BingX, established as a global cryptocurrency exchange, offers a platform to engage in futures trading among various other financial instruments linked to the world of digital assets.

With over 5 million users, BingX boasts a significant user base and an impressive average daily trading volume, highlighting its status as a preferred hub for crypto enthusiasts.

The exchange is renowned for its user-friendly features catering to novice and experienced traders, providing tools such as copy trading and grid bots to automate and enhance trading strategies.

Low fees and high liquidity make BingX stand out, ensuring you can execute trades swiftly and at desirable prices.

How to Trade Crypto Futures on BingX: BingX Futures Trading Strategy & Basics

Trading crypto futures on BingX requires a solid understanding of trading strategies and risk management.

With futures, you can speculate on the price of cryptocurrencies without owning the actual assets. A well-crafted strategy helps you make informed decisions and manage your risks effectively.

Understanding Futures Trading Strategies:

- Trend Following: You’ll capitalize on the market’s momentum by identifying and following a trend.

- Scalping involves making numerous trades for small profit margins throughout the day.

- Hedging: Protect your portfolio from adverse price movements by taking an opposite position to your current holding.

- Index and Fair Price: Watch the index and fair prices for discrepancies that can signal trading opportunities.

- Funding Rate: The rate can influence your returns, especially in perpetual contract trades.

Applying Strategies on BingX:

- Always start with a thorough market analysis before entering a trade. This will guide you in selecting the right trading pair and position (long or short).

- Choose between an Isolated Margin to limit risk to a single position or a Cross Margin for risk spread across all open positions.

- Utilize BingX’s Order Calculator to assess potential profits and losses, helping you stay informed about your exposure.

- Consider the order type best suits your strategy: Market Order for immediate execution, Trigger Order for specific conditions, or Limit Order for a predetermined entry point.

Best Practices:

- Regularly review your strategy and make adjustments as market conditions evolve.

- Implement stop-loss orders to mitigate unforeseen losses.

- Keep abreast of market news and developments, as they can profoundly impact futures prices.

- Practice trading with a demo account on BingX to familiarize yourself with the platform’s tools and features before risking natural capital.

How to Create an Account on BingX

To engage in crypto trading as a trader on BingX, sign up for a free account by following these straightforward steps:

- Go to the BingX Website or App:

Launch your web browser and visit the official BingX website, or download the BingX app from your mobile’s app store. - Initiate Registration:

Click on the “Register” button, typically located at the top navigation bar of the page. - Provide Your Details:

- Select your preferred registration method using your email address or phone number.

- Enter your details in the provided fields.

- If you have a referral code, enter it here to potentially benefit from bonuses for new users.

- Verification Process:

- Upon submission, you’ll receive a one-time password (OTP) via email or SMS, depending on your registration method.

- Validate your account by entering the OTP.

- Security Settings:

- Complete your security settings by setting up a strong password.

- Opt-in for two-factor authentication (2FA) to enhance the security of your assets.

After these steps, your BingX account is ready for crypto futures trading.

Take the time to familiarize yourself with the platform’s interface and consider exploring educational resources that BingX offers to enhance your trading strategies.

Secure trading practices begin with a secure account, so never compromise your security settings.

How to Deposit and Withdraw Funds on BingX

When you’re ready to manage your funds on BingX, the platform makes it streamlined for depositing and withdrawing crypto and fiat currencies. Here’s a simplified walkthrough to assist you in these transactions.

Depositing Funds

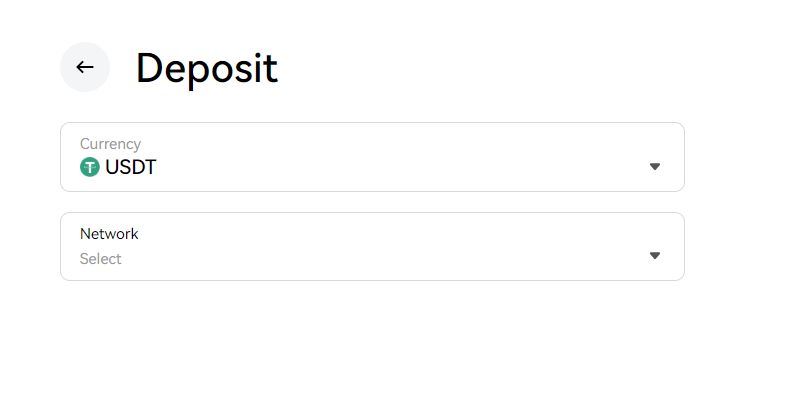

To deposit funds:

- Log into your BingX account.

- Click the wallet icon at the top right corner.

- Select Deposit, choose your desired currency (e.g., USDT, BTC) and network.

- You’ll be provided with a deposit address. Copy this address.

- Go to the withdrawal platform (where your funds currently are) and initiate a transfer to the copied address.

Withdrawing Funds

To withdraw funds:

- Navigate to the Withdraw section of your wallet.

- Verification might be required for security, such as a code from Google Authenticator or via your phone.

- Please enter the amount you wish to withdraw to ensure it’s within BingX’s set limits.

- Confirm the transaction details and submit your request.

Payment Methods, Limits, and Fees

- Payment methods include bank transfers, credit/debit cards, and supported crypto transfers.

- Minimum and maximum limits vary by currency; check the platform for precise figures.

- Fees are usually a small percentage of the transaction, and BingX may offer different rates for larger trades.

- Stablecoins like USDT can efficiently move fiat-equivalent values into and out of your BingX account.

Processing Time

Transactions usually reflect quickly. Crypto asset transfers depend on the network speed and congestion, while fiat transactions might take several business days, depending on your bank and location. Always check the current conditions for the most accurate processing times.

How to Transfer Funds to the Futures Wallet

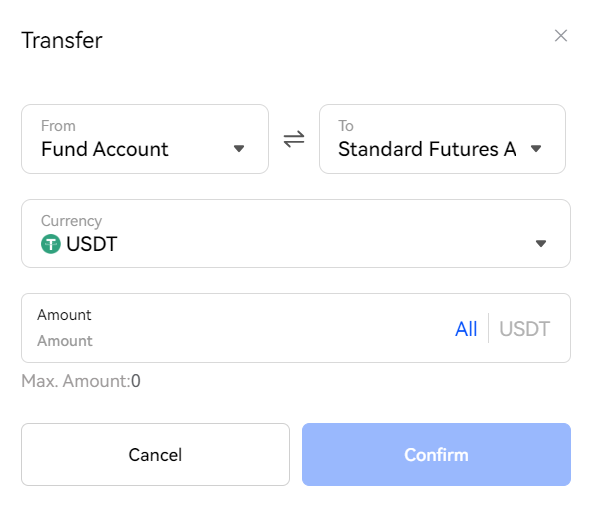

Before engaging in futures trading, you must transfer funds from your spot wallet to your futures wallet on BingX.

Your spot wallet contains the currency available for immediate transactions. In contrast, your futures wallet is designated for engaging in futures contracts, a type of derivative trading where you agree to buy or sell a financial instrument at a predetermined price in the future.

To transfer funds:

- Log in to your BingX account.

- Navigate to the “Wallet” section.

- Locate and click on the “Transfer” option.

- Select the “From Spot Wallet to Futures Wallet” transfer direction.

When transferring funds, be aware of the supported currencies. BingX supports a variety of currencies, ensuring traders from the EU, Canada, Australia, and other regions can participate seamlessly.

Ensure you transfer the appropriate amount by considering minimum and maximum transfer limits.

These limits are in place to maintain market stability and protect traders. The specifics of these limits can typically be accessed within the transfer section or through BingX’s support channels.

Transferring funds within BingX between your wallets is generally swift and cost-free, allowing you to start trading futures confidently and efficiently.

How to Choose Between Standard Futures and Perpetual Futures

You can choose between standard and perpetual futures when trading cryptocurrency futures like BTC/USDT on BingX.

Each serves a different need based on your trading preferences, the type of exposure you seek, and the market strategies you want to employ.

Standard Futures

Standard futures are derivative contracts that obligate you to buy or sell an asset, such as BTC/USDT, at a predetermined price on a specific date in the future. They are a way to hedge against price movements or to speculate on them. It’s essential to note a few specifics about these contracts:

- Expiration Date: Standard futures have set expiration dates, after which the contract settles.

- Leverage: BingX allows trading standard futures with leverage. This means you can control a prominent position with relatively little capital.

Advantages:

- Protect against price volatility with a predefined settlement date.

- Provide opportunities for strategic long-term planning.

Disadvantages:

- Limited flexibility due to fixed expiration dates.

Examples:

- BTC/USDT quarterly futures expire on the contract month’s last FridayPerpetual Futures

Perpetual futures are a variant of futures contracts that do not have an expiration date, thus allowing you to hold a position for as long as needed.

Here are the unique characteristics of perpetual futures:

- No Expiry: Positions can be held indefinitely, with no need to roll over or settle until you decide to close.

- Funding Rates: They use a mechanism to anchor the market price to the spot price. This involves periodic payments between those in long and short positions based on market conditions.

Advantages:

- It is ideal for traders who wish to avoid the complexities of rolling over contracts.

- More flexibility and can react to market changes in real time.

Disadvantages:

- It involves regular funding payments that can add up over time.

Examples:

- Perpetual contracts like BTC/USDT mirror the spot market price with leverage.

By understanding the mechanisms of each type of futures contract offered on BingX, you can better align your trading strategy with your financial goals, risk tolerance, and market outlook.

Remember to evaluate market conditions and the unique features of standard and perpetual futures to make informed decisions.

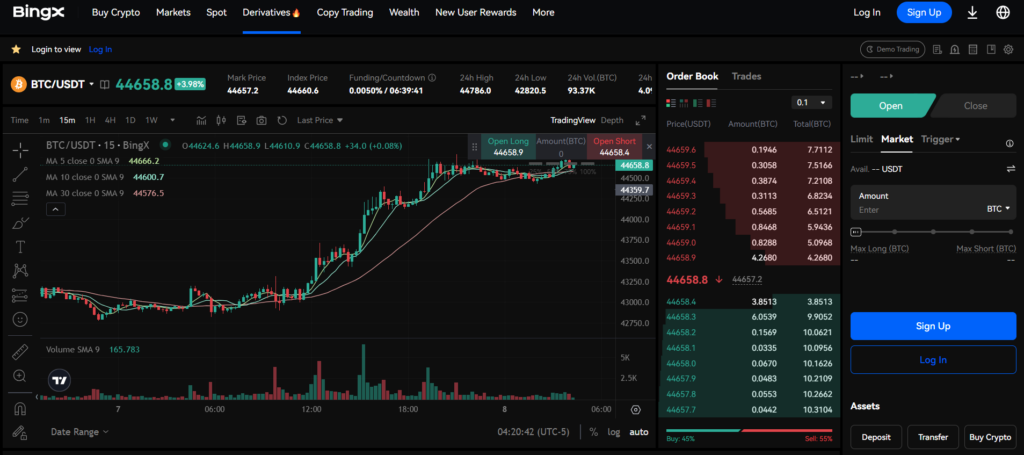

How to Understand the Futures Trading Interface

When you trade cryptocurrency futures with BingX, you interact with a comprehensive trading interface designed to provide all the essential information and tools at your fingertips.

Familiarizing yourself with the interface’s components is crucial to effectively navigating the market’s volatility.

- Chart Area: The chart displays the real-time market price with options for different timeframes and technical analysis indicators at the heart of the interface. It visually represents market trends and helps you make informed trading decisions.

- Order Book: Adjacent to the chart is the order book, which lists current buy and sell orders. It indicates market depth, showing the demand and supply volumes at different price levels. Monitoring this area helps you to gauge market sentiment and liquidity.

- Trade Panel: The trade panel is where you can place your orders. It typically includes fields to input the type of order (market, limit, etc.), the quantity, and the price. Advanced options may also allow for the direct placing stop-loss and take-profit orders.

- Position Panel: Once you enter a trade, your open position will be displayed in the position panel. This section shows critical information such as entry price, the current value of the position, and unrealized profit or loss, enabling you to manage your trades effectively.

- Customization and Tools: BingX offers customization options, allowing you to tailor the interface layout to your needs. You can move and resize elements to create a personalized trading environment. Additionally, the platform equips you with trading tools such as risk management features and access via iOS devices, ensuring you can trade on the go.

BingX strives to cater to experienced traders and newcomers venturing into cryptocurrency futures trading through its user-friendly interface and advanced trading tools.

How to Place and Manage Orders on BingX Futures

When trading crypto futures on BingX, you have several order types. Understanding and using these orders effectively is critical to managing price volatility and risk.

Market Order: This is an order to buy or sell immediately at the current market price. It’s advantageous for those aiming to enter or exit the market quickly but may result in slippage, especially during volatile market conditions.

Limit Order: A limit order lets you specify the price you want to buy or sell. You’ll avoid slippage with this order type as it’s only executed at your specified price or better.

Trigger Order: This is a conditional market order placed that triggers at a specified price. It’s often used for risk management strategies, like stopping losses.

Here’s how to execute orders:

- Log into your BingX account.

- Navigate to the Futures section.

- Select the asset you wish to trade.

- Choose from ‘Buy’ or ‘Sell’ to define your position.

- Specify your order type (Market, Limit, or Trigger).

- Set your leverage, which amplifies potential profits as well as risks.

- Confirm the margin requirements for your position.

The leverage and margin system requires careful consideration. Leverage can increase your exposure to the market with less capital, but it raises the stakes, making risk management practices crucial, like using stop-loss orders.

To manage an open position, monitor it in the ‘Positions’ tab. You can close it manually, or it may close automatically if the price hits your Stop Loss or Take Profit level.

Regarding settlements, remember that BingX futures have a funding rate exchanged between buyers and sellers, which can affect your trading costs. This rate ensures future prices are in line with the spot market.

Monitor fees and incorporate them into your strategy to ensure they don’t erode your potential profits. Understanding these mechanisms helps you trade with more confidence and clarity.

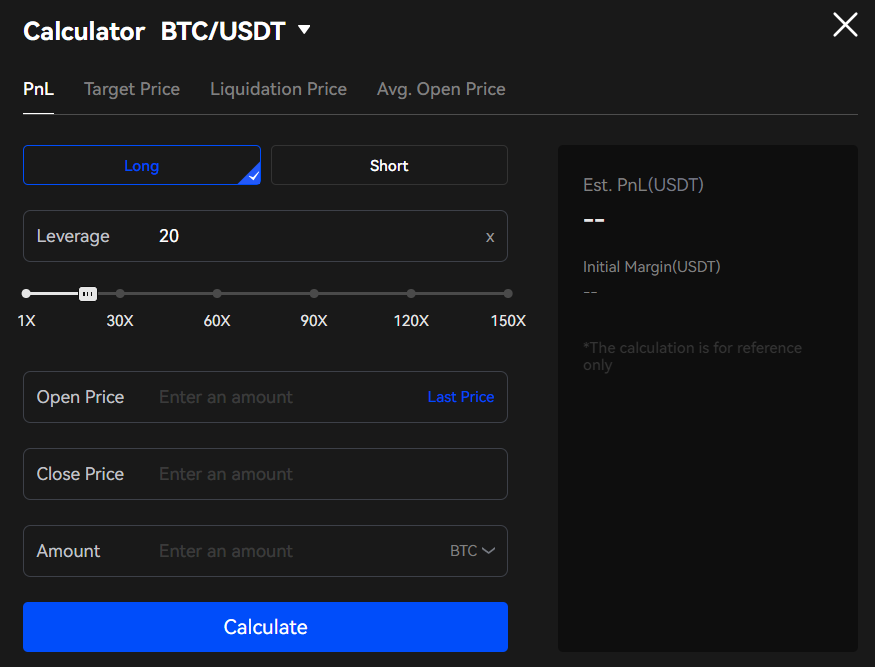

How to Use the BingX Order Calculator

The BingX order calculator is an essential tool for trading futures on the BingX platform. This calculator helps you determine potential profits and losses and manage risks associated with margin trading.

To access the BingX order calculator, navigate to the trading interface and look for the calculator icon, which is typically located near the order entry fields. Once you’ve opened the calculator, you’ll need to input several parameters:

- Entry Price: The projected price at which you plan to enter the trade.

- Exit Price: The anticipated price at which you intend to exit the trade.

- Position Size: The number of contracts or the value of your position.

- Direction of Trade: Indicate whether you are going “Long” (buying) or “Short” (selling).

After providing the required details, the calculator displays the following results:

- Required Margin: The amount of collateral required to open the position.

- Trading Fee: The cost incurred when entering and exiting the trade.

- Potential Profit or Loss: Estimated earnings or losses for the entered trade scenario.

Here are simplified examples:

- Going Long:

- Entry Price: $30,000

- Exit Price: $35,000

- Position Size: 1 BTC

- Result: Calculates the profit minus trading fees should the price rise to your exit point.

- Going Short:

- Entry Price: $30,000

- Exit Price: $25,000

- Position Size: 1 BTC

- Result: Determine the gain factoring in the trading fee if the price falls below your target exit price.

Always consider your financial situation before initiating trades, and use the order calculator to understand the potential outcomes of trades under varying market conditions.

How to Use the BingX Copy Trading Feature

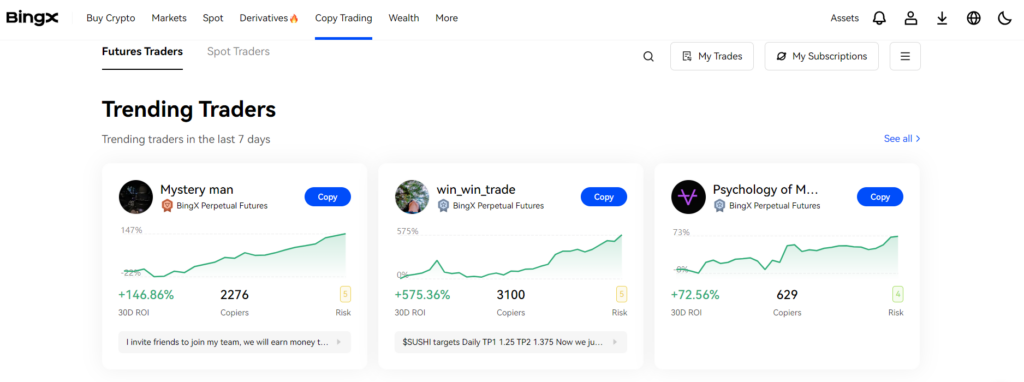

BingX offers a copy trading feature that allows you to tap into the expertise of seasoned traders within the BingX community.

This function is valuable for enhancing your trading experience by providing access to various trading strategies executed by other traders in real time, presenting a significant trading opportunity for both novices and experienced traders.

Accessing Copy Trading

To start using this feature:

- Navigate to the BingX platform

- Select Copy Trading from the homepage; this could be through the web or the mobile app.

Selecting a Trader

When you reach the copy trading section:

- Look for Trending Trader or Conservative Trader lists.

- These lists are created based on the traders’ historical performance and reliability.

- Click on a trader of your choice to inspect their trading history and statistics.

Setting Up Copy Trading

Upon choosing a trader, you need to set your parameters:

- Define the amount of funds you want to allocate.

- Set a stop-loss limit to minimize potential losses.

- Monitor the trader’s performance and adjust your settings at any time.

Using Different Strategies

Different traders employ diverse strategies:

- Aggressive traders may offer high-reward opportunities but carry higher risks.

- Conservative traders usually focus on stability and steady growth.

- Choose a strategy that aligns with your risk tolerance and investment goals.

You can learn from successful traders using the BingX copy trading feature while managing your risk exposure.

Review each trader’s performance metrics and risk level to align with your investment objectives.

How to Use the BingX Futures Grid Bot

The BingX Futures Grid Bot is an innovative tool allowing automated futures trading on the BingX platform.

This trading bot especially thrives in periods of market volatility, as it can systematically execute trades based on predefined parameters, efficiently managing market risk.

To start utilizing the BingX Futures Grid Bot, you need to:

- Log in to your BingX account.

- Navigate to Grid Trading → Futures Grid via the platform’s interface.

Within the Futures Grid section, you will be prompted to configure the bot settings:

- Trading Pair: Select the cryptocurrency pair you wish to trade.

- Grid Quantity: Determine the number of grids. More grids equate to more minor price differences between orders.

- Price Range: Set the minimum and maximum price limits for your grid.

- Investment Amount: Allocate the amount of capital to be used by the bot.

Once your bot is activated, it will carry out trades within the parameters of your grid.

The bot splits your investment among several limit orders at varying prices, automating buy low, sell high strategies without needing constant manual intervention.

Here are examples of strategies that you might deploy:

- Buy the Dip: Configure the bot to purchase at lower prices and sell as the market recovers.

- Trend Following: Adjust your grid to buy and sell in tandem with a trending market—ideal for extended rises or drops in price.

Remember: No trading tool can eliminate market risk, and evaluating your risk tolerance is crucial before engaging in futures trading. Using the BingX Futures Grid Bot enables you to trade with precision and control, maximizing opportunities with market volatility.

Conclusion

When approaching crypto futures trading on BingX, technical analysis is critical to inform your trades.

The ability to predict price movements through chart patterns can play an essential role in deciding when to enter long (buy) or short (sell) positions.

Remember, trading is a form of investment and carries risk, especially in the volatile cryptocurrency market.

It is essential to consider that past performance does not indicate future results. Thus, always exercise due diligence and consult professional advice before committing to trades. Utilize BingX’s terms of use to understand the platform’s guidelines and ensure compliance with trading practices.

If you want to start futures trading, BingX can provide a user-friendly experience for novice and veteran traders. For additional learning and support:

- Visit BingX Learn for educational content.

- Check out the BingX Help Center for guidance and assistance.

Trading with BingX allows you to explore diverse strategies and potentially capitalize on market trends. Stay informed, make disciplined decisions, and leverage BingX’s tools to enhance your trading journey.

Explore how BingX compares to its competitors:

- BingX vs Bitget: Ultimate Trading Platform Comparison

- BingX vs MEXC: Ultimate Trading Platform Comparison

- BingX vs Binance: Ultimate Trading Platform Comparison

- BingX vs Bybit: Ultimate Trading Platform Comparison