GMX is a decentralized exchange that empowers you to trade perpetual cryptocurrency futures with the added advantage of leverage up to 50x.

Providing a highly accessible trading platform, GMX enables you to engage in the futures market on a range of popular cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and Avalanche (AVAX).

The platform’s foundation on decentralization ensures that you can trade with the assurance of transparency and without the need for intermediaries.

As a trader on GMX, you benefit from the platform’s utility via the GMX token, which serves governance purposes, and from its unique liquidity pool.

The platform supports a user-friendly experience, whether you’re purchasing GMX tokens or actively trading.

GMX Futures Trading Strategy & Basics

When engaging with GMX, a decentralized platform for cryptocurrency futures trading, it’s essential to understand the core concepts that govern this financial instrument.

A futures contract is an agreement to buy or sell a particular asset at a predetermined price at a specified time.

Leverage, a vital feature on GMX, allows you to trade more prominent positions than your current balance would ordinarily permit.

It’s a double-edged sword that can amplify gains and increase potential losses. Trading with leverage involves borrowing funds, so understanding the margin is crucial.

Margin is the initial capital you must deposit to open a leveraged position.

If the market moves against you and your margin balance falls below a certain threshold, you could face liquidation, where your position is closed to prevent further losses.

Two distinct margin modes on GMX are:

- Cross Margin Mode: This mode pools your entire account balance to manage losses, which can be safer and riskier if all trades move against you.

- Isolated Margin Mode: Only the margin assigned to a particular trade is at risk of liquidation, protecting your other positions and account balance.

In futures trading, the index price is the average price of an asset across major exchanges, while the fair price helps prevent price manipulation.

GMX employs these to establish a funding rate — a periodic payment you make or receive to keep the price in line with the spot market.

To effectively manage trades and estimate potential profits or losses, use the GMX order calculator. This tool accounts for entry price, position size, and leverage.

Risk management is crucial to leveraging the advanced trading features GMX provides. Always stay informed of market movements and trade with a clear strategy to capitalize on the GMX futures market.

How to Create an Account on GMX

Creating an account on GMX, a decentralized exchange (DEX), allows you to trade crypto futures non-custodial, meaning you retain complete control over your funds without intermediaries. Here’s a step-by-step guide:

- Visit the Platform: To begin, navigate to the official GMX website via your preferred web browser (website1) or download their mobile application (app2).

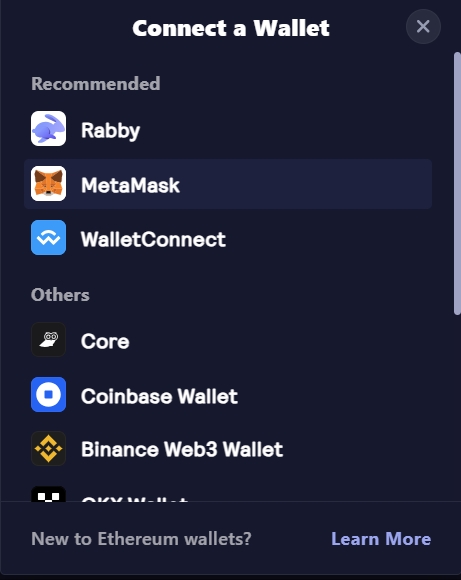

- Connect Your Wallet: On GMX, instead of creating a traditional account, you connect a blockchain wallet that supports Ethereum or Avalanche. Click on “Connect Wallet” and choose your wallet provider.

- MetaMask

- WalletConnect

- Coinbase Wallet

- Other supported wallets

Your wallet is your unique identifier and ensures regulatory compliance through its public address.

- Complete Verification (If Needed): Some features may require you to verify your connected wallet. Follow any prompts to complete this step, ensuring you meet the community and DeFi standards for security and compliance.

- Security Measures: Examine the security recommendations provided by the GMX platform to ensure the safety of your funds. Enable features such as two-factor authentication (2FA) from your wallet provider.

- Staking and Bonuses: Explore the opportunity to participate in staking, which bolsters the GMX ecosystem and can yield rewards for your contribution. Look out for a referral program – if you have a referral code, input it during this step to capitalize on any joining bonuses offered to new users.

By connecting your wallet and going through these steps, you effectively have a trading account on GMX.

This process emphasizes the benefits of decentralized exchanges over centralized exchanges in terms of control and privacy while upholding the community-led ethos of blockchain and DeFi.

How to Deposit and Withdraw Funds on GMX

First, to deposit funds on GMX, ensure you have a compatible wallet, such as MetaMask. Follow these steps:

- Navigate to the GMX dashboard.

- Connect your wallet by clicking the “Connect Wallet” button.

- Select the asset you wish to deposit.

- Enter the amount and confirm the transaction in your wallet.

No fees are imposed by GMX when depositing, but you should consider network fees. Deposits usually reflect instantly but might vary based on blockchain conditions.

Withdrawing Funds:

- Click the “Withdraw” option in your dashboard.

- Choose the cryptocurrency to withdraw.

- Input the withdrawal amount.

Remember that minimum and maximum limits apply, which vary for different assets. GMX does not charge withdrawal fees except for the inherent network transaction costs. Withdrawal processing times are typically fast, depending upon the congestion of the network.

Supported Payment Methods:

- Cryptocurrencies: BTC, ETH, and others.

- Stablecoins: USDT, USDC.

Deposit Limits: None are specified by GMX, but they adhere to personal wallet limits and network conditions.

Remember always to secure your transactions and verify all details before confirming deposits and withdrawals.

How to Transfer Funds to the Futures Wallet

When trading crypto futures on GMX, you work with two distinct types of wallets: your main wallet and the futures wallet.

Your main wallet is where your funds are stored by default after depositing them into GMX, while the futures wallet is specifically designed for trading futures contracts.

To engage in futures trading, you must transfer the necessary funds from your main wallet to your futures wallet.

To initiate a transfer, follow these steps:

- Log in to your GMX account.

- Navigate to the wallet or balance section.

- Look for an option labeled “Transfer” or similar.

- Select the currency you wish to transfer to the futures wallet.

- Enter the amount you want to transfer.

- Confirm the transfer details and execute the transaction.

GMX typically supports several currencies for futures trading, so select one of the supported currencies.

Before transferring, be aware of the minimum and maximum transfer amounts to ensure the transaction is successful.

Note: Transfers between your main wallet and futures wallet on GMX are usually processed quickly, but always verify the transaction completion in your futures wallet before proceeding to trade.

How to Choose Between Perpetual and Futures Contracts

When trading on GMX, you’re presented with two derivative contracts: perpetual and futures. Perpetual agreements do not have an expiry date, allowing you to hold a position for as long as needed.

This flexibility is countered by a funding rate that ensures the contract’s price stays anchored to the underlying asset.

Futures contracts have a set expiration date. They are settled on the date agreed, creating a scenario where you can strategize around this temporal endpoint, whether anticipating a market move or planning for a long-term position.

Perpetual Contracts: Advantages and Disadvantages

- Advantages:

- There is no expiration; trade freely without time constraints.

- Ideal for short-term speculative trading.

- Funding rates can be profitable if you’re on the right side of the trade.

- Disadvantages:

- Funding rates may eat into profits during sideways or long-term trades.

- It may require more monitoring.

Futures Contracts: Advantages and Disadvantages

- Advantages:

- Expiration dates enable strategic planning.

- Potentially avoid frequent funding rate costs.

- It can be more favorable for long-term positions.

- Disadvantages:

- There is less flexibility due to the expiration date.

- Possible time decay if the market doesn’t move as anticipated.

Examples of contracts on GMX include perpetual future contracts for coins like Bitcoin (BTC) and Ethereum (ETH) and traditional futures contracts with various expiry dates, such as quarterly or bi-quarterly contracts for the same assets.

Your choice hinges on your trading strategy, considering factors like the flexibility you need, market conditions, and financial goals. Use this information to align your selection with your trading plan on GMX.

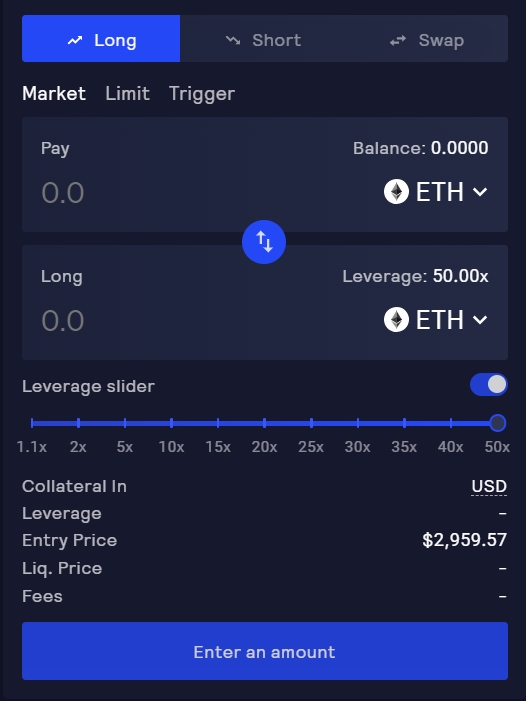

How to Understand the Futures Trading Interface on GMX

When you approach the GMX futures trading interface, you’re presented with a comprehensive yet user-friendly dashboard. Familiarizing yourself with the critical components of a practical trading experience is essential.

Chart

The chart is prominently displayed, providing real-time price action of the selected cryptocurrency. Detailed technical analysis is possible with moving averages and RSI (Relative Strength Index).

Order Book

To the side of the chart lies the order book, listing buy and sell orders at various price levels. This gives you insight into the market depth and potential support or resistance zones.

Order Panel

Here, you can place your trades. You’ll find options to set the order type (market, limit, etc.), the amount to invest, and leverage for your trade. Remember, higher leverage increases both potential profit and risk.

Position Panel

This area shows your open positions, including unrealized profit and loss. You can manage your trades here, setting stop losses or taking profits to mitigate risk.

Tools and Customization

Across the platform, GMX offers customization of the trading interface. You can rearrange panels and select which data is most important to you. Utilize drawing tools to map out your technical analysis directly on the chart.

The interface offers a balance between depth of functionality and ease of navigation. Familiarizing yourself with these elements can help you make informed trading decisions on GMX’s decentralized platform.

How to Place and Manage Orders on GMX Futures

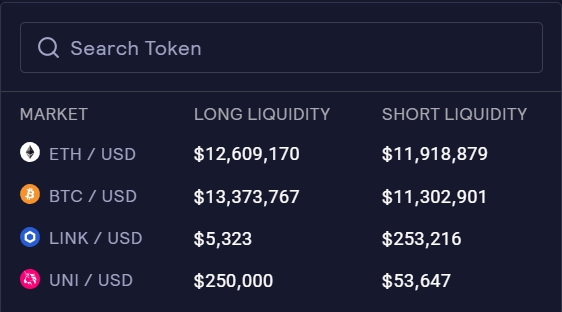

When trading crypto futures with GMX, your journey begins by selecting a trading pair like USDT/BTC and the type of contract to deal with.

With different leverage levels offered, you can choose one that aligns with your risk tolerance and strategy, bearing in mind that higher leverage increases potential gains and losses.

Choosing a Contract and Leverage

- Select a Trading Pair: For example, USDT/BTC.

- Pick a Contract Type: Futures contracts are standard.

- Determine Leverage: GMX supports varying degrees, such as up to 200x. Greater leverage amplifies the impact of price movements.

Different Types of Orders

- Market Orders: Execute immediately at the current market price.

- Limit Orders: Set a specific price to buy or sell, providing control over the execution price.

- Stop Orders: Trigger a buy or sell order when the market hits a predetermined price, acting as a risk management tool.

Placing and Managing Orders

To place an order:

- Navigate to the GMX trading interface.

- Select the USDT/BTC pair.

- Choose your order type (market, limit, or stop).

- Enter the amount and set prices as required.

- Confirm and execute the order.

Managing positions involves monitoring the order book and trading volume, adjusting leverage, and using API trading features for advanced strategies. Always be aware of the fees generated from trading, which impact net returns.

Leverage and Margin System

GMX’s margin system allows you to borrow funds to increase trade size. Remember, margin increases both the potential upside and risk.

Funding Rate and Settlement

Understand the funding rate, which is paid between longs and shorts to balance the market, and settlement mechanisms that are integral for realizing profits or losses. Manage positions with staking options in the DEX to reduce potential risks.

Closing positions is as simple as reversing the original order. Buy to close a short or sell to close a long, depending on your initial trade direction.

Stay informed on the current funding rate and settlement times to optimize your trade closures.

How to Use the GMX Order Calculator

The GMX order calculator is essential for managing your trades on the GMX exchange, especially when dealing with crypto futures.

It helps you to calculate potential profit, loss, and risk before you commit to a trade.

To access the GMX order calculator, navigate to the GMX dashboard and locate the calculator icon.

Once open, you’ll encounter several fields to input your trade’s parameters. Here’s what you need to know about each parameter:

- Entry Price: The price at which you plan to enter the trade.

- Exit Price: Your expected price to close the trade.

- Position Size: The total value of your trade.

- Leverage: The multiplier of your investment capital.

When you fill in these fields, the GMX order calculator will display results such as:

- Potential Profit or Loss: Estimates your gains or losses at the exit price.

- Liquidation Price: The price at which your position will automatically close at a loss.

Here’s how you might use the calculator in different scenarios:

- Going Long: Imagine you expect a cryptocurrency to rise. You set your entry and exit prices based on your market analysis, choose your position size, and decide on the leverage. The calculator then shows potential outcomes.

- Going Short: If you predict a price drop, adjust the entry and exit prices accordingly. Again, select your position size and leverage and review your potential profit or loss, including the liquidation price.

Remember, the calculations assume the market moves according to your predictions. Always be mindful of market volatility and ensure you have a risk management strategy.

How to Use the GMX Copy Trading Feature

GMX offers a copy trading feature that allows you to mirror the positions of experienced traders.

This tool is excellent for those looking to leverage the skills of seasoned traders without needing to develop in-depth trading strategies themselves.

Accessing the Copy Trading Platform:

- Create an account on GMX.

- Navigate to the copy trading section.

- Review the list of professional traders available to copy.

- Select a trader based on their performance metrics and risk profile.

Using the Copy Trading Platform:

- Choose a Trader: Look at the trader’s past performance, trading style, risk level, and the assets they typically trade.

- Set Parameters: Decide the capital you want to allocate to copy trading.

- Monitor Your Trades: Keep track of the copied trades through your dashboard.

Benefits:

- Leverage Expertise: Gain from the experience of successful traders.

- Time-Saving: No need to constantly analyze the markets yourself.

Risks:

- Market Volatility: Trades are subject to market risks and the possibility of loss.

- Dependence on Others: Your success is linked to the performance of the trader you are copying.

Tips for Choosing Copy Traders:

- Evaluate traders based on a comprehensive track record, not just recent wins.

- Consider consistency over time and how they manage losses.

- Diversify by following multiple traders to spread your risk.

By following these steps and recommendations, you can confidently navigate copy trading on GMXconfidently.

Remember to conduct your due diligence and understand that while copy trading can be advantageous, it has risks.

Frequently Asked Questions

In this section, you’ll find answers to common questions about trading crypto futures on GMX, specifically as they apply to US-based traders and what sets GMX apart from other platforms.

What are the requirements for US-based traders to trade crypto futures on GMX?

To trade crypto futures on GMX as a US-based trader, you must ensure that you comply with all relevant US regulations regarding cryptocurrency trading.

Since GMX operates as a decentralized exchange, you must review and understand the legal framework for such platforms in your jurisdiction.

Note that decentralized platforms might have different requirements or restrictions than centralized exchanges.

How does GMX differentiate itself from other futures trading platforms?

GMX stands out by offering a decentralized ecosystem for spot and perpetual futures trading without an intermediary, which is standard on centralized exchanges.

It operates on the Arbitrum and Avalanche networks, providing low-fee trading environments.

The platform is appreciated for its easy-to-navigate interface and the distinctive feature of distributing 100% of the protocol revenue to its token holders, enhancing the potential for actual yield.

Conclusion

Futures trading on GMX offers a decentralized platform to leverage your position in the cryptocurrency market. Utilizing GMX’s suite of tools, you can engage in perpetual contracts without needing a traditional exchange.

Key reasons to choose GMX for trading:

- Decentralized Nature: Trade with peace of mind, knowing you retain full custody of your assets.

- Reduced Risk: The platform’s unique liquidity pool minimizes the risks of futures trading.

For assistance and community support, join the GMX Discord community or explore the rich knowledge base on the GMX Blog. If you’re seeking to deepen your understanding, consider exploring the following educational resources:

- Crypto Futures Trading Courses: Coursera offers a variety of specialized courses.

- Investopedia’s Futures Trading Basics: A solid foundation on futures trading principles.

Remember to start small and use the available tutorials and support to increase your confidence and capabilities.

With responsible trading practices and continuous learning, you can navigate futures trading on GMX and potentially capitalize on this innovative financial instrument.