With the advent of platforms like Phemex, traders have access to sophisticated tools that enable them to navigate the volatile crypto markets with greater confidence.

This step-by-step guide is designed to demystify the process of trading crypto futures on Phemex, providing you with the knowledge and strategies needed to execute trades effectively.

From understanding the fundamentals of futures contracts to mastering the intricacies of the Phemex platform, this tutorial will cover all the essentials.

Whether you’re a seasoned trader looking to refine your skills or a newcomer eager to take your first steps in the crypto futures arena, this guide will be valuable.

So, let’s dive into the world of Phemex futures trading and unlock the potential of this dynamic market.

How to Trade Crypto Futures on Phemex: Phemex Futures Trading Strategy & Basics

When trading crypto futures on Phemex, you need to understand the fundamentals of futures contracts.

Futures are financial derivatives that let you buy or sell cryptocurrencies like Bitcoin or Ethereum at a predetermined price on a specific future date.

Leverage is a critical concept in futures trading. It allows you to control prominent positions with comparatively less capital, referred to as margin.

However, leverage amplifies both gains and potential losses. Phemex offers varying leverage levels, so it’s imperative to understand that high leverage can lead to liquidation.

Liquidation is when your position is automatically closed if the margin falls below the maintenance level.

- Trading Strategy includes technical analysis, fundamental analysis, or a combination of both. Build a strategy that fits your risk tolerance.

- Risk Management is crucial, given the high stakes of leveraged trading. Implement stop-loss orders to limit potential losses.

Phemex provides two types of futures contracts:

- Coin-margined Futures: These contracts settle in the cryptocurrency underlying the contract, such as Bitcoin (BTC).

- USDT-margined Futures: Settle in USDT, and the margin is posted in USDT.

Index Price represents the average price of an asset based on significant spot markets and their relative trading volume.

Meanwhile, the Mark Price is used by Phemex to mitigate unnecessary liquidations during volatile market movements.

The Funding Rate ensures the futures price is in line with the spot price and is exchanged between buyers and sellers every 8 hours on Phemex.

Utilize the Phemex order calculator for an educated approach. Before entering a trade, this tool lets you estimate potential profits, losses, and required margins. It helps in aligning with your trading strategy and risk appetite.

Knowledge and risk management are your best tools when trading crypto futures.

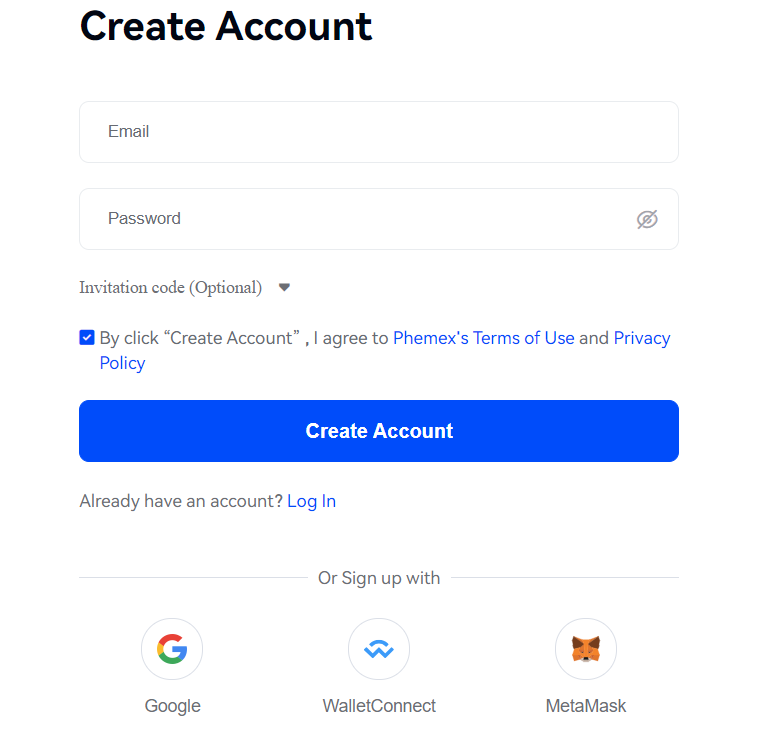

How to Create an Account on Phemex

You must create an account to start trading crypto futures on the Phemex platform. The process is straightforward whether you choose to sign up using the Phemex website or their mobile app.

Step 1: Go to the Phemex Website or Download the App

- Website: Visit the official Phemex website.

- App: Download the Phemex app from your respective app store.

Step 2: Sign-Up

- Click on the ‘Create Account’ button.

- Fill in your email address and create a password.

Step 3: Email Verification

- Check your email for a verification message from Phemex.

- Click on the verification link to activate your account.

During the sign-up process and as you use the service, Phemex ensures your security with robust measures:

- Two-factor authentication (2FA) adds an extra layer of protection.

- Secure your account by choosing a solid password and mixing uppercase, lowercase, numbers, and symbols.

Step 4: Identity Verification

- Complete KYC (Know Your Customer) requirements by providing the necessary identification documents.

- You may need to submit a photo ID and additional information to satisfy regulatory compliance.

How to Deposit and Withdraw Funds on Phemex

Managing your funds on Phemex is straightforward. Whether you plan to deposit or withdraw, Phemex provides a secure platform with multiple payment options. Let’s go over the specific steps you need to follow.

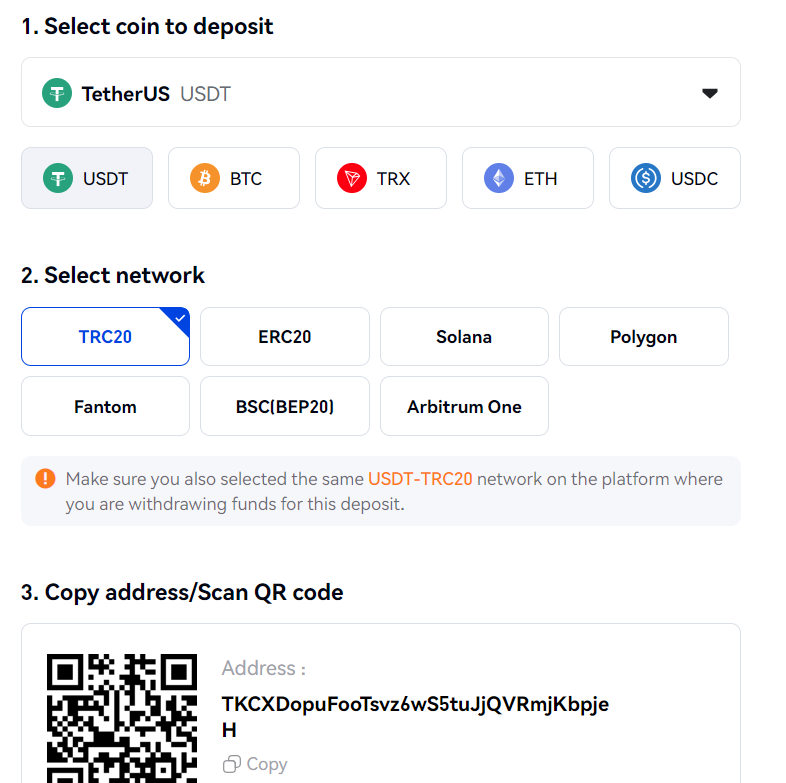

How to Deposit Funds

To deposit cryptocurrencies like BTC or ETH to your Phemex account, follow these steps:

- Log in to your Phemex account.

- Navigate to the ‘Assets’ section and click on ‘Deposit’.

- Choose the type of currency you want to deposit (e.g., BTC, ETH).

- A unique deposit address will be provided. Send your cryptocurrency to this address from your external wallet or another exchange.

For fiat currencies, Phemex allows deposits through:

- Bank transfers

- Credit cards

- Debit cards

Remember to check for:

- Minimum and Maximum Limits: These vary based on the currency and method.

- Fees: Deposits can be subject to fees, which are typically low.

- Processing Time: Crypto deposits are usually fast but can vary depending on network congestion.

How to Withdraw Funds

Withdrawing funds from Phemex is a secure and user-friendly process:

- Access the ‘Assets’ section and select ‘Withdraw’.

- Choose the cryptocurrency you wish to withdraw (e.g., BTC, ETH).

- Enter the withdrawal address for your external wallet.

- Please specify the amount you want to withdraw, ensuring it meets the minimum limit.

For withdrawing in fiat:

- Withdrawals can be sent to a bank account linked to your Phemex account.

- Use your registered credit or debit card to withdraw the money.

Be aware of:

- Security: All withdrawals are protected by Phemex’s security measures.

- Liquidity: Phemex ensures high liquidity for swift withdrawals.

- Withdrawal Limits: There are both minimum and maximum withdrawal limits.

- Fees: Each withdrawal may incur a fee, depending on the currency.

- Processing Time: Withdrawals have a processing time that can range from instant to a few hours.

How to Transfer Funds to the Futures Wallet

Before initiating a fund transfer to your futures wallet on Phemex, it is essential to understand the distinction between a spot wallet and a futures wallet.

Your spot wallet is where you hold cryptocurrencies that you can immediately trade at current market prices.

On the other hand, the futures wallet is designated for trading futures contracts—agreements to buy or sell assets at predetermined prices in the future.

To transfer funds from your spot wallet to your futures wallet, follow these steps:

- Log in to your Phemex account.

- Navigate to the Assets page, which you can typically find at the top of the screen.

- Under the Spot Wallet, find the currency you wish to transfer.

- Click on the Transfer button.

- In the pop-up window, select Futures Wallet as the destination for the transfer.

- Enter the amount you want to transfer.

- Confirm the transaction details and execute the transfer by clicking Confirm.

Phemex supports various cryptocurrencies that you can use for futures trading.

Check the list of supported currencies directly on Phemex’s platform, as this may change over time. Additionally, be aware of the minimum and maximum transfer limits to ensure a successful transaction.

By funding your futures wallet, you are one step closer to participating in the futures market, providing leverage and hedging opportunities against the volatile crypto market.

Remember to trade cautiously and within your risk tolerance, as futures trading involves significant risk.

How to Choose a Trading Pair and a Contract Type

Selecting a trading pair is the first step when entering the crypto futures market with Phemex. Trading pairs consist of two different assets, such as the Bitcoin/US Dollar (BTC/USD) pair.

Your choice will depend on market familiarity, volatility preferences, and investment strategy.

Perpetual contracts and fixed-date contracts are the two main types you will find on Phemex. Perpetual contracts, as the name suggests, don’t expire, allowing you to hold a position for as long as desired.

In contrast, fixed-date contracts expire on a set date, necessitating a close or rollover of your position.

Perpetual contracts provide flexibility; you are not required to keep track of expiration dates.

However, they may require you to pay funding fees periodically. Fixed-date contracts, while having an expiration date, typically don’t need these funding fees, which can be advantageous if you plan to hold for more extended periods.

Examples on Phemex include:

- Perpetual: BTC/USD, ETH/USD

- Fixed-date: BTC/USD quarterly, ETH/USD quarterly

In your selection, consider the liquidity of the asset, as it can impact the ease with which you can open and close positions.

High liquidity for Bitcoin futures, for example, means lower slippage and closer adherence to market prices.

However, with options like crypto futures, market conditions can change rapidly, underscoring the importance of constant vigilance and risk management.

How to Understand the Futures Trading Interface on Phemex

When you enter the Phemex platform to engage in futures trading, you will be greeted by an interface that integrates various elements designed to provide comprehensive trading information at a glance.

TradingView Charts:

Central to your trading experience, the Phemex interface features advanced TradingView charts.

These charts offer various technical analysis tools and indicators, enabling you to analyze market trends and patterns in real time.

You can customize your chart’s layout, switch between different time frames, and apply various indicators that suit your trading strategy.

Order Book:

To the right of the chart, you will find the order book. This is a real-time list of open buy and sell orders for the selected cryptocurrency futures.

The order book helps you assess the market depth and price levels at which other traders are willing to enter or exit the market.

- Buy Orders: Reflect the prices and quantities traders are willing to purchase.

- Sell Orders: Show the prices and quantities traders are eager to sell.

Order Panel:

Below the charts is the order panel, where you can execute trades. This panel is where you input the type of order you wish to place, such as market, limit, or stop orders.

Additionally, you can specify your desired leverage and set parameters for taking profit or stopping loss.

Positions Panel:

Once you have an active trade, the positions panel displays your open positions. It includes important details such as entry price, current value, unrealized P&L (profit and loss), and margin.

Phemex provides several trading tools, such as multiple order types and customizable alerts, to optimize your trading strategies.

The interface is designed for clarity, ensuring you are equipped with the information to make informed trading decisions confidently.

How to Place and Manage Orders on Phemex Futures

When trading crypto futures on Phemex, you must first understand the leverage and margin systems. Leverage allows you to trade more prominent positions with less capital.

To choose a leverage level, navigate to the trading interface and select your desired multiplier. Remember that higher leverage amplifies both profits and losses.

Margin mode can be isolated or crossed. Isolated uses a specific amount of funds for a position, whereas cross utilizes all available funds to avoid liquidation.

On Phemex, you have the choice between three order types. A limit order lets you specify the price you wish to buy or sell.

A market order is executed at the current market price. Lastly, a conditional order acts as a stop-loss or take-profit, triggering at predefined conditions.

To place an order, go to the BTC/USDT trading pair on Phemex:

- Choose the order type.

- Set the price for limits or conditions for conditional orders.

- Select your leverage.

- Specify the number of contracts.

- Confirm the order and monitor its status in the order book.

Phemex futures also involve a funding rate exchanged between long and short traders, ensuring the futures price stays close to the spot price. Settlement occurs every 8 hours when the funding is exchanged.

To manage or close a position:

- Monitor open positions under the ‘Positions’ tab.

- Use a stop-loss to mitigate risk or a take-profit to lock in gains.

- Close the position by executing an order opposite to your open position.

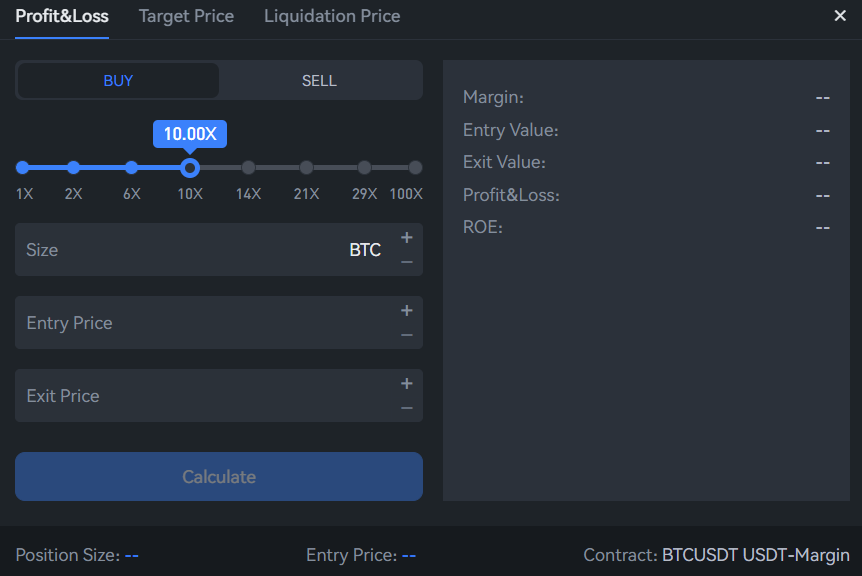

How to Use the Phemex Order Calculator

The Phemex Order Calculator is a powerful tool designed to assist you in managing risks and strategizing effectively while engaging in futures trading on the platform.

Before executing a trade, you can utilize this calculator to estimate potential profits, losses, the impact of fees, and the necessary initial investment, considering the leverage you plan to apply.

To access the Phemex Order Calculator, log into your Phemex account and find the calculator feature on the trading interface. The process is straightforward:

- Select the asset you wish to trade from the dropdown menu.

- Enter the entry and exit prices to predict possible profits or losses.

- Input the size of your position to measure how much capital is required.

- Adjust the leverage slider to see how leverage affects your potential outcome.

Remember that leverage trading amplifies profits and losses and should be used cautiously.

Within the calculator, you will need to provide specific parameters:

- Entry Price: The price at which you plan to enter the trade.

- Exit Price: The price at which you intend to close the trade.

- Position Size: The total value of your trading position.

- Leverage: The multiplier of your initial investment to increase buying power.

Once you have entered these details, the calculator will display the potential outcome of the trade, considering the factors above.

Here are scenarios illustrating how the calculator works:

- Low leverage (2x): Your initial investment is less multiplied, presenting lower risk and potential.

- High leverage (50x): Your initial investment is significantly multiplied, increasing potential returns and risks.

Frequently Asked Questions

Before diving into specific queries, you need clarity on the opportunities and considerations when trading crypto futures on Phemex.

Is Phemex a suitable platform for US traders seeking crypto futures?

As of my last update, Phemex did not provide services for traders in the United States due to regulatory reasons. You should always check the current legal framework and Phemex’s terms of service for the latest information regarding eligibility.

How can I utilize a trading bot for crypto futures on Phemex?

If you’re looking to automate your trading strategy, Phemex allows the integration of third-party trading bots. Please ensure the bot you choose is compatible with Phemex’s API and abide by their usage guidelines to ensure a smooth trading experience.

What are the fees associated with trading crypto futures on Phemex?

Phemex charges a trading fee for crypto futures that can vary depending on whether you’re a maker or taker in the transaction. The fee structure is competitive and designed to incentivize liquidity. Check Phemex’s official fee schedule for the most current rates.

Conclusion

Trading crypto futures with Phemex gives you access to a dynamic trading platform with various services designed to facilitate your dive into the crypto market.

Through Phemex, you can exploit the opportunities that come with market volatility and have the potential to profit regardless of the direction the market is trending.

- Comprehensive Support: Phemex provides extensive educational resources to bolster your knowledge and confidence.

- Variety of Contracts: The platform offers perpetual contracts and futures, catering to diverse trading strategies.

Phemex Academy is a notable resource with detailed guides and articles on enhancing your trading skills. Their customer service is attentive, providing timely assistance when you need it.

Before embarking on your trading journey, it’s crucial to delve into research. A solid understanding of the market dynamics can differentiate between success and failure.

Always bear the inherent risks and ensure proper risk management strategies are in place.

For ongoing learning and updates on the crypto market, consider the following steps:

- Sign up for webinars or online courses focusing on crypto futures.

- Join Phemex-related forums and discussion groups for trader experiences and tips.

- Regularly visit crypto news sites to stay informed about market trends.

Remember, with Phemex, your foray into crypto futures is backed by a reliable trading platform. It enables you to explore the market with the tools and support designed to aid in your pursuit of trading objectives.

Start trading with Phemex today and leverage the potential of the crypto market to your advantage.

Explore how Phemex compares to its competitors:

- Phemex vs Kraken: Head-to-Head Platform Comparison

- Phemex vs PrimeXBT: Head-to-Head Platform Comparison

- Phemex vs Bitget: Head-to-Head Platform Comparison

- Phemex vs Binance: Head-to-Head Platform Comparison