OKX and KuCoin are prominent cryptocurrency exchanges catering to a global audience with a variety of digital assets. OKX, known for its robust trading platform, offers advanced features like futures and options trading, alongside a user-friendly interface suitable for beginners and professionals alike.

KuCoin, often dubbed “The People’s Exchange,” emphasizes accessibility and diverse coin listings, providing users with extensive trading pairs and low fees. Both platforms offer unique benefits and tools, making them popular choices for crypto enthusiasts seeking reliable and comprehensive trading environments.

Comparing OKX and KuCoin helps traders decide which exchange best suits their investment strategies and preferences.

Your choice between OKX and KuCoin may depend on various factors, including fees, features, and the history of the exchanges.

Below is a table to help you compare the critical aspects of each:

| Feature | OKX | KuCoin |

|---|---|---|

| Founded | 2017 | 2017 |

| Founders | Xu Mingxing | Michael Gan, Eric Don |

| Headquarters | Belize | Hong Kong |

| Spot Trading Fees | – Maker: 0.1% Taker: 0.15%* | – Maker: 0.1% Taker: 0.1%** |

| Futures Trading Fees | – Maker: 0.02% Taker: 0.05% | – Maker: 0.02% Taker: 0.06% |

| Number of Coins | 400+ | 200+ |

| Products Offered | Spot trading, Futures, Margin trading, OTC, Pools, NFTs | Spot trading, Futures, Margin trading, Lending, Staking |

| Leverage Options | Flexible | Up to 10x (Margin Trading) |

| Deposit Methods | Bank Transfer, Crypto | Bank Transfer, Crypto, Credit Card |

As you analyze this data, remember that the fees can fluctuate based on your trading volume or using the respective platform’s tokens to pay transaction fees.

Both OKX and KuCoin boast a comprehensive suite of trading options, and it can be beneficial to review their interfaces, tools, and community support to discern which aligns best with your trading style and needs.

OKX Vs. Kucoin: Products And Services

When exploring the products and services of OKX and KuCoin, you’ll find they both offer a comprehensive suite of trading options.

However, some nuances might sway your preference depending on your trading needs.

OKX offers:

- Spot Trading: Trade a vast array of cryptocurrencies.

- Futures Trading: Access futures contracts with competitive leverage options.

- Options Trading: A platform for trading options, a type of derivative.

- Perpetual Swaps: Virtual derivative products settled in digital currencies, supporting coin and USDT margined contracts.

- Staking: Earn interest by staking your crypto assets.

- Additional Services: Includes an NFT marketplace and various developer tools.

On the other hand, KuCoin boasts:

- Spot Trading: A wide choice of digital assets for spot trading.

- Futures Trading: Including leveraged trading opportunities.

- Margin Trading: Borrow funds to trade more significant amounts.

- Leveraged Tokens: Offering magnified exposure to price movements.

- Staking: Similar to OKX, with options to earn rewards.

- NFT Marketplace: A platform for buying and selling NFTs.

- Trading Bots: Automated trading systems to enhance your trading strategies.

Both platforms provide you with advanced charting and analysis tools, enhancing the user experience for technical traders.

KuCoin‘s advantage lies in its robotic trading support, which can be decisive for traders looking for automated strategies.

Conversely, OKX emphasizes its derivatives and various financial products, potentially attracting those interested in diversified trading instruments.

The choice ultimately depends on your trading preferences and the importance of a wide range of products and innovative financial instruments.

OKX Vs. Kucoin: Contract Types

When you trade on OKX, you’ll find an array of contract types. This includes inverse perpetual contracts settled in the underlying cryptocurrency (like BTC).

It’s useful as you can hold a position indefinitely without an expiry date.

Linear perpetual agreements are also available and settled in a stablecoin like USDT, making them easier to manage if you prefer calculating in fiat equivalent.

In addition, you can access inverse futures contracts, which work similarly to inverse perpetual contracts but have an expiry date.

OKX offers options contracts, giving you the flexibility to speculate on the price movement of assets with a predetermined expiration date and strike price.

Moreover, there’s a distinction between COIN-M futures and USD-M futures; the former is settled in the cryptocurrency the contract represents, while the latter is settled in stablecoin.

KuCoin follows suit, with similar offerings to complement your trading strategies. The platform also supports inverse perpetual contracts and linear perpetual contracts.

However, the availability and variety of contract types, such as options and futures, may differ, so it’s essential to check the latest offerings from KuCoin.

When comparing these platforms:

- For inverse contracts, pay attention to the asset used for settlement.

- Linear contracts could be preferable if you want to avoid the volatility of the base currency.

- Explore options if you’re looking for contracts with more defined risk parameters.

- Differentiate between COIN-M and USD-M futures to decide the best fit for your settlement preferences.

By understanding these contract types, you can better tailor your trading to your financial goals and the strategies you’re most comfortable with.

OKX Vs. Kucoin: Supported Cryptocurrencies

When selecting a cryptocurrency exchange, it’s vital to consider the breadth of its offerings. OKX and KuCoin provide a wide variety of cryptocurrencies, giving you the flexibility to trade multiple assets.

KuCoin stands out with a robust selection, offering over 750 different cryptocurrencies.

This encompasses a vast spectrum, from well-known coins like Bitcoin and Ethereum to newer and more niche coins that may interest those seeking emerging opportunities.

In contrast, OKX offers a more selective range, with over 350+ cryptocurrencies. While the number is smaller than KuCoin, OKX focuses on a well-curated selection, aiming for quality and prominence in their listings.

In terms of futures trading, the two exchanges also differ:

- KuCoin lists an impressive array of futures contracts. You can find USDT-M and Coin-M futures with options across dozens of trading pairs.

- OKX, on the other hand, might offer fewer future options but is praised for its curated futures trading pairs, which still provide ample trading opportunities.

Table: Most Popular Futures Trading Pairs

| Exchange | Popular Futures Trading Pairs |

|---|---|

| KuCoin | BTC/USDT, ETH/USDT |

| OKX | BTC/USDT, LTC/USDT |

Remember, the availability of specific cryptocurrencies can vary, and it’s always prudent to verify the current listings on each exchange.

Additionally, the diversity of futures and leverage trading offerings can provide different strategic options based on your trading preferences and risk appetite.

OKX Vs. Kucoin: Leverage And Margin Trading

When considering leverage and margin trading on cryptocurrency exchanges like OKX and KuCoin, you’re looking at tools that can enhance your trading power and potential returns, albeit with increased risk.

OKX offers a user-friendly platform with a range of leverage options. They allow you to select the level of leverage you are comfortable with, depending on the trade you’re making.

- Maximum Leverage: Flexible options tailored to each market.

- Margin Requirements: Varies by market, with real-time adjustments based on market liquidity.

- Liquidation Risks: Automatic and manual warnings regarding market conditions.

- Funding Rates: Dynamic and depend on the underlying liquidity of the asset.

On the other hand, KuCoin also supports margin trading, letting you borrow funds to increase your buying power.

- Maximum Leverage: Offers a predetermined maximum leverage level.

- Margin Requirements: A minimum percentage of your position as margin is required to maintain open positions.

- Liquidation Risks: Has a margin call system to notify you of low margin levels before liquidation.

- Funding Rates: Indicative of short-term borrowing costs, which can fluctuate.

As a trader, you should carefully consider the leverage offered by each platform, the margin requirements to hold a position, the risks of liquidation, and the funding rates that can impact the cost of holding leveraged positions.

Always be mindful of the margin and leverage trading risks, as these can amplify losses and gains.

OKX Vs. KuCoin: Trading Volume

When considering the trading volume of OKX and KuCoin, your understanding of market liquidity is crucial. Trading volume effectively influences your trading efficiency and the likelihood of slippage.

OKX:

- Spot Volume: As of the latest data, OKX is commanding in trading volume rankings. OKX’s volume suggests a robust market conducive to high liquidity for derivatives transactions.

- Derivatives Volume: Your derivatives trade executions are facilitated by solid volume, reducing slippage.

Metrics: Volume metrics from sources like CoinMarketCap often feature OKX in the upper echelons.

KuCoin:

- Spot Volume: KuCoin’s spot trading volume is substantial, hosting many pairs and facilitating efficient trading.

- Derivatives Volume: With many derivative products, KuCoin’s derivatives volume also contributes to effective executions.

Rankings and Liquidity Data: Metrics and rankings on platforms like CoinMarketCap reflect KuCoin’s competitiveness in volume.

In sum, these factors should influence your experience with either OKX or KuCoin regarding trading volume. A higher trading volume on any exchange typically leads to better liquidity, which aids in faster order executions and reduces the chances of price slippage. Always refer to the most recent data for an accurate assessment.

OKX Vs Kucoin: Futures Trading Fees And Rewards

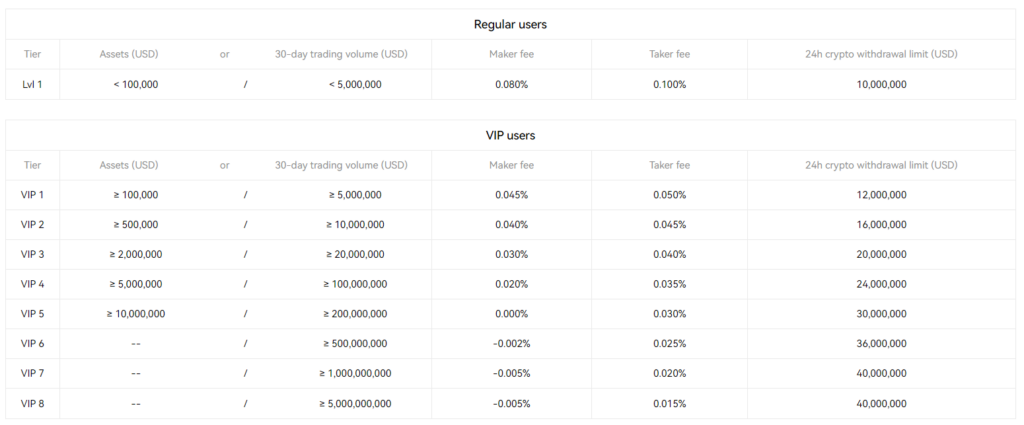

When you engage in futures trading with OKX or KuCoin, it’s essential to understand their respective fee structures and rewards systems. Both exchanges offer competitive fees and incentives that can notably influence your trading profitability.

OKX Futures Trading Fees:

- Maker Fee: 0.02%

- Taker Fee: 0.05%

OKX incentivizes higher trading volumes with reduced fees; your fees can diminish significantly as you climb their VIP tiers.

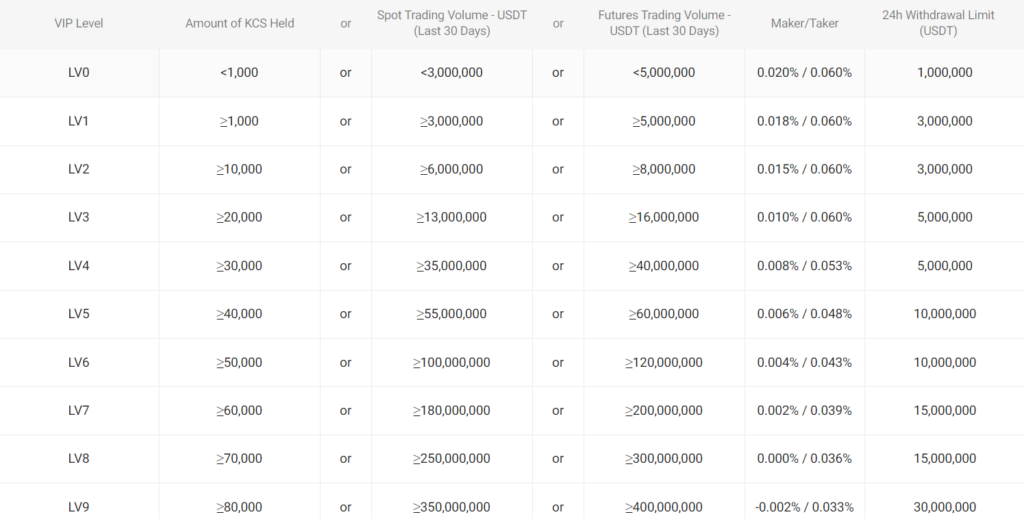

KuCoin Futures Trading Fees:

- Maker Fee: 0.02%

- Taker Fee: 0.06%

Additionally, KuCoin offers a unique reward through its KCS token, which allows for an extra fee discount, enhancing overall trade profitability.

To illustrate:

If you execute a $10,000 futures trade, as a maker, your fee on OKX would be $2 (0.02%), while on KuCoin, it would be the same, assuming no additional discounts. As a taker, you would pay $5 on OKX and $6 on KuCoin.

Rewards and Discounts:

- OKX: Earn rewards through OKB token usage, VIP levels, and regular promotions.

- KuCoin: Save fees by paying with KCS tokens and benefit from volume-based discounts and occasional promotional events.

Beyond trading fees, you must consider the efficiency of deposits and withdrawals, as each platform may offer varying rates.

For instance, withdrawal fees can vary depending on the type and volume of cryptocurrency you intend to transfer.

Both exchanges strive to balance lucrative rewards and a structured fee schedule to cater to different levels of traders, from novices to professionals.

Review each platform’s fee policy in detail to understand how it aligns with your trading behavior and volume.

OKX Vs Kucoin: Deposits & Withdrawal Options

When you explore the variety of deposit and withdrawal options that OKX and KuCoin offer, you’ll notice distinctions that could sway your preference based on convenience, speed, and costs associated with funds transfer.

Deposits:

- OKX:

- Currencies Supported: Primarily cryptocurrency

- Method: No fiat deposits, but you can buy crypto via credit/debit card or third-party payment processors.

- Fees: Purchasing cryptocurrency might incur high fees of up to 6%, varying by currency.

- Processing Time: Generally quick for crypto deposits, dependent on the network.

- KuCoin:

- Currencies Supported: Both fiat and cryptocurrency

- Method: Besides crypto, you can deposit fiat using credit/debit cards.

- Fees: Crypto deposits are free. Fees for purchasing crypto with cards or payment processors are present and can vary.

- Processing Time: Typically fast for crypto deposits; fiat processing times vary depending on the method.

Withdrawals:

- OKX:

- Currencies: Cryptocurrency

- Limits: Vary by verification level, with higher limits for more verified accounts.

- Fees: A variable fee structure based on the type of cryptocurrency being withdrawn.

- Processing Time: This can be fast but varies based on network congestion and the currency.

- KuCoin:

- Currencies: Both fiat and cryptocurrency

- Limits: Similar to OKX, with tier-based limits, more verified accounts enjoy higher limits.

- Fees: Charges on withdrawals apply and are currency-dependent; typically, a fixed amount plus a withdrawal percentage.

- Processing Time: Crypto withdrawals generally are fast, but fiat withdrawals may take longer.

Your choice might depend on whether you prioritize fiat currency options or look to minimize transaction fees and processing times.

Each platform aligns differently regarding these factors, guiding your decision based on your trading needs.

OKX Vs. Kucoin: Native Token Usage

OKX and KuCoin offer their native cryptocurrencies to users, providing a range of benefits within their ecosystems.

OKX Native Token: OKB

- Discount: As an OKB holder, you can receive up to a 20% discount on trading fees.

- Utility: OKB is used within the OKX platform to access special features and rewards.

KuCoin Native Token: KCS (KuCoin Shares)

- Discount: Paying with KCS grants you a 20% discount on trading fees, which can make them lower than those on OKX.

- Earnings: Holding KCS entitles you to a share of the exchange’s profits.

In terms of fee reduction:

| Level | Maker Fee OKX | Taker Fee OKX | Maker Fee KuCoin | Taker Fee KuCoin |

|---|---|---|---|---|

| Level 5 | 0.06% | 0.06% | 0% | 0.07% |

OKX Vs. Kucoin: KYC Requirements & Limits

KYC Requirements

When choosing between OKX and KuCoin, understanding their Know Your Customer (KYC) requirements is essential for compliant and secure trading.

Both platforms operate with tiered KYC frameworks determining your trading, deposit, and withdrawal capacities.

OKX:

- Level 1: Basic personal information. Deposits and trades are allowed; however, withdrawals are limited.

- Level 2: Requires government-issued ID, facial recognition, and additional information. Increases limits substantially.

KuCoin:

- Verification-Unverified: Basic information allows for deposit and trading. Withdrawal limits are tight.

- Verified Account: ID verification with a government-issued document, proof of address, and a photo. This expands your withdrawal and trading limits.

Limits

The KYC tier you choose influences your daily withdrawal limits and trading experience.

On OKX:

- Level 1: You can enjoy limited withdrawal allowances.

- Level 2: Opens up higher limits.

For KuCoin:

- Unverified Users: Expect severe constraints on withdrawals.

- Fully Verified: Unlocks higher thresholds for withdrawals without any cap on trading volume.

However, by adhering to these rules, both exchanges strive to provide you with a secure trading environment.

The exact limits can vary based on policy changes, so checking the latest updates on each exchange’s website is recommended.

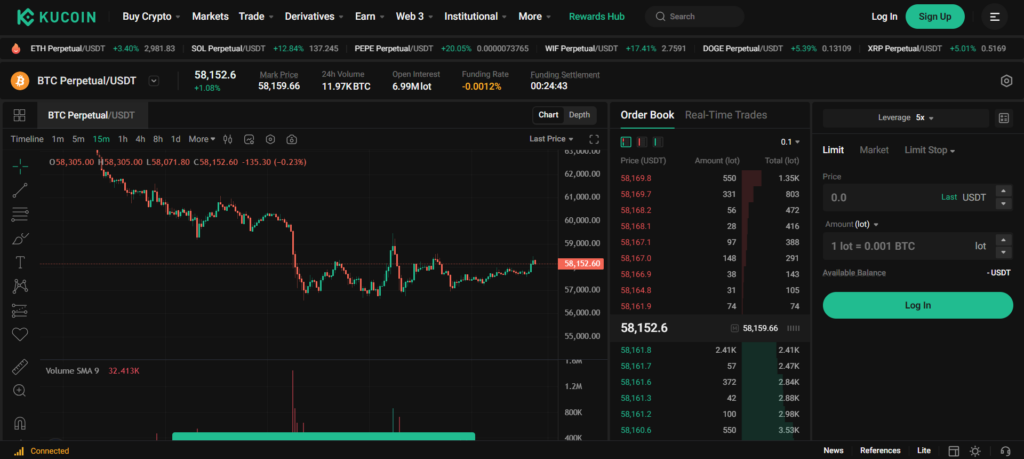

OKX Vs. Kucoin: User Experience

When you navigate the visual landscape of OKX and KuCoin platforms, you’ll notice they feature intuitive interfaces geared towards novice and experienced traders.

OKX offers a user-friendly layout with a dark mode option, which can be easier on the eyes, especially after long periods of use.

OKX Interface:

- Design: Modern and intuitive, with dark mode available

- Navigation: Straightforward, with critical features easily accessible

- Speed: High performance, with quick response times

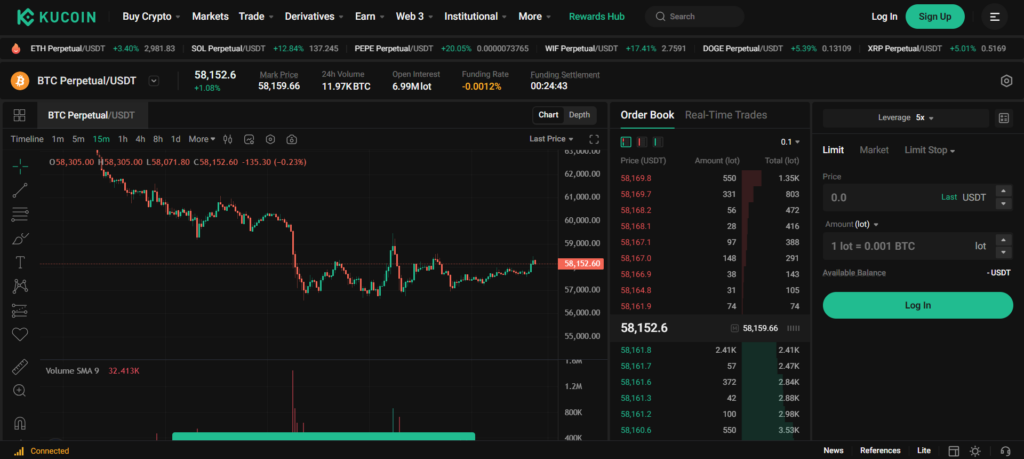

On the other hand, KuCoin’s trading platform supports a broad range of services while maintaining a clean design that helps prevent information overload.

KuCoin Interface:

- Design: Sleek with attention to trader’s workflow

- Navigation: Well-organized, ensuring features are a few clicks away

- Speed: Responsive with minimal latency

Both exchanges have mobile apps that reflect their commitment to providing a seamless trading experience on the go.

Mobile Experience:

| Feature | OKX App | KuCoin App |

|---|---|---|

| Ease of Use | Intuitive UI, user-centric design | User-friendly, precise feature placement |

| Functionality | Full platform capabilities on mobile | Comprehensive trading features |

| Performance | Fast and reliable | Smooth operation, low crash incidence |

In terms of features, each exchange has aimed to streamline the process of spot, margin, and derivatives trading with well-designed interfaces that enhance usability.

You’ll find that both OKX and KuCoin prioritize a flawless trading experience through their matching and trading engines to support the complex needs of traders at all levels.

OKX vs KuCoin: Order Types

When trading on OKX and KuCoin, understanding the range of order types is crucial for effective strategy execution and risk management.

Both exchanges offer a variety of orders to cater to the different needs of traders.

Market Orders: Your most basic order type is the market order. On both platforms, you can execute a trade immediately at the current market price. This impacts rapid entry or exit from the market but does not allow for price control.

Limit Orders: Limit orders let you set a specific price you want to buy or sell. This gives you price control, ensuring you don’t pay more or receive less than your specified price.

Stop Orders: These are essential for managing risk. A stop order triggers a buy or sell action once the asset reaches a defined price. It’s used mainly to limit potential losses.

Conditional Orders: On OKX, you can place conditional orders that only execute when certain conditions are met. This advanced order type is helpful for traders with specific entry and exit strategies.

Post-Only Orders: For those looking to add liquidity to the market, post-only orders ensure your order will not be executed immediately, avoiding taker fees. It’s a favorite among makers for its fee-saving potential.

Reduce-Only Orders: Another risk management tool, reduce-only orders, ensure that an order can only reduce your position, not increase it, protecting you from overextending on a position.

Here’s how you might leverage these orders on each platform:

- Utilize market orders on either platform for quick trades.

- Use limit orders to control the price of your trades.

- Implement stop orders on both exchanges to help protect your positions.

- Place conditional orders on OKX for more complex trading strategies.

- Employ post-only orders to maintain maker status and lower fees.

- Choose reduce-only orders to safeguard from increasing an open position inadvertently.

Each order type serves a distinct purpose, from straightforward market entries to advanced and conditional setups, allowing you to optimize your trading approach.

OKX vs Deribit: Security Measures & Reliability

When assessing the security of OKX and Deribit, you’ll find both exchanges take the safety of their users’ funds and data seriously.

OKX Security Measures:

- Two-Factor Authentication (2FA): An essential feature that OKX provides to bolster account security.

- Anti-Phishing Codes: These codes help verify the authenticity of communication from the exchange.

- Cold Storage: Many digital assets are stored offline to reduce the risk of hacks.

In the past, OKX (formerly known as OKEx) experienced a hack in 2017. Since then, they have enhanced their security protocols to safeguard against similar incidents.

Deribit Security Measures:

- Cold Wallets: Like OKX, Deribit segments most of its funds into cold storage.

- 2FA: They require users to set up two-factor authentication, adding an extra layer of security.

- Real-Time Audits: Continuous monitoring to ensure the integrity of their systems.

Deribit, while not reporting major security breaches, maintains a steady focus on preemptive security measures to mitigate potential threats.

Both platforms continuously update and review security measures in response to evolving cybersecurity challenges. It would be best if you utilized all the security options available on your chosen platform to enhance the safety of your assets.

OKX vs Deribit: Insurance Fund

When comparing insurance funds between OKX and Deribit, you are looking at the safety nets these exchanges have in place to protect your funds.

OKX:

- Insurance Fund: Aimed at protecting you in the event of excessive losses, especially in derivative trading. This fund occurs if a trader’s balance drops below zero and the liquidation process cannot cover the losses.

- Transparency: Historical insurance fund balances are generally published for you to review.

Deribit:

- Insurance Fund: Deribit also maintains an insurance fund to shield your profits and cover negative balances that could occur when a trader gets liquidated at a price worse than their bankruptcy price.

- Fund Utility: Anytime a liquidation occurs, Deribit uses this fund to ensure winning traders receive their expected profits.

- Fund Growth: The insurance fund increases with profitable liquidations to the exchange, providing a straightforward mechanism for fund accrual.

Comparison:

| Feature | OKX Insurance Fund | Deribit Insurance Fund |

|---|---|---|

| Purpose | Covers negative balance from bad trades | Covers profits for winning trades in case of lousy liquidation |

| Transparency | Publishes fund balances | Provides details on how the fund accrues |

Your trading style, risk tolerance, and preference for transparency may influence your decision on which platform’s insurance measures provide you with more confidence.

OKX vs Deribit: Customer Support

When selecting a cryptocurrency exchange, you must consider the quality of customer support. Good support can significantly enhance your trading experience, especially during urgent situations.

OKX Customer Support

- Availability: 24/7 support through live chat, email, and social media channels.

- Responsive: Recognized for prompt responses to inquiries.

Deribit Customer Support

- Options: Offers support via email and live chat.

- Efficiency: Known for an efficient support team that handles issues effectively.

| Feature | OKX | Deribit |

|---|---|---|

| Availability | 24/7 | 24/7 |

| Methods | Live chat, Email, Social Media | Email, Live chat |

| Response Time | Usually quick | Generally efficient |

Remember, your choice should align with your needs for availability, response time, and the preferred platform you are comfortable with. Test both exchanges’ customer support to evaluate their effectiveness before committing to an exchange for your trading activities.

OKX vs Deribit: Regulatory Compliance

When considering the regulatory compliance of OKX and Deribit, you should note that both exchanges operate with different levels of adherence to global regulations.

OKX:

- Licenses & Audits: OKX prides itself on having a robust compliance framework. Being one of the top exchanges, it has a history of engaging with regulatory bodies to ensure that it meets a high standard of compliance.

- Jurisdictions: It offers services in various jurisdictions, making it imperative to abide by the rules set forth by multiple regulatory authorities.

Deribit:

- Licenses & Audits: Focused primarily on derivatives and futures contracts, Deribit is not as widely known for regulatory engagement as OKX, but it still maintains a level of regulatory compliance.

- Jurisdictions: It’s more narrowly focused than OKX, catering to a specific segment of the crypto market.

Both platforms provide tools and implement procedures to help ensure legal and ethical trading practices:

- KYC Procedures: Both implement strict Know Your Customer (KYC) procedures to prevent illicit activities.

- AML Policies: They also have anti-money laundering (AML) policies, vital for operating within the legal framework.

While OKX has a broader regulatory footprint due to its more comprehensive array of services and global presence,

Deribit, though more niche, takes measures to remain compliant within its scope of operation; you need to consider the specific legal requirements in your region when selecting an exchange, as this may impact the services available to you.

Conclusion

Your trading preferences and financial goals are paramount when selecting a cryptocurrency exchange. OKX and KuCoin are reputable and offer extensive services, yet they cater to different user needs.

KuCoin:

- Suited for: Traders who seek competitive trading contests and a gamified experience.

- Fees: Zero maker fees, which can be ideal if you frequently provide liquidity to the market.

- Additional Benefits: A life-long 60% trading fee discount when you sign up through specific promotions.

OKX:

- It is suited for Those looking for robust technical trading tools and a wide array of tokens.

- Fees: Equitable fee structure for makers and takers, with the opportunity to decrease expenses using OKB tokens.

- Security: Heightened security measures, though past incidents like the Twitter account compromise, should be considered.

| Feature | KuCoin | OKX |

|---|---|---|

| Trading Fees | 0% maker fee, 0.07% taker fee | 0.06% maker/taker fee (level 5 users) |

| Promotions | 60% lifetime trading fee discount | Discounts with OKB token usage |

| User Experience | Trading contests, gamified products | Dynamic charts, tools for technical traders |

Your decision should be informed by which aspects of a trading platform are most relevant to your strategy.

Whether it’s the fee structure, trading tools, security history, or specific promotions and token benefits, your choice should align with your trading preferences.

Explore how OKX and KuCoin compare to their competitors:

- Bybit vs KuCoin – An In-Depth Analysis

- KuCoin vs Deribit – An In-Depth Analysis

- KuCoin vs Bitget – An In-Depth Analysis

- KuCoin vs BitMEX – An In-Depth Analysis

- KuCoin vs Binance – An In-Depth Analysis

- KuCoin vs Kraken – An In-Depth Analysis