Phemex and BitMEX are leading cryptocurrency exchanges specializing in derivatives trading. Phemex offers high leverage options, zero-fee spot trading for premium members, and a user-friendly platform. BitMEX focuses on perpetual contracts and futures, providing high liquidity and leverage, catering to professional traders seeking advanced trading strategies.

When comparing Phemex and BitMEX, you’ll find differences in trading fees, available cryptocurrencies, and platform specifics. Here’s a concise comparison:

| Feature | Phemex | BitMEX |

|---|---|---|

| Trading Fees | Competitive fees | Dynamic fees depending on contract type and position in trade |

| Cryptocurrencies | BTC, ETH, XRP, LTC, LINK, XTZ, and ADA, among others | Primarily Bitcoin-focused; offers other currencies like ADA, ETH |

| Trading Volume | High, with growing liquidity and user base | Generally high, with significant BTC trading volume |

| Leverage | Offers leverage on certain trading pairs | High leverage available, especially on Bitcoin contracts |

| Trading Pairs | BTCUSD, ETHUSD, and more | Multiple pairs, but primarily BTC-based derivatives |

| Deposit Methods | Bank transfers, third-party partners like Advcash, Simplex | Crypto only, no fiat deposit methods available |

| Platforms | Highly-rated mobile app, user-friendly web interface | Web platform known for advanced features suitable for professionals |

Phemex tends to be more attractive if you’re interested in a broader selection of cryptocurrencies and user-friendly deposit options. Their mobile application is well-received, which can enhance your trading experience on the go. In contrast, BitMEX might suit your needs if you’re looking for a platform with a strong focus on Bitcoin and high leverage possibilities, especially adept for experienced traders. Both platforms have their own set of strengths and cater to different types of cryptocurrency traders.

Phemex vs BitMEX: Products and Services

When you compare Phemex and BitMEX, you’ll find both platforms offer a range of trading options tailored to different types of traders. Phemex provides a mix of spot trading, crypto derivatives, including futures contracts, and perpetual contracts. The platform is known to offer features such as zero-fee spot trading to its premium members. This membership scheme enhances your trading experience by removing the burden of transaction fees.

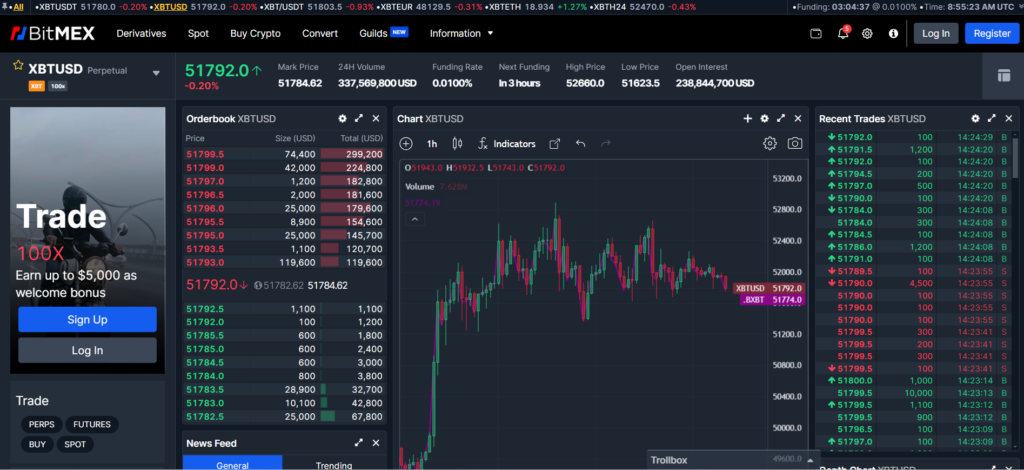

In contrast, BitMEX specializes in sophisticated crypto derivatives and is recognized for its advanced futures and perpetual contracts. It’s a platform that attracts those of you looking for margin trading with significant leverage, which can go up to 100x on certain contracts.

While Phemex offers a welcoming bonus (noted in recent offers as up to $2200), here’s how the services compare in key areas:

| Service | Phemex | BitMEX |

|---|---|---|

| Spot Trading | Available, with the option for zero fees for premium members. | Available, commonly with standard fees. |

| Futures | Several trading pairs with competitive leverage. | Extensive range, with high leverage options. |

| Derivatives | Multiple derivative products available. | Focus on derivatives, with more comprehensive offerings. |

| Leverage | Up to 100x on certain products. | Up to 100x, particularly attractive for high-risk traders. |

| Membership | Premium option offering zero-fee spot trading. | Standard model, fees applicable on trades. |

Your choice between Phemex and BitMEX will largely depend on the importance of feeless spot trading vs. the range of derivatives. Both platforms offer robust trading experiences, but the nuances in their products and services could make a significant difference in your trading strategy.

Phemex vs BitMEX: Contract Types

When comparing Phemex and BitMEX, you will find that both platforms offer a range of contract types suited to different trading strategies. Each exchange has its own approach to facilitating the trade of crypto derivatives, such as futures and perpetual contracts.

Phemex provides an array of contracts including:

- Perpetual Contracts: These contracts do not have an expiry date, allowing you to hold a position for as long as desired. Phemex offers both Inverse Perpetual Contracts and Linear Perpetual Contracts, which means you can trade with cryptocurrencies as collateral or with stablecoins like USDT.

- Futures Contracts: These contracts have a set expiry date. Traders can speculate on the future price of an asset, like Bitcoin.

BitMEX also specializes in various contract types:

- Inverse Perpetual Contracts: You can trade these with cryptocurrency as the underlying collateral. This contract does not expire, providing flexibility in trading.

- Inverse Futures Contracts: Unlike perpetual contracts, these have a predetermined expiry date and are settled in the underlying cryptocurrency.

- Option Contracts: BitMEX allows for more complex trading strategies through options, which give you the right, but not the obligation, to buy or sell at a predetermined price.

Comparison Table:

| Feature | Phemex | BitMEX |

|---|---|---|

| Perpetual Contracts | Inverse and Linear | Inverse |

| Futures Contracts | Yes | Inverse Futures |

| Options | Not Available | Available |

| Contract Settlement | Crypto and USDT | Crypto |

While BitMEX offers COIN-M Futures and USD-M Futures that are settled in the underlying coin or in USD, respectively, Phemex does not currently offer a gold/USD futures contract, which is a unique feature that could appeal to those interested in diversifying beyond pure cryptocurrency-based contracts.

In summary, your choice between Phemex and BitMEX will depend on the types of contracts you intend to trade, the collateral you’re willing to use, and whether you need features like options trading. Each platform offers its own benefits, and you should consider what aligns best with your trading requirements.

Phemex vs BitMEX: Leverage and Margin

When exploring the capabilities of Phemex and BitMEX, you’ll find that both platforms offer you the opportunity to engage in margin trading, which allows you to leverage your positions for potential greater gains. On both exchanges, leverage can amplify your trading power, as well as your potential return.

Phemex equips traders with the option to leverage up to 100x on BTC futures contracts. This means that with a smaller capital investment, you can control a much larger position. However, bear in mind that increased leverage comes with higher liquidation risks if the market moves against your position.

BitMEX also offers a robust leverage option, providing up to 100x leverage on some of its contracts. As with Phemex, the use of leverage on BitMEX should be approached with caution, especially for traders new to leverage trading.

| Aspect | Phemex | BitMEX |

|---|---|---|

| Maximum Leverage | Up to 100x | Up to 100x |

| Margin Trading | Yes, with integrated liquidity | Yes, with various contracts |

| Liquidation Risk | High risk at maximum leverage | High risk at maximum leverage |

| Funding Rates | Variable, based on market conditions | Variable, based on market conditions |

As an experienced trader, you will appreciate the need to manage your margin carefully to mitigate the risk of liquidation. This is particularly crucial during highly volatile market periods when sudden price swings can occur. Both platforms use funding rates to encourage market neutrality. These rates can affect the cost of holding positions over a period of time and will be an essential factor for you to consider.

Remember, while the use of high leverage may offer the potential for higher returns, it significantly increases the risk of your position being liquidated if the market moves unfavorably in relation to your trade. Both Phemex and BitMEX facilitate margin trading, but it is imperative to weigh risks and rewards.

Phemex vs BitMEX: Liquidity and Volume

When you trade cryptocurrency, liquidity and trading volume are vital factors that influence your trading strategy. High liquidity ensures that trades are executed quickly and with minimal slippage, whereas trading volume can give you insights into the activity and health of the market.

BitMEX has been recognized for its significant 24-hour derivatives trading volume, which is reported to be USD 981 million, placing it 12th globally. This suggests that as a market maker or liquidity provider, you have better chances of executing large orders without significant price impact.

On the other hand, Phemex has shown impressive trading volume figures as well, with a 24-hour trading volume of USD 912 million. This indicates a robust trading environment, which is essential for executing trades efficiently and minimizing slippage.

| Exchange | 24h Trading Volume USD | Global Rank |

|---|---|---|

| BitMEX | 981 million | 12th |

| Phemex | 912 million | 11th |

Both exchanges offer competitive leverage options, though BitMEX offers up to 100x on BTC contracts which might contribute to higher liquidity and trading volumes because of larger position sizes. Comparatively, Phemex provides similar leverage opportunities, though with slight differences in the range for specific contracts.

Your awareness of these metrics and data sources can influence your choice between Phemex and BitMEX, especially if you prefer trade execution with the least amount of slippage or if you value market depth for larger transactions. Each platform’s liquidity and volume directly impact your trading efficiency, so consider these factors wisely when choosing an exchange for your trading needs.

Phemex vs BitMEX: Fees and Rewards

When comparing Phemex and BitMEX, the fee structure and rewards programs are vital in determining your potential profitability and incentives. Understanding these details will help you maximize gains and minimize costs as you trade cryptocurrencies.

Trading Fee & Deposit/Withdrawal Fee Compared

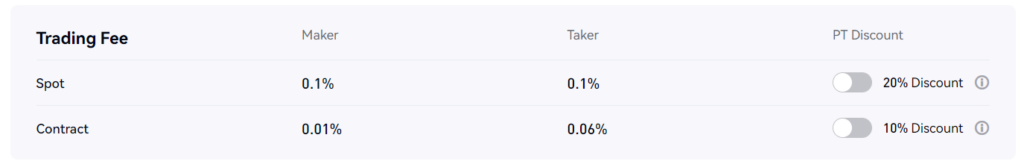

Phemex employs a market maker-taker fee model with competitive trading fees. Here’s a brief comparison:

- Maker Fees: Phemex offers a rebate for makers, encouraging liquidity on the platform.

- Taker Fees: Phemex taker fees are set to incentivize trading but are higher than maker fees to balance the liquidity.

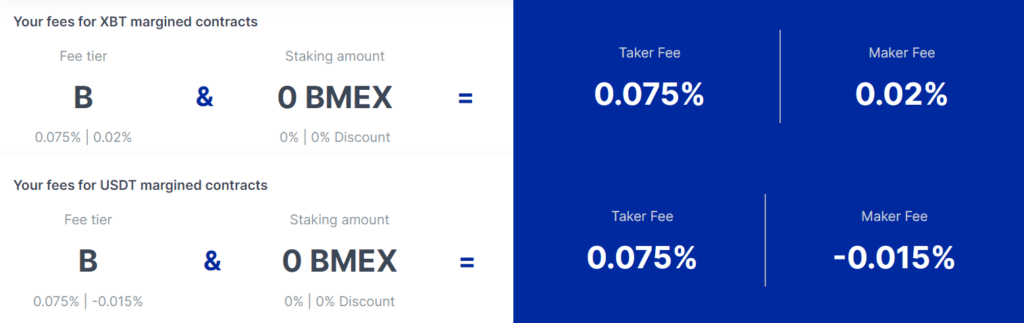

BitMEX also operates on a maker-taker fee model:

- Maker Fees: Like Phemex, BitMEX offers rebates, essentially paying makers to trade.

- Taker Fees: Taker fees are charged when orders are filled immediately.

Withdrawal Fees and Funding Fee: Both exchanges charge fees for withdrawals, with amounts varying based on network conditions.

To illustrate, if you place a limit order on Phemex that adds liquidity, you could receive a maker rebate. Conversely, a market order immediately taken from the books incurs a taker fee. Fees can depend on the traded asset and volume.

Deposits & Withdrawal Options

Both Phemex and BitMEX support multiple deposit and withdrawal methods, which are crucial for your trading convenience.

- Deposits: Funding your account can be done with various cryptocurrencies. Phemex might offer greater flexibility with additional deposit methods.

- Withdrawals: Crypto withdrawals are subject to minimum and maximum limits which are different for both exchanges. While Phemex may offer certain withdrawal advantages, both platforms ensure security.

Transaction times and limits can influence how quickly you can trade or cash out your profits. It’s essential to consider these aspects when choosing the right exchange for your trading needs.

Phemex vs BitMEX: KYC Requirements & KYC Limits

When choosing between Phemex and BitMEX, understanding the Know Your Customer (KYC) requirements and limits that come with them is crucial for your trading experience.

Phemex KYC:

- Verification Levels: Phemex operates on a tier-based system, with different levels of verification determining your deposit and withdrawal limits.

- Documents Required: Typically, you’ll need to present an identity document such as a passport or a valid ID card.

- Withdrawal Limits: For non-KYC verified users, there are withdrawal limits imposed. Once KYC is completed, higher limits are available. Phemex updates its policy periodically, so check their website for the most current limits.

BitMEX KYC:

- Verification Levels: BitMEX also requires users to undergo KYC verification to access higher limits for withdrawals.

- Documents Required: Similarly, a government-issued ID, proof of residence, and a selfie could be required for verifying your identity.

- Withdrawal Limits: The exchange does not charge for deposits or withdrawals, but limits are in place depending on your verification status.

| Exchange | KYC Required | Deposit Limits (KYC) | Withdrawal Limits (KYC) |

|---|---|---|---|

| Phemex | Yes | Unlimited with KYC | 2 BTC without KYC* |

| BitMEX | Yes | No limit post-KYC | Limits based on level* |

*Always check the current limits on the respective exchange’s website, as these can change based on policy updates.

The KYC process serves a dual purpose of security and regulatory compliance, helping protect your assets from illicit activities and ensuring the exchange operates within legal frameworks. While it may add an additional step before you can fully utilize the exchanges’ capabilities, completing KYC can enhance your access and provide a more secure trading environment.

Phemex vs BitMEX: Order Types

When trading on Phemex and BitMEX, you have access to a range of order types that allow you to implement your strategies effectively.

Phemex provides you with several core order types:

- Limit Order: You can set the price at which you wish to buy or sell, allowing for precise entry points.

- Market Order: This executes immediately at the current market price.

- Conditional Order: It functions as a trigger for placing limit or market orders if certain conditions are met.

Advanced order options include:

- Post-Only Order: Ensures the order adds liquidity by only being executed as a maker order.

- Reduce-Only Order: This type of order ensures that your position size can only be reduced, not increased.

BitMEX also offers a similar suite of order types, with slight differences in naming or functionality:

- Limit Order: Set your desired entry or exit price.

- Market Order: Instant execution at the best available current price.

- Stop Order: A type of conditional order that triggers at a predetermined price, acting as a stop loss or stop entry order.

BitMEX’s additional order types:

- Stop Limit Order: Combines stop with a limit order, giving you control over the price at which your stop order is executed.

- Trailing Stop Order: Your stop price adjusts by a set amount of points as the market price moves.

- Iceberg Order: Large orders are broken into smaller, concealed portions to hide the total order quantity.

Both platforms’ advanced and conditional orders help you manage risk and are particularly useful when you cannot monitor the markets constantly. By understanding and using these order types wisely, you can better control your potential profits and losses, and execute your trading plan with more precision.

Phemex vs BitMEX: Security and Reliability

When assessing Phemex and BitMEX, your security is paramount. Both platforms deploy robust measures to ensure the safety of your funds and data.

Phemex:

- Implements a hierarchical deterministic cold wallet system, storing assets in an offline environment.

- Integrates tradingview charting to provide you with advanced analytical tools and a seamless trading experience.

- Utilizes multi-signature withdrawal processes for increased safety.

In the past, Phemex has maintained a clean record without any significant security breaches. Their customer support is responsive, and they comply with international KYC/AML regulations, ensuring a reliable trading environment.

BitMEX:

- Takes advantage of multi-signature wallets for all transactions to secure your funds.

- Provides you with a TradingView-powered interface, allowing access to comprehensive charting tools.

- Offers a mandatory two-factor authentication (2FA) to protect your account.

BitMEX experienced a notable email leak in 2019 but moved quickly to reinforce its security framework. User scores on various platforms attest to the increased reliability since then. BitMEX is known for its stringent security practices and has a committed support team to address your issues.

Both exchanges have demonstrated their capability to manage threats effectively, thus bolstering their reputations for security and reliability. Your choice between Phemex and BitMEX should consider your preferences for trading features and user experience, as both platforms have shown dedication to safeguarding their users’ interests.

Phemex vs BitMEX: Regulation and Compliance

When assessing Phemex and BitMEX, it’s crucial for you to understand their compliance with regulatory standards. Phemex operates with a focus on adherence to regulatory requirements and has implemented a robust AML (Anti-Money Laundering) program. Although not explicitly stated, Phemex mirrors regulatory frameworks designed to offer you a secure trading environment.

BitMEX, on the other hand, faced regulatory challenges in the past. The platform was previously charged by the U.S. Commodity Futures Trading Commission (CFTC) for operating an unregistered trading platform and violating AML regulations. However, BitMEX has taken steps to improve its regulatory standing, including implementing KYC (Know Your Customer) measures and overhauling its management team to better comply with global regulations.

Phemex

- AML Program: In place to ensure safe transactions

- Focus: Stringent adherence to regulatory norms

BitMEX

- Past Challenges: CFTC charges for regulatory violations

- Recent Improvements:

- KYC Measures: Now requires user verification

- Management Changes: To align with global compliance standards

Your security and trust in these platforms are paramount. Both exchanges have looked to reassure users through compliance efforts and by fostering transparent relations with regulators. However, it’s essential you keep abreast of current regulatory statuses as they can affect your trading experience.

Phemex vs BitMEX: User Experience

When evaluating Phemex and BitMEX, your experience on each platform is largely defined by the user interface, accessibility, and available support.

Phemex is recognized for its clean and intuitive interface, suitable for both beginners and experienced traders. The platform offers an app available on both iOS and Android, ensuring trading on-the-go is streamlined and efficient. Account creation is user-friendly, and many have noted the onboarding process to be fast and straightforward.

| Phemex | BitMEX |

|---|---|

| Intuitive interface | More complex interface |

| Quick account setup | Account setup more intricate |

| Both iOS and Android app | Primarily web-based |

BitMEX leans towards a more complex interface that might appeal more to professional traders. Despite this complexity, the platform’s robust features offer a comprehensive trading experience. It is important to note that BitMEX is more web-focused, and while they offer a mobile experience, it might not be as refined as Phemex’s dedicated apps.

In terms of customer support, Phemex users have reported prompt and helpful service while BitMEX also provides adequate support, though the feedback suggests there may be slight delays at times.

Remember, your choice between Phemex and BitMEX should be influenced by your preference for interface complexity, device compatibility, and the level of customer support you expect.

Keep in mind that these observations are based on user feedback and platform performance as of 2024 and may change over time.

Conclusion

In comparing Phemex and BitMEX, it’s important to assess your individual trading needs. Phemex provides a range of trading pairs and claims attractive bonuses, making it appealing if you’re seeking variety and potential rewards. They offer pairs such as BTCUSD and ETHUSD, which are staples for traders.

BitMEX is recognized for its established presence in the cryptocurrency derivatives market. If you prioritize longevity and reputation in your trading platforms, BitMEX might align more with your preferences.

For costs, both exchanges offer competitive trading fees, akin to other market players like Bybit and Binance. When considering factors such as fees and features, you should compare them with alternatives like Kraken, PrimeXBT, Bitfinex, Kucoin, and Deribit to ensure you’re choosing the most cost-effective platform.

- Variety of Trading Options: Phemex seems to offer a more diverse selection.

- Reputation and Longevity: BitMEX has a longstanding reputation in the market.

- Competitive Fees: Both Phemex and BitMEX offer fees comparable to peers like Bybit.

Your ultimate selection should factor in the availability of trading pairs, fee structure, platform security, and user experience. For novice traders, a platform with extensive educational resources and an intuitive interface, such as Binance or Kraken, may be beneficial. Experienced traders who are looking for advanced trading options and higher leverage might prefer an exchange like Phemex or Deribit.

Remember, it’s essential to perform due diligence and consider your risk appetite when choosing an exchange. Always stay updated with recent changes, as the crypto landscape is continually evolving.

Explore how Phemex and Bitget compare to their competitors:

- Phemex vs Binance: Detailed Comparison

- Phemex vs BingX: Detailed Comparison

- Phemex vs Bybit: Detailed Comparison

- BitMEX vs Binance: Detailed Comparison

- BitMEX vs Bybit: Detailed Comparison

- BitMEX vs PrimeXBT: Detailed Comparison