In the fast-paced world of cryptocurrency futures trading, understanding the fee structure is crucial to maintaining profitability.

When trading crypto futures, you encounter several fees, each potentially impacting your bottom line.

Consider the exchange’s fee policy before trading to optimize your trading strategy and minimize costs.

Some exchanges offer reduced fees for higher volume traders or discounts when using their native token to pay for expenses.

Keeping a watchful eye on these factors will allow you to trade more efficiently.

It can considerably affect preserving your capital and maximizing your profits in the competitive arena of crypto futures trading.

Type Of Crypto Futures Trading Fees

Exchanges like BingX and Bybit typically charge trading fees, including maker and taker fees ranging from 0% to 1.5% per trade.

The ‘maker’ fee applies when you add liquidity to the market by placing a limit order, and the ‘taker’ fee is for orders that take away liquidity, such as market orders.

Additionally, you might incur network fees, which are costs associated with the blockchain network, and there can also be fees for depositing and withdrawing funds from the trading platform.

Maker and taker fees are significant because they incentivize different market behaviors, with makers often receiving a lower fee rate as they contribute to the market’s liquidity.

Network fees are equally important as they can vary widely depending on the congestion of the network and the cryptocurrency in question.

They underscore the importance of selecting the right moments for transferring your assets.

Let’s get into each of those now:

Trading Fees

In crypto futures trading, your profits are significantly influenced by trading fees. These fees vary based on your role in the market transactions — either as a maker providing liquidity or a taker removing it.

Maker Fees

Maker fees apply when you place a trade that doesn’t immediately fill, such as a limit order, adding liquidity to the market. This fee is typically lower since you contribute to the exchange’s trading volume and depth.

For instance, if you place an order to sell a future at $10,500 and it doesn’t match an existing order, you’re a maker. The fee for makers can be a small percentage of the transaction, often lower than 0.1% on exchanges like Binance.

Taker Fees

Conversely, taker fees are charged when your trade order is matched instantly with an existing order, thus removing liquidity from the market. They are usually higher than maker fees, incentivizing traders to fill the order book.

For example, placing an instantaneous buy order at the best available market price is considered a taker transaction. These fees can range from 0.04% to 0.2% per transaction.

Trading fees are critical in determining your net profitability from crypto trading.

Additionally, the fee structure and the existence of a spread – the difference between the buy and sell price – can impact your bottom line.

Exchanges prompt different fee levels based on volume, offering lower fees for higher-volume traders to maintain liquidity.

Your aim should include strategies for minimizing these fees to maximize potential profits.

Funding Fees

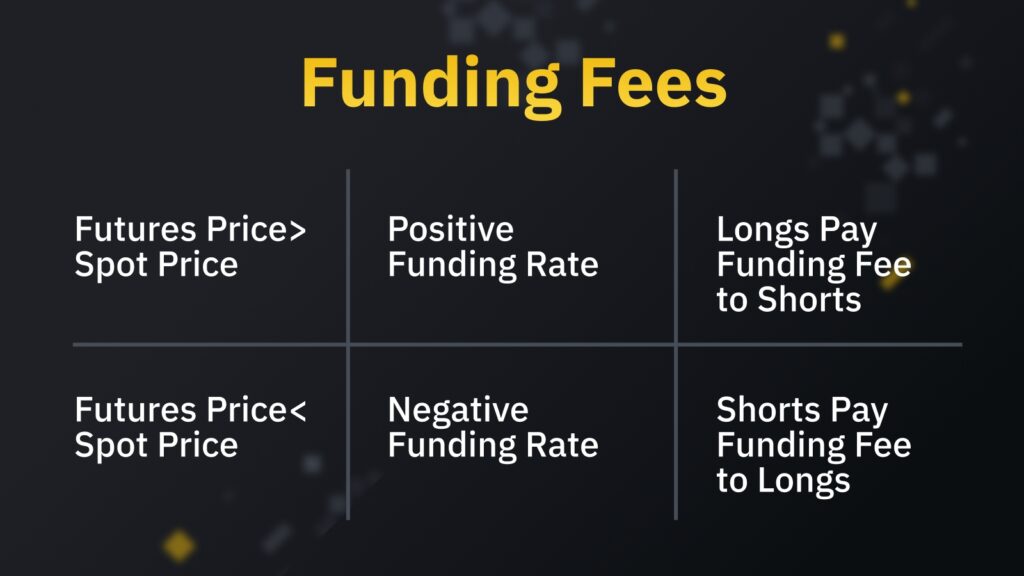

In crypto futures trading, funding fees are periodic payments that traders might exchange to maintain the alignment between the perpetual contract prices and the spot price of the underlying asset.

These fees are typically settled every eight hours and are determined by a combination of factors:

- Interest Rate: Reflects the cost of borrowing capital to leverage positions.

- Premium Index: Indicates the divergence between futures and spot market prices.

When you’re trading perpetual contracts, funding fees ensure that the futures prices do not deviate significantly from the actual market price of the cryptocurrency.

This is achieved by a mechanism where long position holders pay short position holders if the cost of the perpetual contract is higher than the spot price, and vice versa.

Examples of Funding Fee Variations:

- High Volatility: During volatile market conditions, the premium index might increase, affecting the funding rate.

- Stable Markets: In less volatile times, the premium might remain closer to zero, resulting in lower funding rates.

Managing funding fees effectively involves being vigilant about the funding rate during the funding interval. If you anticipate that you will be paying a high funding fee, you might choose to reduce your position before the funding timestamp to minimize costs.

| Market Condition | Funding Fee Impact |

|---|---|

| High Volatility | Increased funding fee |

| Low Volatility | Decreased or neutral funding fee |

| Market Downturn | Potential increase in funding fee |

Crypto Futures Trading Withdrawal And Deposit Fees

When trading crypto futures, you must know that withdrawal and deposit fees can affect your bottom line.

Withdrawal Fees:

You’re usually charged a withdrawal fee whenever you withdraw your funds from a crypto exchange. Your fees vary widely across different exchanges and depend on the specific cryptocurrency you’re starting. They cover transferring your assets from the exchange to your wallet or another exchange.

Deposit Fees:

On the other hand, deposit fees are not as standard as withdrawal fees.

If they are present, they are typically lower. Some exchanges charge a small deposit fee, especially if they involve fiat currencies or use specific deposit methods like wire transfers.

| Transaction Type | Fee Characteristics |

|---|---|

| Deposit Fees | Rare, can depend on method and currency |

| Withdrawal Fees | Joint varies by currency and exchange policy |

Minimizing Fees:

- Choose a crypto exchange that offers low or no deposit fees.

- Opt for withdrawal methods that have lower fees, if available.

- Consolidate your withdrawals to reduce the number of transactions and total fees paid.

Always check the fee structure on your exchange’s website before initiating any deposit or exchange. This helps ensure you are not met with unexpected costs that can affect your trading profits. It’s a crucial step in managing your funds effectively. It’s the crypto trading landscape.

Settlement Fees

Understanding settlement fees is crucial for efficient portfolio management when trading crypto futures. Settlement fees come into play after a futures contract when the actual exchange of the asset’s ownership occurs (the settlement). These fees are based on the exchange, asset liquidity, and market conditions.

Types of Settlement and Associated Fees:

- Cash Settlement: Often involves a fee subtracted from your final profit or added to yoursthat’ssetIt’stlement future price determines it. It’s intact, typically involving no exchange of the physical asset.

- Physical Settlement: Incurs fees related to the actual movement of the cryptocurrency and any associated transaction costs on the blockchain.

Minimizing Fees:

- Adequate Liquidity: Trade contracts with high liquidity to reduce the spread, which can lower potential settlement costs.

- Fee Structures: Prioritize exchanges with transparent and competitive settlement fee structures.

- Regular Monitoring: Monitor fluctuating funding rates to avoid surprises during the settlement.

Overnight Fees

When you engage in crypto futures trading, mainly with margin trading, you need to be aware of overnight fees, also known as funding fees or rollover fees.

These fees apply when you hold a leveraged position open past a particular time, usually the end of the trading day in the respective time zone of the exchange.

Understanding Overnight Fees:

- Market Conditions: The amount you’ll earn as an overnight fee is connected to liquidity and lending rates between long (buy) and short (sell) positions.

- Fee Calculation: Exchanges often calculate this fee based on the position size and the specified funding rate. This funding rate can change daily and varies between exchanges.

Minimizing Overnight Fees:

- Monitor Position Duration: Be strategic about how long you hold a position. Consider closing it before the daily cutoff time for calculating overnight fees.

- Funding Rate Alerts: Some platforms offer alerts when funding rates increase. Use these to avoid high overnight fees.

- Regular Balancing: Rebalance your positions frequently to mitigate prolonged exposure to fluctuating funding rates.

Remember:

- Short-term Trading: If you’re a trader, these fees may not apply since you have positions overnight.

- Fee Transparency: AlwwonAlwwon’theckee structure on your chosen trading platform for the latest rates and calculation methods.

Strategies to Minimize Fees and Maximize Profits

Adopting strategies that effectively reduce costs and enhance potential gains is essential when engaging in crypto futures trading. The nuances of exchange policies, order types, and market dynamics significantly affect how much you pay in fees and, consequently, your overall performance.

- Choose The Right Exchange

Select an exchange that offers competitive fees. Binance and Coinbase are popular crypto exchanges; however, their fee structures differ. Typically, you’ll pay a percentage of each trade as a fee, with your fees varying based on the exchange and your trading volume.

- Use Limit Orders

By using limit orders, you maintain control over the price at which your trade executes, potentially reducing the spread and commission costs. Limit orders can help you avoid slippage – the difference between a trade and a completed price.

- Volume Discounts

Most trading platforms offer discounts for high-volume traders. The larger your transactions, the lower your fees as a percentage of your trade. Ensure you understand the tiered fee schedule to benefit from these volume discounts.

- Fee Rebates through Exchange Tokens

Tokens such as BNB on Binance offer reductions in trading fees. Utilize these exchange tokens to receive fee rebates or access promotional transaction discounts.

- Stay Informed

Keep up-to-date with the latest crypto exchange news and policies. Being well-informed can help you capitalize on temporary fee reductions or special trading promotions.

- Consider Trading Pairs and Liquidity

Trading pairs with higher liquidity typically have lower spreads, minimizing your costs. Analyze the liquidity of different pairs to choose the most cost-effective trading strategy.

- Tax Considerations

Understand the tax implications of your trading strategies, as these can affect your net profits. Ensure you know regulations and required disclosures, as you may have associated costs that impact personal finance.

- Reducing Slippage and Market Impact

Effective risk management involves minimizing market impact and slippage. Choose suitable timeframes and enter the market at points where the liquidity is sufficient to absorb your trade without large price deviations.

- Choosing the Right Leverage and Contract Size

Adjust your leverage and position sizing based on the market analysis. While high leverage might amplify gains, it can also magnify fees relative to your account balance. A balanced approach to leverage and contract size is critical in futures trading.

- Using different Timeframes

Your trading charts and timeframes can influence fee-related decisions. Short-term traders may face higher cumulative fees due to the frequency of trades. Meanwhile, long-term traders might optimize for lower fees over extended periods.

Conclusion

Understanding and optimizing trading fees are crucial for your profitability in crypto futures trading. Various factors can influence the costs you incur.

These factors include trading volume, market depth, and the use of particular order types. It’s essential to consider the fee structures of different exchanges, as these can vary significantly.

- Maker vs. Taker fees: Maker fees are lower than taker fees. This is due to the liquidity makers provide to the market.

- Fees across exchanges: Binance, for example, offers a maker fee that starts at 0.02% and a taker fee of 0.04%. These rates can be reduced to even lower with higher trading volumes or using their native token.

- Fee discounts: Utilize exchange tokens or aim for higher volume tiers to receive discounts.

Diligence in research is your ally in managing and minimizing costs.

You must stay current with fee updates and understand how funding and other charges, such as withdrawal and deposit fees, contribute to your trading costs.

Different exchanges have distinct fee structures and incentives that can be leveraged to your advantage.

Lastly, effective risk management is indispensable. Educate yourself on the intricacies of crypto futures and use cost-effective strategies wisely.

By keeping yourself informed, you’re better equipped to navigate the crypto future of your trading performance.