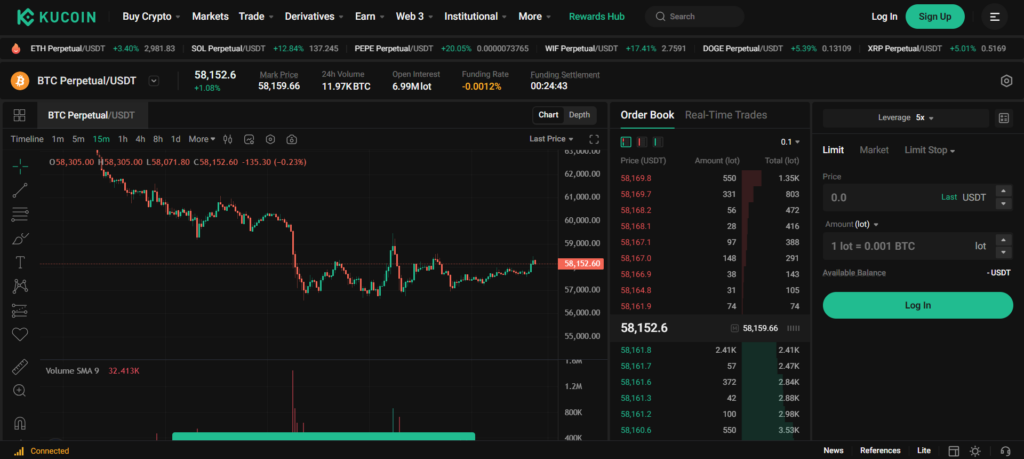

Bybit and KuCoin are two prominent cryptocurrency exchanges, each offering unique features and benefits to their users. KuCoin is renowned for its extensive range of supported cryptocurrencies, user-friendly interface, and comprehensive trading options including spot, margin, and futures trading. It also provides various financial services such as staking, lending, and token launch platforms, catering to a broad spectrum of traders from beginners to experts.

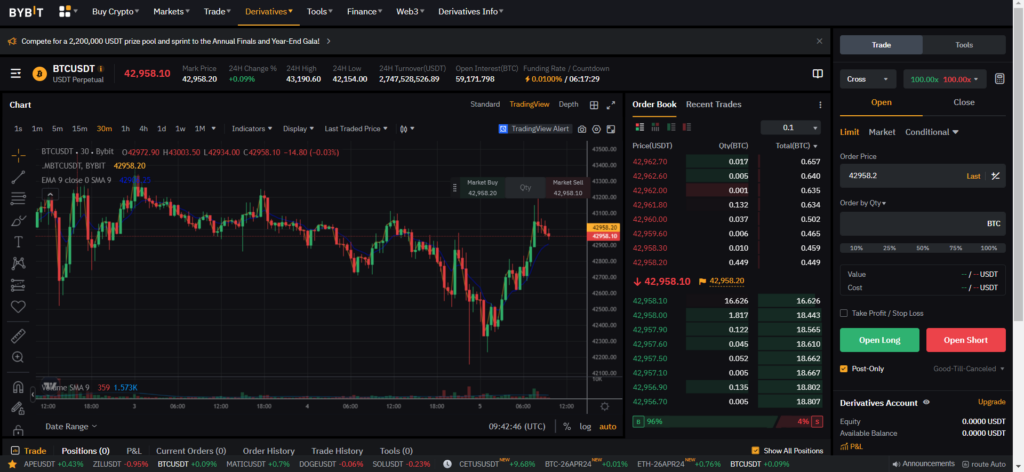

Bybit, on the other hand, is particularly known for its robust derivatives trading platform, offering high leverage options and advanced trading tools. Bybit focuses on providing a seamless and secure trading experience with features like perpetual contracts and competitive trading fees. Its emphasis on speed and reliability makes it a preferred choice for professional traders seeking high leverage and advanced trading capabilities.

To help you choose between the two, here is a concise comparison between Bybit and KuCoin.

Below is a table that juxtaposes their main features, fees, and products, helping you to understand the variances and similarities between the two platforms.

| Feature | Bybit | KuCoin |

|---|---|---|

| Founded | 2018 | 2017 |

| Founder(s) | Ben Zhou | Michael Gan, Eric Don |

| Spot Trading Fees | Makers: 0.1%, Takers: 0.1% | Makers: Often starts at 0.1%, Takers: Often starts at 0.1% |

| Derivatives Fees | Makers: 0.01%, Takers: 0.06% | Varies based on the platform’s structure |

| Supported Coins | Varies, with a focus on mainstream tokens | Over 1000 tokens, including altcoins |

| Leverage | Up to 100x on certain products | Up to 10x on certain products |

| Trading Volume | High, particularly in derivatives | Also high, with a significant spot market |

| Deposit Methods | Cryptocurrency, third-party fiat gateways | Cryptocurrency, fiat through P2P, and others |

| Withdrawals | Supports crypto withdrawals | Supports crypto and fiat withdrawals |

| Security Features | Strong record, focus on derivatives security | Robust environment with a focus on altcoins |

| Regulation | Less regulation | Less regulation |

| Products | Spot trading, futures, derivatives, staking | Spot trading, futures, derivatives, staking, lending |

Make sure to verify the most recent updates on each platform as they continually evolve to meet the market’s demands.

Bybit vs KuCoin: Products and Services

In the ever-evolving world of cryptocurrency exchanges, Bybit and KuCoin offer a range of products and services designed to cater to the diverse needs of traders.

Bybit is renowned for its derivative trading options, providing you with futures and options trading platforms that are intuitive and user-friendly.

You can engage in spot trading with a flat fee of 0.1% for both makers and takers, which aligns with the industry standard.

| Service Type | Bybit | KuCoin |

|---|---|---|

| Spot Trading | 0.1% fee for makers and takers | 0.1% fee for makers and takers |

| Derivatives | Lower fees: 0.01% for makers, 0.06% for takers | Competitive fees |

| Asset Variety | Over 400+ tradeable assets | 850+ tradeable digital assets |

| NFT Marketplace | Not prominently featured | Available with a selection of tokens |

| Staking | Available | Available with more options |

| Innovation | Focus on derivative markets | A broad set of trading products and crypto services |

Meanwhile, KuCoin holds an edge regarding sheer asset variety, boasting over 850+ tradeable assets.

Your trading experience on KuCoin is enhanced by this extensive range and the addition of services such as an NFT marketplace and a more comprehensive array of staking options, which may be appealing if you are looking for more than just trading.

Both exchanges are accessible worldwide, but you should note that some services might be restricted based on your location due to local regulations.

However, Bybit tends to be more specialized, optimizing derivative trading, while KuCoin appeals to a broader audience with its comprehensive offerings.

Bybit vs. KuCoin: Contract Types

When exploring the array of contract types available, you’ll find that Bybit and KuCoin offer diverse instruments tailored to different trading strategies.

- Inverse Perpetual Contracts: Bybit provides inverse perpetual contracts where the margin and settlement are in the underlying cryptocurrency, which can be more intuitive if you prefer dealing directly with digital assets. KuCoin, on the other hand, may not have as prominent a focus on inverse contracts.

- Linear Perpetual Contracts: Both Bybit and KuCoin offer linear perpetual contracts. These contracts are settled in USDT or another stablecoin, simplifying the process if you want to avoid the volatility associated with using the underlying crypto for margin and settlement.

- Inverse Futures Contracts: Available on Bybit, you’re allowed to trade with an expiration date. This type of contract might appeal to you if you’re looking for a predetermined settlement date, unlike perpetual agreements that don’t expire.

- COIN-M Futures: If you trade on KuCoin, COIN-M futures are an option, allowing you to use the cryptocurrency as a margin. Bybit also offers similar contracts, expanding your flexibility.

- USD-M Futures: You will appreciate the USD-M futures on Bybit, which utilize stablecoins as margin. This might help stabilize your collateral value against the volatility of cryptocurrencies.

- Options: While Bybit offers options trading, giving you the right, but not the obligation, to buy or sell at a predetermined price, it’s essential to consider that these might carry more complexity and could be more suited to advanced traders.

Bybit vs KuCoin: Supported Cryptocurrencies

When evaluating Bybit and KuCoin, you’ll notice that both platforms offer a broad array of cryptocurrencies to cater to their users’ diverse trading preferences. Here’s how they compare:

Bybit

- Futures & Leverage: Bybit supports a variety of cryptocurrencies for futures and leverage trading. This includes significant coins such as Bitcoin (BTC), Ethereum (ETH), and XRP, among others.

- Popular Trading Pairs: Some of the most popular futures trading pairs on Bybit include BTC/USD, ETH/USD, and XRP/USD, reflecting the demand for prominent cryptocurrencies.

KuCoin

- Futures & Leverage: KuCoin also provides futures and leverage trading, extending support to over 700 cryptocurrencies ranging from well-known to smaller altcoins.

- Popular Trading Pairs: BTC, ETH, and the exchange’s native token, KuCoin Shares (KCS), are some of the featured pairs for futures trading.

Your trading experience will hinge upon the diversity of options these exchanges provide. Bybit is renowned for its robust derivatives market. At the same time, KuCoin is appreciated for its extensive array of supported cryptocurrencies that you can trade directly or use on their crypto debit card, the KuCard.

Supported Cryptocurrencies and Pairs Comparatively:

| Feature | Bybit | KuCoin |

|---|---|---|

| Futures & Leverage | BTC, ETH, XRP, and more | Over 700 various cryptocurrencies |

| Popular Futures Pairs | BTC/USD, ETH/USD, XRP/USD | BTC, ETH, KCS, and others |

For futures and leverage traders, your choice may lean towards Bybit for its leading pairs, whereas if your focus is a vast selection, KuCoin might be your preferred exchange.

Bybit vs KuCoin: Leverage and Margin Trading

Leverage and margin trading are powerful tools at your disposal when trading cryptocurrency. Bybit and KuCoin both offer these options, but there are key differences to consider.

Bybit offers a high level of leverage in its margin trading, going up to 100x for specific contracts. This allows you to amplify your potential returns – and risk – significantly.

Keep in mind that with higher leverage, liquidation risks increase. Bybit employs a dual-price mechanism to provide fair liquidation and prevent unnecessary liquidations due to market manipulations.

Margin Requirements: Bybit’s margin requirement will vary based on your position size and the leverage you’re using. A higher leverage will require less margin but increases the risk of liquidation.

Funding Rates: They are dynamic and will depend on market conditions, which reflect the cost of holding positions.

KuCoin’s approach to leveraging is also aggressive, though typically, its cap is at 10x for spot margin trading and varies for other trading options.

For futures, it provides different leverages, which can be lower or higher based on the contract specifications.

With KuCoin, you can trade on margin across various assets, which can benefit diversifying strategies.

Margin Requirements: KuCoin requires you to monitor your risk level carefully, as higher leverage will also mean closer attention to margin balance to avoid liquidation.

Liquidation Risk: Similar to Bybit, KuCoin’s liquidation protocols are in place to manage sudden market movements, though managing your trades proactively is crucial.

Funding Rates: Just like Bybit, KuCoin’s funding rates vary based on market liquidity and the underlying asset for the contract.

In summary, both platforms provide the means to leverage trades, but it’s essential to understand the associated risks and how different leverage levels can impact your positions. Always consider liquidation risks and funding rates when choosing your leverage level.

Bybit vs. KuCoin: Trading Volume

When you assess Bybit and KuCoin, two prominent names in the world of cryptocurrency exchanges, their trading volumes are a definitive factor in your trading experience.

KuCoin boasts a substantial user base, with over 20 million registered users. It generates a significant daily trading volume surpassing $1.2 billion.

This heavy trading activity reflects on the liquidity of assets, facilitating efficient trade execution with minimal slippage. You can expect various trading options: spot, margin, and futures.

Bybit, while known for targeting professional traders, presents itself as a competitive platform emphasizing leverage and derivatives trading.

It is mainly known for offering up to 100x leverage. The volume related to these high-leverage products can be substantial, impacting order fulfillment efficiency and the prevalence of slippage.

| Exchange | User Base | Daily Trading Volume | Notable Trading Options |

|---|---|---|---|

| KuCoin | 20M+ | $1.2B+ | Margin, Spot, Futures |

| Bybit | Not specified | Not specified | High leverage, Derivatives |

When you participate in trades on these exchanges, consider the mentioned trading volumes as they gauge the market’s liquidity.

High liquidity generally correlates with accurate price discovery and steadier markets, making it a critical element for casual and professional traders.

Liquidity rankings and volume metrics from independent security rating teams and other sources aid you in determining the robustness of each platform.

For instance, Bybit’s improvement in security ranking correlates with its commitment to providing a dependable trading environment.

Each exchange’s liquidity and volume data influence your trading experience by dictating the ease of entering and exiting positions.

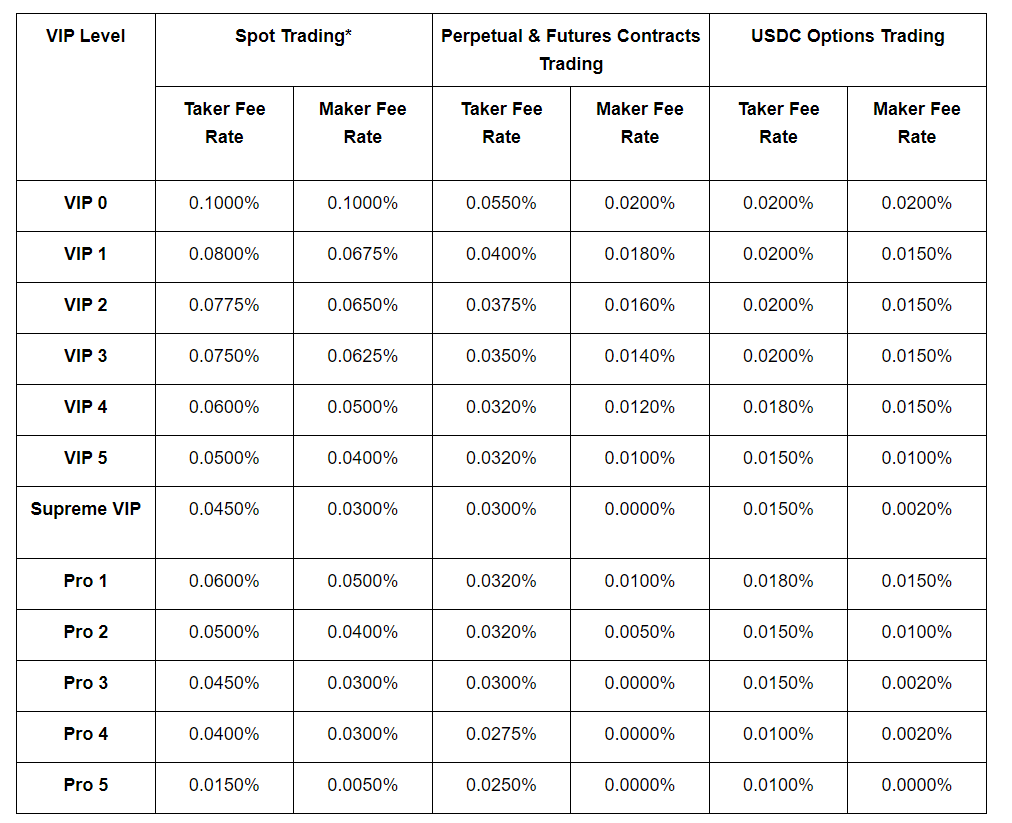

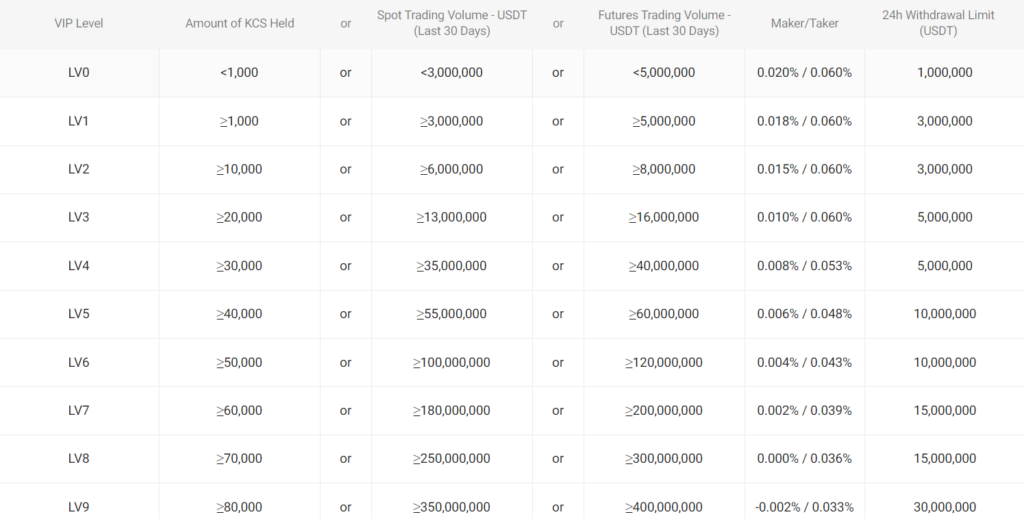

Bybit vs KuCoin: Futures Trading Fees and Rewards

In scrutinizing the differences between Bybit and KuCoin’s futures trading fees, you’ll find similarities and discrepancies that can impact your trading costs.

Trading Fee Structure

Bybit features a futures trading maker fee of 0.02% and a taker fee of 0.06%.

As a maker, if you place a limit order that adds liquidity to the market for a trade of $10,000, your fee would be $2. Conversely, as a taker, placing an order that matches immediately with an existing order would raise the cost to $6 for the same trade size.

KuCoin, on the other hand, matches Bybit’s maker fee at 0.02% for futures but has a slightly higher taker fee of 0.06%. Additionally, they may offer a futures trading fee discount for those holding their KCS token, which could further reduce costs.

Deposit and Withdrawal Fees

Regarding deposits, both Bybit and KuCoin do not typically charge fees for cryptocurrency deposits. However, when it comes to withdrawals, the scenario differs.

Bybit does not support fiat withdrawals, and cryptocurrency withdrawal fees can vary depending on the asset and network conditions.

KuCoin has implemented fees on withdrawals that are in line with the industry standards and are adjusted regularly to reflect blockchain network conditions.

While KuCoin supports fiat withdrawals, associated fees would depend on the chosen payment method and can be higher than cryptocurrency transactions.

You need to consider these fees when planning your trading strategy on either platform, as they directly affect the profitability of your trades.

By comparing both exchanges’ fee structures and rewards, you are better positioned to make informed decisions that cater to your trading preferences and maximize your potential returns.

Bybit vs KuCoin: Deposits & Withdrawal Options

When considering Bybit and KuCoin for cryptocurrency transactions, you’ll find that both exchanges offer varied methods for depositing and withdrawing funds.

Your choice may depend on how these options align with your preferences for convenience and efficiency.

Bybit does not support fiat currency withdrawals, meaning you can’t directly withdraw to your bank account. However, you can deposit and withdraw cryptocurrencies efficiently.

Since Bybit predominantly deals with crypto assets, processing times may be relatively rapid, allowing you to transfer funds without significant delays.

For KuCoin, there is a broader range of options. You can deposit both fiat and cryptocurrencies.

While fiat withdrawals are available, the processing times, limits, and fees vary depending on your chosen method.

The availability of direct bank transfers can be convenient but might come with additional verification steps and potential processing delays compared to crypto transactions.

Here is a quick breakdown:

| Exchange | Fiat Deposits | Fiat Withdrawals | Crypto Deposits | Crypto Withdrawals |

|---|---|---|---|---|

| Bybit | No | No | Yes | Yes |

| KuCoin | Yes | Yes | Yes | Yes |

Considering minimum and maximum amounts for deposits and withdrawals on each platform is essential. The exchanges set such limits and can affect how much you can transfer at any time.

In terms of cost, you’ll encounter trading fees, with Bybit charging a flat fee of 0.1% for spot trading and KuCoin’s fee structure involving different rates for makers and takers.

Consider any network fees associated with crypto transactions for withdrawals, as these can fluctuate based on the blockchain’s congestion level.

Before initiating transfers, ensure you know the processing times and any possible fees or limits affecting your transactions so you can manage your funds effectively.

Bybit vs KuCoin: Native Token Usage

When considering the native tokens of Bybit and KuCoin, you’ll find that both platforms offer their respective cryptocurrencies that integrate into their ecosystems in unique ways.

Bybit does not currently have a proprietary native token. Instead, it operates on its trading platform with a broad range of cryptocurrencies.

KuCoin, on the other hand, offers KuCoin Shares (KCS) as its native token. By holding KCS, you can enjoy several benefits:

- Reduced Trading Fees: Get discounts on trading fees when you use KCS.

- KCS Bonus: A share of daily exchange profits is distributed to KCS holders.

- Participation in Special Events: Access to participate in new coin launches and other events.

| KuCoin Token | Benefit |

|---|---|

| KCS | Trading fee discounts |

| KCS | Participation in special events |

| KCS | Bonus rewards from daily profits |

As a proud owner of KCS, your overall experience on the KuCoin platform is enhanced through these incentives.

Including a native token such as KCS encourages activity within the KuCoin ecosystem, often resulting in a more engaged user base.

As you navigate your options between Bybit and KuCoin, consider the additional utility and potential cost savings you could leverage through the strategic use of KuCoin’s native token.

Bybit vs KuCoin: KYC Requirements & Limits

When choosing between Bybit and KuCoin, your account’s KYC (Know Your Customer) requirements and the resulting limits are initial asBybit allows you to trade, deposit, and withdraw without KYC verification. Despite this, you will be encouraged to complete KYC procedures upon reaching certain account thresholds or increasing security measures. To do this, you provide:

- A government-issued ID

- Proof of address

- A selfie to confirm identity

Once KYC is completed, your withdrawal limits are increased significantly, securing higher operational freedom on the platform.

KuCoin, on the other hand, often promotes itself as “The People’s Exchange.” It’s known for its leniency in KYC, although it has levels of verification offering different limits:

-

Unverified Accounts:

- Can deposit and exchange cryptocurrencies

- Have lower daily withdrawal limits

-

Verified Accounts:

- Require a government-issued ID and a selfie

- Offer higher withdrawal limits and a more comprehensive range of services

These KYC requirements reinforce the security of your transactions and can be seen as a benefit for creating a safer trading environment. However, users who highly value privacy may see these protocols as invasive.

For both platforms, these procedures aim to prevent fraud, combat money laundering, and finance terrorism.

It’s crucial for you, as a trader, to decide which balance of privacy and security aligns with your personal trading strategies and how the exchange’s respective KYC processes and limits will affect your trading capacity.

Bybit vs. KuCoin: User Experience

When you navigate Bybit’s platform, you’ll notice a focus on reducing complexity. Its design is meant to simplify tasks, allowing you to access the features you need quickly.

Bybit’s web interface and mobile app aim to streamline your trading experience, featuring intuitive layouts and responsive execution crucial for fast-paced crypto trading.

In contrast, KuCoin may present a steeper learning curve, especially if you’re new to cryptocurrency exchanges.

Its advanced interface offers a variety of order types and trading tools, which, while powerful, can be intimidating for beginners.

However, KuCoin’s mobile app and website are highly regarded for enabling both beginner and advanced trading with their distinct user interfaces.

-

Design & Intuitiveness

- Bybit: Clean, minimalist interface; promotes ease of use.

- KuCoin: Feature-rich platform with dual interfaces to cater to different user levels.

-

Functionality & Accessibility

- Bybit: Smooth user experience with accessible tools for various trades.

- KuCoin: Advanced tools are available, yet it can be challenging for new users to navigate.

-

Customer Support Quality

- Consistency in support quality may vary for each but is an essential aspect of user experience.

If you’re leaning towards a user-friendly experience that’s straightforward and less complex, Bybit could be your preferred exchange.

Alternatively, if you’re seeking a platform that provides advanced functionality and doesn’t mind a steep learning curve, KuCoin might suit you better.

Remember to consider the quality of customer support as part of your user experience when deciding.

Bybit vs. KuCoin: Order Types

When trading on Bybit and KuCoin, you have a range of order types at your disposal, each serving a specific purpose to align with your trading strategies and risk management.

Bybit supports several key order types:

- Market Orders: Execute trades instantly at the current market price.

- Limit Orders: Set a specific price you want to buy or sell.

- Conditional Orders: Automatically place an order when certain conditions are met.

- Stop Orders: Enable selling at a predefined price to mitigate losses.

- Post-Only Orders: Ensure the order is added to the order book and not matched immediately, typically for fee discounts.

- Reduce-Only Orders: Restrict orders to reduction of your position size only.

KuCoin, on the other hand, provides these order types:

- Market Orders: Quickly execute a trade at the best available current price.

- Limit Orders: Dictate the maximum or minimum price you’re willing to buy or sell.

- Stop-Limit Orders: Set a stop price and a limit price for buying or selling, combining stop and limit orders.

- Iceberg Orders: Large orders are hidden except for a small visible portion to avoid impacting the market price.

- Time in Force Conditions: Customize how long an order remains active, including Good-Till-Cancelled (GTC), Immediate-Or-Cancel (IOC), and Fill-Or-Kill (FOK) options.

Both exchanges offer a range of options for executing trades that align with various investment approaches, whether you aim for immediate execution with market orders or have specific price goals in mind with limit orders.

Conditional and stop orders are precious for managing risk, while post-only orders can be used to take advantage of lower fees on maker orders.

By understanding these order types, you can efficiently execute trades on Bybit or KuCoin.

Bybit vs KuCoin: Security Measures & Reliability

When assessing the security measures of both Bybit and KuCoin, it’s essential to consider their historical performance and current practices.

Bybit has enhanced its security protocols over time.

In recent times, Bybit’s dedication to security has propelled it into the top ten of security rankings by Certified, achieving a Triple-A rating.

The exchange has set up multi-signature wallets and employs an industry-standard risk management system with regular security audits by third-party services.

On the other hand, KuCoin has faced security challenges, such as a significant hack in September 2020, leading to a loss of funds.

KuCoin responded by partnering with other exchanges to recover a portion of the stolen cryptocurrency and worked on enhancing their security systems.

As of 2024, KuCoin is still a valuable player but was ranked 35th by Certified.

Here’s a quick comparison:

| Feature | Bybit | KuCoin |

|---|---|---|

| Security Rating | AAA (Top 10) | Ranked 35th |

| Hack Incident | No major incidents reported | Hacked in September 2020 |

| Wallet Security | Multi-signature wallets utilized | Upgraded after the hack, details undisclosed |

| Security Audits | Regular audits by third-party services | Regular audits after the hack |

You’ll notice that both platforms potentially use cold storage to secure most assets, an essential feature in protecting your funds.

Ensuring the safety of your investments, both Bybit and KuCoin have taken steps to regularly update their security measures and procedures, addressing vulnerabilities as they arise.

Bybit vs. KuCoin: Insurance Fund

When trading on cryptocurrency exchanges, the insurance fund is a critical facet that protects you in market volatility or when a trader cannot cover the losses of a leveraged position.

Each platform uses an insurance fund differently, and you need to understand these differences.

Bybit

Bybit’s insurance fund is designed to prevent investors from losing their entire margin on a trade if the market turns volatile and positions are liquidated.

The fund covers the shortfall between a position’s liquidation price and the price it’s filled during market auto-deleveraging.

- Funding Sources: The insurance fund grows from liquidation fees when a position is liquidated at a price better than the bankruptcy price.

- Transparency: Bybit provides regular updates on the size of its insurance fund, ensuring you are well informed about the platform’s ability to cover potential shortfalls.

KuCoin

KuCoin also has an insurance fund to mitigate the risks of leverage trading, although details may differ from those of Bybit.

- Usage: Similar to Bybit, its fund acts as a buffer to protect your positions and margin from being wiped out due to forced liquidation.

- Visibility: Information regarding the size and handling of the insurance fund on KuCoin might be less frequent, which may affect your ability to make an informed decision.

| Feature | Bybit | KuCoin |

|---|---|---|

| Purpose | Protects margins during volatility | Protects margins during extreme market conditions |

| Updates | Regularly provided | Information may be less frequent |

Understanding these mechanisms is central to your trading strategy, especially if you engage in leveraged trading with heightened risks.

Bybit vs. KuCoin: Customer Support

When choosing a cryptocurrency exchange, the quality of customer support is an essential factor to consider. Bybit and KuCoin provide customer support, but their delivery methods differ.

Bybit is known for its 24/7 customer support, which includes an email service.

The platform has made efforts to ensure that your issues are addressed promptly, creating a positive user experience. Bybit’s dedication to customer support has been recognized by users, praising the accessibility and efficiency of the service.

KuCoin also offers customer support around the clock, but its primary method of assisting users is through a web ticketing system and email.

KuCoin has integrated a chatbot that is capable of answering common inquiries. However, it does not offer direct access to live human support, which could be a limitation if you prefer personalized assistance.

When using either exchange, you’ll find comprehensive help centers and FAQ sections designed to help you quickly find answers to common questions.

| Feature | Bybit | KuCoin |

|---|---|---|

| 24/7 Support | Yes | Yes |

| Email Support | Yes | Yes |

| Live Support | Not specified | No |

| Help Center | Yes | Yes |

| FAQs | Yes | Yes |

| Chatbot | Not specified | Yes |

Remember, your preference for customer support style might lead you to choose one platform. If live human support is crucial for you, these differences are significant.

Bybit vs KuCoin: Regulatory Compliance

When considering the regulatory aspect, you must understand how Bybit and KuCoin align with legal frameworks. Each exchange operates within distinct jurisdictions; here’s how they stand:

Bybit’s Regulatory Compliance

Bybit exerts efforts to remain regulatory compliant, ensuring adherence to international laws and regulations. This entails a focus on:

- Conducting business within the legal parameters of operational countries.

- Engaging with local financial authorities to maintain licensure and certifications.

- Adapting to changing regulations and applying measures to comply with them.

While Bybit has not faced significant regulatory hurdles publicly, the crypto space’s ever-evolving nature means it must continuously monitor and adjust compliance strategies.

KuCoin’s Regulatory Compliance

Comparatively, KuCoin’s regulatory approach involves:

- Broader asset support, which mandates rigorous compliance checks.

- Commitment to adhering to the laws and guidelines of the countries they serve.

- Investing in legal counsel to navigate complex regulatory landscapes.

KuCoin must manage its diverse asset offerings with a strong compliance strategy to maintain its position in the market.

When choosing between Bybit and KuCoin, your decision should consider each platform’s commitment to regulatory adherence.

Conclusion

When selecting Bybit and KuCoin, your decision should align with your trading preferences and requirements.

For Security-Conscious Traders:

Bybit has enhanced its security measures and now boasts a Triple-A security rating, indicating a robust security infrastructure. If security is your top priority, Bybit’s recognition in this area could make it preferable.

Fees Structure:

- Spot Trading: Both exchanges offer competitive fees for spot trading; Bybit and KuCoin charge a 0.1% fee.

- Derivative Trading: Bybit may be more attractive if you’re interested in derivatives trading due to its lower maker and taker fees than KuCoin.

Withdrawals:

- If you require fiat withdrawals, you must look elsewhere, as Bybit does not support this option.

- Bybit generally imposes lower withdrawal fees, which could benefit traders looking to minimize costs when moving funds.

Trading Options and Marketplace Offerings:

- KuCoin offers a broader range of tokens for trading, which might appeal to traders seeking diversity.

- Bybit, on the other hand, provides a platform for cryptocurrency trading and accessing staking, loans, and an NFT marketplace, catering to various crypto-related needs.

As you consider your options, weigh these factors carefully against your trading style, the importance of fees, the desired security level, and the need for a diverse trading portfolio or additional services.

Both Bybit and KuCoin have distinct advantages, positioning them to cater to different segments of the crypto trading community.

Explore how Bybit and KuCoin compare to their competitors:

- Bybit vs Binance: A Comprehensive Comparison of Trading Platforms

- Bybit vs BingX: A Comprehensive Comparison of Trading Platforms

- Bybit vs Bitget: A Comprehensive Comparison of Trading Platforms

- KuCoin vs OKX: A Comprehensive Comparison of Trading Platforms

- KuCoin vs Binance: A Comprehensive Comparison of Trading Platforms

- KuCoin vs Kraken: A Comprehensive Comparison of Trading Platforms