In the dynamic world of cryptocurrency trading, futures contracts have emerged as a vital tool for traders looking to hedge their positions or speculate on future prices. When you trade crypto futures, you agree to buy or sell a cryptocurrency at a predetermined price at a specific date in the future, regardless of the market price at that time. This financial instrument can potentially amplify gains if the market moves in your favor, but it can also magnify losses if the market goes against your position.

To navigate the complexities of futures trading, you’ll need access to robust trading tools and platforms. A range of specialized tools is essential for conducting in-depth market analysis, executing trades efficiently, and managing risk effectively. Whether tracking real-time market data, setting up automated trading strategies, or utilizing research platforms for informed decision-making, these tools can significantly enhance your trading experience.

Popular platforms like Binance, OKX, and Coinmarketcap offer different features, from perpetual and futures contracts in various cryptocurrencies to market data and research tools that provide vital information. As you begin to explore these platforms, consider how each tool aligns with your trading style and goals. While futures trading can be profitable, it is important to approach it with a clear strategy and an understanding of the potential risks involved.

Trading Platforms

When you’re exploring crypto futures trading platforms, it’s important to look for ones that balance advanced features with user-friendly interfaces. The trading landscape in 2024 offers numerous platforms, each with its own set of tools and advantages.

- Binance Futures: Offers a comprehensive range of futures contracts with competitive fees. Known for its robust trading system and wide acceptance.

- Coinbase Advanced: Tailored for US users, combining regulatory compliance with a strong selection of trading options.

- PrimeXBT: Known for versatility, supporting crypto futures and providing a copy trading feature.

- MEXC: Stands out for offering some of the lowest industry fees, at just 0.02% per trade. Accommodates a plethora of altcoins as well as high leverage options up to 200x on Bitcoin futures.

Volume and Liquidity

Consider platforms like OKX that handle significant daily trading volume—over $10 billion—in the derivatives market. High liquidity ensures you can enter and exit positions at fair prices with minimal slippage.

Fees and Leverage

Be cognizant of trading fees which can impact your profitability. Leverage is a powerful tool to amplify your trades, but it comes with increased risk; it’s crucial to use it judiciously.

Table 1: Platform Features at a Glance

| Platform | Notable Feature | Fee Structure | Maximum Leverage |

|---|---|---|---|

| Binance | Wide range of futures | Competitive | Varies |

| Coinbase | US-centric, compliance | Market-dependent | Varies |

| PrimeXBT | Copy trading feature | Low | Varies |

| MEXC | Low fees, high leverage on BTC | 0.02% per trade | 200x on BTC |

| OKX | Wide range of contracts, high volume | Varies | Varies |

Select a platform that aligns with your trading style and risk tolerance. Remember, the right tool can make a significant difference in your trading endeavors.

Portfolio Management

Managing your cryptocurrency investments effectively requires robust portfolio management tools, especially when dealing with futures trading. Here are some key aspects and tools to consider:

Tracking and Analytics: Your portfolio management tool should provide comprehensive tracking capabilities. A tool like CoinTracker can automatically track balances and trades across various exchanges and supports a multitude of cryptocurrencies. This saves you from manual data entry and helps maintain accuracy.

Exchange Integration: With support for over 300 exchanges, tools like Delta.App enable you to manage and visualize your positions across different platforms. This centralization of data is critical for informed decision-making and streamlined management.

Real-time Data: Access to real-time data is essential. Look for a portfolio tool that offers real-time spot trading, margin trading, price data, and arbitrage opportunities. Some tools come equipped with features to conduct copy trading, which can be beneficial if you’re looking to replicate strategies of successful traders.

Security Features: Advanced anti-theft technology can protect your investments from unauthorized access. When choosing a portfolio management tool, make sure it upholds stringent security measures to keep your assets safe.

Portfolio management tools breakdown:

| Tool | Key Features | Support |

|---|---|---|

| CoinTracker | Automatic transaction tracking, tax reporting | 2,500+ cryptocurrencies |

| Delta.App | Centralized management, personalized notifications | 300+ exchanges, 7,000+ currencies |

| Coinmarketcap | Market data, research tools | Comprehensive crypto information |

Note that while some portfolio tools offer free transaction tracking or base features, in-depth analytics and advanced functions may require a paid subscription. Choose a portfolio management tool that aligns with your trading style and needs for futures trading.

Technical Analysis Tools

In the realm of crypto futures trading, your success can benefit significantly from technical analysis tools. These are instruments that allow you to evaluate market trends and forecast potential price movements.

Charting Software: These platforms provide you with real-time charts and a host of auxiliary tools. They enable you to plot price movements over various time frames and apply multiple technical indicators.

- Popular Charting Tools:

- TradingView

- CryptoCompare

- Coinigy

Technical Indicators: These are complex calculations based on the price and/or volume of a cryptocurrency.

- Common Technical Indicators:

- Moving Averages (MA)

- Relative Strength Index (RSI)

- Moving Average Convergence Divergence (MACD)

- Bollinger Bands

Candlestick Patterns: Understanding these can offer you insights into market sentiment and potential price direction.

- Key Candlestick Patterns:

- Hammer

- Engulfing

- Doji

- Morning Star

Integrating these tools into your trading strategy can help you discern valuable information from the noise and intricacies of the crypto markets. By utilizing such analytics effectively, your decision-making can be both informed and improved.

Tax Reporting Software

When engaging in crypto futures trading, it’s vital to keep track of your tax obligations. Tax reporting software has become indispensable for simplifying this complex task. These tools integrate with exchanges and wallets to calculate capital gains and losses, ensuring compliance with tax regulations.

- Koinly: Known for its user-friendly interface, Koinly assists you in seamless navigation and tax report preparations. It suits both beginners and experienced traders.

- ZenLedger: Suitable if you’re trading on DeFi exchanges. It provides a comprehensive tax solution and helps with IRS form generation.

- CoinLedger: Offers a cost-effective solution for generating IRS Form 8949 and might be a good fit if you’re budget-conscious.

- TokenTax: Gains popularity among beginners for its approachability and straightforward design.

- TaxBit: Specifically caters to US taxpayers, supporting over 500 crypto exchanges, wallets, and DeFi platforms.

Remember, while these tools can greatly reduce your workload, you should ensure that the software complies with the tax jurisdiction of your country. Here is a simple comparison:

| Software | Interface | Form Support | Special Features |

|---|---|---|---|

| Koinly | User-friendly | Comprehensive | Multi-platform |

| ZenLedger | Detailed | DeFi-focused | Investor’s Choice |

| CoinLedger | Budget-friendly | Form 8949 | Cost-Efficiency |

| TokenTax | Beginner-friendly | Varied | Beginner’s Choice |

| TaxBit | US-focused | Comprehensive | Syncs with Numerous Platforms |

Choose the software that aligns with your trading habits and tax reporting needs, ensuring a streamlined process come tax season.

Risk Management Features

Understanding Risk Management:

Risk management is a vital aspect of crypto futures trading. You need to leverage various features and tools to protect your investments. Here’s a concise guide to mechanisms that can help you manage your risks effectively.

Essential Tools:

- Cooling-off Period: Some platforms offer a cooling-off period that temporarily restricts trading after a period of intense activity. This helps prevent impulsive decisions.

- Stop Loss Orders: Place a stop loss order to automatically sell your futures contract at a predetermined price to minimize potential losses.

- Take Profit Orders: Conversely, take profit orders allow you to set a target price at which your position will be automatically closed to secure your earnings.

- Leverage Limiters: Adjusting leverage limiters can ensure you do not overextend your position beyond your risk tolerance.

Technical Indicators:

- Moving Averages: Utilize moving averages to identify trends over specific periods.

- RSI (Relative Strength Index): RSI is useful for gauging market momentum and potential reversals.

Execution Strategies:

- Laddering: Spread your orders at varying prices to average your entry or exit positions.

- Hedging: Open positions in opposite directions to mitigate potential losses if the market moves against you.

Remember to continually assess your risk tolerance and adjust these tools and features accordingly to maintain a responsible trading approach.

Strategic Trading Tools

In the landscape of cryptocurrency futures trading, various strategic tools enable you to navigate the market more adeptly. These tools form the backbone of a robust trading strategy, ensuring that you can execute trades based on set conditions, thereby managing risk and capitalizing on opportunities promptly.

Market Orders and Limit Orders are the fundamental tools at your disposal. A market order allows you to buy or sell immediately at the best available current price, providing swift execution without guaranteeing the price. In contrast, limit orders allow you to specify the exact price at which you’re willing to buy or sell, ensuring price certainty but not immediate execution.

Advanced Order Types carry your strategy further:

- Grid Trading: It operates by placing multiple buy and sell orders at predefined intervals around a set price, which constructs a grid pattern of orders. This approach can be most beneficial in fluctuating, sideways markets.

- TWAP (Time-Weighted Average Price): It breaks up a large order into smaller chunks, sold at regular intervals to reduce the market impact.

- Advanced TP/SL (Take Profit/Stop Loss): These conditional orders help lock in profits and limit losses by automatically closing your positions once specific conditions are met.

- Multi-Symbols Trading Page: Manage and view multiple trades across different crypto pairs simultaneously from a single dashboard for simplified oversight.

Embracing these tools will empower you to execute your trading strategies with greater precision and control. Remember, effective utilization of these tools requires continual learning and adaptability to the fast-paced crypto market conditions.

Mobile Apps

When trading crypto futures, having access to the market on the go is crucial. Your mobile device can become a powerful trading tool with the right app. Here are some apps to consider:

Delta.App

- Availability: iOS, Android

- Features: Track over 7,000 cryptocurrencies and manage your portfolio across 300+ exchanges.

- Benefits: Get personalized notifications and watchlists to stay informed.

Binance App

- Supported Cryptos: Over 600, including Bitcoin, Ethereum, Dogecoin

- Features: Trade perpetual and futures settled in various cryptocurrencies.

- User Level: Suitable for both novices and experienced traders.

Kraken App

- Futures Markets: Support for 95 cryptocurrencies with up to 50x leverage.

- Compatibility: Known for its user-friendly spot trading, now with a futures market option.

Other Notable Apps:

- 3Commas:

- Smart trading terminal

- Automated trading bots

- Koinly:

- Portfolio management

- Taxation tool

- Coinmarketcap:

- Market data

- News and asset information

Ensure your chosen app aligns with your investment strategy and risk tolerance. Good trading tools should enhance your decision-making, not complicate it. Always prioritize security, functionality, and market access when selecting your mobile trading application.

Trading Bots

In the context of cryptocurrency futures, trading bots are automated software that execute trades on your behalf guided by parameters you set. These bots can be highly beneficial for managing risk and executing strategies efficiently.

Types of Trading Bots:

- AI-Powered Bots: Leverage machine learning to adjust strategies in real-time.

- Pre-Programmed Algos: Execute strategies based on pre-set rules.

- Custom Bots: Tailored to your trading style and preferences.

Advantages of Using Trading Bots:

- Time Saving: They operate 24/7, allowing you to step away from your desk.

- Emotionless Trading: Bots eliminate the emotional aspect of trading decisions.

- Backtesting: Most platforms offer a feature to test strategies against historical data before live execution.

Considerations When Choosing a Bot:

- Reliability: Select bots known for consistent performance.

- Security: Opt for platforms with robust security measures.

- Usability: Ensure the bot interface is user-friendly.

- Support: Good customer support is essential for addressing issues that arise.

- Profitability: Check historical performance and reviews, but be wary of unrealistic claims.

Here’s a brief list of notable trading bots:

| Trading Bot | Notable Feature | Free Trial |

|---|---|---|

| Cryptohopper | Strategy designer using AI | Available |

| KuCoin | Intuitive platform with built-in tools | Not specified |

| Cornix | Telegram integration for trade automation | Not specified |

| 3Commas | Extensive range of tools and features | Available |

| ArbitrageScanner.io | Arbitrage opportunities tracking | Not specified |

Remember: Always perform your own due diligence before using any trading bot, as the success of automated trading can never be guaranteed.

Order Books

When you engage in crypto futures trading, understanding and utilizing order books is crucial. An order book lists all buy and sell orders currently placed for a particular asset on an exchange. Here is how you can interpret an order book:

- Buy Orders: Located on the left, these are prices at which traders are willing to purchase the cryptocurrency. They form the bid side.

- Sell Orders: On the right, these show the prices at which sellers are open to parting with their crypto, known as the ask side.

The highest bid price and the lowest ask price are neighbors at what’s called the spread. This is the gap that any trade must bridge for an order to be executed.

What Can You Learn from Order Books?

- Market Depth: Order books provide a clear visualization of market depth, showing how many orders are present at various price points. A dense order book can indicate high liquidity.

- Price Movements: You can infer potential short-term price movements by analyzing the number of buy and sell orders.

- Whale Activity: Large orders might signal activity by ‘whales’, traders with the capital to significantly move the market.

Use this information to your advantage by:

- Identifying price points with significant orders to predict support and resistance levels.

- Watching for large orders that could indicate imminent price movement.

Remember, while order books can be a powerful tool for gauging market sentiment, they only show pending orders, not the complete picture of all market activity.

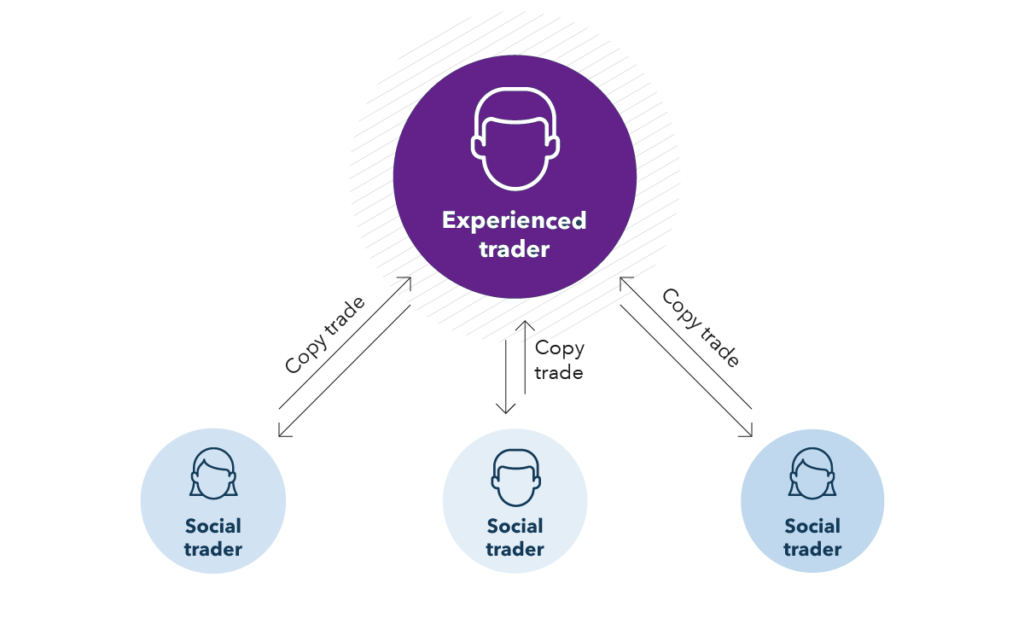

Copy Trading

Copy trading is a strategy that allows you to mirror the trades of experienced cryptocurrency traders. When you engage in copy trading, your chosen platform will automatically execute the same trades as the trader you are following, proportionally to the funds you have allocated.

Advantages:

- Efficiency: Save time by not having to conduct your own research or market analysis.

- Learning: Observe and learn from the strategies of skilled traders.

- Diversification: Spread your risk by copying multiple traders.

Popular Platforms for Copy Trading Futures:

| Platform | Features |

|---|---|

| eToro | User-friendly interface, a range of assets. |

| OKX | Variety of trading options, global availability. |

| Bybit | High leverage, derivative trading options. |

| PrimeXBT | Diverse portfolio building opportunities. |

| MEXC | Access to new crypto assets for trading. |

When selecting a trader to copy, consider their risk profile, return on investment, and trading style to ensure alignment with your personal trading goals. Review past performance, but be cautious, as past returns do not guarantee future results.

Fee Structures to Consider:

- Spot-trading fees typically range from 0.08%-0.1%.

- Futures and Options often have lower fees, around 0.03%-0.05%.

You may be required to pay a percentage of your profits to the traders you copy, which is usually around 10%. Always ensure you understand the fee systems before committing your funds to copy trading.

Conclusion

Crypto futures trading has rapidly become a go-to tool for traders looking to leverage market movements. Risk management is crucial; tools like stop-loss orders and position-sizing calculators help mitigate potential losses. Research tools, including historical price charts and market analysis platforms, are vital in developing informed strategies.

Efficient use of trading tools can potentially lead to profits, but remember, with high leverage comes the risk of substantial losses. Ensure you have a solid understanding of the following before you begin trading:

- Market Analysis: Study trends and use technical indicators to forecast price movements.

- Risk Control: Use tools to set boundaries on losses and protect gains.

- Trading Platforms: Choose platforms offering robust features and security.

Remember, futures trading is not for everyone; it requires discipline, a cool head, and regular evaluation of your strategies. Approach the market with caution and always stay informed.

| Key Tools | Purpose |

|---|---|

| Stop-loss Order | Limit potential losses |

| Position Size Calculator | Determine trade size |

| Market Analysis Platforms | Facilitate strategy development |

| Leverage Management | Control risk exposure |

Final word: Educate yourself, stay up-to-date with market trends, and use trading tools effectively to navigate the volatile waters of crypto futures.