In the rapidly evolving world of cryptocurrency trading, you may find yourself comparing Bybit and Bitget, two reputable platforms that have garnered attention in the crypto exchange landscape.

When deciding between Bybit and Bitget, both platforms offer unique features catering to specific trader needs.

This comparison provides a concise overview to help you understand key differences.

| Feature | Bybit | Bitget |

|---|---|---|

| Founded | 2018 | 2018 |

| Headquarters | Singapore | Dubai |

| User Interface | Modern and intuitive | Simplified and accessible |

| Products | Derivatives, Spot, and Futures | Derivatives, Spot, and Copy Trading |

| Supported Coins | Offers a wide selection | It provides a diverse range as well |

| Maximum Leverage | Up to 100x | Up to 100x |

| Trading Volume | High, indicating liquidity | Also high with competitive liquidity |

| Deposit Methods | Multiple, including crypto and fiat | Crypto mainly, with no KYC feature |

| Regulation | Stringent regulations in place | Dubai Virtual Assets Regulatory Authority MVP License |

| Fees | Competitive trading fees | Similarly, low fees for trading |

Bybit has established itself as a leading platform since its inception in 2018, gaining a solid reputation for its derivative and futures trading options.

Offering leverage of up to 100x, Bybit appeals to traders looking for significant exposure to cryptocurrency markets while maintaining competitive fees and a user-friendly interface.

In contrast, Bitget, founded in 2018, has distinguished itself with features catering to crypto traders prioritizing privacy and potentially higher leverage options.

With its no-KYC (Know Your Customer) policy and the option to leverage trades up to 100x, Bitget positions itself as a compelling choice for users who value anonymity and high-stakes trading opportunities in their crypto endeavors.

Bybit vs Bitget: Products and Services

When it comes to cryptocurrency trading options, both Bybit and Bitget offer a comprehensive suite of services.

You can engage in spot trading on both platforms, which is ideal for exchanging one cryptocurrency for another at current market prices.

For those interested in futures trading, Bybit provides a robust platform focusing on derivatives and futures, offering up to 25x leverage for your trades.

This can amplify your gains, but it also increases the risk of losses.

Bitget steps up the game here, offering even higher leverage of up to 100x on futures trades, catering to those prioritizing high-risk, high-reward scenarios.

Derivatives trading is another field where these two platforms shine.

Bybit is renowned for its derivatives offerings, ensuring a competitive edge with solid regulatory clarity and various deposit methods.

Bitget matches the competition with its broad product offerings that include derivative products. Still, it stands out with its no-KYC policy, which might appeal if you prefer to maintain your privacy.

Regarding product innovation, both futures trading crypto exchanges are on the front lines, continually updating their services to meet your needs.

Bitget and Bybit also provide additional services like staking and access to an NFT marketplace, paving new avenues for asset diversification.

The user experience is where your personal preference comes into play;

whether you favor the straightforward simplicity of Bybit or the privacy-conscious approach of Bitget, both platforms are designed to facilitate a seamless trading experience.

| Feature | Bybit | Bitget |

|---|---|---|

| Leverage on Futures | Up to 25x | Up to 100x |

| KYC Policy | Standard KYC procedures | No KYC required |

| Spot Trading | Available | Available |

| Regulatory Clarity | Clear Regulatory Status | MVP License by Dubai Authorities |

| Product Offerings | Derivatives, Futures, Spot, Staking, NFT Market | Derivatives, Futures, Spot, Staking, NFT Market |

Bybit vs Bitget: Contract Types

In your exploration of contract types between Bybit and Bitget, you’ll find that both offer various options to cater to different trading preferences.

Bybit’s offerings include:

- Inverse Perpetual Contracts: These contracts are settled in the base currency, making them suitable for those holding the underlying asset.

- Linear Perpetual Contracts: Settled in USDT, allowing a straightforward entry for those using stablecoins.

- Inverse Futures Contracts: A future contract type where the quote and settlement are in the base currency.

- Options Trading: This gives you the flexibility to hedge or speculate on the future price of an asset.

Bitget, on the other hand, provides similar contract types with its unique features:

- COIN-M Futures: These futures are margined and settled in cryptocurrency, like BTC or ETH, giving you direct exposure to the asset’s price changes.

- USD-M Futures: Allows you to trade contracts margined with stablecoins, often viewed as less volatile.

- Leveraged Tokens: A unique offering that provides additional leverage without managing collateral or margin.

Both platforms offer versions of spot and futures markets with distinct liquidity and fee structures. It’s essential to weigh these differences against your trading style and risk tolerance.

Bybit and Bitget provide varied contract types designed for different trading strategies.

Whether you’re looking for traditional futures settled in cryptocurrency or more innovative leveraged tokens, both exchanges come equipped to serve your trading needs.

Understanding the benefits and potential drawbacks is crucial to making informed choices in your trading endeavors.

Bybit vs Bitget: Leverage and Margin

When trading on Bybit and Bitget, you’ll find both platforms offer competitive leverage and margin trading options.

Leverage allows you to amplify your position size, giving you the power to increase potential returns with less capital.

However, it also comes with higher liquidation risks if the market moves against you.

On Bybit, you can access up to 25x leverage for certain derivatives and futures products. You can hold a position worth twenty-five times that amount for every dollar in your account.

Margin requirements vary depending on the asset and position size, which helps manage risk effectively. Remember that higher leverage can lead to quicker liquidation, so you need to monitor your trades closely.

Meanwhile, Bitget ups the ante with leverage of up to 100x on some trading pairs. It’s particularly appealing if you’re looking to maximize your trading power.

However, with greater leverage comes the increased chance of liquidation, so it’s crucial to understand the margin thresholds and maintain sufficient balance to avoid premature closures of your positions.

Both exchanges calculate funding rates, which are periodic payments you make or receive depending on your position relative to the market. These rates can influence the cost of holding a leveraged position over time.

- Bybit: Up to 25x leverage

- Bitget: Up to 100x leverage

For you as a professional trader, choosing the proper exchange for leverage and margin trading depends on your risk tolerance, trading strategy, and how actively you manage your positions.

Both exchanges provide robust platforms, but it’s vital to use leverage wisely to capitalize on its benefits while mitigating risks.

Bybit vs Bitget: Liquidity and Volume

When choosing a cryptocurrency exchange, liquidity and trading volume are critical factors that impact your trading experience.

Liquidity ensures you can execute trades quickly and at a price close to the market rate, minimizing slippage.

Bybit is known for its robust liquidity, particularly in the derivatives market. Its trading volume reflects a strong presence in the crypto space, facilitating efficient trade execution.

For example, with deeper liquidity, Bybit typically offers tighter spreads, which is advantageous when trading in spot and derivatives.

In contrast, Bitget also supports many cryptocurrencies and has gained traction amongst traders.

However, specific reviews suggest that Bybit might have an edge over Bitget in terms of liquidity, which could influence the speed and slippage of your trades.

Nevertheless, Bitget could still be a viable option, depending on your trading needs and the specific cryptocurrencies you’re interested in.

To assess the liquidity and volume of these exchanges, consider the following metrics and rankings:

- 24-Hour Trading Volume: A direct indicator of an exchange’s activity.

- Order Book Depth: Reflects the market’s ability to absorb large orders without significant price changes.

- Spread: The gap between the bid and ask price is directly influenced by liquidity.

Here’s a snapshot of how Bybit and Bitget compare in these areas:

| Metrics | Bybit | Bitget |

|---|---|---|

| Trading Volume | High (particular strength in derivatives) | Moderate |

| Liquidity | Robust (tighter spreads) | Sufficient for most needs |

| Supported Cryptos | Numerous, strong in both spot and derivatives | Diverse range, competitive |

Remember these considerations as they directly affect your trading experience on Bybit and Bitget.

Remember, higher liquidity typically equates to more efficient trading, while higher volume can suggest a more active and dynamic market presence.

Bybit vs Bitget: Fees and Rewards

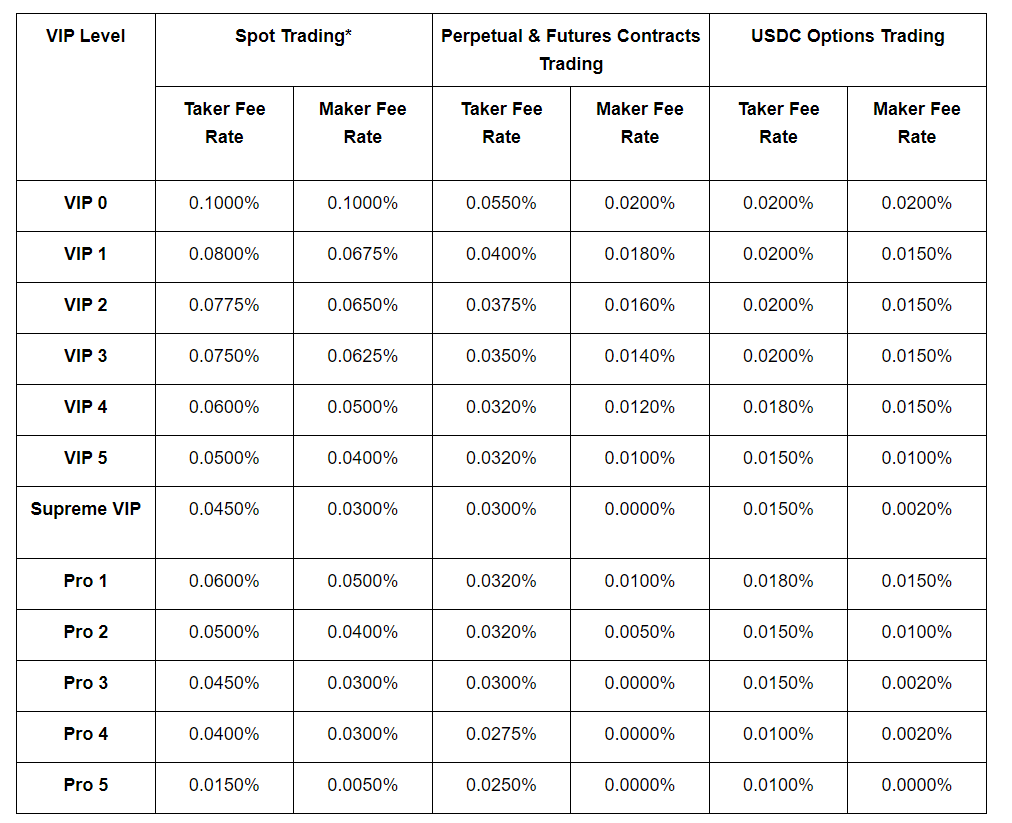

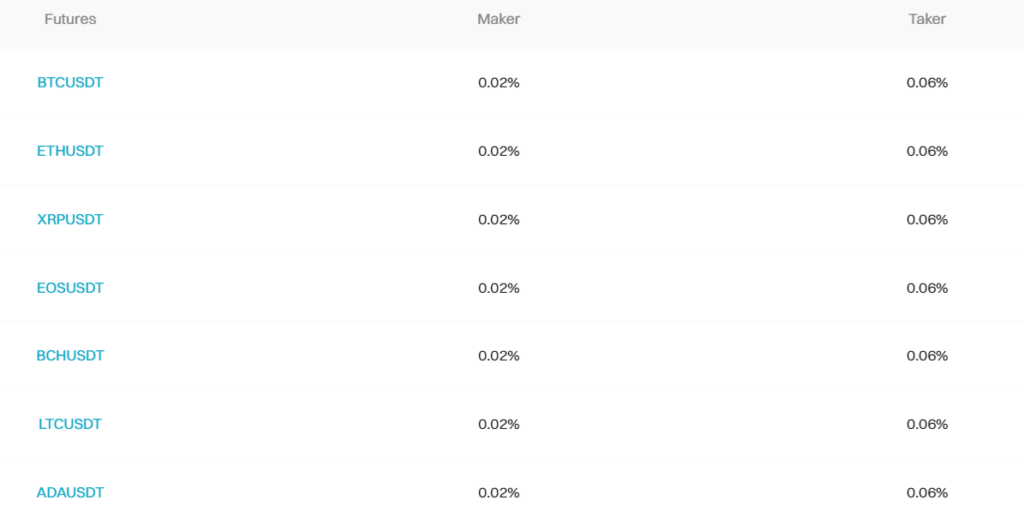

When evaluating Bybit and Bitget, you’ll find differences in their fee structures and reward programs, which are crucial factors to consider when optimizing your trading experience and profit margins.

Trading Fee & Deposit/Withdrawal Fee Compared

Bybit: The trading fee structure includes maker and taker fees. As a maker, which means you add liquidity to the market, there is a maker fee; as a taker who takes liquidity away, you incur a taker fee.

For futures trading, Bybit charges a maker fee of 0% and a taker fee. It’s important to note that fees may vary based on the specific contract you trade.

- Maker Fee: 0%

- Taker Fee: 0.06% (standard rate)

- Withdrawal Fee: Dynamic, based on blockchain conditions

Deposits are free, whether they are made in crypto or fiat. However, fiat withdrawals incur a fee determined by the third-party service used. Crypto withdrawals come with a network fee that changes dynamically based on the network congestion.

Bitget: This platform boasts higher leverage but also comes with a fee structure that includes maker and taker fees that are competitive in the industry.

- Maker Fee: 0.08% (standard rate)

- Taker Fee: 0.10% (standard rate)

- Withdrawal Fee: Subject to the cryptocurrency’s network conditions

There are no fees for crypto deposits, but like Bybit, crypto withdrawals incur a network fee. For fiat transactions, fees depend on the chosen method.

Deposits & Withdrawal Options

Bybit:

Users have a wide array of deposit options, allowing for crypto and fiat currency deposits.

The platform doesn’t impose deposit fees and supports multiple cryptocurrencies for deposits.

Bybit also allows for fiat deposits through various third-party payment processors, with the fee structure varying depending on the processor chosen.

Bitget:

Similar to Bybit, deposit options are varied and include both fiat and cryptocurrency. With a no-KYC policy, Bitget appeals to those valuing anonymity.

There are no fees for cryptocurrency deposits.

Fiat deposit methods are also available and are partnered with third-party services where fees can be applicable based on the service used.

Rewards and Bonuses:

Both platforms offer a variety of rewards and bonuses, including trading fee discounts for holding their native tokens or through referral programs.

Additionally, sign-up bonuses are occasionally offered to new users as an incentive to begin trading on the platform.

Bybit vs Bitget: KYC Requirements & Limits

When considering crypto exchanges like Bybit and Bitget, understanding their KYC requirements is crucial as it determines your trading limits, privacy, and security.

Bybit has been known for providing regulatory clarity with KYC verification procedures in place. You must present identification documentation, such as a passport or ID card and proof of address.

Bitget has traditionally been attractive to users who value privacy due to its no-KYC policy. Nevertheless, this policy is changing.

According to a recent announcement, Bitget is set to introduce mandatory KYC requirements starting in September 2023. This shift aims to strengthen compliance and regulation adherence.

Comparing limits, Bitget previously permitted users to operate with relatively high leverage—up to 100x—without stringent KYC checks.

However, with the new regulations, users must undergo KYC to maintain access to all services.

Bybit KYC Levels:

- Level 0 (No KYC): Limited deposits and withdrawals

- Level 1 (ID Verification): Increased withdrawal limits, ability to deposit fiat

- Level 2 (Advanced Verification): Higher withdrawal limits, full access to platform features

Bitget KYC Levels:

- Pre-KYC Introduction: High leverage, no KYC required for crypto deposits/withdrawals

- Post-KYC Introduction: Mandatory verification for account activation, leverage, and withdrawal limits adjusted based on KYC status

Remember that KYC is a regulatory and security feature—though it can impose limits, it also protects your assets and personal information on the platforms.

Bybit vs Bitget: Order Types

When you’re looking to trade on Bybit or Bitget, understanding the various order types at your disposal is crucial for executing your trading strategies effectively and managing your risks.

Bybit offers a variety of order types:

- Market Orders: These orders are executed immediately at the current market price.

- Limit Orders: Set your buy or sell order at a specific price.

- Stop Orders: Trigger a buy or sell order when the market reaches your set stop price.

- Conditional Orders: These are executed when certain conditions are met, combining features of stop and limit orders.

- Post-Only Orders: They ensure the order is added to the order book and not executed against an order immediately, enabling you to pay only the maker fees.

- Reduce-Only Orders: This ensures that an order will only reduce your position, not increase it.

In your trading on Bitget, you’ll find similar order types with additional features that cater to different trading strategies:

- Market and Limit Orders: To enter or exit the market swiftly or at a predetermined price.

- Stop-Limit and Stop-Market Orders: These orders become active only after the market reaches a specified price for risk management.

- Conditional Orders: Combining the mechanics of market or limit orders under specific conditions.

- Post-Only and Reduce-Only Orders: To provide traders with the benefits of maker fees and managing position sizes.

Both platforms offer advanced features like:

- Trailing Stop Orders: These are for following price movements and locking in profits dynamically.

Knowing these order types empowers you to be more strategic in your trades—immediately responding to market changes with market orders or strategically setting prices with limit orders.

Advanced features like trailing stops bolster your ability to automate tactics, secure profits, and limit losses.

Understanding these tools on Bybit and Bitget is essential to leverage their full potential in crypto trading.

Bybit vs Bitget: Security and Reliability

When comparing Bybit and Bitget, security is paramount for your peace of mind.

Bybit protects your funds through cold wallets, which minimizes the risks associated with online hacking attempts. Bitget also maintains a robust security framework, though details of their cold storage practices are less publicized.

For enhanced reliability, both platforms employ multi-signature authorization to ensure transactions are processed securely.

This adds a layer of safety, requiring multiple sign-offs before funds can move, deterring unauthorized access.

You’ll also find that Bybit and Bitget provide an insurance fund built to protect against unexpected losses due to extreme market volatility or system failures. It’s a financial safety net that can reassure you.

| Feature | Bybit | Bitget |

|---|---|---|

| Cold Wallets | Yes | Yes |

| Multi-Signature | Yes | Yes* |

| Insurance Fund | Available | Available |

| Regulatory Compliance | High | Varies by region |

| Known Security Incidents | Few to no reported | Few to no reported |

Regarding regulatory compliance, Bybit shows higher transparency and adherence to international guidelines.

Bitget’s regulatory stance can differ, so applying a no-KYC policy depending on jurisdiction might be a consideration for your privacy concerns.

Past security incidents have been minimal for both exchanges; minor issues were quickly addressed, showcasing a quick response time and a serious approach to customer support. Swift’s resolution demonstrates each platform’s commitment to reliability.

In the customer support landscape, Bybit tends to have more consistent feedback for its responsiveness and effectiveness, which can be crucial when quick assistance is required.

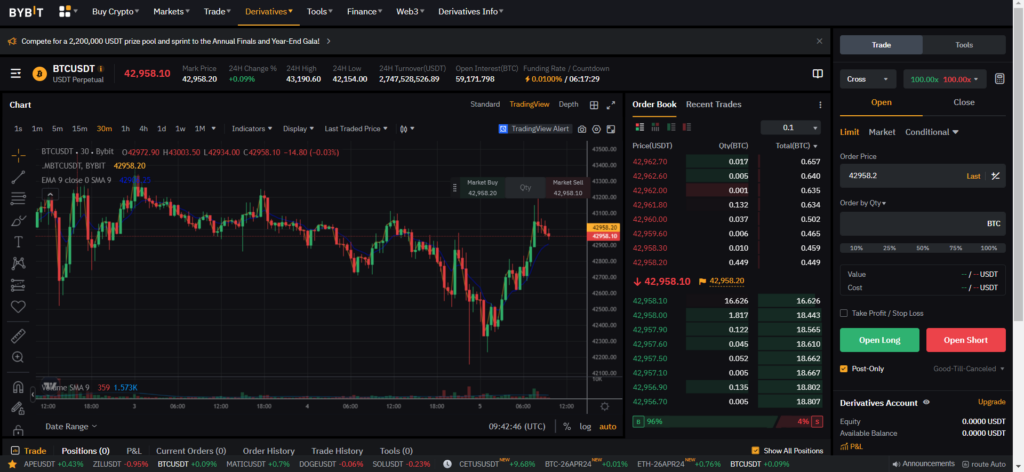

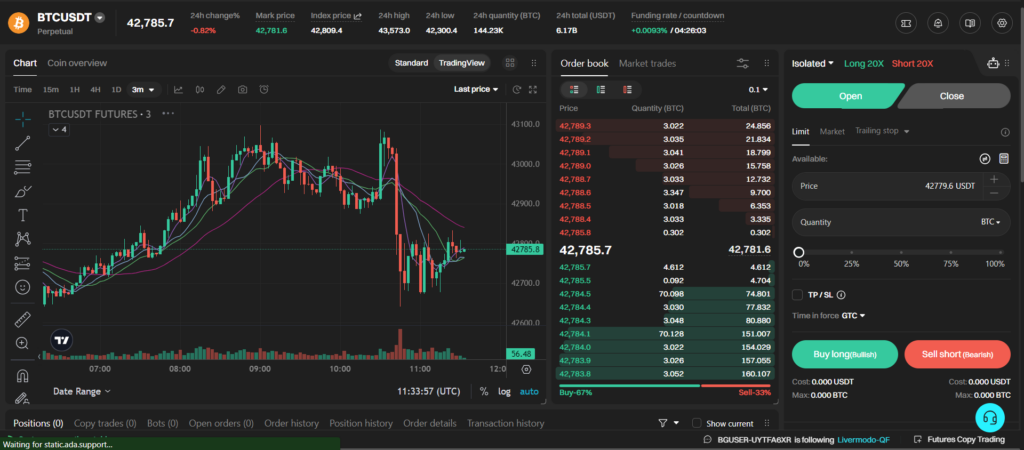

Bybit vs Bitget: User Experience

When choosing the right crypto trading platform, the user experience (UX) can be just as necessary as fees or features.

Both Bybit and Bitget have strongly emphasized ensuring a user-friendly experience and efficient customer support systems.

Bybit’s Trading Interface: The platform is praised for its intuitive interface, sleek design, and TradingView chart integration.

This allows you to conduct technical analysis with ease. The exchange is designed to be straightforward for beginners while providing advanced tools for seasoned traders.

- Speed and Design: Users generally find Bybit to be fast and responsive, reducing the frustration of delays during high-volume trading periods.

- Customer Support: Bybit offers 24/7 customer support through several channels, ensuring you can get assistance when needed.

Bitget’s Trading Platform: Bitget also offers a clean interface that caters to the needs of both new and experienced traders. Including advanced trading, bots enhance your ability to engage in automated trading strategies.

- Mobile Apps: Bybit and Bitget offer mobile applications for iOS and Android devices, meaning you can manage trades on the go. The apps maintain a balance between functionality and simplicity.

- Trading Bots: Bitget’s trading bots are a notable feature, allowing for a hands-off approach to trading, which can be a significant aspect of the UX for some users.

Regarding reviews, there is a consensus that both platforms provide a high-quality trading experience.

Some users have noted occasional difficulties with the mobile apps, but regular updates show a commitment to ongoing improvement.

Each platform’s customer support options reflect its dedication to a positive user experience.

Bybit vs Bitget: Education and Community

When exploring Bybit and Bitget, both exchanges prioritize education and nurturing their respective crypto communities.

Bybit offers a comprehensive ‘Learn’ section where you have access to a wealth of articles and guides covering topics from basic cryptocurrency concepts to more advanced trading strategies.

This section caters to various levels of traders, ensuring you can find information relevant to your experience level.

Bitget also emphasizes education through its support and learning resources.

Tutorials, FAQs, and insightful blog posts are readily available to help you navigate the complexities of crypto trading.

These resources are invaluable to expand your knowledge of savings, earning, and liquidity mining.

| Platform | Educational Content |

|---|---|

| Bybit | Advanced trading guides |

| Bitget | In-depth tutorials |

Both platforms engage in NFTs and other trending crypto topics, providing a thorough analysis for enthusiasts and traders. If you’re interested in the latest crypto innovations, Bybit and Bitget have information on these evolving markets.

The concept of copy trading is also supported on both exchanges.

Bybit and Bitget offer you the opportunity to follow the trades of seasoned investors, which can be incredibly educational if you’re looking to understand strategy and decision-making in trading.

In terms of community, both establish a strong presence on various social media platforms, creating an environment where you can interact with fellow traders.

Bybit’s influence is notable, as it has a large following, and its engagement through online events and announcements keeps you up-to-date.

Similarly, Bitget keeps you informed and connected, fostering community among its users.

Remember to engage with these resources to stay informed and maximize your crypto trading journey.

Frequently Asked Questions

When considering Bybit and Bitget for your cryptocurrency trading needs, you likely have questions about their trading fees, copy trading features, and the variety of trading pairs offered.

The following are common queries to help elucidate the differences and features of these two trading platforms.

What are the main differences between Bybit and Bitget regarding trading fees?

Bybit’s trading fees for spot markets are set at 0.1% for both maker and taker orders, with derivatives trading fees lower at 0.01% for maker orders and 0.06% for taker orders.

Bitget charges a flat rate of 0.1% for maker and taker orders in spot trading, but its derivative contracts’ fees are slightly higher.

How do Bybit and Bitget compare in terms of copy trading features?

Bybit and Bitget offer copy trading features, allowing you to mimic more experienced traders’ trades. These features are designed to be user-friendly, but Bybit is often seen as having a more intuitive platform for navigation and trade execution, which could be beneficial if you’re new to copy trading.

Which platform offers more diverse crypto trading pairs, Bybit or Bitget?

In cryptocurrency trading pairs, Bybit typically provides a substantial range of options. However, it is essential to check the most recent listings on each platform, as the assortment of available trading pairs can fluctuate based on market demand and platform updates.

Conclusion

Both platforms were established in 2018 and have become significant players within the cryptocurrency exchange landscape.

You’ll find that both platforms have taken user-friendly interfaces seriously, with Bybit based in Singapore and Bitget in Dubai showing their global outreach.

Fees, leverage options, and product offerings are comparable. Still, the choice comes down to your preference for regulation versus privacy and whether you are interested in copy trading, a feature Bitget brings to the table.

Bybit stands out for its robust derivatives and futures trading platform, offering up to 25x leverage and various deposit methods. This exchange provides vital regulatory clarity, making it a reliable choice if you prioritize a regulated trading environment.

On the other hand, Bitget is noteworthy for its no-KYC policy and higher leverage options, reaching up to 100x. This might be more appealing if you value your privacy and seek a platform with a less stringent verification process.

For derivative traders looking for a wide range of products and a regulated environment, Bybit could be your go-to exchange.

However, if you prefer anonymity and wish access to higher leverage, you might find Bitget better suited for your needs.

Explore how Bybit and Bitget compare to their competitors:

- Bybit vs. Binance: Comprehensive Evaluation

- Bybit vs. BingX: Comprehensive Evaluation

- Bybit vs Phemex: Comprehensive Evaluation

- Bitget vs BingX: Comprehensive Evaluation

- Bitget vs Phemex: Comprehensive Evaluation

- Bitget vs MEXC: Comprehensive Evaluation