When you compare BingX and Bitget, two prominent players in the crypto exchange market, it’s essential to look at their core offerings and user experience.

Both platforms provide various services, including spot trading and futures contracts, though they have distinct features that may appeal to different users.

Here’s a brief comparison:

| Feature | BingX | Bitget |

|---|---|---|

| Supported Cryptos | Multiple cryptos available | Multiple cryptos available |

| Leverage | Up to 100x | Varies |

| User Experience | Mobile-focused with social trading | Comprehensive trading features |

| Trading Volume | High with competitive liquidity | High, competitive in the market |

| Deposit Methods | Diverse options, including fiat | Various, including fiat and crypto |

| Security | Commendable security measures | Strong security protocols |

| User Scores | High ratings, reasonable customer satisfaction | Generally jovial, with loyalty perks |

Both exchanges invest in security and offer a range of cryptocurrencies for trading.

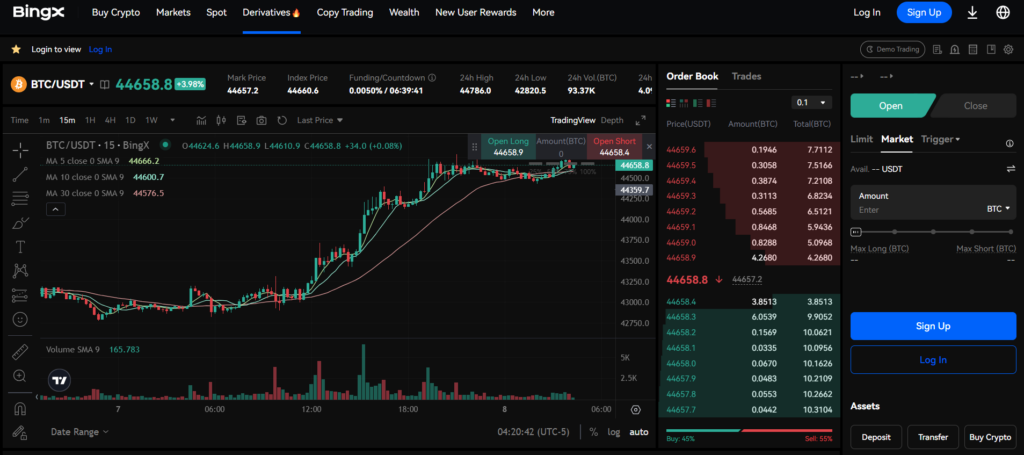

BingX leans towards a mobile experience and offers the niche feature of social trading, allowing you to copy experienced traders’ trades.

This may be particularly appealing if you’re new to trading or want to leverage more experienced traders’ strategies.

On the other hand, Bitget tends to cater to a wide range of trading activities and puts a strong emphasis on offering a solid user experience across all devices.

It also offers different trading leverage forms, which can suit your experience and risk tolerance levels.

You should consider the type of trading you’re interested in, the devices you prefer to trade on, and the importance of community features when deciding between BingX and Bitget.

Each has made its mark in the industry and stands out for different reasons, with high user scores indicating their reliability and service quality.

BingX vs Bitget: Products and Services

When considering products and services in the landscape of cryptocurrency exchanges, BingX and Bitget offer a wide variety of trading options.

BingX is known for its social trading platform, which allows you to engage in copy trading.

This service enables you to mirror the trades of seasoned traders, which can be particularly useful if you are new to cryptocurrency trading or seeking to diversify your strategies.

Apart from its innovative approach to trading, BingX provides spot trading services for a range of cryptocurrencies, allowing you to buy and sell digital assets.

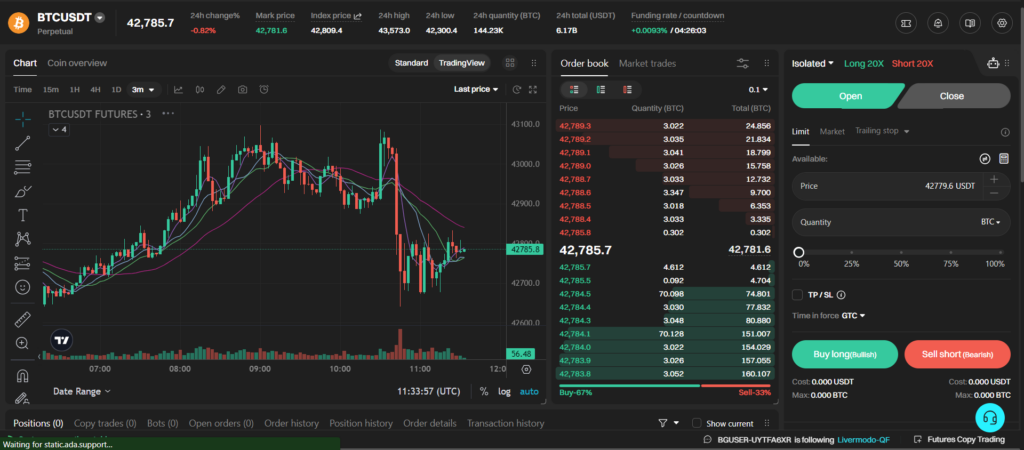

On the other hand, Bitget stands out with its robust futures trading platform.

If you’re interested in speculative trading or hedging, Bitget allows you to trade on the future price of cryptocurrencies with leverage, which can amplify gains and losses.

Beyond futures, Bitget also supports spot and options trading, catering to various trading preferences.

| Feature | BingX | Bitget |

|---|---|---|

| Spot Trading | ✅ | ✅ |

| Futures | :x: | ✅ |

| Options | :x: | ✅ |

| Social Trading | ✅ | :x: |

| Copy Trading | ✅ | :x: |

While both platforms might seem similar at first glance, each excels in different areas. BingX’s copy trading and social aspects are a standout, fostering a community-centric trading environment.

Meanwhile, Bitget’s futures and options offerings are at the forefront for traders seeking these services.

Understanding your trading goals and preferences will guide you in choosing between BingX and Bitget, as each excels in different services that may cater to your needs in the crypto exchange landscape.

BingX vs Bitget: Contract Types

When comparing BingX with Bitget, it’s essential to understand the contract types each platform offers. Contract types are pivotal in trading because they define the terms and the underlying asset.

BingX offers a range of trading types, including:

- Spot Trading: Trade cryptocurrencies directly.

- Futures Trading: Includes leverage trading up to 100x.

- Social Trading: Allows you to copy trades from seasoned traders.

Specifically for contracts, BingX provides linear perpetual agreements. These contracts are quoted and settled in a stablecoin, such as USDT, simplifying the process for those who prefer to think about fiat currency value.

Bitget, on the other hand, is known for offering various derivatives trading options. They offer:

- USD-M Futures: Representing contracts margined with fiat or stablecoin.

- Inverse Perpetual Contracts: Typically margined and settled in the cryptocurrency itself.

- Inverse Futures Contracts: These are settled at a predetermined date.

Both platforms cater to different preferences.

If you favor a straightforward approach and wish to settle in stablecoins, BingX’s linear perpetual contracts might appeal to you.

For a more diverse set of contracts, if you prefer to margin in cryptocurrencies, Bitget’s offerings, including COIN-M futures, could provide the flexibility you want.

To decide the right platform for your trading needs, consider the variety and intricacies of each contract type.

Remember, each contract type has different exposure levels to underlying asset volatility and margin requirements.

BingX vs Bitget: Leverage and Margin

In assessing BingX and Bitget, understanding their margin and leverage offerings is crucial for maximizing your trading strategy.

You will find that both platforms offer competitive options, each with specific features tailored to enhance your trading experience.

Margin Trading

When you participate in margin trading on BingX or Bitget, you’re borrowing funds to increase your trading position beyond what’s available in your balance.

BingX allows for a straightforward margin trading experience with a user-friendly interface. On the other hand, Bitget’s margin trading may encompass an enormous scope of cryptocurrencies.

BingX:

- Minimum Margin Requirements: Clearly defined and vary per asset.

- Liquidation Risks: Automated warnings and margin calls to manage risk.

Bitget:

- Minimum Margin Requirements: Slightly differing requirements, offering flexibility.

- Liquidation Risks: Liquidation protocols are in place to protect both the user and the platform.

Leverage Options

Leverage is a powerful tool allowing you to amplify your trading position. Both exchanges offer substantial leverage but with varying ceilings.

BingX:

- Maximum Leverage: Offers up to 125x leverage on specific trading pairs.

- Funding Rates: Implement competitive funding rates, which are periodically updated.

Bitget:

- Maximum Leverage: Similar offerings can be found with 125x leverage available.

- Funding Rates: Funding rates are set to facilitate the leverage options and may differ from BingX.

In conclusion, Your trading volume and strategy will dictate your best platform; consider your risk tolerance when engaging with high leverage and margin trading.

BingX vs Bitget: Liquidity and Volume

When choosing a cryptocurrency exchange, liquidity and trading volume are crucial factors that significantly affect your trading experience.

Here’s a comparison of these aspects between BingX and Bitget.

BingX is reputed for maintaining a robust liquidity pool, which means you’re less likely to face substantial slippage when executing large trades.

High liquidity on BingX ensures that your orders are filled efficiently, minimizing the gap between the expected and executed prices.

BingX supports many trading pairs, allowing you to diversify your trading strategies across different cryptocurrencies.

- BingX Liquidity Metrics:

- Trading Pairs: Diverse selection

- Order Book Depth: Strong

- Slippage: Minimal

Bitget, on the other hand, has been competing fiercely in liquidity and trading volume.

Although the trading volume might fluctuate, Bitget strives to provide consistent liquidity, vital for smooth trade execution.

Bitget’s liquidity is bolstered by a comprehensive range of supported cryptos, giving you access to various trading opportunities.

- Bitget Liquidity Metrics:

- Trading Pairs: Extensive variety

- Order Book Depth: Competitive

- Slippage: Low

To assess liquidity and trading volume, you can refer to metrics and rankings from independent financial data sources like CoinMarketCap or CoinGecko.

These platforms evaluate the exchanges based on liquidity scores and 24-hour trading volumes, offering a transparent market view.

In your trading endeavors, always consider how liquidity and volume interact to affect trade execution.

BingX vs Bitget: Fees and Rewards

Understanding the fee structure and rewards is crucial for your trading success when choosing a cryptocurrency exchange. Let’s critically examine how BingX and Bitget stack up in this regard.

Trading Fee & Deposit/Withdrawal Fee Compared

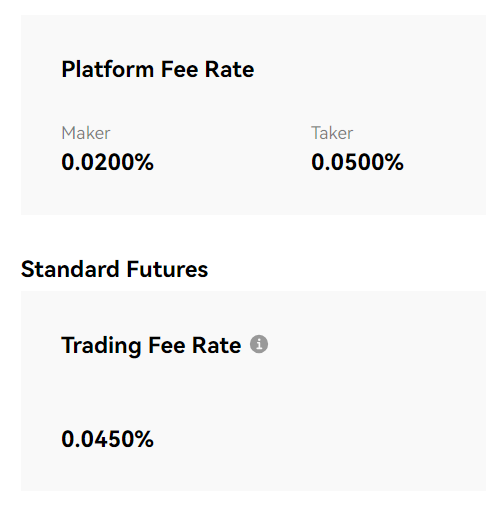

BingX Fee Structure

- Trading Fees:

- Maker Fee: Typically lower than taker fees.

- Taker Fee: Slightly higher, incentivizing liquidity provision.

- Deposit Fees: Generally free of charge for cryptocurrencies.

- Withdrawal Fees: Vary by asset; some coins may command higher fees.

Trading Example: If you place a limit order that provides liquidity, your maker fee will apply. Conversely, market orders removing liquidity incur the taker fee.

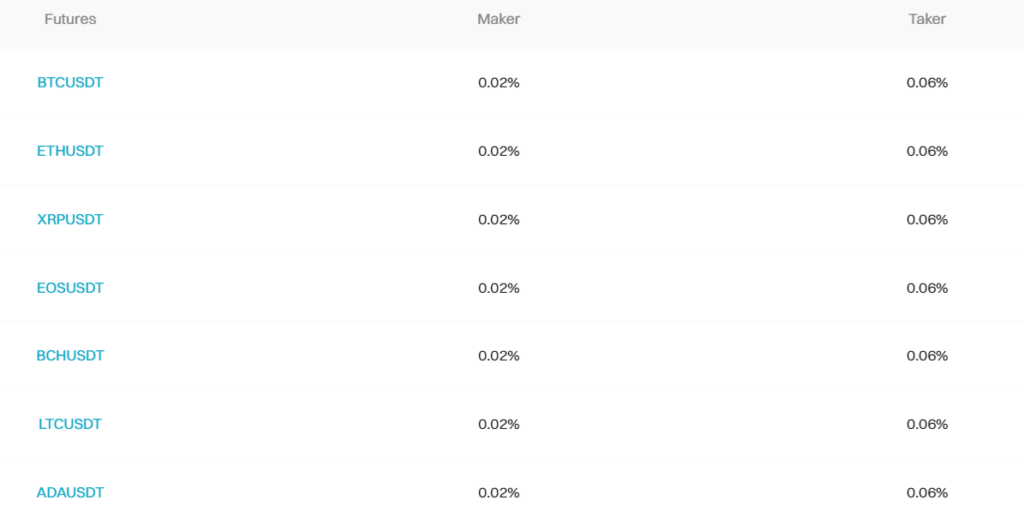

Bitget Fee Structure

- Trading Fees:

- Maker Fee: Competitive rates aimed to encourage market making.

- Taker Fee: Higher than maker fees, varies based on the asset traded.

- Deposit Fees: None; free deposits are available for all supported cryptocurrencies.

- Withdrawal Fees: Structured based on the network fee for the withdrawn cryptocurrency, which can be a fixed amount for each coin or percentage-based.

Example: As a maker, your fee can be lower than a taker’s. For example, placing a GTC limit order that doesn’t fill immediately may earn you a rebate or reduced cost.

Note on Rewards:

Both exchanges offer bonuses or discounts on trading fees, possibly subject to terms like trading volume or promotional events. These can significantly reduce the cost of trading for active users.

In your transactions, always calculate the fees based on the specific trade type and consider any applicable discounts or rewards to optimize your trading costs.

Each exchange’s fee schedule is tiered; thus, the more you trade, the lower your fees.

Keep an eye out for any changes in withdrawal fees, as these are subject to fluctuation with the underlying blockchain network conditions.

BingX vs Bitget: Deposits & Withdrawal Options

Understanding the fine print regarding deposits and withdrawals is crucial when choosing a cryptocurrency exchange.

Both BingX and Bitget offer a range of options to fund your account and access your money.

BingX:

- Currencies: Supports an array of fiat and cryptocurrencies.

- Deposit Methods: Credit/debit cards, bank transfers, and cryptocurrency transfers.

- Withdrawal Methods: Primarily through cryptocurrency transfers.

- Processing Times: Varied depending on the method; crypto transactions are typically processed within the blockchain’s confirmation time.

- Limits: Minimum and maximum limits may apply, differing by method and account level.

Bitget:

- Currencies: Likewise, it accommodates numerous digital and fiat currencies.

- Deposit Methods: Bank wires, credit/debit cards, and direct crypto deposits.

- Withdrawal Methods: Primarily, crypto withdrawals, although some fiat options may be available.

- Processing Times: Like BingX, this is influenced by method, but crypto withdrawals are subject to the blockchain network’s speed.

- Limits: Set thresholds for depositing and withdrawing funds, subject to change and user verification status.

Your choice of exchange may hinge on these details, especially if you prefer specific payment methods or deal with certain currencies.

Before initiating a deposit or withdrawal, it’s wise to scrutinize any associated fees, as these can vary based on the transaction size and the method selected.

Both exchanges tout a commitment to speed and security, aiming to process transactions promptly while ensuring the safety of your funds.

BingX vs Bitget: KYC Requirements & Limits

When comparing BingX and Bitget, you’ll find that both exchanges have Know Your Customer (KYC) policies implemented to enhance the platform’s security and comply with regulatory standards, particularly in jurisdictions like Singapore and Hong Kong, which have stringent financial regulations.

BingX KYC Verification & Limits:

- Initial Registration: Requires basic personal information.

- Full KYC: Necessary for accessing higher withdrawal and deposit limits.

- Documents: Government-issued ID, proof of address, and a photo verification.

- Limits: Without full KYC, you may face restrictions on deposit and withdrawal amounts.

Bitget KYC Verification & Limits:

- Mandatory KYC: Bitget started requiring KYC for all users on September 1, 2023.

- Documents: Similar to BingX, a government-issued ID and facial recognition check.

- Limits: Completing KYC is a prerequisite for all trading activities, with strict limitations on non-verified users.

For support, both exchanges guide their help centers or customer service for users struggling with the KYC process.

Security and Privacy:

KYC is crucial for ensuring that platforms operate within legal boundaries and safeguard against fraudulent activities.

However, it inherently requires you to share personal information, possibly affecting your privacy. Both BingX and Bitget utilize advanced security practices to safeguard your data.

Accessibility:

KYC verification can impact your experience by determining the level of access you get on the exchange.

Higher-level features, such as increased limits for withdrawals and trading, depend on your verification status.

Although this could be seen as a hurdle, it’s a standard industry practice aimed at maintaining platform integrity.

BingX vs Bitget: Order Types

When trading on BingX and Bitget, various order types allow you to implement different trading strategies and manage risk effectively.

Understanding the functionalities and differences of these orders is critical to optimizing your trading experience.

- Market Orders: BingX and Bitget support market orders, executed immediately at the current market price. This type of order is proper when you want to enter or exit the market quickly.

- Limit Orders: You can set a limit order on both platforms to buy or sell an asset when it reaches a specific price. This allows you to control the price at which your trades are executed.

Order Types Unique to Each Platform

BingX and Bitget do have some unique order offerings:

- BingX:

- Conditional Orders: This platform allows you to set orders that are only executed when certain conditions are met.

- Reduce-Only Orders: These orders ensure you only reduce your position, not increase it, which can be a critical aspect of risk management.

- Bitget:

- Post-Only Orders: This order type ensures your limit order will be added to the books, potentially earning you a maker fee rather than being executed immediately.

- Stop Orders: They trigger a buy or sell order when the price reaches your set stop price on Bitget and are essential for managing losses.

BingX and Bitget facilitate Stop Loss and Take Profit orders, pivotal features for traders looking to minimize risks and lock in earnings on positions.

Trading Options

Trades on either platform can vastly benefit from these functionalities, affording you the flexibility to strategize and plan according to market movements and your trading preferences.

By harnessing these order types wisely, you can effectively manage your risk and potentially improve your trading outcomes.

Remember, each order type has its implications and should be used in the context of a well-thought-out trading plan.

BingX vs Bitget: Security and Reliability

When deciding between BingX and Bitget, understanding their approaches to security and reliability is crucial.

Both platforms have measures to protect your funds and personal data, but it’s essential to examine their track records and support systems to make an informed decision.

BingX:

- Security: Implements a multi-tier and multi-cluster system architecture.

- Regulatory Compliance: Often conforms with local regulations where it operates.

- Past Incidents: Transparent about security breaches and acts to strengthen systems accordingly.

- Support: Provides 24/7 customer support through various channels.

Bitget:

- Security: Employs industry-leading encryption and security practices.

- Regulatory Compliance: Follows a stringent compliance framework, aligning with international standards.

- Past Incidents: Has taken proactive steps to address security challenges, enhancing protective measures.

- Support: Offers dedicated support and a comprehensive help center.

| Feature | BingX | Bitget |

|---|---|---|

| Fund Security | Multi-tier protection | Industry-standard encryption |

| Data Security | Multi-cluster system | Robust security protocols |

| Compliance | Adheres to local laws | Stringent international standards |

| Customer Support | 24/7 availability | Multiple support channels |

BingX and Bitget treat security with the highest priority and are trusted by their user base.

They have shown adaptability and resilience in response to industry challenges. You have access to reliable customer support with either exchange, ensuring assistance is always within reach should you need it.

Consider your personal trading needs and preferences when choosing between the two, as each offers a secure platform to trade cryptocurrencies.

BingX vs Bitget: User Experience

When it comes to user experience in the realm of cryptocurrency exchanges, both BingX and Bitget offer distinct features aimed at their respective audiences.

If you’re new to the crypto field, BingX’s user-friendly platform may appeal to you, with its clean design and straightforward navigation facilitating your initiation into trading.

- Ease of Use: BingX has a reputation for an interface that supports smooth onboarding.

- Customer Support: Accessible customer service is highlighted, contributing to a positive experience, especially for newcomers.

- Training Resources: Guides and educational materials are readily available, easing the learning curve.

Conversely, Bitget is tailored for the experienced trader, offering advanced tools that could be overwhelming for beginners but are highly valued by the seasoned.

- Speed and Functionality: Bitget is characterized by its robust technology, which accommodates fast-paced trading.

- Design: The interface with tools and charts is dense, indicating a steep learning curve.

- Customer Support: Supports a comprehensive approach but can be technical.

BingX is often commended in comparing feedback for its intuitive nature, making it a go-to for starting in crypto. At the same time, Bitget is acknowledged for its sophisticated tools that proficient traders require.

Reviews from users often underline the responsive customer support from BingX and the efficiency of Bitget for complex trading strategies.

Your choice hinges on your familiarity with crypto trading and the complexity of the tools and support you expect from an exchange.

BingX vs Bitget: Regulation and Compliance

When considering BingX and Bitget’s regulatory standing, examining their adherence to international compliance standards is critical.

Both platforms operate within the stringent requirements of the jurisdictions they service, working to secure the necessary licenses and conduct regular audits to maintain good legal standing.

BingX has structured its operations to comply with global financial regulations. This means that, as a user, you can expect it to follow anti-money laundering (AML) guidelines and know your customer (KYC) policies strictly.

If BingX is accessible in your country, it will likely meet your nation’s legal standards for trading platforms.

Bitget, similarly, ensures compliance with international laws. As a platform, it secures the necessary certifications and undertakes regular audits to demonstrate its commitment to operational transparency and security.

As with BingX, Bitget’s availability in your country suggests it aligns with local financial regulatory requirements.

Here’s a simplified comparison to help you understand their regulatory positions:

| Feature | BingX | Bitget |

|---|---|---|

| Licenses | Obtained as per jurisdiction | Obtained as per jurisdiction |

| KYC/AML | Rigorous procedures | Rigorous procedures |

| Audits | Regular financial audits | Regular financial audits |

| Certifications | Appropriate as per services | Appropriate as per services |

| Controversies | Minimal public record | Minimal public record |

Frequently Asked Questions

This section will provide specific information addressing common queries regarding BingX and Bitget’s offerings.

Which platform offers a broader range of cryptocurrencies for trading, BingX or Bitget?

BingX is known for its focus on popular cryptocurrencies, which provide a more streamlined platform that’s easy to navigate, especially for those interested in mainstream options.

Bitget, however, often competes by offering a variety of cryptocurrencies, including less-known altcoins, which might be appealing if you’re looking to diversify your trading portfolio with more exotic options.

What support options are available for BingX and Bitget users?

For user support, both BingX and Bitget provide essential help services.

BingX boasts over a million app downloads and high user ratings, suggesting a reliable and user-friendly experience. They likely offer support through multiple channels, such as in-app support, email, and help desks.

Bitget also provides customer support, including straightforward account registration, emphasizing accessibility and user satisfaction.

However, the exact support modes, such as live chat, phone support, or ticketing systems, may vary between the two platforms and should be confirmed on their respective websites or user agreements.

Conclusion

In evaluating BingX and Bitget, your decision will rest on factors such as establishment year, operational headquarters, supported cryptocurrencies, and platform services.

Since 2018, BingX has been operating out of Singapore, similar to Bitget, which began in 2017. Both offer an extensive range of digital assets for trading, which is pivotal to your diversified investment strategy.

BingX’s growing user base—over 5 million across 100 countries—signals a firm stance in the market. Their platform is known for its user-friendly interface, which benefits beginners.

On the other hand, Bitget has been frequently highlighted for its competitive trading and withdrawal fees, appealing more to cost-conscious investors.

The differences in trading fees, deposit methods, and withdrawal fees between BingX and Bitget are significant for active traders.

Regular updates on these figures are vital since they directly impact your profitability. Comparisons show variations that may influence your choice depending on trading volume and frequency.

If you prioritize a seamless user experience and are new to cryptocurrency trading, BingX might be the more suitable choice.

Conversely, if you’re focusing on cost efficiency and perhaps have more experience, Bitget could be advantageous.

Ultimately, the preference between BingX and Bitget comes down to your specific needs and trading habits. Assess these details carefully to align with your investment goals and operational comfort within the crypto trading landscape.

Explore how BingX and Bitget compare to their competitors:

- BingX vs Bybit: An In-Depth Comparison of Cryptocurrency Exchanges

- BingX vs PrimeXBT: An In-Depth Comparison of Cryptocurrency Exchanges

- BingX vs MEXC: An In-Depth Comparison of Cryptocurrency Exchanges

- Bitget vs Phemex: An In-Depth Comparison of Cryptocurrency Exchanges

- Bitget vs MEXC: An In-Depth Comparison of Cryptocurrency Exchanges

- Bitget vs Binance: An In-Depth Comparison of Cryptocurrency Exchanges