Bitget and KuCoin are prominent cryptocurrency exchanges, each offering distinct features to their users. KuCoin, established in 2017, is known for its extensive range of supported cryptocurrencies, user-friendly interface, and comprehensive trading options, including spot, margin, and futures trading. It also provides various financial services like staking, lending, and token launch platforms, making it a versatile choice for traders of all levels.

Bitget, on the other hand, has carved a niche in the market with its focus on copy trading and social trading features, allowing users to follow and replicate the trades of experienced traders. Additionally, Bitget offers a robust futures trading platform with competitive fees and advanced trading tools.

When choosing a cryptocurrency exchange, it’s important to compare the features of Bitget and KuCoin. Please see below for a comparative table outlining their key features:

| Feature | Bitget | KuCoin |

|---|---|---|

| Founded | 2018 | 2017 |

| Founders | N/A | Michael Gan, Eric Don, Top Lan, Kent Li, John Lee, Jack Zhu, Linda Lin |

| Supported Coins | Offers a variety of cryptocurrencies | Offers a wide range of cryptocurrencies |

| Leverage | Offers leverage in some products | Offers leverage in some products |

| Trading Volume | High, with a rapidly growing user base | Consistently high, top-five in the world |

| Deposit Methods | Crypto deposits; fiat options vary by payment provider | Crypto deposits; fiat options vary by payment provider |

| Trading Fees | Spot: ~0.1% (reducible with Bitget token) | Spot: ~0.1% (reducible with KuCoin token) |

| Futures Fees | Maker: 0.02% – 0.0015%, Taker: 0.06% – 0.035% | Maker: 0.02%, Taker: 0.06% |

| Deposit Fees | None for crypto; variable for fiat | None for crypto; variable for fiat |

| Security Features | Multi-layered security, 2FA, cold storage, insurance | Multi-layered security, 2FA, cold storage, insurance |

Your choice between Bitget and KuCoin will depend on your preferences, trading style, and the features you value most in a cryptocurrency exchange.

Both platforms offer a competitive range of services and have established their presence in the crypto trading community.

Bitget vs KuCoin: Products and Services

As you explore the cryptocurrency trading platforms Bitget and KuCoin, you’ll find various products tailored to different trader needs.

Bitget primarily focuses on derivative products, featuring futures and options trading with support for USDT and USDC, allowing you to pair these with various altcoins.

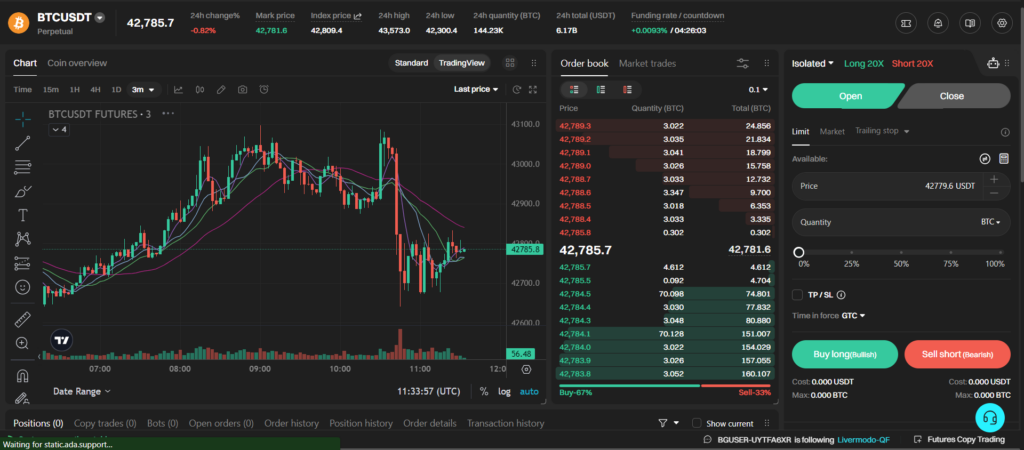

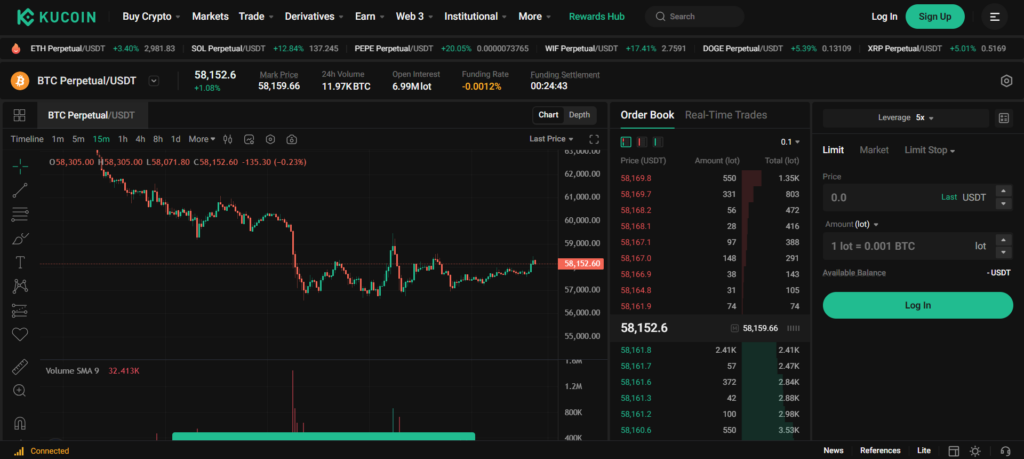

- Futures Trading: Bitget offers notable leverage, reaching 125x, which can significantly amplify your gains and losses. Meanwhile, KuCoin also includes a futures trading platform, albeit with a maximum leverage of 100x.

- Spot Trading: Both exchanges cater to spot traders. Bitget provides spot trading with a 10x margin, while KuCoin also offers a competitive spot trading environment with many altcoins to trade.

- Options Trading: Options are available on Bitget, giving you more strategies for hedging and speculating on cryptocurrency price movements.

KuCoin excels in service variety, offering additional products like:

- Leveraged Tokens: Enabling traders to gain leveraged exposure without worrying about liquidation.

- Staking: Allowing you to earn rewards by holding specific cryptocurrencies.

- NFT Marketplace: KuCoin steps into the digital collectible space with its NFT platform, further broadening its service scope.

Your choice between Bitget or KuCoin may depend on whether you prioritize a derivatives-focused platform or one with a broader range of services, including innovative products like NFTs and leverage tokens.

Advanced trading screens and technical analysis tools enhance User experience on both platforms. Still, kucoin’s additional features may offer a more rounded experience if diversity in trading and investment options is a priority for you.

Bitget vs KuCoin: Contract Types

When comparing contract types between Bitget and KuCoin, it’s essential to examine the variety and flexibility each platform offers to meet your trading preferences.

Bitget provides a range of contract types, including:

- Inverse Perpetual Contracts: Use cryptocurrency as the margin to trade against its value, which is suitable if you prefer your profits and losses to be in the base currency.

- Linear Perpetual Contracts: These contracts are margined and settled in USDT, which can be more straightforward if you wish to keep a stable margin currency.

- Copy Trading: A feature that allows you to mimic the trades of experienced users, which isn’t a contract but a strategy you can utilize within available agreements.

KuCoin, on the other hand, offers its selection:

- Inverse Futures Contracts: Similar to inverse perpetual contracts but with a set expiration date.

- COIN-M Futures: Futures contracts are margined with the cryptocurrency rather than a stablecoin.

- USD-M Futures: Futures contracts are margined and settled in USDT, offering a stable valuation and a more straightforward calculation of profits and losses.

- Options: KuCoin allows you to buy or sell an asset at a predetermined price before a specific date, allowing you to leverage market predictions flexibly.

Both platforms cater to varied trading needs and preferences.

Your choice might depend on whether you want to directly use digital assets as a margin (Bitget’s forte) or seek a more varied set of financial instruments, including options and futures (where KuCoin shines).

Each contract type has risks and benefits; understanding these can help you make informed decisions aligned with your trading strategy.

Bitget vs KuCoin: Supported Cryptocurrencies

The variety of supported cryptocurrencies is paramount when choosing between Bitget and KuCoin for your trading needs.

Both exchanges offer a broad spectrum of coins, allowing you to explore various trading pairs.

Bitget boasts an extensive list of available cryptocurrencies for trading, including futures and leveraged trades.

Your options are not limited to the mainstream selections; you can also engage in markets involving lesser-known altcoins.

The most popular futures trading pairs on Bitget tend to include significant cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

On the other hand, KuCoin also supports a wide range of cryptocurrencies, providing you with an impressive selection for futures trading.

KuCoin frequently updates its listings to ensure that you have access to the latest and most in-demand cryptocurrencies.

Here’s a brief comparison of the futures trading offerings:

| Feature | Bitget | KuCoin |

|---|---|---|

| Number of Cryptocurrencies | Impressive Variety | Wide Range |

| Popular Futures Pairs | BTC/USD, ETH/USD, etc. | BTC/USD, ETH/USD, etc. |

| Leverage Trading | Available | Available |

Consider other factors such as liquidity, fee structure, and platform usability when selecting an exchange for futures trading.

The diversity in cryptocurrencies offered by Bitget and KuCoin provides robust opportunities for experienced traders and newcomers to participate in the crypto futures market.

Bitget vs KuCoin: Leverage and Margin Trading

Bitget and KuCoin offer traders the ability to engage in leverage and margin trading, enhancing your potential for higher returns, albeit with increased risk.

Bitget: You are given a robust leverage system to engage in futures trading with up to 125x leverage.

Bitget allows you to trade with a maximum of 10x margin for spot trading. It’s crucial to be aware of the liquidation risks involved at such high leverage levels, as market volatility can lead to the rapid depletion of your margin.

- Futures Margins: Requires a certain percentage of the total order value.

- Liquidation Risks: Higher leverage magnifies the position’s liquidation risk during market swings.

- Funding Rates: Variable based on the underlying asset’s liquidity and market rates.

KuCoin: On this platform, margin trading is capped at 10x leverage, allowing you to amplify your trading position to a limited degree compared to Bitget.

Like Bitget, futures trading offers substantial leverage, though the specific rate wasn’t mentioned in the search results.

- Spot Trading with Leverage: This enables you to borrow up to 10 times your original investment.

- Liquidation Risks: As with leveraged trading, you must closely monitor your margin levels to avoid liquidation.

- Funding Rates: Influenced by the market and subject to change, these rates can impact the cost of holding leveraged positions.

Table: Comparative Overview of Leverage and Margin

| Bitget | KuCoin | |

|---|---|---|

| Max Leverage (Futures) | 125x | Not specified |

| Max Leverage (Spot) | 10x | 10x |

| Liquidation Risk | High at maximum leverage | High at maximum leverage |

| Funding Rates | Variable | Variable |

Your trading strategy should consider these leverage and margin features carefully, ensuring you’re comfortable with each platform’s associated risks and requirements.

Bitget vs KuCoin: Trading Volume

When comparing Bitget and KuCoin, you’ll find that both exchanges boast significant trading volumes, which is a vital aspect of their appeal.

KuCoin has been prominently established as a top-five crypto exchange by trading volume for several years, signifying its vast user base and high level of trading activity.

The large volume suggests that you can expect high liquidity, which typically results in more efficient trade execution and potentially lower slippage.

In contrast, Bitget has emerged as a formidable market presence.

Though it was founded later than KuCoin, its trading volume has grown, attracting a broad user base interested in spot and futures trading.

The increasing volume on Bitget can also contribute to enhanced trading experiences, as high volumes can minimize the impact of large trades on the market price, thereby reducing slippage.

| Exchange | Spot Trading Volume | Futures Trading Volume |

|---|---|---|

| KuCoin | High | High |

| Bitget | Growing | Growing |

Financial analytics platforms track rankings and metrics for trading volume and liquidity on both exchanges and can typically be found on market aggregator websites.

Remember, liquidity is crucial since it affects how quickly and at what cost you can open and close positions.

You need to monitor these platforms for the latest data on trading volumes, as they can change frequently in response to market conditions and the exchanges’ activities.

By understanding the volume profile of each exchange, you can make more informed decisions regarding trading strategies and execution efficiency.

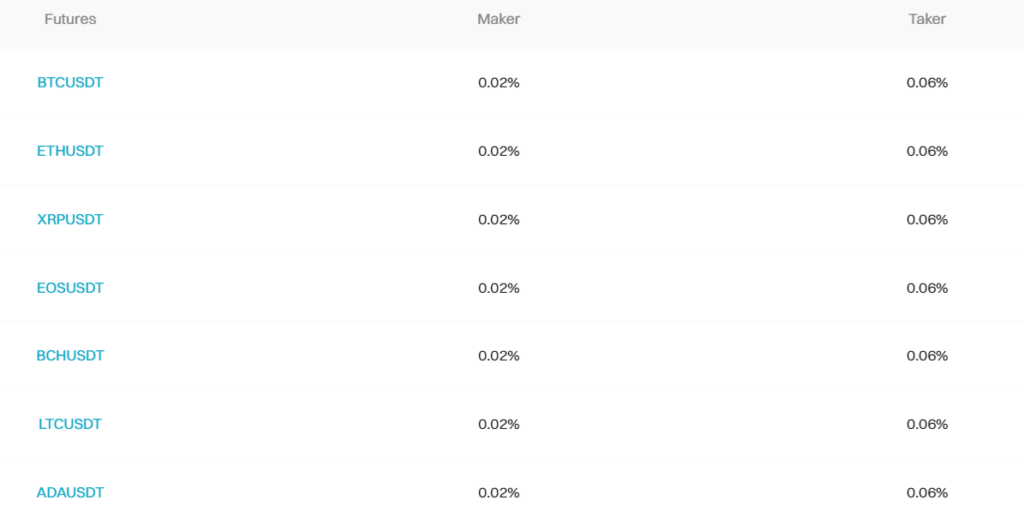

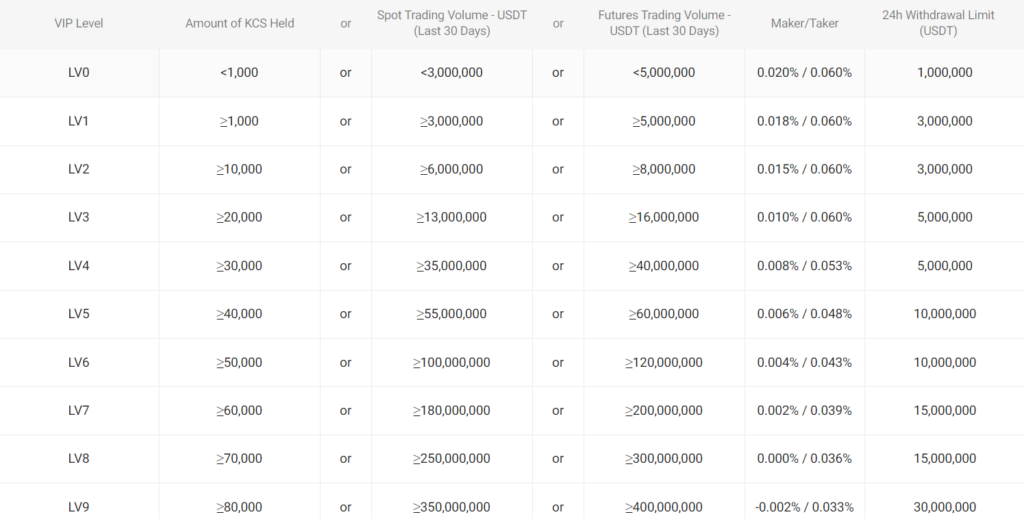

Bitget vs KuCoin: Futures Trading Fees and Rewards

When trading futures on Bitget or KuCoin, it’s crucial to understand the fee structures, as they directly impact your profitability. Both Bitget and KuCoin charge maker and taker fees.

As a maker, you add liquidity to the market by creating a limit order that isn’t immediately filled, while as a taker, you take liquidity away by filling orders instantly.

Bitget has set its maker fee for futures at 0.02% and the taker fee at 0.06%. These fees can decrease for high-volume traders, potentially going as low as 0.0015% for makers and 0.035% for takers.

KuCoin, on the other hand, begins with the same maker and taker fees for its futures market at 0.02% and 0.06%, respectively. However, KuCoin offers an additional incentive, wherein the maker fee can become harmful, dropping to -0.015%, effectively rewarding makers for adding liquidity.

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| Bitget | 0.02% | 0.06% |

| KuCoin | 0.02% to -0.015% | 0.06% |

Furthermore, both platforms offer ways to reduce these costs further.

On Bitget, using the BGB token may lower fees, and KuCoin offers similar discounts when paying fees with its native KCS coin.

It’s also worth noting that both exchanges may offer bonuses or promotions, which can effectively reward users for their trading activity and volume.

Remember that these fee structures are designed to incentivize market participation and liquidity.

As you trade more, you ascend through various user levels, unlocking lower fees and potentially other rewards that bolster your trading advantage.

Always review the latest fee schedule on the exchange’s official website, as fees and structures may change.

Bitget vs KuCoin: Deposits & Withdrawal Options

When examining Bitget and KuCoin’s capabilities for moving funds, you’ll encounter distinct features and limitations that cater to various user preferences.

Bitget simplifies the process for you:

- Cryptocurrency Deposits: Free for supported cryptos such as BTC, ETH, and LTC.

- Fiat Transactions: Has introduced bank deposits and wire transfers, potentially at low or no fees.

KuCoin, keeping pace, offers:

- Cryptocurrency Withdrawals: Available for over 400 coins across significant networks.

- Fees: Tends to provide economical withdrawal rates, especially for USDT and BUSD using TRC20 or BEP20, typically at a flat fee of $1.

- Fiat Options: Limited compared to Bitget, affecting variety and accessibility.

Here’s a quick breakdown to guide you:

| Feature | Bitget | KuCoin |

|---|---|---|

| Crypto Deposits | Free for BTC, ETH, LTC, etc. | Accessible for a wide range of >400 cryptocurrencies |

| Fiat Deposits | Bank deposits and wire transfers are available | Comparatively limited options |

| Withdrawal Fees | Vary by coin/network; competitive for major cryptos | Vary; particularly low for USDT, BUSD (TRC20/BEP20) |

| Processing Times | Subject to network speed; generally prompt | Similar to Bitget, network-dependent |

| Min/Max Amounts | Specific to each cryptocurrency and payment method used | Also specific to currency and method, with both low/high limits |

Both exchanges strive to offer you ease of use and minimal withdrawal costs, positioning themselves competitively in the market.

However, introducing fiat transactions on Bitget could provide you with broader options for fund transfers, contrasting with KuCoin’s more crypto-centric approach.

Your choice may hinge on whether you prioritize fiat transactions or the range of supported cryptocurrencies for withdrawals.

Bitget vs KuCoin: Native Token Usage

Both Bitget and KuCoin feature native cryptocurrencies that offer a variety of benefits within their respective platforms.

As you navigate the landscape of these digital currency exchanges, understanding the utility of these tokens can be crucial to optimizing your trading experience.

Bitget harbors its own native token named Bitget Token (BGB). This ERC-20 token is designed to facilitate several incentives for its holders:

- Reduced Trading Fees: As a BGB token holder, you are entitled to a discount on trading fees. This could substantially lower your cost of transactions.

- In-exchange Utility: BGB can be used within Bitget for various purposes, enhancing your trading operations and engagement on the platform.

As for KuCoin, its native currency is KuCoin Shares (KCS). Similar to BGB, KCS is an ERC-20 token that comes with a suite of advantages:

- Fee Discounts: Holding KCS tokens enables you to get a cut on trading fees, akin to Bitget’s BGB.

- Revenue Sharing: By owning KCS, you can receive a share of the exchange’s trading fees, turning it into a source of potential passive income.

- Access to Exclusive Promotions: Your KCS holdings can unlock special promotions and offers exclusive to KCS users.

| Exchange | Native Token | Trading Fee Benefits | Additional Perks |

|---|---|---|---|

| Bitget | BGB | Discounts on fees | Varies |

| KuCoin | KCS | Discounts on fees | Revenue sharing, access to exclusive promotions |

When choosing between Bitget and KuCoin, consider the discounts and trading benefits their tokens provide and how they can enhance your overall engagement with the platform’s offerings.

Bitget vs KuCoin: KYC Requirements & KYC Limits

When choosing between Bitget and KuCoin, it’s essential to consider how KYC (Know Your Customer) requirements can influence your experience.

Both exchanges employ KYC verification to enhance security and comply with regulatory standards.

Bitget offers a tiered KYC system:

- Level 1 KYC: You can sign up and trade with basic information. However, your daily withdrawal limit is set to a maximum of $499.

- Level 2 KYC: By providing additional identification documents, such as a government-issued ID, your daily withdrawal limit increases to $1,999.

- Level 3 KYC: The highest verification level requires further documentation and can unlock withdrawal limits up to $999,999 daily.

In contrast, KuCoin also uses a tiered system for KYC:

- Non-verified Users: Without KYC, you are subject to certain limitations, although you can still deposit and trade.

- Verified Users: You can increase your withdrawal limits by completing KYC verification, which involves providing personal information and identification documents. The exact limits may vary, and obtaining a higher tier can be achieved by providing additional information and documentation.

Your choice depends on how much you value privacy against the need for higher limits and enhanced security features.

Both platforms have built-in measures to protect your assets, but undergoing KYC verification can give you access to improved limits and a fuller set of services on the exchange.

Remember that these regulations are in place to prevent financial crimes and maintain the integrity of the trading environment.

Bitget vs KuCoin: User Experience

When examining the user experience between Bitget and KuCoin, it’s essential to consider ease of use, functionality, and design for mobile apps and web interfaces.

Bitget:

- Ease of Use: Designed with simplicity in mind, Bitget offers a user-friendly platform suitable for traders of all levels.

- Functionality: The platform includes essential trading features and tools, balancing power and accessibility.

- Design: The interface is clean, with an intuitive layout that guides you through trading operations without clutter.

- Mobile App: The app is responsive, allowing you to trade on the go with a coherent feature set similar to the web version.

KuCoin:

- Ease of Use: KuCoin is known for its user-centered design, which efficiently caters to rookies and seasoned traders.

- Functionality: Offers a comprehensive range of features with advanced charting tools and various trading pairs.

- Design: The web interface is professional, with strategic layout choices that enhance your trading actions.

- Mobile App: KuCoin’s mobile app mirrors its web counterpart, delivering a seamless experience with quick access to market updates and trade execution.

In terms of speed, both platforms perform well, with rapid load times and reliable execution speeds crucial for timely trades.

Prioritizing a straightforward interface or a feature-rich environment will heavily influence your choice between Bitget and KuCoin.

Both exchanges invest significantly in their user experience, but each caters to different preferences in the user interface and functionality aspects.

Bitget vs KuCoin: Order Types

When trading on Bitget and KuCoin, you can use various order types to execute your strategies and manage risks efficiently.

Bitget offers a range of order types, handy for derivative trading:

- Market Orders: Execute a trade immediately at the current market price.

- Limit Orders: Set a specific price to execute a trade.

- Stop Orders: Trigger a buy or sell operation when the market reaches a specified price.

- Advanced order types for a strategic edge include:

- Conditional Orders: Execute based on predefined conditions.

- Reduce-Only Orders: Ensure that an order only reduces your position.

Similarly, KuCoin supports multiple order types catering to different trading approaches:

- Market Orders: These are for immediate execution at the best available price.

- Limit Orders: Allow you to define the price to buy or sell.

- Stop-Limit Orders: Specify the price to trigger the limit order.

- Stop-Market Orders: Trigger a market order when a specified price is hit.

- Other order options include:

- Post-Only Orders: Ensure the order adds liquidity by entering the order book.

- Time in Force policies like GTC (Good Till Canceled) and IOC (Immediate or Cancel) to control the order’s lifespan.

Each of these order types serves a particular purpose:

- Market orders are best for quick entry or exit from the market.

- Limit and stop orders allow for precision in entering or exiting positions.

- Conditional, reduce-only, and post-only orders allow sophisticated traders to fine-tune strategies and maintain specific trading intentions, like avoiding position increases or ensuring market-making activities.

Utilizing these order types enables you to trade more effectively by tailoring your operations to market conditions and risk management strategy.

Bitget’s focus on advanced derivatives trading and KuCoin’s broad variety support novice and experienced traders.

Bitget vs KuCoin: Security Measures & Reliability

When evaluating the security landscape of both Bitget and KuCoin, you must consider how each platform safeguards your assets and personal data.

Bitget has adopted a multifaceted security strategy. You can expect features like:

- Two-factor authentication (2FA) for an added layer of account security.

- Cold storage practices for most funds minimize exposure to online threats.

- An insurance fund that covers potential losses in the event of system flaws or security breaches.

KuCoin, on the other hand, also emphasizes robust security measures, including:

- A notable portion of crypto assets are stored in cold storage to limit risks associated with online storage.

- Partnerships with security firms, such as Onchain Custodian, aim to fortify the assets’ safety on the exchange.

- Security certifications and frequent audits to maintain a high standard of user protection.

Both platforms have experienced security incidents but have taken steps to address and mitigate the consequences.

For example, KuCoin faced a significant security breach in 2020 but recovered most of the stolen funds and enhanced its security measures post-incident.

In your comparison, consider the transparency of each exchange regarding its security practices and readiness to improve and adapt in response to past challenges.

It should give you a clearer picture of not just the existing security infrastructure but also the reliability and responsiveness of Bitget and KuCoin to unforeseen threats.

Bitget vs KuCoin: Insurance Fund

When trading on Bitget or KuCoin, you have the safeguard of an insurance fund designed to protect your assets in extraordinary situations.

Bitget:

- Relies on an Insurance Fund to cover losses from system flaws or breaches.

- The fund is a layer of protection beyond the exchange’s multi-layered security measures like 2FA and cold storage.

KuCoin:

- Charges a 10% fee that contributes to its insurance fund.

- This fund is part of KuCoin’s risk management system to minimize your exposure in case of unforeseen events.

Key Differences:

- Fee Structure: KuCoin has a specific fee earmarked for its insurance fund, whereas Bitget integrates it into its overall security framework.

- Security Integration: Bitget emphasizes its fund as part of a comprehensive security protocol, contrasting with KuCoin’s separate fee approach.

| Feature | Bitget | KuCoin |

|---|---|---|

| Insurance Fund | Integrated security fund | 10% fee-based reserve |

| Security | Multi-layered, 2FA | Risk management system |

Remember to evaluate the insurance fund alongside other features when choosing the right platform; protection is just one of many aspects to consider.

Bitget vs KuCoin: Customer Support

When choosing between Bitget and KuCoin, it’s crucial to consider the quality of customer support each platform offers.

Bitget:

- Availability: Offers 24/7 customer support.

- Channels of Communication: You can access live chat, email, and social media.

- Response Quality: Support is known for being responsive and proficient.

KuCoin:

- Availability: Customer support is also available around the clock.

- Channels of Communication: KuCoin provides help via live chat, email, and a ticketing system.

- Response Quality: The team is dedicated to helping users, with satisfaction reflected in higher app store ratings.

| Support Aspect | Bitget | KuCoin |

|---|---|---|

| 24/7 Availability | Yes | Yes |

| Live Chat | Yes | Yes |

| Email Support | Yes | Yes |

| Social Media Interaction | Yes | Limited |

| User Ratings (App Store) | 4.4 | 4.6 |

| User Ratings (Google Play) | 4.6 | 4.2 |

Your experience with customer support may vary, but both platforms strive to provide timely and practical assistance.

User reviews and ratings suggest satisfaction with the support received on both platforms, though individual experiences can differ.

It’s recommended you consider what type of support channel you’re most comfortable with when making your choice.

Bitget vs KuCoin: Regulatory Compliance

When selecting a cryptocurrency exchange, evaluating their adherence to regulatory compliance is crucial for your safety and the legality of your transactions.

Bitget

- Compliant Operations: Bitget is known for its regulation-friendly stance. It complies with the laws of the jurisdictions where it operates.

- International Standards: It adheres to international financial regulations, which can contribute to a secure trading experience.

- Regulatory Bodies: Bitget’s specific licenses and certifications have not been publicly detailed; however, its commitment to compliance is a core aspect of its operations.

KuCoin

- Regulatory Approach: KuCoin takes a proactive approach towards security and regulatory compliance, although it is less transparent about the percentage of crypto assets held in cold storage.

- Security Partnerships: KuCoin has forged partnerships, for instance, with Onchain Custodian, to bolster the exchange’s security infrastructure.

- Regulatory Challenges: Controversies or challenges regarding Kucoin’s compliance with regulations are not highlighted, suggesting a lack of such instances or a low-profile approach toward regulatory issues.

In your decision-making, consider the commitment of both Bitget and KuCoin to comply with regulatory standards as a reflection of their dedication to secure and lawful trading.

Check for updates on their compliance status as regulations and compliance landscapes evolve rapidly in the crypto industry.

Conclusion

When selecting a cryptocurrency exchange, your preferences and trading needs are paramount.

KuCoin, with a longer track record since 2017, may appeal to you if you prioritize a robust range of coins and a well-established platform.

It offers competitive fees—at 0.1% for spot trading—and is known for its 24/7 customer support, albeit with some reports of slow response times.

On the other hand, Bitget, established in 2018, has swiftly grown in user numbers, indicating its rising popularity.

It caters well to cost-conscious traders, offering slightly lower fees for spot transactions and incentives for using its native token, BGB. If you engage in spot trading frequently, these marginal savings could be significant over time.

For futures trading, you might lean towards Bitget for its competitive rates of 0.02% for makers and 0.06% for takers, potentially benefiting if you’re an active futures trader.

However, KuCoin’s rates are on par with Bitget’s base spot trading fees and can be reduced using KCS, KuCoin’s native token.

Explore how Bitget and KuCoin compare to their competitors:

- Bitget vs Bybit: A Comprehensive Analysis of Trading Platforms

- Bitget vs PrimeXBT: A Comprehensive Analysis of Trading Platforms

- Bitget vs MEXC: A Comprehensive Analysis of Trading Platforms

- KuCoin vs BitMEX: A Comprehensive Analysis of Trading Platforms

- KuCoin vs Kraken: A Comprehensive Analysis of Trading Platforms

- Bybit vs KuCoin: A Comprehensive Analysis of Trading Platforms