Stormgain, a cutting-edge platform, offers a gateway to this dynamic market with its robust futures trading features.

This step-by-step guide is designed to demystify the process of trading crypto futures on Stormgain, providing both novice and experienced traders with the knowledge needed to navigate the market confidently.

From understanding the fundamental concepts of futures contracts to executing trades precisely, this tutorial will cover all the essentials.

Whether you’re looking to hedge your portfolio or capitalize on market trends, Stormgain’s platform facilitates your trading journey.

So, buckle up and prepare to embark on an educational expedition into the heart of crypto futures trading on Stormgain.

Stormgain Futures Trading Strategy & Basics

When engaging in futures trading with Stormgain, it’s essential to understand that you’re trading contracts based on the future value of cryptocurrencies, not the cryptocurrencies themselves.

This lets you speculate on asset prices’ rise (buy) or fall (sell). Leverage allows you to amplify your trading power, using a relatively small amount of capital (margin) to control a more prominent position.

Stormgain offers high-leverage options, but with increased leverage comes increased risk.

Understanding Leverage and Margin

- Leverage: Borrowing funds to increase potential returns.

- Margin: The initial capital required to open a position.

- Liquidation: If the market moves against your position and your margin is insufficient to cover it, your position may be liquidated.

Cross Margin vs Isolated Margin Mode

- Cross Margin shares your account balance across all open positions to manage risk, potentially preventing immediate liquidation.

- Isolated Margin restricts risk to the individual position, safeguarding the rest of your balance from a negative trade.

Key Pricing Concepts

- Index Price: An average price from several exchanges, ensuring you’re trading at a market-consistent rate.

- Fair Price: Adjusts the index price to prevent unnecessary liquidations during market manipulations.

- Funding Rate: The periodic payment exchanged between buyers and sellers, reflective of market interest rates and leverage.

Order Management

- Utilize stop-loss orders and take profit orders to manage risk effectively.

- Experiment with limit and market orders, understanding the different implications for your trades.

To better estimate your potential profits and losses, it is advisable to use Stormgain’s order calculator, which factors in leverage, fees, and other critical variables.

Always consider the volatile nature of cryptocurrency trading and employ prudent risk management practices when trading crypto assets on futures contracts.

How to Create an Account on Stormgain

To start trading crypto futures with Stormgain, the initial step is to create a trading account. Here’s a simplified guide on setting one up:

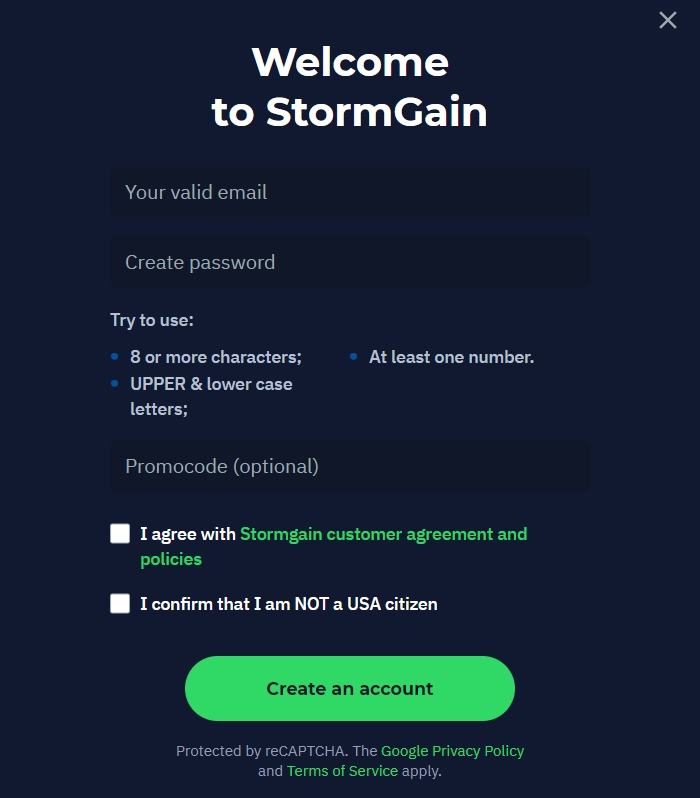

Step 1: Registration Process

- Go to the Stormgain website or download the mobile app.

- For the website, navigate to the Stormgain registration page.

- Install the app from your device’s respective app store.

Step 2: Set Up Your Account

- Fill in your details:

- E-mail address: Enter a valid e-mail address, as this will be your login credential.

- Password: Choose a solid and secure password to protect your account.

Step 3: Account Verification

- Verify your e-mail address by clicking the verification link sent to your inbox.

- Complete the KYC (Know Your Customer) process, if required:

- This step may include submitting identification documents for security purposes.

Step 4: Security Measures

- Enable Two-Factor Authentication (2FA) for an added layer of security on your account.

Step 5: Funding Your Wallet

- Deposit funds into your Stormgain wallet to start trading.

- The platform supports multiple cryptocurrencies for your convenience.

Additional Benefits

- As a new member, you may be eligible for a referral program and receive bonuses for signing up.

Now, you’re all set to navigate the crypto market as a trader with Stormgain. Remember that mastering trading takes patience and continuous learning.

How to Deposit and Withdraw Funds on Stormgain

Follow these streamlined instructions for deposits and withdrawals to manage your funds on Stormgain with confidence and clarity.

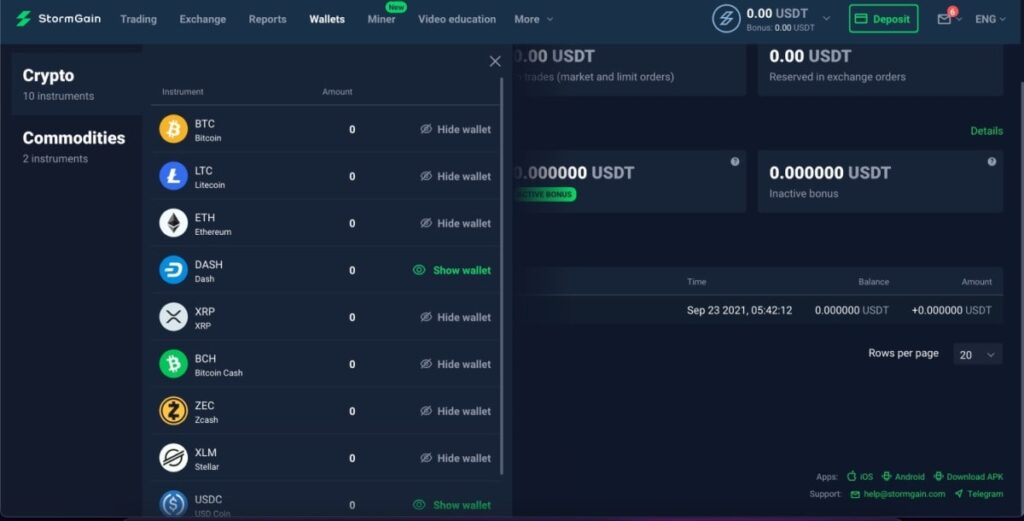

Depositing Funds

To add funds to your Stormgain account:

- Navigate to your Wallet,

- Select the cryptocurrency you wish to deposit,

- Click on Deposit next to the relevant wallet,

- Copy the provided wallet address,

- Complete the transfer from your external wallet or bank account to the provided address.

Stormgain supports deposits using crypto wallets or fiat currency through bank transfer and payment services like Simplex. The minimum and maximum limits vary depending on your chosen payment method.

Withdrawing Funds

To withdraw funds from your account:

- Access the Wallets section within your app,

- Choose the cryptocurrency for withdrawal,

- Click on Withdrawal,

- Enter the amount you wish to transfer,

- Select your payment method from the available options.

Withdrawals can be made directly to crypto wallets. Do remember to double-check withdrawal addresses to ensure security.

Fees and Processing Time

Deposits made via crypto wallets or Simplex may entail different fees. While crypto transactions often resolve within 30 minutes, other methods might vary.

Always be aware of possible fees and processing timelines associated with your chosen method for moving funds.

By staying informed of Stormgain’s funding processes, you maintain control over your crypto assets and fiat currency, ensuring a smoother trading experience.

How to Transfer Funds to the Futures Wallet

Before trading futures on Stormgain, you must transfer funds from your main wallet to your futures wallet.

Your main wallet is used for spot trading and holding your assets, while the futures wallet is specifically designed for trading futures contracts on cryptocurrencies.

To begin the transfer process, follow these steps:

- Log in to your Stormgain account.

- Navigate to the ‘Wallet’ section on the platform.

- Locate and click ‘Transfer’ alongside the cryptocurrency you wish to use for futures trading, typically USDT or other supported cryptocurrencies.

Stormgain allows the transfer of various assets, including but not limited to USDT, BTC, and ETH. Transfers within your Stormgain account between the main wallet and the futures wallet happen off the blockchain, therefore, no blockchain fees apply and transfers are instant.

Transfer Limits:

- Minimum: The minimum amount varies per currency, so check the specified limit before transferring.

- Maximum: Similarly, maximum transfer amounts are set, and it’s crucial to be informed of these limits to manage your trades effectively.

After entering the amount you wish to transfer:

- Confirm all details are correct.

- Click ‘Confirm Transfer’.

Your futures wallet will be credited, and you can start trading various futures contracts available on Stormgain.

It’s essential to be mindful of market volatility and trade responsibly. Stormgain offers tools and resources to aid in effective trading on their intuitive platform.

How to Choose Between Perpetual and Futures Contracts

When considering trading crypto futures with Stormgain, it’s essential to understand the distinctions between perpetual and traditional futures contracts. Both are derivatives, meaning they derive value from an underlying asset but operate differently.

Perpetual contracts are a type of futures contract without an expiration date.

This means you can hold a position for as long as you need, provided you can meet the margin requirements and are prepared to pay funding fees, periodic payments that can be viewed as an interest of sorts, to keep the trade open.

The funding fee is exchanged between long and short positions and helps anchor the perpetual prices to the spot market.

| Perpetual Contracts | Futures Contracts |

|---|---|

| No expiration date | Expiration date set |

| Funding fees apply | No funding fees |

| Tied to the underlying asset’s price | Agreed upon future price |

On the other hand, futures contracts are agreements to buy or sell an asset at a predetermined price on a specific date.

They suit traders with a more straightforward strategy around market movements and wish to set prices. There’s no funding fee, but they lack the flexibility of perpetual contracts.

On Stormgain, you’ll choose between the two based on the following:

- Risk Management: Perpetual contracts provide more flexibility but require attention to funding rates, which may add to the cost.

- Leverage: Both allow significant leverage, but ensure it aligns with your risk tolerance.

- Trading Fees: Consider the fees associated with both contract types.

- Positions and Orders: Are you looking for a short-term or long-term position? Your order strategy must align with the contract chosen.

For instance, on Stormgain, you can access Bitcoin perpetual contracts for a flexible trading strategy and futures contracts for more structured trades with set time frames. Ultimately, your choice will hinge on your trading strategy, handling risk, and preference for flexibility versus structure.

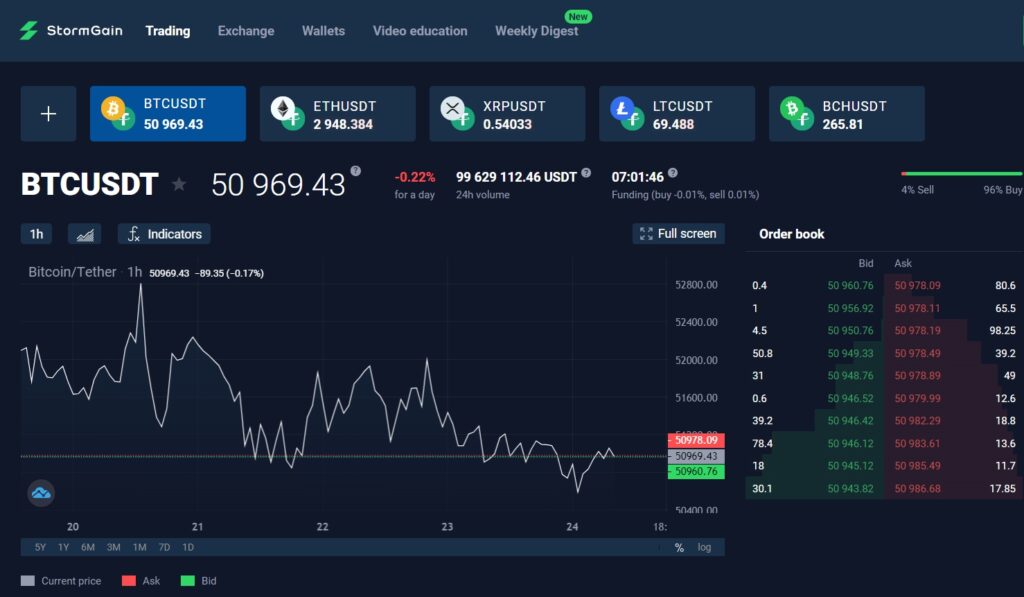

How to Understand the Futures Trading Interface on Stormgain

When you trade crypto futures on Stormgain, navigating the trading interface efficiently is crucial for a successful experience.

Understanding the components will be foundational in performing technical analysis and making informed decisions.

Trading Chart: You’ll find the trading chart at the core of Stormgain’s interface. This visual representation shows price movements over time, allowing you to analyze market trends. Utilize a variety of indicators, such as moving averages and MACD (Moving Average Convergence Divergence), which are integral tools for your technical analysis.

- Order Book: The order book displays live orders for buy and sell positions, giving insight into potential resistance and support levels. It’s a real-time reflection of trader sentiment and market dynamics.

- Instruments Panel: This panel lists all available instruments for trading. Selecting an asset here will update your trading chart and order book with specific market data.

- Order Panel: Place your trades here by setting parameters such as trade amount and leverage. You can also set your Stop Loss and Take Profit levels to manage risk.

- Position Panel: After you’ve opened a trade, you can monitor its performance in the position panel. It provides a snapshot of your open positions, including unrealized gains or losses.

Customization plays a vital role on the platform, allowing you to adjust the layout and settings of the charts and tools to suit your trading style.

Use the information efficiently and remember that a clear grasp of Stormgain’s futures trading interface will aid in making precise trades.

How to Place and Manage Orders on Stormgain Futures

In trading crypto futures with Stormgain, selecting your trading pair is the first step. For instance, if you choose the USDT/BTC pair, you’re speculating on the price movement of Bitcoin against USDT. To begin:

- Navigate to the Futures section to view the instrument list.

- Choose your desired pair, like USDT/BTC.

Choosing Contract and Leverage:

- Select the type of contract you wish to trade.

- Adjust the leverage based on your risk tolerance. Stormgain offers options for high leverage, but this also increases risk.

Understanding Orders:

- Market orders execute trades at the current market price.

- Limit orders are set to execute at a specific price point.

- Stop orders trigger a sale or purchase when a specific price is reached, enabling risk management.

Placing an Order:

- In the ‘New trade’ window:

- Choose a wallet.

- Enter your trade amount.

- Set leverage.

- Define Stop Loss and Take Profit to manage risk.

| Parameters | Description |

|---|---|

| Stop Loss | Limits potential loss by setting a price to exit your position. |

| Take Profit | Secures profit by establishing a target price to close a profitable position. |

| Leverage | It allows you to trade more significant amounts with a smaller capital investment. |

Managing Positions:

- Monitor positions through the trading chart using various indicators.

- You can close positions manually by selecting them and choosing to sell (for longs) or buy (for shorts).

Understanding Funding Rate and Settlement:

- The funding rate affects your trading cost, influencing positions held over a specified time.

- Settlement occurs automatically, determining the final transfer of assets at the contract’s expiration.

By understanding these elements, you can navigate the Stormgain platform with confidence and clarity to manage your trading strategy effectively.

How to Use the Stormgain Order Calculator

The Stormgain order calculator is an indispensable tool for traders who wish to engage in crypto futures trading.

This calculator aids you in determining potential profits, margins, and risks before you open a position, ensuring you make well-informed trading decisions.

To access the Stormgain order calculator, navigate to the trading chart of your chosen asset on the Stormgain platform.

The calculator is often found in the ‘Trading’ or ‘Order’ panel. Once you have the calculator open, you’ll need to input several vital parameters:

- Lot size: The amount of the asset you want to trade.

- Leverage: The multiplier expresses the borrowed funds’ ratio to your position. Stormgain provides various leverage options to amplify trading results.

- Opening price: The price at which you plan to enter the market.

- Closing price: Your predicted price when you close the position.

After entering these details, the calculator will display the potential outcome of your trade, which includes:

- Value: The total worth of the position at the current market price.

- Profitability: An estimation of the profit or loss you might incur based on your input parameters.

- Margins: The required margin for your position, considering the leverage used.

For example, suppose you’re trading a lot of Bitcoin with 10x leverage and predict an opening price of $40,000 and a closing price of $45,000. In that case, the order calculator will calculate this position’s potential profit and necessary margins.

If the market moves as expected, your profitability may increase, but remember that leverage increases your risk if the market turns against your predictions.

Using the Stormgain order calculator, you can better manage your positions and understand the influence of leverage on your trades in the volatile crypto market.

Consider the risks and use the calculator to assess your trades before entering the market.

How to Use the Stormgain Copy Trading Feature

Stormgain offers a distinctive feature known as copy trading, which allows you to emulate the trades of experienced traders within the platform.

This tool is designed to assist you in diversifying your portfolio and aims to enhance potential profitability by leveraging the expertise of seasoned traders.

To get started with copy trading on Stormgain, follow these simple steps:

- Create an Account: Register on the Stormgain platform if you haven’t already done so.

- Navigate to Copy Trading: Locate your dashboard’s ‘Copy Trading’ section.

- Select a Trader: Browse through the list of traders. Important metrics include profitability, trade volume, and risk management profiles.

- Allocate Funds: Decide the amount you wish to allocate for copying trades. It’s essential only to invest funds you are prepared to risk.

- Follow and Copy: Once you’ve selected a trader, click ‘Copy’. Your positions will automatically mirror the trader’s future positions in proportion to your allocated funds.

When selecting traders to follow, consider the following:

- Trading Signals: Review the trader’s history to understand their strategy.

- Risk: Assess the risk level. Higher potential returns often come with increased risk.

- Consistency: Look for consistency in trade volume and success rate.

Remember that while copy trading can potentially lead to gains, it doesn’t come without risks.

Conducting due diligence and not allocating funds that would cause financial distress in the case of losses is crucial.

Consider starting with a small amount and only increase your investment as you grow more familiar with derivative trading and the specific traders you are copying.

Frequently Asked Questions

In this section, you’ll find straightforward answers to some of the most common questions about trading crypto futures with StormGain, aimed at equipping you with the essential knowledge to navigate the platform.

Can beginners trade crypto futures easily using the StormGain app?

Yes, beginners can trade crypto futures using the StormGain app. The platform offers a user-friendly interface with a trading chart to help you visualize price movement and an easily accessible instruments panel for selecting trading instruments.

How does one withdraw mining earnings from StormGain?

To withdraw mining earnings from StormGain, you must transfer the mined cryptocurrency to your StormGain wallet. From there, you can follow the platform’s withdrawal process, which usually involves specifying the amount and destination wallet address.

Can you earn around $100 daily by trading cryptocurrency on StormGain?

Earning a specific amount, such as $100 daily, by trading cryptocurrency on StormGain depends on factors like market conditions, trading strategies, and the amount of capital you invest.

While possible, risks are involved, and profits can never be guaranteed in trading.

Conclusion

Stormgain is a comprehensive trading platform for those interested in speculating cryptocurrency price movements through futures.

With its provision of up to 200x leverage, the platform can amplify your potential profits, but this also increases the level of risk.

As you consider entering the futures market, prioritize strengthening your education in trading. Stormgain facilitates this with resources tailored to enhance your skill set.

The platform’s market analysis tools and integrated news blog provide timely insights for making informed trades.

Cryptocurrencies are highly volatile and demand a structured approach to trading. Utilize Stormgain’s features, such as demo accounts, to practice strategies without financial risk. For further learning, explore their educational section here:

Remember, successful futures trading on Stormgain or any other platform depends on continuous learning and a disciplined approach to market analysis. When ready, you can start your trading journey with Stormgain, confident in its infrastructure and support systems to assist you.

Explore how StormGain compares to its competitors:

- StormGain vs Bybit: Head-to-Head Platform Comparison

- StormGain vs PrimeXBT: Head-to-Head Platform Comparison

- StormGain vs Binance: Head-to-Head Platform Comparison