Bybit, established in 2018 and headquartered in Singapore, has quickly ascended to prominence within the cryptocurrency trading community. Recognized for its robust platform, Bybit facilitates futures trading, offering competitive advantages like low trading fees, substantial liquidity, and a suite of tools tailored to both novice and experienced traders. With more than 20 million users and a daily trading volume surpassing $10 billion, it stands as a testament to the exchange’s significant influence in the crypto market.

Trading cryptocurrency futures on Bybit allows you to speculate on the future price movements of digital assets. By engaging in futures trading, you’re not just limited to profiting from rising markets but can also capitalize on price declines, a feature absent from simple spot trading. This guide will navigate you through the essentials of trading crypto futures on Bybit, covering everything from account setup to executing your first trade. By the end, you’ll have the necessary insights to start trading with confidence.

How to Trade Crypto Futures on Bybit

In Bybit’s crypto futures market, you get the opportunity to speculate on the future prices of various cryptocurrencies using leverage, potentially amplifying your profits. It’s crucial to understand the platform’s mechanics and always employ a robust trading strategy and risk management framework.

Bybit Futures Trading Strategy & Basics

Developing a Futures Trading Strategy: To trade futures on Bybit effectively, you need a solid strategy. Trend following involves identifying and going along with the market momentum, while scalping focuses on profiting from small price changes. Hedging helps protect your investments from adverse price movements. A well-formulated strategy can guide your actions in the market and help manage risks.

Understanding Key Concepts:

- Index Price: The average price from multiple spot exchanges, ensuring a fair benchmark for futures contracts.

- Fair Price: Prevents unnecessary liquidations during times of high volatility by deviating from the Last Traded Price.

- Funding Rate: A periodic payment exchanged between long and short positions, keeping the futures prices in line with the spot market.

Executing a Trade on Bybit:

- Choose between USDT Perpetual or inverse contracts depending on which suits your trading style.

- Decide on the leverage level — Bybit offers leverage up to 100x, but high leverage also increases risks of liquidation.

- Place a Market Order to execute at the current market price or use a Limit Order to set a specific entry point.

- Leverage can be set to either Cross or Isolated. Cross leverages all your available margin, while Isolated uses only the margin you specify for a particular position.

Trading Tips:

- Employ stop-loss and take-profit orders to manage risks and secure profits automatically.

- Familiarize yourself with Bybit’s order calculator to estimate potential profits and losses before executing trades.

- Stay informed about market conditions and keep a close eye on the funding rate, which can impact your trading costs.

Bybit’s trading interface accommodates both novice and advanced traders. With this insight, you’re ready to apply your chosen futures trading strategy on Bybit. Remember, consistent practice and risk management are the cornerstones of a successful futures trader.

How to Create an Account on Bybit

Creating an account on Bybit is a straightforward process. You can sign up either through the Bybit website or via the Bybit mobile app. Follow these steps to get started:

- Navigate to the Bybit Sign Up Page

- Click on the “Sign Up” button located in the top right corner of the homepage.

- Choose Your Sign Up Method

- You can register using your Email or Mobile Phone number.

- If opting for email, enter your email address.

- If opting for mobile, enter your phone number.

- You can register using your Email or Mobile Phone number.

- Finalize Account Creation

- Create a secure password.

- Enter the verification code sent to your chosen method.

- (Optional) If you have a referral code, enter it to potentially receive a bonus.

- Complete KYC Verification

- Bybit adheres to Know Your Customer (KYC) standards.

- Identity verification is necessary to access full features.

- Provide the required documents for KYC.

- Security Measures

- Set up two-factor authentication (2FA) for an added layer of security.

Once your identity is verified, you’ll have full access to Bybit’s products and services. The verification process enhances the security of your transactions and protects your account.

Bybit may offer bonuses for new users who sign up with a referral code. Check their website for the latest promotions to make the most of your new account.

How to Deposit and Withdraw Funds on Bybit

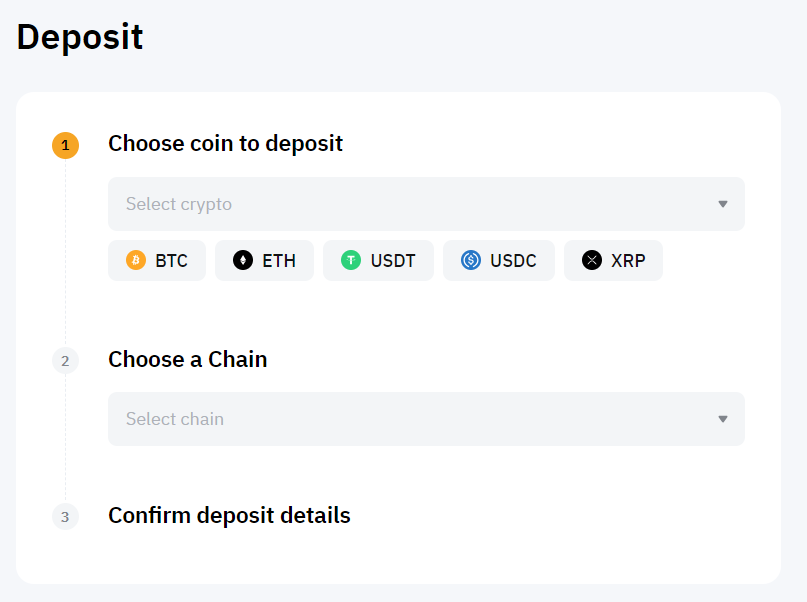

To deposit funds on Bybit, first log into your account. Navigate to the ‘Assets’ section and select ‘Deposit’. You can deposit cryptocurrencies like BTC, USDC, and others directly into your spot account. Choose the currency you wish to deposit and a wallet address will be provided for the transaction. Transfers between wallets are usually fast, but confirmations may vary based on blockchain conditions.

Depositing via fiat currency is supported through credit/debit card payments and third-party payment platforms. Bybit’s P2P trading option is also available for fiat transactions.

| Step | Description |

|---|---|

| Select Currency | Choose the type of asset you want to deposit (e.g., BTC, USDC). |

| Provide Details | Enter or select your deposit amount. |

| Confirm Transaction | Verify transaction details and confirm. |

For withdrawals, go to the ‘Assets’ section and click on ‘Withdraw’. Specify the chain type and input the wallet address of your receiving wallet. Enter the withdrawal amount or use the ‘All’ option to withdraw your entire balance. The final step is to submit your withdrawal request.

Withdrawals are also subject to minimum and maximum limits, which vary depending on the specific cryptocurrency. Bybit may charge a withdrawal fee, which is typically a small fixed amount of the cryptocurrency being withdrawn. Withdrawal fees and limits are clearly stated during the process. The processing time ranges from instant to a few hours, depending on network congestion and security checks.

Remember, it’s crucial to double-check wallet addresses and transaction details to avoid errors in deposits and withdrawals.

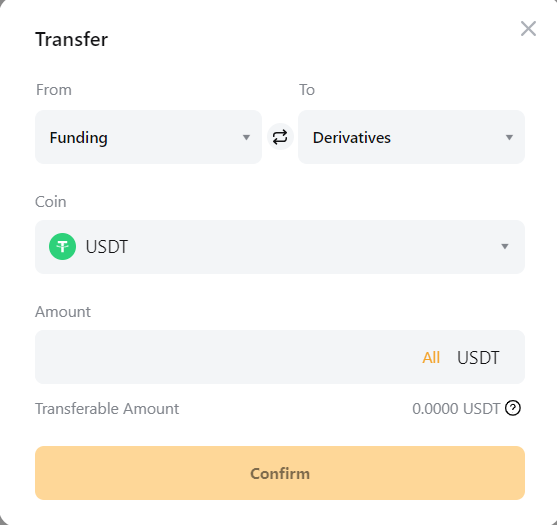

How to Transfer Funds to the Futures Wallet

On Bybit, you have two main types of wallets: the Spot Wallet and the Futures Wallet. Your Spot Wallet is used for holding currencies that you may use for immediate buying and selling on the spot market. The Futures Wallet, however, is designated for trading futures contracts, a financial derivative where you agree to buy or sell an asset at a future date.

To transfer funds to your Futures Wallet:

- Log in to your Bybit account.

- Navigate to the Assets section at the top of the page.

- Locate and click on Transfer in the derivatives area.

In the transfer window:

- Choose from the “From” dropdown that your funds are coming from the Spot Wallet.

- Select the “To” dropdown to the Futures Wallet.

- Enter the amount you wish to transfer.

Bybit supports several currencies for transfer, including cryptocurrencies like BTC, ETH, and USDT. Each currency has its own minimum and maximum transfer amounts, and these limits ensure the system’s stability and your fund’s security. Before executing the transfer, also make sure to check any fees that may apply.

Once you’ve inputted the desired amount within the stipulated limits:

- Click Confirm to initiate the transfer.

- The funds should appear in your Futures Wallet almost immediately, allowing you to start trading futures contracts.

How to Choose Between Inverse and Linear Futures

When trading on Bybit, your choice between inverse and linear futures contracts is pivotal. Inverse contracts are denominated in the base cryptocurrency, such as BTC, allowing you to post margin in BTC when trading BTC/USD contracts. Meanwhile, linear futures are typically denominated in a stablecoin like USDT or USDC, which means you will use stablecoins for margin and settlement.

Inverse Futures:

- Denominated in the cryptocurrency itself (e.g., BTC for BTC/USD)

- Margin and P&L are in the base coin

- Advantage: Direct exposure to the base crypto’s price movements without the need for stablecoins

- Disadvantage: Complexity in managing the position’s value due to BTC’s price volatility

Linear Futures:

- Denominated in a stablecoin (e.g., USDT-margined)

- Margin and P&L are in the stablecoin

- Advantage: Simplified accounting and less volatility in margin value

- Disadvantage: No direct exposure to the base crypto’s price in the same way as holding the coin itself

Examples on Bybit include BTC/USDT for linear futures, reflecting a stablecoin margin approach, and BTC/USD as an inverse contract, allowing you to trade directly with BTC as the margin.

- Assess your comfort with volatility and portfolio composition.

- Choose inverse contracts if you prefer to keep your funds in crypto with direct exposure.

- Opt for linear futures for a more stable margin value through stablecoins.

- Consider the impact of market movements on your collateral; inverse contract values can fluctuate more dramatically.

Keep this information in mind to align your trading strategy with your financial goals on Bybit.

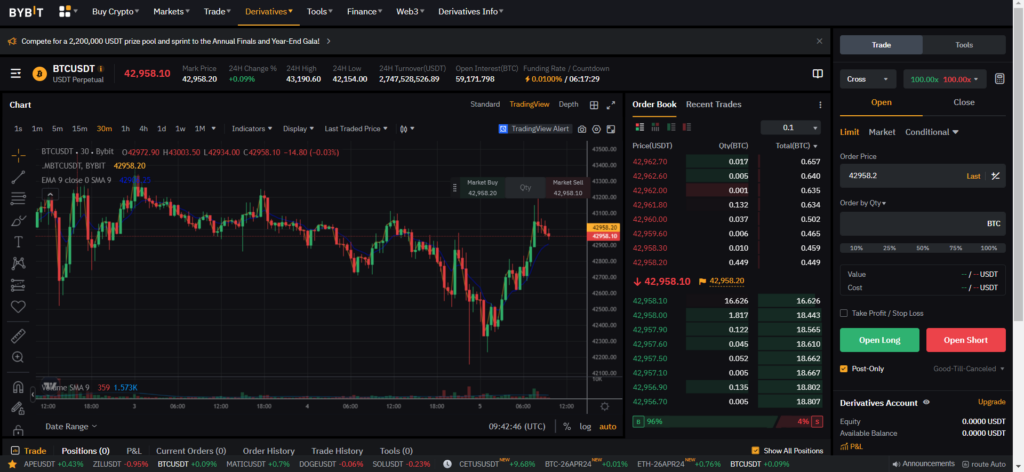

How to Understand the Futures Trading Interface

When you log into Bybit and navigate to the futures trading section, you are greeted with a comprehensive user interface designed to streamline your trading process. Understanding this interface is crucial to effectively trade futures.

First, locate the search box at the top of the page; this is where you can find the specific futures contracts you wish to trade. The central part of your screen will typically display the chart, which gives real-time visualization of price movements. Customization options are available to tweak its appearance and functionalities according to your trading style.

To your right, the order book presents a list of current buy and sell orders, showing market depth and the range of limit prices. The order entry panel, just below the chart, is where you place your orders. Here, you can input your limit price—the price you’re willing to buy or sell a contract—and set a trigger price for conditional orders.

For immediate execution, the market price option allows you to enter or exit the market swiftly without specifying a price. Keep in mind, selecting this option often results in a higher taker fee, as it removes liquidity from the market. Conversely, by setting a limit price, you add liquidity, potentially qualifying for a lower maker fee.

The trading fee structure on Bybit is clearly outlined in the trade information section; it’s essential to understand these costs as they impact your trading profitability. On the bottom of the interface, you will find the position panel, which provides detailed information on your open positions, including size, margin, unrealized P&L, and more.

Bybit also offers various trading tools and widgets that can be added to your interface for enhanced analysis and trading efficiency. Familiarize yourself with each component to leverage the full potential of Bybit’s futures trading interface.

How to Place and Manage Orders on Bybit Futures

To engage in trading on Bybit futures, you must understand how to effectively place and manage orders. There are three primary types of orders: market orders, limit orders, and conditional orders.

- A market order is executed instantly at the best available price.

- A limit order allows you to set a specific price at which you wish to buy or sell.

- Conditional orders are executed when certain predefined conditions are met.

When you’re ready to place an order, navigate to the Bybit trading interface. To execute a market order, select ‘Market’ from the Order Type options, and enter the amount you want to buy or sell. For a limit order, you’ll need to specify the price as well as the amount.

Managing leverage is vital when trading on Bybit futures. Leverage allows you to control a larger position with a smaller amount of capital. However, it increases the risks as well. Use the leverage slider to adjust the desired level of leverage for your trade.

As for positions, you can modify an open order before it’s filled, or you can cancel it entirely. To close a position, select ‘Close Position’ at the current market price or set a limit price for closure.

Finally, be mindful of the funding rate, which is periodic payments exchanged between buyers and sellers holding open positions past the settlement time. It ensures the last traded price is anchored to the spot price. Settlement occurs twice a day, bringing all open positions to fruition at the prevailing market price.

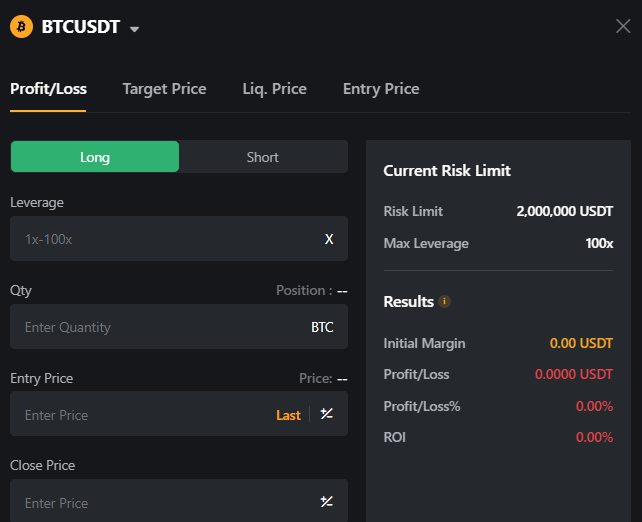

How to Use the Bybit Order Calculator

The Bybit order calculator is an invaluable tool designed to assist you with risk management and potential Profit/Loss (PnL) estimation while trading crypto futures. It aids in projecting your trade outcomes considering the entered parameters.

Accessing the Bybit Order Calculator:

- Navigate to Bybit’s trading interface.

- Locate the calculator icon usually positioned at the top right of the Order Zone.

Using the Calculator:

- Select Calculation Type: You can choose from these options:

- Profit/Loss (PnL)

- Target Price

- Liquidation Price

- Entry Price

- Input Parameters:

- Entry Price: The price at which you plan to enter a position.

- Exit Price: Your desired price to close the position.

- Quantity: The amount of the asset involved in the trade.

- Leverage: The level of leverage you intend to use.

Understanding the Results:

The calculator outputs estimated results for the selected scenario without incorporating trading fees and funding fees.

Example Scenarios:

- Profit/Loss Calculation:

- If leveraging 10x, entering at $10,000 and targeting an exit at $11,000 for 1 BTC, the calculator estimates your profit excluding fees.

- Liquidation Price Determination:

- The liquidation price is calculated based on your chosen leverage and entry price, giving an indication of the market price that would trigger a forced closure of your position.

By using the Bybit order calculator, you’re able to confidently strategize trades, manage risks, and estimate outcomes. However, remember to account for fees separately as they can affect your end results.

How to Use the Bybit Futures Grid Bot

The Bybit futures grid bot is a powerful tool for automated trading, designed to help you implement your strategies effectively on the Bybit exchange. It enables the execution of futures trades automatically within a specified price range, creating opportunities for profit in fluctuating markets.

Accessing the Bot:

- Log in to your Bybit account.

- Navigate to the Trade section and select Trading Bot.

- Click on Create Now to initiate setting up a new Futures Grid Bot.

Configuring the Bot:

- Set the Price Range: Determine the upper and lower price limits for your trades.

- Grid Quantity: Decide on the number of grid levels within your price range.

- Investment Amount: Allocate the total amount of funds to be used by the bot.

Once you’ve configured your bot, activate it to start trading. Bybit’s AI algorithms manage the grid bot’s functions, ensuring it adheres to your specified strategy.

Performance Monitoring:

Monitor the bot’s performance directly on the platform. You can track:

- Total Profits

- Bot Creation Time

- Status (Active/Inactive)

Examples of strategies:

- Long-Term Holding: Adjust grid levels widely for significant market fluctuations.

- Short-Term Profits: Set narrow grid levels to capture minor price movements.

Remember, each futures grid bot runs on a specific future contract, and Bybit allows up to 50 bots per user. Use these bots to enhance your trading strategy and potentially streamline your crypto futures trading activities.

Conclusion

Trading crypto futures on Bybit can be a strategic move for your investment portfolio, giving you access to a range of financial instruments and the potential for high rewards. Bybit has claimed a strong position in the market with a substantial user base and significant daily trading volume, emphasizing its reliability and scale.

Key Takeaways:

- Registration: Start by creating an account on Bybit, ensuring you follow all necessary security protocols for a safe trading experience.

- Understanding the Platform: Familiarize yourself with the interface, trading tools, and features offered by Bybit to enhance your trading strategies.

- Trading Futures: Learn the fundamentals of futures trading, from opening positions, utilizing leverage wisely, to closing your trades effectively, either through market or limit orders.

Remember that futures trading carries risk, just like all forms of trading. Prioritize learning and practice, possibly through a demo account, to build confidence in a risk-free environment before committing real funds.

For ongoing support or to deepen your understanding, refer to Bybit’s resources:

- Bybit’s Help Center: Bybit Support

- Learning Resources: Bybit Learning Hub

Feel free to explore these to solidify your foundation in crypto futures trading. With due diligence, appropriate risk management, and continuous education, you can get started on Bybit and join the hundreds of thousands who are already navigating the futures market.

Explore how Bybit compare to it’s competitors:

- Bybit vs Deribit: Head-to-Head Platform Comparison

- Bybit vs BitMEX: Head-to-Head Platform Comparison

- Bybit vs PrimeXBT: Head-to-Head Platform Comparison

- Bybit vs Kraken: Head-to-Head Platform Comparison