When considering Binance and Bitget for your crypto trading needs, evaluating the differences between these platforms is essential.

You’ll find that Binance is the larger platform that offers a more extensive selection of cryptocurrencies.

Bitget, while newer, also provides a competitive range of services, particularly in derivatives trading.

Here’s a summarized comparison of their features and fees to assist you in making an informed decision.

| Feature | Binance | Bitget |

|---|---|---|

| Founded | 2017 | 2018 |

| Supported Cryptocurrencies | 500+ | 100+ |

| Spot Trading Fees | up to 0.1% | up to 0.1% |

| Futures Trading Fees | 0.02% maker, 0.04% taker | 0.02% maker, 0.06% taker |

| Trading Volume | World leader | Top 10 globally |

| Maximum Leverage | 125x | 100x |

| Native Token Discount | 25% with BNB | 20% with BGB |

| Deposit Methods | Various, including bank transfer and credit card | Multiple, but may vary by region |

| User Score | High ratings across platforms | Generally positive reception |

| Mobile App Ratings (iOS/Android) | 4.7/Varies | 4.5/4.5 |

Both platforms offer discounts on trading fees when using their native tokens. The trading volumes reflect the popularity and liquidity of each exchange, with Binance having a significant edge.

Remember these differences, as they may affect your trading strategy and preferences.

Bitget vs Binance: Products and Services

When examining the products and services of Binance and Bitget, you’ll notice that both platforms offer a range of options catering to various trading preferences.

- Spot Trading:

Both Binance and Bitget allow you to engage in spot trading, where you can buy or sell cryptocurrencies at current market prices.

Binance is recognized for its expansive selection of available cryptocurrencies, surpassing the variety offered by Bitget.

- Futures Trading:

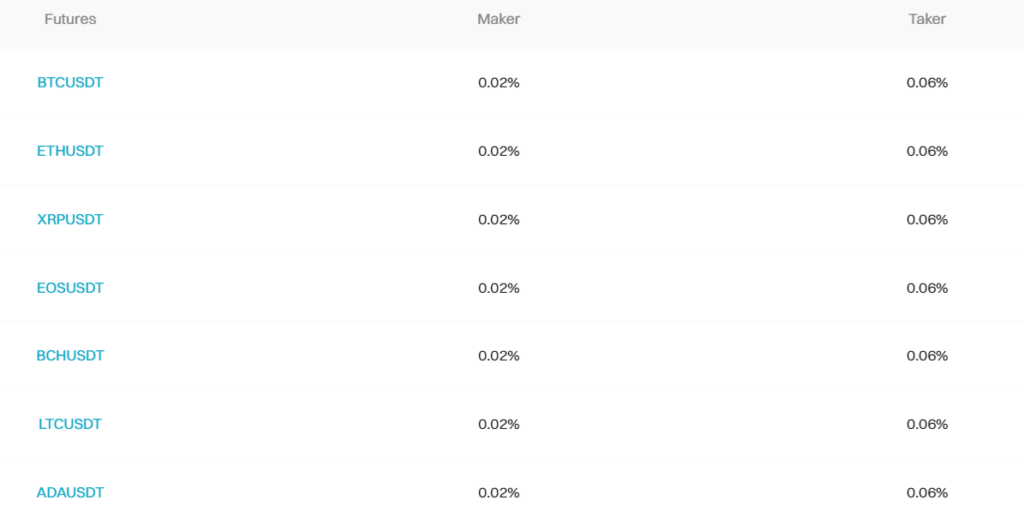

In future trading, Bitget will offer competitive rates, charging a 0.02% maker fee and a 0.06% taker fee.

Binance also provides futures trading but with a different fee structure.

Bitget and Binance incentivize using their native cryptocurrencies (BGB and BNB, respectively) by offering discounts on trading fees.

- Leveraged Tokens and Options Trading:

Binance supports leveraged tokens and options trading, giving traders more sophisticated financial instruments.

Bitget has not matched this variety regarding the current state of information.

- NFT Marketplace:

Binance has entered the NFT space, offering an NFT marketplace, something that Bitget hasn’t provided, signifying Binance’s push into areas aside from typical exchange services.

- Staking Services:

On both platforms, you can stake specific cryptocurrencies, which might be an attractive service if you are interested in generating a passive yield on your holdings.

Regarding innovation, Binance often leads with a broader range of services and functionality targeted at beginners and experienced traders.

Bitget, while smaller, has carved out a niche with competitive fees and is often recognized for an intuitive user experience, particularly for those focused on futures trading.

When choosing between the two, your decision might hinge on the specific services you require and the platform that aligns best with your trading needs.

Bitget vs Binance: Contract Types

When comparing the contract types between Binance and Bitget, you’ll find a range of options that cater to various trading strategies and preferences. Here’s a breakdown to help you understand what each platform offers:

Binance Contract Types:

- Inverse Perpetual Contracts allow you to trade cryptocurrency contracts with the coins as collateral.

- Linear Perpetual Contracts: You can trade contracts priced and settled in stablecoins like USDT, reducing the need to maintain multiple coin balances.

- Inverse Futures Contracts: Similar to inverse perpetual but with an expiration date, requiring an understanding of the settlement process.

- COIN-M Futures: These futures contracts use the underlying cryptocurrency for margin and settlement.

- USD-M Futures: Margined and settled in stablecoins, these contracts offer straightforward trading without the complexity of multiple currencies.

- Options: For more experienced traders, options provide opportunities to hedge risks or speculate with more strategies available.

Bitget Contract Types:

- Inverse Perpetual Contracts: Bitget offers these, allowing traders to use the cryptocurrency as collateral and margin.

- Linear Perpetual Contracts: Geared towards simplicity, you can trade with stablecoin collateral, avoiding volatility concerns in your margin account.

Both Binance and Bitget offer contract types suitable for different trading needs.

Binance’s more diversified portfolio, including options trading, appeals to a broader audience. At the same time, Bitget focuses primarily on linear and inverse perpetual contracts, which could be more straightforward for newcomers to the futures market.

Assessing your trading goals and risk tolerance when selecting a platform is essential.

Bitget vs Binance: Leverage and Margin

When trading on Binance and Bitget, you have access to leverage and margin that can significantly amplify your positions.

Leverage allows you to borrow funds to increase your buying or selling power. However, with greater potential returns, liquidation risks rise if the market moves against you.

Binance:

- Spot Margin Trading: Offers leverage between 5x and 10x.

- Futures Trading Leverage:

- USDT-M Futures: Up to 125x leverage.

- COIN-M Futures: Variably up to 125x.

Bitget:

- Spot Margin Trading: These are leverage options similar to Binance.

- Futures Trading Leverage:

- Leverage up to 100x is available.

Your margin requirements – the funds you must hold to maintain a position – can vary between the two exchanges. They depend on the level of leverage used and the size of your position.

Liquidation Risks:

- Both exchanges implement a liquidation process to prevent your account balance from falling below zero.

- On Binance, the risk is managed by a tiered margin system that adjusts with position size.

- Bitget also uses a tiered margin system and offers a ‘One-Click Reverse’ feature for quick position adjustments.

Funding Rates:

- These exchanges charge funding rates on leveraged positions to balance the market; rates fluctuate based on market conditions and position sizes.

Always consider the rate at which leverage can magnify both profits and losses.

| Exchange | Maximum Leverage | Spot Margin Trading | Futures Leverage |

|---|---|---|---|

| Binance | Up to 125x | Yes (5x to 10x) | Up to 125x |

| Bitget | Up to 100x | Yes (Similar to Binance) | Up to 100x |

Bitget vs Binance: Liquidity and Volume

When you trade cryptocurrencies, liquidity and volume are crucial to smooth transactions and minimal slippage.

Binance consistently ranks as one of the top liquidity and trading volume exchanges.

This means you can expect high efficiency and low slippage during trading, as Binance has many buyers and sellers actively trading at any time.

Volume Rankings:

- Binance: Typically ranks within the top 3

- Bitget: Often found in the top 10

In contrast, Bitget, while smaller, still manages to hold its own with competitive liquidity and volume.

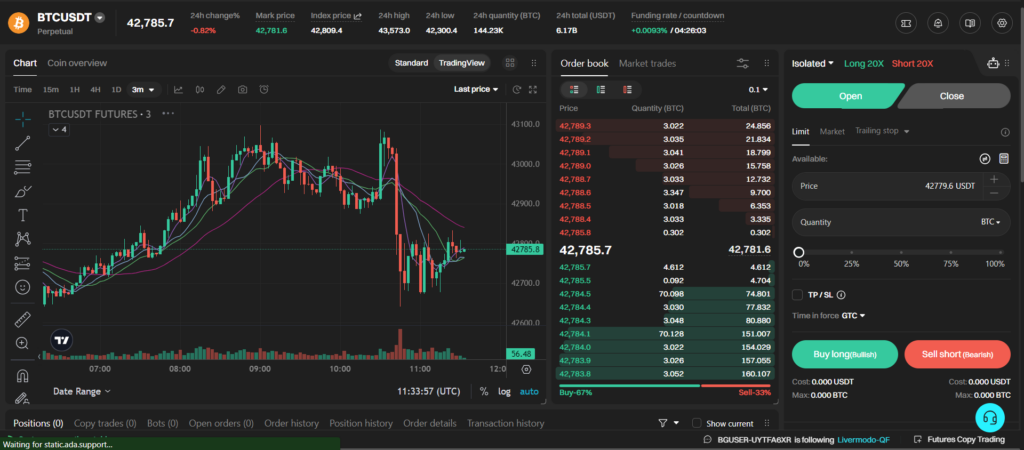

For futures trading, Bitget offers considerable liquidity and a daily futures trading volume that occasionally reaches $6-8 million.

This places Bitget among the better competitors in the market, which is impressive for its size and can provide you with a reliable trading experience.

Liquidity Metrics:

- Bid/Ask Spreads: Lower on Binance, signifying better liquidity

- Order Book Depth: Binance generally shows a deeper order book

Binance offers unmatched liquidity that translates into more stable prices.

In high-liquidity markets provided by Binance, your trades are more likely to be executed at your desired price.

On the other hand, Bitget offers you a competitive environment, especially in future markets. Still, the overall liquidity may lag slightly behind Binance, potentially leading to higher slippage during periods of volatility or large orders.

Bitget vs Binance: Fees and Rewards

Understanding the fee structure and reward system can significantly impact cryptocurrency trading profitability.

On Binance, you’ll encounter a base fee for spot trades, which starts at 0.1% for both maker and taker.

If you use Binance’s native BNB token to pay for fees, you get a 25% discount, reducing your costs notably.

Bitget applies a 0.02% maker and 0.06% taker fee for futures trading, which is competitive.

If you pay fees using Bitget’s native token, BGB, you’re entitled to a 20% discount.

Compared to Binance’s discount, Bitget’s native token incentive is slightly less, yet it still provides a tangible benefit.

Example Scenario:

If you placed a futures order on Bitget as a maker with a value of $5,000, your fee would be:

- $5,000 x 0.02% = $1.00 (before discounts)

With the BGB discount applied:

- $1.00 – 20% = $0.80

For a similar spot trade on Binance, your fee before using BNB would be:

- $5,000 x 0.1% = $5.00

With BNB’s discount, your fee would be reduced to:

- $5.00 – 25% = $3.75

These platforms also offer bonus incentives. On Binance, you might find a welcome bonus for new users or referral rewards, enhancing the trading experience and providing additional value.

By calculating and comparing fees and taking advantage of rewards and discounts, you can work towards maximizing your trading profitability and experience on both Binance and Bitget.

Bitget vs Binance: Trading Fee & Deposit/Withdrawal Fee Compared

When trading on Binance, the standard maker and taker fees are set at 0.1% for spot trading.

However, Binance’s native cryptocurrency, BNB, allows for a 25% discount on these fees. Binance doesn’t charge deposit fees, but withdrawal fees vary based on the cryptocurrency.

Bitget, on the other hand, presents a different fee structure. For spot trading, the fees are comparable but become distinct with futures trading—where you’ll find a maker fee of 0.02% and a taker fee of 0.06%.

Like Binance, using the exchange’s native token, BGB grants a 20% discount on trading fees. There are no deposit fees on Bitget, while withdrawal fees are subject to change based on the cryptocurrency involved.

Here’s a quick comparison to help you see the difference:

- Maker Fee:

- Binance: 0.1% (0.075% with BNB discount)

- Bitget: 0.1% (0.08% with BGB discount)

- Taker Fee:

- Binance: 0.1% (0.075% with BNB discount)

- Bitget: 0.1% (0.08% with BGB discount)

- Futures Maker Fee:

- Bitget: 0.02%

- Futures Taker Fee:

- Bitget: 0.06%

- Withdrawal Fees:

- Varies per coin and network congestion

- Deposit Fees:

- There are none for either platform

Both platforms adjust their fee structures based on your trading volume and VIP level, offering incentives and lower fees for high-volume traders.

Always verify the current fees directly on the exchanges, as they may update their fee schedules.

Bitget vs Binance: Deposits & Withdrawal Options

When managing your cryptocurrency funds, the ease of depositing and withdrawing is crucial. Binance and Bitget provide a range of options to accommodate your needs.

Starting with Binance, you have multiple choices for deposits:

- Cryptocurrency Transfer: Fast and, depending on the asset, sometimes free.

- Bank Transfer: including SEPA and SWIFT with varying speeds and potential fees.

- Credit/Debit Cards: Instant but usually with higher fees.

For withdrawals, Binance supports:

- Crypto: Withdraw to personal wallets or other exchanges.

- Fiat Money: Via bank transfer or card, fees and limits apply.

Moving to Bitget, your deposit methods are similar:

- Crypto Transfer: Fast and cost-effective.

- Credit/Debit Cards and Bank Transfers include SEPA and Fast Payment Poli payment methods.

The withdrawal options on Bitget are:

- Crypto: Direct transfers to your chosen destination.

- Fiat: Bank transfers and other payment services may be available.

Both exchanges work with a broad selection of cryptocurrencies, ensuring you can manage a diverse portfolio.

Each method can come with minimum and maximum amounts you can transfer and varying processing times.

So, before you transfer, check the specific limits and fees that apply to your chosen method on the respective platforms.

Remember that using Binance’s native token, BNB, might reduce your costs on the platform, whereas Bitget also pushes to keep the fees competitive, especially for futures trading.

Bitget vs Binance: KYC Requirements & KYC Limits

When comparing Binance and Bitget, it’s crucial to consider their Know Your Customer (KYC) requirements and associated limits because they affect your privacy, security, and trading capabilities on each platform.

Binance KYC Requirements:

- Initial Verification: Requires a government-issued ID and a selfie.

- Advanced Verification: Additional documents like proof of address may be needed for higher limits.

- Limitations:

- Without KYC, withdrawals and P2P trading are restricted.

- Verified accounts have higher withdrawal and trading limits.

Bitget KYC Requirements:

- Mandatory Verification: You must complete KYC to trade, deposit, or withdraw.

- Verification Process: Involves submitting a government ID and potentially additional documentation.

- Limitations:

- Trading, withdrawals, and deposits are unavailable without KYC.

| Feature | Binance (Unverified) | Binance (Verified) | Bitget (Unverified) | Bitget (Verified) |

|---|---|---|---|---|

| Deposits | Possible | Unlimited | Not Allowed | Unlimited |

| Withdrawals | Restricted | Higher Limits | Not Allowed | No Limit |

| Trading | Limited | Full Access | Not Allowed | Full Access |

Complying with each exchange’s KYC procedures substantially expands your access to their services. The verification process also enhances the security framework of these platforms, as it is a deterrent against illicit activities, including money laundering.

Both Binance and Bitget offer different levels of access and permissions, pivoting on your verification status. Binance allows limited access for unverified users, whereas Bitget enforces a strict policy prohibiting trading without KYC completion.

This underlines the significance of understanding KYC requirements’ impact on your exchange experience and operational scope within these platforms.

Bitget vs Binance: Order Types

When trading cryptocurrencies, you’ll encounter different orders on exchanges like Binance and Bitget. These order types help you execute your strategies and manage risks effectively.

Binance supports a variety of order types:

- Market Orders: These orders are executed immediately at the current market price.

- Limit Orders: You can set a specific price you want to buy or sell.

- Stop-Loss Orders: These orders help you limit your losses by setting a sell order at a lower price than the current market level.

- Take Profit Orders: Like stop-loss, it is placed to secure profits at a predetermined price.

- OCO (One Cancels the Other) Orders: This combines a limit order with a stop-limit order, but only one of the two can be executed.

- Trailing Stop Orders: They allow you to place a stop-loss order at a percentage rather than a set price.

Bitget, on the other hand, offers these order types:

- Market Orders: Like Binance, they are executed at the best available current price.

- Limit Orders: Specify the price you wish to buy or sell, accompanied by time conditions like GTC (Good ‘Til Cancelled) and IOC (Immediate or Cancel).

Both Binance and Bitget also include advanced order types such as:

- Conditional Orders: These orders are activated only when certain conditions are met.

- Post-Only Orders: Ensures the order is added to the order book and not filled immediately, allowing traders to pay only the maker fees.

- Reduce-Only Orders: These orders ensure you can only reduce a position, not increase it.

By utilizing these order types, you can make more strategic decisions, such as entering a trade at a specific price with limited orders or automating risk management with stop-loss orders.

Bitget vs Binance: Security and Reliability

When examining the security features of Binance and Bitget, it is evident that both platforms prioritize the safety of your funds and personal data.

Binance:

- Cold Storage: A significant portion of assets are held in offline cold storage to reduce the risk of hacking.

- Two-Factor Authentication (2FA): Mandates an additional layer of security at login.

- Regulatory Efforts: Strives to comply with global regulatory standards, enhancing trust and reliability.

- Incident Response: Historically, Binance has demonstrated a robust response to security breaches, including a well-documented 2019 hack, after which all affected users were compensated.

Bitget:

- Security Measures: Implements standard security protocols to safeguard user assets.

- Leverage: Offers high leverage of up to 100x on certain products, which, though potentially increasing profit, also adds risk.

- Compliance: Pursues compliance with international regulations, which may reflect their reliability as a trading platform.

Both exchanges assist multiple channels, including email support and help centers. The efficiency and responsiveness of support can often reflect an exchange’s overall reliability. Exchange ‘science with each platform may also hinge on other users’ feedback and any persona users ‘erences for interface and usability.

As you research and choose where to trade, consider the historical resilience and current measures these platforms employ to secure and support your trading journey.

Bitget vs Binance: User Experience

When you navigate through Binance and Bitget, your experience hinges on the design, functionality, and overall ease of use of each platform.

Binance, the more prominent exchange, provides a wealth of features and tools that cater to beginner and experienced traders.

Its interface is advanced and customizable, which may be more appealing to seasoned traders who require in-depth analysis and expansive trading tools.

Binance Features:

- Advanced and customizable interface

- Binance Pay for convenient crypto spending

- It is more complex for beginners due to feature richness

Bitget Features:

- It has a simpler interface, possibly better for newcomers

- Straightforward navigation with less information overload

The tradeoff with Binance’s comprehensive functionalityBinance’s complexity can overwhelm new users.

It offers a well-designed interface but is densely packed with information and trading options.

On the other hand, Bitget presents a more streamlined experience that is less intimidating for those new to cryptocurrency trading.

Its web interface is easier to navigate and less cluttered, which can contribute to a more engaged user base.

Feedback from users underscores Binance’s reputation as a robustBinance’siable platform, while Bitget is often praised for its user-friendliness and approachability.

Both platforms prioritize security; however, the user experience differs mainly in the balance between sophistication and simplicity.

Bitget vs Binance: Education and Community

When choosing between Binance and Bitget, your decision may be influenced by their commitment to education and community engagement.

Binance has a vast array of educational content available on Binance Academy. This includes:

- Articles and Guides: Covering various topics from blockchain basics to advanced trading strategies.

- Glossary: A helpful resource for understanding crypto-specific terms.

- Video Tutorials: Visual learners can benefit from step-by-step instructions.

Binance also has a significant social media presence, fostering a large community of users across platforms like Twitter, Telegram, and Reddit. Here, you can interact with other traders and stay updated on the latest news.

Bitget isn’t far behind in offering international resources. These feature:

- Blogs and Updates: Insights into market trends and platform updates.

- Video Guides: Simplified content to help you navigate their trading system.

- Webinars: Sessions held by experts for real-time learning and Q&A.

It has a growing community that engages through social media and dedicated support channels.

You’ll find support structures such as user forums and help centers where you’ll be assisted when participating in either platform.

Each exchange strives to educate its users for a better trading experience and to maintain an active, informed community.

Your preference might lean towards Binance for more comprehensive learning resources or Bitget for more intimate expert sessions and evolving content.

Bitget vs Binance: Regulation and Compliance

When choosing between Binance and Bitget, you should consider their adherence to regulatory standards.

Both platforms operate in numerous countries and must navigate various legal landscapes.

Binance:

- Geographic Reach: Binance operates globally and has to comply with a diverse range of financial regulations.

- Regulatory Actions: Several regulators have scrutinized Binance, and it has since worked on improving its compliance.

- Licenses and Certifications:

- They hold a certification from the ISO/IEC in information security.

- They also acquired several national permits.

Bitget:

- Foundation Year: Bitget was founded in 2018 and is a newer platform, but it has made significant progress in compliance.

- Licenses:

- Bitget has obtained licenses from countries such as Canada and the USA.

Both exchanges demonstrate a commitment to compliance through continuous security and regulatory adherence updates.

This includes:

- Know Your Customer (KYC) and Anti-Money Laundering (AML) checks to prevent illicit activities.

- Audit and Compliance Reports: Both undergo regular audits and publish reports that reflect their current compliance status.

Remember that regulations can impact the availability of services and features on the exchanges, so stay updated with the latest changes.

Conclusion: Which is better Bitget or Binance?

Both Binance and Biget offer crypto trading focused on derivatives; however, bitget has lower trading fees than Binance. Therefore, Bitget is a better choice when choosing between Binance or Bitget.

Both platforms offer a range of services to accommodate different user needs.

Fees Comparison:

- Binance:

- Discount for using BNB (25%)

- Tiered fee structure

- Bitget:

- Flat trading fee

- Discount for using BGB (20%)

Trading Options:

- Binance:

- Vast number of pairs

- Higher leverage options

- Bitget:

- Competitive in spot and futures markets

Bitget’s flat fee structure may simplify the trading process for new customers.

However, if you engage in high volumes or various trading pairs, Binance’s tiered fee structure and leverage options could be more appealing. If you prioritize fee discounts, Binance offers a slightly larger discount when you use its proprietary BNB token.

Consider how often you plan to trade and which exchange provides the most cost-effective structure for your trading frequency and volume.

Leverage the native apps and interfaces of each platform to determine which aligns better with your user experience preferences.

Both platforms provide robust mobile and web platforms.

Choose the best exchange with your trading goals and strategies, considering the security, fees, user experience, and supported trading pairs.

Explore how Binance and Bitget compare to their competitors:

- Binance vs Bybit: Ultimate Trading Platform Comparison

- Binance vs MEXC: Ultimate Trading Platform Comparison

- Binance vs BingX: Ultimate Trading Platform Comparison

- Bitget vs Phemex: Ultimate Trading Platform Comparison

- Bitget vs BingX: Ultimate Trading Platform Comparison

- Bitget vs Bybit: Ultimate Trading Platform Comparison