Crypto futures trading has emerged as a significant feature in the digital asset markets, providing you with various advantages over traditional spot trading. It offers the opportunity to trade on the future price of cryptocurrencies without the need to actually own the underlying assets. This means that you can speculate on price movements and potentially profit from both rising and falling markets. Additionally, futures contracts allow you to access leverage, amplifying your trading capital and enabling larger trades with a smaller capital outlay.

One of the primary benefits of crypto futures trading is the ability to hedge against volatile market movements. As an investor, you can protect other investments or your portfolio from unfavorable price shifts by taking an opposite position in the futures market. Moreover, compared to spot trading, futures markets typically offer higher liquidity, facilitating smoother and quicker transactions, which is particularly valuable in the fast-paced environment of cryptocurrency trading.

Participating in the crypto futures market also allows for greater diversification of your investment strategy. With futures contracts, you can explore a range of trading options with different expiration dates and strike prices, giving you a flexible toolkit for managing your market exposure. The standardized nature of these contracts ensures a transparent and regulated trading environment, contributing to a more structured approach to your investment portfolio in the crypto space.

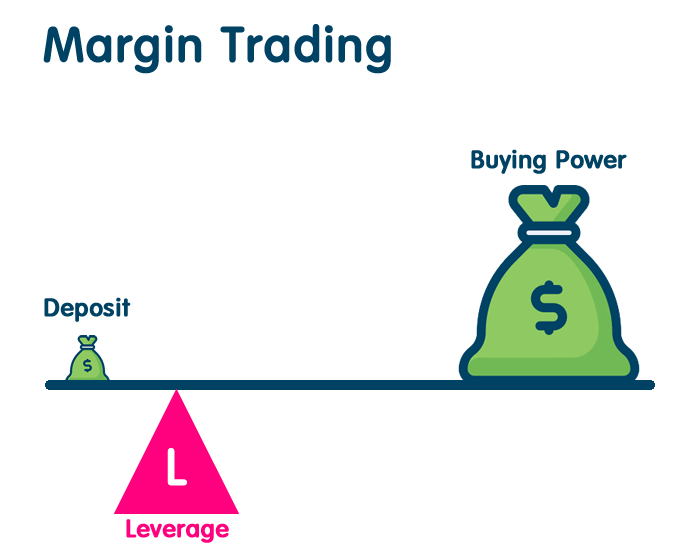

Leveraging Capital with Margin Trading

When you engage in margin trading within the cryptocurrency market, you’re effectively using borrowed funds from a broker to trade. This process magnifies your trading capacity, enabling you to open larger positions than what your current capital would allow.

The Mechanics:

- Initial Margin: The percentage of the position’s value that you must have in your trading account.

- Maintenance Margin: The minimum balance necessary to keep your positions open. If your account falls below this balance, you’ll receive a margin call.

Advantages:

- Amplified Profits: Any gains are calculated based on the total value of your position, not just your invested capital.

- Diversification: Increased financial leverage allows for the exploration of diverse markets and assets.

Considerations:

- Risk Management: It’s essential to have a well-thought-out strategy to manage the inherent risks that come with amplified exposure.

- Interest Costs: Keep in mind potential interest costs associated with borrowing funds.

By understanding leverage and margin, you can utilize increased capital efficiently. Remember, while the potential for higher profits is enticing, the risk of amplified losses should always be considered.

Diversification of Investment Portfolio

Incorporating crypto futures into your investment strategy can serve as a powerful tool for diversifying your portfolio. This section explains how crypto futures offer benefits through hedging and access to different assets.

Hedging Against Spot Market Volatility

Crypto futures allow you to hedge your investments and mitigate risks associated with the spot market’s unpredictability. By taking a position in a futures contract, you can manage potential losses in your spot market investments. This is because the performance of futures can offset spot market movements, providing a form of insurance against volatile price swings.

- Hedge long positions: If you hold cryptocurrencies and anticipate a market downturn, you can open a short position in futures contracts to hedge your bets.

- Hedge short positions: Conversely, if you’ve sold cryptocurrencies and expect a sudden spike, going long on futures can protect against potential losses.

Example: If you own Bitcoin and predict a drop in price, shorting a Bitcoin futures contract can help balance the potential loss in your spot holdings.

Accessing Different Asset Classes

Crypto futures open the door to a wider range of assets, broadening your investment horizon beyond the limitations of the spot market.

- Access to altcoins: Futures contracts may be available for a variety of cryptocurrencies, including those not readily accessible in the spot market.

- Sector-specific futures: You might engage in futures that focus on specific sectors within the blockchain ecosystem, such as DeFi (Decentralized Finance) or NFT (Non-Fungible Token) markets.

Table: Examples of Crypto Futures

| Futures Contract | Asset Class |

|---|---|

| BTC Futures | Major Cryptocurrency |

| ETH Futures | Second Largest Cryptocurrency by Market Cap |

| DEFI Index Futures | Decentralized Finance Sector |

| NFT Index Futures | Non-Fungible Token Sector |

By engaging in various classes of futures, you diversify not only by cryptocurrency type but also by exposure to different market sectors. This can reduce the risk of overexposure to any single asset or market niche.

24/7 Market Availability

One of the key advantages you have with crypto futures trading is unrestricted access to the markets at all hours. This means you can react and adapt to market changes in real time, providing a flexibility that’s unparalleled in traditional markets.

Flexible Trading Hours

You are no longer bound by the typical 9-to-5 window of stock exchanges. Crypto futures markets operate 24/7, giving you the freedom to trade on your schedule, whether that’s during the day, at night, or even on weekends and holidays. This continuous availability allows you to capitalize on opportunities as they arise, without having to wait for markets to open.

- Trade at your convenience

- Respond to market events as they unfold

Global Market Access

Crypto futures trading is a global affair, with traders from around the world participating. You have access to a diverse set of markets, which are not limited by geography or time zone.

- Access markets across different countries

- No need to adjust for market hours in different time zones

The 24/7 market availability for crypto futures trading means you have the freedom to operate on a schedule that suits you best, with the ability to tap into a global trading community at any time.

Lower Transaction Fees

When you engage in crypto futures trading, one of the notable benefits is the potential for lower transaction fees compared to other forms of trading. The fee structure typically involves maker and taker fees.

- Maker fees are charged when you add liquidity to the market, generally through a limit order.

- Taker fees occur when you take liquidity away from the market, often with a market order.

These fees vary by exchange, but they are generally competitive. For instance:

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| Bybit | 0.01% | 0.06% |

| Binance Futures | Starts at 0.02% | Starts at 0.05% |

It’s important to note that as a VIP-tiered trader, additional discounts may apply, reducing these fees even further. An exchange like Bybit offers 0.006% as the maker and 0.05% as the taker fee for VIP 1 traders.

Fees are strategically structured to attract both liquidity providers and those seeking immediate execution of their trades. Your costs are directly linked to the rate established by your chosen platform, which underscores the importance of selecting an exchange that balances features with cost-effectiveness. Moreover, these competitive fees can enhance your trading strategy’s overall profitability by reducing the cost of entry and exit in positions.

High Liquidity in Crypto Futures

In the crypto futures markets, liquidity is a fundamental factor that you should consider. High liquidity indicates a healthy market where buying and selling can be performed quickly and with minimal slippage. You’ll find that the ease of entering and exiting positions in these markets is greatly enhanced when there are many active participants.

Key Aspects of High Liquidity in Crypto Futures:

- Minimal Slippage: Your trades are more likely to be executed at desired prices.

- Speedy Transactions: Buying and selling orders can be fulfilled swiftly.

- Better Price Discovery: A robust number of trades contribute to establishing fair market prices.

Higher liquidity in crypto futures markets might be a result of increased institutional investment. Institutional traders are often drawn to markets that support larger volumes without large price impacts. Here’s what high liquidity means for you:

- Dynamic Trading: You have the facility to trade various instruments, seeking out profit opportunities.

- Market Stability: A liquid market is typically less volatile, as trades are absorbed without significant price disruptions.

Reasons for High Liquidity:

- 24/7 Trading: Crypto markets operate round the clock, enhancing liquidity.

- Global Participation: Traders from across the globe contribute to a continuous flow of orders.

- Ease of Access: The digital nature of cryptocurrencies allows easy market access.

In summary, high liquidity in the crypto futures markets presents you with an environment conducive to efficient trading activity. This is essential for applying strategies and managing the risks associated with crypto futures trading.

Potential for Short Selling

In the realm of crypto futures trading, you have the ability to engage in short selling. This strategy empowers you to profit from declining prices of digital currencies. Here’s how it works: you borrow a cryptocurrency and sell it at the current market value. If and when the price falls, you buy back the same cryptocurrency at the lower price to return it to the lender.

Your profit is the difference between the price at which you sold the borrowed crypto and the price at which you repurchased it. Remember that there’s an additional cost—usually in the form of interest or fees—that you pay for borrowing the digital asset.

Short selling can be summarized as follows:

- Borrow crypto and sell it at market value.

- Wait for the price to fall.

- Buy the crypto back at the lower price.

- Return the borrowed amount plus any incurred interest.

- Profit from the difference (minus any fees or interest).

The use of leverage in futures trading enhances your potential gains from short selling by allowing you to borrow more than your initial capital would usually permit. However, it also amplifies the risks, and losses can exceed your invested funds.

Utilizing futures contracts for short selling has a strategic advantage; it offers a way to hedge your investments against market volatility. By taking a short position through a futures contract, you provide a counterbalance to your spot market exposure, potentially reducing overall risk in a fluctuating market environment.

Be mindful that while the potential for profit exists, short selling is complex and carries risks. It’s essential you understand the mechanisms and are aware of market trends when considering this strategy.

Innovative Financial Instruments

In the realm of cryptocurrency, futures trading has introduced innovative financial instruments that open up new opportunities for managing risks and leveraging your investments.

Perpetual Contracts

Perpetual contracts are a type of futures contract that is peculiar to the cryptocurrency market, distinguished by the fact that they do not have an expiration date. This allows you to hold a position for as long as desired. With perpetual contracts, the main features you will encounter are:

- Leverage: You can control large positions with a relatively small amount of capital, thereby amplifying potential returns.

- Price Mechanism: These contracts typically include a funding rate mechanism to keep the trading price close to the spot price of the underlying asset, providing a fair trading environment.

Regulatory Oversight

When you trade regulated leveraged crypto futures, your transactions fall under the watchful eye of financial authorities like the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) in the United States. These bodies are tasked with creating a safer trading environment, ensuring fair and orderly markets, and protecting investors from fraud and manipulations.

- CFTC – Supervises the trading of commodities futures and options, which includes futures contracts for cryptocurrencies. They approved Bitcoin futures trading in December 2018, indicating a more progressive approach towards crypto regulation.

- SEC – Primarily concerned with securities law, the SEC regulates initial coin offerings (ICOs) and the trading of crypto assets considered to be securities.

In this regulatory framework, Coinbase Financial Markets (CFM) stands out by making futures more accessible to retail crypto traders. They offer contracts specifically sized for retail investors, such as 1/100th of a Bitcoin and 1/10th of an Ethereum. This not only enables broader participation but also upholds investor protection within a regulated environment.

Your interaction with regulated crypto futures can offer peace of mind through:

- Enhanced Transparency: Exchanges and brokers are required to provide clear information about trading activities.

- Account Protection: Regulations mandate practices to safeguard your funds.

- Fair Play: Oversight helps prevent unfair practices and promotes market integrity.

Entering the regulated futures market means being a part of a financial ecosystem designed to secure your interests and maintain market stability.

Price Discovery

In the realm of crypto futures trading, price discovery plays a crucial role. It refers to the mechanism by which the market determines the fair present value of an asset based on the interactions between buyers and sellers. Price discovery is essential as it provides a consensus on value at which trades can be made with confidence.

Your understanding of price discovery is vital because it reflects the aggregate sentiment of market participants about future prices of cryptocurrencies. Through the use of futures contracts, you gain insight into what the market believes a cryptocurrency will be worth at a future date, which is invaluable for making informed investment decisions.

Here are some key aspects of price discovery in crypto futures trading:

- Market Sentiment: It allows you to gauge whether the majority of traders are bullish or bearish on a cryptocurrency.

- Transparency: Futures trading can offer a more transparent view of market expectations through publicly available trade data.

Remember, while price discovery offers insights into market trends, it also involves risks due to the volatile nature of cryptocurrencies. Here’s how price discovery could potentially impact your trading:

| Factor | Impact on Your Trading |

|---|---|

| Aggregate Sentiment | Helps inform buy/sell decisions |

| Volatility | May necessitate a cautious approach with leverage |

Being aware of these factors empowers you to navigate crypto futures markets more effectively and to use price discovery as a guiding component in your trading strategy.

Volatility

In the realm of cryptocurrencies, volatility is a prominent feature that makes these digital assets both enticing and daunting. Your encounter with crypto futures trading allows you to strategize around this volatility. Significantly, futures enable you to hedge against price swings and potentially profit from them, without the need to own the actual cryptocurrency.

Here are precise ways futures trading reacts to volatility:

- Hedging: By entering a futures contract, you can lock in prices to protect against unfavorable price movements. For instance, if you expect the price to drop, you can take a short position to hedge your holdings.

- Leverage: Crypto futures provide the ability to control a substantial value of assets with a relatively small investment. Although leverage amplifies risks, it equally magnifies opportunities in volatile markets.

Risk Management: Futures come with predefined risk factors. You should utilize stop-loss orders and position sizing to manage risk effectively in turbulent market conditions.

Remember, while volatility can indeed lead to profit-making opportunities in futures trading, it also increases the potential for losses. Your use of leverage should be carefully considered against the backdrop of these swift market movements.

| Strategy | Utilization in Volatile Markets |

|---|---|

| Long Positions | Speculate on future price increases |

| Short Positions | Speculate on future price decreases |

| Stop-Loss Orders | Limit potential losses during downturns |

As you navigate the waters of crypto futures trading, staying informed and prepared for volatility can improve your trading outcomes.

Hedging

When you engage in crypto futures trading, one significant benefit is the ability to hedge against your current holdings. Hedging is a risk management strategy designed to protect your investments from adverse price movements.

In practice, you would take a position in a futures contract that moves inversely compared to your current portfolio. For example, if you hold Bitcoin and anticipate a drop in its price, you can short a Bitcoin futures contract. This means if the market price falls, the gains from your futures position can offset the losses from your spot holdings.

- Offsetting Risks: By appropriately hedging, you aim not to profit but to balance your risks.

- Leverage: Futures often require less capital outlay compared to buying the actual cryptocurrency, so you can hedge without tying up as much capital.

Here are some common hedging strategies with crypto futures:

- Protective Puts: Buy a put option to sell your cryptocurrency at a set price, ensuring you can manage losses if the spot price falls.

- Short Selling: Sell futures contracts to secure a price now and buy back later at a potentially lower price.

By employing these strategies, hedging can serve as a safeguard, allowing you to navigate the volatile cryptocurrency market more confidently. Remember, the objective of hedging is to create a balance that might protect your portfolio from significant losses during unfavorable market conditions.

Conclusion

Cryptocurrency futures trading offers a range of benefits that may align with your investment goals and risk management strategies. While it comes with its risks, it also provides leverage, hedging opportunities, and the ability to speculate on price movements without owning the underlying asset. Before entering the crypto futures market, ensure you’ve done thorough research and understand the following key points:

- Leverage: You can control a large position with a relatively small amount of capital, potentially amplifying your gains. However, this also increases the risk of amplified losses.

- Hedging: Protect your portfolio from adverse price movements by taking an opposite position in the futures market.

- Market Access: Access cryptocurrencies round the clock with crypto futures markets typically operating 24/7, unlike traditional markets.

- Price Speculation: Benefit from both rising and falling market trends by going long or short on futures contracts.

Success in crypto futures trading hinges on a robust understanding of the market dynamics and sound risk management practices. Remember that the volatility of the crypto markets can lead to rapid gains or losses, and always consider using stop-loss orders to mitigate potential losses. Your ability to react to market changes and maintain discipline in your trading approach will be crucial to navigating the complexities of cryptocurrency futures.