When evaluating BingX and Binance, you’re looking at two competitive platforms for futures trading in the cryptocurrency exchange market.

Each offers unique features and capabilities that cater to a range of traders.

BingX is known for its social trading experience, allowing you to engage in copy trading. This is particularly advantageous if you’re new to trading and wish to learn from experienced traders.

In contrast, Binance is celebrated for its extensive market reach and higher leverage options, reaching up to 125x for perpetual futures trading.

Binance’s volume and liquidity are exceptional, providing a robust environment for trading many cryptocurrencies.

Here is a quick comparison between the two:

| Feature | BingX | Binance |

|---|---|---|

| Trading Options | Spot, Copy P2P, Margin (up to 5x leverage) | Spot, Margin (up to 125x leverage on futures), Options, Futures, P2P |

| User Interface | User-friendly with a focus on social trading features | Highly functional with advanced tools for both beginners and experts |

| Supported Coins | Offers a variety of popular coins | Thousands of trading pairs, more extensive range of coins |

| Trading Volume | Lower than Binance but sufficient for its supported coins | One of the highest in the industry, offering deep liquidity |

| Deposit Methods | Multiple options, including credit cards, cryptocurrency, and others | Extensive range, including bank transfers, credit cards, crypto, and more |

BingX’s interface is approachable, suiting users seeking a community-driven trading approach.

Binance offers a more complex interface tailored to novice users seeking simplicity and professional traders looking for comprehensive tools and analytics.

In terms of fees, each platform has its structure, with Binance often having a competitive edge due to its high volume and economies of scale.

BingX vs Binance: Products and Services

When comparing BingX and Binance, you’ll encounter a range of products and services that cater to various aspects of the crypto trading experience, from spot and futures trading to innovative features like copy trading and entering the NFT market.

- Spot Trading and Futures Trading

BingX presents a robust spot trading platform that enables you to trade various cryptocurrencies.

Futures trading on BingX is notable for offering up to 150x leverage on USDT pairs, which might appeal to you if you prefer high-leverage trading.

In contrast, Binance steps ahead in leverage for margin trading, providing 3x to 5x leverage, and also features an extensive list of perpetual futures in USDT, crypto tokens, and BUSD with up to 125x leverage.

Here, Binance might be preferable if you’re looking for a wider range of assets and leverage options.

- Staking and Savings

On Binance, you can take advantage of staking and savings products to earn interest on your crypto holdings, and you have the flexibility to choose from various options suited to different risk tolerances and time preferences.

While BingX might offer similar services, it doesn’t highlight them as a primary feature compared to Binance, which emphasizes these services and often introduces innovative savings products.

- Copy and Social Trading

BingX shines in copy trading, making it simple for you to emulate the strategies of seasoned investors, which can be an attractive service if you’re new to trading or prefer a more hands-off approach.

Binance, while it focuses heavily on the core trading experience, may not offer as robust a copy trading platform.

- NFT Marketplace

You will find that Binance has invested in an NFT marketplace, creating an ecosystem where you can buy, sell, or trade NFTs.

This expansion into the NFT space reflects Binance’s commitment to providing a holistic crypto experience.

BingX’s presence in the NFT market isn’t as prominent, which might sway your preference toward Binance if you’re interested in the burgeoning NFT space.

BingX vs Binance: Contract Types

Each platform may have different contract types that cater to your trading preferences, whether you prioritize diversity, leverage options, or the type of margins used.

BingX Contract Types

BingX provides perpetual futures trading with different leverage options. Specifically, BingX offers:

- Perpetual Futures: You can trade with leverage, generally up to 125x, using USDT as the Margin.

- USDT-Margined Futures: These are a type of perpetual contract margined with USDT, offering a linear contract structure.

Binance Contract Types

Binance, known for its comprehensive derivatives market, includes:

- Inverse Perpetual Contracts: You trade coin-margined contracts that are settled in cryptocurrency.

- Linear Perpetual Contracts: These contracts are settled in a stablecoin such as USDT.

- Inverse Futures Contracts: Futures settled in the coin rather than USDT.

- COIN-M Futures: These coin-margined futures offer both perpetual and dated delivery options.

- USD-M Futures: US dollar-margined futures are also available, with the option of high leverage.

- Options: European-style options are available, but they can only be executed at the time of expiration.

| Feature | BingX | Binance |

|---|---|---|

| Perpetual Contracts | Up to 125x leverage in USDT | COIN-M and USD-M, inverse and linear options |

| Futures | USDT-margined, not widely diverse | Both COIN-M and USD-M diverse selection |

| Options | Not specified | European style options |

| Leverage Options | Limited to USDT margin | Leverage up to 125x in various margins |

| Contract Settlement | Generally in USDT | Coin or USDT for different contracts |

Your preference in contract type will depend on whether you prioritize stablecoin-based settlements or opt for settlements in crypto assets.

Binance offers a broader range of contract types, whereas BingX focuses on USDT-based trading, which may be more straightforward for new traders.

BingX vs Binance: Leverage and Margin

When trading on BingX and Binance, you can use margin trading to borrow funds and amplify your trading positions.

Both platforms offer a form of leverage, enhancing your profit potential while increasing your risk exposure.

Binance provides various trading pairs with leverage options, reaching up to 125x for specific cryptocurrencies.

Your margin requirement will depend on the size of your position and the asset being traded.

The liquidation risk is present if the market moves against your position and your margin balance falls below the maintenance threshold.

Binance employs a tiered margin ratio system to determine liquidation levels.

- Maximum Leverage: Up to 125x for some assets

- Margin Trading: Tiered based on position size

- Liquidation Risks: Varied according to tiered margin ratio

- Funding Rates: Adjust dynamically based on the market

BingX also supports margin trading with considerable leverage, although it may not always match the peak levels found on Binance.

BingX’s focus tends to be on providing a user-friendly experience with transparent risk management features.

Like Binance, BingX has liquidation policies to protect the system and traders from excessive loss.

- Maximum Leverage: Often less than Binance’s 125x

- Margin Trading: User-friendly interface

- Liquidation Risks: Policy to mitigate excessive loss

- Funding Rates: Competitive with industry standards

Both platforms will charge funding rates for holding leveraged positions, which are subject to change based on the prevailing market conditions.

You must always be mindful of these rates as they can impact the cost of maintaining your position over time.

Consider your risk tolerance and trading strategy when using leverage and margin features. Each exchange’s offerings cater to different preferences in risk and potential return.

BingX vs Binance: Liquidity and Volume

High liquidity signifies more efficient trading, allowing your transactions to be executed promptly with minimal slippage, thus affecting the market less.

Binance, reputed for its extensive user base, typically leads in liquidity and volume—Binance rakes in high trading volumes across a multi-faceted platform, including spot and futures trading.

The market depth on Binance is substantial, which means your trades, especially large-volume ones, are less likely to cause significant price changes.

BingX also maintains respectable liquidity, with a diverse array of over 600 cryptocurrencies for spot and futures trading.

However, compared to Binance, BingX might have slightly less depth in market listings, potentially influencing trade execution and slippage for larger trades.

| Exchange | Liquidity Rank | Average Trading Volume | Number of Trading Pairs |

|---|---|---|---|

| Binance | High | Very High | Very High |

| BingX | Moderate | Moderate | High |

These rankings and metrics come from aggregator sites and individual exchange statistics, showing where each platform stands regarding liquidity and volume.

Your trading approach should consider these factors. With Binance, you can access deeper liquidity pools, meaning your trades will likely be executed swiftly and at competitive prices.

If you prefer a more comprehensive array of altcoins and a platform where KYC is not required for trading, BingX might align with your preferences, even though it may not offer the same volume as Binance.

BingX vs Binance: Fees and Rewards

When considering BingX and Binance, two leading cryptocurrency exchanges, it’s essential to understand how their fee structures and reward systems can influence your trading experience and potential for profit.

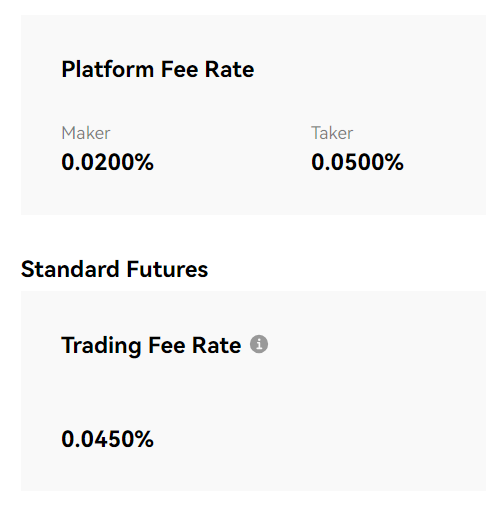

Trading Fee & Deposit/Withdrawal Fee Compared

BingX

- Trading Fees: Charges a competitive rate for spot and futures trading. You’ll typically encounter a maker-and-taker fee structure for spot markets. Perpetual futures trading in USDT allows for leverage up to 150x. The exact maker and taker fees would vary depending on your level within the BingX ecosystem.

- Deposit/Withdrawal Fees: Standard fees apply for withdrawals, while deposits are usually free. The withdrawal fees depend on the type of cryptocurrency you wish to withdraw.

Binance

- Trading Fees: Offers a structure where the fees also include maker and taker fees, with the advantage of lower costs for higher volume traders. Margin trading leverage ranges from 3x to 5x. For perpetual futures trading using USDT, Binance provides up to 125x leverage.

- Deposit/Withdrawal Fees: Deposits are typically free, whereas withdrawal fees are adjusted regularly based on blockchain conditions. This ensures users pay a fair fee relative to the current network demand.

Fee Example: If you’re a trader executing a $10,000 trade on the spot market, with a taker fee of 0.1%, you will pay $10 in trading fees on both platforms, assuming no discounts or higher user-level reductions apply.

Rewards and Signup Bonuses

BingX

- Rewards: Offers a range of rewards, including potentially a signup bonus for new users. The details of such rewards are typically subject to change and might involve specific trading volume requirements.

- Signup Bonus: The exact nature of signup bonuses can fluctuate, but they may include discounts on trading fees or a cash bonus deposited into your account upon completion of specific actions.

Binance

- Rewards: Provides a comprehensive reward system, including discounts when using their native BNB token to pay for trading fees. They also have a tier system that rewards users for higher trading volumes.

- Signup Bonus: New users may be eligible for signup bonuses. These can include a one-time fee discount or a small amount of cryptocurrency added to your wallet.

It’s essential to remain aware of the conditions attached to rewards and bonuses, such as completing verification steps or reaching a particular trade volume. Always read the terms carefully to benefit fully from these incentives.

BingX vs Binance: KYC Requirements & KYC Limits

When you choose a cryptocurrency exchange, understanding the Know Your Customer (KYC) policies is crucial.

KYC requirements can dramatically affect your privacy, security, and accessibility to the platform’s features. Let’s look at BingX and Binance to see how they stack up in these areas.

BingX:

- KYC Requirements: As far as the available information is concerned, BingX allows you to deposit, trade, and withdraw without identity verification, making it an attractive option if you prioritize privacy.

- KYC Limits: Despite the lack of mandatory KYC, undisclosed limits apply to unverified users.

Binance:

- KYC Requirements: Binance requests identity verification for enhanced account security and to comply with regulations. You must provide personal information, a government-issued ID, and, in some cases, a selfie.

- Verification Levels: Binance has different tiered verification levels, with higher tiers requiring more extensive documentation but granting higher transaction limits.

- KYC Limits: Binance imposes limits on withdrawals for unverified users. These limits increase once you complete the required verifications, and full platform functionality becomes available.

| BingX | Binance | |

|---|---|---|

| KYC Needed for Basic Trading | No | Yes |

| Standard KYC Procedure | Not required | ID, personal info, selfie |

| Deposit Limits for Unverified Users | Unspecified | Low |

| Withdrawal Limits for Unverified Users | Unspecified | Low |

| Maximum Verification Levels | Not applicable | Several tiers |

Both exchanges balance the trade-off between ease of access and the security and regulatory compliance provided by KYC procedures.

If anonymity is essential for your crypto activities, BingX might seem more appealing.

However, if you are willing to comply with more stringent KYC requirements for higher limits and the use of full platform features, Binance could be a better fit.

Understanding each exchange’s policies will guide you in choosing the right one based on your trading needs and privacy preferences.

BingX vs Binance: Order Types

When trading on cryptocurrency exchanges like BingX and Binance, understanding the different order types available is crucial for executing your strategies and managing risks effectively.

BingX provides the following order types:

- Market Orders: Execute immediately at the best available price.

- Limit Orders: Set a specific price you want to buy or sell.

- Stop Orders: Trigger a buy or sell when the market reaches your set price.

- Conditional Orders: Execute based on specific conditions you set.

- Post-only Orders: Ensure your limit order adds liquidity to the market, avoiding any taker fees.

- Reduce-only Orders: These orders reduce your position, preventing you from increasing it.

Binance, on the other hand, offers a comprehensive set of order types aimed at giving you more flexibility:

- Market Orders: Fill immediately according to current market prices.

- Limit Orders: Provide control over the price at which you trade.

- Stop-Limit Orders: These act as a stop order that turns into a limit order once a specific price is reached.

- Stop-Market Orders: Like stop orders, triggering at the market price once your stop price is hit.

- OCO (One Cancels the Other): Combines a limit order with a stop-limit order; if one triggers, the other gets canceled.

- Trailing Stop Orders: Automate selling as the price decreases a specified distance from the peak.

- Post-only Orders: These add liquidity and avoid hitting the taker fee.

- Iceberg Orders: Large orders are hidden except for a small visible portion to prevent price slippage.

BingX and Binance offer these essential tools to help you trade according to your personalized strategy, with Binance providing a slightly broader range that caters to beginners and advanced traders.

Use these order types to manage market risks and execute trades more effectively.

BingX vs Binance: Security and Reliability

When looking at the security framework of BingX and Binance, one crucial aspect is two-factor authentication (2FA), which both platforms support.

This feature significantly enhances your account’s security by requiring a second form of verification in addition to your password.

Regarding cold storage practices, both exchanges claim to store most of the crypto assets in offline wallets. This minimizes the risk of theft from online hacking attempts.

BingX and Binance emphasize the importance of proof of reserves.

Binance provides public proof that customer funds are fully backed, with reserves that often exceed 100% of the assets, ensuring that your funds are readily available for withdrawal.

| Feature | BingX | Binance |

|---|---|---|

| Two-Factor Authentication | Yes | Yes |

| Cold Storage of Assets | Yes | Yes |

| Proof of Reserves | Yes | Yes |

Both platforms have faced incidents where they quickly responded to resolve any issues. They’ve made continual improvements to security protocols to protect your assets.

Regarding regulatory compliance, both exchanges work to comply with the jurisdictions in which they operate.

Customer support is available on both platforms, with Binance having a more extensive infrastructure due to its larger user base and more extended operating history.

Your funds and data protection are taken seriously by BingX and Binance, as they both employ robust security measures to ensure reliability.

However, no system is entirely risk-free, so you must use all available security features and follow best practices for safeguarding your accounts.

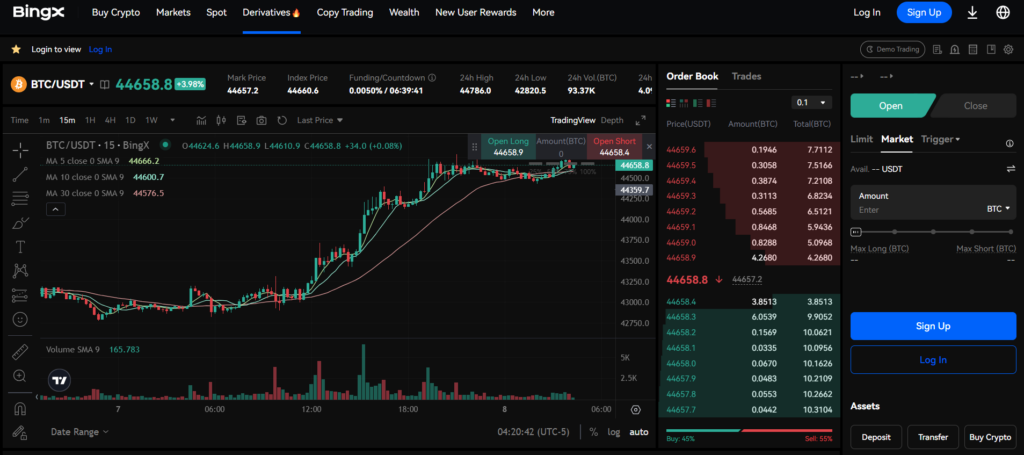

BingX vs Binance: User Experience

When considering the user experience on BingX and Binance, you’ll find that each has distinct features catering to different preferences.

BingX prides itself on an interface that balances simplicity with functionality. This makes it more accessible if you’re new to cryptocurrency trading.

Their mobile app is known for being user-friendly, ensuring that managing your cryptocurrency portfolio is smooth, even when you’re on the go.

In contrast, Binance offers a more feature-rich platform that may appeal to experienced users.

The interface is robust, with advanced trading tools and an array of charts and technical analysis indicators. While this might be overwhelming for novices, seasoned traders value the detailed control this provides.

| Feature | BingX | Binance |

|---|---|---|

| Usability | Easy for beginners | Complex, feature-rich for advanced users |

| Interface | Intuitive design | Detailed and comprehensive |

| Mobile App | Streamlined and accessible | Powerful, mirrors the website’s functionality |

| Customer Support | Responsive and helpful | Extensive resources but slower response times |

Users typically highlight BingX’s responsive customer support, which enhances your experience by providing timely assistance when you need it.

Binance, while offering comprehensive support resources, sometimes receives feedback about slower response times.

Functionality aside, the design and speed of both platforms are top-notch, providing a seamless and efficient trading environment.

The choice between BingX and Binance often comes down to your experience level and what you value more—simplicity and support or depth and complexity.

User reviews frequently reflect that Binance’s interface provides a steep learning curve, yet those well-versed in trading find it exceptionally powerful.

BingX vs Binance: Regulation and Compliance

When trading cryptocurrencies, understanding your exchanges’ regulatory and compliance measures is crucial.

BingX and Binance adhere to different standards in regulation and compliance, and these distinctions matter for the security and legality of your transactions.

BingX operates with a focus on regulatory compliance.

Traditionally, it has implemented KYC (Know Your Customer) requirements to verify the identity of its users, which aligns with global anti-money laundering (AML) standards.

BingX tailors its compliance measures to meet the legal expectations of the jurisdictions it serves.

Binance, one of the largest global cryptocurrency exchanges, has stringent KYC verification processes to enhance user security and ensure compliance.

Binance has engaged with regulators worldwide and adheres to the regulations set forth by FinCEN in the United States, indicating its commitment to combating potential financial crimes on its platform.

| Exchange | KYC Verification | Regulatory Adherence |

|---|---|---|

| BingX | Mandatory | Global Compliance |

| Binance | Mandatory | FinCEN, EU, Global |

Both platforms have committed to compliance with the evolving regulations in the cryptocurrency industry.

They maintain rigorous measures to remain updated with legal changes, especially in key markets such as the EU and globally.

While BingX and Binance have made significant strides in regulatory compliance, the landscape of cryptocurrency regulation is perpetually in flux.

As such, they must continually assess and modify their compliance strategies to stay ahead of new regulatory developments and potential challenges.

Frequently Asked Questions

In this section, you’ll find specifics regarding the cryptocurrency offerings and security measures of both BingX and Binance, providing you with essential insights to inform your platform choice.

Which platform, BingX or Binance, offers a broader range of cryptocurrencies?

Binance, one of the largest cryptocurrency exchanges globally, offers you access to over 600 cryptocurrencies for trading. BingX also provides a diverse selection, but Binance takes the lead in various coins that are available.

What are the security measures implemented by BingX in comparison to Binance?

Binance implements a multi-tier and multi-cluster system architecture to enhance the security of your assets.

Additionally, it offers two-factor authentication (2FA) and device management tools.

BingX also uses industry-standard security practices, including SSL encryption, 2FA, and wallet security measures.

Both platforms continuously update their security protocols to ensure your investments are well protected.

Conclusion

As you conduct trades and interact with these platforms, you’ll find that both offer distinct advantages.

Your choice depends on your trading style, the level of risk you’re comfortable with, and the type of interface that best suits your needs.

When considering BingX and Binance, you’re faced with two robust platforms that serve crypto traders with varying needs.

- BingX is commendable for its user-friendly interface and support for over 600 digital assets, making it ideal for traders who value variety and ease of use. Its no KYC requirement simplifies the onboarding process.

- Binance, on the other hand, is known for its comprehensive suite of trading options, including spot trading, margin trading with leverage up to 5x, perpetual futures with up to 125x leverage, and even European Style Options and Leveraged Tokens. Its diverse financial products cater to new and experienced traders seeking advanced trading capabilities.

As for choosing the right crypto trading platform:

- If a simple, straightforward trading experience with an expansive choice of cryptocurrencies is your primary preference, BingX might suit you best.

- However, if you’re an investor or trader looking for a platform with intricate trading tools and higher potential ROI through leverage and futures, Binance should be your go-to exchange.

Explore how BingX and Binance compare to their competitors:

- BingX vs MEXC: A Detailed Comparison

- BingX vs Bybit: A Detailed Comparison

- BingX vs Phemex: A Detailed Comparison

- Binance vs Phemex: A Detailed Comparison

- Binance vs MEXC: A Detailed Comparison

- Binance vs Bybit: A Detailed Comparison