Phemex has become a notable player in the global cryptocurrency exchange landscape.

It caters to a broad audience by providing a diverse range of trading options, including spot, contract, and leveraged trading.

Originating from a foundation laid by former Wall Street traders and engineers, it aims to deliver a platform that combines the swiftness and reliability of traditional financial markets with the innovative edge of cryptocurrency transactions.

One of the standout features of Phemex is its zero-fee trading model for premium members, a unique offering that sets it apart from many other exchanges.

This could significantly reduce the cost of trading for active users. Alongside this, even non-members benefit from competitive fee structures.

As a platform designed to be accessible globally, Phemex serves users in over 100 countries.

Phemex Product Offerings

Phemex provides comprehensive trading options tailored to your diverse cryptocurrency needs. Here is a breakdown of its primary offerings:

- Spot Trading: You can buy or sell assets instantaneously at the current market price. This form of trading involves the actual exchange of the underlying cryptocurrency with no applied leverage or expiry date.

- Contract Trading: This allows you to agree to buy or sell an asset at a predetermined price in the future. Contract trading is performed using leverage, and these contracts have specific expiration dates that must be considered.

- Leveraged Trading: With this, you can increase the potential return on your trades by using borrowed funds to gain a more extensive exposure to the market. Leveraged trading can amplify possible gains and losses, offering up to 100 times the initial investment.

Additionally, Phemex innovates beyond mere trading with the following financial services:

- Savings Account: Store your idle funds in a Phemex savings account to earn interest over time, making your cryptocurrency work for you even when you’re not trading.

- Yield Farming: Use various DeFi protocols by staking your tokens through Phemex. This product allows you to earn rewards, contributing to the liquidity and overall health of the DeFi ecosystem.

Each of these products comes with its features and benefits tailored to meet your individual trading and investment preferences. Whether you are a seasoned trader or new to the space, Phemex’s offerings are designed to help you navigate the crypto markets effectively.

Phemex Supported Coin List

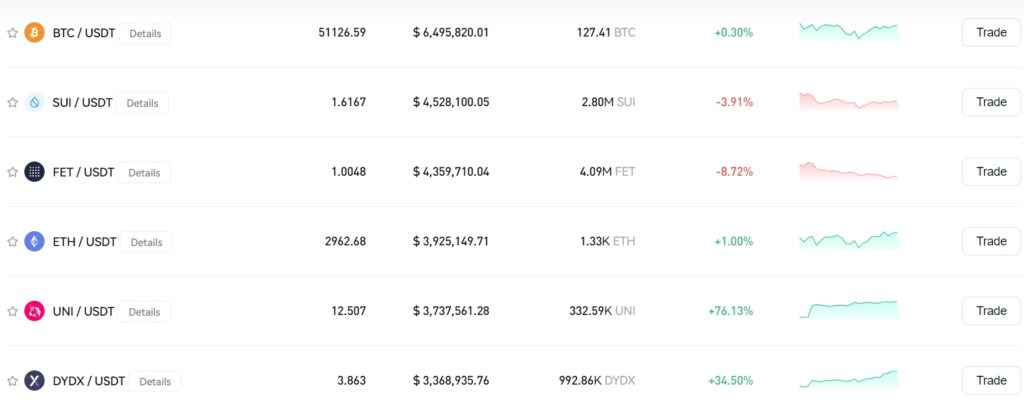

Phemex, a dynamic crypto exchange, caters to various trading preferences with an extensive list of supported cryptocurrencies.

On this platform, you can engage in spot, contract, and leveraged trading. Here’s a closer look at the different categories:

Spot Trading:

Phemex supports a diverse range of cryptocurrencies for spot trading.

You’ll find significant coins like Bitcoin (BTC) and Ethereum (ETH), along with popular altcoins such as Ripple (XRP) and ChainLink (LINK).

For those who use stablecoins, Tether (USDT) is also available. There are over 50 cryptocurrencies to choose from when trading on the spot market.

Contract Trading:

For those interested in futures and contract trading, Phemex offers a solid selection.

More than 20 cryptocurrencies, including heavyweights like Bitcoin (BTC) and Ethereum (ETH), are available to trade in this format.

Contract trading features additional options like Ripple (XRP) and ChainLink (LINK).

Leveraged Trading:

Phemex stands out with its offering for leveraged trading.

If you’re looking to magnify your positions, you can utilize leverage with more than ten cryptocurrencies, including the likes of Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP).

DeFi Tokens:

The exchange also extends its selection to popular DeFi tokens for broader market exposure.

You can trade Uniswap (UNI), Aave (AAVE), Compound (COMP), and others, tapping into the innovative arena of decentralized finance.

To provide a comprehensive view, the table below summarizes the supported coins across different trading modalities:

| Trading Type | Supported Cryptocurrencies |

|---|---|

| Spot Trading | Over 50 cryptocurrencies, including BTC, ETH |

| Contract Trading | Over 20 cryptocurrencies, including BTC, ETH |

| Leveraged Trading | Over ten cryptocurrencies, including BTC, ETH |

| DeFi Tokens | UNI, AAVE, COMP, and more |

Engage with Phemex to access a broad spectrum of cryptocurrencies, meeting the needs of traders and investors alike.

Phemex Order Types

Phemex offers a variety of order types to cater to your trading needs, allowing you to enter and exit the market according to your strategy.

- Market Order: This order type is used for immediate execution at the best price. When choosing a market order, you prioritize speed over price control.

- Limit Order: A limit order allows you to specify the price you want to buy or sell. This order will only be executed at your specified price or better, giving you control over the execution price.

- Stop Order: Stop orders are designed to protect against significant losses. This order will trigger a market order once the market price hits the price you’ve set.

- Conditional Order: Conditional orders are similar to stop orders but provide more flexibility. These orders can trigger either a limit or market order when the market price reaches your predetermined level.

Phemex also implements advanced order features for more experienced users:

- Post-Only: This feature ensures your limit order is added to the order book and not matched with a pre-existing order, allowing traders to benefit from the market maker rebate.

- Reduce-Only: A reduce-only order ensures that the only effect an order can have is to reduce your position, protecting you from accidentally increasing your position.

- Close-On-Trigger: This feature guarantees that an order will only execute if it is closing a position, providing an extra layer of security.

- Fill-Or-Kill: With fill-or-kill orders, your order must be fully executed immediately, or it gets canceled, which is essential for traders interested in prominent volume positions without affecting the market price.

Phemex’s Liquidation Mechanism

Phemex employs a systematic approach to managing liquidations on leveraged positions. Understanding Phemex’s liquidation mechanism can help you manage your trades effectively.

Mark Price: This is the benchmark for determining the fair value of an asset on Phemex. It’s computed by incorporating the index price of the asset along with the prevailing funding rate.

The purpose of the mark price is to reflect a more accurate market price and prevent unfair liquidations that can occur during market manipulation or extreme volatility.

Liquidation Price: Your liquidation price is the specific price level at which your position will be forcefully closed.

Phemex calculates this price using the established mark price in conjunction with your chosen level of leverage. You must monitor this price as it signifies the threshold at which you could lose your initial investment.

Bankruptcy Price: The bankruptcy price represents where your position value drops to zero, calculated based on your entry price and leverage. This is the theoretical price at which your invested capital is depleted.

To safeguard traders and the platform’s insurance fund, Phemex has implemented a Partial Liquidation process.

This system divides the liquidation of your position into stages, considering market conditions and position size, thus reducing the impact on your investment and the market.

Furthermore, Phemex utilizes an Auto-Deleveraging system, which proportionally decreases the positions of profitable traders if the insurance fund or market cannot absorb the liquidated positions.

This mechanism is in place to prioritize platform stability and trader equity.

By comprehending these components, you’re better equipped to navigate the risks of high-leverage trading on Phemex.

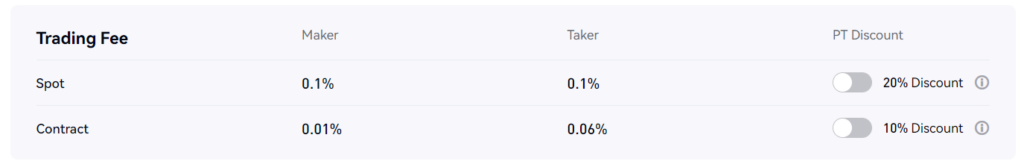

Phemex Trading Fees

Phemex operates on a fee structure that caters to various trading activities.

Your experience with their platform regarding fees will largely depend on the type of trading you engage in. Below is a breakdown of the different trading fees you can expect:

Spot Trading:

A flat rate of 0.1% applies to both makers and takers for your spot trading transactions. This fee is standardized across all spot trading activities.

Contract Trading:

When participating in contract trading, fees become variable. This variability depends on your role as a trader (maker or taker) and the contract types you are trading with.

- Makers: Typically pay a lower fee as they provide liquidity to the market.

- Takers: Often incur a slightly higher fee for taking liquidity from the market.

Leveraged Trading:

Engaging in leveraged trading incurs variable fees as well. These are determined by the contract type and the level of leverage you choose. Higher leverage may be associated with higher risk and different fee structures.

Funding Fees:

You’ll need to consider the funding fee for contract and leveraged trading. This is charged periodically and reflects the ongoing difference between the contract’s mark and spot prices.

Premium Membership:

If you opt for a premium membership on Phemex, you can enjoy zero-fee trading. This requires a paid subscription that can be purchased monthly or annually, potentially offering considerable savings on transaction fees for active traders.

Remember that the fee rates mentioned are subject to promotions and may change. Always refer to the latest information available on the Phemex website or directly within your transaction records. You can also use our Phemex Invitation code during signup process to get discount in the trading fees.

Phemex Funding Rates/Fees

Funding Rates

Phemex implements a funding rate mechanism to ensure the price of perpetual contracts remains close to the underlying spot price. Your understanding of this fee structure is crucial when engaging in leveraged trading.

- Determination of Funding Rates: The rates are calculated based on the difference between the perpetual contract’s mark price and the spot price.

- Adjustment Interval: These rates adjust every eight hours, meaning you may receive or pay to fund thrice daily, depending on market conditions and position types.

Fee Mechanics

- Favorable Rates: If the funding rate is positive, you, as a holder of a long position, will pay the short position holders.

- Negative Rates: Conversely, when the funding rate is negative, short position holders pay those holding long positions.

Application to Notional Value

- Notional Value Calculation: Funding rates apply to the notional value of your position, which is the total value of the contracts you hold, factoring in the size and number of contracts.

Understanding the Impact

- Not Phemex Fees: It’s important to note that Phemex does not charge these funding rates as a fee. Instead, they serve as a peer-to-peer exchange mechanism.

By keeping these details in mind, you can better manage your trading activities on Phemex. Remember, funding rates are integral to the perpetual contracts market and can affect your trading profitability.

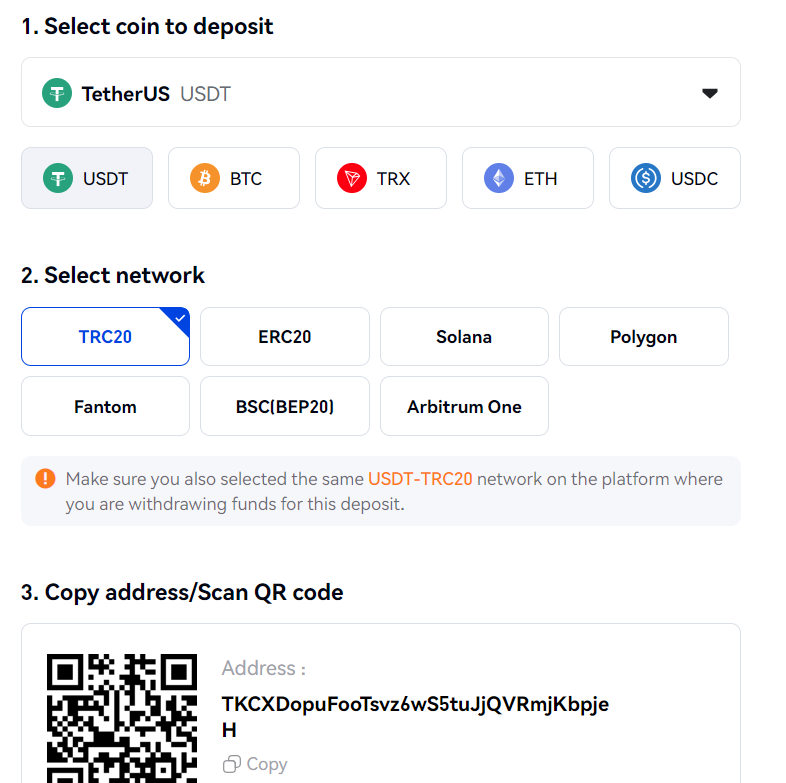

Phemex Deposit & Withdrawal Fees

When engaging with Phemex for your cryptocurrency transactions, it’s essential to know the associated fees, particularly concerning deposits and withdrawals.

Deposits:

Remarkably, Phemex does not impose any fees for depositing cryptocurrencies. You can transfer your digital assets to the platform without incurring charges.

Withdrawals:

For withdrawals, the situation is a bit different. Phemex does implement a fee for most cryptocurrencies when you’re looking to withdraw.

The exact fee depends on the type of cryptocurrency and the amount you wish to withdraw.

Moreover, a minimum withdrawal amount is stipulated for each cryptocurrency, which is variable based on the type and quantity.

Phemex’s withdrawal processing operates on a scheduled basis, executing transfers three times daily at fixed hours: 08:00, 16:00, and 24:00 UTC. This helps you plan your transactions with predictability.

Before initiating a withdrawal, Phemex mandates a security verification process to protect your funds. This multi-step authentication may include:

- Email confirmation

- SMS verification

- Google Authenticator

This layered security measure assures that your assets are safeguarded during withdrawal.

Phemex Account Types

In cryptocurrency exchanges, understanding the account types available to you is crucial for optimizing your trading experience. Phemex offers options for varied user needs, with its standard and premium accounts complemented by a structured Know Your Customer (KYC) system.

Phemex KYC Tiers & Limits

Tier 0

Daily Withdrawal Limit: 2 BTC

Tier 1

Verification Requirements: Name, Email, Phone Number

Daily Withdrawal Limit: 10 BTC

Additional Features: Fiat-to-crypto purchases

Tier 2

Verification Requirements: Government-issued ID, Selfie, Proof of Address

Daily Withdrawal Limit: 100 BTC

Additional Features: Higher fiat-to-crypto limits

When you start with Phemex, you are automatically placed in the Tier 0 KYC level.

Should you wish to enhance your limits or access additional features, you can opt to complete further verification steps.

Moving to Tier 1 involves providing your name, email, and phone number, which boosts your daily withdrawal limit significantly.

For even higher withdrawal capacity and more significant fiat transactions, Tier 2 is your target, requiring detailed personal documentation for the most extensive access and benefits offered by Phemex.

Phemex Trading Platform & Tools

Your trading experience on Phemex begins with a web-based platform accessible across various browsers and devices. You’ll find that the interface prioritizes user-friendliness and is highly customizable.

It caters to your specific trading needs through various widgets and indicators.

When analyzing financial markets, the versatility in chart types and time frames can be crucial.

On Phemex, switch seamlessly between chart types like candlestick, line, area, and Heikin-Ashi.

Analyze market trends on time frames that range from 1 minute to 15 minutes and beyond, providing granular control over your trading analysis.

To enhance your trading strategies, the platform offers a suite of tools.

Use trend lines, Fibonacci retracements, moving averages, and Bollinger bands. These tools are integral for technical analysis and can help make informed trading decisions.

You’ll also appreciate the real-time data integrated into the platform.

The order book, recent trades, open positions, open orders, and order history are all clearly presented, ensuring you’re well-informed before you place, alter, or cancel your orders.

Education is vital to honing your trading skills, and the Phemex Academy is the educational resource you need.

With comprehensive material from crypto basics to advanced trading strategies and risk management, your knowledge base can expand significantly.

Lastly, for those who prefer trading on the move, Phemex facilitates this with their mobile app.

Available for iOS and Android, the app mirrors the web platform’s functionality, letting you execute trades and monitor the markets anytime, anywhere.

Phemex Insurance Fund

Phemex incorporates an Insurance Fund to provide a safety net for its users.

When trading on the platform, this fund prevents your positions from being Auto-Deleveraged.

Auto-deleveraging, or ADL, is typically used when the platform’s liquidity is insufficient to cover leveraged positions.

What does the Insurance Fund do? It mitigates the risk when a trader’s position is about to be liquidated but cannot be filled at the bankruptcy price. Essentially, it acts as a buffer.

The process is as follows:

- When a liquidation occurs, the platform attempts to close the position at the bankruptcy price.

- The insurance fund will cover the shortfall if the position cannot be filled.

- This method assists in managing the platform’s risk and protecting users from ADL.

Essential Aspects of the Insurance Fund:

- Purpose: To prevent early auto-deleveraging of traders’ positions.

- Usage: It covers unfilled liquidation orders before ADL handles them.

- Protection: Offers an extra layer of security for your trades.

Remember, while the Insurance Fund adds a layer of protection, it also indicates the platform’s overall health and risk management strategies.

As an informed trader, keep an eye on the size and frequency of its use, as this can provide insights into the market’s volatility and the platform’s liquidity.

Phemex Deposit Methods

Phemex offers several deposit methods to fund your trading account with ease. You can choose between cryptocurrency deposits or fiat transfers to get started. Let’s look at your options:

Cryptocurrency Deposits

- Direct Crypto Transfer: You can deposit many cryptocurrencies directly into your Phemex account. You generate a deposit address from within your account and transfer funds from your external wallet or another exchange.

- BTC, ETH, XRP, and More: Prominent cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) are accepted among others.

Fiat Deposits

- Bank Transfer: You can wire funds directly from your bank account.

- Third-party Payment Processors: Depending on your region, options may include Simplex, MoonPay, and others,

| Method | Type | Notes |

|---|---|---|

| Crypto Transfer | Cryptocurrency | Check for minimum deposit amounts. |

| Bank Transfer | Fiat | It may involve bank fees and longer processing times. |

| Third-party Processors | Fiat | Instant transactions may include processing fees. |

Before making a deposit:

- Verify all transaction details carefully.

- Use the correct deposit address for the type of cryptocurrency you are transferring.

- Look into any deposit fees that may apply when using fiat deposit methods.

Your transactions are secured, but always double-check for additional security measures you can take to protect your funds during the deposit process.

Remember to consider processing times, especially for fiat transfers, which can vary depending on your bank and the payment processors involved.

Phemex Security Features

Phemex is committed to maintaining stringent security protocols to safeguard your assets and personal information. Here’s a breakdown of the critical security features that Phemex employs:

Multi-Signature Cold Wallet Storage

Your digital assets are predominantly stored in multi-signature cold wallets. This method ensures that your assets are not all housed in one place and require multiple parties to confirm transactions, significantly reducing the risk of unauthorized access.

Hot Wallet System

For withdrawal transactions, Phemex leverages a hot wallet system. These wallets have limited funds, are only used for day-to-day withdrawals, and are refilled periodically from the more secure cold wallets.

Data & Communication Encryption

When it comes to data on the platform:

- All your data on Phemex is encrypted

- Uses SSL encryption, ensuring that the data passed between the web server and browsers remain private

- AES-256 encryption is employed, which is a standard security practice for data protection

Additional Security Measures

Phemex enforces additional layers of security, including:

- Two-factor authentication (2FA) to verify your identity

- Email verification for new login devices and withdrawal requests

- SMS verification as additional security for critical account actions

- Anti-phishing codes to help you identify genuine communications from Phemex

- The option to set up IP allowlisting to restrict account access

Insurance Fund

In the event of market anomalies, Phemex has an insurance fund that covers the losses of positions that cannot be filled by the market or through its auto-deleveraging system, providing an extra layer of financial security.

Phemex Customer Support

Phemex ensures that you can access customer support through multiple channels. Whether you encounter a technical issue, have a query about account verification, or need help with deposits and withdrawals, their team is prepared to assist. Here’s how you can reach out to them:

- Email: Get in touch with their support team directly.

- Live Chat: Available for real-time assistance on their website.

- Phone: A dedicated line for more personalized support.

- Social Media: Active presence for quick queries and updates.

The support team operates 24/7, catering to a global audience in various languages, including English, Chinese, Japanese, and Korean. Engaging with their customer service, you can expect a responsive and professional experience, as they are equipped to handle a broad spectrum of issues.

For those who seek more tailored service, Phemex offers premium membership. Premium members receive priority customer support and benefit from exclusive services like trading signals and educational materials.

Furthermore, your feedback is vital. Phemex’s team doesn’t just troubleshoot; they communicate your input to the development team to enhance overall user experience and satisfaction.

Is Phemex a Legal & Safe Platform?

Phemex is recognized as a legal entity, having established its operations under the crypto-friendly jurisdiction of Singapore.

This location is amenable to cryptocurrency exchange and enforces a clear legal framework to which Phemex adheres.

- Location: Singapore, crypto-friendly jurisdiction

- Legal Compliance: Consistent with local laws and regulations

- Authority Collaboration: Cooperation with legal authorities

Comprehensive Know Your Customer (KYC) and Anti-Money Laundering (AML) policies reinforce your safety on the platform. These procedures are designed to curb fraudulent activities and safeguard the platform against the use of money laundering.

- Best Practices: Following KYC and AML policies

- Platform Integrity: Measures to prevent fraud and money laundering

Since its inception in 2019, Phemex has upheld a robust security record with no hacks or compromises reported. Such a clean track record has contributed to a positive reputation within the cryptocurrency community.

- Security Record: No known hacks since the launch

- Community Trust: Favorable reputation among users

To ensure a transparent trading experience, Phemex maintains a straightforward fee structure and opposes unfair trading practices. The platform’s commitment to fair play means you are unlikely to encounter hidden fees, market manipulation, or conflicts of interest.

- Trading Environment: Transparent and fair

- Fee Structure: No hidden fees

- Market Practices: No market manipulation or conflicts of interest

Phemex takes multiple steps to ensure your trading experience remains secure and within the scope of legal standards.

Conclusion

Phemex offers a platform to engage with over two hundred digital assets. Users appreciate the low trading fees, specifically the 0.1% charged for spot fees, positioning it favorably within the competitive crypto exchange market.

Highlights

- User Interface: You benefit from a user-friendly interface, making navigation straightforward.

- Mobile Accessibility: A highly-rated mobile app enhances your trading experience on the go.

- Trading Options: From spot to margin trading, including derivatives such as perpetual contracts, you have various tools at your disposal.

When engaging with Phemex, you can utilize its various trading bots and leverage options up to 100 times.

This provides the flexibility necessary for different trading strategies.

It is essential to note that the platform excludes services in several significant markets, which could impact global traders looking for a unified exchange solution.

Explore how Phemex compares to its competitors:

- Phemex vs Bybit: Side-by-Side Comparison

- Phemex vs Binance: Side-by-Side Comparison

- Phemex vs Bitget: Side-by-Side Comparison

- Phemex vs MEXC: Side-by-Side Comparison