Crypto futures leverage is a way of trading cryptocurrencies with borrowed funds, which can increase your buying or selling power, potential profits, and risks.

Different types of leverage trading products are available on various crypto trading platforms, such as futures, options, margin accounts, and tokenized derivatives.

Each product has its features, benefits, and drawbacks, depending on your trading goals, preferences, and risk appetite.

Here is a brief explanation of how it works:

- Crypto futures are contracts that allow you to buy or sell a certain amount of cryptocurrency at a fixed price on a future date. For example, you can agree to buy five bitcoins at $50,000 each on March 1, 2024.

- Leverage is the ratio of the borrowed funds to your capital (also called margin or collateral). For example, if you have $10,000 in your account and use 10x leverage, you can trade with $100,000 worth of cryptocurrencies.

- Leverage can amplify your returns if the market moves in your favor. For example, if you buy five bitcoins at $50,000 each with 10x leverage and the price rises to $60,000, you can sell them for $300,000 and make a profit of $200,000 (minus fees and interest). This is a 20x return on your initial capital of $10,000.

- However, leverage can also magnify losses if the market moves against you. For example, if you buy five bitcoins at $50,000 each with 10x leverage and the price drops to $40,000, you can only sell them for $200,000 and lose $100,000. This is a 10x loss on your initial capital of $10,000.

- Moreover, if the price falls below a certain level (called the liquidafiveion price), the exchange automatically closes your position, and you will lose your entire margin. For example, if you buy five bitcoins at $50,000 each with 10x leverage, your liquidation price might be around $45,000. If the price reaches this level, your position will be liquidated, and you will lose $10,000.

To help you compare leverage trading options for the top 10 crypto futures exchanges in 2024, I have summarized some critical information from the web search results below:

| Exchange | Products | Leverage | Fees | Supported Cryptos |

| MEXC | Perpetual futures | Up to 200x | 0.02% per slide | Over 100 |

| OKX | Perpetual futures, options | Up to 100x | 0.03% per contract | Bitcoin, Ethereum |

| Binance | Perpetual and delivery futures, options, leveraged tokens | Up to 125x | 0.03% per slide | Over 600 |

| PrimeXBT | CFDs, perpetual swaps | Up to 1000x | Varies by market | 31 |

| KuCoin | Endless and inverse futures, 3x leverage tokens | Up to 100x | 0.06% per slide | Over 100 |

| Bybit | Perpetual, inverse, and delivery futures, options | Up to 125x | Varies by market | 180 contracts |

| Gate.io | Perpetual futures, options | Up to 100x | 0.05% per slide | Over 100 |

| Kraken Pro | Margin accounts, futures | Up to 50x | 0.05% per slide | Over 95 |

| Deribit | Futures, options | Up to 100x | Varies by market | Bitcoin, Ethereum |

| BingX | Spot trading, contracts | Up to 100x | 0.02% per slide | Over 50 |

| Bitget | Futures, options | Up to 125x | Varies by market | Over 100 |

| GMX | Perpetual futures, options | Up to 100x | 0.05% per slide | Over 80 |

| Bitfinex | Margin accounts, futures, options | Up to 100x | Varies by market | Over 200 |

| Poloniex | Margin accounts, futures | Up to 100x | 0.05% per slide | Over 100 |

| Phemex | Spot trading, CFDs, perpetual swaps | Up to 1000x | Varies by market | 31 |

What is 100x leverage in crypto futures?

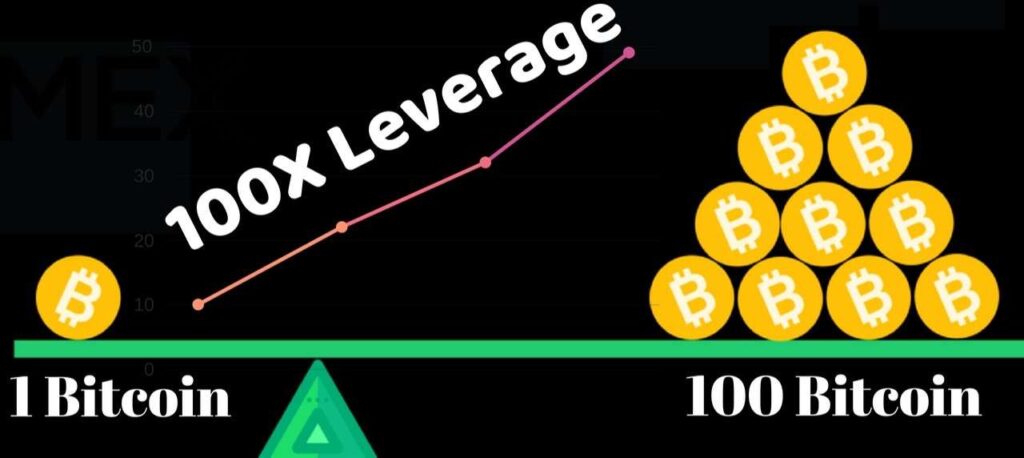

100x leverage in crypto futures means you can trade with a position size 100 times larger than your margin or collateral.

For example, if you have $100 in your account and want to open a trade worth $10,000, you need to use 100x leverage.

This means that you are multiplying your position size by 100 times.

However, leverage also increases your risk, as you can lose more than your initial margin if the market moves against you.

To prevent this, the platform will liquidate your position if your margin balance falls below a certain level. This is called the liquidation price.

Let’s use BTC as an example. Suppose you want to go long on BTC/USDT, trading at $50,000.

You have $100 in your account and use 100x leverage to open a trade worth $10,000. This means you are buying 0.2 BTC with $100 of your own money and $9,900 of borrowed money.

Your liquidation price is the price at which your margin balance becomes zero. This depends on the platform’s fee structure, but let’s assume it is 0.5% per slide. This means you pay 0.5% of the position value as a fee when opening and closing the trade.

To calculate your liquidation price, subtract the fees from your margin balance and divide it by the position size. In this case, it is:

[100−(0.005×10,000×2)]/ 0.2=49,000

If BTC/USDT drops to $49,000 or below, your position will be liquidated, and you will lose your entire margin of $100. On the other hand, if BTC/USDT rises to $51,000, you will make a profit of $200, which is 200% of your margin.

Calculating Profit and Loss of Leveraged Crypto Futures Trades

The profit or loss from a leveraged trade can be calculated as follows:

- Example: If you enter a Bitcoin futures contract using 10x leverage with an entry price of $10,000 for 1 BTC, and the exit price is $10,500:

- Position Size without leverage: 1 BTC

- Position Size with leverage: 10 BTC (1 BTC of your funds and 9 BTC borrowed)

- Profit = ($10,500 – $10,000) × 10 = $5,000

Note: This example does not account for trading fees, funding rates, or potential slippage, which can affect the outcome.

Conclusion

As you can see, leverage can amplify your gains and losses, so you need to be careful when using it.

It would be best to consider the crypto market’s volatility, which can cause sudden price movements.

You can use order types such as stop-loss orders or use lower leverage, or trade with smaller amounts to reduce your risk.