In the rapidly evolving world of cryptocurrency trading, two platforms have risen to prominence: Bybit and StormGain. These exchanges offer a range of services aimed at catering to the diverse needs of crypto traders worldwide. Bybit, established in 2018, is known for its wide selection of cryptocurrencies and its focus on derivatives trading, including inverse and perpetual futures contracts with leverage options up to 1:100. Its offerings are dedicated to providing traders with sophisticated financial instruments and a platform designed for high-performance trading experiences.

On the other hand, StormGain, which entered the market in 2019, has quickly gained traction among traders looking for an intuitive trading platform. StormGain provides not only crypto trading but also additional services like over-the-counter trading, leverage options, and DeFi functions such as mining and staking. This positions StormGain as a versatile option for those seeking to engage with the crypto market’s various aspects. Your understanding of each platform’s features, fee structures, and product offerings is crucial as you consider which exchange best suits your trading strategies and needs.

| Feature | Bybit | StormGain |

|---|---|---|

| Founded | 2018 | 2019 |

| Trading Volume | Exceeds $10 billion (24h) | Lower than Bybit; moderate trading volume |

| Leverage | Up to 100x for specific contracts | Offers high leverage options |

| Fees | Low trading fees, varies by contract | Competitive fees, transparent structure |

| KYC Requirements | Optional but provides higher withdrawal limits without KYC | Optional but may enhance features |

| Contract Options | Multiple, including inverse and linear futures | Includes perpetual contracts and others |

| Liquidity | High liquidity, especially in popular pairs | Solid liquidity, generally below Bybit |

| Margin Trading | Supported with various margin types | Supported with high leverage |

| Security | Robust security measures | High standards of security |

| Additional Features | Advanced trading tools, mobile app | User-friendly interface, built-in wallet, cloud mining |

Bybit vs Stormgain: Comparison at a Glance

When you’re exploring the crypto exchange landscape, Bybit and Stormgain are two platforms you may encounter. Each has distinct features and services to cater to your trading needs.

Bybit is recognized for its broad selection of cryptocurrencies and advanced trading features. It boasts a robust trading infrastructure and competitive fees, making it a platform suited for both novice and experienced traders. Bybit’s impressive leverage options can amplify your trading strategies, although they also increase risk.

On the other hand, Stormgain prides itself on a range of products designed to support your market exploration and trading strategies. It offers services like over-the-counter (OTC) trading and leveraged trading. While offering fewer cryptocurrencies than Bybit, Stormgain still provides a suite of features that may be attractive to certain traders.

Below is a table summarizing the key aspects of Bybit and Stormgain:

| Feature | Bybit | Stormgain |

|---|---|---|

| Supported Coins | Wide variety | Limited variety |

| Leverage | High leverage options | Available |

| Trading Volume | High trading volume | Moderate trading volume |

| Deposit Methods | Multiple methods | Various options |

| Fees | Competitive | Competitive |

| User Support | Comprehensive | Adequate |

| Additional Features | Advanced trading tools | OTC trading, wallet services |

For an in-depth understanding of the fee structure and specific deposit methods each platform offers, you’re encouraged to visit their respective websites as these details may change periodically.

Make sure to weigh these factors according to your trading preferences and risk tolerance. Whether you prioritize a wide array of cryptocurrencies or a platform with specific products like leveraged or OTC trading will guide your choice between Bybit and Stormgain.

Bybit vs Stormgain: Products and Services

When you compare Bybit and Stormgain, you’ll notice that both platforms offer a range of services catered toward cryptocurrency traders, but there are clear distinctions in their offerings.

Bybit is recognized for its robust derivatives market, specifically:

- Futures Contracts: It provides both inverse and perpetual futures.

- Leverage: Up to 100x leverage on certain contracts.

- Liquidity: Generally high, contributing to smooth trade execution.

In addition, Bybit offers spot trading, providing you with an opportunity to trade cryptocurrencies directly.

Stormgain, on the other hand, offers a mix of services including:

- Leverage Trading: This platform is known for allowing trades with higher leverage, although typically less than Bybit’s.

- Spot Trading: Stormgain includes this traditional exchange feature in its array of options.

- Crypto Indices: A unique offering that allows for broader market exposure.

Stormgain sets itself apart with features such as over-the-counter trading and crypto mining services which are not standard on Bybit.

While Bybit leans heavily on its derivatives and futures products, appealing to traders looking for high leverage and volume, Stormgain provides a varied experience, integrating additional services like mining and indices. Your choice between the two may hinge on whether you prefer the high liquidity and extensive leverage options of Bybit or the diverse product range and unique features offered by Stormgain.

Bybit vs Stormgain: Contract Types

When examining contract types, you’ll find that Bybit offers a diverse range of derivative products including inverse perpetual contracts, linear perpetual contracts, inverse futures contracts, and options. Inverse perpetual contracts allow you to trade cryptocurrency derivatives with the coin itself as collateral, which can be advantageous due to potentially lower transaction fees when exchanging within the same coin type.

Linear perpetual contracts, on the other hand, are quoted and settled in a stablecoin such as USDT, making them more accessible if you prefer a stablecoin base. This can simplify the trading experience by providing a clearer understanding of your profits and losses in a stable currency.

Bybit also features inverse futures contracts, which are similar to inverse perpetual contracts with a set expiry date. These can be beneficial for those looking to hedge against future price fluctuations within a specific timeframe.

On the topic of COIN-M futures, Stormgain does not currently offer this type of contract which can be a downside if you’re looking for flexibility in futures trading.

In contrast, Bybit’s USD-M futures are settled in USDT and potentially offer greater liquidity due to their pairing with a stablecoin, advantageous for managing risks associated with volatile market movements.

Finally, Bybit’s options on cryptocurrencies provide you with the flexibility to speculate or hedge at various strike prices and expirations, enhancing the strategic depth of your trading experience.

Here’s a concise comparison:

| Feature | Bybit | Stormgain |

|---|---|---|

| Inverse Perpetual | Available | Not Available |

| Linear Perpetual | Available | Available |

| Inverse Futures | Available | Not Available |

| COIN-M Futures | Not Available | Not Available |

| USD-M Futures | Available | Not Specified |

| Options | Available | Not Available |

Bybit’s contract offerings encompass a broader spectrum which may suit your needs if you’re looking for a variety of derivatives trading options. Stormgain, while offering leverage trading, lacks the diversity in contract types compared to Bybit.

Bybit vs Stormgain: Leverage and Margin

When you engage in leverage trading on either Bybit or Stormgain, you have the opportunity to magnify your trading positions beyond your initial capital. This financial tool is a double-edged sword, as it can heighten both potential profits and losses.

Bybit provides you with a maximum leverage of up to 100x. This level of leverage applies to your BTC and ETH trading activities, among other cryptocurrencies. To maintain your positions, you’re required to meet the margin requirements, which denote the minimum balance you need to hold to keep the trades open. Be mindful of liquidation risks: if your account balance falls below the maintenance margin, your positions may be automatically closed to prevent further losses.

Conversely, Stormgain offers a substantially higher maximum leverage—sometimes reaching up to 500x. Such high leverage can significantly increase your exposure to the crypto market with the same initial investment. Do consider, however, the liquidation risks attached to margin trading, as the threshold for market movements triggering a closeout is much narrower with high leverage.

Keep an eye on funding rates on both platforms, as they can affect the cost of holding leveraged positions over time. Funding rates essentially ensure the alignment of spot and margin trading prices and are periodically settled between users, based on the market’s lending rate.

Remember that leverage and margin trading dramatically increase your exposure to market volatility. It’s crucial to manage your risk appropriately to avoid substantial financial loss. Both Bybit and Stormgain offer different conditions for trading on margin, so consider your experience level and risk tolerance when choosing the platform that suits your trading strategy.

Bybit vs Stormgain: Liquidity and Volume

When selecting a cryptocurrency exchange, understanding liquidity and volume is crucial for your trading efficiency. Liquidity refers to the ease with which an asset can be bought or sold without affecting its price, while volume is the total amount of crypto that has been traded within a set period.

Bybit is known for its substantial liquidity and high trading volumes, particularly for Bitcoin and Ethereum. Such robust liquidity ensures you can execute large trades with minimal slippage – the difference between the expected price and the executed price of a trade. Bybit’s trading volume also indicates active participation and the ability to find counterparties for trades effortlessly.

In contrast, Stormgain tends to have lower liquidity and volume compared to Bybit. Although it offers a variety of services like leverage trading, the relatively smaller user base might result in higher slippage and potentially less efficient trade executions.

To assess the liquidity and volume on each exchange, you can reference market analytics platforms that analyze data across various exchanges. Metrics to check include the bid-ask spread, order book depth, and 24-hour trading volume.

| Exchange | Average Daily Volume | Noted Trading Pairs |

|---|---|---|

| Bybit | High | BTC/USD, ETH/USD |

| Stormgain | Comparatively Lower | Varied Cryptocurrencies |

For an updated and comprehensive view of liquidity and volume rankings, financial market reports and exchange ranking websites are valuable resources. They will provide you with the latest statistics, helping you make informed decisions based on recent market behavior.

Bybit vs Stormgain: Fees and Rewards

When deciding between Bybit and Stormgain, understanding the detailed fee structure and reward mechanisms is critical for optimizing your trades and maximizing potential profits.

Trading Fee & Deposit/Withdrawal Fee Compared

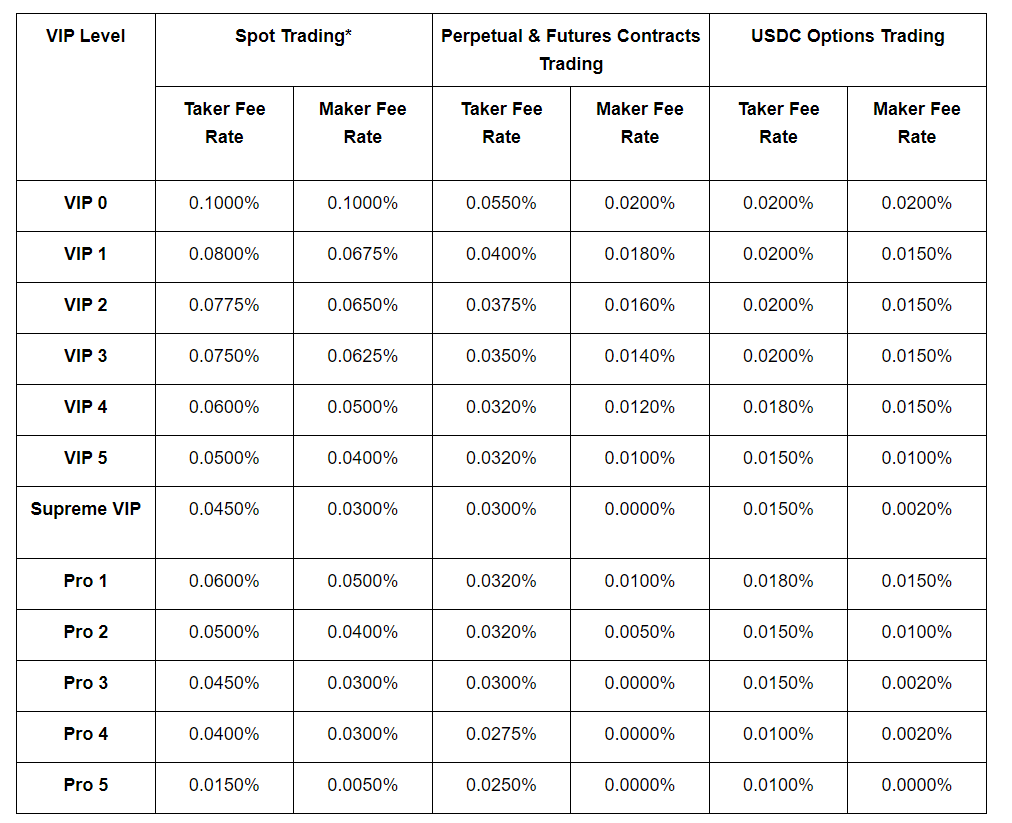

Bybit uses a maker-taker fee model for its trading fees. As a maker, providing liquidity to the order book, you’ll pay lower fees compared to being a taker, who takes liquidity away.

- Maker Fee: 0.025%

- Taker Fee: 0.075%

Various order types and a dual price mechanism help protect traders from market manipulations. Depending on the cryptocurrency, such as BTC, ETH, or USDT, fees may vary slightly.

Stormgain also implements a maker-taker model but the fees may differ:

- Maker Fee: Typically lower than taker fees

- Taker Fee: Generally higher than maker fees

Transaction fees on Stormgain could include a withdrawal fee depending on the asset. Promotions and rewards can occasionally offset these fees.

Example Calculation:

If you place a BTC trade where you are the maker, and the trade value is $1,000 on Bybit:

$1,000 x 0.025% = $0.25

And if you are a taker:

$1,000 x 0.075% = $0.75

Stormgain has a minimum fee for transactions, and the exact fee can depend on the asset and the account status. It’s crucial to consider your frequency of trading and the volume to understand how much these fees will affect your profits.

Discounts on Bybit can occur for users holding their platform’s token or for high-volume traders. Stormgain may offer rewards or bonuses under certain conditions, such as account opening or referrals.

Deposits & Withdrawal Options

Depositing and withdrawing funds can directly influence your trading experience’s convenience and cost.

Bybit supports several cryptocurrency deposits, including but not limited to BTC, ETH, and USDT, with no deposit fees. Withdrawals have a standard fee depending on the crypto asset withdrawn. Credit card purchases are facilitated through third-party providers and may include additional fees.

Stormgain also allows for deposits in a variety of cryptocurrencies. However, a fee might be associated with depositing or withdrawing, and it usually varies by the type of cryptocurrency. Similarly to Bybit, credit card deposits are possible and might incur service charges.

The time required for processing withdrawals may vary. For Bybit:

- BTC withdrawals processed three times a day

- ETH and USDT: multiple times a day

Stormgain also processes withdrawals several times a day, but times may vary based on the currency and current network load.

Regarding the minimum and maximum amounts, both exchanges have their set limits which can influence your decision-making process depending on your trading needs.

To summarize, while both Bybit and Stormgain offer competitive fees and diverse reward systems, your specific trading strategies and preferred assets could make one more advantageous over the other. Keeping a close watch on applicable fees, available rewards, deposit and withdrawal conditions will aid in making an informed decision.

Bybit vs Stormgain: KYC Requirements & KYC Limits

When you choose a cryptocurrency exchange, understanding the Know Your Customer (KYC) requirements is crucial. Both Bybit and Stormgain have implemented KYC policies that impact account limits.

Bybit’s KYC Requirements:

- Required Documents: To fulfill Bybit’s KYC protocols, you will need to provide personal identification documents.

- Verification Levels: There are different levels of verification, with increased limits awarded after each level’s completion.

- Non-KYC Limits: If you opt not to complete KYC, Bybit imposes a daily withdrawal limit of 2,000 USDT and a monthly limit of 100,000 USDT.

On the other hand, information about Stormgain’s specific KYC requirements from the provided search results is not available, but generally, similar exchanges will require photo ID, proof of residence, and possibly additional verification for higher transaction limits.

Stormgain’s KYC Requirements:

- Verification Status: Not explicitly detailed in the provided results.

- Leverage Limits: It offers up to 50X leverage for some trading pairs, which could imply higher KYC requirements for higher leverage access.

KYC requirements are there for your security and to ensure the exchange complies with anti-money laundering laws. While these measures add to the security, they can also restrict your anonymity. By understanding and completing KYC, you’ll enable a smooth and secure trading experience with appropriate limits tailored to your needs on platforms like Bybit and Stormgain.

Bybit vs Stormgain: Order Types

When trading cryptocurrencies, the diversity of order types allows you to execute strategies effectively and manage risks. Both Bybit and Stormgain offer a variety of order types tailored to different trading preferences.

Bybit supports several order types:

- Market Orders: Execute immediately at the best available price.

- Limit Orders: Set a specific price for the order to execute.

- Stop Orders: Trigger a buy or sell order when the market reaches your set price, which can be a stop-loss or take-profit.

- Conditional Orders: Execute only when certain conditions are met.

- Post-Only Orders: Ensure the order is added to the order book and not matched with a pre-existing order.

- Reduce-Only Orders: Explicitly designed to reduce a position, not increase it.

Bybit’s Dual Price Mechanism protects from market manipulation, with the Mark Price preventing unfair liquidations.

Stormgain, on the other hand, provides:

- Market Orders: For immediate execution.

- Limit Orders: Enabling you to set a desired entry or exit price.

- Stop Orders: Used mainly for stop-loss but can also be applied for taking profit.

Stormgain doesn’t explicitly list conditional, post-only, or reduce-only orders, which might limit advanced strategy implementation.

Adjust Orders feature allows you to amend order parameters in response to market movements. Bybit offers more sophistication here with a wider range of adjustable order types, reflecting its focus on serving experienced traders with intricate strategies. Stormgain has simpler adjust order options likely to cater to the needs of newcomers or intermediate traders preferring a straightforward interface.

Choose your platform based on the complexity of the orders you intend to use and the level of control you require over your trading activities.

Bybit vs Stormgain: Security and Reliability

When assessing the security of Bybit and Stormgain, it’s essential to consider the range of safeguards they employ to protect your funds and data. Both exchanges implement industry-standard security measures, including two-factor authentication (2FA), to enhance the safety of your account.

Bybit is known for its robust security infrastructure. It utilizes multi-signature wallets for transaction processing, ensuring that no single party can move your funds without authorization from multiple parties. In terms of regulatory compliance, Bybit is headquartered in Dubai and caters to a global audience, with an emphasis on adhering to local regulatory standards where it operates.

- Two-Factor Authentication: Available on both platforms.

- Multi-Signature Wallets: Used by Bybit for enhanced security.

Stormgain, on its part, has also implemented effective security protocols. Though Stormgain has not reported significant hacking incidents, it’s important to recognize the proactive approach it takes towards securing your information and funds. Advanced security measures such as encryption and ongoing security monitoring are part of Stormgain’s efforts to maintain a safe trading environment.

Stormgain has consistently worked to maintain regulatory compliance, ensuring it meets the standards set by the authorities governing its operations. Customer support plays a pivotal role in handling any security issues, and both exchanges provide assistance to resolve users’ concerns promptly.

Your experience with these exchanges should be smooth, but remember that no system is immune to risks. You should always use the security features provided and stay informed on the best practices to protect your digital assets.

Bybit vs Stormgain: User Experience

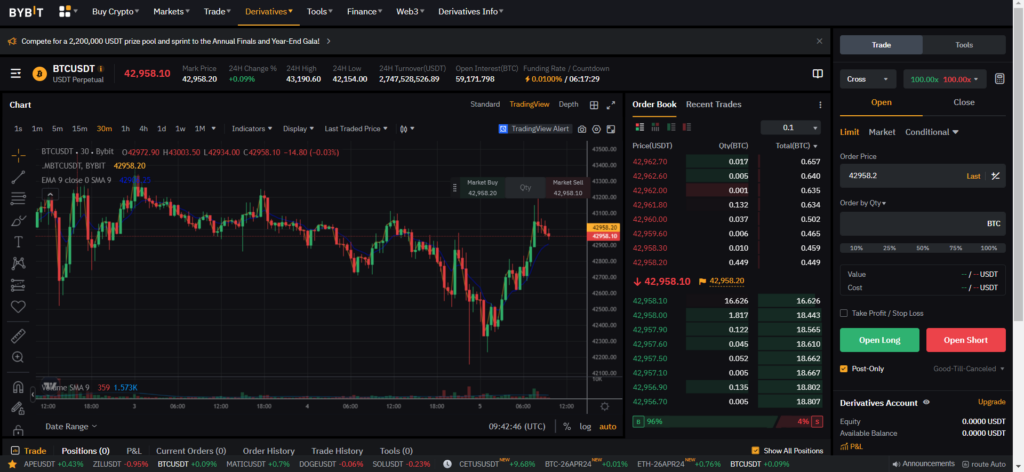

When choosing a cryptocurrency exchange, the user experience is paramount. Both Bybit and Stormgain offer platforms that cater to a variety of user preferences.

Bybit boasts a sleek design with a user-friendly interface that allows you to navigate and execute trades efficiently. Its mobile app is highly regarded for its functionality and smooth performance, giving you the ability to manage trades on the go. Bybit’s platform is robust, offering a seamless trading experience with minimal downtime and quick load times.

Stormgain, on the other hand, provides a comprehensive platform that integrates trading signals and educational resources. Its website and mobile app are designed to be intuitive, which can be especially beneficial if you’re new to crypto trading. Stormgain’s demo account feature allows you to experiment with trading without real financial commitment, a valuable asset for learning and practice.

| Feature | Bybit | Stormgain |

|---|---|---|

| Design & Ease of Use | Intuitive, minimalistic | User-friendly, resource-rich |

| Mobile App | High-functionality, reliable | Intuitive, includes extra tools |

| Speed & Performance | Fast loading, responsive | Consistent, efficient |

| Demo Account | Not commonly mentioned in reviews | Yes, useful for practice |

Reviews and user feedback highlight that Bybit’s customer support and platform stability are points of confidence for its users. Stormgain’s users appreciate the all-in-one nature of its platform, with the option to store, mine, and trade assets in one place.

Both platforms perform well across various devices and have garnered positive responses for their ease of use and well-structured layouts. However, individual preferences may vary, and you might find one more suitable based on your specific trading style and need for additional features.

Bybit vs Stormgain: Education and Community

When choosing a cryptocurrency exchange, education and community engagement are crucial for both newcomers and seasoned traders. Bybit and Stormgain each offer resources tailored to their user base.

Bybit focuses heavily on educational content, suitable for beginners and experienced traders alike. You’ll find a variety of:

- Guides: Step-by-step assistance for all exchange features.

- Videos: Detailed tutorials that walk you through various trading strategies and tools.

- Research: In-depth analysis of market trends and educational articles to broaden your understanding of the crypto market.

Bybit’s community extends to popular platforms like Telegram where discussions, updates, and support are readily available.

On the other hand, Stormgain tailors its education to encompass a broader range of services. Their offerings include:

- Trading signals: An advantageous tool, especially for beginners, to help identify potential trades.

- Educational software: A suite of applications designed to enhance your trading knowledge.

Stormgain’s approach to community is multifaceted, with a presence on social media where they share insights, updates, and engage with users.

| Feature | Bybit | Stormgain |

|---|---|---|

| Guides and Tutorials | Comprehensive for both beginners and advanced users | Focused on trading signals and platform-specific tools |

| Video Content | Extensive tutorials covering a range of topics | Not prominently advertised |

| Community Engagement | Active Telegram group, social media presence | Social media engagement and updates |

| Research Materials | In-depth market analysis and educational articles | Limited availability |

Your choice between the two will depend on what you value more: the breadth of educational materials and community interaction offered by Bybit or the combined trading and educational structure of Stormgain. Both platforms are proactive in equipping you with the knowledge to navigate the crypto space confidently.

Bybit vs Stormgain: Regulation and Compliance

When evaluating Bybit and Stormgain, it’s crucial to consider how they align with regulations and compliance that govern cryptocurrency exchanges. Your understanding of their adherence to these regulations can significantly impact your choice of platform, especially when considering security and legality.

Bybit has established itself as a platform that prioritizes user security and regulatory compliance. They operate in accordance with the requirements of multiple regulatory bodies, ensuring a diverse and secure trading environment. Bybit’s efforts include collaboration with regulators to stay compliant with the evolving legal frameworks in different jurisdictions where they offer their services.

On the other hand, Stormgain operates with a focus on user accessibility and has been catering to various markets. However, specifics on regulatory licenses or certifications are not explicitly detailed in the search results provided.

| Feature | Bybit | Stormgain |

|---|---|---|

| Regulation | Complies with multiple regulators | Information not explicitly detailed |

| Fiat Currency | Supports various fiat currencies | Offers services in multiple fiat options |

| Country of Origin | No clear information | No clear information |

| SEC Compliance | Efforts to align with SEC norms | SEC-related compliance unclear |

Despite the lack of explicit details for Stormgain, both platforms are expected to align with international compliance standards, including Anti-Money Laundering (AML) and Know Your Customer (KYC) policies. These are crucial in preventing financial crimes and ensuring the legitimacy of transactions on the exchanges.

In your consideration of these platforms, remain aware of their compliance with the legal standards of the countries in which they operate. Keep in mind that regulatory landscapes can shift, necessitating ongoing monitoring of an exchange’s status regarding regulation and compliance.

Conclusion

Bybit has distinguished itself with a broader array of cryptocurrencies available for trading. This feature might appeal to you if diversity in crypto assets is a priority. The platform also provides a range of trading products and could be more suited to your needs if you are looking for variety and depth in trading options.

StormGain, on the other hand, is recognized for its comprehensive offering of services, including over-the-counter (OTC) trading and leverage trading. If your trading strategy involves leveraged trades or you’re interested in OTC options, StormGain can be the preferable choice.

Bybit – Best For:

- Traders seeking a wide selection of cryptocurrencies

- Users who desire a robust product offering

StormGain – Best For:

- Traders interested in leverage trading options

- Those who prefer a platform with OTC trading facilities

For further learning, consider exploring additional resource sites and trading forums. Always ensure to conduct thorough research and due diligence. Whether it’s staying updated on crypto-related news on CoinTelegraph, learning from user-generated content on TradingView, or joining discussions on Reddit’s r/CryptoCurrency, continuous learning will enhance your trading capabilities.

Choose the platform that aligns with your trading preferences and don’t hesitate to use demo accounts or educational resources provided by the exchanges themselves to gain firsthand experience without financial risk. Remember, your choice should be informed by your individual investment goals and appetite for risk.

Explore how Bybit vs StormGain compare to their competitors:

- Bybit vs PrimeXBT: Detailed Review and Comparison

- Bybit vs Deribit: Detailed Review and Comparison

- Bybit vs Phemex: Detailed Review and Comparison

- Bybit vs Binance: Detailed Review and Comparison

- StormGain vs PrimeXBT: Detailed Review and Comparison

- StormGain vs Binance: Detailed Review and Comparison