Bitget and PrimeXBT are prominent cryptocurrency exchanges with distinct features. Bitget is known for its focus on copy trading, allowing users to follow and replicate the trades of experienced traders. It also offers spot and derivatives trading with competitive fees and advanced tools, catering to a broad range of traders.

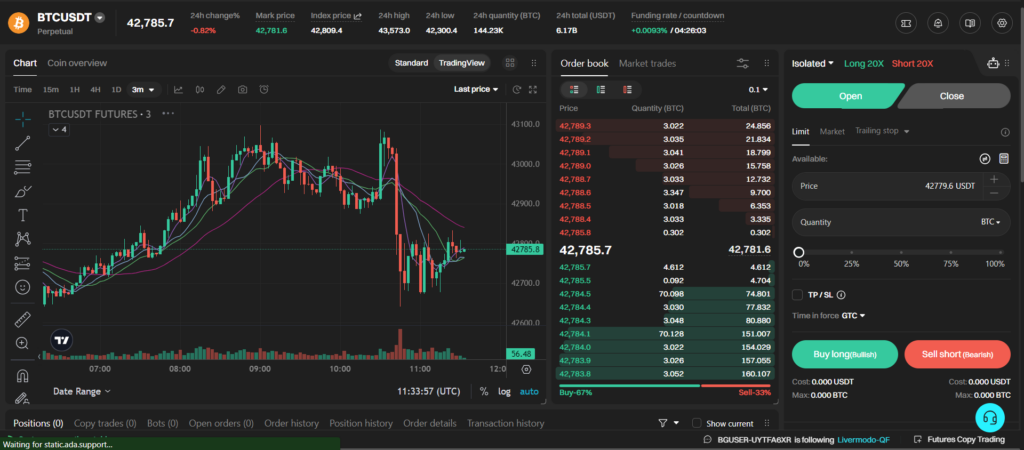

PrimeXBT specializes in leveraged trading across various asset classes, including cryptocurrencies, forex, commodities, and indices. It provides advanced trading tools and high leverage options, targeting professional traders seeking sophisticated strategies.

When choosing between Bitget and PrimeXBT, you should consider several factors such as their main features, fees, and offered products. The table below outlines key differences and similarities to help with your decision.

| Feature | Bitget | PrimeXBT |

|---|---|---|

| Supported Cryptos | Offers a selection including BTC, LTC, ETH, and USDT | Provides a variety of trading pairs across cryptocurrencies |

| Trading Types | Spot, futures, and cryptocurrency trading | CFD trading with cryptocurrencies, forex, commodities, stocks, and more |

| Leverage | Not specified | Up to 1:200 for certain trading pairs |

| Trading Fees | Not specified | Not specified, updated monthly |

| Withdrawal Fees | Not specified | Not specified |

| Deposit Methods | Not specified | Not specified |

| Platforms | User-friendly, suitable for traders of all levels | Advanced trading and charting platform |

| Established | Not specified | 2018 |

| User Scores | Not specified | Not specified |

| Sign-up Bonus | Not mentioned | Up to $100 bonus may be available |

Note: The specific trading fees, deposit methods, and withdrawal fees are not detailed here, and you should check the current terms on each platform as they may be subject to monthly updates. Both platforms offer their own advantages depending on your trading priorities, whether it’s the types of instruments available or the potential for leverage.

Bitget vs PrimeXBT: Products and Services

When comparing the offerings from Bitget and PrimeXBT, you’ll notice both cater to different trader preferences within the cryptocurrency space. Each platform has carved out distinct services that appeal to various aspects of trading.

Bitget emphasizes its feature set for both spot and futures trading. As a trader looking for variety, you’ll find Bitget provides a full spectrum of cryptocurrency trading pairs. The added advantage lies in its futures market, which presents a robust set of tools for those looking to engage in more advanced trading strategies.

- Spot Trading: A wide selection of pairs.

- Futures Trading: Comprehensive instruments available.

- Options Trading: Not prominently advertised.

- Leveraged Tokens: Not provided.

- NFT Marketplace: Not offered.

- Staking Facilities: Available, further enriching your investment options.

PrimeXBT, on the other hand, prides itself on diversity by offering not just cryptocurrency trading, but also forex, commodities, and indices. For traders seeking a platform that branches out beyond digital currencies, PrimeXBT can be a compelling choice.

- Spot Trading: Not the main feature.

- Futures Trading: Includes competitive fees and crypto futures.

- Unique Feature: PrimeXBT Turbo caters to short-term trading opportunities.

- Leveraged Tokens: Not specified.

- NFT Marketplace: Absent.

- Staking: Does not feature prominently.

Both platforms showcase a dedication to innovation. Bitget provides a user-friendly interface geared primarily toward crypto enthusiasts, while PrimeXBT broadens the horizon with additional markets and its novel Turbo feature. Whether you prefer a focused or diverse approach to trading, each exchange offers distinct strengths to match your trading style.

Bitget vs PrimeXBT: Contract Types

When comparing the contract types available on Bitget and PrimeXBT, you’ll find a variety of options that cater to different trading strategies and preferences.

Bitget primarily offers the following:

- Inverse Perpetual Contracts: These allow you to trade cryptocurrency contracts with the coin itself as collateral.

- Linear Perpetual Contracts: In this case, you trade contracts with USDT as collateral, simplifying the process for those who prefer a stablecoin collateral.

- Options: These are financial instruments that give you the right, but not the obligation, to buy or sell an asset at a pre-agreed price and date.

PrimeXBT, on the other hand, has a somewhat different range:

- Inverse Futures Contracts: These contracts take the form of an agreement to buy or sell an asset at a future date, with the asset itself serving as collateral.

- COIN-M Futures: This type of contract uses the cryptocurrency itself for margin and settlement.

- USD-M Futures: These futures contracts are margin and settled in USD, or its equivalent, offering a measure of stability against crypto market volatility.

Both Bitget and PrimeXBT offer contracts that can benefit your trading by providing leverage options, allowing for short or long positions, and enabling you to manage risk through hedging. It’s important to understand the associated risks, as futures and options trading can lead to substantial profits, but also significant losses, especially when leveraging positions.

Bitget vs PrimeXBT: Leverage and Margin

When trading on Bitget or PrimeXBT, you can utilize leverage, which essentially allows you to borrow funds to increase the size of your position beyond what your initial capital would permit. This amplifies your potential profits as well as your potential losses.

Bitget leverages:

- Max Leverage for Futures: 1-125x

- Cryptos: Offers a range of cryptocurrency pairs.

PrimeXBT leverages:

- Max Leverage: Up to 1-1000x, varying by asset

- Cryptocurrencies: Up to 1:200 for BTC and ETH, and 1:100 for altcoins

- Indices and Commodities: Up to 1:100

- Forex Pairs: Up to 1:1000

For both platforms, the margin you provide, also known as the initial capital, is necessary to open a leveraged position. The margin represents a fraction of the total position value. PrimeXBT, for instance, might require a 0.5% margin for cryptocurrency trades at 200x leverage.

Margin requirements should be carefully monitored to avoid liquidation, which can occur if the market moves against your position and your margin is insufficient to sustain it. Both Bitget and PrimeXBT provide tools and features to manage this risk, including stop-loss orders.

Lastly, when trading on leverage, be aware of the funding rates, which are payments exchanged between buyers and sellers that hold open positions in perpetual contracts. These rates vary based on market conditions and the positions held by traders.

Remember, leveraging can significantly increase your exposure to the market, so it’s important to trade responsibly and be aware of the risks involved.

Bitget vs PrimeXBT: Liquidity and Volume

When you’re comparing Bitget and PrimeXBT, two prominent figures in the cryptocurrency exchange market, you’ll notice that liquidity and trading volume are key indicators of their performance and reliability. High liquidity ensures that you can execute trades quickly at predictable prices, while volume indicates the activity level and overall health of the marketplace.

Bitget

- Liquidity: Offers competitive liquidity which may result in relatively low slippage. Regular updates and monitoring maintain adequate liquidity levels. Rankings may vary, but consistently performs well.

- Volume: Bitget boasts a stable trading volume, reflecting a healthy trading environment and demonstrating reliability for executing trades efficiently.

PrimeXBT

- Liquidity: Known for high liquidity levels offering swift order execution often averaging below 7.12 milliseconds. Reliable liquidity providers contribute to this efficiency.

- Volume: PrimeXBT has a significant daily trading volume cited to be over $123,000,000. A high trading volume is indicative of a vibrant market with a large number of participants.

Both exchanges offer you different advantages, so your choice will hinge on your trading preferences. Bitget, with stable liquidity and volume, can be a reliable choice. On the other hand, PrimeXBT, renowned for high liquidity and an impressive trading volume, may provide an edge, especially for trading CFDs and similar assets.

Always refer to the latest sources and metrics for up-to-date comparisons. These are subject to change and can have a direct impact on your trading experience regarding slippage and order execution.

Bitget vs PrimeXBT: Fees and Rewards

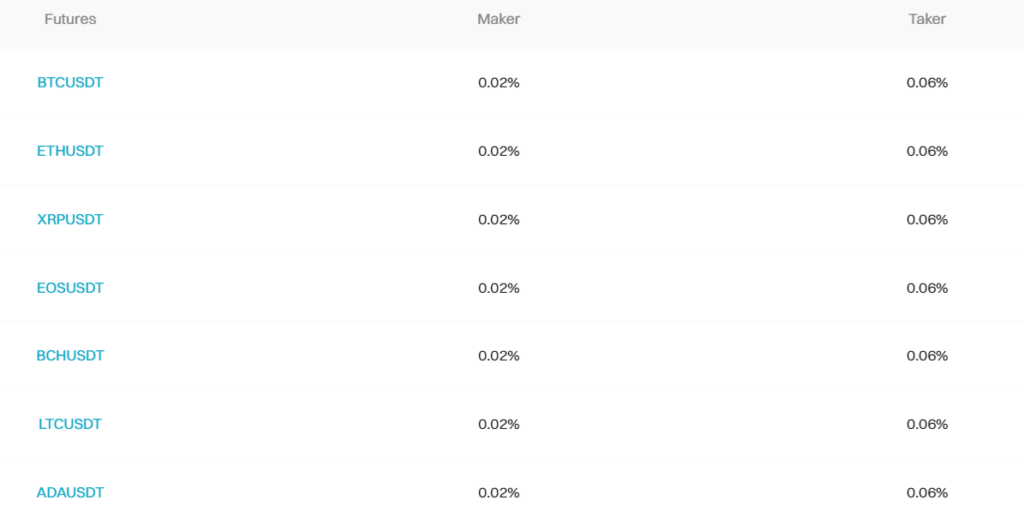

When trading on Bitget, you’ll encounter a fee structure characterized by low maker and taker fees. Specifically, you are charged a maker fee of 0.02% and a taker fee of 0.06%. These fees are relatively competitive when compared to other exchanges in the market. Additionally, Bitget incentivizes new users with bonus funds, which can be earned through actions such as registration, verification, and account funding, and may be utilized to offset commission costs.

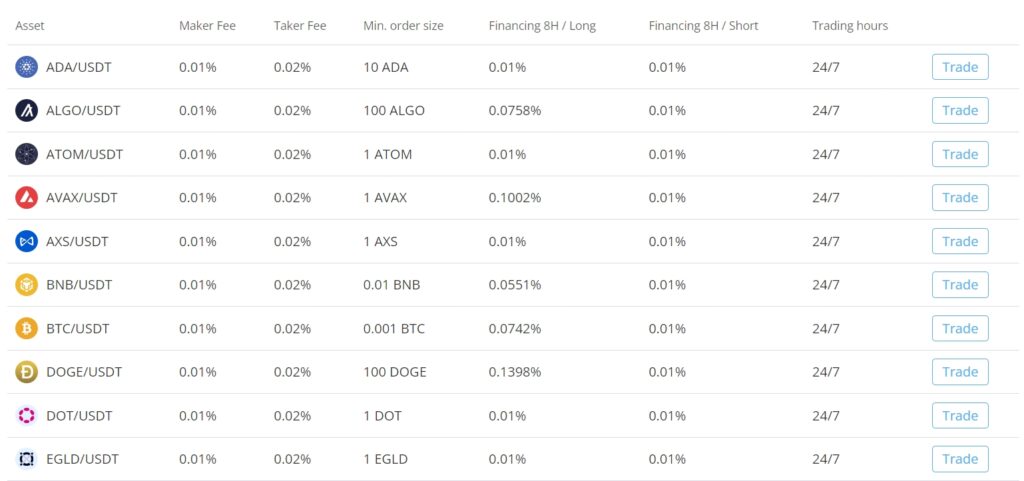

In contrast, PrimeXBT prides itself on offering leverage and a multi-asset trading platform while maintaining a low fee schedule. For trading crypto futures, the fees are set at 0.01% for makers and 0.02% for takers. If you’re diversifying into global markets using the platform, the costs are slightly higher, with fees being 0.05% for both makers and takers. These fees allow for cost-effective trading, especially when dealing with large volumes.

- Example Bitget Fee Calculation: If you’re a taker placing an order for $10,000 worth of cryptocurrency, a 0.06% taker fee would amount to $6.

- Example PrimeXBT Fee Calculation: As a maker trading $10,000 in crypto futures, a 0.01% fee comes out to just $1.

Apart from basic trading costs, both platforms may offer trading incentives or volume-based discounts, which can further reduce fees for active traders, although specifics vary over time and you should check the latest terms directly on each platform.

Bitget vs PrimeXBT: Trading Fee & Deposit/Withdrawal Fee Compared

When trading on Bitget, you’ll encounter a maker fee of 0.02% and a taker fee of 0.06%. Using bonus funds granted upon certain account activities can reduce Bitget’s fee. For withdrawal and deposit fees, Bitget offers competitive rates often connected to the specific type of transaction. You may also benefit from a 20% discount on fees by using Bitget’s native token, BGB.

On the other hand, PrimeXBT charges crypto futures trading fees with 0.01% for makers and 0.02% for takers. Trading fees for global markets are set at 0.05% for both makers and takers. Your withdrawal fee on PrimeXBT depends on the asset; it’s 0.0005 BTC for Bitcoin and 0.002 ETH for Ethereum. Different network choices affect fees as well, like withdrawing USDT could cost you 10 USDT as an ERC-20 token and 0.8 USDT as a BEP-20 token.

Regarding deposit methods, these platforms provide various options, but the fees may vary based on the payment method and network congestion at the time of your transaction.

Here is a brief comparison:

| Exchange | Maker Fees | Taker Fees | Withdrawal Fee (BTC) | Deposit Fee | Special Discounts |

|---|---|---|---|---|---|

| Bitget | 0.02% | 0.06% | Varies | Varies | 20% with BGB |

| PrimeXBT | 0.01% | 0.02% | 0.0005 BTC | Varies | N/A |

Before making any transactions, ensure you review the latest fee structure as it may be updated periodically.

Bitget vs PrimeXBT: Deposits & Withdrawal Options

When choosing a cryptocurrency exchange, understanding how to manage your funds is crucial. Both Bitget and PrimeXBT facilitate transfers but differ in their methods, currencies, and limits.

Bitget supports a range of cryptocurrencies for deposit and withdrawal. You can fund your Bitget account or take out your earnings using popular digital currencies. However, the exact options available to you may depend on your region and the specific policies of Bitget at the time of your transfer. The processing times vary and are generally quick, though network congestion can sometimes cause delays.

On the other hand, PrimeXBT allows transactions in cryptocurrencies, and you manage funds in a digital wallet. PrimeXBT requires a minimum deposit amount to start trading, and while there are no deposit fees, withdrawal fees apply. The withdrawal process might take a bit longer compared to Bitget due to security measures and processing times.

Here is an overview of deposit and withdrawal aspects for each platform:

| Feature | Bitget | PrimeXBT |

|---|---|---|

| Supported Currencies | Multiple cryptocurrencies | Multiple cryptocurrencies |

| Deposit Methods | Cryptocurrency transfers | Cryptocurrency transfers |

| Withdrawal Methods | Cryptocurrency transfers | Cryptocurrency transfers |

| Processing Times | Typically fast; may vary | May take longer due to security verifications |

| Minimum Amounts | Varies, may be influenced by current promotions | Required minimum deposit amount |

| Maximum Amounts | Dependent on account level and currency | Dependent on account level and currency |

| Fees | Variable transaction fees for withdrawals | No deposit fees; withdrawal fees apply |

Bitget vs PrimeXBT: KYC Requirements & KYC Limits

Know Your Customer (KYC) protocols ensure that exchanges operate within regulatory compliance and also provide a measure of security for your investments.

Bitget has recently mandated KYC verification for all users. As of September 1, 2023, this exchange requires you to complete KYC verification upon registration. The process typically includes providing personal information, a government-issued ID, and occasionally a proof of address.

Here’s a simplified breakdown of KYC requirements for Bitget:

- New Users: Mandatory KYC on registration

- Verification Documents: Government-issued ID, possible requirement of address proof

- Impact on Limits: Enhanced transaction limits upon successful KYC completion

On the other side, PrimeXBT also enforces KYC procedures, although specific details regarding their requirements and limits are not indicated in the provided search results. Therefore, it’s important you check PrimeXBT’s official resources for exact KYC protocols.

- New Users: KYC likely required

- Verification Documents: Standard KYC documents similar to Bitget may be expected

- Impact on Limits: Depends on the level of verification completed

Bitget vs PrimeXBT: Order Types

In comparing Bitget and PrimeXBT, you’ll find a range of order types designed to cater to diverse trading strategies and risk management preferences.

Bitget supports:

- Market orders: These orders are executed immediately at the current market price.

- Limit orders: Set your price to buy or sell, and the order will execute when the market reaches that price.

- Stop orders: These orders become active only after a specified stop price is reached, typically to limit potential losses.

In addition, Bitget may offer advanced types such as conditional orders, which are executed only if certain conditions are met.

PrimeXBT offers:

- Market orders: Similar to Bitget, allowing instant execution.

- Limit orders: You can specify the price you’re willing to take.

- Stop orders: To stop losses or protect profits by executing at a specified price.

PrimeXBT also extends its order types with options like OCO (One-Cancels-the-Other), where two orders are placed and if one is triggered, the other is canceled, streamlining trade management.

Both exchanges also feature post-only orders ensuring you pay the maker fee, and reduce-only orders, which limit the size of your position.

Here’s a brief comparison:

| Order Type | Bitget | PrimeXBT |

|---|---|---|

| Market | Yes | Yes |

| Limit | Yes | Yes |

| Stop | Yes | Yes |

| Conditional | Yes | No |

| Post-Only | Yes | Yes |

| Reduce-Only | Yes | Yes |

| OCO | No | Yes |

Bitget vs PrimeXBT: Security and Reliability

When trading cryptocurrency, your security and the reliability of the platform you choose are paramount. Both Bitget and PrimeXBT understand this and have implemented measures to protect your funds and data.

Bitget: This exchange ensures security through a combination of cold wallet storage, real-time monitoring, and a multi-signature system. These layers help to safeguard your digital assets against unauthorized access. Additionally, Bitget has know your customer (KYC) procedures in place to prevent fraud and ensure regulatory compliance.

- Incidents: No major security breaches have been reported for Bitget.

- Regulatory Compliance: Bitget adheres to the necessary legal requirements in the regions it operates.

- Customer Support: Offers 24/7 support to address your queries and concerns.

PrimeXBT: PrimeXBT’s strong stance on security is evident in its advanced security features which include cloudflare to prevent DDoS attacks, secure SSL encryption, and hardware security modules with rating FIPS PUB 140-2 Level 3 or higher.

- Incidents: There have been no significant reports of security breaches at PrimeXBT. The platform’s commitment to security is often noted by users.

- Regulatory Compliance: The exchange operates under the regulatory framework of its registered locations and upholds a strict anti-money laundering (AML) policy.

- Customer Support: PrimeXBT also provides continuous customer support to assist you with any issues.

Bitget vs PrimeXBT: User Experience

When you navigate to Bitget or PrimeXBT, you’ll find that both platforms prioritize ease of use, catering to traders of varying experience levels.

Bitget offers a straightforward experience, emphasizing rapid navigation and a user-friendly design. You can start trading within a few moments of registration.

PrimeXBT, on the other hand, takes pride in its sleek interface that mirrors its desktop functionalities onto its mobile app. The convenience of trading across assets and markets is enhanced by smooth in-app transactions and a minimalistic starting requirement—getting started with as little as $5.

Comparison:

- Speed and Design: PrimeXBT stands out with a quick and responsive mobile app, while Bitget offers a competent, if slightly less dynamic, interface.

- Functionality: Both exchanges feature a range of functionalities. PrimeXBT provides a sliding leverage system, allowing for high leverage on crypto and traditional assets. Meanwhile, Bitget’s interface might be simpler, but it ensures all essential tools are accessible.

- User Feedback:

- PrimeXBT: Users appreciate the comprehensive trading tools and the option to engage in both crypto and global market trades.

- Bitget: Its user-centric approach garners a positive response, particularly for its clear layout and smooth trading process.

Features:

- Bitget: Focused on crypto trading.

- PrimeXBT: Offers a broader spectrum of markets, including crypto, forex, and stocks.

Bitget vs PrimeXBT: Education and Community

When it comes to education and community, both Bitget and PrimeXBT provide resources that cater to traders who seek to enhance their knowledge and engage with other users.

Bitget:

- Demo-Account/Paper Trading: Offers a way for you to practice trading without risking real money.

- Articles: Regular updates and educational content are available to help you stay informed.

- Social Media Presence: Active on various platforms, allowing for community engagement and support.

PrimeXBT:

- Demo-Account/Paper Trading: Like Bitget, you have access to a simulated trading environment.

- Articles: Informative articles are provided to guide you through various aspects of trading.

- Social Media Presence: Maintains a strong presence online, fostering a community for user interaction.

Neither platform offers courses, videos, or webinars as part of their educational content. However, both appear to be focused on providing you with written materials and a platform where you can practice trading strategies.

Your choice between these two might come down to the user interface, ease of access to information, and the responsiveness of their social media channels. You might want to consider how active each platform’s community is, and which provides the support and engagement that aligns with your needs.

Bitget vs PrimeXBT: Regulation and Compliance

When choosing a cryptocurrency exchange, it’s crucial to consider how each platform adheres to regulations and maintains compliance within their operational jurisdictions. Understanding the legal posture of Bitget and PrimeXBT helps ensure you’re engaging with services that prioritize your security and operate within established legal frameworks.

Bitget:

- Established: Region-specific regulations apply.

- Compliance: Employs measures for KYC (Know Your Customer), AML (Anti-Money Laundering), and CTF (Counter Terrorism Financing).

- Audits: Regular audits by third-party security firms to ensure the safety of funds and user data.

PrimeXBT:

- Registration: Registered in Seychelles, with offices in St. Vincent and the Grenadines.

- Compliance: Implements KYC and AML policies to align with global standards.

- Safety: Safety of funds is a prime commitment, subject to frequent security evaluations.

| Aspect | Bitget | PrimeXBT |

|---|---|---|

| Jurisdiction | Varies based on regional presence | Registered in Seychelles |

| KYC/AML | Strict policies in place | Global standards compliance |

| Security | Third-party audits | Regular evaluations |

| Licenses | Acquires necessary local licenses | Adheres to local license requirements |

| Controversies | None stated | None stated |

Conclusion

When comparing Bitget and PrimeXBT, it’s important to consider your experience level and trading needs.

PrimeXBT excels with its advanced features and diverse market offerings. Its platform is tailored for experienced traders.

PrimeXBT users can access high leverage and a broad range of assets, including cryptocurrencies, forex, and commodities.

Bitget, on the other hand, appeals to those interested in spot and futures cryptocurrency trading. Especially with its selection of coins like BTC, LTC, and ETH, Bitget is designed to cater to enthusiasts in the crypto space.

| Exchange | User-Friendliness | Asset Variety | Trading Types | Fees |

|---|---|---|---|---|

| Bitget | Suitable for crypto trades | Crypto-focused | Spot, Futures | Competitive |

| PrimeXBT | Advanced Users | Wide Range | CFDs across multiple markets | Competitive |

Your choice should hinge on the trading environment you prefer.

If you prioritize a crypto-centric community with efficient trading mechanisms, Bitget may be the way to go. Meanwhile, PrimeXBT stands out for broad market access and high-leverage trading capabilities.

Both exchanges provide a platform with unique advantages and some limitations. Assess these carefully in light of your trading strategy.

Remember, while competitive fees are important, the overall experience and security should never be overlooked. Choose the exchange that aligns best with your risk tolerance and trading goals.

Explore how Bitget and PrimeXBT compare to their competitors:

- Bitget vs Bybit: Unveiling the Best Trading Platform for You

- Bitget vs BingX: Unveiling the Best Trading Platform for You

- Bitget vs Phemex: Unveiling the Best Trading Platform for You

- PrimeXBT vs Binance: Unveiling the Best Trading Platform for You

- PrimeXBT vs StormGain: Unveiling the Best Trading Platform for You

- PrimeXBT vs Phemex: Unveiling the Best Trading Platform for You