In the evolving landscape of cryptocurrency trading platforms, two names stand out for their distinctive features and growing user base: Bybit and Binance.

You may be familiar with Binance, one of the largest and most well-established exchanges globally, offering a wide array of trading pairs and known for its significant trading volume. Conversely,

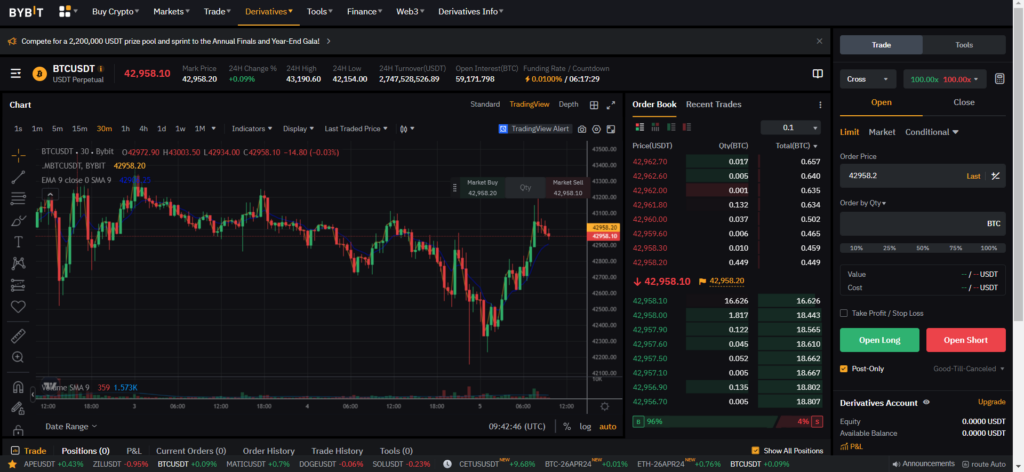

Bybit has emerged as a strong contender, focusing on derivatives trading and gaining attention for its user-friendly interface and advanced trading features.

Binance is often touted for its comprehensive ecosystem, including many tokens and additional financial services. At the same time, Bybit is praised for its intuitive design and formidable approach to security, enhancing overall trading safety.

The choice between these two platforms will significantly influence your trading strategies and outcomes, and understanding the nuances of each can empower you to make an informed decision tailored to your needs.

After comparing Bybit and Binance exchanges on crucial features, fees, and liquidity, overall, Bybit leads with a score of 9.4 compared to Binance’s 8.5. This makes Bybit a clear winner in this comparison with Binance, as it offers users a robust trading platform and competitive trading fees.

| Feature | Bybit | Binance |

|---|---|---|

| Leverage | Up to 100x for crypto & derivatives | Up to 125x for Futures |

| Trading Volume | $5+ billion (ranked 5th) | $13+ billion (ranked 1st) |

| Supported Coins | Offers a variety of coins | 400+ spot cryptocurrencies |

| Liquidity | High with competitive spreads | Very high, often leading in the market |

| Trading Fees | Competitive fees | Low fees, with tiers for higher volumes |

| VIP Program | Yes, with additional perks | Yes, including extra resources |

| User Experience | Streamlined interface | Smooth, intuitive user experience |

| Regulation & Safety | Holds required licenses | Extensively licensed and regulated |

| Deposit Methods | Multiple methods supported | Supports a wide array of deposit methods |

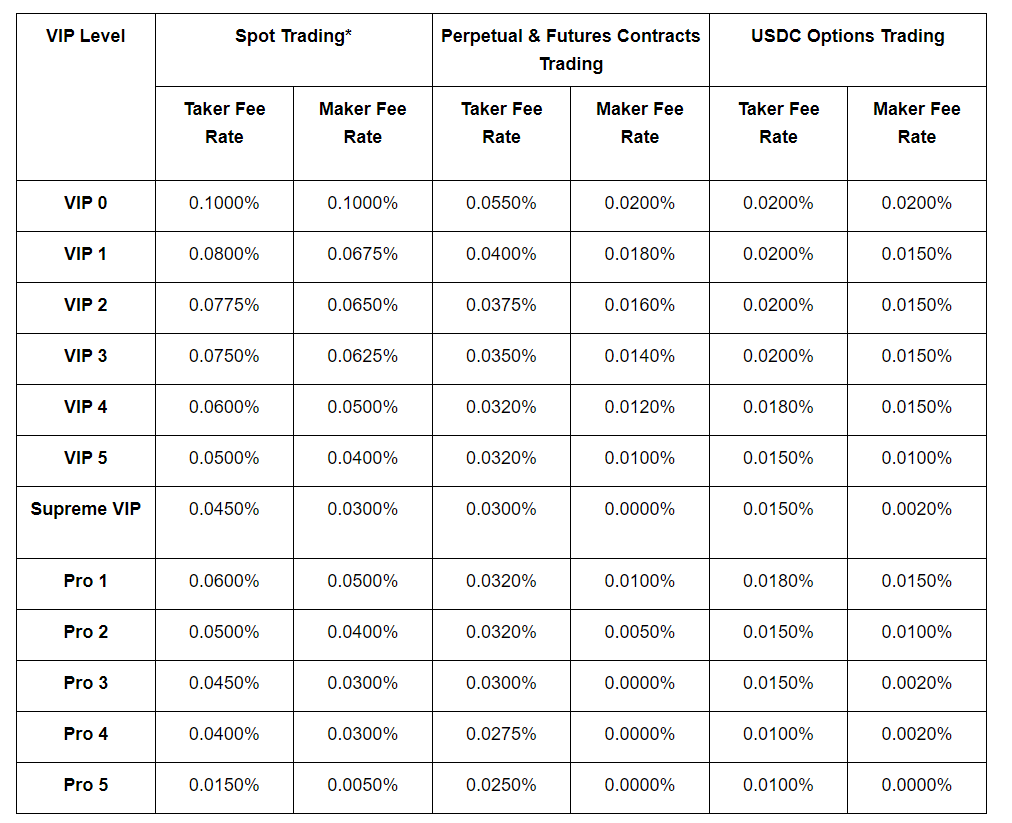

Each platform offers distinct VIP programs to enhance your trading experience, with Binance leaning towards a comprehensive educational approach, including exclusive materials.

Liquidity is a focal point for any trader, and Binance generally holds the lead with higher market volumes and more spot cryptocurrencies available, suggesting a more extensive user base.

Bybit Vs. Binance: Products and Services

When navigating the cryptocurrency landscape, it’s crucial to understand the service offerings of various platforms. Bybit and Binance are two titans in the space, each with a distinct set of products.

Spot Trading: Both platforms provide robust spot trading options. However, Binance edges out with a slightly more extensive selection of cryptocurrencies.

Futures Trading: You’ll find that Binance offers up to 125x leverage on futures, while Bybit also provides a substantial 100x leverage. Binance takes the lead in leveraging options, although both exchanges are competitive.

P2P Trading: If you prefer direct transactions, Binance supports peer-to-peer (P2P) trading, which can be a convenient feature depending on your trading strategy.

Staking: Binance provides a comprehensive staking platform for those interested in earning rewards through staking. Bybit’s services in this area are limited.

NFT Marketplace: Only Binance offers an NFT marketplace, making it your go-to to diversify into non-fungible tokens.

Margin Trading: Both platforms support margin trading. Bybit is recognized for its user-friendly interface, whereas Binance offers a slightly more comprehensive experience here because of the wider variety of digital assets.

Leveraged Tokens: Binance also offers leveraged tokens, giving you more choices if your trading strategy involves these instruments.

Bybit Vs. Binance: Contract Types

Bybit and Binance offer a range of contract types to cater to diverse trading strategies and preferences.

Bybit Contracts:

- Inverse Perpetual Contracts: You trade contracts that settle in cryptocurrency rather than fiat currency. This means the margin you use and the profit or loss are denominated in the base cryptocurrency.

- Inverse Futures Contracts: Similar to inverse perpetual contracts, these also settle in the base cryptocurrency but with an expiry date.

- Linear Perpetual Contracts: These are quoted and settled in USDT (Tether), making them more accessible if you prefer to think in terms of fiat value.

Binance Contracts:

- USDⓈ-M Futures (USD-M): These are linear futures settled in USDT or BUSD (Binance USD), offering a straightforward way to speculate on future prices.

- COIN-M Futures are inverse futures, settling in the underlying cryptocurrency, similar to Bybit’s offering.

- Perpetual Futures Contracts: Binance sets itself apart by offering both USD-M and COIN-M perpetual futures, giving you more flexibility in how you want to trade.

- Options: A unique offering on Binance, options give you the right, but not the obligation, to buy or sell a cryptocurrency at a predetermined price within a specified timeframe.

Bybit and Binance leverage systems range from low to high: Bybit provides up to 100x, while Binance offers up to 125x for futures.

Risk management is essential when engaging with these products due to the high leverage.

Each platform’s interface is designed to cater to beginners and experienced traders, with risk indicators and tools to help manage trades effectively.

Bybit Vs. Binance: Leverage and Margin

When trading on Bybit, you can use up to 100x leverage for specific crypto and derivatives trading pairs.

This high level of leverage allows you to open a position with a value much more significant than your initial margin, which is the capital required to open and maintain a position.

However, with the high potential for amplified returns, the risk of liquidation increases if the market moves against you.

In comparison, Binance offers up to 125x leverage on futures contracts, making it slightly more geared toward traders looking for maximum leverage.

Binance also incorporates a tiered fee structure based on your 30-day trading volume, with maker and taker fees decreasing as your trading activity increases. Here’s a quick view of the potential fees:

| Exchange | Max Leverage | Maker Fee | Taker Fee |

|---|---|---|---|

| Bybit | 100x | 0.025% | 0.075% |

| Binance | 125x | Start at 0.02% | Start at 0.04% |

It’s important to understand that leverage can magnify both profits and losses. Adequate liquidity ensures you can enter and exit positions near your desired price points.

Both Bybit and Binance provide deep liquidity pools, which generally allow for efficient trade execution, even with significant leverage.

Remember that trading with leverage involves margin requirements that must be met to keep the position open. Failure to meet the margin requirement can lead to forced liquidation, where the exchange automatically closes your position, often at a loss.

Additionally, funding rates on both platforms must be considered, as they can affect the overall cost of holding leveraged positions over time.

Bybit Vs Binance: Liquidity and Volume

When analyzing liquidity and trading volume, you’re looking at how quickly and efficiently you can execute trades on each platform.

In the context of Bybit and Binance, these factors are pivotal for your BTC and ETH transactions, affecting trading efficiency and potential slippage.

Starting with Binance, it consistently ranks as one of the highest in liquidity and trading volume.

CoinMarketCap statistics highlight Binance leads with a reported trading volume exceeding $13 billion over 24 hours.

This high volume suggests you can expect minimal slippage and faster execution when trading cryptocurrencies like BTC and ETH.

Bybit, on the other hand, while smaller, still maintains a considerable presence. It secures a place within the top five crypto exchanges, with a trading volume surpassing $5 billion in the same timeframe.

The impressive volume indicates a robust system where trades for cryptocurrencies, including BTC and ETH, are usually filled with efficiency.

Here’s a quick breakdown:

| Exchange | 24h Trading Volume | Rank |

|---|---|---|

| Binance | >$13 billion | 1st |

| Bybit | >$5 billion | 5th |

The liquidity for each exchange will impact how easily you can enter and exit positions.

Higher liquidity means less price discrepancy between the listing and execution price. Binance, with its more extensive user base, generally offers greater liquidity, which translates into more stable prices even during market fluctuations.

Binance would perhaps serve your interests better for large-volume trading and seeking stability.

Bybit, while smaller, still offers a competitive environment for BTC and ETH trading, just with slightly less liquidity than its larger counterpart.

Bybit Vs. Binance: Fees and Rewards

In comparing Bybit and Binance, understanding their fee structures and reward systems is critical for your trading strategy and overall experience.

Trading Fee & Deposit/Withdrawal Fee Compared

Bybit operates with a tiered fee structure, charging a 0.075% taker fee and offering a -0.025% maker rebate. This means as a maker, you earn a rebate on trades.

Binance also follows a tiered fee approach, with maker/taker fees starting at 0.10% and 0.10%, respectively. However, costs can decrease substantially for higher-volume traders and BNB token users due to Binance’s VIP levels.

Trading Fee Example: If you execute a $10,000 trade on Bybit as a taker, the fee would be $7.50. As a maker, you’d receive a $2.50 rebate. On Binance, the same trade would cost you $10.00 as both maker and taker without considering VIP discounts.

Both exchanges offer a welcome bonus for new users, adding an incentive to start trading. Binance sometimes provides temporary zero fees for specific trading pairs as promotions.

Deposit Fees on both platforms are generally free, although network fees apply for blockchain transactions.

Withdrawal fees, on the other hand, vary depending on the cryptocurrency but are regularly updated to reflect blockchain conditions.

Deposits & Withdrawal Options

For both Bybit and Binance, you have multiple options for depositing funds, including cryptocurrencies and fiat, via various payment methods.

Both platforms support direct crypto deposits without incurring fees from the exchange, although network fees apply.

Regarding withdrawal, Bybit’s and Binance’s fees vary across different assets. It’s essential to check the most current rates on their respective websites.

Binance also offers advanced withdrawal options with its P2P trading platform, providing users flexibility and potentially lower fees if they trade with peers.

Always calculate potential costs before executing trades or withdrawals to better manage your finances.

Knowing the various fees and bonuses can ensure you make the most informed choices regarding your trading activities on Bybit or Binance.

Bybit Vs Binance: KYC Requirements & KYC Limits

When choosing between Bybit and Binance, understanding their Know Your Customer (KYC) requirements is crucial, as it influences your privacy, security, and regulatory compliance.

Both platforms have implemented KYC procedures to enhance security and adhere to financial regulations.

Bybit KYC Requirements:

- Level 0:

- No KYC is required.

- Deposit: Unlimited

- Withdrawal: 2 BTC per day

- Level 1:

- Documents: Government-issued ID, Selfie

- Procedure: Manual review

- Deposit: Unlimited

- Withdrawal: Increased from Level 0

- Level 2:

- Documents: Address proof, Enhanced due diligence

- Deposit: Unlimited

- Withdrawal: Further increased from Level 1

Binance KYC Requirements:

- Basic Verification:

- Documents: Government-issued ID

- Withdrawal: Up to 2 BTC per day without KYC

- Advanced Verification:

- Documents: Additional personal information, ID, Facial verification

- Procedure: Automated + Manual review

- Withdrawal: Up to 100 BTC per day

You should be aware that submitting documents for KYC can impact your privacy. However, this is balanced by increasing security measures and aligning with global regulations.

With higher levels of verification, you gain access to more significant withdrawal and trading limits, enhancing your trading capabilities on the exchange.

Trading without KYC may suffice if your needs are minimal, but completing KYC is typically necessary for access to full platform functionality.

Both Bybit and Binance regularly update their security and compliance measures, so stay informed about the latest requirements to ensure seamless trading experiences without interruptions.

Bybit Vs. Binance: Order Types

When trading on Bybit and Binance, you can access various order types designed to suit multiple trading strategies, allowing you to execute trades and manage risks efficiently.

Bybit primarily focuses on derivative trading, including futures. The platform offers:

- Market Orders: Execute immediately at the best available price.

- Limit Orders: Set a specific price for the order to trigger.

- Conditional Orders: Activated when certain conditions are met.

- Post-Only Orders: Ensure the order adds liquidity to the market by executing as a maker order.

- Reduce-Only Orders: Limit the size of your position to prevent it from increasing.

The simplicity of Bybit’s order types makes the platform user-friendly, particularly for newcomers in derivative trading.

Binance, known for both its spot and futures trading, provides a more diversified set of order types:

- Market Orders: Buy or sell instantly at current market prices.

- Limit Orders: Determine your desired buy or sell price.

- Stop-Limit Orders: Set a stop price that, once reached, triggers a limit order.

- OCO (One-Cancels-the-Other): Combines a limit order with a stop-limit order; execution of one automatically cancels the other.

- Stop Market Orders: Like stop-limit, they trigger a market order when your stop price is hit.

- Trailing Stop Orders: Adjusts the stop price at a fixed distance from the market price as it moves.

- Post-Only Orders: Ensure you pay the maker fee by not matching with existing orders.

- Iceberg Orders: Large orders are broken into smaller, less visible quantities to minimize market impact.

Binance’s extensive range of order types can be more appealing if you seek flexibility and comprehensive features, including advanced tools for risk management and strategy execution.

Each order type on both platforms serves a purpose, whether you’re looking to trade immediately, at a specific price, or under certain conditions.

Bybit Vs. Binance: Security and Reliability

When considering your options for cryptocurrency exchanges, security and reliability are paramount. Bybit and Binance have established robust security measures to protect your investments.

Bybit ensures the safety of your funds through a multi-signature cold wallet system, where most assets are stored offline, significantly reducing the risk of unauthorized access.

Two-factor authentication (2FA) is mandatory, adding an extra layer of protection for account login and withdrawal processes.

Binance, one of the largest crypto exchanges, prioritizes security with an extensive cold storage system, safeguarding a significant portion of your assets from potential online threats.

Binance has further integrated 2FA and advanced security features like device management and anti-phishing measures.

Despite rigorous security protocols, both platforms have faced challenges. Binance experienced a significant hack in 2019, where hackers stole $40 million worth of Bitcoin.

Binance covered these losses through its Secure Asset Fund for Users (SAFU), mitigating the financial impact on you. While not facing significant attacks, Bybit continually updates its security measures to prevent such incidents.

Regarding reliability, both exchanges comply with various regulatory standards, striving to offer you a secure trading environment.

They provide 24/7 customer support to address any concerns promptly. Regular third-party audits are conducted to ensure system integrity and reliability.

Bybit Vs. Binance: User Experience

When you choose a cryptocurrency exchange, the user experience can significantly affect your trading efficiency and comfort. Both Bybit and Binance focus on providing a seamless experience, though they approach it differently.

Mobile App:

- Bybit: Offers a user-friendly mobile app with a clean interface, enhancing trading on the go.

- Binance: Provides a feature-rich mobile app, often praised for its functionality and design.

In use, you’ll find that both apps are highly rated, but Binance might edge out with more features available.

Customer Support:

- Bybit: Known for responsive support through multiple channels, including live chat and email.

- Binance: Offers extensive support options, though feedback indicates variable response times.

It would be best to consider that while both offer help, your experience with response times may vary.

User Interface:

- Bybit: Features a straightforward interface that’s welcoming for new traders.

- Binance: Has a more complex but customizable interface catering to beginners and advanced users. To learn more about it, you can check the Binance tutorial.

Reviews suggest that Binance’s complexity comes with a learning curve rewarded with robust functionality.

Reviews:

- Bybit: Users often appreciate the simplistic design and ease of navigation.

- Binance: Reviews commonly highlight the comprehensive features while noting the busier interface.

Finance leads with more features, while Bybit provides a sleek simplicity that might be preferred by those looking for straightforward trading.

Frequently Asked Questions

In this section, you’ll find a straightforward comparison to help you understand the critical fee structures and tools for crypto analysis provided by Bybit and Binance.

What are the differences in trading fees between Bybit and Binance?

Bybit typically offers a maker rebate and charges a taker fee, which can be as low as 0.025% for the maker and 0.075% for the taker.

Binance also differentiates between maker and taker fees, with the standard trading fee being 0.1%. However, costs can be lower if you hold Binance Coin (BNB) or your trading volume is high.

Which provides better tools for crypto analysis, Bybit or Binance?

Binance offers a comprehensive suite of tools for analysis, including advanced charting options, technical indicators, and various order types.

Bybit also provides valuable tools, but Binance leads with its integrated features like research analysis, historical data, and market insights, which can help make informed trading decisions.

Conclusion

When determining which crypto exchange, Bybit or Binance, aligns with your trading and investment needs, consider the following key aspects:

- Fees: Binance offers a progressive fee structure with the potential for lower fees at higher trade volumes and through Binance Coin (BNB) usage. Bybit typically provides a flat fee model. Your trading volume will significantly influence your decision here.

- Leverage: Bybit provides up to 100x leverage on crypto and derivatives, while Binance goes a bit higher, offering up to 125x on futures. Binance’s offering might be more appealing if you’re a high-risk trader.

- Regulatory Compliance: Binance is extensively licensed and has greater regulatory compliance, potentially offering more security for your investments.

- Crypto Options and Pairings: Binance lists more cryptocurrencies, making it ideal if you’re looking for diverse trading pairs or investing in emerging tokens.

- User Experience: Both platforms offer a robust user experience with various tools suited for new and experienced traders. Bybit’s interface is touted as slightly more user-friendly, a fact to consider if you’re new to crypto trading.

- Support: Binance has a more global reach and offers extensive customer support options, which can be crucial for timely issue resolution.

For seasoned investors or those trading at higher volumes, Binance’s comprehensive offerings and competitive fees may provide a better solution.

Newer traders or those engaging in occasional trading might favor Bybit’s straightforward approach and easy-to-navigate platform.

Your choice should account for your trading frequency, the desired level of risk, and the importance you place on regulatory adherence and market variety.

Explore how Bybit and Binance compare to their competitors:

- Bybit vs Bitget: Head-to-Head Platform Comparison

- Bybit vs Phemex: Head-to-Head Platform Comparison

- Bybit vs MEXC: Head-to-Head Platform Comparison

- Binance vs BingX: Head-to-Head Platform Comparison

- Binance vs Kraken: Head-to-Head Platform Comparison

- Binance vs Phemex: Head-to-Head Platform Comparison