Bitget, established in 2018 with its headquarters in Singapore, is a prominent player in the crypto derivatives exchange arena, which makes this possible.

You can access various futures contracts that offer leverage through a user-friendly interface, potentially amplifying your trading strategies.

As a leading Web3 company, Bitget boasts a substantial user base with a sizeable daily trading volume, illustrating its reputable position in the market.

The platform is designed to cater to beginners and experienced traders by providing features like low transaction fees, high-leverage options, and a diverse range of contract types.

This combination of benefits makes Bitget an attractive exchange for those looking to start trading crypto futures.

How to Trade Crypto Futures on Bitget: Bitget Futures Trading Strategy & Basics

When trading crypto futures on Bitget, leverage plays a crucial role.

This tool allows you to multiply your exposure to a position without increasing your capital investment. However, it comes with increased risk.

A slight price movement can lead to significant profits or losses with leverage. Margin is the capital required to open and maintain a leveraged position, acting as collateral.

If the market moves against your position, you may face liquidation, where your position is automatically closed to prevent further losses.

Bitget offers two types of margin modes: cross margin and isolated margin. Cross-margin mode pools all available balances in your account to prevent liquidation.

In contrast, isolated margin mode limits your potential losses to the margin placed on a specific position, safeguarding the rest of your funds from liquidation risks.

To ensure fairness in pricing, Bitget uses an index price, a composite of prices from multiple exchanges, to represent the actual spot price of an asset.

Fair prices are used to avoid unnecessary liquidations during market manipulation or volatility.

Moreover, the funding rate ensures that future prices are anchored to spot prices. It’s exchanged between long and short traders and varies with market conditions.

Use the Bitget order calculator to estimate potential profits and losses for effective risk management. This can help you make informed decisions and manage your positions responsibly.

- Leverage: Multiplies investment exposure.

- Margin: Collateral for leveraged positions.

- Liquidation: Automatic closure of high-risk positions.

- Cross Margin: Complete account balance used to cover losses.

- Isolated Margin: Limits losses to the specific position’s margin.

- Index Price: Reflects the average asset price from several exchanges.

- Fair Price: Counters volatility and manipulation.

- Funding Rate: Balances futures and spot prices.

How to Create an Account on Bitget

The first step to trading crypto futures with Bitget is registering for a free account. This can be done either through the Bitget website or by downloading the Bitget app on your smartphone.

- Navigate to the Registration Page

- On the Bitget website, click on the “Sign Up” button.

- In the app, find the registration entrance.

- Choose Your Registration Method

- You can register using a valid email address or mobile number or connect a Google, Apple ID, Telegram ID, or web3 wallet such as Metamask.

- Create a Strong Password

- Choose a robust password to enhance the security of your account.

- Complete KYC Verification

- Provide the required personal information.

- Upload identification documents (such as a national ID, passport, or driver’s license) to verify your identity.

- Submit a selfie as part of the verification process to confirm your identity matches the provided documents.

- Verify Your Contact Information

- A verification code will be sent to your chosen email or mobile number.

- Enter the code to confirm the legitimacy of your contact information.

- Enable Security Features

- For added security, enable two-factor authentication (2FA), which provides an extra defense against unauthorized access.

Once these steps are complete, your Bitget account will be set up and ready to use. Keep your password secure, and do not share your login credentials with anyone. With your new Bitget account, you can deposit funds and start trading crypto futures.

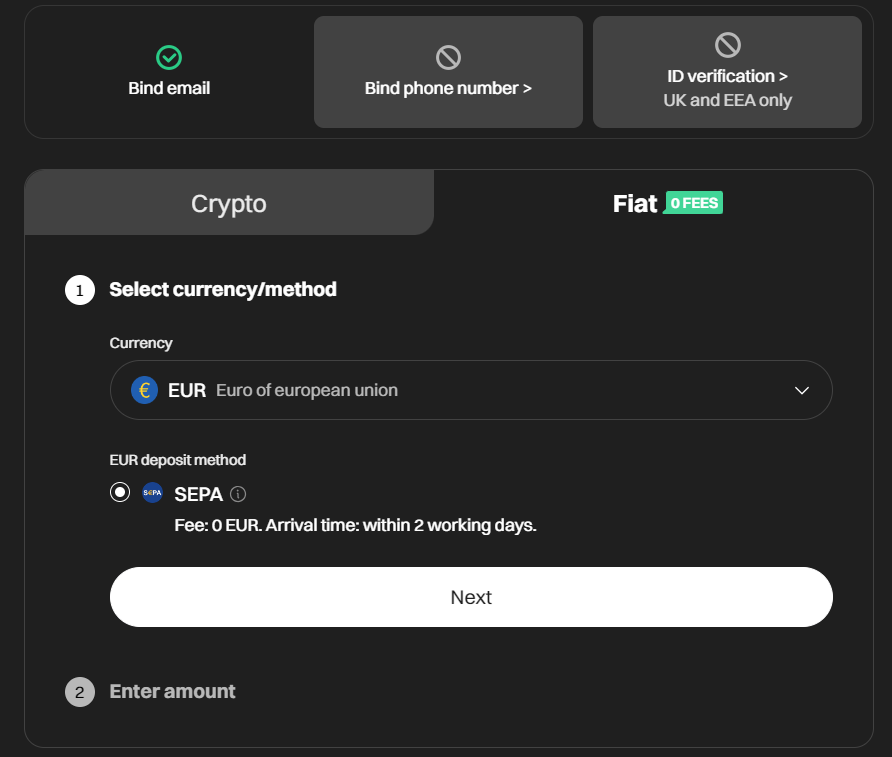

How to Deposit and Withdraw Funds on Bitget

To start trading crypto futures on Bitget, you must deposit funds into your account. For cryptocurrency deposits:

- Log in to your Bitget account.

- Navigate to Assets > Spot Account > Deposit.

- Select the cryptocurrency you wish to deposit.

- Use the provided address or QR code to transfer crypto from an external wallet.

For fiat currency deposits with a credit card:

- Go to Buy Crypto.

- Choose the Credit/Debit Card option.

- Follow the on-screen instructions to finalize the deposit.

To withdraw funds:

- Click on the Wallet icon and select Withdraw. (Note: Withdrawals are from your spot account).

- Select the cryptocurrency and enter the external wallet address for a crypto withdrawal.

- For fiat withdrawal, choose the fiat currency and the withdrawal amount. Then, confirm the transaction details.

Transfer funds between your Spot and Futures account by selecting the Transfer option in the Assets section. The transfer incurs no fees and is instant.

Bitget supports various fiat currencies and payment methods, including bank deposits and withdrawals.

Always check for the minimum and maximum limits for transactions, along with any fees.

Processing time varies; crypto transactions typically take a few minutes to an hour, while fiat transactions can take several business days based on the payment method and bank processing times.

Bitget’s platform clearly outlines any associated fees before you confirm a transaction.

How to Transfer Funds to the Futures Wallet

When trading crypto futures on Bitget, you must understand that you have two separate wallets: the Main and Futures Wallets.

The Main Wallet stores your funds by default when you deposit into Bitget. These funds are used for spot trading and other standard exchange operations.

In contrast, the Futures Wallet is designated for use in the futures market; you must transfer funds there before you can start trading futures contracts.

Transferring funds from your Main Wallet to your Futures Wallet on Bitget is straightforward:

- Log in to your Bitget account.

- Navigate to the Futures section.

- Locate and click on the Transfer option.

- You’ll be prompted to select the currency you wish to transfer.

- Enter the amount you want to move from the Main Wallet to the Futures Wallet.

- Confirm the transfer details and complete the transaction.

Supported Currencies and Transfer Limits:

- Bitget supports a variety of cryptocurrencies for futures trading, including but not limited to BTC, ETH, and LTC.

- The platform will specify the minimum and maximum transfer amounts for each currency. These limits can vary, ensuring traders can manage their risk and investment size according to their preferences.

Transferring funds into your Futures Wallet is essential to participating in the futures markets. Keep an eye on transfer minimums and maximums to control your trading activity.

How to Choose Between Coin-Margined and USDT-Margined Futures

When diving into crypto futures on Bitget, you must decide which type of contract aligns with your trading strategy: coin-margined or USDT-margined futures.

Coin-margined futures involve the underlying cryptocurrency as collateral. This means your future contract is leveraged against coins like BTC or ETH. These are beneficial if you prefer holding the actual asset and are looking at long-term investments.

USDT-Margined Futures uses USDT, a stablecoin pegged to the US dollar, providing convenience and simplicity. They’re designed to be straightforward, as profits and losses are directly represented in fiat value.

Pros and Cons:

| Coin-Margined | USDT-Margined | |

|---|---|---|

| + | Holding the actual crypto asset | Convenient, simple calculations |

| Potentially beneficial for long-term | Direct accounting in fiat | |

| – | Complex margin risk management | Less exposure to the underlying asset |

Examples on Bitget:

- Coin-Margined: You might engage in a BTC-margined future, where your profits and losses are realized in Bitcoin itself.

- USDT-Margined: Opting for a USDT-margined contract, you would trade based on a fiat value peg, such as the USDT-margined BTC future, where outcomes are measured in the stablecoin equivalent.

Choose coin-margined futures if you are comfortable with complexity and aim for asset accrual.

Conversely, USDT-margined futures are suitable if you favor simplicity and stable value calculation during volatile market movements.

Your preference for risk exposure and how you want your returns denominated are critical determinants in your choice of Bitget.

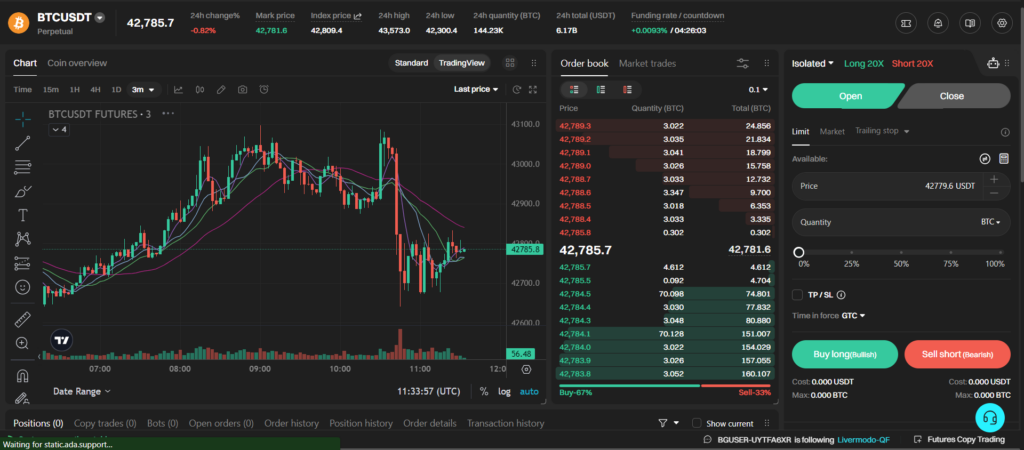

How to Understand the Futures Trading Interface on Bitget

When you log into Bitget, you’ll first see the futures trading interface, which can seem quite complex at first glance. The layout is designed to provide real-time data and trading tools you need to execute trades effectively.

- Chart Area: This interface portion presents a dynamic chart displaying the price movements of various cryptocurrencies, including Bitcoin. You can customize the chart with different time frames and technical indicators to analyze market trends.

- Order Book: Located next to the chart, the order book is a list showing all current orders for buy and sell in the market. This table aligns buy orders in green and sell orders in red, helping you grasp the market depth and the potential direction of price movement at a glance.

- Order Panel: Below the chart is where you can execute your trades. You’ll find options to place different orders, such as market or limit orders. To buy or sell futures contracts, choose your order type, set your prices and quantities, and confirm the transaction.

- Position Panel: Here, you’ll see all your open positions, including the size, entry price, unrealized profit and loss (P&L), and margin. This panel is crucial for monitoring and managing your trades, allowing you to make timely decisions based on market changes.

- Trade Executions and Order History: Beneath the position panel lies a record of your executed trades and a tab to view your comprehensive order history. This helps track your trading activity and performance over time.

Finally, Bitget’s interface is accessible on desktop and mobile apps, proceeding the go.

These tools allow you to interact confidently and efficiently with the crypto futures market. Trading involves risk, and proceeding with knowledge and caution is necessary.

How to Place and Manage Orders on Bitget Futures

Understanding placing and managing orders effectively is crucial to trading on Bitget Futures. Mastery of order types and leverage settings can significantly impact your trading outcomes.

Placing and Managing Orders

- Choosing a Trading Pair and Contract Type

First, select a trading pair such as USDT/BTC. Then, decide on the specific futures contract you want to engage with. These contracts often come with different expiration dates or can be perpetual.

- Setting Leverage

Determine the level of leverage you’re comfortable with. Leverage amplifies potential profits and losses, so choose a level that aligns with your trading strategy and risk tolerance.

Order Types: Limit, Market, and Stop Orders

- Limit Order: A limit order allows you to specify the exact price you want to buy or sell. This ensures precise entry points but may delay execution if the market doesn’t reach your price.

- Market Order: Market orders are executed immediately at the current market price, ensuring your position is opened or closed quickly.

- Stop Loss: A stop loss is critical for managing risk. Set this at a price that limits your potential loss on a position.

- Placing Orders

To place an order:

- Navigate to the Bitget Futures trading interface.

- From the order panel, choose the ‘Limit’ or ‘Market’ order.

- Input the quantity of the contract you wish to trade.

- For limit orders, set the price. This is not required for market orders.

- Assess and set the leverage slider as needed.

- Confirm and execute your order.

- Managing Positions and Leverage

After execution, monitor your positions closely. Adjust leverage if necessary, considering higher leverage increases exposure to upside and downside fluctuations.

- Managing and Closing Positions

You can close your position by executing an order opposite your opening trade. For instance, if you buy a contract, you close by selling an equivalent contract amount, and vice versa.

- Understanding Funding Rates and Settlement

Futures contracts on Bitget come with a funding rate paid to long or short positions, typically exchanged every 8 hours. This rate ensures that future prices align with spot market prices. Positions held at the time of settlement will need to account for this rate.

- Settlement Mechanism

Positions on Bitget Futures are marked to market, meaning they are valued at the current market price, and profits or losses are realized at the point of settlement or when the position is closed.

Trading on Bitget

Futures involve significant risk and potential rewards. They are employing a disciplined, informed approach when trading and managing your positions is essential.

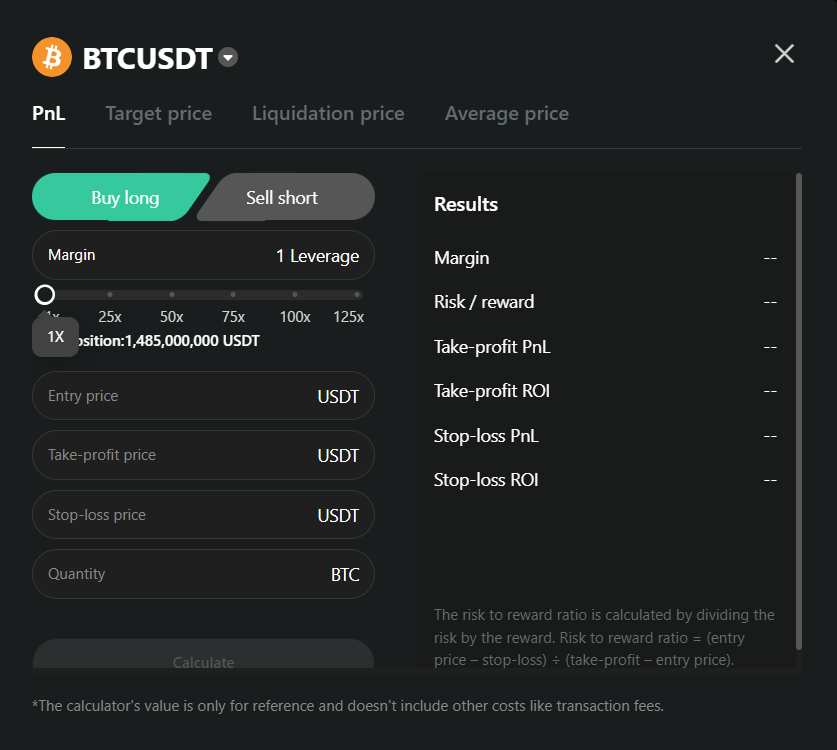

How to Use the Bitget Order Calculator

The Bitget order calculator is an essential tool for managing your futures trades. This feature aids in the calculation of potential profit/loss, required margin, and the liquidation price before you execute your trade.

Accessing the Calculator:

- Navigate to the Bitget trading page.

- Find the calculator icon typically located near the order entry fields.

Using the Calculator:

- Select the Contract: Choose the futures contract you plan to trade.

- Set Your Parameters:

- Position Margin: Input the margin you will lock for the trade.

- Entry Price: The price you intend to enter into the futures contract.

- Close Price: Your expected price level for closing the contract.

- Choose the Leverage: Specify the leverage you wish to use, which amplifies your buying power.

Interpreting Results:

- P/L (Profit/Loss): The potential gain or loss for the trade based on your inputs.

- Liquidation Price: The price at which your position will be automatically closed due to insufficient margin.

Examples:

- Scenario 1: You are bullish on BTC and enter a long futures position with a 10x leverage. Utilize the calculator to identify the liquidation price to manage risk.

- Scenario 2: For short positions, the calculator helps to determine the close price needed for a desired return, considering the impact of the chosen leverage.

Remember, while the Bitget order calculator is a helpful resource for planning your trades, it’s essential to factor in transaction fees and slippage, which can affect trade outcomes. Use it as a guide, not as a guarantee of results.

How to Use the Bitget Copy Trading Feature

Bitget copy trading offers an accessible approach that allows you to mirror the trades of professional traders. This feature taps into their expertise and strategies without requiring you to manage every trade actively. To leverage this innovative platform, follow these steps:

- Create a Bitget Account: If you’re new to Bitget, set up an account. Ensure you complete all required security measures and verifications.

- Navigate to Copy Trading: On the Bitget website or mobile app, look for the ‘Copy Trading’ option. Here, you’ll find two main copy trading categories:

- Spot Copy Trading: Useful for copying trades involving cryptocurrencies like Bitcoin and Ethereum without leverage.

- Futures Copy Trading: For copying trades that involve bitcoin futures contracts or Ethereum with leverage, providing the potential for higher returns (and higher risk).

- Select a Trader to Follow: Professionals are ranked by their performance metrics, such as ROI, win rate, and the size of their managed assets (AUM).

Metrics to Consider Description ROI Reflects the return on investment of the trader’s strategies. Win Rate Shows the percentage of trades that have closed profitably. AUM Indicates the total assets under management, providing a sense of trust and scale. - Evaluate and Choose: Assess the traders based on their portfolio performance and trading strategies. It’s crucial to align their risk management practices with your risk tolerance.

- Set Parameters: Once you’ve selected a trader, you can set specific parameters for copy trading, such as the amount of capital to allocate and the stop-loss limits.

Benefits of using Bitget copy trading include exposure to experienced trader strategies and a potentially diversified portfolio.

However, it’s wise to remember that trading carries inherent risks, and past performance doesn’t guarantee future results.

To optimize your experience:

- Start with a small amount to understand the system’s dynamics.

- Regularly review and adjust your chosen traders based on performance.

- Always maintain a level of risk management that suits your investment goals.

Conclusion

Trading crypto futures on Bitget can be strategic if you want to diversify your experience beyond traditional spot trading.

Bitget is known for its intuitive platform, offering leverage and the ability to long or short various cryptocurrencies.

Key advantages of trading with Bitget:

- Leverage: Enhance your trading power with leverage options.

- Variety: Access a wide range of digital assets beyond just Bitcoin.

- Fees: Benefit from competitive trading fees in the market.

Steps for beginning your journey in crypto futures on Bitget:

- Register: Open your account at the Bitget website.

- Verify: Ensure you complete the necessary KYC procedures.

- Fund: Deposit funds, be it BTC, USDT, GBP, or other supported fiat and cryptocurrencies.

- Trade: Navigate to the futures section and execute your transactions.

Remember, futures are derivative products, distinct from spot trading. They allow speculation on the future price of an asset. If you are accustomed to exchanges like Binance, you’ll find Bitget’s trading exchange platform user-friendly and robust.

For a detailed Bitget review or additional crypto trading and futures resources, consider exploring educational materials from recognized third-party finance and cryptocurrency authorities.

Note: Always employ risk management strategies and trade responsibly.

Support: If you have questions or need support while trading on Bitget, visit the Support Center for assistance.

Explore how Bitget compares to its competitors:

- Bitget vs Binance: Ultimate Trading Platform Comparison

- Bitget vs Phemex: Ultimate Trading Platform Comparison

- Bitget vs BingX: Ultimate Trading Platform Comparison

- Bitget vs Bybit: Ultimate Trading Platform Comparison