BitMEX and PrimeXBT are prominent cryptocurrency exchanges known for their focus on leveraged trading. BitMEX specializes in high-leverage derivatives trading, offering perpetual contracts and futures, with a focus on Bitcoin and other major cryptocurrencies. PrimeXBT, on the other hand, provides leveraged trading across a diverse range of assets, including cryptocurrencies, forex, commodities, and indices, with advanced trading tools and features for professional traders.

Below is a direct comparison between BitMEX and PrimeXBT to guide you through key aspects of each platform.

| Feature | BitMEX | PrimeXBT |

|---|---|---|

| Supported Coins | Predominantly Bitcoin (BTC) | Various, including Bitcoin (BTC) |

| Leverage | Up to 100x for Bitcoin | Up to 100x for Bitcoin |

| Trading Fees | -0.025% rebate for makers – 0.075% for takers |

Lower fees compared to BitMEX |

| Trading Volume | High, with a strong focus on derivatives | Also high, competitive in the industry |

| Deposit Methods | Crypto only | Crypto and fiat options |

| User Satisfaction | Good, but can vary based on user preferences | Good, factors such as ease of use contribute |

| Products | Derivatives, margin trading | Margin trading, CFDs |

You can discern that both platforms offer high leverage and competitive trading volumes, standing out for their offerings in crypto margin trading.

With BitMEX, the focus is more on Bitcoin, while PrimeXBT caters to a wider array of cryptocurrencies.

Fees structure is a standout difference; BitMEX provides a rebate to makers, potentially attracting users who contribute to the market liquidity, whereas PrimeXBT is known for lower fees overall, which may appeal if cost is a predominant concern.

Both platforms have unique features that cater to different preferences, so your choice may depend on whether you prioritize a broad selection of cryptocurrencies, low fees, or specific products like derivatives or CFDs.

Remember to consider the deposit methods that suit your needs—crypto only or the inclusion of fiat options.

Bitmex Vs Primexbt: Products and Services

When you’re evaluating BitMEX and PrimeXBT for their products and services, you’ll observe certain distinctions and similarities that define each platform’s offerings.

BitMEX, established in 2014, is known primarily for crypto derivatives trading. Their services include:

- Perpetual contracts: Open-ended contracts that do not expire

- Traditional futures: Contracts that have a set expiration date

- Options: Contracts that give you the right, but not the obligation, to buy or sell an asset at a predetermined price

BitMEX is also recognized for its high market liquidity, which can be a significant advantage when entering or exiting positions.

PrimeXBT, which came onto the scene in 2018, extends its services to a suite of trading markets. Their products include:

- CFD trading: Contracts for difference across various asset classes

- Cryptocurrencies: A selection of popular digital currencies

- Forex: Access to the foreign exchange market

- Commodities: Such as gold and oil

- Indices: Broad market exposure

PrimeXBT is registered in Seychelles with additional offices, indicating a physical presence in the international market.

Comparing the two, you’ll find that BitMEX focuses largely on cryptocurrency and derivatives, providing a deep pool of liquidity which can enhance your trading experience.

On the other side, PrimeXBT offers a broader scope of markets, not limited to cryptocurrencies, which is favorable if you prefer a diversified trading portfolio.

Each platform has crafted its services to appeal to different segments of traders, with BitMEX catering to dedicated crypto derivative traders and PrimeXBT serving multi-asset traders seeking a wide-ranging platform.

Bitmex Vs Primexbt: Contract Types

When exploring BitMEX and PrimeXBT, you’ll discover various contract types available for your trading strategies.

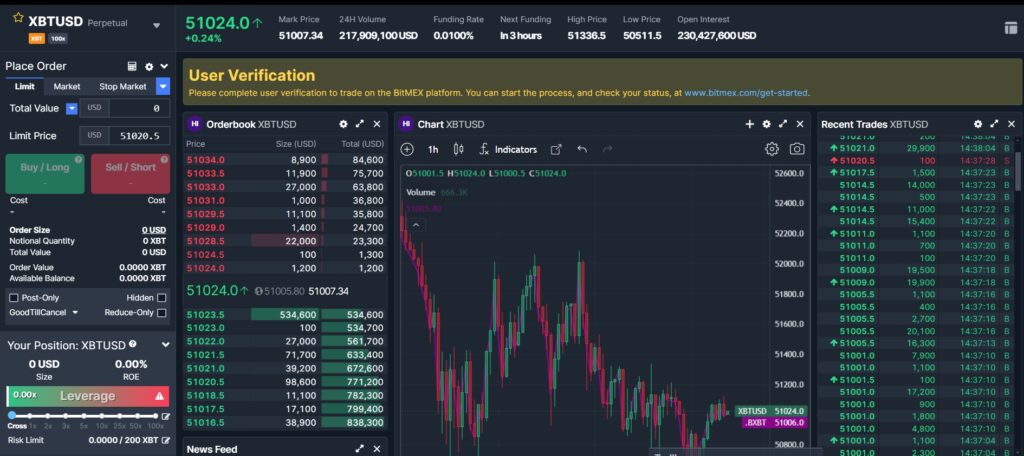

On BitMEX, you have the option to trade Inverse Perpetual Contracts, which means your profits, losses, margin, and settlement are denominated in the cryptocurrency, such as Bitcoin. The popular XBTUSD is such a contract where Bitcoin acts as the underlying currency. These contracts deliver high leverage but carry the risks associated with the currency’s volatility.

BitMEX also offers Inverse Futures Contracts, where the settlement is also in cryptocurrency, providing a fixed expiry date to the contract. This type of contract suits traders who wish to bet on future price movements with a set timeframe in mind.

On the other hand, PrimeXBT provides COIN-M Futures, involving the actual cryptocurrency for margin and settlement. They facilitate trading across various coin pairings and are similar to BitMEX’s inverse contracts.

For those who want settlement in stablecoins, PrimeXBT has USD-M Futures. Your margin and profits are calculated in a stable currency like USD, which can offer peace of mind during market turbulence. Contracts such as these can offer a less volatile way to engage with crypto derivatives.

By choosing the right type of contract, you could leverage your positions to amplify your trading results while being aware of the innate risks:

- Inverse Perpetual Contracts: High leverage, BTC settlement, market volatility factor.

- Inverse Futures Contracts: Set timeframe, BTC settlement, suited for strategic future bets.

- COIN-M Futures: Coin-based margin, appeals to crypto-focused traders.

- USD-M Futures: Stablecoin (USD) margin, lower volatility, and a calmer approach to trading.

Bitmex Vs Primexbt: Leverage and Margin

When you’re examining BitMEX and PrimeXBT for leverage and margin trading, there are different functionalities and limits that you should be aware of.

BitMEX offers you leverage up to 1:100 on Bitcoin and some other contracts. The exchange uses a system of cross-margin and isolated margin—the former allows you to pool all your account balances to avoid liquidation, while the latter lets you control the amount of margin allocated to individual positions to manage risk.

On the other hand, PrimeXBT presents you with a higher leverage cap of up to 1:200 for Bitcoin and Ethereum pairs, which can significantly amplify your trading position. Additionally, PrimeXBT utilizes both cross margin and isolated margin options, allowing you to strategize risk across various trades.

Here’s a simplified breakdown of the key features:

| Feature | BitMEX | PrimeXBT |

|---|---|---|

| Max Leverage | 1:100 | 1:200 |

| Cross Margin | Available | Available |

| Isolated Margin | Available | Available |

| Contracts | Bitcoin, others | Bitcoin, Ethereum, others |

Be mindful of the liquidation risks; higher leverage can lead to higher returns but also increases the possibility of liquidation. If the market moves against your position significantly, you may lose more than your initial margin.

Additionally, you should consider the funding rates, which are payments made between buyers and sellers that can affect the profitability of trades in a leveraged position. These rates often vary depending on market conditions and typically on an 8-hour schedule on both platforms.

Bitmex Vs Primexbt: Liquidity and Volume

When you assess an exchange’s efficiencies, such as BitMEX or PrimeXBT, liquidity and trading volume are critical metrics to evaluate.

BitMEX: Known for its high liquidity, BitMEX often leads in market liquidity among cryptocurrency exchanges. This translates to more efficient trade execution and typically lower slippage for your transactions.

The exchange reports trading volumes north of $1.5 billion over the last 24 hours, signaling a robust marketplace. This high volume ensures that your orders are likely filled at your desired prices, especially when dealing with large volumes.

PrimeXBT: While PrimeXBT might have a lower trading volume – approximately $545 million over the same period – it compensates with integration to over 12 liquidity providers. This ensures that your trades are executed swiftly, with minimized slippage compared to markets with less liquidity.

| Exchange | Reported 24h Volume | Liquidity Providers |

|---|---|---|

| BitMEX | $1.5 Billion+ | N/A |

| PrimeXBT | $545 Million | 12+ |

The large volume on BitMEX provides more flexibility, especially for big trades where the impact on market price is a concern. On the other hand, PrimeXBT’s strategic partnerships offer instant execution which might benefit you when markets are volatile.

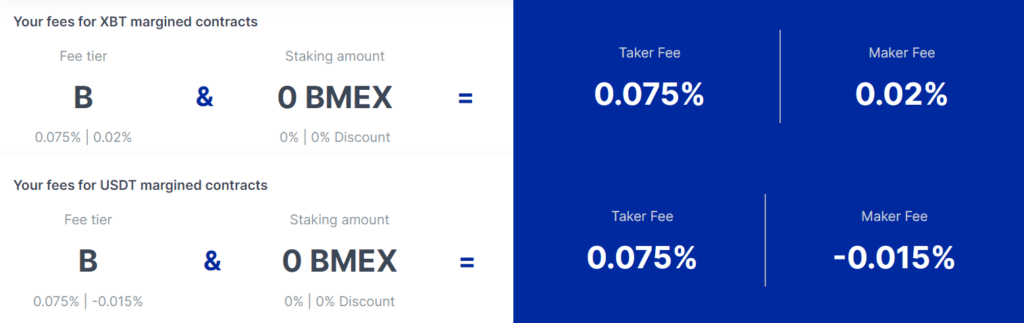

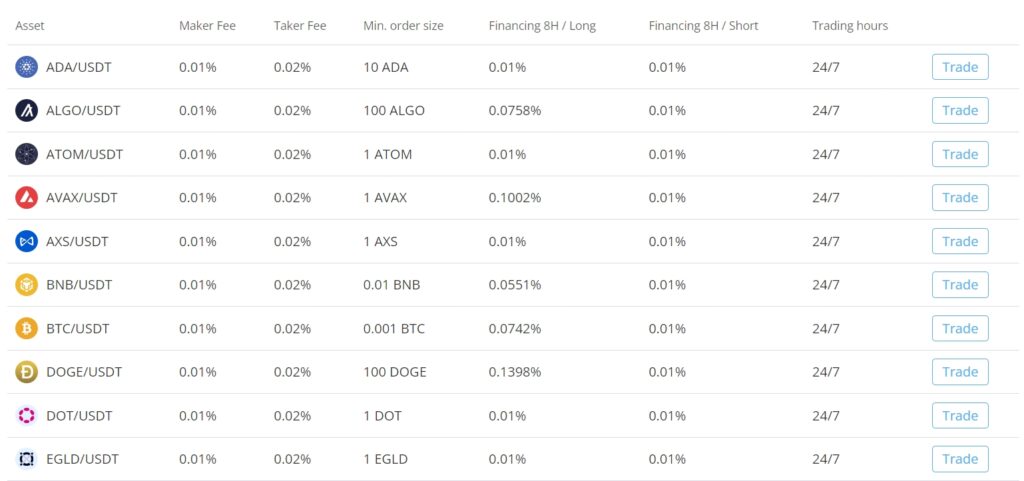

Bitmex Vs Primexbt: Fees and Rewards

Assessing the financial implications of trading on Bitmex and PrimeXBT depends heavily on their respective fee structures and rewards systems, both integral to a trader’s bottom line.

Trading Fee & Deposit/Withdrawal Fee Compared

BitMEX Fees:

- Maker Fee: Incentivizes market makers with a rebate of 0.025%.

- Taker Fee: Charges 0.075% from market takers.

- Deposit Fee: None.

- Withdrawal Fee: Varies depending on network conditions and Bitcoin price.

Simplifying the structure – if you place a limit order that adds liquidity, you’re rewarded with a rebate. For a $10,000 trade as a market maker, you would earn $2.50. Conversely, as a taker, that same trade would cost you $7.50.

PrimeXBT Fees:

- Trading Fee: A flat rate of 0.05% for all trades.

- Deposit Fee: None.

- Withdrawal Fee: Free of charge, no fees on withdrawals.

- Other Fees: May include overnight financing rates (for margin positions).

Putting it into perspective – for a $10,000 trade, regardless of being maker or taker, your cost would be $5.00 on PrimeXBT. Overnight financing might add to the cost depending on how long the position is held.

Both exchanges offer different incentives: BitMEX rewards makers with rebates, potentially increasing your profitability if you contribute to the liquidity.

PrimeXBT’s flat fee model offers simplicity and predictability, beneficial for calculating costs up-front.

Remember, while BitMEX’s taker fee might seem higher, active market makers can find the rebate system more advantageous. PrimeXBT shines with its no withdrawal fee policy, potentially saving you money on frequent or large withdrawals.

Bitmex Vs Primexbt: Deposits & Withdrawal Options

When you’re considering BitMEX and PrimeXBT for your trading needs, understanding their deposit and withdrawal options is essential.

BitMEX:

- Currencies Supported: BitMEX exclusively deals with cryptocurrencies. Bitcoin (BTC) is its primary deposit currency, and no fiat currency support is provided.

- Payment Methods: Deposits can only be made with BTC.

- Withdrawals: The exchange itself doesn’t charge any fees for withdrawals. However, you are subject to the network fee, which is dynamically set based on the blockchain load.

PrimeXBT:

- Currencies Supported: Like BitMEX, PrimeXBT is Bitcoin-focused for deposits. However, it offers the added flexibility of fiat deposits through a credit card exchange service.

- Minimum Deposit: PrimeXBT requires a minimum BTC deposit amount, typically around 0.001 BTC.

- Fees: PrimeXBT does not charge fees on deposits but enforces a minimum network fee for withdrawals, often pegged at 0.0005 BTC.

| Feature | BitMEX | PrimeXBT |

|---|---|---|

| Fiat Currency Support | No | Yes, through credit card exchange |

| Primary Deposit Currency | BTC | BTC |

| Deposit Fee | No | No |

| Withdrawal Fee | Network Fee only | 0.0005 BTC minimum network fee |

| Minimum Deposit | None | 0.001 BTC |

Bitmex Vs PrimeXBT: KYC Requirements & KYC Limits

When you’re choosing a cryptocurrency exchange, understanding the Know Your Customer (KYC) requirements and limits is crucial for ensuring your privacy and security while complying with legal standards.

BitMEX:

BitMEX enforces KYC verification for all its users. To trade on BitMEX, you must complete the following steps:

- Provide personal information

- Submit identification documents such as a passport or ID card

- Proof of address through utility bills or bank statements

Upon completion, you’ll have full access to their services without any deposit or withdrawal limits. This mandatory verification strengthens security but may feel intrusive if you’re sensitive about privacy.

PrimeXBT:

Contrastingly, PrimeXBT historically did not enforce strict KYC procedures. This meant you could create an account and begin trading with fewer personal details. However, as regulatory landscapes change, PrimeXBT has implemented industry-standard financial monitoring procedures as part of their KYC/AML policies. Although less restrictive than BitMEX, be prepared to go through additional due diligence if your account activities warrant it.

| BitMEX | PrimeXBT | |

|---|---|---|

| KYC Policy | Mandatory for all users, with full identity verification required. | Financial monitoring is in place; conditional KYC may be applied. |

| Documents | Passport/ID, Proof of Address | Varies |

| Limits | No limits post-verification. | May vary based on account activity and conditional KYC results. |

Bitmex Vs Primexbt: Order Types

When evaluating BitMEX and PrimeXBT, it is vital to understand the variety of order types each platform offers. These are instrumental in executing your trading strategies and managing risks.

BitMEX Order Types:

- Market Order: A market order allows you to buy or sell immediately at the best available current price.

- Limit Order: This order type lets you specify the price at which you want to buy or sell, providing more control over the entry or exit points.

- Stop Order: Also known as a stop-loss order, it is designed to limit an investor’s loss on a position.

- Take Profit Order: It enables setting a target price on a position in order to lock in profits.

- Post-Only Order: This ensures your limit order is added to the order book and not matched with a pre-existing order, thereby making you a market maker.

- Reduce-Only Order: This feature ensures that positions are only reduced, not increased, when executing orders.

PrimeXBT Order Types:

- Market Order: Immediate execution at current market prices is also available on PrimeXBT.

- Limit Order: You can set your desired entry or exit price, just as on BitMEX.

- Stop Order: Useful for setting a stop-loss to potentially minimize losses on your positions.

- OCO (One Cancels the Other) Order: PrimeXBT provides this advanced order type where two orders are placed, and the execution of one order automatically cancels the other.

- Protection Orders: Including stop-loss and take-profit orders, which help secure your trades and lock in profits.

Bitmex Vs PrimeXBT: Security and Reliability

When considering cryptocurrency exchanges, the security and reliability of your assets are paramount. BitMEX has implemented robust security measures, including multi-signature deposits and withdrawals, which require multiple keys to authorize a transaction, enhancing the security against unauthorized transfers. They also utilize offline cold storage for the bulk of funds, real-time auditing for system integrity, and Amazon Web Services’ world-class security.

In its history, BitMEX did face a notable incident in 2019 regarding an email privacy breach where users’ email addresses were accidentally disclosed. However, no funds were lost, and BitMEX swiftly moved to strengthen its privacy and security systems.

PrimeXBT similarly takes your security seriously with cold storage for assets, securing them offline away from potential online threats. It also leverages full data encryption and multi-factor authentication, adding layers of security for accessing accounts. To date, there have not been significant security incidents reported by PrimeXBT.

Your concerns regarding reliability extend to regulatory adherence. BitMEX has had brushes with regulators, leading to enhanced compliance measures and heightened focus on user verification processes. On the other hand, PrimeXBT tends to operate with more opacity in regulation, which may be a consideration in your decision-making process.

In case of issues, both exchanges offer customer support channels through email and live chat. Your experience with their responsiveness can vary, but it’s vital for resolving potential security concerns swiftly.

Bitmex Vs PrimeXBT: User Experience

While using BitMEX, you’ll find a platform that is geared towards experienced traders, featuring comprehensive charting tools and a variety of order types. The interface, although rich in functionality, can be overwhelming for newcomers due to its complexity. On the contrary, PrimeXBT offers a more user-friendly experience with a sleek and intuitive design, making it easier for you to get started and execute trades.

Ease of Use:

- BitMEX: Advanced interface that may have a steeper learning curve.

- PrimeXBT: Streamlined dashboard for quick access and management.

Speed and Performance:

- Both platforms perform well under high traffic, but PrimeXBT’s simpler interface may lend itself to quicker navigation and order execution for some users.

Design and Functionality:

- BitMEX: Detailed and professional layout with an emphasis on depth of trading tools.

- PrimeXBT: Cleaner and more straightforward layout focusing on essential tools.

Expert Feedback:

- Users and experts acknowledge BitMEX’s robust engine and professional-grade tools.

- PrimeXBT is often recognized for its user-friendly approach, suitable for traders at different levels.

| Feature | BitMEX | PrimeXBT |

|---|---|---|

| Interface | Complex | User-friendly |

| Charting Tools | Extensive | Sufficient |

| Order Types | Multiple | Standard |

Bitmex Vs PrimeXBT: Education and Community

When assessing the educational resources offered by BitMEX and PrimeXBT, you’ll find that both platforms cater to traders with a range of materials.

BitMEX provides a comprehensive Knowledge Base, featuring articles and guides that go into detail about their products and the mechanics of trading.

Additionally, BitMEX hosts webinars with experts that can be valuable for expanding your understanding of the cryptomarket.

PrimeXBT, on the other hand, emphasizes education through its Trading Academy. This section includes educational videos and tutorials designed to guide you, whether you’re a beginner or a seasoned trader.

You’ll also find technical analysis guides to help in making informed decisions, and a 24/7 live chat support for immediate assistance.

When it comes to community, interaction and support are key aspects:

- BitMEX:

- Focuses on professional traders and institutions

- Community interaction largely centered around blog updates and strategic partnerships

- PrimeXBT:

- Offers a more community-focused approach

- Engages users through social media channels like Discord and Telegram

- Provides a space for community members to connect and share insights

Both platforms are active on social media platforms, with BitMEX holding a prominent position on platforms like Twitter, where they share market insights and updates.

Similarly, PrimeXBT commands an impressive following with regular updates and engaging content aimed at crypto traders.

Your preference for education and community will depend on the depth of analysis and interaction you seek. Whether you favor self-directed learning or community engagement, each exchange provides resources to improve your trading experience.

BitMEX vs PrimeXBT: Regulation and Compliance

When evaluating BitMEX and PrimeXBT, you need to consider their approaches to regulation and compliance, as they operate in a market known for rapidly shifting legal expectations.

BitMEX traditionally stood as an influential player in the realm of cryptocurrency derivatives trading. However, its lack of regulatory compliance has raised concerns.

Previously, BitMEX faced legal challenges with U.S. authorities, which underlines the importance of verifying the platform’s current compliance with trading regulations in your jurisdiction.

PrimeXBT, on the other hand, may not offer the same level of regulatory clarity you would find with more traditional financial institutions.

Although the exchange offers a variety of trading instruments, you should be aware that a lack of strict regulation might mean less protection for your investments.

Both platforms operate globally and face the complex challenge of adhering to diverse regulatory standards.

Neither BitMEX nor PrimeXBT hold licenses akin to those of banks or stock exchanges. Your due diligence as a trader should include:

- Research into any recent updates on their regulatory status.

- Understanding the risks associated with exchanges that provide high leverage with limited regulatory oversight.

- Monitoring news for any regulatory changes that might affect the way these platforms operate.

Ensure that your trading strategy aligns with the levels of oversight provided by BitMEX and PrimeXBT, and stay informed about the evolving landscape of cryptocurrency regulation which can impact your trading activities.

Conclusion

In comparing PrimeXBT and BitMEX, key distinctions have emerged that cater to different trader profiles.

PrimeXBT:

- KYC Regulations: Absence of KYC may appeal to traders seeking anonymity.

- Supported Coins: Offers a smaller selection of 10 cryptocurrencies.

- User Interface: Known for a user-friendly platform.

- Fees: Competitive taker fees, with no charges on withdrawals enhancing profitability.

BitMEX:

- KYC Requirements: Implements KYC procedures.

- Cryptocurrency Variety: Extensive with 27 different coins.

- Liquidity: High market liquidity, advantageous for high-volume traders.

- Trading Options: Broad derivatives offering, including perpetual and futures contracts.

- Fees: Higher taker fees, but compensates makers with rebates.

If you value a more intuitive interface and lower fees, especially if a newer trader, PrimeXBT may be more accommodating. The absence of withdrawal fees also maximizes your returns on successful trades.

Conversely, if you’re experienced and looking for a robust platform with a broad array of cryptocurrencies and higher liquidity, BitMEX stands out.

For further insight, consider subscribing to trading forums or following cryptocurrency news outlets.

Continuous learning through resources like Coin Bureau or industry reports will refine your trading strategies and keep you updated on exchange developments.

Remember, your choice should align with your trading style, experience, and priorities. Stay informed and choose wisely to suit your needs.

Explore how BitMEX and PrimeXBT compare to their competitors:

- BitMEX vs Bybit: Side-by-Side Comparison

- BitMEX vs Phemex: Side-by-Side Comparison

- BitMEX vs Binance: Side-by-Side Comparison

- PrimeXBT vs Bybit: Side-by-Side Comparison

- PrimeXBT vs Binance: Side-by-Side Comparison

- PrimeXBT vs StormGain: Side-by-Side Comparison