KuCoin and BitMEX are two well-known cryptocurrency exchanges, each with unique features and strengths. KuCoin, established in 2017, is recognized for its wide variety of supported cryptocurrencies, user-friendly interface, and diverse trading options including spot, margin, and futures trading. It also offers additional financial services such as staking, lending, and a platform for token launches, catering to both novice and experienced traders.

BitMEX, launched in 2014, is renowned for its focus on leveraged trading and derivatives. It specializes in Bitcoin and other cryptocurrency futures and perpetual contracts, offering high leverage options that attract professional traders and institutions. BitMEX’s advanced trading tools and deep liquidity make it a preferred choice for those looking to engage in sophisticated trading strategies.

When comparing KuCoin and BitMEX, it is essential to consider various factors that cater to your trading needs. Below is a table to help you understand the differences between the two platforms.

| Feature | KuCoin | BitMEX |

|---|---|---|

| Founded | 2017 | 2014 |

| Founder(s) | Michael Gan, Eric Don | Arthur Hayes, Ben Delo, Samuel Reed |

| Supported Coins | 200+ | Mainly derivatives of BTC and other major coins |

| Leverage | Up to 10x (for some markets) | Up to 100x on Bitcoin derivatives |

| Trading Volume | High | High |

| Deposit Methods | Crypto, Credit/Debit cards, Bank Transfer | Only Bitcoin (BTC) |

| Spot Trading | Yes | No |

| Futures Trading | Yes | Yes |

| Perpetual Contracts | Yes | Yes |

| Fees | Low; varies by market | Low; varies by contract type |

Remember that both KuCoin and BitMEX frequently update their services and features.

For the most recent and detailed information, it is recommended to visit their respective websites. This table is a general guide to help you with the preliminary analysis of both platforms.

KuCoin Vs. Bitmex: Products And Services

KuCoin and BitMEX are recognized platforms in the cryptocurrency exchange, yet they offer distinctive services and products tailored to different user needs.

KuCoin provides an extensive array of services, including:

- Spot Trading: You can trade various cryptocurrencies on the spot market.

- Futures Trading: Offers the ability to hedge or leverage your positions.

- Lending: Lend your crypto to earn interest.

- NFT Marketplace: A platform for non-fungible tokens.

- Staking: Stake your coins to earn rewards.

- User Experience: Known for a more user-friendly interface suited to both beginners and advanced traders.

On the other hand, BitMEX is known for specializing in advanced trading products:

- Futures Trading: Provides a robust platform for futures and perpetual contracts.

- Leveraged Trading: Offers high-leverage options on trades.

- Derivatives: A strong focus on derivative products.

- Liquidity: BitMEX is known for high liquidity, especially in the derivatives market.

While KuCoin offers more variety, including P2P exchange and spot trading, which might appeal to a broader audience, BitMEX stands out with its offering of crypto derivatives, catering mainly to users focused on leveraged and futures trading, which may require a platform with high liquidity.

KuCoin Vs. Bitmex: Contract Types

When comparing KuCoin and BitMEX, you’ll find that both platforms offer a diverse range of contract types catering to various trading strategies. Each type has different mechanics and is suitable for different trading goals.

KuCoin primarily offers the following contracts:

- Inverse Perpetual Contracts: These allow you to trade cryptocurrency contracts with coins as collateral, which means you bet on the coin’s price movement.

- COIN-M Futures: These are coin-margined futures contracts that you can settle in the cryptocurrency on which the contract is based.

BitMEX, on the other hand, provides these contract offerings:

- Inverse Perpetual Contracts: Similar to KuCoin, these contracts use the underlying cryptocurrency as collateral. However, BitMEX is known for its high liquidity in this area, which might interest you if you’re looking for rapid execution.

- Linear Perpetual Contracts: You use stablecoins (like USDT) to trade these contracts, offering you a way to stay within cryptocurrency while avoiding volatility in your collateral.

- Inverse Futures Contracts: This is a traditional form of futures contract where the asset delivered at expiry is the cryptocurrency itself.

- Quanto Futures Contracts: These contracts have a fixed Bitcoin multiplier regardless of the fiat value of the contract. This can be beneficial if you’re looking to trade on price movements without direct exposure to the underlying asset’s price in fiat terms.

- Options: BitMEX offers options that give you rights but not the obligation to purchase or sell the underlying asset at a predefined price.

You need to assess the risks and rewards associated with each contract type. Perpetual contracts are famous for their lack of expiry date, which provides flexibility.

However, they may involve funding fees that can add up. Futures and options, while offering clarity with their set expiry dates, require a more strategic approach considering the settlement date.

The choice between coin-margined and stablecoin-margined contracts further depends on your risk tolerance for volatility.

KuCoin Vs. Bitmex: Supported Cryptocurrencies

When comparing KuCoin and BitMEX, you’ll find that both exchanges offer diverse cryptocurrencies but with distinct differences, especially regarding futures and leverage trading.

KuCoin provides a wide selection of over 700 cryptocurrencies.

This expansive offering includes not only the major players like Bitcoin (BTC) and Ethereum (ETH) but also a multitude of altcoins. Your futures trading on KuCoin is well-supported with various pairs, including:

- BTC

- ETH

- KCS (kucoin’s token)

BitMEX, on the other hand, focuses primarily on the derivatives market and offers a narrower range of cryptocurrencies for futures and leverage trading.

However, its futures contracts, particularly those for BTC, are popular among traders. The most traded futures pairs on BitMEX include:

- XBT: Bitcoin

- ETH: Ethereum

BitMEX is known for offering up to 100x leverage on some Bitcoin contracts, a significant draw for traders looking for high-risk and high-reward opportunities.

KuCoin

| Futures Trading Pairs |

|---|

| BTC |

| ETH |

| KCS |

BitMEX

| Futures Trading Pairs |

|---|

| XBT |

| ETH |

Remember that each platform’s support for various cryptocurrencies and trading pairs may evolve, ensuring they stay competitive and meet traders’ demands.

As you consider your trading options on KuCoin and BitMEX, keep a close eye on the available cryptocurrencies and pairs for a tailored trading strategy.

KuCoin Vs Bitmex: Leverage And Margin Trading

When comparing KuCoin and BitMEX, it’s crucial to understand their respective leverage and margin trading features.

Leverage trading amplifies your position beyond your initial capital, increasing potential risks and rewards.

KuCoin’s Leverage Options:

- Maximum Leverage: Up to 10X for specific cryptocurrencies.

- Margin Requirements: Varies by asset, emphasizing risk management and user protection.

- Liquidation Risks: KuCoin implements a tiered margin system to prevent significant liquidation events.

- Funding Rates: Competitive, with discounts if using their native token KCS to pay for fees.

BitMEX’s Leverage Options:

- Maximum Leverage: BitMEX offers up to 100X leverage for some of its contracts, notably higher than KuCoin.

- Margin Requirements: Since BitMEX offers higher leverage, the margin requirements are stringent. You’re operating with higher capital efficiency but at increased risk.

- Liquidation Risks: Close monitoring is advised, as high leverage can lead to quick liquidation if the market moves unfavorably.

- Funding Rates: Rates are based on market conditions and can vary. Periodic funding ensures positions can be held as long as necessary, given fees are covered.

Leverage trading on both KuCoin and BitMEX can offer significant opportunities for gains.

With KuCoin, you benefit from a moderate leverage cap, which might be attractive for risk-averse traders.

BitMEX goes further in market liquidity and leverage options, potentially providing more flexibility for experienced traders looking for higher stakes.

KuCoin Vs. Bitmex: Trading Volume

When trading on exchanges like KuCoin or BitMEX, the trading volume is an essential factor to consider. It gives you a sense of the liquidity available—key for efficient trade execution and minimizing slippage.

KuCoin is known for offering a wide variety of assets, with its trading volume indicating active participation, which could lead to better price discovery and more stable trading.

If you’re trading popular pairs, KuCoin’s volume can ensure that your trades are completed without significantly affecting the market price.

On the other hand, BitMEX specializes in derivative products like futures and perpetual swaps, which has historically attracted many traders. This can particularly benefit you if you want to execute large-volume trades quickly.

- Trading Volume Metrics

- KuCoin: Supports a robust trading environment for a diverse range of crypto assets.

- BitMEX: Provides high liquidity, especially in crypto derivatives trading.

The volume and liquidity rankings sources include platforms like CoinMarketCap, which are critical to getting real-time and accurate data before trading.

- Rankings of Liquidity and Volume

- KuCoin: Offers many markets and supports fiat trading, which can contribute to its volume.

- BitMEX: Focusing mainly on derivatives attracts a different type of trading volume, one that’s centered around more sophisticated trading instruments.

Your choice between the two exchanges may boil down to the types of trades you intend to execute and the volume associated with those trading activities.

KuCoin Vs Bitmex: Futures Trading Fees And Rewards

When you engage in futures trading on KuCoin and BitMEX, understanding the fee structure is essential for your trading strategy.

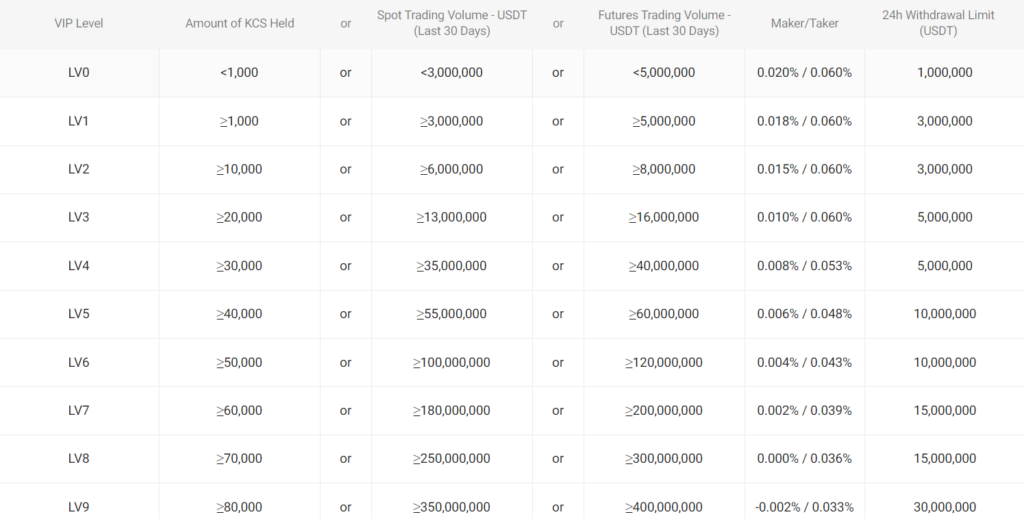

KuCoin Futures Trading Fees:

- Maker Fee: 0.02%

- Taker Fee: 0.06%

- Rewards: Trading fee discounts for using KCS (KuCoin’s native token) and for higher trade volumes.

For example, if you execute a trade worth $10,000 on KuCoin as a maker, your fee would be $2. Conversely, as a taker, it would be $6. By holding KCS, you could further reduce these fees.

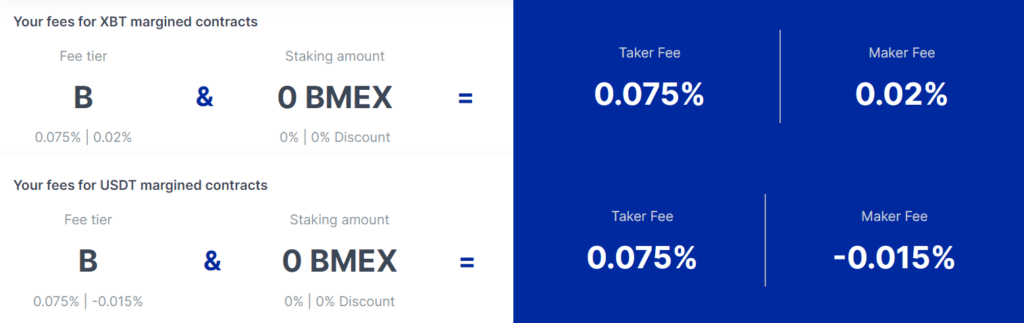

BitMEX Futures Trading Fees:

- Maker Fee: -0.025% (You earn a rebate)

- Taker Fee: 0.075%

- Rewards: No explicit rewards system is mentioned, but the maker fee rebate incentivizes liquidity provision.

For the same $10,000 trade on BitMEX, you would earn a $2.50 rebate as a maker, whereas, as a taker, you would pay a fee of $7.50. This creates an incentive for you to provide liquidity to the market.

Fee Comparisons:

- Withdrawal Fees: Vary depending on network conditions. Both exchanges adjust withdrawal fees based on blockchain conditions.

- Deposit Fees: Generally, there are no deposit fees on either exchange.

On KuCoin, as your trading volume increases or your KCS holdings grow, you can unlock additional benefits, such as lower taker fees.

BitMEX does not offer a tiered fee structure but provides a unique advantage for makers earning rebates rather than paying fees.

Each platform offers a different approach to futures trading fees and rewards. KuCoin uses a traditional fee structure with discounts for high-volume trading and KCS usage.

In contrast, BitMEX has a distinctive model that rewards makers with rebates, which can be particularly attractive to traders who often provide liquidity to the market.

KuCoin Vs Bitmex: Deposits & Withdrawal Options

When considering KuCoin and BitMEX, deposit and withdrawal options differ and are tailored to their respective user bases.

KuCoin provides a broader range of options for funding your account. You can use:

- Cryptocurrency transfers

- Bank wire transfer

- Credit/debit cards through Simplex, Banxa, PayMIR

Withdrawals on KuCoin are generally processed swiftly, though the time can vary based on the method chosen and the current network load. There is support for numerous cryptocurrencies and fiat currencies, which allows for greater flexibility.

BitMEX, on the other hand, is more restrictive. Your funding and withdrawal options include:

- Only Bitcoin (BTC) deposits and withdrawals

This focus on Bitcoin means that transactions are straightforward, but your options are limited to a single cryptocurrency.

Users must handle conversions between Bitcoin and other currencies independently. Withdrawals on BitMEX are processed once daily, providing additional security but potentially causing delays.

Here’s a quick comparison for clarity:

| Feature | KuCoin | BitMEX |

|---|---|---|

| Supported Currencies | Multiple cryptocurrencies and some fiat currencies | Bitcoin (BTC) only |

| Deposit Methods | Crypto, bank wire, credit/debit cards | Crypto (BTC) only |

| Withdrawal Processing | Varies based on method and load | Once per day at a set time |

| Limitations | Depends on currency and verification level | N/A |

Remember, it’s essential to review the fees and limits associated with each method and exchange, as they can impact your transfer’s total cost and amount.

KuCoin Vs. Bitmex: Native Token Usage

KuCoin and BitMEX, as digital asset exchange platforms, employ native tokens that serve varying roles within their ecosystems.

KuCoin: KCS Token

- Purpose: KuCoin shares (KCS) is the native token of KuCoin. It functions primarily as a utility token, allowing you to participate in the growth of the exchange.

- Ecosystem Integration: KCS is integrated into the KuCoin ecosystem by providing trading fee discounts, access to special events, and other in-exchange benefits. For instance, holding KCS may earn you daily dividend rewards, a portion of the exchange’s trading fee revenues.

BitMEX: BMEX Token

- Purpose: BitMEX’s native token is notably used for trading fee discounts, similar to KCS. These tokens are crucial in engaging active platform users and incentivizing trading activities.

- Ecosystem Integration: Within the BitMEX ecosystem, possessing BMEX tokens may yield lower trading fees and enhance your trading experience.

Trading Fees Benefits

- KuCoin: Users holding KCS may enjoy significant reductions in trading fees, a benefit that is enhanced by the number of KCS held.

- BitMEX: BitMEX also offers advantages in trading fees to BMEX token holders, although the structure may differ from KuCoin’s.

In-Exchange Utility

- KuCoin: Beyond trading fee concessions, KCS holders often get access to exclusive promotions, offers, and potentially higher yields on crypto products.

- BitMEX: BMEX holders can similarly enjoy periodic promotions and may gain an edge during platform-centric events or features.

Your experience on both platforms is notably enriched by utilizing their native tokens, which provide an array of utilities and incentives beyond basic trading functionality.

KuCoin Vs Bitmex: KYC Requirements & KYC Limits

When engaging with KuCoin, you will encounter a compulsory KYC (Know Your Customer) policy implemented starting July 15, 2023.

You must complete the KYC process and comply with global regulations to prevent illegal activities such as fraud and money laundering.

Once you’ve completed the KYC verification, it enables higher daily withdrawal limits.

KuCoin Verification Levels and Limits:

- Primary Verification: Your full name, date of birth, and country of residence are required. You will encounter restrictions on withdrawals and deposits.

- Advanced Verification: Requires submitting a government-issued ID and a selfie. This level significantly increases or may remove the caps on your transactions.

BitMEX, on the other hand, operates as a cryptocurrency derivatives platform that emphasizes enforcing KYC measures on all its customers globally.

BitMEX’s verification process requires you to submit identification documents and proof of address and answer a few questions related to your trading experience and sources of funds.

BitMEX Verification Levels and Limits:

- Unverified Accounts: Limited access to platform features; unable to withdraw funds.

- Verified Accounts: Access to full platform functionality, including unlimited deposits and withdrawals.

Your choice between KuCoin and BitMEX may hinge on how these KYC requirements align with your preferences for privacy, trading needs, and the level of access you require.

Each exchange’s procedures ensure security, yet they also signal a commitment to regulatory standards, which impacts your access to the different services they provide.

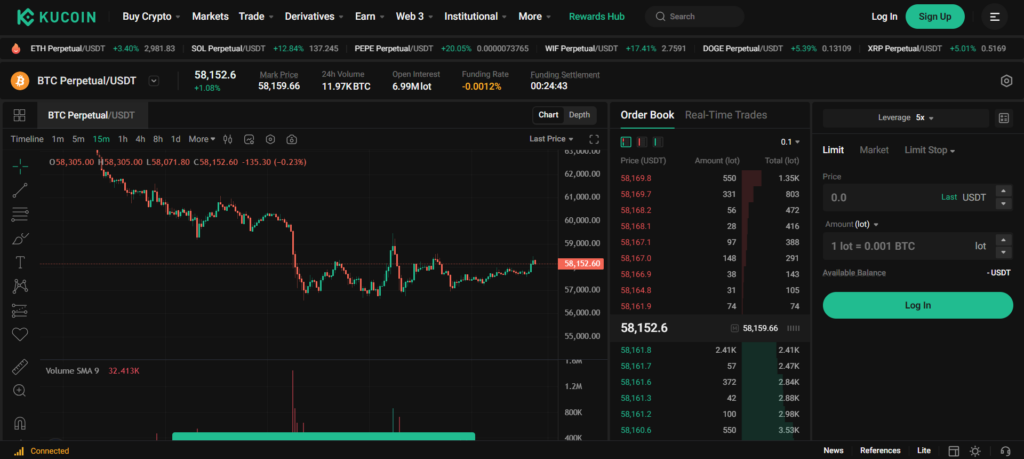

KuCoin Vs Bitmex: User Experience

When navigating KuCoin and BitMEX, your experience is shaped by their respective platforms’ functionalities and design, both on mobile and web interfaces.

KuCoin:

With KuCoin:

- You notice a user-friendly interface designed for ease of use.

- Beginners and advanced users alike find the navigation intuitive.

- The mobile app is responsive and retains full exchange capabilities.

- Features like real-time order books, interactive charts, and a suite of trading tools are readily accessible.

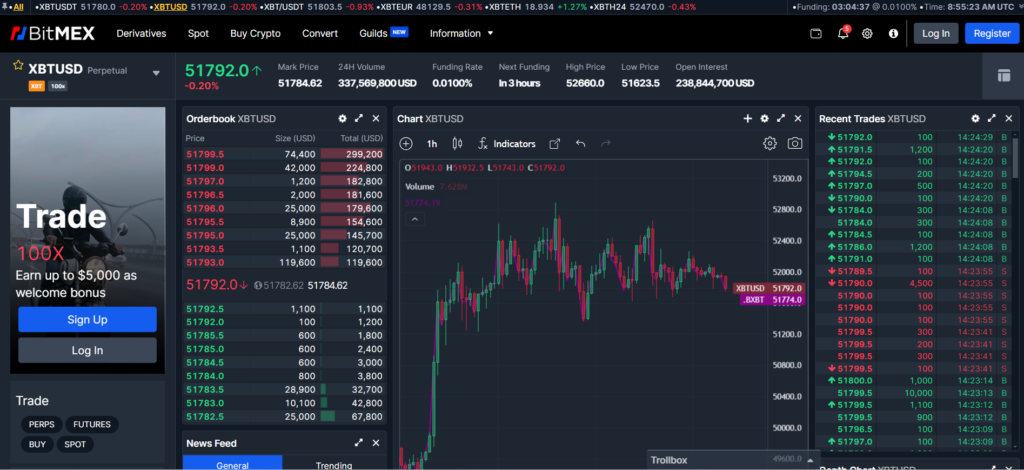

BitMEX:

Using BitMEX:

- The platform’s focus is on advanced traders.

- You face a steep learning curve if you are new to derivative trading.

- You might find reduced functionality on the mobile app compared to the web platform.

- However, BitMEX offers in-depth analysis tools that, once mastered, provide a comprehensive trading experience.

Direct Comparison:

- Design: KuCoin’s interface is clean and modern, while BitMEX is more data-intensive, catering to sophisticated traders.

- Functionality: Both exchanges offer advanced features, but KuCoin is recognized for broader accessibility.

- Speed: Transactions and trades on both platforms are executed swiftly, but KuCoin offers a smoother experience for casual browsing.

Both platforms uphold high user experience standards, yet each caters to different user needs and preferences. The choice between KuCoin and BitMEX essentially hinges on your personal requirements and trading expertise.

KuCoin Vs. Bitmex: Order Types

When trading cryptocurrencies on KuCoin and BitMEX, you have access to various order types that enable you to execute your trading strategies effectively. Here’s how these platforms compare in terms of the orders they support:

KuCoin:

- Market Orders: You can buy or sell immediately at the current market price. This is the fastest way to enter or exit the market. Still, the execution price may vary slightly from the displayed price during order placement due to market volatility.

- Limit Orders: Set your price for buying or selling a cryptocurrency. Your order will execute only if the market reaches your specified price.

- Stop Orders: These are designed to limit your losses, automatically executing a market order once a specific price (the stop price) is reached.

- Stop-Limit Orders: A hybrid between stop and limit orders, activating a limit order when the stop price is hit.

KuCoin also offers a range of other advanced order types, enhancing your risk management and trading strategy execution.

BitMEX:

- Market Orders: Like KuCoin, BitMEX provides immediate execution at the current market price.

- Limit Orders: You can set a specific price to enter or exit the market, offering you control over the execution price.

- Stop Orders: Known as ‘Stop Market Orders’ on BitMEX, triggering a market order at your predetermined stop price.

- Take Profit Orders: Executed when a profit target is reached, ensuring you can lock in profits according to your trading plan.

- Post-Only Orders: Ensure you pay the maker fee, not the taker fee, by preventing your order from being executed immediately against the market.

- Reduce-Only Orders: Ensures that an order only reduces your position, not increases, protecting you from overexposure.

Both platforms offer conditional and time-in-force options, like ‘Good Till Cancelled,’ giving you further control over executing your orders.

KuCoin vs BitMEX: Security Measures & Reliability

When choosing a cryptocurrency exchange, understanding the security measures is crucial.

KuCoin, a platform serving traders since 2017, emphasizes user security through several layers of protection.

Noteworthy are its bank-level encryption practices and dynamic multifactor authentication.

Despite a security incident in 2020, KuCoin’s measures to recover lost funds and improve its security systems have reinforced its commitment to users’ safety.

On the other hand, BitMEX is primarily known for crypto derivatives and has incorporated robust security protocols as well.

It uses multisignature deposits, and all withdrawals are manually reviewed. BitMEX also employs a multi-party computation (MPC) protocol to enhance wallet security.

| Feature | KuCoin | BitMEX |

|---|---|---|

| Encryption | Bank-level | Standard |

| Two-factor authentication (2FA) | Yes | Yes |

| Multi-Sig Wallets | Not Publicly Specified | Yes |

KuCoin has faced criticism regarding security, but it has taken that as an impetus to advance its safety measures and improve transparency.

It’s important to note that securities in digital platforms evolve with emerging threats, and both platforms continue to adapt.

BitMEX’s approach to reliability includes a unique system that ensures any trade, whether it’s futures or perpetual contracts, is executed without unnecessary delays and with accurate tracking.

You should always remain vigilant and use all available security features like 2FA and withdrawal allowlists to protect your funds and data on either exchange.

Remember, past incidents can often lead to more robust security measures for the future.

KuCoin vs BitMEX: Insurance Fund

When you trade on a cryptocurrency exchange, an insurance fund provides additional security for your funds, particularly when engaging in leveraged trades.

KuCoin and BitMEX have mechanisms to protect traders from negative balance and system losses.

BitMEX, known for its crypto derivatives and leverage trading, has an Insurance Fund that plays a crucial role.

This fund helps prevent Auto-Deleveraging in traders’ positions by ensuring that liquidated positions are closed at a price better than the bankruptcy price.

The BitMEX Insurance Fund has seen significant growth, adjusting its balance in response to the market’s needs. It covers the system’s losses that traders’ margins cannot absorb.

- Insurance Fund Usage: Protect against negative balance, system losses

- BitMEX’s Approach: Covers deficits in liquidations, preventing Auto-Deleveraging

KuCoin, on the other hand, doesn’t openly advertise an insurance fund in the same manner. However, your funds are also protected on this platform through other security measures, and the exchange has a reputation for a solid safety record.

- Insurance Fund Transparency: Not publicly emphasized by KuCoin

- Security Record: Strong emphasis on overall platform safety

As you consider which platform to use, understand that both prioritize the security of your trades, albeit through different mechanisms. BitMEX’s insurance fund details are more publicly accessible, reflecting its focus on derivative trading, where such a fund is critical.

To make an informed decision, review each exchange’s exact terms, which should outline how your funds are protected in the event of unforeseen system losses.

KuCoin vs BitMEX: Customer Support

When selecting a cryptocurrency exchange, customer support is a critical factor for you to consider. KuCoin and BitMEX both offer customer support, but their services differ.

For KuCoin:

- You have access to a 24/7 support system.

- You can ask for help via email or their website ticketing service.

- Additionally, KuCoin provides a live chat option for immediate assistance.

- An extensive FAQ section is available on their website to help with everyday issues.

For BitMEX:

- Support is primarily provided via a contact form on their website.

- BitMEX also has a detailed FAQ section that you can consult for general inquiries and troubleshooting.

| Feature | KuCoin | BitMEX |

|---|---|---|

| Availability | 24/7 | Business hours |

| Methods | Email, ticket service, live chat, FAQ | Contact form, FAQ |

| Response Time | Often quick, depending on traffic | Varies and can be slower during high-volume times |

Both platforms strive to provide you with the help you need, but KuCoin’s live chat might be more suitable if you want more immediate interaction.

Always check the availability of each support channel and the expected response time to ensure it aligns with your expectations.

KuCoin vs BitMEX: Regulatory Compliance

When comparing KuCoin and BitMEX, your understanding of their regulatory compliance is critical to making informed decisions in the cryptocurrency exchange landscape.

For KuCoin, although it predominantly serves an international market, you might find its stance on regulatory compliance to be relatively proactive.

They typically adhere to the know-your-customer (KYC) protocols and anti-money laundering (AML) guidelines relevant to Canadian users and more broadly. As a user, you’ll benefit from their attention to legal frameworks that aim to protect your investments.

In contrast, BitMEX has faced several regulatory challenges. Historically, they focused predominantly on crypto derivatives and have been subject to legal scrutiny.

Their operations are a testament to the tightrope walk of regulation in the digital currency space, highlighting the necessity for robust compliance infrastructure.

Regulatory Highlights:

-

KuCoin:

- Peer-to-peer trading with an adherence to KYC regulations.

- Futures trading capabilities under the scrutiny of regulatory bodies.

-

BitMEX:

- She was previously known for lax KYC/AML policies, but it is now under heightened legal regulation.

- She contended with legal action due to non-compliance with required standards.

Remember that regulations are evolving, and your vigilance in tracking how these platforms comply is crucial.

Both platforms have had to evolve rapidly to meet the increasing demand for a regulated cryptocurrency trading environment.

As you consider engaging with either KuCoin or BitMEX, keep their compliance histories in mind and how they’ve adapted to meet these new regulatory measures.

Conclusion

When choosing KuCoin and BitMEX, your decision should align with your trading needs and preferences.

KuCoin:

- This is for more advanced traders who demand a more comprehensive range of trading options, including peer-to-peer (P2P) trades and futures.

- It offers additional services like crypto lending, which might interest you if you want to generate passive income.

- It has a user-friendly interface that benefits individuals who prioritize a smooth trading experience.

If you’re situated in Canada or regions where KuCoin operates without constraints, you may find its services more accessible.

BitMEX:

- It specializes in crypto derivatives, including futures and perpetual contracts, and it is appealing if you want to trade on margin.

- It is often preferred by traders who focus on such derivatives and understand the risks of high-leverage trading.

Ensure you are aware of the regulatory environment in your country as it relates to BitMEX to avoid any compliance issues.

Both exchanges have their strengths and cater to different user profiles.

Your choice should be informed by your trading strategies, preferred transaction types, and the regulatory climate of your home country.

Before committing to an exchange, consider fees, liquidity, and security features.

Explore how KuCoin and Phemex compare to their competitors:

- KuCoin vs GMX: An In-Depth Look at Trading Platforms

- KuCoin vs Binance: An In-Depth Look at Trading Platforms

- KuCoin vs BingX: An In-Depth Look at Trading Platforms

- BitMEX vs Bybit: An In-Depth Look at Trading Platforms

- BitMEX vs Phemex: An In-Depth Look at Trading Platforms

- BitMEX vs Binance: An In-Depth Look at Trading Platforms