Phemex and Binance are leading cryptocurrency exchanges, each offering distinct features to traders. Phemex is known for its robust derivatives trading platform, high leverage options, and zero-fee spot trading for premium members. It focuses on speed, security, and providing a seamless trading experience.

Binance, one of the largest exchanges globally, offers a comprehensive range of services including spot, margin, and futures trading, staking, savings, and a wide variety of cryptocurrencies. It is recognized for its high trading volumes, advanced trading tools, and strong security measures. Comparing Phemex and Binance helps traders choose between specialized derivatives trading and a broad array of crypto services.

To help you choose a crypto exchange between the two, below is a summarizing table of the main points you should consider:

| Feature | Phemex | Binance |

|---|---|---|

| Supported Coins | Offers a limited selection, focusing on significant cryptocurrencies | Over 350 cryptocurrencies, including a wide array of altcoins |

| Fees | Competitive trading fees with different structures for market makers | 0.1% trading fee with discounts available for BNB token holders |

| Leverage | Offers leverage on future products | Provides high-leverage options across various products |

| Trading Volume | Moderate compared to Binance | One of the highest trading volumes in the cryptocurrency exchange market |

| Deposit Methods | Crypto deposits: some fiat deposit options may be available | Wide range of deposit methods, including bank transfer, credit cards, and crypto |

| Mobile App | User-friendly mobile app | Comprehensive mobile app catering to all trading and exchange services |

| Security Features | Industry-standard security features | Comprehensive security features with an established history of handling threats |

Remember to choose an exchange that aligns best with your trading preferences and experience level.

Phemex vs Binance: Products and Services

Phemex and Binance have established themselves as leading cryptocurrency exchanges, providing products and services that cater to different trader needs.

Phemex:

- Spot Trading: A streamlined experience focusing on simplicity and speed.

- Futures Trading: Offers perpetual contracts for significant cryptocurrencies.

- Services: Mainly a futures-only platform, settling contracts in BTC and USD.

- User Experience: Tailored towards a quick and straightforward trading process. Limited variety compared to Binance but efficient for new users focusing on the future.

Binance:

- Spot Trading: Supports a vast selection of over 350 cryptocurrencies.

- Futures Trading: Offers a wide range of futures and options trading with leverage.

- Leveraged Tokens: Provides options for high-risk, high-reward trading strategies.

- NFT Marketplace: Binance integrates an NFT marketplace for contemporary digital asset handling.

- Staking and Savings: Give users options for staking cryptocurrencies to earn rewards and savings products.

- Launchpad: Hosts new cryptocurrency projects, offering early access to tokens.

- Services: A feature-dense platform that provides comprehensive services catering to beginners and seasoned traders.

- User Experience: Offers a robust platform that may seem complex but aims for a feature-rich trading experience.

Regarding innovation and variety, Binance stands out with its extensive offerings and additional services like the NFT marketplace and Launchpad, making it a one-stop shop for diverse crypto activities.

In contrast, Phemex draws users looking for a more focused trading environment, especially if you prioritize futures trading over the breadth of services.

Phemex vs Binance: Contract Types

Phemex and Binance are prominent cryptocurrency exchanges catering to various trading preferences by offering different contract types. Your choice of platform may depend on the range of contract trading options you prefer.

Phemex is known for its selection of perpetual contracts that focus on derivatives trading. These contracts don’t expire, allowing you to hold a position as long as needed. Phemex primarily offers:

- Inverse Perpetual Contracts: The contract is settled in a cryptocurrency like BTC rather than fiat.

- Linear Perpetual Contracts: Settlement in these contracts is in fiat currency, offering a more straightforward approach to those familiar with traditional currencies.

Binance, on the other hand, presents a broader mixture of futures and options contracts, appealing to a more comprehensive range of traders with varying interests and risk tolerances. Its contract types include:

- USD-M Futures: Margined and settled in USD stablecoins, providing a stable valuation reference.

- COIN-M Futures: Margined and settled in the respective cryptocurrency, suited for those who prefer dealing in digital assets directly.

- Options: Binance offers more complex contract types, such as options, which provide strategies for different market conditions.

When comparing trading volumes, Binance often leads, which is attributed to its more comprehensive range of trading products and deeper liquidity pools.

Contract trading on Binance caters to novice and experienced traders with a combination of perpetual and standard futures contracts, including quotes in USD or cryptocurrencies.

In summary, your choice between Phemex and Binance should align with your trading style and the contracts you want to trade.

Whether you prefer the focused offerings of Phemex or the wide variety from Binance, ensure the contracts fit your trading strategies and risk management practices.

Phemex vs Binance: Leverage and Margin

When comparing leverage and margin trading between Phemex and Binance, you’ll notice distinct offerings catering to different traders.

Both platforms enable you to amplify your positions and potential returns, but it’s essential to understand their specific terms.

Phemex offers up to 100x leverage on BTCUSD futures contracts, which is significant but comes with high liquidation risks if the market moves adversely.

Additionally, other trading pairs on Phemex provide up to 20x leverage.

On the other hand, Binance varies its leverage based on the pair and the position size, with maximums commonly reaching up to 125x for specific contracts.

Here are some key points to consider for both exchanges:

- Initial Margin: The initial amount you must deposit to open a leveraged position.

- Maintenance Margin: The minimum amount must be kept in your account to prevent liquidation.

- Liquidation Risks: The potential for your position to be settled if the value falls below the maintenance margin.

| Exchange | Max Leverage | Initial Margin | Maintenance Margin | Liquidation Risk |

|---|---|---|---|---|

| Phemex | 100x (BTCUSD) | Varies | Varies | High |

| Binance | 125x | Varies | Varies | High |

Funding Rates: Both exchanges have rates that apply to perpetual contracts, which can influence your holding costs. They’re determined by market liquidity and can vary over time.

In summary, while Phemex and Binance provide powerful tools through leverage and margin trading, they carry considerable risk.

It’s crucial to assess both the opportunities and the potential downsides when using high leverage, considering that substantial gains can accompany equally substantial losses.

Always understand the terms and implications before engaging in margin trading on any exchange.

Phemex vs Binance: Liquidity and Volume

When evaluating Phemex and Binance, understanding their liquidity and trading volume is critical for your trading efficiency.

Liquidity refers to how easily assets can be bought or sold at stable prices on an exchange. Higher liquidity indicates more efficient markets, leading to less price slippage.

Binance consistently ranks top in daily trading volume, contributing to its high liquidity.

With its large user base and a wide array of trading pairs, it can provide a very liquid market environment. This often results in tighter spreads and more favorable order execution for you.

Phemex, while more minor in comparison, offers a competitive trading environment with a focus on speed and simplicity.

Although it may not match Binance’s volume, it ensures adequate liquidity for the trading pairs it offers, which is especially important for future contracts predominantly settled in BTC and USD.

Here’s a brief comparison:

- Trading Volume: Binance leads with a significantly higher daily trading volume.

- Liquidity Sources: Binance’s liquidity comes from a global pool of traders, whereas Phemex’s is more concentrated.

- Execution and Slippage: Binance’s higher liquidity minimizes slippage, enhancing execution quality. Phemex strives for high execution quality, but you may experience slightly more slippage during peak volatility due to lower volume.

Phemex vs Binance: Fees and Rewards

Evaluating the fees and rewards on Binance and Phemex is essential for traders to understand potential costs and incentives when trading on these platforms.

Phemex vs Binance: Trading Fee & Deposit/Withdrawal Fee Compared

Binance Trading Fees:

- Maker Fee: Generally starts at 0.1%

- Taker Fee: Typically also 0.1%

- Discounts: BNB token holders can receive a discount on trading fees

- Deposit Fee: Free for all cryptocurrencies

- Withdrawal Fee: Varies by asset; for example, withdrawing Bitcoin incurs a fee based on the current network condition

Phemex Trading Fees:

- Maker Fee: Can be as low as 0.025%

- Taker Fee: Can be up to 0.075%

- Bonuses: Phemex often provides sign-up bonuses for new users

- VIP Program: Offers fee reductions based on trading volume

- Deposit Fee: No fee for cryptocurrency deposits

- Withdrawal Fee: Fixed rate per asset; BTC withdrawals have a standard fee

Trading Scenario Example: If you are trading 1 BTC on Binance with a 0.1% taker fee, you will pay 0.001 BTC. On Phemex, under the same conditions but with a 0.075% taker fee, you would pay 0.00075 BTC, rewarding users with slightly lower fees.

Phemex vs Binance: Deposits & Withdrawal Options

Binance Deposits & Withdrawals:

- Currencies: Supports a wide range of cryptocurrencies and several fiat currencies

- Payment Methods: Bank transfer, credit/debit cards, third-party payment systems like PayPal

- Minimum/Maximum: Varies by cryptocurrency; higher limits for verified accounts

- Processing Times: Instant for cryptocurrencies, may vary for fiat transactions

Phemex Deposits & Withdrawals:

- Currencies: Focuses on a selection of popular cryptocurrencies

- Payment Methods: Primarily cryptocurrency; fiat transactions possible through third-party services

- Minimum/Maximum: Set minimum for cryptocurrencies; no maximum limits indicated

- Processing Times: Immediate for crypto, depends on the third-party service for fiat transactions

Your choice between Binance and Phemex for depositing and withdrawing funds will depend on your preference for payment methods and the currencies you intend to use.

Binance offers greater flexibility with multiple fiat options and instant crypto transactions, while Phemex keeps it simple with a focus on cryptocurrencies and third-party services for fiat conversions.

Phemex vs Binance: KYC Requirements & Limits

Regarding KYC (Know Your Customer) requirements, Phemex and Binance adopt different approaches that impact your privacy, security, and accessibility on their platforms.

Phemex allows you to begin trading without immediate KYC verification. Initially, you can deposit, withdraw, and trade on their spot and futures markets with basic sign-up information.

However, to increase your withdrawal limits and enhance account security, you are encouraged to complete KYC verification, which involves providing a government-issued ID and facial recognition.

Binance, on the other hand, has more stringent KYC procedures and has been made more robust in response to increasing regulatory scrutiny from bodies like the SEC.

After registering, you must complete the identity verification process to enable deposits and engage in trading.

Binance requires a government-issued ID, proof of address, and facial verification to upgrade your account to higher service tiers.

| Feature | Phemex | Binance |

|---|---|---|

| Initial KYC | Not required | Required |

| Full KYC | Optional | Required for full access |

| Documents | Government ID, Facial recognition | Government ID, Proof of address, Facial recognition |

| Withdrawal Limit without KYC | Low | None |

| Withdrawal Limit with KYC | High | Very high |

The verification levels establish what you can do on the exchange. Non-verified users on Phemex face lower withdrawal limits than verified users, but they can still trade.

On Binance, verification is mandatory for transactions to comply with security measures and regulatory requirements.

By securing your account through KYC verification on both exchanges, you enhance the safety of your assets and contribute to a more secure trading environment overall.

However, the exact limits and account features are subject to change, so it’s wise to consult the exchanges’ most recent policies and terms of service.

Phemex vs Binance: Order Types

When trading on Phemex or Binance, you have access to various order types that allow you to implement your trading strategies effectively and manage risk.

Phemex supports these orders:

- Market Orders: Execute immediately at the best available market price.

- Limit Orders: Set a specific price to buy or sell.

- Conditional Orders: Triggered when certain conditions are met; includes Stop Market, Stop Limit, and Trailing Stop.

- Take Profit and Stop Loss: Automatically close positions to take profit or stop losses.

Binance offers a similar yet broader range of order types:

- Market Orders: Immediately filled at current market price.

- Limit Orders: You specify the price at which to buy or sell.

- Stop-Limit Orders: Execute a limit order once the stop price is reached.

- OCO (One Cancels The Other): A pair of orders combining stop and limit orders. If one is executed fully or partially, the other is automatically canceled.

- Trailing Stop Orders: Adjust the stop price at a fixed percent or dollar amount below the market price as it rises.

- Post-Only Orders: Ensure the order is added to the order book and does not match a pre-existing order.

- Reduce-Only Orders: Ensure the order reduces your position and does not increase it.

Both platforms facilitate trading pairs in significant cryptocurrencies, providing you with the flexibility to trade across a variety of assets.

While Binance has a more extensive list of trading pairs and order types, Phemex focuses on simpler tools catering to straightforward trading strategies.

Your choice of platform may depend on whether you prefer a more comprehensive array of order functionalities or a more streamlined trading experience.

Phemex vs Binance: Security and Reliability

When choosing a cryptocurrency exchange, your platforms’ security and reliability are paramount—your funds and personal information demand the highest level of protection.

Phemex takes several robust security measures:

- Two-factor authentication (2FA): Adds an extra layer of security to user accounts.

- Cold storage: Keeps many digital assets offline to protect against online theft.

- SSL encryption: Secures your data as it travels between the server and your browser.

Additionally, Phemex has not reported any major security breaches, indicating a solid track record in safeguarding user assets.

Binance, on the other hand, is equipped with a comprehensive security infrastructure:

- Secure Asset Fund for Users (SAFU): In the event of a security breach, this emergency insurance fund aims to protect users’ funds.

- Advanced SSL encryption: Binance utilizes advanced technology to secure transactions and user communications.

- Regulatory compliance: Adheres to international regulations to enhance security measures.

Binance has faced security issues, such as the well-publicized 2019 hack. However, Binance resolved these incidents promptly, reimbursing affected users through the SAFU without affecting their pockets.

Both exchanges provide customer support for any support issues or concerns, though response times can vary based on the influx of inquiries and the complexity of your problem.

Remember, while both exchanges employ rigorous security measures, it’s always wise to use personal security practices, such as not sharing your 2FA codes and being cautious of phishing attempts.

Phemex vs Binance: User Experience

When evaluating the user experience of Phemex and Binance, user interface and ease of use are critical factors.

Phemex prides itself on a direct approach with a design emphasizing speed and simplicity. This can be particularly advantageous if you favor a less complex, more streamlined trading environment.

Binance, in contrast, boasts a feature-dense platform. Although this presents many tools and options for traders, it can potentially overwhelm new users.

However, its interface is well-organized, and many users find that its diverse functionalities allow for a more tailored experience, depending on their trading needs.

Regarding customer support, Binance has a comprehensive help center and offers support through multiple channels, including chat and email.

Phemex also provides vital customer service, emphasizing quick response times. Both exchanges gather feedback consistently to improve their services.

- Phemex:

- Simplistic, fast interface.

- Beginner-friendly.

- Responsive support team.

- Binance:

- Highly feature-rich, it can be complex for beginners.

- Multiple support channels.

- Extensive customization options.

The platforms differ in catering to users, with Phemex targeting those who appreciate usability and speed. At the same time, Binance focuses on providing an enriched feature set for the more venturesome trader.

User reviews often highlight the user-friendly aspect of Phemex for newcomers, whereas Binance receives praise for its depth in serving seasoned traders.

In your assessment, consider what aligns best with your trading strategy and level of expertise.

Each platform offers unique benefits in terms of user experience, and choosing between Phemex and Binance depends mainly on your personal trading preferences.

Phemex vs Bitget: Regulation and Compliance

When considering trading on either Phemex or Bitget, understanding their commitment to regulation and compliance is crucial.

Both platforms operate in a complex legal landscape and strive to adhere to the rules set forth by various international regulatory bodies.

Phemex has positioned itself as a trustworthy exchange by pursuing compliance with industry standards.

They focus on user security and regulatory adherence, though specific license and certification details might not be publicly available. You should always check for the latest updates directly from Phemex for their regulatory status.

On the other hand, Bitget proclaims a dedication to user safety and legal compliance.

They are known to implement KYC (Know Your Customer) procedures against fraud and money laundering – a standard practice for exchanges adhering to regulatory demands.

Bitget’s transparency regarding its compliance policies can typically be confirmed through its official communication channels.

Here’s a quick overview for your reference:

| Aspect | Phemex | Bitget |

|---|---|---|

| KYC | Not specified in the public domain | Mandatory KYC practices |

| Audits | Periodic security audits (not always publicized) | Regular security and compliance audits |

| Certification | Industry-standard certifications (details vary) | Pursues industry certifications where available |

While both exchanges have faced challenges, such as the evolving regulatory frameworks and shifting market conditions, they continue to adapt and make efforts to maintain compliance.

It would be best to verify both exchanges’ current compliance status, as regulations can frequently change, affecting how they operate in your jurisdiction.

Frequently Asked Questions

In this section, you will find precise answers to some common questions regarding the accessibility and advantages of using Phemex and Binance.

Can traders from the USA legally use Phemex?

No, traders from the USA cannot legally use Phemex. The platform does not provide services to residents of the United States due to regulatory restrictions.

What are the advantages of using Binance over Phemex?

Binance offers a more diverse range of products and features than Phemex.

This includes a more extensive selection of cryptocurrencies to trade, various advanced trading features, and comprehensive market analysis tools that enhance your trading experience.

Conclusion

When comparing Phemex and Binance, trustworthiness and security are paramount when choosing a crypto exchange. Both platforms have established themselves as secure options in cryptocurrency trading.

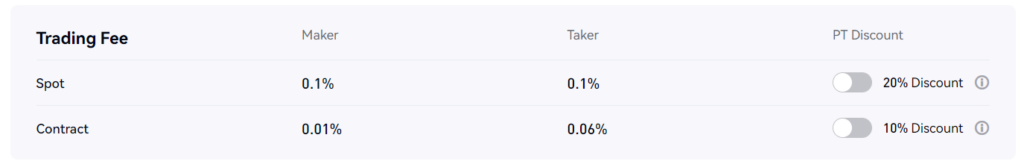

- Phemex

- Spot Fees: 0.1% for both makers and takers

- Futures Fees: 0.01% for makers, 0.06% for takers

- Binance

- Spot Fees: 0.1% for makers and takers (with volume discounts)

- Futures Fees: 0.02% for makers, 0.04% for takers

- More trading pairs and options

- Additional discounts through BNB and referrals

For experienced traders who prioritize fast trade execution and advanced order types, Phemex may provide the edge you require. Its interface is tailored for efficiency, making it a favorable environment for those with a well-versed background in crypto trading.

On the other hand, Binance’s extensive range of trading pairs and additional fee discounts can be particularly advantageous for users engaged in high-volume trading. Its broader market accessibility makes it a versatile choice, suitable for new and seasoned investors.

Your decision should align with your trading habits and needs. Whether you value a streamlined, powerful trading experience or a comprehensive platform with a broad market reach, Phemex and Binance are competent contenders in the trading platform comparison.

Explore how Phemex and Binance compare to their competitors:

- Phemex vs MEXC: In-Depth Exchange Comparison

- Phemex vs BingX: In-Depth Exchange Comparison

- Phemex vs Bybit: In-Depth Exchange Comparison

- Binance vs Bybit: In-Depth Exchange Comparison

- Binance vs MEXC: In-Depth Exchange Comparison

- Binance vs BingX: In-Depth Exchange Comparison