Binance and PrimeXBT are prominent cryptocurrency exchanges, each with unique offerings. Binance is known for its extensive range of cryptocurrencies, high trading volumes, and advanced trading tools, providing services like spot, margin, futures trading, staking, and savings. PrimeXBT, on the other hand, specializes in leveraged trading, offering high leverage options and a user-friendly platform for trading cryptocurrencies, forex, commodities, and indices.

When choosing between Binance and PrimeXBT, consider the specific features that matter to you. Below is a comparative summary of what each platform offers.

| Feature | Binance | PrimeXBT |

|---|---|---|

| Supported Cryptocurrencies | Wide range of coins and tokens | Selection focused on major cryptocurrencies |

| Leverage | Up to 125x for certain pairs | Up to 100x on some assets |

| Trading Fees | Generally lower fees | Higher fees compared to Binance |

| Security | Strong emphasis on user security measures | Robust security features |

| User Experience | Comprehensive and suitable for all levels | Intuitive for both beginners and experienced traders |

| Regulation and Compliance | Faces scrutiny in multiple jurisdictions | Generally compliant with regulations |

| Additional Products | Futures, options, staking, and more | Forex, commodities, and indices trading |

Binance stands out for its extensive selection of cryptocurrencies and lower trading fees, making it an attractive option for a diverse portfolio. It caters to both novice and seasoned traders, offering additional products such as futures and staking.

PrimeXBT, on the other hand, offers leverage trading and focuses on the significant digital assets. It extends its services to forex, commodities, and indices, which provides you with an opportunity to diversify beyond cryptocurrencies.

When deciding, you should consider the platform’s compliance with regulations, as Binance has faced issues with the SEC regarding securities violations. Both exchanges prioritize user security, but it’s important to review their approaches to ensure your funds’ safety.

Binance vs PrimeXBT: Products and Services

When assessing products and services, Binance outshines PrimeXBT in variety. Binance, being one of the largest cryptocurrency exchanges globally, offers a wide range of tradable assets including spot trading, futures trading, options trading, and an NFT marketplace.

Your experience with Binance is enhanced by additional services such as staking, mining, and liquidity farming, positioning it as a one-stop shop for diverse crypto activities.

| Service | Binance Availability | PrimeXBT Availability |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures Trading | ✓ | ✓ |

| Options Trading | ✓ | ✗ |

| Leveraged Tokens | ✓ | ✗ |

| NFT Marketplace | ✓ | ✗ |

| Staking | ✓ | ✗ |

| Mining | ✓ | ✗ |

| Liquidity Farming | ✓ | ✗ |

On the other hand, PrimeXBT focuses on a more streamlined service offering, specializing in margin trading with leverage up to 100x on select assets. PrimeXBT also facilitates trading in markets beyond cryptocurrencies, such as forex and traditional stocks.

It’s important to note that Binance’s extensive offering is coupled with competitive trading fees and discounts for active traders, potentially providing better value for your money.

In contrast, despite a smaller selection, PrimeXBT may appeal to you if seeking a platform with a straightforward focus on leveraged and multi-market trading.

User experience varies as well; Binance’s platform is often praised for its robustness and user-friendly interface, making it suitable if you prefer a comprehensive trading platform with numerous tools at your disposal.

PrimeXBT’s narrower focus may offer a simpler gateway if your primary interest lies in leveraged trading across various asset classes.

Binance vs PrimeXBT: Contract Types

When you engage in trading on cryptocurrency platforms, the types of contracts offered are vital to understand. Binance and PrimeXBT, two prominent exchanges, provide various contracts, each designed to cater to different trading strategies and risk tolerances. Here is a concise comparison of the contract types on both platforms:

Binance Contracts

- Inverse Perpetual Contracts: These allow you to speculate on the price of cryptocurrencies against other digital assets, rather than fiat currency. They can be ideal if you wish to remain within the crypto ecosystem.

- Linear Perpetual Contracts (USDT-Margined): Your trades are denominated in a stablecoin (USDT), reducing the complexity of interacting with different cryptocurrencies for margin requirements.

- Inverse Futures Contracts: Similar to inverse perpetuals, but with an expiration date, providing clear settlement times which can be useful for short-term trading strategies.

- COIN-M Futures: These contracts use the underlying cryptocurrency as margin. They can be an attractive option if you prefer to hold the actual asset for margin.

- USDⓈ-M Futures: This category enables trading on the futures market using stablecoins pegged to the USD, offering a more familiar pricing structure for those used to fiat.

- Options: Binance offers European-style options, providing the right but not the obligation to buy or sell an asset, giving you more flexibility in hedging strategies.

PrimeXBT Contracts

- CFD Contracts: PrimeXBT is known for its CFDs (Contracts for Difference) that provide leverage on price movements without owning the asset. While they can amplify gains, they also increase the risk of losses.

Both Binance and PrimeXBT’s contracts offer leverage, which can potentially lead to significant profits or losses. Your choice between these contract types should consider factors such as your risk tolerance, trading strategy, familiarity with derivatives, and preference for margin denomination.

Remember, with increased potential returns comes an increased level of risk. Always trade responsibly.

Binance vs PrimeXBT: Leverage and Margin

Leverage allows you to amplify your trading position beyond the initial capital you provide, effectively increasing your potential returns, but it also magnifies risks, including the possibility of liquidation. Both Binance and PrimeXBT offer leverage trading, but they have different levels of leverage available and margin requirements.

Binance allows for a wide range of leverage options depending on the asset you are trading. For cryptocurrencies, you can access leverage up to 100x, although the leverage available might be lower for less popular coins or in certain jurisdictions due to regulatory limits.

Your positions on Binance are subject to liquidation if the market moves against you and your margin level becomes insufficient to support the leveraged position. Binance uses a tiered margin system where the maintenance margin requirements increase with the size of your position.

- Maximum Leverage: 100x

- Liquidation Risk: Based on tiered margin and maintenance margin levels

- Funding Rates: Vary based on market conditions and position size

PrimeXBT, on the other hand, focuses on a well-selected range of major cryptocurrencies and also supports a maximum leverage of up to 100x. The margin requirements are clearly laid out, and you will also need to pay close attention to these, as they directly affect your liquidation risk.

- Maximum Leverage: 100x

- Liquidation Risk: Depends on margin requirements and market price movement

- Funding Rates: Subject to changes in line with market liquidity and volatility

Be aware of funding rates on both platforms, as they are periodic payments exchanged between the buyers and sellers of perpetual contracts and can affect the cost of holding positions over time.

Binance vs PrimeXBT: Liquidity and Volume

When you compare the liquidity and volume of Binance and PrimeXBT, you’re looking at two key factors that influence your trading experience. Binance, being one of the largest cryptocurrency exchanges globally, generally provides high liquidity and volume.

This means that your orders are likely to be executed swiftly with minimal slippage, due to the large number of market participants and the substantial amount of assets changing hands daily.

Liquidity Providers:

- Binance: A broad network, ensuring fluid market movement.

- PrimeXBT: Over 12 liquidity providers, maintaining competitive order execution.

Daily Trading Volume:

- Binance: Averages over $15 billion, indicating a high level of activity.

- PrimeXBT: Over $1.5 billion, despite a focus on a smaller range of assets.

In terms of rankings, Binance frequently appears at the top due to its volume, which reflects the vast number of users and trades on the platform.

On the other hand, PrimeXBT, while smaller in comparison, still maintains sufficient liquidity. This is achieved through its integration with numerous liquidity providers, which helps in processing orders at the requested quotes without significant delays.

For you as a trader, Binance’s higher liquidity and volume can lead to better price discovery and lower transaction costs due to the tighter bid-ask spreads.

PrimeXBT, albeit having lower volumes, still ensures effective trade execution, which is crucial if you’re trading with significant amounts or leveraging positions.

Remember, though, volume isn’t the sole indicator of liquidity, as order size and spread are also pertinent factors in your trading strategy.

Binance vs PrimeXBT: Fees and Rewards

In comparing the fees and rewards offered by Binance and PrimeXBT, you’ll find that both platforms have distinct structures affecting your potential trading costs and incentives.

Binance Fees:

Binance employs a tiered fee structure based on your 30-day trading volume. For the lowest volume tier (VIP 0):

- Maker fee: 0.020%

- Taker fee: 0.040%

If you hold Binance Coin (BNB) and use it to pay for fees, you receive a 25% discount. Further reductions apply as you move up the VIP levels.

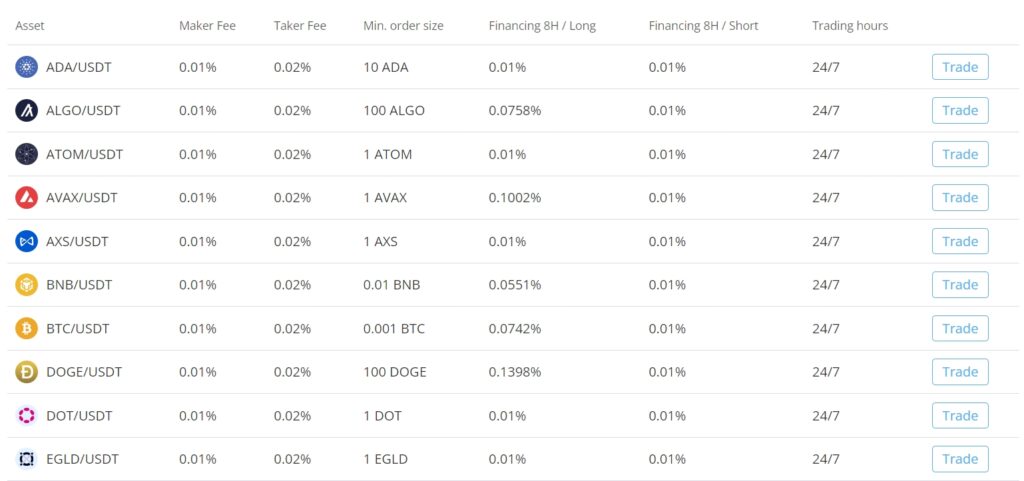

PrimeXBT Fees:

PrimeXBT tends to have a flat fee structure:

- Trade fee: 0.05%

This is applied to all trades, irrespective of the asset class or trade size.

Rewards:

Binance offers a rewards program to regular traders, which includes:

- BNB fee discounts

- Referral kickbacks

- Occasional trading competitions with prize pools

PrimeXBT also offers incentives such as:

- Referral programs

Fees Calculation Example:

For a Binance trade worth $10,000 at VIP 0 level without BNB discounts, your taker fee would be $4. With the BNB discount, it would be $3.

A similar trade on PrimeXBT would incur a $5 fee, regardless of your trading volume.

Choosing between Binance and PrimeXBT will depend on your trading volume and whether the incentive structures align with your trading strategies. Binance’s tiered fee system can benefit high-volume traders, whereas PrimeXBT’s flat rate might be more predictable for consistent trading levels.

Binance vs PrimeXBT: Trading Fee & Deposit/Withdrawal Fee Compared

Binance: Trading Fees

- Maker/Taker Fees: Your trading volume over the past 30 days and your balance of Binance Coin (BNB) determine your maker and taker fees. These fees can be as low as 0.1%. Higher trading volumes and BNB holdings can reduce these fees further.

- Discounts: Paying fees with BNB can earn you a discount, cutting down costs further.

Binance: Deposit/Withdrawal Fees

- Deposit Fees: No fees when you deposit cryptocurrencies.

- Withdrawal Fees: Vary based on the cryptocurrency; these are periodically adjusted according to blockchain conditions.

PrimeXBT: Trading Fees

- Flat Fee: A straightforward 0.05% fee is charged for all trades, regardless of the trade type or frequency.

PrimeXBT: Deposit/Withdrawal Fees

- Deposit Fees: No information suggests that there are fees for cryptocurrency deposits.

- Withdrawal Fees: Details about withdrawal fees are not specified but are an important aspect to check, as they can influence your net withdrawal amount.

Binance vs PrimeXBT: Deposits & Withdrawal Options

When considering Binance and PrimeXBT, you’ll find distinct options for managing your funds. Your choice of exchange should align with your payment preferences and transaction needs.

Binance:

- Currencies: Supports a wide array of both fiat and cryptocurrencies.

- Methods: Offers bank transfers, credit/debit cards, and third-party payment systems like Simplex.

- Processing Times: Can vary; instant for cryptocurrencies, while fiat transactions depend on the method.

- Limits:

- Deposits: Generally high or no limits, but minimum amounts apply.

- Withdrawals: Vary based on verification level; higher limits for verified users.

PrimeXBT:

- Currencies: Primarily deals with cryptocurrencies.

- Methods: Focuses on crypto deposits and withdrawals; fiat options are limited.

- Processing Times: Usually swift, owing to the crypto-centric approach.

- Limits:

- Deposits: No minimum mentioned; check on the platform for the latest updates.

- Withdrawals: Also not specified; typically, crypto exchanges set minimum withdrawal amounts.

Transaction costs can differ significantly between the two platforms; Binance often has the advantage in terms of trading fees, which could translate to lower costs for moving funds. Meanwhile, speed of transactions is usually faster with Binance for cryptocurrencies due to its infrastructure, while PrimeXBT’s crypto-focused methods ensure quick transfers in its preferred domain. The breadth of payment methods and supported currencies is broader on Binance, offering you greater flexibility.

Binance vs PrimeXBT: KYC Requirements & KYC Limits

When comparing the Know Your Customer (KYC) policies of Binance and PrimeXBT, it is essential to consider how these requirements impact your experience.

Binance breaks down its KYC process into multiple tiers:

- Tier 1 (Verified): Requires basic personal information.

- Tier 2 (Verified Plus): Demands additional details and identification documents.

- Custom Limit: Offered upon request, subject to local regulations.

The higher your tier, the more privileges you have, such as increased deposit and withdrawal limits. However, if privacy is a concern, higher verification levels mean sharing more personal information.

PrimeXBT operates differently. KYC procedures can vary since PrimeXBT may enforce different standards based on jurisdiction. PrimeXBT typically requires personal information and expects documentation for identity verification. However, detailed specifics on tier systems and associated limits are less publicly direct, suggesting a need for direct inquiry to understand full implications for your trading capacity.

Binance vs PrimeXBT: Order Types

When trading on Binance and PrimeXBT, you’re presented with a variety of order types that allow you to execute your trading strategies and manage risk effectively. The order types available on each platform include, but are not limited to, the following:

Binance offers a comprehensive range of order types to enhance your trading experience:

- Market Orders: Execute immediately at the best available price.

- Limit Orders: Set a specific price to buy or sell.

- Stop-Limit Orders: Trigger a limit order when the market reaches your set stop price.

- OCO (One Cancels the Other) Orders: Place two orders together; when one is filled, the other is canceled.

PrimeXBT provides essential order types with a few unique features:

- Market Orders: Like Binance, these are executed instantly at current market prices.

- Limit Orders: Specify the price at which you want to enter a position.

- Stop Orders: Also known as stop-loss orders, these help limit potential losses by setting a stop price.

- Protection Orders: Include stop-loss and take-profit orders configured upon entering a trade.

Both platforms support advanced order types to help you manage trades:

- Conditional Orders: Execute an order based on specific conditions being met.

- Post-Only Orders: Ensure the order adds liquidity to the market by being placed in the order book and not filled immediately.

- Reduce-Only Orders: A type of order that will only reduce your position, not increase it.

Binance vs PrimeXBT: Security and Reliability

When considering the security and reliability of Binance and PrimeXBT, your focus should be on how they safeguard your funds and personal information. Both platforms deploy a spectrum of security measures to mitigate risks.

Binance, as one of the largest cryptocurrency exchanges globally, implements two-factor authentication (2FA), advanced encryption technology, and security alerts. An important part of their security ecosystem is the Secure Asset Fund for Users (SAFU), which serves to protect your funds in extreme cases. However, Binance has faced scrutiny from regulators and has encountered security breaches in the past. They have taken measures to resolve incidents transparently, reimbursing affected users and bolstering their security protocols.

PrimeXBT, on the other hand, maintains a high level of security by incorporating features such as hardware security modules (HSM) and multi-signature cold storage for the cryptocurrency assets under its management. Like Binance, PrimeXBT also employs 2FA and has a record of proactive measures against potential threats.

As for reliability, you can find both exchanges equipped with robust trading systems. They manage high volumes with minimal downtime, although occasional maintenance updates are necessary.

Regarding regulatory compliance, both Binance and PrimeXBT must navigate the complex landscape of international crypto regulations. Binance has made considerable efforts to work with regulatory bodies to ensure compliance, whereas PrimeXBT complies with the laws of the countries in which it operates.

Customer support is crucial when issues arise. Binance provides a comprehensive customer service platform, including 24/7 chat support. PrimeXBT similarly offers a dedicated support team to assist you with your needs.

Binance vs PrimeXBT: User Experience

When you navigate to Binance, you’ll find a platform rich in features with a wide range of options for trading various cryptocurrencies. Its interface is detailed and may be somewhat overwhelming to new users. However, once you get accustomed to it, the additional features and tools can enhance your trading experience.

The speed of trading on Binance is generally fast, which is crucial in the volatile crypto market.

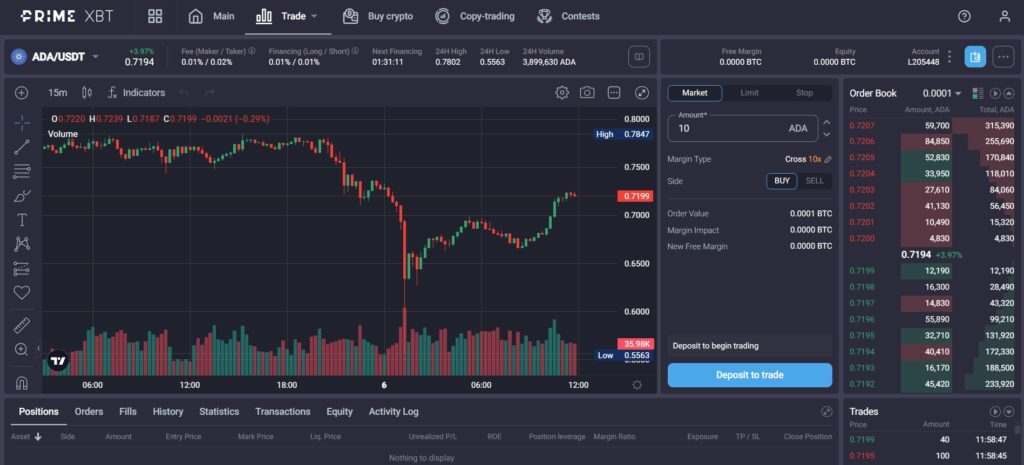

In contrast, PrimeXBT’s interface is tailored to a focused selection of major cryptocurrencies, which could simplify your decision-making process. The less cluttered interface could be easier for you to use if you prefer a more straightforward experience.

Also, PrimeXBT offers a customizable layout, which allows you to adjust your trading environment according to your preferences.

Both platforms offer mobile apps, which means you can trade on-the-go:

- Binance: Feature-rich mobile app, mirroring the complexity of the web platform.

- PrimeXBT: Simplified app, focusing on core trading functions.

Feedback from users suggests that Binance’s array of features and robustness may feel more suited to experienced traders, while PrimeXBT might be favored by those seeking a leaner approach. The choice between the two may depend on your familiarity with trading platforms and your need for advanced features versus a streamlined experience.

Binance vs PrimeXBT: Education and Community

When evaluating Binance and PrimeXBT, take into account their dedication to educating traders and fostering vibrant communities.

Binance Academy stands out as a comprehensive resource. Here, you’ll find a variety of materials, from articles and glossaries to videos, all tailored to different skill levels.

Binance’s commitment to education extends to:

- Articles & Tutorials: In-depth guides covering fundamental and advanced crypto topics.

- Glossary: A resource for understanding complex crypto terminology.

- Videos: Visual learning for users who prefer media content.

Moreover, Binance strengthens its community through:

- Social Media Engagement: Active presence on platforms like Twitter and Telegram.

- User Support: Accessible customer service and a helpdesk.

On the other side, PrimeXBT offers a more focused educational suite with resources primarily geared towards trading on their platform. Their educational support includes:

- Trading Guides: Focused mostly on strategy and platform use.

- Blog Updates: Information on market trends and platform news.

Community-wise, PrimeXBT:

- Social Media Presence: Keeps users informed and engaged, mainly through Twitter and a blog.

- Customer Support: Offers help through live chat and email.

Engagement and Involvement:

- PrimeXBT is known to interact with their user base, offering support and updates.

- Binance, with a larger user base, caters to a wider community, hosting events and fostering discussions that go beyond its platform.

Binance vs PrimeXBT: Regulation and Compliance

When you’re examining the regulatory landscape for Binance and PrimeXBT, it’s crucial to understand how these platforms conform to international laws and financial standards.

Binance:

- Jurisdictions: Initially established in Hong Kong, Binance has expanded globally and complies with various jurisdictional regulations.

- Licenses: Binance holds several licenses globally, adapting to regional financial regulations.

- Compliance Efforts: They invest in compliance infrastructure and employ a sizeable compliance team.

- Audits: Engages in regular audits to ensure financial transparency and security.

- Controversies: Despite its licensing, Binance has faced scrutiny in different jurisdictions over regulatory matters, leading to proactive adjustments in its operations.

PrimeXBT:

- Jurisdictions: PrimeXBT serves clients internationally and complies with the legal requirements of the countries in which it operates.

- Licenses: The specific licensing details might not be as publicly promoted as Binance, but PrimeXBT follows standard compliance measures.

- Compliance Efforts: Robust KYC (Know Your Customer) procedures help maintain legal compliance.

- Audits: Conducts internal and third-party security audits to secure clients’ assets and data.

- Controversies: PrimeXBT, like many trading platforms, works continuously to keep up with the evolving regulatory landscape to meet compliance demands.

Conclusion

In comparing Binance and PrimeXBT, several factors stand out. Binance is a larger exchange established in 2017. It offers a comprehensive selection of altcoins and generally has lower trading fees. Lower fees can be crucial for your long-term portfolio growth. Changpeng Zhao, commonly known as CZ, leads Binance and has a reputable background in the industry.

PrimeXBT, operating since 2018, distinguishes itself by offering not just cryptocurrencies but also other CFD markets like forex, commodities, and stocks. It could suit your needs if you’re interested in a platform that supports various types of assets.

| Aspect | Binance | PrimeXBT |

|---|---|---|

| Founded | 2017 | 2018 |

| Trading Focus | Altcoins | Multi-asset CFDs |

| Fees | Lower | Higher |

| Market Suitability | General traders | Diverse investors |

If your focus is primarily on altcoin trading with competitive fees, Binance might be the better choice. It’s suited for frequent traders who value a robust trading environment. For those who seek diversity in their investments and the ability to trade various markets under one platform, PrimeXBT could be preferable.

To deepen your knowledge and make an informed decision, consider visiting comparison websites like Cryptoradar, reviewing customer feedback, and exploring educational resources from reputable sites like Coin Bureau. Your choice should align with your trading style, risk tolerance, and investment goals.

Explore how Binance and PrimeXBT compare to their competitors:

- Binance vs Phemex: Head-to-Head Platform Comparison

- Binance vs BingX: Head-to-Head Platform Comparison

- Binance vs Bybit: Head-to-Head Platform Comparison

- PrimeXBT vs BingX: Head-to-Head Platform Comparison

- PrimeXBT vs MEXC: Head-to-Head Platform Comparison

- PrimeXBT vs Phemex: Head-to-Head Platform Comparison