Phemex and Bitget are leading cryptocurrency exchanges. Phemex excels in derivatives trading with high leverage options and zero-fee spot trading for premium members. Bitget focuses on copy trading, allowing users to replicate trades of experienced traders, alongside offering spot and derivatives trading with competitive fees.

When deciding between Phemex and Bitget, several factors come into play. Such as:

| Feature | Phemex | Bitget |

|---|---|---|

| Supported Cryptos | Phemex supports a range of cryptocurrencies | Bitget offers a similar variety with a focus on altcoins |

| Trading Types | Futures, spot trading | Spot, Futures, Perpetual, Dual Investment, Staking, Copy Trading |

| KYC Requirements | Mandatory for withdrawals | Also necessary for engaging in trade activities |

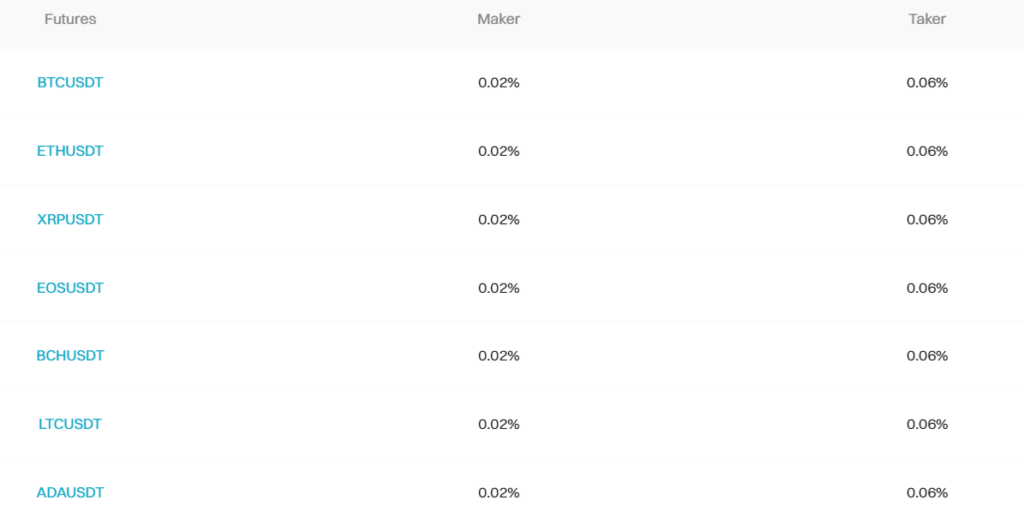

| Trading Fees | Low futures contract fees of 0.01 – 0.06% per trade | Fees vary; typically competitive |

| Deposit Methods | Multiple payment methods are available | Various methods, though specifics can differ |

| Leverage | Offers competitive leverage for certain products | Comparable leverage, often aiming at a broad user base |

| Global Availability | Generally wide but restricted in some countries due to regulations | Broad global availability |

| Trading Volume | High, catering to both novice and experienced traders | Substantial, with a growing user base |

| User Experience | Intuitive interface, suitable for different trader levels | User-friendly with advanced features for seasoned traders |

Each exchange has unique offerings designed to cater to the needs of different traders. Below is a comparison to help you gauge where each one stands.

Phemex vs Bitget: Products and Services

When exploring Phemex and Bitget for cryptocurrency trading, you’ll discover a range of offerings designed to suit various trading strategies and preferences.

Phemex is well-equipped with:

- Spot Trading: Trade a broad selection of cryptocurrencies.

- Futures Trading: Offers contracts for significant crypto assets with competitive leverage.

- Margin Trading: Increase your buying power.

- Additional Services: Earn through their ‘Earn Crypto’ platform, which includes fixed and flexible savings.

Bitget, on the other hand, provides:

- Spot Trading: A solid range of cryptocurrencies are available for instant trading.

- Futures Trading: Futures contracts with high-leverage options to amplify your trading.

- Leveraged Tokens: Manage risks while using leverage via these derivative products.

- Staking: Participate and earn rewards by staking your coins.

Both exchanges place a strong emphasis on security and user experience, aiming to make trading as efficient and safe as possible.

Phemex stands out with its no-KYC policy for spot trading and a beginner-friendly interface. In contrast, Bitget is recognized for its broader range of innovative trading products, such as leveraged tokens and staking opportunities.

| Feature | Phemex | Bitget |

|---|---|---|

| Spot Trading | Yes | Yes |

| Futures Trading | Yes, with leverage | Yes, with high leverage |

| Margin Trading | Yes | Not prominently featured |

| Leveraged Tokens | Not prominently featured | Yes |

| Staking | Not prominently featured | Yes |

Phemex vs Bitget: Contract Types

Phemex and Bitget offer a variety of contract types catering to different trading strategies and preferences. Here’s a comparison to guide you through their offerings.

Phemex:

- Inverse Perpetual Contracts: Your account balance is denominated in the underlying cryptocurrency, which means you bet on the price with the cryptocurrency itself, providing a natural hedge against the crypto market.

- Linear Perpetual Contracts: These are quoted and settled in USDT or other stablecoins, making it an approachable option for those considering fiat currency values.

- Inverse Futures Contracts: Similar to inverse perpetual, these contracts have a set expiration date, providing opportunities for longer-term strategies.

Bitget:

- COIN-M Futures: A type of futures contract where settlements are done in the actual cryptocurrency instead of a cash equivalent.

- USD-M Futures: These contracts are traded and settled in stablecoins, providing a more stable valuation tied to fiat currency.

- Options: This form gives you the right, but not the obligation, to buy or sell an asset at a specified price within a preset period, adding versatility to your trading arsenal.

| Feature | Phemex | Bitget |

|---|---|---|

| Inverse Perpetual | Available | Not specified |

| Linear Perpetual | Available (USDT settlement) | Presumed available (USDT or stablecoin) |

| Inverse Futures | Available | Not specified |

| COIN-M Futures | Not available | Available |

| USD-M Futures | Not available | Available |

| Options | Not available | Available |

Each contract type presents its risks and benefits.

Inverse contracts can appeal to cryptocurrency natives; linear contracts usually attract those with a background in traditional finance, futures contracts cater to long-term positions influenced by the expiration date, and options offer strategic flexibility.

Phemex vs Bitget: Leverage and Margin

When trading on Phemex and Bitget, you can use leverage to amplify your positions.

Leverage is a powerful tool that can increase your potential returns, but it also comes with higher liquidation risks if the market moves against your position.

Phemex offers leverage up to 100x for specific contracts. This means you can enter a position 100 times the value of your margin.

However, higher leverage comes with closer liquidation points, so managing risk is crucial. Phemex uses a tiered margin system, which adjusts the required margin as your position size changes.

Margin Requirements:

- Varies by position size and market

- Lower leverage usually requires less margin.

Bitget also provides leverage, with the maximum available leverage being 125x on certain products. Similar to Phemex, using maximum leverage on Bitget entails higher liquidation risk. Bitget implements a dynamic margin system to help you manage risk efficiently.

Margin Requirements:

- It also varies by position size and contract

- More minor positions can utilize higher leverage.

Both platforms have funding rates affecting the cost of a leveraged position. These funding rates can change based on market conditions, so it’s essential to stay updated:

- Phemex: generally lower funding rates.

- Bitget: competitive rates, which can adjust more frequently.

Lastly, be mindful of liquidation risks. If the market price reaches the liquidation price of your position, your trade will be closed, and you could lose your margin. Each exchange provides tools and resources to calculate margin requirements and potential liquidation prices, ensuring you can trade confidently and clearly.

Phemex vs Bitget: Liquidity and Volume

When you’re trading on cryptocurrency exchanges like Phemex and Bitget, two factors that significantly impact your trading efficiency are liquidity and volume.

Liquidity refers to how easily assets can be bought or sold at stable prices, while volume pertains to the amount of trading activity.

High liquidity and volume can contribute to smoother trades and less slippage — the difference between the expected price of a trade and the price at which the trade is executed.

- Phemex:

- Liquidity: Generally offers strong liquidity, which could lead to narrower spreads and better execution.

- Volume: Tends to have a solid trading volume, with consistent spikes seen during active trading periods.

- Bitget:

- Liquidity: Similar to Phemex, it provides ample liquidity, potentially easing entering and exiting positions.

- Volume: Features a robust volume that complements its liquidity, fostering an efficient trading environment.

To assess the liquidity and volume, you might use sources like CoinMarketCap or data directly from each exchange’s order book.

Remember, these metrics can fluctuate based on market conditions and time, so consult the exchanges or real-time analytics platforms for the most current data.

Metrics to consider include:

- Bid/Ask Spread: Narrower spreads are indicative of higher liquidity.

- 24-Hour Trading Volume: A higher volume suggests a more active market, which typically implies better liquidity.

Rankings from established financial analytics services will give you a comparative idea of where Phemex and Bitget stand regarding liquidity and volume, ensuring you can make more informed trading decisions.

Phemex vs Bitget: Fees and Rewards

Understanding the cost structure and potential earnings through rewards is crucial for profitability when trading cryptocurrencies. Here, we’ll compare the fee schedule and reward programs of Phemex and Bitget to inform you of your trading decisions.

Phemex vs Bitget: Trading Fee & Deposit/Withdrawal Fee Compared

Phemex:

- Trading Fees: You can expect a maker fee of 0.025% and a taker fee of 0.075% on Phemex. This tiered fee structure rewards those who provide liquidity (makers) with lower costs than those who take liquidity from the market (takers).

- Withdrawal Fees: The withdrawal fees on Phemex are not fixed and depend on the actual blockchain load at the time of your withdrawal.

- Deposit Fees: Phemex does not charge any fees for depositing cryptocurrencies.

- Examples and Discounts: If you’re a high-volume trader, you could benefit from lower fees, as Phemex offers a VIP program that reduces fees based on your 30-day trading volume.

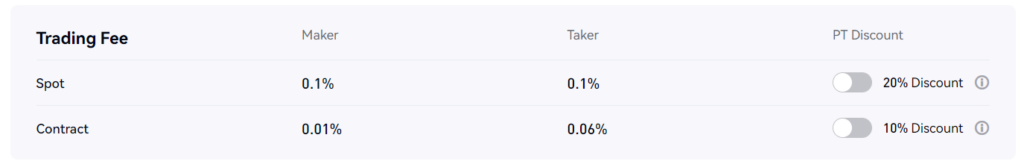

Bitget:

- Trading Fees: For Bitget, maker and taker fees are typically set at 0.1%. However, Spot trading offers a lower cost compared to Futures trading.

- Withdrawal Fees: Bitget has variable withdrawal fees, calculated based on the network’s condition and the asset you are withdrawing.

- Deposit Fees: Depositing funds into your Bitget account is free, allowing you to allocate more capital towards trading.

- Examples and Discounts: Bitget provides several ways to earn rewards and bonuses, such as through its Dual Investment and Staking services. Additionally, users can receive discounts on trading fees by holding the platform’s native token.

Manager’s note: Please remember that while discounts and reduced fees can enhance your trading experience, always keep abreast of any applicable terms and conditions. Markets and fees can change, and staying informed will help you trade effectively.

Phemex vs Bitget: Deposits & Withdrawal Options

When managing your funds on cryptocurrency exchanges like Phemex and Bitget, you’ll find that both platforms offer various options for deposits and withdrawals.

These options can influence how quickly and efficiently you can move your funds.

Phemex supports multiple payment methods, including cryptos and fiat currencies, making it accessible to a diverse user base.

Your deposit times can vary, with cryptocurrency transactions typically being quicker. Phemex offers low withdrawal fees and a range of minimum and maximum limits, ensuring flexibility for your transactions.

Bitget, on the other hand, is noted for its extensive range of trading features and for facilitating various payment methods suitable for global users.

With Bitget, you’ll find competitive processing times that enable swift transfers into and out of your trading account.

| Feature | Phemex | Bitget |

|---|---|---|

| Supported Cryptos | Multiple, including top assets | Extensive, strong altcoin support |

| Fiat Currency Support | Yes | Limited |

| Deposit Methods | Crypto, Bank Transfer, Cards | Crypto, Third-party Payment Processors |

| Withdrawal Fees | Low | Comparable to industry standards |

| Minimum Deposit | Varies by asset | Varies by asset |

| Minimum Withdrawal | Asset-dependent, competitive | Also asset-dependent, aligns with norms |

Remember that both platforms may have varying restrictions depending on your location, and it’s essential to stay informed about these to make the best choices for your trading activities.

Phemex vs Bitget: KYC Requirements & KYC Limits

When trading on Phemex or Bitget, understanding the Know Your Customer (KYC) requirements and limits is crucial for a smooth experience.

Phemex KYC Requirements:

- Verification Levels: Phemex has a simple verification process, including uploading an identification document and a photo.

- Documentations: Typically, you’ll need a government-issued ID.

- Procedure: Verification is fast and can usually be completed in minutes if all documents are correct and precise.

Phemex KYC Limits:

- Level 1 Verification (Unverified): Restricted access to services with lower withdrawal limits.

- Level 2 Verification (Verified): Increased limits on withdrawals and deposits and full access to trading features.

Bitget KYC Requirements:

- Verification Levels: Bitget requires users to review their verification protocols to unlock full platform capabilities.

- Documentations: A government-issued ID is necessary, among possibly other documents.

- Procedure: The process is typically user-friendly, with clear instructions provided by the exchange.

Bitget KYC Limits:

- Unverified Accounts: These may have restrictions on deposits, withdrawals, and trading services.

- Verified Accounts: Usually have higher limits and broader access to various trading services.

Your privacy, security, and accessibility are affected by these exchanges’ KYC processes. While both exchanges prioritize security, they balance this with the need for accessibility.

Understanding these requirements will ensure you are not surprised by sudden restrictions and can trade confidently.

Phemex vs Bitget: Order Types

When trading cryptocurrencies on Phemex or Bitget, understanding the different types of orders available can significantly impact your strategy and risk management.

Both platforms offer a variety of order types catered to diverse trading styles and objectives.

- Market Orders: On both Phemex and Bitget, a market order allows you to buy or sell at the best available current price. It’s immediate and executed at the prevailing market rates.

- Limit Orders: Your limit order specifies the maximum or minimum price you are willing to buy or sell. This provides you with control over the price, unlike market orders.

- Stop Orders: A stop order is akin to a trigger for your trade. When the market hits your set stop price on Phemex or Bitget, your stop order becomes a market order and is executed at the next available rate.

- Conditional Orders: This type is an advanced tool where your order is carried out only under conditions you define. Phemex and Bitget offer these to help tailor your trading to specific market movements.

- Post-Only Orders: These are designed to ensure you pay the maker fee, not the taker fee. Your order will be added to the order book but won’t be executed immediately if it matches the opposing order book.

- Reduce-Only Orders: To prevent increasing your position, reduce-only orders are used. This order will only reduce your position and cancel automatically if it increases it.

Phemex differentiates itself by providing certain types of conditional orders that are specially crafted for crypto derivatives trading.

On the other hand, Bitget emphasizes simplicity in its order types, potentially making it more accessible to new traders.

Both platforms are competitively equipped with order types catering to novice and experienced traders, ensuring you can effectively execute your strategies and manage risks.

Phemex vs Bitget: Security and Reliability

When you trade on Phemex or Bitget, the security and reliability of your funds and personal data are paramount. Both platforms employ industry-standard security measures, but exploring how each one does so is essential.

Phemex uses multi-signature cold wallet systems to ensure your funds are not readily accessible online. This adds an essential layer of security against hacking attempts. Phemex applies SSL encryption for personal data to protect your information during transmission.

Bitget also prioritizes the security of its users’ assets through similar cold storage solutions. It implements industry-standard practices to protect funds and uses SSL encryption to safeguard your data.

| Exchange | Security Feature | Description |

|---|---|---|

| Phemex | Multi-Signature Wallets | Funds stored in offline wallets require multiple keys. |

| Bitget | Cold Storage | The majority of assets are held offline, away from online threats. |

Both exchanges have had their challenges. However, Phemex and Bitget tackle issues quickly and transparently, often enhancing systems post-incident to bolster security.

Regarding regulatory compliance, Phemex and Bitget aim to adhere to international standards, with Bitget often highlighting their compliance efforts in various jurisdictions. They offer KYC procedures to increase the security and integrity of their platforms.

Customer support is a critical aspect of reliability, and you’ll find that Phemex and Bitget provide varied support channels, including live chat and ticket systems, ensuring assistance when needed.

Remember, while both exchanges have demonstrated a commitment to security and reliability.

You must use best practices in securing your accounts, such as using strong and unique passwords, enabling two-factor authentication, and being cautious of phishing attempts.

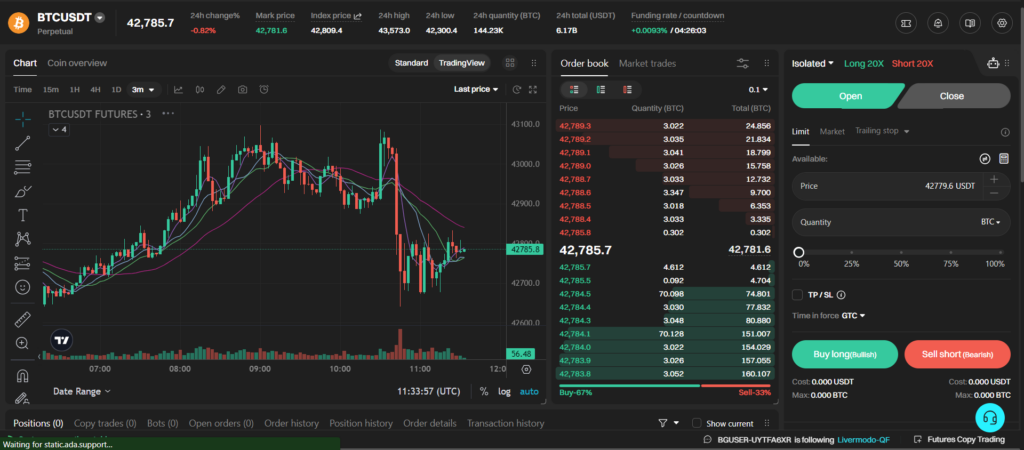

Phemex vs Bitget: User Experience

When evaluating the user experience of Phemex and Bitget, your consideration should include both the platforms’ ease of use and functionality.

Phemex:

- Interface: Designed with a clean and intuitive layout, Phemex provides a user-friendly experience suitable for beginners and experienced traders.

- Performance: It prides itself on high-speed trade execution, minimizing slippage, which can be critical during volatile market conditions.

- Features: Advanced tools such as spot trading, futures contracts, and conditional orders are available, enhancing your trading strategies.

Bitget:

- Interface: Bitget’s platform offers a sleek design, aiming to simplify navigation and efficiency, regardless of your trading aptitude.

- Performance: Known for its competitive trading speed, Bitget ensures that your trades are placed promptly and effectively.

- Features: It stands out with features like copy-trading, which allows you to mirror the trades of seasoned traders, a usually appreciated feature among novices.

Users on both platforms benefit from comprehensive charting packages, numerous technical indicators, and various order types that foster in-depth market analysis and trading precision.

The onboarding process is streamlined, making it easier to start trading without cumbersome delays.

Phemex vs Bitget: Regulation and Compliance

When considering the regulation and compliance of Phemex and Bitget, you should note the differences in their operational jurisdictions and adherence to regulatory standards.

Phemex operates with restrictions in certain countries due to regulatory challenges. You might find that Phemex offers more payment methods, which could indicate broader compliance with international financial transaction regulations.

However, the platform may not be available in your region due to local laws and compliance issues.

On the other hand, Bitget is known for its global availability, suggesting it has effectively navigated various regional compliance requirements.

Bitget’s expansion could be attributed to its ability to secure necessary licenses and satisfy audit requirements across multiple jurisdictions.

Here’s a brief comparison:

- Global Reach and Restrictions: Phemex faces restrictions in some regions, whereas Bitget boasts global availability.

- Compliance Measures: Both exchanges have likely implemented KYC (Know Your Customer) processes, aligning with anti-money laundering standards.

- Certifications and Licenses: Specific information about certifications and licenses may vary, and you’re encouraged to check the latest updates directly from the exchanges.

Your choice between Phemex and Bitget may depend on the compliance framework within your country and how these platforms align with those legal standards.

Conclusion

When deciding between Phemex and Bitget for your trading needs, consider the unique features each exchange offers.

Phemex is known for its solid selection of cryptocurrencies, making it a reliable choice if you prioritize a more curated trading experience.

If diversity in altcoins and the potential for higher profitability are essential to you, Bitget may be the preferable choice due to its expansive offering.

Fees and UX should also weigh heavily in your decision. Bitget’s competitive edge in the marketplace, alongside the user experience, could be deciding factors. On the other hand, Phemex has been recognized for providing a user-friendly platform with a straightforward fee structure.

For those focused on volume and liquidity, Phemex’s 5 million active users suggest a robust trading environment. Bitget, although smaller with 2 million users, should not be dismissed as it offers unique trading products and leverage options.

In summary:

- Phemex: Recommended if you prefer a more selective array of cryptocurrencies and value a user-friendly interface with transparent fees.

- Bitget: Suitable for traders seeking a broad spectrum of altcoins and innovative trading features.

Your decision should align with your individual trading goals and the specificities of your investment strategy. Both exchanges have their respective strengths, and the best choice is the one that complements your trading style and requirements.

Explore how Phemex and Bitget compare to their competitors:

- Phemex vs Bybit: An Unbiased Comparison

- Phemex vs Kraken: An Unbiased Comparison

- Phemex vs MEXC: An Unbiased Comparison

- Bitget vs MEXC: An Unbiased Comparison

- Bitget vs Binance: An Unbiased Comparison

- Bitget vs BingX: An Unbiased Comparison