Bybit and Phemex: these platforms have risen to prominence in the industry by offering user-friendly services tailored to novice and seasoned traders.

This comparison will illuminate the distinct features, fees, and services that distinguish each exchange, helping you determine which platform aligns with your trading requirements.

Bybit and Phemex boast competitive fees and robust security measures, making this comparison essential to discerning the most suitable exchange for crypto trading endeavors.

Both exchanges have established themselves by focusing on user experience, trading options, and security measures, yet they cater to different preferences and trading styles.

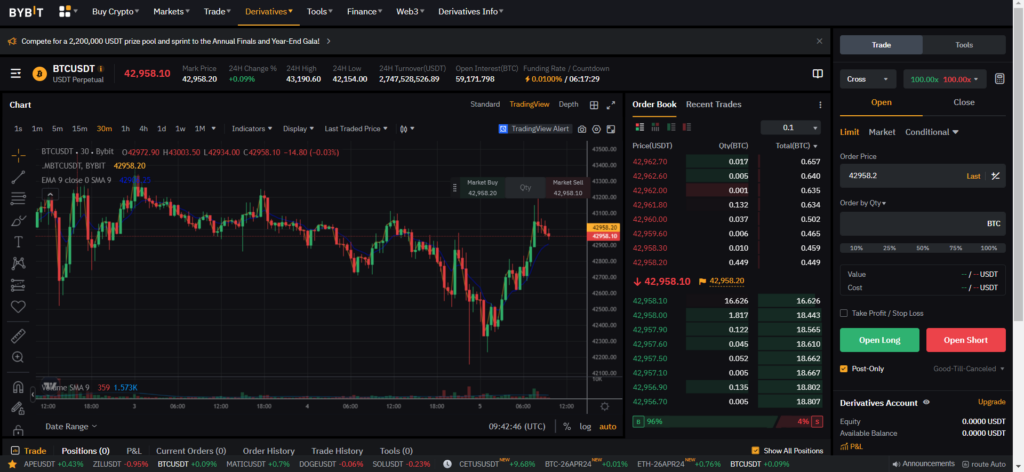

Bybit, established in 2018, has quickly become one of the leading exchanges in the derivatives space, with substantial trading volumes that enable high liquidity. The platform offers advanced trading tools and continues to capture traders’ attention through features such as perpetual contracts and high-leverage options.

Phemex, on the other hand, stands out for providing a broad assortment of trading pairs and prides itself on its speed and flexibility. Since its inception in late 2019, Phemex has been keen on enhancing the user experience with a focus on security and trading efficiency.

Here’s a concise table to help you quickly understand the strengths and differences between Bybit and Phemex:

| Feature | Bybit | Phemex |

|---|---|---|

| Founded | 2018 | 2019 |

| Trading Volume | Exceeds $10 billion (24h) | Lower than Bybit; ranks around 20th |

| Leverage | Up to 100x for specific contracts | Offers similar leverage options |

| Fees | Low trading fees varies by contract | Competitive fees may differ per contract |

| KYC Requirements | It is optional but provides higher withdrawal limits without KYC | Optional but may enhance features |

| Contract Options | Multiple, including inverse and linear futures | Includes perpetual contracts and others |

| Liquidity | High liquidity, especially in popular pairs | Solid liquidity, generally below Bybit |

| Margin Trading | Supported with various margin types | Supported with cross and isolated margins |

| Security | Robust security measures | Comparable high standards of security |

Both Bybit and Phemex allow for a degree of anonymous trading, giving you the option to trade without completing KYC procedures, although restrictions apply.

Liquidity is crucial for your trading success, and here, Bybit generally takes the lead, offering a more liquid market, which can be especially beneficial if you’re trading larger volumes or during periods of high volatility.

As your trading needs grow, the platform’s security becomes more crucial.

Each exchange ensures a high-security standard to protect your assets, employing various strategies like cold wallet storage and multi-signature systems.

Remember that fees are an essential consideration, and while both platforms strive to keep them low, it’s vital to assess them about the trading contracts you intend to use to ensure cost-effectiveness.

When choosing the right platform for your trading activities, consider how these features align with your trading strategies and goals.

Bybit vs Phemex: Products and Services

When you compare Bybit and Phemex, both exchanges offer a range of products that cater to various crypto trading needs.

Bybit:

- Spot Trading: Access to cryptocurrencies, including major ones like BTC and ETH.

- Derivatives: Bybit specializes in derivatives such as inverse futures and perpetual contracts.

- Leveraged Tokens: Offers an opportunity to trade with higher risk and potentially higher rewards.

- NFT Marketplace: Bybit includes a marketplace for non-fungible tokens, expanding your trading portfolio.

Phemex:

- Spot Trading: Similar to Bybit, Phemex provides several spot trading pairs.

- Futures: Offers contract trading, with a focus on BTC and ETH.

- Leveraged Tokens: These are not as prominent as on Bybit, but they are still available for traders seeking leveraged exposure without managing margin.

- Staking: A distinctive service where you can stake certain assets for rewards.

| Service | Bybit | Phemex |

|---|---|---|

| Spot Trading | Extensive range | Extensive range |

| Futures | Inverse and perpetual | Standard futures |

| Leveraged Tokens | Available | Available, less variety |

| NFT Marketplace | Offered diverse options | Not available |

| Staking/Lending | Not prominently featured | Staking available, lending not clear |

You will find that Bybit generally boasts higher liquidity and trading volume, which can be a significant advantage for trading efficiency and order execution.

Phemex, although smaller in trading volume, focuses on an intuitive user experience and has competitive offerings like staking that may appeal if you seek such features.

Bybit vs. Phemex: Contract Types

Contract types are a crucial factor when selecting a derivatives exchange for trading. Both Bybit and Phemex offer a range of contracts tailored to different trading strategies.

Bybit provides a comprehensive suite of contracts:

- Inverse Perpetual Contracts: You can trade cryptocurrencies with others as collateral. Prices are quoted in cryptocurrency rather than fiat, which might be beneficial if you prefer managing your investments directly in digital assets.

- Linear Perpetual Contracts: Quoted and settled in USDT, these contracts are more accessible if you think in fiat terms and wish to avoid the complexities of the underlying crypto asset pricing.

- Inverse Futures Contracts: Like inverse perpetual, these are settled in the underlying cryptocurrency with a set expiration date.

- Options: Currently, Bybit’s options are relatively new to the platform and cater to traders looking for a more advanced, strategic form of trading.

Phemex, on the other hand, has geared its offerings to cater to a broad user base:

- USD-M Futures: These are US Dollar-margined futures contracts. Like traditional futures markets, you can trade with a fixed expiration date.

- COIN-M Futures: Margined and settled in the coin itself, giving you direct exposure to the underlying cryptocurrency’s price fluctuations.

- Perpetual Contracts: USD-M and COIN-M perpetual contracts are available, providing flexibility without expiration.

Both exchanges aim to meet the needs of diverse traders through these offerings.

Consider the type of collateral you are comfortable with, the settlement currency you prefer, and whether you want the option to hold a contract to expiration.

These preferences will guide you in choosing between USD-margined and crypto-margined contracts and between futures with set expirations and perpetual agreements.

Bybit vs Phemex: Leverage and Margin

When considering leverage in cryptocurrency exchanges, Bybit and Phemex offer you the ability to control a more prominent position with a smaller amount of your capital. This tool is crucial for traders looking to amplify their potential returns, though it also increases risk.

On Phemex, you can access leverage of up to 100x on certain products, meaning you can multiply your exposure to market changes a hundredfold. Bybit similarly provides up to 100x leverage, allowing for significant position enhancement.

Regarding margin trading, both exchanges operate with a margin system that requires you to commit a fraction of your total position size.

This margin is collateral and undergoes adjustments based on market conditions and the leverage size. Bybit facilitates margin trading with digital assets like USDT, while Phemex also supports various cryptocurrencies for margin.

Funding rates are critical as they reflect the cost of holding leveraged positions. These rates can vary between the exchanges, impacting your net cost as a trader.

- Bybit: The funding rates change based on the market and are exchanged between long and short positions, thereby keeping the exchange risk-neutral.

- Phemex: Charges a funding rate to ensure the last traded price is anchored to the global spot price, which is typical for such platforms.

It’s essential to be aware of the liquidation risk when trading on margin.

If the market moves against your position by a certain percentage, your trades will be liquidated, which means your initial margin is forfeited to prevent further losses.

Bybit and Phemex have mechanisms such as ‘Partial Liquidation’ and ‘Auto-Deleveraging’ to mitigate this risk, but you must understand these features fully to trade responsibly.

Bybit vs Phemex: Liquidity and Volume

When evaluating crypto trading platforms, liquidity and volume are crucial metrics determining how quickly and efficiently you can execute trades.

Bybit is often recognized for having high liquidity and volume, ranking as the third-largest crypto derivatives exchange in daily trading volume. This robust liquidity minimizes slippage during trading, ensuring you can buy and sell assets close to the market price.

On the other hand, Phemex has seen a fluctuation in its position but remains among the significant names within the market.

Despite being ranked 20th in daily trading volume, Phemex provides a stable trading environment, reflected in the platform’s ability to maintain order book depth.

Depth in the order book is vital, implying you’re less likely to face significant price changes for large-volume trades.

Here’s a quick breakdown:

- Bybit:

- Rank: 3rd in daily trading volume

- Advantages: Higher liquidity often ensures tighter spreads and larger order sizes without significant price impacts.

- Phemex:

- Rank: 20th in daily trading volume

- Advantages: Offers a competent level of liquidity that can suit most traders’ needs.

The data on liquidity and volume come from financial metrics and rankings provided by sources like CoinMarketCap.

For you as a trader, high liquidity markets like those on Bybit can present more favorable conditions for trading, leading to potentially better prices and faster order execution.

Conversely, lower volume on exchanges like Phemex may mean more price movement from trades and more opportunities for price arbitrage.

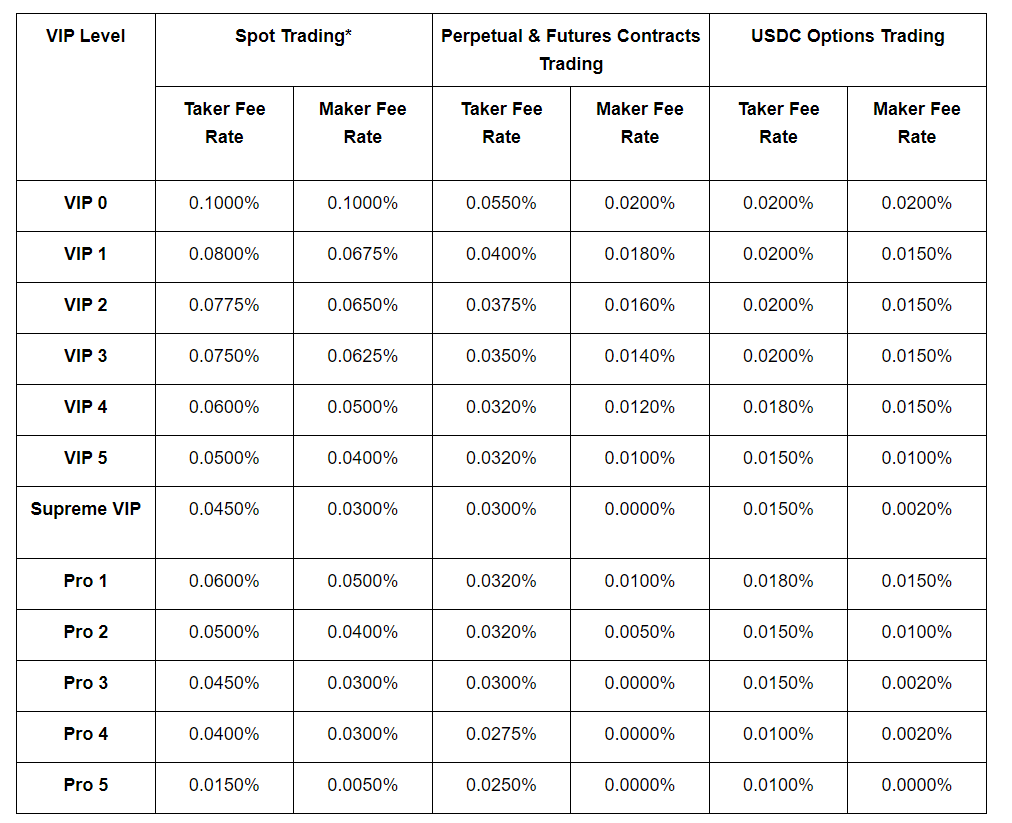

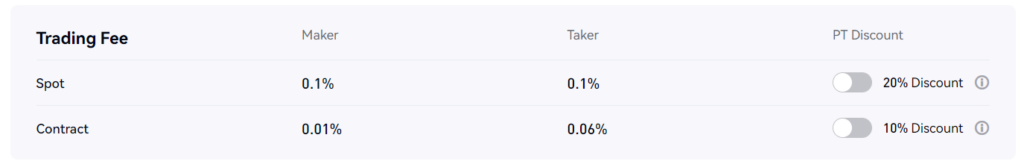

Bybit vs Phemex: Fees and Rewards

When trading cryptocurrencies, understanding the intricacies of fee structures and reward systems is crucial for maximizing profits.

Bybit and Phemex offer competitive fees and rewards that can significantly influence your trading strategy.

Trading Fee & Deposit/Withdrawal Fee Compared

Bybit Fees:

- Trading Fees:

- Maker Fee: 0.025%

- Taker Fee: 0.075%

- Deposit Fees: Free

- Withdrawal Fees: Variable. Dependent on the blockchain network load at the time of withdrawal.

Phemex Fees:

- Trading Fees:

- Maker Fee: 0.025%

- Taker Fee: 0.075%

- Deposit Fees: Free

- Withdrawal Fees: Fixed. Specific to the crypto being withdrawn.

Both exchanges use a maker-taker model to incentivize liquidity on their platforms.

If you place a limit order that adds liquidity to the market (a maker), you’ll be charged a lower fee than a market order (taker), which takes liquidity away.

Reducing trading fees can be vital in enhancing your profitability, especially if you are a frequent trader.

For illustration, on a trade worth $10,000:

- As a maker, you would pay $2.50 for Bybit and Phemex.

- As a taker, the fee would be $7.50 on both platforms.

When you’re withdrawing crypto, Bybit’s fees will vary, typically aligned with the network’s current congestion.

Phemex, however, sets a fixed withdrawal fee for each cryptocurrency, giving you a predictable cost whenever you decide to move your funds external to the exchange.

Trading fee discounts and bonuses may be available for high-volume traders or during promotional periods. B

other exchanges implement a tiered fee structure, where your fees can diminish as your trading volume increases, offering an advantage to active users.

Bybit vs Phemex: Deposits & Withdrawal Options

When considering Bybit and Phemex, it’s essential to understand their respective deposit and withdrawal options. This information is crucial for efficiently managing your funds.

Bybit offers a range of cryptocurrencies for deposit and withdrawal, including popular options like Bitcoin (BTC) and Ethereum (ETH). You can transfer funds to and from your account using:

- Cryptocurrencies

- Fiat (via third-party processors)

For fiat deposits, you might use:

- Bank transfers (ACH)

- Debit cards

- Credit cards

Crypto deposits are typically processed quickly, dependent on network conditions.

Depending on the payment method or bank policies, Fiat transactions may take longer. Minimum and maximum limits are applied but can fluctuate due to market conditions.

Phemex, in contrast, supports numerous cryptocurrencies but emphasizes that it doesn’t directly handle fiat transactions. Instead, it employs third-party services to facilitate:

- Bank account transfers

- Debit card usage

- Credit card transactions

The speed of deposits and withdrawals in Phemex can be similar to Bybit’s, heavily depending on crypto network congestion.

While Phemex doesn’t handle fiat, the third-party services may accept USD among other currencies, yet processing times may vary.

Bybit vs Phemex: KYC Requirements & KYC Limits

When trading on cryptocurrency exchanges like Bybit and Phemex, knowing the KYC (Know Your Customer) requirements and limits is crucial.

Bybit:

- Verification Levels: Bybit has tiers of verification levels, where providing more information elevates your trading capabilities.

- Documents Required: To complete the KYC process, you’ll typically need a government-issued ID, proof of address, and, in some cases, a selfie with the date and Bybit’s name.

- Limits: Without completing KYC, you can still trade, but your withdrawal limits will be lower. Complete verification increases these limits.

Phemex:

- Verification Levels: Phemex also implements a tiered verification system, which affects your daily withdrawal limits.

- Documents Required: You’re asked for documents similar to those from Bybit, which include a photo ID and proof of residence.

- Limits: Initial trading and withdrawal can be done without completing KYC, but your limits will be significantly less than those of a fully verified account.

Both platforms comply with Anti-Money Laundering (AML) regulations, and while verification increases your limits, it also reduces anonymity.

Access to advanced trading features on Bybit and Phemex hinges on your KYC level.

Unverified users have access to basic trading options, while verified users benefit from higher withdrawal and deposit thresholds and become eligible for additional services.

Bybit vs. Phemex: Order Types

When trading on Bybit and Phemex, the variety of order types at your disposal allows for a flexible approach to the market. On both platforms, you can utilize several common order types:

- Market Orders: You order to buy or sell immediately at the best available current market price. Market orders prioritize speed over price control, which is suitable for when you need to enter or exit the market quickly.

- Limit Orders: These orders allow you to set a specific price you want to buy or sell. Limit orders provide you with price control, but there’s no guarantee the order will be filled if the market doesn’t reach your specified price.

- Stop Orders: A stop order, also known as a stop-loss order, is designed to limit potential losses. It will execute as a market order once the price reaches a predetermined level.

Bybit and Phemex both offer additional order types that cater to advanced trading strategies and better risk management:

- Conditional Orders: Conditional orders on Bybit are executed when specific criteria are met, combining elements of stop and limit orders. Phemex offers similar functionality, helping you manage positions based on changing market conditions.

- Post-Only Orders: As a trader looking to pay lower fees on maker trades, you can use post-only orders. These orders ensure you add liquidity to the market by being added to the order book instead of being filled immediately.

- Reduce-Only Orders: These orders are crucial for risk management. They reduce your position and prevent new positions from being accidentally opened.

Both Bybit and Phemex offer these order types, but each platform might have unique features or slight variations in how these orders are implemented.

Bybit vs Phemex: Security and Reliability

Protecting your funds and personal data should be paramount when choosing a cryptocurrency exchange. Bybit and Phemex employ a robust security framework to safeguard user assets.

Bybit operationalizes security through a multi-tier and multi-cluster system. It supports two-factor authentication (2FA), an essential feature for account security, adding an extra layer of defense against unauthorized access.

Bybit’s platform emphasizes using cold wallets to store most users’ funds, significantly reducing the risk of hacking.

Phemex also prioritizes security measures, incorporating not only 2FA but also advanced monitoring systems to detect and neutralize threats.

Like Bybit, Phemex maintains a highly secure offline storage system for assets, demonstrating a commitment to preserving your investment against online threats.

Bybit Security Features:

- 2FA: Extra layer of security

- Cold Wallets: Majority of funds stored offline

- System Architecture: Multi-tier and multi-cluster

Phemex Security Features:

- 2FA: For enhanced account security

- Advanced Monitoring: Real-time threat detection

- Cold Wallets: Offline asset storage

While no significant security breaches have been reported recently for either exchange, both have shown a proactive approach to risk management. Each platform has procedures in place to swiftly resolve any issues, indicating a high level of reliability.

In terms of regulatory compliance, Bybit has been proactive in adhering to international standards, which instills confidence in its operations.

Phemex, while also following regulatory measures, has occasionally faced scrutiny but continues to adjust its framework to align with global compliance requirements.

Both exchanges offer customer support, with Bybit and Phemex providing resources to assist you in case of inquiries or disputes, ensuring you have a reliable channel to resolve any concerns.

In assessing reliability, it becomes evident that both Bybit and Phemex have established solid grounds to earn your trust as reliable platforms, each with stringent security measures and a commitment to fostering a secure trading environment.

Bybit vs Phemex: User Experience

When considering the differences between Bybit and Phemex regarding user experience, it’s essential to focus on several aspects, such as interface, trading experience, customer support, and mobile app functionalities.

Interface:

Bybit has a reputation for a clean and intuitive interface. It is designed to be user-friendly, enabling both novice and experienced traders to navigate the platform with ease.

With its responsive design, you can find necessary functions quickly and execute trades without unnecessary complexity.

Phemex, on the other hand, offers a streamlined interface that caters to traders of all levels. The platform’s structure is made to provide quick access to trading tools and account settings.

Trading Experience:

Bybit’s platform is praised for its quick trade execution speeds, reducing the likelihood of slippage. The platform offers advanced trading features and tools that can benefit analytical trade planning.

Phemex provides a similar level of performance with competitive trade execution speeds and a stable environment during high-volatility periods. Both platforms are appreciated for their real-time data and customizable charts.

Customer Support:

Bybit:

- 24/7 live chat support

- Extensive help center

Phemex:

- Multiple support channels

- Offers educational resources

Both platforms are recognized for their robust customer support systems.

Mobile App:

The mobile apps for both Bybit and Phemex are comprehensive, mirroring the functionality of their web counterparts.

You can manage trades, check your portfolio, and access customer service directly from the app. Users report that both mobile applications provide a seamless trading experience.

When choosing between Bybit and Phemex, consider your preferences for interface aesthetics, specific trading tools, and the importance of customer service responsiveness.

Both platforms are well-equipped, but your choice may hinge on which user experience aligns best with your trading style.

Bybit vs Phemex: Regulation and Compliance

When evaluating Bybit and Phemex, it’s paramount that you consider their approaches to regulation and compliance, as this ensures your assets are managed on platforms that respect legal and ethical standards.

Both platforms operate primarily in the cryptocurrency derivatives space, which has legal complexities.

Bybit is known for its international user base and has taken steps to comply with global regulatory standards.

However, the specific licenses and certifications may not be as transparently communicated to its users or publicly disclosed.

Given the often-changing landscape of crypto regulations, you need to verify Bybit’s compliance with the rules of your jurisdiction.

On the other hand, Phemex has made efforts to adhere to regulatory standards, though the details of their compliance may also vary.

As with Bybit, continuous updates and changes in crypto regulations can lead to shifts in Phemex’s compliance strategy. It is advisable to stay informed about the current regulatory stance of Phemex, mainly how it affects you, depending on where you reside.

- Licenses and Certifications:

- Specifics about licenses are not widely broadcasted for either Bybit or Phemex. This opacity is not uncommon in the industry but calls for due diligence.

- Audits and Compliance Challenges:

- Cryptocurrency exchanges often undergo third-party audits to assess security and compliance. Information on whether Bybit or Phemex has completed recent audits is not explicitly detailed in widely available resources.

- Controversies:

- Both platforms may have faced significant challenges or controversies as international scrutiny on crypto exchanges has increased. Staying current with news surrounding the platforms will provide you with the most updated understanding of their regulatory situations.

In summary, while both Bybit and Phemex provide platforms for trading crypto derivatives, the explicit details of their regulatory compliance are less clear.

Conclusion

When choosing between Bybit and Phemex, your decision should align with your trading preferences and requirements.

Bybit is notable for its high leverage on trading pairs, making it a strong candidate if leverage is a priority for you.

Its platform features also include DEXs, wallets, NFT Marketplaces, lending, and borrowing, catering to diverse trading activities.

In contrast, Phemex edges out with more trading pairs and the unique offering of gold as a tradable asset. Its ultra-speedy transaction processing speed (TPS) can be crucial for traders who value execution speed.

| Bybit | Phemex |

|---|---|

| High leverage | More trading pairs |

| Diverse platform features | Gold as an asset |

| High transaction processing speed |

Your level of experience in cryptocurrency trading can also influence your choice:

- If you are new to trading, Phemex, with its user-friendly interface, might be more suitable.

- For seasoned traders requiring advanced features and a robust trading environment, Bybit might better suit your needs.

For further learning, explore:

- Official exchange tutorials and resources.

- Online courses on cryptocurrency trading.

- Community forums and discussions.

Remember, due diligence is vital before engaging with any trading platform.

Review each platform’s security measures, fee structures, and compliance with regulations pertinent to your region. Your informed decision is critical to a successful trading experience.

Explore how Bybit vs Phemex compares to their competitors:

- Bybit vs Binance: Detailed Platform Review and Comparison

- Bybit vs Bitget: Detailed Platform Review and Comparison

- Bybit vs BingX: Detailed Platform Review and Comparison

- Phemex vs BitMEX: Detailed Platform Review and Comparison

- Phemex vs Binance: Detailed Platform Review and Comparison

- Phemex vs Bitget: Detailed Platform Review and Comparison