ranks high on liquidity metrics across various platforms.

For example, liquidity rankings can be viewed on sites such as CoinMarketCap or CoinGecko, where Bybit often appears in top positions.

On the other hand, BingX also provides competitive liquidity, though it may not match Bybit’s sheer volume.

Real-time liquidity information for BingX can also be sourced from these ranking sites and is essential for understanding the efficiency of your trades.

| Exchange | Spot Trading Volume | Derivatives Volume | Liquidity Rank |

|---|---|---|---|

| Bybit | High | Very High | Top Tier |

| BingX | Moderate to High | High | Competitive |

In terms of market volatility, greater liquidity tends to dampen price fluctuations.

Bybit’s larger trading volume can offer more stability during volatile markets. This ensures you can execute trades closer to your desired entry and exit points.

Remember, trading volume isn’t static; it can fluctuate based on market trends and user activity. Frequent checks of trading volume stats will help you stay informed.

While both platforms aim to optimize your trading experience, Bybit’s advantage in liquidity and volume might offer superior execution with minimal slippage during most market conditions.

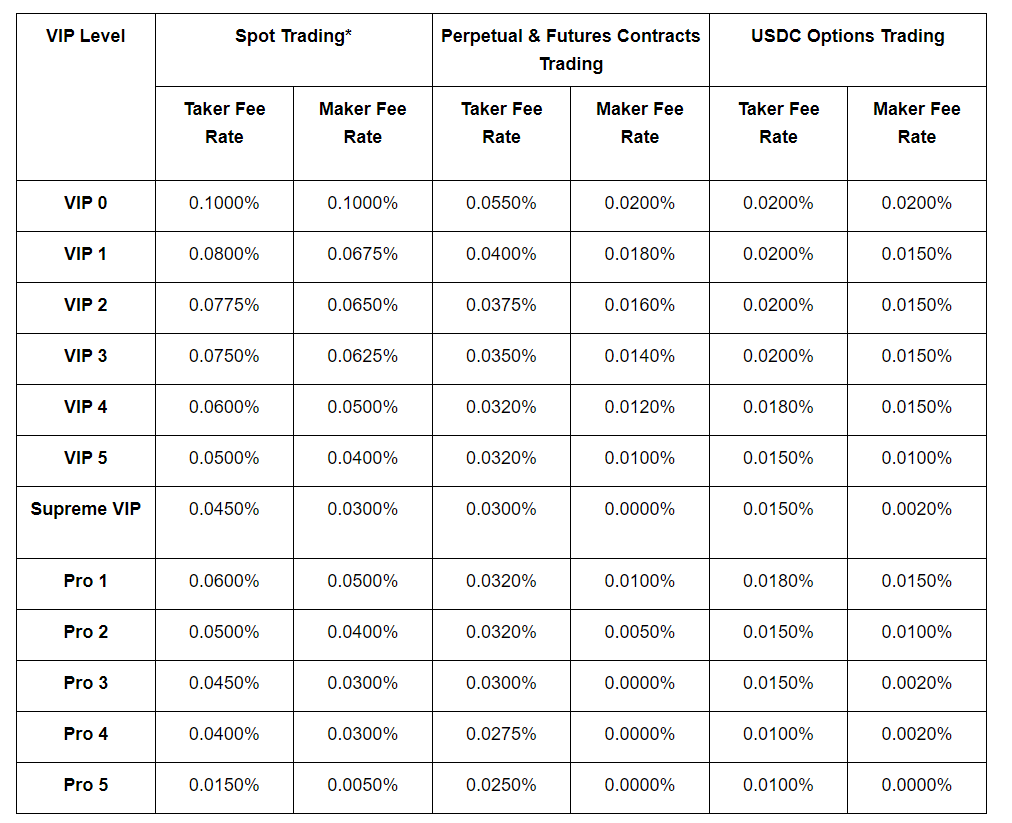

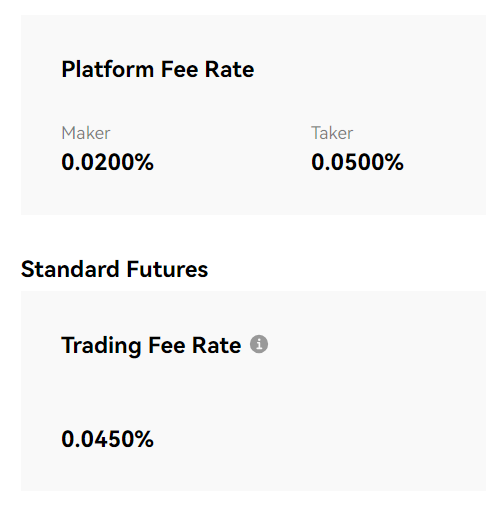

Bybit vs BingX: Fees and Rewards

When choosing between Bybit and BingX, understanding the specific details about trading fees and deposit or withdrawal charges is essential to make an informed decision.

Knowing the rewards or incentives offered can significantly impact your trading experience.

Trading Fee & Deposit/Withdrawal Fee Compared

Bybit has a trading fee structure based on the maker-taker model. The maker fee is generally set at -0.025%, which means makers earn a rebate, while the taker fee is around 0.075%.

For example, if you place a limit order that adds liquidity and it’s executed for a total of $10,000, you would earn $2.50 as a maker.

Conversely, for a market order that takes liquidity at the same amount, you pay $7.50 as a taker. There are no fees for depositing funds, but withdrawal fees vary depending on the cryptocurrency.

BingX also follows a maker-taker fee model, albeit with different rates. Makers are charged a fee of around 0.1%, and takers are charged approximately 0.1%.

In this case, trading $10,000 as either a maker or a taker would result in a fee of $10.

BingX imposes withdrawal fees that vary per coin and can have promotional periods with reduced or zero fees for fiat withdrawals. There is typically no charge for deposits.

Deposits & Withdrawal Options

Bybit supports a range of deposit methods, including cryptocurrency transfers and fiat deposits through third-party providers.

Fiat deposit methods involve different types of bank transfers, credit or debit cards, and certain e-wallets, though Bybit itself does not directly handle fiat deposits or withdrawals.

Depending on your chosen method, the processing times can vary from instant to a few days.

You should know the minimum and maximum withdrawal limits that differ for each cryptocurrency, with minimums usually set low to accommodate smaller traders.

BingX offers various deposit options, like Bybit, including cryptocurrency deposits and third-party services for fiat transactions.

The exchange provides a blend of payment methods, such as bank transfers, credit cards, and more, with processing times and limits similar to Bybit’s.

You must check the latest information as exchanges periodically update their supported currencies, deposit methods, and associated fees or limits.

Bybit vs BingX: KYC Requirements & Limits

When choosing between Bybit and BingX, consider the Know Your Customer (KYC) requirements and their impact on your trading experience.

Bybit KYC:

Bybit operates with a tiered KYC system. Initially, you can register using just an email or phone number.

For further features, you’ll need to complete KYC verification, which includes providing ID and possibly proof of address, depending on your country. The KYC process affects your deposit and withdrawal limits:

- Tier 0 (No KYC): Trade with limitations on the withdrawals.

- Tier 1 (ID Verification): Increased withdrawal limits vary by asset.

- Tier 2 (Full KYC): Access the full range of services with higher withdrawal limits.

BingX KYC:

BingX, in contrast, is known for its no-KYC process, allowing you to remain anonymous while using essential services.

You don’t have to verify your identity to deposit, trade, and withdraw on BingX. However, there are still rules and limits for unverified users:

- No KYC: Trade and withdraw with certain restrictions.

- Verification: For higher trading volumes and withdrawal limits, identity verification may be required.

| Exchange | KYC Required | Deposit Limits | Withdrawal Limits | Services Accessible |

|---|---|---|---|---|

| Bybit | Optional | Tier-based | Tier-based | Full with KYC |

| BingX | No | None | Rules-based | Basic without KYC |

Your choice depends on your preference for privacy versus the need for higher transaction limits and a more comprehensive range of services.

User scores often reflect the balance each exchange offers between the security provided by KYC protocols and the accessibility for users with varying levels of verification.

Bybit vs. BingX: Order Types

When trading on Bybit or BingX, understanding the various order types is crucial for your strategy and risk management. Both platforms offer various orders catering to different trading styles and preferences.

Bybit:

- Market Orders: Execute at the current market price.

- Limit Orders: Set your desired buy or sell price.

- Conditional Orders: Triggered when specific conditions are met, acting as a market or limit order.

- Stop Orders: Stop-Loss or Take-Profit activate at a predefined price.

- Post-Only Orders: Ensure the order is added to the order book and not filled immediately, avoiding taker fees.

- Reduce-Only Orders: Used in position management, this order type can only reduce your position, not increase it.

BingX:

- Market Orders: Instant execution at prevailing market prices.

- Limit Orders: This allows you to define your buy or sell price.

- Stop Orders (Stop-Loss): Places an order that gets executed once a specific price is reached to minimize losses or secure profits.

- Automated trading options are also supported on BingX, enabling you to set up strategies to effectively utilize these order types.

Both exchanges offer slippage protection mechanisms, typically through stop-limit options or other features that help maintain the expected entry or exit price levels.

When considering automated trading, both Bybit and BingX have APIs for integrating customized bots and algorithms.

This allows you to apply automated trading techniques, which can be aligned with the specific order types offered by the respective exchanges.

Take the time to familiarize yourself with each order type, as both platforms provide a nuanced set of tools designed to help you execute your trades according to your strategy and manage trading risks accordingly.

Bybit vs BingX: Security and Reliability

Bybit has implemented various security features, such as SSL encryption, two-factor authentication (2FA), and a multi-signature withdrawal process, which minimizes the risks associated with unauthorized access.

Additionally, Bybit employs a robust risk management system, protecting your funds from extreme market volatility.

- Regulatory Compliance: Bybit is recognized for its efforts to comply with international regulatory standards, instilling confidence in its operations.

- Incident Response: Bybit has maintained a strong track record, handling minor incidents transparently and efficiently.

Moving to BingX, the company also places high importance on securing your data and funds. It offers similar security mechanisms, including the obligatory 2FA and encryption to safeguard your account.

- Customer Support: BingX provides a responsive customer service team ready to address your concerns regarding security or other issues.

- Market Presence: Despite its smaller size than Bybit, BingX has proven to be a reliable trading platform.

Neither exchange has been immune to risks inherent in the crypto industry.

Past events have prompted Bybit and BingX to enhance their security protocols and risk management systems further.

| Feature | Bybit | BingX |

|---|---|---|

| Encryption | SSL encryption throughout the platform | SSL encryption for data protection |

| Authentication | Two-factor authentication (2FA) | Two-factor authentication (2FA) |

| Regulatory Compliance | Strong efforts to meet international standards | Actively working on regulatory compliance |

| Support | Available 24/7 for assistance | Prompt customer support |

| Risk Management | Advanced risk management framework | Reliable risk management practices |

Bybit vs. BingX: User Experience

When you first sign up for Bybit or BingX, you’ll notice both platforms require your email and a secure password to create an account.

Verification may extend to providing your phone number to enhance account security.

Sign-up Process:

- Bybit: Streamlined sign-up that takes only a few minutes.

- BingX: A comparable sign-up process to Bybit; quick and easy.

In terms of platform accessibility, both Bybit and BingX offer mobile applications for iOS and Android users, and their websites are designed to be user-friendly.

When exploring the mobile apps, you will find that they are both well-optimized for trading on the go.

Mobile Apps:

- Bybit: Offers sleek, robust apps for a seamless mobile experience.

- BingX: Intuitive apps that are user-friendly for traders of all levels.

The user interfaces on both platforms are modern and efficient, incorporating TradingView chart integration.

This provides you with sophisticated charting tools essential for analyzing market trends and making educated trade decisions.

Trading Tools:

- Bybit: Advanced tools and a highly responsive interface.

- BingX: Simplified tools aimed at both new and experienced traders.

Users have different experiences regarding interface speed and ease of navigation, but generally, user scores reflect satisfaction with the overall experience on both platforms.

The feedback suggests that Bybit may offer a slightly more refined user experience, particularly for experienced traders.

User Scores:

- Bybit: High scores for its advanced features and functionality.

- BingX: Commended for its user-centric design and approachability.

Each exchange has curated its user experience to cater to its audience. Bybit focuses on a feature-rich environment for severe traders, and BingX emphasizes ease and accessibility for broader user adoption.

Bybit vs BingX: Education and Community

Bybit and BingX offer various educational resources to cater to your trading expertise.

Bybit’s Learning Hub features a variety of articles, guides, and tutorials. The content ranges from beginner to advanced, encompassing risk management, platform features, and trading strategies.

Bybit also provides demo trading, where you can practice without financial risk.

BingX maintains a similar approach, with an Education Center that delivers articles, trading courses, and market insights.

BingX also focuses on social trading, allowing you to observe and copy trades from experienced users. This can be a practical learning tool, as you can learn from real trading scenarios.

Both platforms have leveraged social media channels to build communities where traders can discuss trends, strategies, and market updates.

Bybit’s presence across multiple social networks extends its reach, offering community engagement through:

- Twitter discussions

- Telegram groups

- Trading competitions

BingX, on the other hand, promotes its Community feature on its website, encouraging users to interact directly with the platform and each other.

| Bybit | BingX | |

|---|---|---|

| Guides & Tutorials | Yes | Yes |

| Demo Trading | Yes | No |

| Social Trading | No | Yes |

| Community Engagement | Multiple Platforms | Direct on Site |

Furthermore, both exchanges actively update their trading bots — automated programs designed to execute trades for you based on predetermined criteria.

These bots can be a part of the educational experience, setting up automatic trades or assisting in understanding market trends.

This feature might be handy to deepen your algorithmic trading knowledge.

Conclusion

In assessing BingX and Bybit, it’s evident that each exchange offers distinct advantages suited to divergent trading preferences and needs.

BingX is recognized for user-friendly interfaces and diverse trading options, including spot, derivatives, copy, and grid trading.

This multi-faceted approach may appeal to you if variety and ease of use rank high on your priority list.

Bybit, on the other hand, is noted for its extensive range of individual crypto coins and a broad array of crypto trading products.

If you focus on having a wide selection of assets and advanced trading tools, Bybit could be the exchange of choice.

| Feature | BingX | Bybit |

|---|---|---|

| User Interface | User-friendly | Comprehensive |

| Asset Range | Wide variety | Extensive selection |

| Trading Types | Spot, Derivatives | Spot, Derivatives |

For novice investors, BingX might be more accessible due to its intuitive design and user guidance.

Seasoned traders looking for in-depth trading and a robust selection would likely find Bybit aligns more closely with their needs.

Explore how Bybit and BingX compare to their competitors:

- Bybit vs Binance: In-Depth Trading Platform Analysis

- Bybit vs Bitget: In-Depth Trading Platform Analysis

- Bybit vs MEXC: In-Depth Trading Platform Analysis

- BingX vs MEXC: In-Depth Trading Platform Analysis

- BingX vs Binance: In-Depth Trading Platform Analysis

- BingX vs PrimeXBT: In-Depth Trading Platform Analysis