BingX: Established in 2018, BingX goes beyond being a mere exchange. It seamlessly integrates social elements into its platform, creating a vibrant community for crypto enthusiasts.

MEXC: Also established in 2018, MEXC has rapidly gained prominence; with over 1690+ listed coins, MEXC offers unparalleled variety.

When choosing between BingX and MEXC for your crypto trading needs, consider their distinctive features, security measures, support services, and API capabilities to determine which exchange suits your requirements best.

Before making a choice, it’s recommended that you review their respective features and trading fees to align with your trading habits and financial goals.

Whether you prioritize a wide selection of cryptocurrencies, low fees, powerful APIs, or robust security measures can guide your decision between BingX and MEXC.

| Feature | BingX | MEXC |

|---|---|---|

| Supported Cryptocurrencies | Several mainstream and altcoins | A wide range of cryptocurrencies, including altcoins and tokens |

| Leverage | Offers competitive leverage options | Provides various leverage choices, often higher for professional accounts |

| Security | Advanced security protocols in place | Robust security measures to protect user assets |

| Trading Volume | High, reflecting a lively trading ecosystem | Often has a high trading volume, indicating strong liquidity |

| Deposit Methods | Multiple options, including fiat and crypto | Diverse deposit methods catering to global users |

| Trading Fees | Competitive fee structure | Generally low fees with discounts available for high-volume traders |

| API Access | Comprehensive API for automated trading | Rich API functionality for developers and algorithmic trading |

| User Support | Accessible customer support with various channels | Multiple support channels, including live chat and ticket systems |

Each exchange offers APIs to integrate with trading bots and other applications, ensuring you have the tools required for automated trading strategies.

Consider the security protocols offered by both, which are crucial for safeguarding your digital assets. Moreover, the user support from both platforms is designed to assist you with any issues you might encounter.

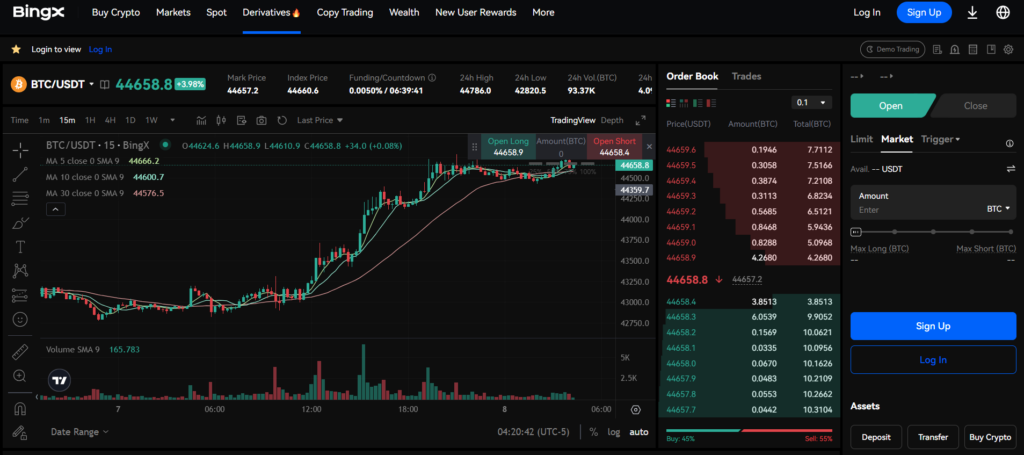

BingX vs MEXC: Products and Services

When you compare BingX and MEXC, you’ll notice that both platforms cater to different aspects of cryptocurrency trading.

BingX is known for its variety, including spot trading and futures trading.

BingX stands out with its copy trading feature, allowing you to follow the trades of experienced investors. This can be particularly attractive if you’re new to trading or looking to leverage the expertise of seasoned traders.

The platform also provides a degree of leverage for trades, enhancing your trading power, though this comes with increased risks.

On the other hand, MEXC offers a robust suite of services with a strong emphasis on liquidity.

It may not have as broad a scope as some more extensive exchanges, but it competes well with a solid offering in spot and futures markets. MEXC uniquely offers various products, which might appeal to traders seeking niche opportunities.

Regarding trading volume, MEXC may not match the larger platforms but still provides a competitive environment. Both exchanges boast an impressive array of altcoins for spot trading.

Here’s a quick comparison to help you grasp the differences:

| Feature | BingX | MEXC |

|---|---|---|

| Spot Trading | Available | Available |

| Futures | Available with leverage | Available |

| Copy Trading | Offered for diversification | Not highlighted |

| Liquidity | Sufficient for most needs | High with depth in offerings |

| Altcoins | Diverse selection | Extensive range |

| Innovation | Copy trading as a key feature | Unique trading products |

Your choice depends on whether you value innovation, copy trading (BingX), liquidity, and niche trading opportunities (MEXC).

Both offer compelling services, so your decision might hinge on specific features that suit your trading style and goals.

BingX vs MEXC: Contract Types

When comparing BingX and MEXC’s contract offerings, it’s essential to understand the different types available to you.

BingX focuses on providing a range of contract types, including:

- Linear Perpetual Contracts: These contracts use stablecoins as collateral, simplifying the process for users who prefer a stable valuation basis.

- Options: These financial instruments give you the choice, but not the obligation, to buy or sell an asset at a predetermined price, providing a way to hedge against price volatility.

On the other hand, MEXC offers a diverse set of contract types, ensuring you have the flexibility to trade according to your preferences:

- Inverse Perpetual Contracts: In these contracts, the cryptocurrency itself is used as collateral, appealing if you prefer to use the underlying crypto for trading.

- Inverse Futures Contracts: These are set for a specific date, usually with larger contract sizes, fitting for more strategic, long-term trading bets on the future price of cryptocurrencies.

- COIN-M Futures: In these contracts, the settlement is in the cryptocurrency on which the future is based, making them attractive if you want to stay within the crypto ecosystem.

- USD-M Futures: They are stablecoin-margined and offer a fixed value, making them ideal for traders looking to avoid the volatility of crypto collateral.

BingX and MEXC provide perpetual contracts without an expiration date, allowing for continuous trading without constantly rolling over positions to future dates.

The choice between BingX and MEXC may hinge on your preferred collateral type, settlement method, and risk management strategies.

BingX vs MEXC: Leverage and Margin

When trading on BingX and MEXC, you can use leverage to amplify your positions and potential returns.

Leverage is a tool that enables you to control a more prominent position than the amount of capital you initially invested.

BingX offers you leverage up to 100x on specific trading pairs. With a small margin, you can open a position worth many times the value of your initial investment.

However, it would be best if you considered the risks since higher leverage amplifies gains and losses. BingX implements a tiered margin system, adjusting your available leverage based on the position size.

As the size of your position increases, the maximum leverage you’re allowed to use decreases.

On MEXC, the leverage can reach up to 125x for specific products. Like BingX, this high leverage could yield significant returns and risk substantial losses.

MEXC uses a dynamic margin system to prevent your position from becoming over-leveraged.

The margin requirements are pivotal in managing risks associated with leverage. Both platforms enforce initial and maintenance margins to protect against market volatility.

- Initial Margin: The amount you need to open a leveraged position.

- Maintenance Margin: You must maintain minimum equity to keep the position open.

Here’s an overview:

| Feature | BingX | MEXC |

|---|---|---|

| Maximum Leverage | Up to 100x | Up to 125x |

| Margin System | Tiered based on position size | Dynamic based on market risks |

| Liquidation Risks | Adjusted with tiered margin | Guarded by a dynamic margin system |

| Funding Rates | Applied to positions open during funding times | Subject to change based on market liquidity |

Remember, if your position falls below the maintenance margin, you are at risk of liquidation.

Liquidation occurs when your position is closed by the exchange because the market has moved against you, and your account value cannot cover the margin requirements.

Additionally, BingX and MEXC charge funding rates for positions kept open over a specified time, which can affect your trading costs.

BingX vs MEXC: Liquidity and Volume

When evaluating BingX and MEXC, two prominent cryptocurrency exchanges, one must consider their liquidity and trading volume.

Liquidity reflects how easily you can execute trades without impacting the market price.

Higher liquidity denotes a more stable and efficient market environment.

BingX has been progressively growing its presence in the crypto exchange market, reflected in its trading volume.

The volume, an indicator of the exchange’s activity level, can give you insights into the market’s trust in BingX’s capability to handle trades efficiently.

However, detailed volume metrics are subject to monthly updates and can vary.

MEXC often ranks well in liquidity and volume, especially in markets where it’s a prevalent choice among traders.

These substantial liquidity and volume figures suggest you can expect relatively low slippage when executing orders, leading to potentially better price execution for your trades.

You can track exchanges’ liquidity and volume rankings through resources such as CoinMarketCap or CryptoCompare.

These rankings are based on specific metrics like order book depth, which indicates the market’s capacity to sustain sizable orders without significant price changes.

Comparison between BingX and MEXC based on liquidity and volume will help inform your trading decisions.

Remember, more significant volume and better liquidity result in a more desirable trading experience, with reduced slippage and more efficient execution of trades.

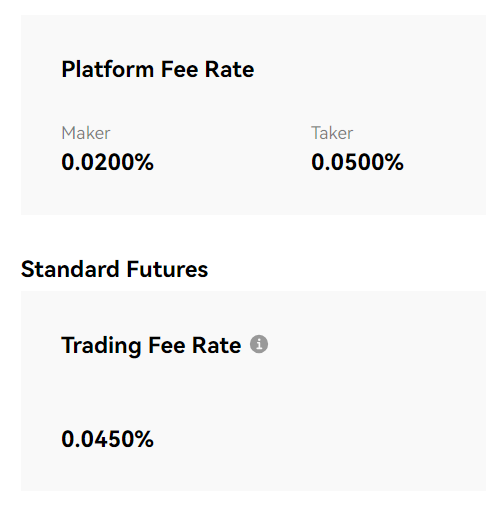

BingX vs MEXC: Fees and Rewards

When evaluating BingX and MEXC, understanding the fee structures and reward systems is crucial to maximizing your trading efficiency and profitability.

Trading Fee & Deposit/Withdrawal Fee Compared

BingX and MEXC have trading fees consisting of maker and taker fees. These fees often vary based on your trading volume or tier level.

BingX typically structures its trading fees to incentivize both makers and takers, decreasing the fee rate as your 30-day trading volume increases.

For example, if you are a Level 1 trader (less than $50,000 in 30-day volume), your maker fee might be 0.10% and the taker fee 0.10%, but this could decrease to 0.08% and 0.10% as you move to higher volume tiers.

Additionally, BingX may offer different fee rates for spot and futures trading.

MEXC, on the other hand, also employs a tiered fee structure based on your 30-day trading volume or holdings.

With similar incentives, MEXC’s spot trading fees could start around 0.20% for both makers and takers but could go lower for VIP users.

For instance, a VIP 1 status might come with a 0.16% maker and taker fee, which rewards users with a higher volume.

Both BingX and MEXC may offer fee discounts when using their native tokens and through referral programs. It’s essential to stay updated on each platform’s promotional activities for potential savings.

Deposits & Withdrawal Options

Deposits and withdrawal options across BingX and MEXC vary and affect how you manage your funds.

BingX offers a range of options for deposits and withdrawals, including bank transfers, credit cards, and various cryptocurrencies.

They aim to provide speedy transaction times, but the exact speed can depend on the asset. Processing bank transfers might take a few business days, while crypto transfers are usually faster.

MEXC also supports multiple deposit and withdrawal methods, focusing on providing users with efficient transaction processes.

They accommodate numerous cryptocurrencies for deposits and withdrawals, enabling quick asset access.

BingX and MEXC typically enforce minimum deposit and withdrawal amounts, which are crucial to consider before initiating transactions.

The fee for withdrawal on both exchanges depends on the cryptocurrency and the amount being transferred. Always verify the latest fees directly on the exchanges, as they frequently change.

BingX vs MEXC: KYC Requirements & KYC Limits

When choosing between BingX and MEXC, you should consider their Know Your Customer (KYC) requirements and the resulting limits that come with different verification tiers.

BingX

- No KYC for Low-Volume: You can withdraw up to 50,000 USDT daily without KYC verification.

- Privacy-Friendly: This limit is often sufficient for casual or those cautious of privacy without providing personal information.

- Documents for Higher Limits: Should you wish to increase your limits, be prepared to submit identification documents such as a passport or government-issued ID.

MEXC

- Tiered KYC Structure: MEXC employs a tiered KYC process, with each level providing increased limits for deposits, withdrawals, and trading.

- Initial Verification: Even primary verification will require some form of identification, usually a government-issued ID.

- Enhanced Verification: Additional documents, proof of address, or a selfie with a handwritten note may be required for higher limits.

| Exchange | No KYC Limits | Basic KYC Required | Enhanced KYC |

|---|---|---|---|

| BingX | Up to 50K USDT/day | Government ID for more | Additional verification steps |

| MEXC | Limited functionality | Government ID | Proof of address, etc. |

The tiered approach affects your security and accessibility.

With BingX, you trade off lower limits for greater privacy if you choose not to complete KYC.

MEXC, in contrast, offers graded access to functions but requires more of your information upfront, even for primary usage.

Your choice will depend on your needs for privacy versus your desire for higher transaction limits.

BingX vs MEXC: Order Types

When trading on BingX or MEXC, you have access to various order types essential for implementing your trading strategies and managing risks effectively.

Understanding each platform’s specific order types can be critical for your trading experience.

BingX Order Types:

- Market Orders: Execute trades immediately at the current market price.

- Limit Orders: Set a specific price you want to buy or sell.

- Stop Orders: Trigger a sale or purchase once the asset hits a predetermined price.

- Conditional Orders: Execute an order only when certain conditions are met.

- Post-Only Orders: Ensure the order adds liquidity to the market by entering as a maker.

- Reduce-Only Orders: Intended to reduce a position and prevent increasing it.

MEXC Order Types:

- Market Orders: Fill your order at the best available current price.

- Limit Orders: Specify the maximum or minimum price you will accept for a buy or sell order.

- Stop-Limit Orders: Combines a stop order with a limit order, activating a limit order once the stop price is reached.

- Iceberg Orders: Large orders are broken into smaller limit orders to hide the actual order quantity.

- IOC (Immediate or Cancel) Orders: Execute all or part of your order immediately and cancel any unfilled portion.

BingX and MEXC facilitate margin trading, with order types like stop orders and limit orders crucial for managing risks on leveraged positions.

Options like conditional orders on BingX and iceberg orders on MEXC provide more control over order execution and market impact.

Your choice of platform might hinge on these distinctions, depending on your trading strategy and risk tolerance.

BingX vs MEXC: Security and Reliability

When choosing a cryptocurrency exchange, your security and reliability are paramount.

BingX and MEXC are two exchanges that prioritize these aspects, but their approaches and track records differ notably.

BingX leverages multi-layer security mechanisms, including two-factor authentication (2FA) and SSL encryption, to safeguard your funds and personal information.

Their focus on user security is evident through their investment in cold storage for most digital assets, minimizing exposure to online threats.

Despite these measures, it’s essential to acknowledge that no exchange is immune to risks. Past incidents have been addressed with transparency and rectification measures to reinforce security infrastructures.

MEXC similarly prioritizes security, employing a comprehensive suite of protection tools. Your accounts benefit from 2FA, withdrawal allowlists, and anti-phishing codes.

This staunch defense strategy is coupled with a robust customer support system to immediately address security concerns.

| Aspect | BingX | MEXC |

|---|---|---|

| 2FA | Yes | Yes |

| Encryption | SSL Encryption | SSL Encryption |

| Cold Storage | Majority of Assets | Information not specified |

| Regulatory Compliance | Adheres to local regulations | Adheres to local regulations |

| Customer Support | 24/7 | 24/7 |

| Past Security Incidents | Handled transparently | Proactive Measures Employed |

Each platform complies with the necessary regulations in their jurisdictions, reinforcing their commitment to your security.

The quality of the exchanges’ customer support is critical in dealing with routine inquiries and unexpected issues.

BingX and MEXC extend 24/7 support, ensuring that your concerns can be addressed promptly regardless of your time zone.

BingX vs MEXC: User Centricity

When you navigate the platforms of BingX and MEXC, you’re met with distinct user experiences that cater to crypto traders. Both exchanges focus on delivering a user-friendly interface, yet they differ in execution and user reception.

BingX prides itself on a streamlined design conducive to beginners and experienced traders.

You’ll find that their interface is intuitive, with a focus on simplifying the trading process. BingX offers a well-reviewed mobile app for trading on the go for its ease of use and functionality.

MEXC, on the other hand, provides robust tools that might appeal to the more seasoned trader.

The platform’s speed and responsiveness are high, allowing for efficient trading. The MEXC mobile app ensures you have access to the market at your fingertips, and it’s designed to be quick and responsive.

| Feature | BingX | MEXC |

|---|---|---|

| Interface | Intuitive and simple | Comprehensive and detail-oriented |

| Mobile App | Highly rated for functionality | Fast and reliable |

| Customer Support | Accessible with positive feedback | Known for a professional support team |

Feedback from users highlights BingX’s customer support as particularly convenient, often noting swift and helpful responses. MEXC is also reputed to offer professional customer assistance, though opinions may vary more.

Your user experience on both exchanges will likely reflect a balance between the convenience of BingX’s straightforward approach and the advanced features MEXC provides.

You must choose the platform that aligns with your trading style and support needs.

BingX vs MEXC: Regulation and Compliance

When you choose a cryptocurrency exchange, understanding how it stands in terms of regulation and compliance is crucial to ensure the security of your investments.

BingX and MEXC operate globally, and their regulatory adherence is essential for their legitimacy and peace of mind.

BingX emphasizes its commitment to regulatory compliance within the jurisdictions in which it operates.

BingX adheres to Know Your Customer (KYC) and Anti-Money Laundering (AML) standards, conducting due diligence to prevent financial crimes.

You need to know that BingX’s operations are subject to the legal frameworks of the countries they serve, and they adjust their compliance measures accordingly.

- Licenses and Certifications: BingX has not publicly listed all their licenses, so you are advised to check the exchange’s website or contact their support for detailed information regarding their regulation status in your country.

MEXC, on the other hand, also aligns itself with international compliance standards, implementing rigorous KYC procedures to verify the identities of its users.

MEXC’s approach to adhering to legal and ethical standards reflects its attention to risk management and safeguarding user assets.

- Regulatory Challenges: It’s important to note that both BingX and MEXC, like many crypto exchanges, face constant scrutiny from regulators. You should be aware of any recent news regarding the regulatory challenges or controversies that may impact their operations.

In summary, as you consider using BingX or MEXC, verify the exchange’s compliance with local laws and how it may affect your trading experience.

Both exchanges take steps to operate within the legal frameworks of the territories they engage in, ensuring that they meet necessary regulatory standards.

Frequently Asked Questions

When comparing BingX and MEXC, you will encounter several differentiators that impact your trading experience. Below are FAQs to guide you through these distinctions.

What are the trading fee comparisons for BingX versus MEXC?

Both BingX and MEXC offer competitive trading fees.

Typically, you will find that fees can vary based on your trading volume and the type of trade. Check each platform’s latest fee structure to ensure you have up-to-date information.

Are any unique trading pairs available on BingX that are not on MEXC?

Yes. Although both exchanges offer a multitude of trading pairs, you might find some unique to BingX or MEXC.

It is advisable to review their current listings for any distinctive offerings that match your interests.

Do BingX and MEXC differ significantly in terms of user experience and interface?

Your experience may differ on BingX and MEXC, as each has its own interface design and user experience philosophy.

While BingX may present a specific layout and set of features, MEXC may offer a different approach that could better suit your preferences.

How do customer support services compare between BingX and MEXC?

Customer support quality can influence your satisfaction with an exchange.

BingX and MEXC are known to provide various support channels, but the response time and effectiveness of the support may vary.

Users typically look for quick and helpful assistance, so consider current reviews of their service for a more informed decision.

Conclusion

In the comparative analysis of BingX and MEXC, it’s been illustrated that both exchanges offer distinct features and benefits. Your choice ultimately hinges on your specific needs as a trader or investor.

Features of BingX:

- Aimed at traders looking for innovative market pairings

- Friendly for users new to the crypto space

- Offers a fresh perspective compared to seasoned exchanges

Features of MEXC:

- Suits experienced traders prioritizing a wide range of altcoins and futures trading.

- Generally preferred for its competitive trading fees

- Hosts a broad array of cryptocurrencies

For New Traders:

If you are stepping into cryptocurrency, you might find BingX’s user-friendly interface more accommodating.

For Veterans & Diverse Portfolio Seekers:

On the other hand, if you’re seeking an expansive selection of trading pairs and altcoin availability, MEXC is likely the superior option.

Each platform caters to different facets of the crypto universe, with BingX orienting toward usability for newcomers and MEXC focusing on depth and variety appealing to seasoned traders. Use the insights from this comparison to align with the exchange that best suits your investment journey.

Explore how BingX and MEXC compare to their competitors:

- BingX vs Bybit: An In-Depth Exchange Comparison

- BingX vs Binance: An In-Depth Exchange Comparison

- BingX vs Phemex: An In-Depth Exchange Comparison

- MEXC vs Binance: An In-Depth Exchange Comparison

- MEXC vs Bybit: An In-Depth Exchange Comparison

- MEXC vs Phemex: An In-Depth Exchange Comparison