KuCoin and Binance are two leading cryptocurrency exchanges, each offering a vast array of digital assets and comprehensive trading features.

Both exchanges were established in 2017. KuCoin was co-founded by Michael Gan and Eric Don, while Binance was founded by Changpeng Zhao, also known as CZ.

Binance supports the trading of over 350 cryptocurrency assets, surpassing the amount funded by KuCoin.

However, regarding leverage, Binance provides up to 125x, significantly exceeding Kucoin’s maximum of 10x. This shows that Binance might be more favorable for high-risk margin trading.

| Feature | KuCoin | Binance |

|---|---|---|

| Founded | 2017 | 2017 |

| Founder(s) | Michael Gan and Eric Don | Changpeng Zhao (CZ) |

| Supported Coins | Over 200 | Over 350 |

| Trading Volume | $494 million (24h) | $5 billion (24h) |

| User Interface | Suitable for beginners and advanced users | User-friendly and highly functional |

| Trading Fees | Up to 0.1% discount with KCS | 0.1% discount with BNB |

| Deposit Methods | Crypto, Limited fiat options | Wide range of fiat and crypto options |

| Leverage | Up to 10x | Up to 125x |

| Security | Robust, not as regulated | High, with more regulatory compliance |

| Products/Services | Spot, Futures, Staking, Lending | Spot, Futures, Derivatives, Staking, Loan |

Your selection between KuCoin and Binance could also depend on the fee structure.

Both exchanges offer low fees that can be further reduced using their native tokens, BNB for Binance and KCS for KuCoin. Deposit methods are more varied on Binance, allowing for a wide range of fiat and crypto options.

Binance leads in 24-hour trading volume, indicating higher liquidity and potentially lower spread for trading pairs.

Finally, Binance is known for its better regulatory stance, possibly providing higher security and transparency than KuCoin.

Kucoin Vs. Binance: Products and Services

KuCoin and Binance provide a range of financial services that cater to different investors and traders in the cryptocurrency market.

While Binance has established itself with more extensive offerings, KuCoin has been recognized for its user-friendly platform and competitive fee structure.

Regarding spot trading, both exchanges offer a robust platform; however, Binance boasts a more extensive selection of cryptocurrencies, with over 242 altcoins available compared to KuCoin’s offering of over 800 distinct cryptocurrencies.

The higher trading volume on Binance ensures better liquidity and potentially lower spreads.

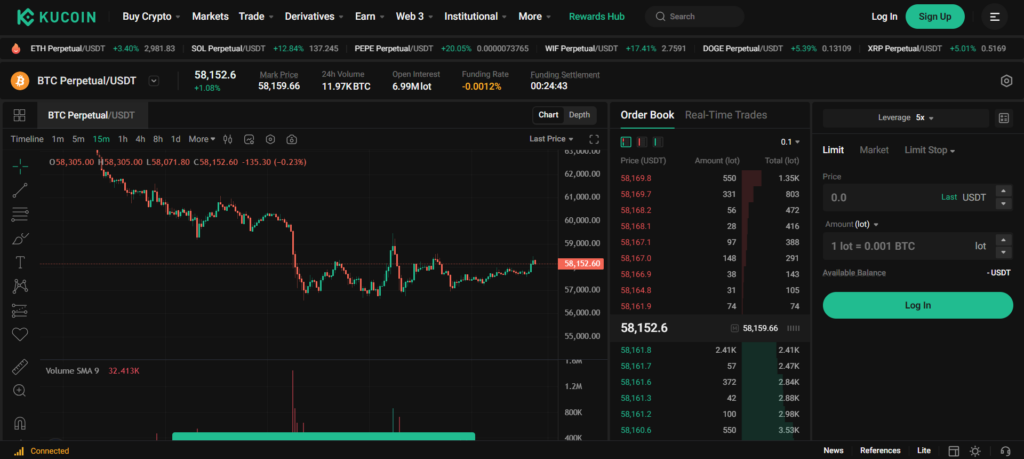

Futures trading is another area where both exchanges excel but with some differences.

Binance provides a comprehensive futures platform with various products like options trading and leveraged tokens.

KuCoin also offers a range of derivative products, making it suitable for more advanced traders looking for margin trading tools.

For enthusiasts interested in NFTs, Binance offers its own NFT marketplace, which may give it an edge over KuCoin for users eager to explore or trade NFTs.

Regarding staking, both platforms support this service, but the rates and available tokens may vary. You’ll find that taking on either platform can be a passive way to earn returns on your holdings.

User Experience

- Binance: Known for its robust platform, Binance tends to be more regulated, which might comfort users who are concerned about security and compliance.

- KuCoin: Often celebrated for its user-friendly interface, it might be the preferred choice for users who prioritize ease of use over an exhaustive list of services.

Kucoin Vs. Binance: Contract Types

When examining contract types, you’ll notice that Binance and KuCoin both provide a range of options catering to various trading strategies and preferences.

- Inverse Perpetual Contracts: You can find inverse perpetual contracts on both exchanges, where the contracts are settled in cryptocurrency rather than fiat currency, which is appealing if you prefer trading directly with your digital assets.

- Linear Perpetual Contracts: Binance offers these contracts, denominated in USDT or other stablecoins, which may simplify your profit and loss calculations as they are tied to a stable value.

- Inverse Futures Contracts: Available on both platforms, these are similar to inverse perpetual contracts but with an expiration date, which may suit your geared short-term trading based on market expiry timelines.

- COIN-M Futures: Binance offers these contracts settled in the cryptocurrency upon which the contract is based, possibly providing a more natural hedge if you hold the base currency.

- USD-M Futures: Only Binance provides these contracts settled in USDT or BUSD, offering convenience if you’re looking to enter and exit positions easily with stablecoin collateral.

- Options: Binance uniquely offers options contracts, giving you the right, but not the obligation, to buy or sell at a predetermined price, which can be a strategic tool for risk management in volatile markets.

| Contract Type | KuCoin | Binance |

|---|---|---|

| Inverse Perpetual | ✅ | ✅ |

| Linear Perpetual | ❌ | ✅ |

| Inverse Futures | ✅ | ✅ |

| COIN-M Futures | ❌ | ✅ |

| USD-M Futures | ❌ | ✅ |

| Options | ❌ | ✅ |

Binance offers various contract types, while KuCoin provides basic options for futures.

Kucoin Vs. Binance: Supported Cryptocurrencies

When comparing KuCoin and Binance, you’ll find that both exchanges have a vast array of supported cryptocurrencies.

Each platform boasts support for over 600 digital currencies, which include significant coins like Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP), as well as a plethora of altcoins.

Futures and Leverage Trading:

Binance:

- It supports a wide range of cryptocurrencies for future trading.

- Popular futures pairs: BTC/USDT, ETH/USDT

KuCoin:

- Offers a selection of cryptocurrencies for futures and leverage trading.

- Popular futures pairs: BTC/USDT, ETH/USDT

Each exchange provides different opportunities concerning futures and leverage trading. You might find a particular platform’s offering aligns better with your trading strategies and preferred pairs.

Spot Trading:

For spot trading, here’s what you can expect from each exchange:

Binance:

- Offers one of the largest selections of cryptocurrencies and trading pairs.

KuCoin:

- They are known for listing smaller-cap altcoins, potentially before they are available on other exchanges.

The breadth of supported cryptocurrencies means you can diversify your portfolio and access well-established and emerging digital assets. It’s essential to regularly check each exchange, as they continuously update their listings and available pairs.

Kucoin Vs. Binance: Leverage and Margin Trading

You can amplify your trading positions beyond your current capital when considering leverage and margin trading. KuCoin and Binance offer these advanced trading tools with specific terms and conditions catering to different types of traders.

Leverage Limits

On Binance, you can access leverage up to 125x for specific trading pairs. This enables you to multiply your potential gains (and losses) beyond your actual investment. KuCoin offers a slightly conservative maximum leverage of 100x.

Margin Requirements

With both exchanges, margin requirements differ based on the leverage used. Higher leverage will entail a lower margin requirement. Here’s a quick comparison:

- Binance: Requires a cross-margin or isolated margin for different leverage levels.

- KuCoin: Allows for cross-margin use with margin requirements similar to Binance.

Liquidation Risks

When you engage in leverage trading, liquidation risk is present if the market moves against your position. Both platforms offer tools and policies to reduce the risk of abrupt liquidation.

- Initial Margin and Maintenance Margin are set to protect from insolvency.

- Automatic Deleveraging systems can kick in during extreme market conditions.

Funding Rates

Both platforms’ funding rates are variable and essential to consider, as they can affect the cost of holding leveraged positions.

- Binance: Offers competitive funding rates influenced by market liquidity.

- KuCoin: Funding rates may be higher than Binance due to lower liquidity.

Remember, while leverage can magnify your positions and potential returns, it’s essential to understand the risks and have strategies to manage them.

Kucoin Vs. Binance: Trading Volume

When assessing KuCoin and Binance, it’s essential to understand their trading volumes because this directly impacts your liquidity, affecting your ability to execute trades quickly and at your desired prices.

Binance:

- 24-hour Trading Volume: $5,273,691,782.44

- Rank by Volume: #1 globally, an indicator of high liquidity

- Effect on Trading: You generally get faster trade execution and narrower spreads, leading to less slippage during high-frequency or high-volume trading.

KuCoin:

- 24-hour Trading Volume: $494,431,638.72

- Rank by Volume: Lower than Binance, indicating less liquidity

- Effect on Trading: Trades might face more slippage and potentially wider spreads, especially for less popular trading pairs.

Data for 24-hour trading volume ranks Binance at the top, according to sources like CoinMarketCap.

The high trading volume on Binance means that you will likely experience efficient trade execution. For active or large-volume traders, Binance’s superior liquidity can be a significant advantage.

In contrast, KuCoin, while still a strong performer, has a lower trading volume.

As a result, you might encounter slightly broader spreads and a potential delay in order execution for certain assets compared to Binance.

Although lower than Binance’s, the trading volume ensures that KuCoin remains competitive for many traders who might prioritize other features over sheer Volume.

Consider how the trading volume fits your trading strategy when evaluating these two exchanges. If maximizing liquidity is paramount for your trades, Binance holds a clear advantage in trading volume and liquidity.

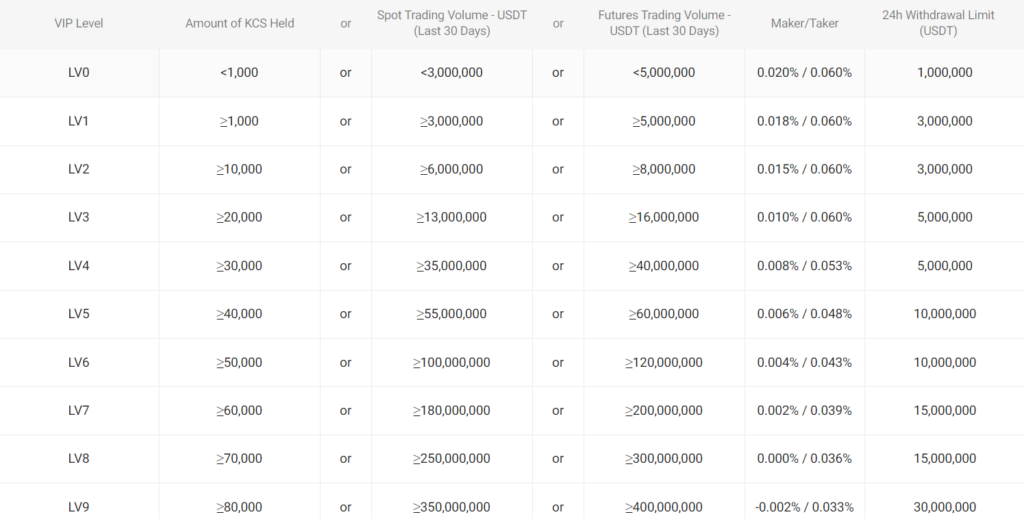

Kucoin Vs Binance: Futures Trading Fees and Rewards

Understanding the fee structure and how it impacts your profitability is crucial when engaging in futures trading.

Binance applies a tiered fee schedule for futures trading based on 30-day trading volume or your balance of BNB, the platform’s native currency.

As a starting point, you’ll encounter a 0.02% maker fee and a 0.04% taker fee.

For example, if you execute a $10,000 futures buy order as a maker, your fee would be $2. Conversely, as a taker, the cost would be $4. These fees decrease as your trading volume or BNB balance increases.

Discounts & Rewards:

- Pay fees with BNB for a 10% discount

- Referral program rewards

Meanwhile, KuCoin offers different fees for its futures trading – 0.02% for makers and 0.06% for takers at the most basic level.

For instance, on a trade worth $10,000, your fee would amount to $2 for making the market or $6 for taking the market. With KCS (KuCoin’s native token), you could potentially lower these costs further.

Discounts & Rewards:

- Fees paid in KCS earn you a discount

- The tiered VIP program offers lower fees

Deposit and Withdrawal Fees:

Binance generally provides free deposits, while withdrawal fees vary by token. KuCoin also offers free deposits, and its withdrawal fees are usually competitive and token-dependent.

| Exchange | Maker Fees | Taker Fees | Deposit Fees | Withdrawal Fees |

|---|---|---|---|---|

| Binance | From 0.02% | From 0.04% | Free | Variable |

| KuCoin | From 0.02% | From 0.06% | Free | Variable |

Note: The fees above are the starting fees and can be reduced based on various factors, including trading volume and the use of native tokens.

Each platform’s VIP levels and native currency holdings influence trading costs—your engagement and investment level will determine the extent of your benefits.

Kucoin Vs Binance: Deposits & Withdrawal Options

When examining the deposit and withdrawal facilities of KuCoin and Binance, it’s essential to scrutinize the diverse tactics you can employ to transfer your funds.

KuCoin:

- Currencies: Primarily supports cryptocurrencies for deposits and withdrawals.

- Payment Methods: Credit cards are accepted through third-party services and cryptocurrency transfers.

- Processing Times: Cryptocurrency deposit times are subject to network speed. Withdrawals are processed promptly after security checks.

- Limits: Varies by cryptocurrency; the platform provides a detailed list of minimum and maximum limits for each coin.

KuCoin’s integration with multiple payment services may involve additional fees, which you should consider when calculating the total cost of the transaction.

Binance:

- Currencies: Accepts both cryptocurrencies and fiat currencies.

- Payment Methods:

- Cryptocurrency transfers

- Credit Card purchases

- Bank Transfer (SEPA, SWIFT)

- Processing Times: These are instant for some methods, while others depend on bank processing times or network congestion for crypto transactions.

- Limits: Minimum and maximum deposit and withdrawal amounts are set based on your account level and chosen currency.

Binance’s more comprehensive range of methods and support for fiat transactions can streamline the process of funding your account or cashing out, potentially offering more flexibility and convenience.

Your choice between KuCoin and Binance may hinge on the preferred currencies and payment methods, especially if you prioritize speedy deposits and withdrawals or if lower transaction fees are a decisive factor for you.

Both exchanges provide detailed guidance on the minima and maxima, which you should review based on your trading needs.

Kucoin Vs. Binance: Native Token Usage

KuCoin and Binance feature native tokens, which play integral roles on their platforms.

KuCoin Token (KCS) is the native cryptocurrency of KuCoin. As a holder of KCS, you can benefit from reduced trading fees, a feature that incentivizes your participation and investment on the platform.

Additionally, holding higher amounts of KCS can lead to more significant fee reductions, with the incentive structure aligned with your 30-day trading volume.

Binance Coin (BNB), on the other hand, serves as the cornerstone of the Binance ecosystem.

Using BNB to pay for trading fees can earn you a discount, fostering a lower cost of transactions on Binance.

Like KuCoin, BNB holders benefit from a tiered fee structure; more BNB means more savings on trade costs.

| Platform | Native Token | Trading Fee Discount |

|---|---|---|

| KuCoin | KCS | Yes (up to 20% with additional discounts for high KCS balance and trading volume) |

| Binance | BNB | Yes (discounts vary based on trading volume and BNB holdings) |

Besides trading fee concessions, both platforms allow their native tokens to serve other utilities.

Your KCS can be used in KuCoin’s various crypto services, while BNB’s applications extend within and outside the Binance ecosystem due to its broad adoption.

KCS and BNB provide more than just ownership in their respective exchanges. Their primary attraction lies in your ability to reduce trading fees alongside other utilities, which enhances your trading experience.

Kucoin Vs Binance: KYC Requirements & KYC Limits

When choosing between KuCoin and Binance, understanding their KYC requirements is vital to assessing privacy, security, and accessibility implications.

KuCoin:

- Verification Levels: Different tiers; primary verification enlarges withdrawal limits.

- Documents: For higher tiers, a government-issued ID, selfie, and proof of address are required.

- KYC Limits: Without KYC, you have a withdrawal limit of 2 BTC per 24 hours. Verified status considerably increases this limit.

Binance:

- Verification Levels: It also offers tiered verification, affecting transaction limits.

- Documents: A government-issued ID and additional address verification are required for higher tiers.

- KYC Limits: Non-verified users have a 2 BTC withdrawal limit per day. Complete verification significantly raises these limits, allowing higher volume trading and withdrawals.

Binance tends to be more stringent for your privacy, requiring detailed personal information for higher limits, contributing to heightened security measures.

KuCoin offers more flexibility for initial tiers, which may appeal to your preference for privacy. However, with flexibility, you may encounter increased risks or limitations in the services available.

As your verification level increases, both platforms improve the security of your transactions, but they require more personal information.

This exchange of privacy for accessibility is typical in the security-conscious environment of cryptocurrency exchanges.

The higher your verification level on both KuCoin and Binance, the more accessibility you have to higher deposit and withdrawal limits and broader trading capabilities.

Kucoin Vs. Binance: User Experience

When you explore KuCoin and Binance, you’ll notice distinct differences and similarities in their user experience (UX).

Both platforms have been designed with the trader in mind, offering a range of features accessible through both web interfaces and mobile app experiences.

KuCoin

- Web Interface: KuCoin’s platform is often commended for its clean and intuitive design. The dashboard is user-friendly, and you can quickly find crucial features such as markets, exchanges, and assets.

- Mobile App: KuCoin’s mobile app mirrors the simplicity of its web counterpart, ensuring a seamless transition between devices. The app is responsive, and the tools for trading are readily accessible.

- Features: Features like built-in trading charts, indicators, and security measures are easily navigable. However, some users may find advanced features less accessible than those on Binance.

Binance

- Web Interface: Binance’s web presence is robust, with a comprehensive range of tools and information. It may have a steeper learning curve due to the abundance of features, which can appear overwhelming to new users.

- Mobile App: On mobile, Binance maintains high functionality, offering nearly all features found on the website. The app is optimized for speed, making trading on the go convenient.

- Features: Binance provides many advanced trading options and tools, which are well-integrated into the interface, though they can be complex for newcomers.

Both KuCoin and Binance provide live customer support and help centers, which are crucial for troubleshooting and enhancing your overall trading experience.

When you decide between KuCoin and Binance, consider your comfort with complexity and the need for a vast array of tools versus a straightforward, streamlined trading experience.

KuCoin vs Binance: Order Types

When trading on KuCoin and Binance, you can access various order types that enhance your trading experience by enabling diverse strategies and risk management techniques.

KuCoin Order Types:

- Market Orders allow you to buy or sell instantly at the best available current price.

- Limit Orders: Place a trade at a specific price or better; you control the price at which your order is executed.

- Stop Orders (Stop-Loss/Take-Profit): Set an order to be triggered when the asset reaches a predefined price.

- Conditional Orders: Execute an order based on predefined triggers that you set.

- Post-Only Orders: Ensure your order is added to the order book and not immediately matched, beneficial for market makers.

Binance Order Types:

- Market Orders: Instantly filled at the current market price.

- Limit Orders: Same as KuCoin, allowing precise control over the execution price.

- Stop-Loss/Take-Profit Orders: Used to limit losses and secure profits by executing trades at your predetermined prices.

- OCO (One-Cancels-the-Other): Submit two orders simultaneously; if one is executed, the other is canceled, which helps establish profit and stop-loss levels.

- Post-Only Orders and Reduce-Only Orders: Ideal for market makers, ensuring the order adds liquidity and doesn’t immediately take liquidity.

Both platforms provide these essential tools to execute your trading strategies efficiently.

Whether your approach is aggressive or conservative, the diversification in order types on both KuCoin and Binance gives you the flexibility to trade according to your individual risk tolerance and market assessment.

Remember, properly using these orders can be critical in achieving your trading objectives.

KuCoin vs Binance: Security Measures & Reliability

When evaluating the security of cryptocurrency exchanges like KuCoin and Binance, there are a few key aspects to consider.

Each platform implements various security measures to protect your funds and personal information.

Binance: Binance has a strong reputation for security, leveraging a multi-tier and multi-cluster system architecture. They offer:

- Two-Factor Authentication (2FA): Bolsters account security.

- Device Management: Reviews devices authorized to access your account.

- Advanced Verification: Ensures that your identity is protected.

Binance has survived several cyber attacks, and in a significant 2019 security breach, hackers stole 7,000 Bitcoin. Binance covered all losses using its “Secure Asset Fund for Users” (SAFU), reinforcing its commitment to user security.

KuCoin: Similarly, KuCoin places a high priority on safeguarding your assets with:

- Encryption Technology: Protects sensitive data.

- Multilayer Security: Offers several layers of protection.

- Dynamic Multifactor Authentication: Enhances login security.

In 2020, KuCoin suffered a hacking incident that affected approximately $280 million. However, they quickly addressed the breach, with the CEO affirming that the insurance fund covered the losses.

Security Incidents Resolutions:

| Exchange | Incident Year | Resolution |

|---|---|---|

| Binance | 2019 | SAFU covered losses |

| KuCoin | 2020 | Insurance fund covered losses |

Both Binance and KuCoin have demonstrated a capacity to resolve security issues effectively.

They continue to evolve their security protocols in response to emerging threats, ensuring that serious security measures and a commitment to reliability back your experience with either platform.

KuCoin vs Binance: Insurance Fund

When trading on cryptocurrency exchanges like KuCoin and Binance, your assets may be exposed to unforeseen risks.

These platforms have established insurance funds to protect users against potential losses, primarily from trading activities.

KuCoin: The exchange has set up the KuCoin Safeguard Insur for protattprotectingunds. This fund is in place to cover losses in extreme cases where market conditions are highly volatile or in the event of a security breach.

- Security Breach Protection: In such an event, the insurance fund can provide a safety net.

- Volatility Protection: During times of extreme market volatility, the fund can defray some of the losses.

Binance: Binance’s Secure Asset Fund for Users (SAFU) is an emergency insurance fund. Initiated in July 2018, SAFU is financed by setting aside a portion of trading fees to ensure protection for your assets.

- User Protection: SAFU covers losses due to various incidents, including security breaches.

- Funded by Fees: A fraction of trading fees contribute to the fund periodically to safeguard users’ interests.

Both funds are designed to enhance your trading experience by providing an extra layer of security. As a user, you must understand how these funds operate and what they cover.

By doing so, your decision on whether to trade with KuCoin or Binance could be better informed.

Always review the terms and conditions of the insurance fund for each platform, ensuring your trading aligns with the safety protocols outlined by the respective exchange.

KuCoin vs. Binance: Customer Support

When choosing a cryptocurrency exchange, you consider various factors, including customer support quality, as they dramatically impact your trading experience.

KuCoin Customer Support:

- Live Chat: KuCoin offers 24/7 live chat support to address issues promptly.

- Response Time: Generally fast, which is convenient for urgent inquiries.

- Channels Available: Additional support through a 24-hour Telegram group.

Binance Customer Support:

- Guides and Learning Center: You can access extensive written material to help you self-serve.

- Response Time: Support tickets might involve a longer wait but are detailed.

- Language Accessibility: Fewer issues with language barriers, aiding global users.

KuCoin and Binance both emphasize customer service to enhance your experience on their platforms.

Your choice may depend on whether you prefer the immediacy of live support or the comprehensiveness of educational resources.

Use this information to weigh which type of support aligns with your needs as a cryptocurrency trader.

KuCoin vs Binance: Regulatory Compliance

As you explore the cryptocurrency exchange landscape, it is imperative to assess the regulation compliance status of the platforms you choose to use.

Binance and KuCoin, two heavyweights in the exchange arena, have distinct regulatory track records.

Binance operates with a notable focus on regulatory compliance. With its extensive user base, Binance has established localized entities to align with specific jurisdictional regulations.

Licenses granted to Binance entities and their investments in compliance infrastructure reflect their commitment to legal standards.

Despite its efforts, Binance has encountered regulatory scrutiny in several countries, which has influenced it to improve its compliance protocols continuously.

In contrast, KuCoin maintains a diverse global service, but it has faced challenges regarding its regulatory status.

Over time, KuCoin has been working towards enhancing its compliance, particularly by actively engaging with regulatory bodies to address legal adherence concerns.

The absence of significant security breaches on the platform demonstrates KuCoin’s investment in safeguarding user interests that are compliant with industry standards.

| Factor | Binance | KuCoin |

|---|---|---|

| Licenses and Certifications | We have obtained licenses in various jurisdictions, reflecting its global regulatory compliance efforts. | Working towards bettering compliance; few publicly known licenses. |

| Regulatory Challenges | Faced and actively addressing regulatory scrutiny in multiple countries, reinforcing its adaptability to legal frameworks. | Continues to engage with regulatory bodies to overcome compliance issues. |

Both platforms continue to adjust to the evolving landscape of cryptocurrency regulation.

While Binance has situated itself as a more regulated entity, KuCoin is progressing toward achieving better regulatory clarity.

As a user, your preference might align with a platform demonstrating a robust regulatory standing or striving for heightened compliance.

Conclusion

When selecting KuCoin and Binance, your decision should hinge on your trading preferences and requirements.

Binance: As the exchange with a higher trading volume, Binance provides robust liquidity.

This means more efficient trade execution without significant price discrepancies.

Binance is well-suited if you are an investor or trader seeking a broad selection of cryptocurrencies and high liquidity but are prepared to navigate a more complex interface.

KuCoin: If you prioritize lower fees, KuCoin may be more attractive to you. Its competitive trading fees can reduce costs, especially if you trade frequently or in large volumes.

In addition, if you hold or are willing to hold KuCoin’s native KCS token, you can benefit from further reductions in fees.

| Feature | Binance | KuCoin |

|---|---|---|

| Trading Volume | Very High | Lower |

| Fees | 0.10% (spot), 0.018%-0.045% (futures) | Up to 0.1%, as low as 0.05% |

| Liquidity | High | Moderate |

| User Interface | Complex | User-centric |

Your choice should reflect your trading volume, preferred fee structure, and comfort with complexity versus a user-centric interface.

The crypto landscape is dynamic, so both Binance and KuCoin continue to evolve to serve you better.

Explore how KuCoin and Binance compare to their competitors:

- KuCoin vs Bybit: In-Depth Trading Platform Analysis

- KuCoin vs BingX: In-Depth Trading Platform Analysis

- KuCoin vs BitMEX: In-Depth Trading Platform Analysis

- Binance vs Bybit: In-Depth Trading Platform Analysis

- Binance vs BingX: In-Depth Trading Platform Analysis

- Binance vs Phemex: In-Depth Trading Platform Analysis