BitMEX and Deribit are leading cryptocurrency exchanges specializing in derivatives trading. BitMEX is known for its high-leverage trading options, particularly in Bitcoin and major cryptocurrencies, offering perpetual contracts and futures. It appeals to professional traders seeking advanced trading tools and high liquidity.

Deribit also focuses on derivatives trading but emphasizes options trading in addition to futures. It provides advanced trading features and tools, particularly excelling in Bitcoin and Ethereum options markets. Deribit’s focus on options makes it a preferred choice for traders looking to engage in sophisticated strategies.

Here’s a brief comparison to help you discern the differences between them.

| Feature | BitMEX | Deribit |

|---|---|---|

| Founded | 2014 | 2016 |

| Leverage | Up to 100x on certain products | Up to 100x on certain products |

| Trading Products | Futures, perpetual swaps (incl. LTC, BCH, XRP & others) | Options, futures, perpetual swaps |

| Trading Volume | Higher compared to Deribit | Lower compared to BitMEX |

| Order Execution | It may take longer due to the higher volume | Generally faster as volume is lower |

| Supported Coins | BTC, ETH, LTC, BCH, XRP, and others | Primarily BTC and ETH |

| Trading Fees | Flat fee model; market maker-taker fee structure | Flat fee model; market maker-taker fee structure |

| Deposit Methods | Cryptocurrency deposits | Cryptocurrency deposits |

| Transaction Times | Typically slower (due to high volume) | Usually faster (milliseconds) |

| Security | Robust security measures | Comparable security with different features |

| Customer Support | Satisfactory | Often cited for responsive support |

| Countries Supported | Broad range but restricted in some jurisdictions (e.g., USA) | Broad range but restricted in some jurisdictions (e.g., USA) |

When choosing between BitMEX and Deribit for your leveraged trading needs, you’ll find each platform has strengths.

BitMEX, founded in 2014, often outpaces Deribit in trading volumes, providing more liquidity, a broader selection of trading products, and higher leverage options.

Bitmex Vs. Deribit: Products And Services

BitMEX is well-known for its derivative products, offering a range of futures contracts and perpetual contracts.

You can trade these with significant leverage, up to 100x for XBT (Bitcoin) contracts and 50x for ETH (Ethereum) contracts, while other contracts allow up to 20x leverage.

This high leverage is one of BitMEX’s defining features. However, it doesn’t offer spot trading, so you can’t purchase cryptocurrencies directly on the platform.

In contrast, Deribit specializes primarily in Bitcoin and Ethereum derivatives, similar to BitMEX, including futures and options.

Your trading mainly focuses on perpetual swaps, traditional futures, and options contracts. The maximum leverage on Deribit is notably lower at up to 100x for Bitcoin futures and 50x for options.

While Deribit provides a dedicated platform for options trading, the liquidity of such products might be lower than that of BitMEX.

Here’s a quick comparison:

| Feature | BitMEX | Deribit |

|---|---|---|

| Futures Trading | ✓ (100x for Bitcoin) | ✓ (100x for Bitcoin) |

| Options Trading | ✗ | ✓ (50x for options) |

| Spot Trading | ✗ | ✗ |

| Leverage | Up to 100x (XBT & ETH) | Up to 100x (BTC futures) |

| User Interface | User-friendly | Standard |

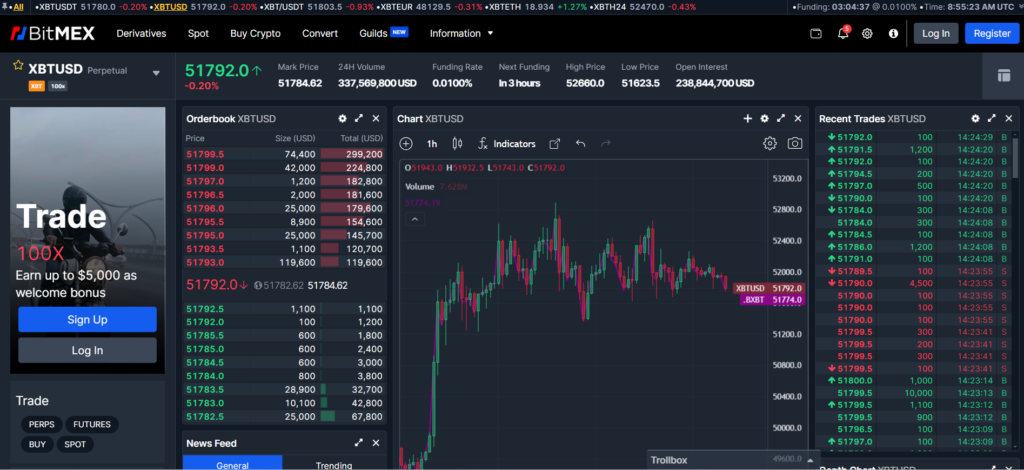

User experience is another important aspect when evaluating an exchange.

The user interface of BitMEX is generally considered user-friendly and efficient, which can be a critical factor in your trading performance.

Furthermore, BitMEX’s trading volume suggests a high level of liquidity, which can ease trade execution and reduce slippage.

Neither exchange provides services like staking, leveraged tokens, or an NFT marketplace, focusing exclusively on derivatives and maintaining a streamlined experience in that niche.

Bitmex Vs. Deribit: Contract Types

When you trade on BitMEX, you’ll find a variety of contract types. Inverse perpetual contracts, which are denominated in Bitcoin, are a primary feature.

You effectively trade contracts where the quote and settlement are in cryptocurrency.

BitMEX also offers linear perpetual contracts, quoted and settled in the base currency (USD), benefiting those who prefer a stablecoin as the collateral base. Additionally, there are inverse futures contracts for a selection of cryptocurrencies.

On Deribit, your options include COIN-M futures, which, like BitMEX’s inverse contracts, are cryptocurrency-margined.

They provide a straightforward way to leverage the underlying coin. You can also access options, allowing for more complex trading strategies involving various strike prices and expiration dates.

Here’s a brief comparison of the contract types:

| Contract Type | BitMEX Features | Deribit Features |

|---|---|---|

| Inverse Perpetual | Denominated in BTC | Not offered |

| Linear Perpetual | Settled in base currency (USD) | Not offered |

| Inverse Futures | Offered for several cryptos | Not offered |

| COIN-M Futures | Not offered | Cryptocurrency-margined |

| USD-M Futures | Not offered | Not offered |

| Options | Not offered | Available with various expirations |

While BitMEX is known for its high leverage options, reaching up to 100x on specific contracts like XBT, your contracts on Deribit are primarily BTC and ETH swaps, options, and futures with continuous premium and discount calculations.

Each platform’s offerings have unique benefits.

With BitMEX, you get a classic setup favored by many traders, while Deribit’s features appeal to those looking for continuous calculations and diverse option contracts.

When choosing between the two, consider what type of contracts align with your trading strategy and risk preference.

Bitmex Vs Deribit: Leverage And Margin

Leverage Options

When you trade on BitMEX, you can access a maximum leverage of 100x on XBT (Bitcoin) perpetual and traditional futures contracts.

This high leverage ratio allows you to magnify your position by up to 100 times with a relatively small margin.

For Ethereum contracts, the leverage is lower at a maximum of 50x. On other agreements offered by BitMEX, you can employ up to 20x leverage.

In contrast, Deribit also permits trading with high leverage, offering similar maximum leverage of up to 100x for Bitcoin.

However, leverage options for other cryptocurrencies like Ethereum are not explicitly stated in the provided search results.

Margin Types

BitMEX supports both Isolated and cross-margin trading strategies.

With an Isolated Margin, you can control the amount of margin allocated to individual positions; this kind of margin specifies a limit to your potential loss to the margin earmarked for a specific order.

Cross Margin, on the other hand, uses all available account balances to prevent liquidation.

Deribit is noted for offering only cross-margin trading. This type of margin, which uses your entire account balance to cover potential losses, could increase the risks of liquidating your account if the market moves unfavorably.

Liquidation Risks and Funding Rates

Both platforms use liquidation as a risk management tool to close positions below maintenance margin requirements.

You must monitor your positions closely to avoid auto-liquidation risk, which could lead to significant losses, especially when trading with high leverage.

As for the funding rates necessary for maintaining positions in perpetual contracts, both BitMEX and Deribit adjust these rates based on market conditions, which can be an additional cost or profit for traders holding positions over the funding intervals.

These rates can considerably impact your trading costs and should be monitored regularly.

Remember, while leverage can amplify gains, it can also increase potential losses. Using these tools with a clear understanding of the risks involved is essential.

Bitmex Vs Deribit: Liquidity And Volume

When you engage in crypto-derivatives trading, the liquidity and volume of an exchange are critical factors. In this regard, BitMEX is often recognized for its high liquidity and massive volume.

Your trades on BitMEX are facilitated by its capacity to execute up to 400,000 BTC a day. This high volume likely results in tighter spreads and lesser slippage, enhancing your trade execution experience.

On the other hand, Deribit is known to execute around 10,000 BTC per day.

While this may pale compared to BitMEX, Deribit ensures faster transaction times that can be measured in milliseconds. This is a crucial aspect to consider for quick order execution.

| Exchange | Daily Volume (Approx.) | Liquidity Impact | Transaction Speed |

|---|---|---|---|

| BitMEX | 400,000 BTC | Tighter spreads, lower slippage | Slower compared to Deribit |

| Deribit | 10,000 BTC | Potential for higher slippage | Very Fast |

Deribit may not compete with BitMEX regarding liquidity, but it offers a robust platform with significant daily trading.

You should also consider that multiple sources of liquidity such as spot exchanges are used by these platforms to derive their price indices.

For instance, BitMEX uses three spot exchanges for its indices, which can affect liquidity perception.

When deciding which exchange suits your trading needs, consider quantitative metrics—such as the volume of trades, and qualitative aspects—like the reputation and reliability of the platform’s liquid market. The right choice balances your need for speed against the depth and stability of the market.

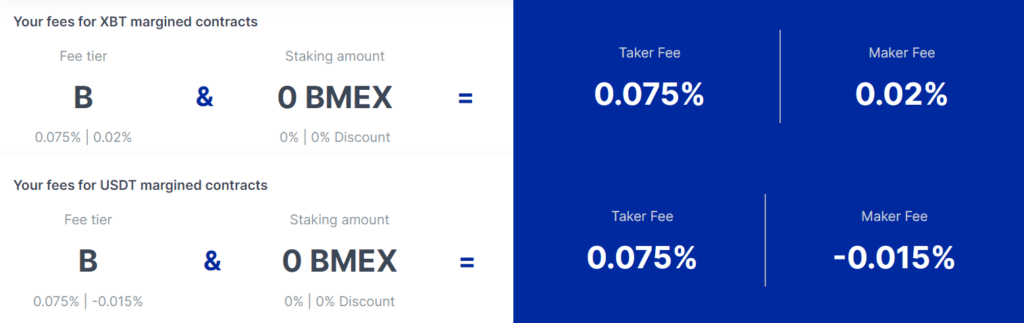

Bitmex Vs. Deribit: Fees And Rewards

Navigating the fee structures and rewards of BitMEX and Deribit is crucial, as these directly impact your trading costs and profit margins.

Here, you’ll find a detailed comparison that elucidates the different fees and incentives each platform provides.

Trading Fee & Deposit/Withdrawal Fee Compared

BitMEX: The fees on BitMEX are distinct for makers and takers. If you place an order that provides liquidity, you’re a maker and receive a rebate of 0.025%. Conversely, taking liquidity with your order incurs a taker fee of 0.075%.

For Bitcoin contracts, they offer up to 100x leverage. This can significantly increase potential profits and fees due to the higher volume traded. It’s important to consider that high leverage can amplify fees in case of a losing position.

For ETH contracts, the leverage available is through a 50x cap.

- Maker Fee: -0.025% (you earn a rebate)

- Taker Fee: 0.075%

- Extended Funding Fee: Variable (paid every 8 hours)

- Short Funding Fee: Variable (received every 8 hours)

- Withdrawal Fee: Dynamic (Based on Blockchain load)

- Deposit Fee: Free

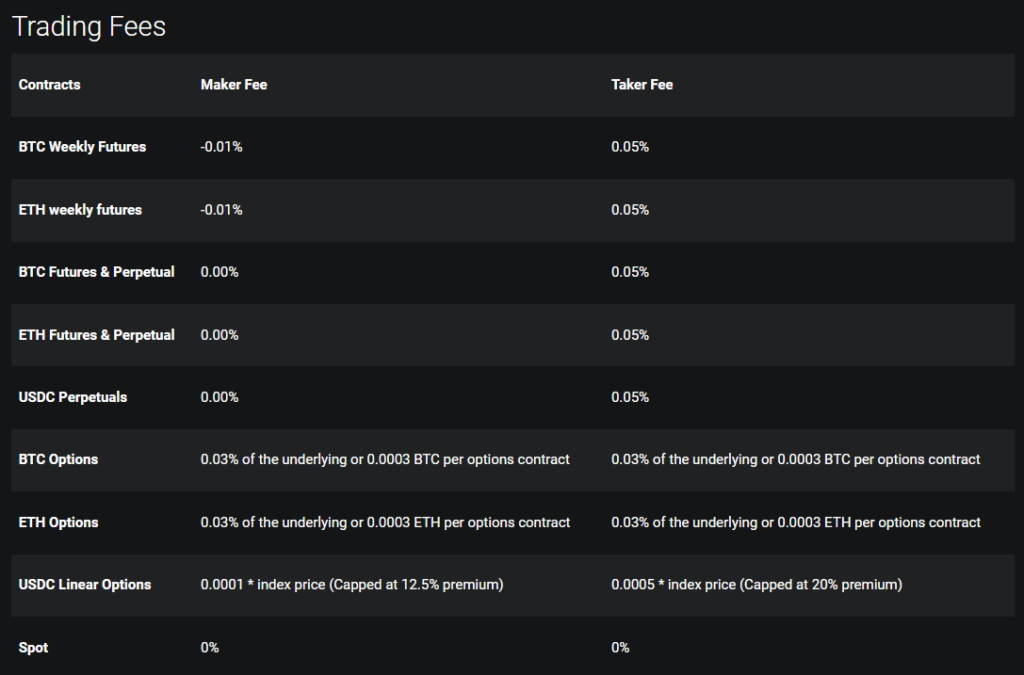

Deribit: Deribit provides a competitive fee structure comparable to BitMEX’s. Trading Bitcoin and Ethereum perpetual swaps, futures, and options, Deribit offers up to 100x leverage on Bitcoin products and a differing leverage scale for other contracts.

The leverage for Bitcoin options can be up to 10x, with settlement fees at 0.05%. Deribit also employs a maker-taker model.

- Maker Fee: -0.025% (rebate for adding liquidity)

- Taker Fee: 0.075%

- Options Trading Fee: Up to 0.04% of the underlying or 0.0004 BTC/option contract

- Withdrawal Fee: 0.0005 BTC for Bitcoin withdrawal

- Deposit Fee: Free

Deposits & Withdrawal Options

BitMEX: BitMEX offers seamless deposit and withdrawal options focusing on cryptocurrency. You’ll appreciate the absence of deposit fees, enabling you to fund your account freely.

Withdrawals, however, are subject to blockchain fees which vary. BitMEX processes withdrawals with a manual review once per day to enhance security. This can be crucial for your peace of mind but may delay fund access.

- Supported Currencies: Bitcoin (BTC)

- Payment Methods: Cryptocurrency only

- Processing Times: Withdrawals once per day

- Minimum/Maximum Amounts: Not specified; depends on market conditions

Deribit: Similarly, Deribit accepts only cryptocurrencies with no fees on deposits, allowing you to start trading without additional costs.

For withdrawals, a flat fee of 0.0005 BTC is charged. Deribit processes withdrawal requests up to three times daily, potentially offering faster access to your funds than BitMEX.

- Supported Currencies: Bitcoin (BTC), Ethereum (ETH)

- Payment Methods: Cryptocurrency only

- Processing Times: Withdrawals are processed three times per day

- Minimum/Maximum Amounts: 0.0001 BTC minimum withdrawal; maximum depends on your account limits and current balance

Bitmex Vs Deribit: KYC Requirements & KYC Limits

When choosing between BitMEX and Deribit for trading, you must consider their Know Your Customer (KYC) requirements and how these might affect your trading experience. Both exchanges have put measures in place for user verification, affecting your privacy, security, and exchange accessibility.

BitMEX KYC Requirements:

- Verification Levels: BitMEX requires all users to undergo a mandatory KYC verification process.

- Documents Required: Government-issued ID, proof of address, and a selfie are typically requested.

- Procedures: The verification process involves submitting the required documents and awaiting approval.

- Limits: Non-verified accounts are typically not permitted. Verified accounts have no specific limits on deposits or withdrawals mentioned.

Deribit KYC Requirements:

- Verification Levels: Deribit has also implemented KYC, escalating your required access level and limits.

- Documents Required: For full account functionality, you must provide detailed information, including ID, proof of residence, and financial details.

- Procedures: Submission of documents plus additional financial profile information for higher limits.

- Limits: The KYC level determines your deposit and withdrawal limits, with more stringent verification allowing for higher volume transactions.

Bitmex Vs. Deribit: Order Types

When trading on BitMEX and Deribit, you can access various order types, each designed to suit different trading strategies and risk management approaches. Here’s a breakdown of order types for these platforms:

BitMEX Order Types:

- Market Orders: Execute immediately at the current market price.

- Limit Orders: Set the price you’re willing to buy or sell at, and the order will be filled when the market reaches that price.

- Stop Orders: Trigger a buy or sell order when the market reaches a specific price, often used as a stop-loss.

- Take Profit Orders: Specify a price to take profit on a position.

- Post-Only Orders: Ensure the order adds liquidity to the market and is not filled immediately as a market order.

- Hidden Orders: These are not shown in the order book and can prevent large orders from influencing the market.

- Iceberg Orders: Only a portion of the total order is displayed to the market.

- Fill or Kill Orders: Must be executed in full immediately or not at all.

Deribit Order Types:

- Market Orders: Quick execution at the current available market price.

- Limit Orders: Determine your price; the order will execute when the market hits that price point.

- Stop Market Orders: A stop order becomes a market order once triggered.

- Stop Limit Orders: Set stop and limit prices, offering more control over the execution price.

- Post-Only Orders: Ensures your order is part of the market-making process, avoiding takers’ fees.

- Reduce-Only Orders: Restricts the order only to reduce a position, not increase it.

- Hidden Orders: Concealed from the order book, minimizing market impact.

- Advanced Orders: Options for setting order triggers based on index, mark, or last prices.

Bitmex Vs. Deribit: Security And Reliability

When considering the security and reliability of BitMEX and Deribit, your primary concern revolves around safeguarding your funds and personal data. Both exchanges have established mechanisms to ensure the security of your assets.

BitMEX Security:

- Cold Storage: BitMEX utilizes multi-signature cold storage to keep your funds secure.

- Security Audits: Regular audits by external firms are conducted.

- Two-Factor Authentication (2FA): This adds an extra layer of security to your account.

Incidents: Despite these measures, BitMEX has faced allegations concerning regulatory compliance, resulting in legal action in the past. They have taken steps to enhance regulatory adherence and improve transparency.

Deribit Security:

- Cold Storage: Many assets are stored in cold storage systems.

- Real-Time Audits: Continuous auditing of accounts to prevent balance manipulation.

- 2FA and PGP encryption: Mandatory two-factor authentication and PGP encryption for emails.

Regulatory Compliance: Both platforms adhere to financial regulations that pertain to the cryptocurrency derivatives market. Deribit, based in Panama, may have different regulatory challenges than BitMEX.

Customer Support: You’ll find that both exchanges offer customer service through various methods, including email support, social media, and help desks. Their response timeframes and the efficiency of issue resolution can vary.

Bitmex Vs Deribit: User Experience

When you trade on BitMEX, you might appreciate their user-friendly interface, which allows for a somewhat intuitive trading experience. Dragging and dropping orders directly on charts simplifies the adjustment of your trading strategy on the fly. This functionality can be crucial in managing your trades efficiently.

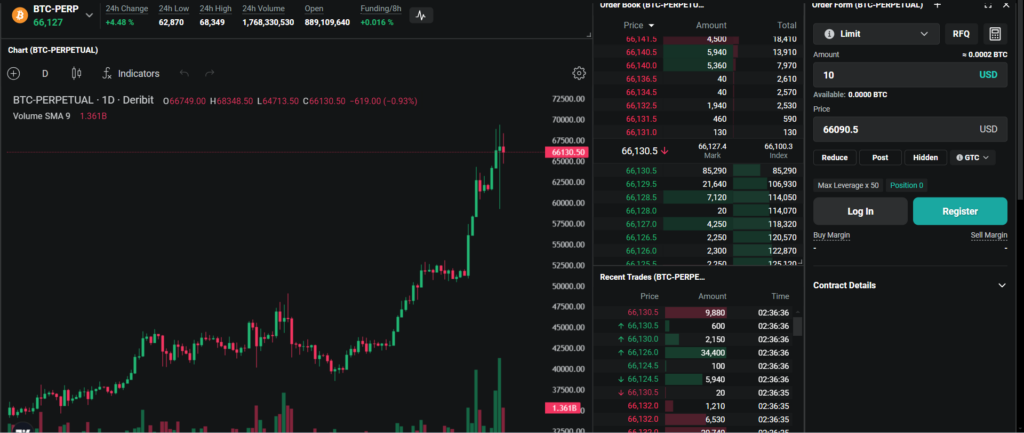

On the other hand, Deribit’s platform is known for its quick order execution, processing transactions in just milliseconds.

Although it may not have the same volume as BitMEX, this speed can be a significant advantage in a fast-paced trading environment.

Ease of use:

- BitMEX: Simplified UI, drag-and-drop orders.

- Deribit: Fast transaction processing.

Regarding platform design and functionality:

- BitMEX: Offers a range of trading pairs, veteran trading experience, and plentiful liquidity. The platform design gears towards accommodating new and seasoned traders, emphasizing the importance of a fluid trading journey.

- Deribit: Also considered to have an intuitive platform, but traders have noted lower liquidity on this exchange. Nevertheless, for traders prioritizing rapid execution over the breadth of trading options, Deribit still stands as a viable choice.

Feedback from users suggests a split preference; some traders lean towards BitMEX for its comprehensive trading options and liquidity, while others prefer Deribit for its lightning-fast transaction times.

| _ | BitMEX | Deribit |

|---|---|---|

| Interface | User-friendly, suitable for various experience levels | Streamlined, optimized for speed |

| Execution Speed | Competitive | Exceptionally fast |

| Design and Functionality | Comprehensive trading options | Focused on rapid execution |

| Liquidity | High | Lower than BitMEX |

Bitmex Vs. Deribit: Education And Community

When deciding between BitMEX and Deribit, considering their communities’ educational content and strength can be vital to your trading success.

BitMEX has been recognized for its comprehensive educational resources. They offer a variety of guides and tutorials aimed at helping you understand complex trading concepts and the specifics of their platform.

Deribit, on the other hand, may not boast as extensive an array of educational content as BitMEX but still provides valuable information to its users. The focus is on practical guidance through direct support and community engagement.

In terms of community, both platforms exhibit a strong presence on social media and have dedicated followers. Here’s a quick breakdown:

- BitMEX Community Outreach:

- Twitter Followers: High

- Engagement: Active discussions and regular updates

- Support: Community forums and 24/7 help desk

- Deribit Community Outreach:

- Twitter Followers: Moderate

- Engagement: Insightful market analysis

- Support: Direct support with a personal touch

Community engagement on platforms like Twitter gives you an insight into the current discourse and sentiment in crypto trading. BitMEX tends to be more active with market updates and crypto news, while Deribit can be the go-to for community-based insights.

Bitmex Vs. Deribit: Regulation And Compliance

When you choose a cryptocurrency derivatives exchange, understanding their regulatory compliance is crucial. Below is an overview of how BitMEX and Deribit adhere to regulations.

BitMEX:

- Jurisdiction: BitMEX, initially based in Seychelles, has been scrutinized for its regulatory stance. As you might be aware, BitMEX faced legal challenges regarding its adherence to regulatory standards.

- Compliance: BitMEX has implemented more rigorous KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures over time. Although historically, it operated without stringent verification processes, current operations demand compliance with international regulations.

Deribit:

- Jurisdiction: Deribit, initially based in the Netherlands, has also experienced the impact of regulatory shifts. To preclude potential regulatory issues, Deribit relocated to Panama in 2020.

- Compliance: Deribit is known for its less strict regulatory adherence than other platforms. However, the evolving landscape has indicated a move towards implementing KYC checks to align with EU guidelines.

Comparative Table:

| Feature | BitMEX | Deribit |

|---|---|---|

| Location | Previously, Seychelles, undergoing regulatory changes | Moved from the Netherlands to Panama due to regulatory concerns |

| KYC/AML | Enforcing more stringent KYC/AML processes | Indicated future KYC implementation for alignment with EU regulations |

| Legal Challenges | Has faced legal action for regulatory non-compliance | No significant legal challenges have been reported publicly as of now |

It would be best to stay informed about the latest regulatory updates affecting these platforms. Monitoring these changes can help you make educated decisions aligned with compliance expectations in the burgeoning crypto market.

Conclusion

When choosing between BitMEX and Deribit for your cryptocurrency trading needs, carefully consider your priorities.

BitMEX is renowned for its high liquidity and diverse trading pairs, making it a strong option if you seek a dynamic trading environment with potentially less slippage.

The platform’s user interface is designed to cater to your need for a seamless trading experience, and it remains a dominant player in the market.

On the other hand, Deribit is recognized for its ultra-fast transactions and advanced perpetual swaps. It’s a robust platform that is gaining credibility and trust within the trading community. However, one must weigh the potential downside of lower liquidity compared to BitMEX.

For experienced traders looking for flexibility and a broad market, BitMEX might be the preferred choice. Newcomers or those prioritizing transaction speed might lean towards Deribit.

Explore how BitMEX and Deribit compare to their competitors:

- BitMEX vs Bybit: An In-Depth Look at Trading Platforms

- BitMEX vs Phemex: An In-Depth Look at Trading Platforms

- BitMEX vs Binance: An In-Depth Look at Trading Platforms

- BitMEX vs PrimeXBT: An In-Depth Look at Trading Platforms

- Deribit vs Bybit: An In-Depth Look at Trading Platforms

- Deribit vs KuCoin: An In-Depth Look at Trading Platforms