Cryptocurrency futures trading offers a compelling avenue for investors to speculate on the future prices of digital assets. By engaging in this form of derivative trading, you can potentially amplify your profits through leverage. However, it is paramount to recognize that the increased leverage also magnifies the risks involved. As digital assets by nature are highly volatile, futures trading can lead to substantial gains or losses in a relatively short time span, necessitating robust risk management strategies to safeguard your investments.

Understanding the regulatory framework of the crypto market is critical for anyone involved in futures trading. Different countries have varying regulations regarding the trading of digital assets, which can impact market access and the strategies available to you. As a trader in this space, staying informed about these regulations is essential to ensure compliance and to make informed decisions based on the legal landscape.

Effective risk management is a cornerstone of responsible crypto futures trading. Just as traditional investment opportunities require due diligence, crypto futures demand an even greater level of scrutiny due to their complexity and the volatility of the underlying assets. By developing a comprehensive trading plan, you can establish clear guidelines for your trading activities, helping to enhance your consistency and to control potential losses. Avoiding overtrading and understanding the mechanics of liquidation are crucial steps in protecting your portfolio from undue risk.

Sources and Types of Risk in Crypto Futures Trading

In crypto futures trading, several risks can affect your investments including market fluctuations and the impact of leverage. It’s crucial to understand the specific risks to navigate the futures market effectively.

Market Risk

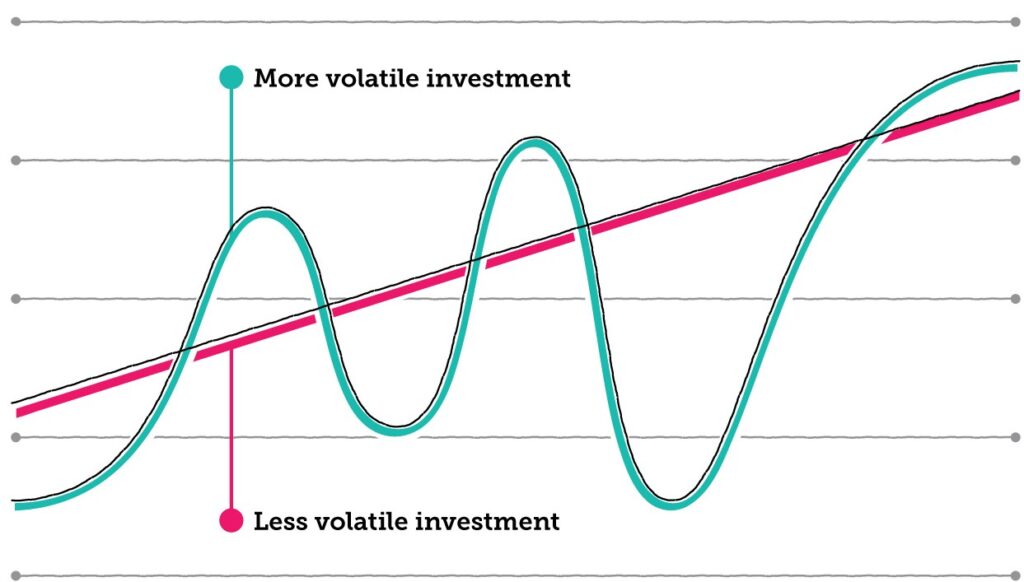

Market risk refers to the potential losses due to the volatile nature of the crypto market. Price fluctuations can be severe, with assets experiencing substantial swings in value over short periods. With crypto futures, you’re engaging in contracts based on predictions of future prices, making market volatility a central concern.

Liquidity Risk

Liquidity risk arises when there are not enough market participants to buy or sell at desired prices. In crypto futures, this can lead to slippage, where orders are filled at different prices than expected, potentially leading to significant losses, especially in less popular or newer cryptocurrencies.

Counterparty Risk

This risk involves the possibility of the other party in the contract defaulting on their obligations. In the realm of crypto futures, your counterparty is typically the exchange or clearinghouse. The security and stability of these platforms are paramount, as failure could result in financial loss.

Operational Risk

Operational risks are associated with technical failures, such as exchange outages or problems with transaction execution. Crypto futures trading is heavily reliant on technology; thus, technical glitches can disrupt trading activities and negatively impact your position.

Regulatory Risk

Regulatory risk deals with the impact of changing laws and regulations, which can vary greatly between jurisdictions. The crypto market is still adjusting to evolving regulations, which can have unpredicted consequences on crypto futures, such as changing underlying asset legality or altering market practices.

Leverage Risk

Leverage allows you to control large positions with a relatively small capital investment, magnifying both gains and losses. Crypto futures often involve significant leverage, which can lead to quick losses if the market moves against your position, known as ‘hard liquidation’ or a total capital wipeout.

Challenges and Difficulties of Crypto Futures Trading

In crypto futures trading, you’re likely to face numerous challenges and difficulties that can affect the outcome of your investments. Understanding these challenges is crucial for successful trading.

High Volatility and Unpredictability of the Crypto Market

The crypto market is infamous for its high volatility, which means that the market price of cryptocurrencies can swing wildly in a short period. This unpredictability can lead to substantial gains, but it also poses a considerable risk of loss.

Technical Issues and Glitches of the Platforms and Brokers

When engaged in crypto futures trading, you may encounter technical issues, such as platform downtime or order execution delays. These glitches can prevent you from trading at crucial moments, potentially leading to financial losses.

Hacking and Cyberattacks

Cybersecurity is a significant concern in the digital world. The platforms you use to trade could be targets for hacks and cyberattacks, which can lead to the theft of assets or personal information. Employing robust security measures and focusing on platforms with strong cryptography practices is essential.

Scams and Frauds

The crypto space is rife with scams and frauds. You must be vigilant and conduct thorough research to avoid falling prey to these schemes that pose as legitimate investment opportunities.

Competition and Manipulation

Your trading environment is highly competitive, with many participants possibly having more information or funds. Furthermore, the threat of market manipulation by these entities can distort prices and influence market conditions to their benefit.

Stay informed and cautious, and use these insights to navigate through the turbulent waters of crypto futures trading.

How to Avoid Risks Of Crypto Futures Trading

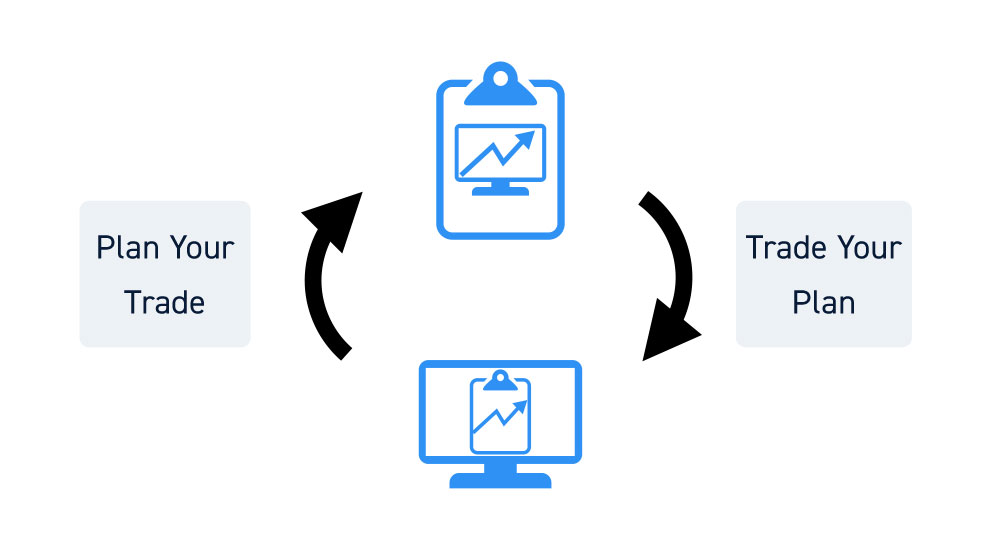

To navigate the waters of crypto futures trading safely, you need to employ a set of strategies that help minimize risk. A clear trading plan is your first line of defense. This should detail your entry, exit, and money management rules.

- Define your risk tolerance and stick to it. Never invest more than you can afford to lose.

- Use stop-loss orders to automatically close a position at a predetermined price, thus limiting your potential losses.

Implement diversification by spreading your investments across different assets, which can help reduce the impact of volatility.

A concept not to overlook is the Cooling-off Period function, which some platforms like Bybit and Phemex offer. It allows you to disable trading temporarily to prevent hasty decisions during high volatility.

- Be aware of market conditions and adapt your strategies accordingly. High volatility requires extra caution.

Educate yourself on the mechanics of futures trading and leverage. While leverage can magnify profits, it also increases the risk of liquidation.

- Practice responsible trading by starting with lower leverage and adjusting it as you gain more experience.

- Always stay informed about the latest market trends and adjust your strategies to align with current market scenarios.

Finally, consider using hedging strategies to offset potential losses. However, make sure you understand how hedging works before implementing it.

By adhering to these principles, you can reduce the risks associated with crypto futures trading while striving for responsible and potentially profitable trading.

Conclusion

In navigating the complexities of crypto futures trading, risk management is pivotal. Your primary goal should be to protect your capital, while optimizing opportunities for profit. To achieve this, consider adhering to a strict set of rules that control your trading engagements.

- Develop a trading plan: Your plan should define your investment goals, risk tolerance, and strategy for entry and exit points.

- Opt for risk mitigation: Utilize stop-loss orders and only allocate a small portion of your portfolio to high-risk trades.

- Stay informed: The market is driven by information, and staying updated can give you an edge.

Remember that despite the allure of high profits through leverage, it’s essential to resist overtrading. Each decision should be calculated and based on thorough analysis rather than emotional impulses. Futures trading can be a high-stake venture, so ensure you’re well-versed in its mechanisms before diving in.

Lastly, continual learning is your ally in the ever-evolving market of cryptocurrencies. Make use of educational resources, and don’t hesitate to consult financial advisors if necessary. By exercising caution and discipline, you can navigate crypto futures trading with a balanced perspective on risk and reward.