Crypto futures trading volume is the amount of money exchanged in these contracts over a given period.

According to CoinGecko, the total volume of crypto derivatives is $195 billion, a -3.46% change in the last 24 hours.

The top three crypto derivative exchanges by open interest are Binance (Futures), Bybit (Futures), and Deepcoin (Derivatives), with $14.08 Billion, $9.13 Billion, and $8.00 Billion, respectively.

According to CoinDesk, in 2021, CME reported an average daily volume of 10,105 bitcoin futures contracts, up 13% on the previous year. CME is one of the world’s largest and most regulated crypto futures platforms.

How Crypto Futures Trading Volume Influences the Cryptocurrency Market

Inferences From Trading Volume

A higher trading volume of cryptocurrency results in more equitable pricing and reduces price distortion, reflecting the equilibrium of opinions between buyers and sellers. It also indicates a high level of market interest and activity.

A low trading volume may signal a lack of market interest, as sellers’ asking prices fail to meet the bids of potential buyers. It may also imply inefficiencies and minimal trades in the market.

Trading volume often surges during significant price fluctuations as traders react to market events and opportunities. For instance, trading volume hit an all-time high during the 2020 COVID meltdown as investors scrambled to cash out or swoop for deals.

Trading volume can also affect the volatility of cryptocurrencies, as it measures the intensity and frequency of price changes. High trading volume can indicate high volatility, reflecting strong market sentiment and rapid price movements.

Conversely, low trading volume can indicate low volatility, reflecting weak market sentiment and slow price movements. However, low trading volume can also precede sudden price spikes, as many trades can significantly impact the price.

External factors like regulations, news, events, and trends influence trading volume. For example, the announcement of the Bitcoin futures launch by the CME Group in 2017 boosted the trading volume and price of Bitcoin.

Trading volume can also vary across different exchanges, platforms, and regions.

For example, some exchanges like BingX, Kraken, Phemex may have higher trading volume due to their reputation, security, fees, and features.

Some platforms may offer more types of crypto futures and derivatives, such as options and perpetual swaps, which can attract more traders. Some regions may have higher trading volumes due to their legal status, adoption, and cryptocurrency demand.

Data Sources and Metrics

When engaging with crypto futures trading volume, your understanding of the market hinges on the data you access. Reliable sources and meaningful metrics are vital for informed trading decisions.

- Volume Data Sources

Your primary avenue for obtaining cryptocurrency futures trading volume data is through exchanges.

Crypto exchanges like the Chicago Mercantile Exchange (CME) and the Chicago Board Options Exchange (CBOE) are instrumental in providing real-time trading volume data.

Digital platforms aggregate this information from various exchanges, offering a consolidated view.

The key benefits of using exchange data include accuracy and timeliness, while aggregators score high on coverage, collating data from multiple sources.

However, accessibility and the inclusiveness of data vary across different providers.

- Metrics for Trading Activity

From the volume data gathered, several metrics help interpret market conditions.

Open Interest measures the total number of outstanding contracts that have not been settled, indicating market participation.

Meanwhile, the funding rate reflects the cost of holding positions, affected by the difference between futures and spot prices. The basis, or the price difference between futures contracts and the spot price, can signal market sentiment.

Another critical metric is the relative volume, which compares volume data against past averages to spot anomalies.

Lesser known yet insightful, the Money Flow Index incorporates price and volume to discern buying or selling pressure.

The On Balance Volume takes cumulative volume flow to predict changes in price momentum.

Each indicator offers a different view on market dynamics, helping you leverage volume data effectively for futures trading on crypto exchanges.

Volume Analysis and Interpretation

Understanding volume analysis is crucial for interpreting market trends and making informed trading decisions in the cryptocurrency futures market.

Technical Analysis

In technical analysis, you use various charts and tools to study price movements and spot trends.

Candlestick charts are handy for understanding the trading volume of crypto futures. Each candlestick reflects the opening and closing prices and the trading volume in that period.

Significant volume alongside a price spike can indicate strong market sentiment, whereas a trend with dwindling volume may suggest a waning momentum and a possible reversal.

It’s essential to recognize that spikes in volume, whether buying or selling, can dramatically affect volatility.

It would be best to look for certain formations, like bullish or bearish divergences, to interpret volume effectively.

For instance, if prices are rising but volume is falling, it could signal that the uptrend is not supported by intense buying pressure and may potentially reverse.

Market Indicators

The volume serves as a critical market indicator to evaluate the strength of price movements and the level of liquidity in the crypto futures market.

Increased trading volume correlates with high liquidity, making executing trades at your desired prices easier. This is known as price discovery, where the market collectively reaches a consensus on price due to ample buying and selling activities.

Employing volume-based indicators like the Volume Weighted Average Price (VWAP) can help you determine the average price a security has traded at throughout the day, based on both volume and price.

This is particularly relevant for traders looking to get in or out of positions without disrupting the market price.

Analyzing volume in conjunction with price provides insights into market trends.

A rising price accompanied by increasing volume can indicate a healthy trend, whereas a rising price against decreasing volume might suggest a forthcoming downtrend.

Remember, trading strategies should involve assessing volume changes to predict future movements more accurately.

Volume can also offer hints about potential price discoveries during a trend. For advanced interpretations, study the relationship between price movements and trading volume using analytical tools to uncover patterns that could indicate a market’s direction.

Monitor external factors like news, regulations, and technological innovations, which can influence trading volume and the broader market.

Your ability to interpret these factors through the lens of volume analysis can give you a more nuanced understanding of the market’s behavior.

Trading Volume and Price

In cryptocurrency futures, trading volume—representing the number of contracts traded within a specific timeframe—is crucial in influencing the underlying asset’s price.

The interaction between volume and price is a core aspect of market dynamics, where an increase in trading volume often signifies heightened trading interest, potentially leading to significant price movements.

Trading volume impacting price:

- Price Pressure: High futures trading volume might indicate an impending price movement. For instance, if volume surges alongside a price uptrend, it could reinforce the upward trajectory.

- Price Discovery: Volume analysis helps establish the spot price by reflecting traders’ consensus on an asset’s value.

- Price Convergence: In futures markets, an increase in volume can lead to convergence towards the spot market, creating a more unified pricing structure.

Influences on Spot and Futures Prices:

- Volume & Spot Price: A robust futures market volume can often precede changes in the spot market as traders anticipate movements.

- Volume & Fluctuation: Sudden spikes or drops in volume can cause sharp fluctuations, affecting traders’ short-term strategies.

| Volume Increase | Price Impact | Market Perception |

|---|---|---|

| High | Likely to Rise | Bullish sentiment, increased demand |

| Low | May Decline | Bearish sentiment, decreased demand |

Using technical analysis tools like volume indicators, you can gauge the strength of a price trend. A high volume associated with a price change often implies a strong trend, while a weak volume might suggest a lack of conviction or an impending reversal.

Volume, therefore, is not just a number—it’s a story of supply and demand, the struggle between bulls and bears, and a precursor to the shifts in the tides of the cryptocurrency markets. Observing volume trends alongside price movements allows you to navigate the market with a more discerning eye for potential outcomes.

Trading Volume and Liquidity

When you engage in crypto futures trading, you’re essentially speculating on the future price of a cryptocurrency.

The volume of these futures trades is a powerful indicator of liquidity, the ability to buy or sell an asset without causing significant price movement.

High trading volume in the futures market can reflect heightened liquidity in the spot market as it signals active interest.

Generally, the higher the volume, the more depth the market has, meaning there are many buy and sell orders at various prices.

This can reduce slippage, which is the difference between the expected price of a trade and the price at which the trade is executed.

Market Efficiency is also influenced by trading volume. Markets are considered more efficient when sufficient liquidity absorbs large trades without destabilizing prices. Here’s how different liquidity indicators can be affected:

- Open Interest: This represents the total number of outstanding futures contracts. A rising genuine interest alongside increasing volume may signify a robust market sentiment.

- Funding Rate: In perpetual futures contracts, this rate is paid by one side of the contract to the other, often signaling which side is more aggressive; volume spikes can cause fluctuations in this rate.

- Basis (or Spread): This is the difference between the spot and futures prices. Higher trading volume can narrow the spread by aligning futures prices more closely with the spot price.

- Skew: It measures the difference in implied volatility between put options and call options. Volume changes can impact market expectations of future price movements, reflecting the skew.

Various tools analyze these indicators, like charts to visualize trends and tables to compare figures.

Understanding the interplay between futures trading volume and liquidity gives you an edge in navigating the market.

Remember, while high volume can suggest deeper liquidity, it doesn’t inherently guarantee market stability.

Trading Volume and Volatility

When you engage with the cryptocurrency market, you’ll quickly notice that trading volume and volatility are tightly interwoven, especially in crypto futures.

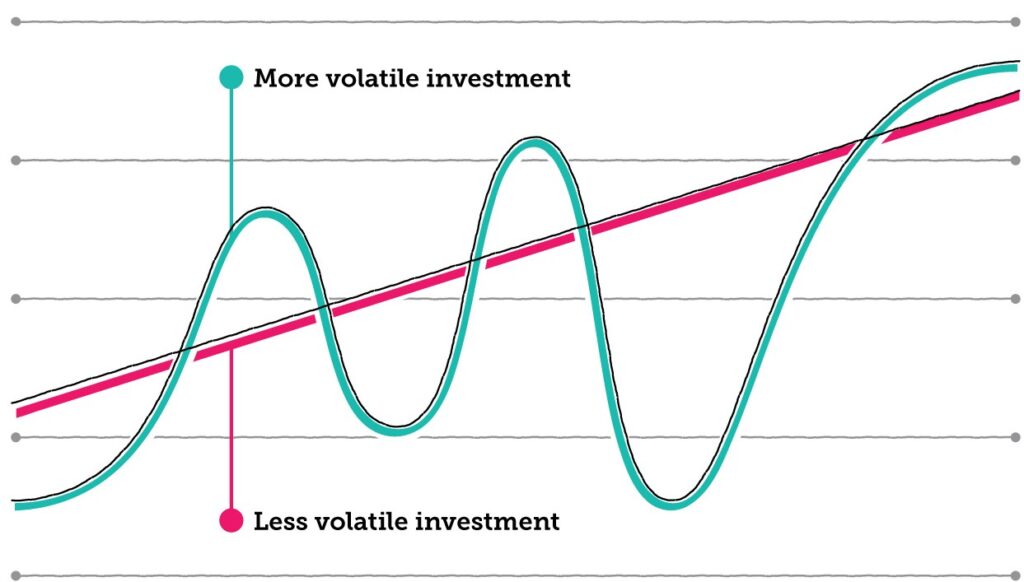

Volume signifies the total number of crypto futures contracts traded within a specific timeframe. At the same time, volatility reflects the rate at which the underlying asset’s price moves up or down.

Higher trading volumes typically indicate large amounts of capital movement, which can increase the volatility of the underlying cryptocurrency. This is because significant trading activity can signal to other market participants that valuable information may be decoded from such trades, prompting them to adjust their strategies accordingly.

For instance, if the market predominantly consists of long futures contracts in a high-volume trading scenario, it can push the spot market prices upward, as these positions bet on rising prices. Conversely, a preponderance of short positions might suggest that traders anticipate a price drop, which can result in quick selloffs and increased volatility.

Exhaustion can occur when a volume surge fails to sustain the price movement direction, indicating that a reversal may be imminent. Monitoring this as part of your hedging strategy is essential, as it can protect against unexpected market shifts.

| Volatility Indicator | Description |

|---|---|

| Standard Deviation | Measures the amount of price variation or dispersion. |

| Historical Volatility | Gauges the fluctuation of historical prices. |

| Implied Volatility | Reflects market forecast of likely movement. |

Tools like charts and graphs can help you visualize the relationship between futures trading volume and underlying asset volatility.

Keeping an eye on volume can provide insights into potential price changes and help anticipate market sentiment, assisting you in making more informed trading decisions.

Frequently Asked Questions

The volume of trading in crypto futures is an essential metric that influences market dynamics and trader decision-making. Understanding it can enhance your trading strategies.

What factors determine crypto futures trading volume?

The trading volume for crypto futures is influenced by market sentiment, investor activity, and global economic events. For instance, a high volume indicates many contracts being traded, which could be triggered by news about regulatory changes or technological advancements.

What are the benefits of high trading volume for crypto futures markets?

A high trading volume in the crypto futures markets typically signals a healthy level of liquidity, making it easier for you to execute trades at competitive prices. It also suggests greater market interest and participation, leading to more efficient price discovery.

How do traders interpret changes in trading volume when trading crypto futures?

Traders view an increase in trading volume as an affirmation of the current price trend, implying firm market conviction. Conversely, a decrease may indicate that the trend is losing momentum. Your analysis of volume changes alongside price action can inform your trading decisions.

Conclusion

Crypto futures trading volume is a vital indicator of market activity, providing insights into liquidity and market sentiment.

A higher trading volume implies a robust market where assets are exchanged efficiently, leading to more stable and reliable pricing.

Conversely, low volume may indicate reduced confidence or interest, affecting liquidity and potentially leading to price volatility.

For you as a trader or investor, understanding these metrics is crucial for making informed decisions.

Volume analysis should be part of your toolkit, allowing you to detect potential trends and price movements.

The impact of futures trading volume on the cryptocurrency market should not be underestimated—it often reflects the underlying strength or weakness of market trends.

Implications for Market Participants:

- Traders: Utilize volume as a critical metric to assess trade entry and exit points and anticipate market moves.

- Investors: Consider volume trends for long-term investment strategies, recognizing high volume as a sign of a healthy and active market.

- Analysts: Integrate volume data into comprehensive market analyses to predict market dynamics and investor behavior.

To navigate the futures market effectively, continue to educate yourself on trading practices, stay updated with market developments, and use volume as one of your strategic tools for analyzing market conditions.

Always approach trading with discipline and an awareness of the risks involved, applying volume analysis to sharpen your market insights.