This BitMEX Futures Trading Tutorial is your comprehensive step-by-step guide to navigating the intricate world of crypto futures on one of the most renowned platforms, BitMEX.

Whether you’re a seasoned trader or taking your first steps in the futures market, this tutorial will equip you with the knowledge to confidently buy and sell contracts that speculate on the future value of cryptocurrencies.

From understanding the basics of futures and perpetual futures contracts to mastering leverage and margin, this guide provides a solid foundation for trading on BitMEX.

How to Trade Crypto Futures on BitMEX: BitMEX Futures Trading Strategy & Basics

Trading futures on BitMEX allows you to buy and sell contracts that speculate on the future value of cryptocurrencies. Before you start, understanding the basics of futures and perpetual futures contracts is crucial.

Leverage is a critical concept in futures trading. It lets you trade more significant amounts with less capital. However, leverage increases risk, as both potential profits and losses are magnified.

Margin is the amount of capital you need to open a position. Liquidation occurs if your position’s value falls to a certain level and you can’t meet the margin requirement; BitMEX will close your position at market price.

You have two margin modes to select from:

- Cross Margin Mode: Shares your account balance across open positions to prevent liquidation.

- Isolated Margin Mode: Limits your potential losses to the margin allocated to a single position.

Prices on BitMEX consist of:

- Index Price: A composite of prices from significant exchanges to represent the spot price of the underlying asset.

- Fair Price: Used by BitMEX to avoid price manipulation. It can impact how the perpetual contract is priced relative to the spot index.

- Funding Rate: A fee paid by one side of the perpetual contracts to the other; this ensures the perpetual prices are anchored to the spot price.

BitMEX provides an Order Calculator to help you estimate potential profits and losses and understand the impact of the fees before you submit an order.

Use it to assess risks and manage your trades effectively. Make informed decisions by developing a Trading Plan articulating your trading strategy and risk management practices.

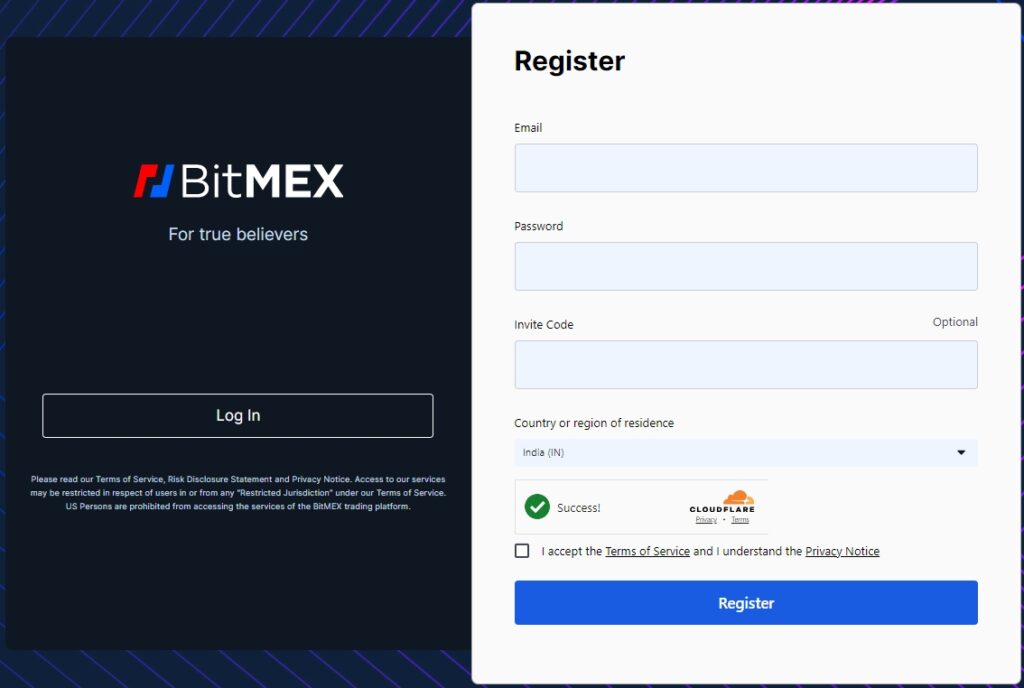

How to Create an Account on BitMEX

Setting up an account is the initial step in trading cryptocurrency futures on BitMEX. Start by navigating to BitMEX’s official website or downloading the BitMEX app, which is available on iOS and Android platforms.

Step-by-Step Registration Guide:

- Navigate to the Registration Page

- Click on the ‘Register’ button to access the account setup.

- Fill in Your Details

- Provide your email address, a strong password, and country of residence.

- Note: The password should be unique and secure to protect your account.

Account Verification:

- After completing the initial form, you must verify your account to comply with regulatory requirements.

- You will be prompted to provide personal identification documents and proof of residence.

- Security Tip: During this process, ensure all documents are clear and legible to avoid delays.

Multi-Factor Security:

- For enhanced security, BitMEX suggests setting up multi-factor authentication (MFA).

- Upon activation, MFA requires two or more verification methods to grant access to your account.

Support and Assistance:

- If you encounter any issues or need guidance, BitMEX’s support team can assist you.

Referral Program:

- BitMEX offers a referral program. By registering via a referral link, you can receive a discount on transaction fees.

Lastly, remember that once your account is set up correctly, the focus on security and verification will contribute continuously to a secure trading environment on BitMEX.

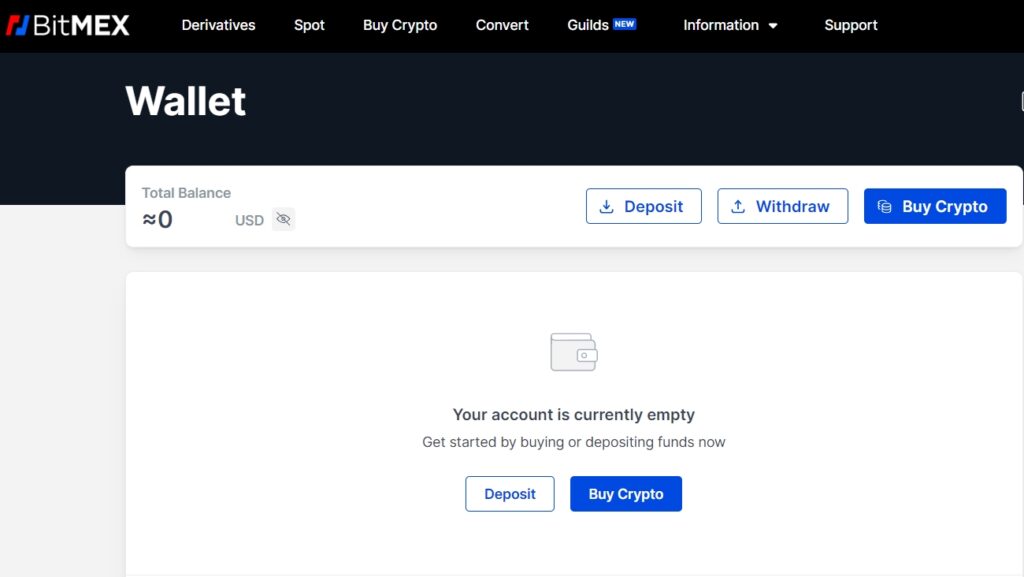

How to Deposit and Withdraw Funds on BitMEX

To deposit funds on BitMEX, follow these steps:

- Log in to your BitMEX account.

- Navigate to the ‘Deposit’ section.

- Select the type of currency you wish to deposit (BTC, ETH, etc.).

- You’ll receive a unique deposit address. Transfer your funds to this address.

- Wait for the network confirmation. The time may vary depending on network congestion.

When it comes to withdrawing funds, you’ll:

- Go to the ‘Withdraw’ page on your BitMEX account.

- Enter the amount you want to withdraw.

- Provide the destination wallet address.

- Review BitMEX’s security measures, such as two-factor authentication, to confirm the withdrawal.

For deposits and withdrawals, BitMEX supports cryptocurrencies such as BTC, ETH, and USDT. Note the following:

- Minimum and Maximum Limits: These vary by currency and market conditions.

- Fees: BitMEX charges a fee for withdrawals, typically a fixed amount, to cover the network transaction fee.

- Processing Time: Deposits are credited after the required network confirmations; withdrawals are processed with a manual review once daily.

For fiat currency, you might need to use a third-party service to convert your fiat into cryptocurrency before depositing. Always understand the current exchange rates and service fees for such conversions.

Remember to consider the security protocols BitMEX has in place and always ensure that your account is secured with strong passwords and two-factor authentication to protect your funds.

How to Transfer Funds to the Futures Wallet

Before you initiate a transfer, it’s essential to understand that BitMEX offers two distinct types of wallets. Your main wallet is where you deposit and withdraw your standard cryptocurrency.

Conversely, the futures wallet is specifically designed for trading futures contracts. These wallets are separate to ensure transparent management of funds specific to futures trading.

To move funds to your future wallet, follow these simple steps:

- Log in to your BitMEX account.

- Navigate to the ‘Wallet’ section.

- Locate and click on the ‘Transfer’ button between the wallets.

- Select the amount you wish to move to the future wallet in the transfer window. Ensure that this amount is within the permissible range for the transfer.

BitMEX Supported Currencies:

- Bitcoin (XBT)

- Ethereum (ETH)

- Ripple (XRP)

- Other supported altcoins

Transfer Amounts:

- Minimum: Varies per asset; usually a tiny fraction of one coin

- Maximum: Can be up to your total balance in the main wallet

Remember: Transfers to and from the wallet of the future on BitMEX are internal and typically processed instantly, allowing you to manage your funds efficiently. Always check the latest information on minimums and maximums, as they can change.

Once the transfer is complete, your futures wallet balance will update, reflecting the new amount available for trading futures contracts.

This separates trading funds from primary holdings, providing clear financial organization and improved account management.

How to Choose Between Perpetual and Futures Contracts

When trading on BitMEX, you can engage in both perpetual and traditional futures contracts. Understanding the critical differences between these two instruments is vital for practical trading strategies.

Perpetual Contracts

Perpetual contracts, often referred to as ‘perps,’ do not have an expiry date, thus allowing you to hold a position for as long as you desire.

This type of contract mimics a spot market but with added leverage. It’s designed to trade close to the underlying reference Index Price and often involves a funding mechanism that ensures price proximity through periodic payments between long and short position holders.

Futures Contracts

In contrast, traditional futures contracts have a predetermined expiry date. This means that the contract will settle on a predetermined date regardless of the position. Futures are suitable for date-specific hedging and speculation.

Advantages and Disadvantages

| Perpetual Contracts | Futures Contracts |

|---|---|

| Advantages | Advantages |

| No expiry date | Date-specific settlement |

| Mimics spot market with leverage | Can align with specific financial planning strategies |

| Disadvantages | Disadvantages |

| Funding fees can add up | Less flexibility post-expiry date |

| Subject to high volatility and liquidation risks | May deviate from spot prices leading up to expiry |

Examples on BitMEX

On BitMEX, you will find a range of perpetual contracts, such as XBTUSD and ETHUSD, which are tied to the value of Bitcoin and Ethereum, respectively. As for traditional futures, contracts like XBTH21 expire in March 2021 and are settled based on the Bitcoin price.

By considering these differences, you can decide whether perpetual or futures contracts align with your trading needs and risk tolerance on BitMEX.

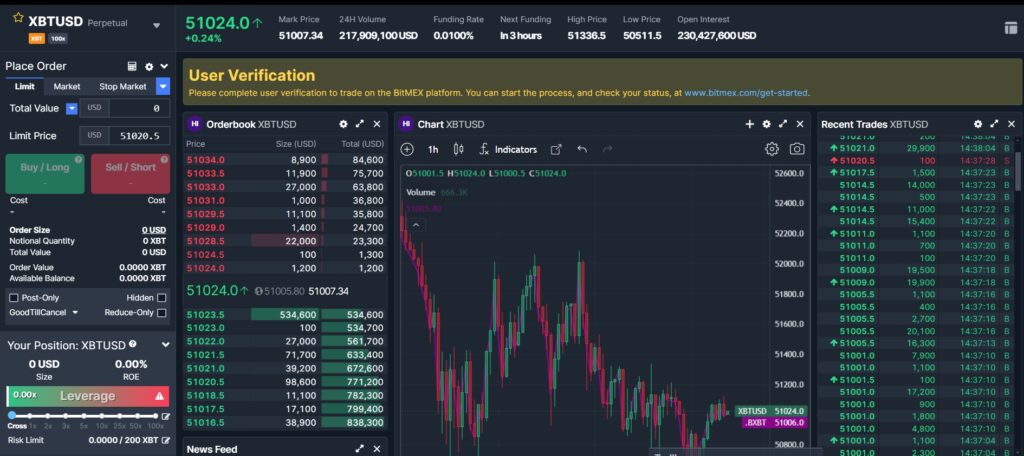

How to Understand the Futures Trading Interface on BitMEX

When you log into BitMEX and select the Futures product, you’ll see a distinctly organized trading interface.

Familiarizing yourself with this layout is critical to efficient trading.

Chart Area: This is the central visual element where you can follow the real-time price movements of the selected futures contract. You can customize the chart by time interval, chart type (like candlestick or bar), and add technical analysis indicators as needed.

Order Book: On the left, the order book displays live bids and asks for future contracts, showing market depth and where potential support and resistance levels might be.

Order Panel: The order panel is where you’ll place trade orders below the chart. You can select from various order types, including:

- Market Order: Executes at the best available price

- Limit Order: Sets a specific price to buy or sell

- Stop Order: Triggers at a predetermined price

- Take Profit Order: Designed to lock in profits

Make sure to specify your predeterminedtity and leverage, considering that BitMEX allows high leverage trading, amplifying profits, and losses.

Position Panel: This displays your open positions, with details like entry price, mark price, unrealized P&L, and leverage used. This panel also allows for position management, including closing and adjustments.

Recent Trades: Shows a real-time feed of transactions recently executed in the market, giving insight into market activity and momentum.

In addition to these components, BitMEX offers various customization options and trading tools that can assist in planning and executing your trading strategies.

Use the risk management features and analysis tools to ensure informed decision-making in the volatile futures market.

Remember, thoroughly understanding each element enhances your navigation and execution capabilities on the BitMEX platform.

How to Place and Manage Orders on BitMEX Futures

When starting with BitMEX futures, your first step is to select a trading pair. Common pairs include XBT/USD, where XBT represents Bitcoin. Once selected, choose your contract types, such as perpetual contracts or fixed-date expiries.

Contract Type Selection:

- Perpetual Contracts

- Fixed-Date Expiries

Next, determine your desired leverage level. Leverage on BitMEX can be high, amplifying both gains and losses.

Choosing Leverage:

- Low Leverage: Less risk, smaller gains or losses

- High Leverage: Greater risk, more significant gains or losses

You have three main order types on BitMEX futures:

- Limit Orders: Set the price at which you want to buy or sell

- Market Orders: Execute immediately at the current market price

- Stop Orders: Triggered when the market hits a specified price

For placing an order using the XBTUSD pair:

- Limit Order Example:

- Price: Set your desired entry price.

- Quantity: Specify the contract amount.

- Buy/Sell: Choose the direction of your trade.

- Execution: Review and confirm to place your order.

Managing leverage and margin requires understanding their interplay:

- Leverage is the amount of exposure compared to your margin.

- Margin is the collateral held against positions.

When managing positions, you can close them by either setting an opposing limit order or executing a market order for the same quantity in the opposite direction.

Lastly, be aware of the funding rate and settlement:

- Funding Rate: Periodic payments exchanged between long and short positions, influencing position-holding costs.

- Settlement: Contracts are rolled over or settled at expiry based on contract specifications.

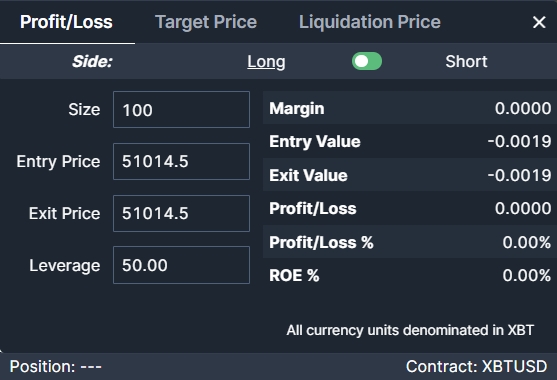

How to Use the BitMEX Order Calculator

The BitMEX order calculator is an essential tool for traders who want to manage risk effectively and make informed decisions when trading futures contracts on the BitMEX platform.

The calculator helps determine potential profits, losses, targets, and liquidation prices.

To access the BitMEX order calculator, navigate to the BitMEX trading dashboard. You will find the calculator icon in the top left area of the “Place Order” widget.

Here are the main parameters you’ll need to input:

- Entry Price: The price at which you intend to enter a position.

- Exit Price: The price at which you plan to exit the position.

- Quantity: The amount of the contract that you want to trade.

Once you input these values, the order calculator will display results that include:

- Profit/Loss (P/L): The potential profit or loss for the trade.

- Target Price: This is the price you need for long positions to reach a desired profit. For short positions, it’s the price at which you would incur an inevitable loss.

- Liquidation Price: The price at which your position would be automatically closed to prevent further losses.

Examples of Calculator Use:

Scenario 1: Long Position

- Entry Price: $10,000

- Exit Price: $11,000

- Quantity: 1 BTC

Results:

- P/L: $1,000 profit

- Liquidation Price: Depends on leverage and margin

Scenario 2: Short Position

- Entry Price: $15,000

- Exit Price: $14,000

- Quantity: 1 BTC

Results:

- P/L: $1,000 profit

- Liquidation Price: Depends on leverage and margin

The calculator not only assists in planning and forecasting but also in applying risk management strategies. Practice inputting different scenarios to understand how changes in entry and exit prices affect your potential outcomes.

How to Use the BitMEX Options Trading Feature

BitMEX options trading offers an advanced method to engage with cryptocurrency derivatives. It is an innovative tool tailored for traders who wish to leverage the unique benefits of options trading in the crypto domain.

To begin using the BitMEX options trading platform, you need to follow these steps:

- Create an Account or Log in:

- Sign up on their platform if you do not have a BitMEX account.

- If you already have an account, log in.

- Access the Trading Interface:

- Navigate to the Options section from the BitMEX dashboard.

- Familiarize yourself with the interface to locate important information and tools.

- Select Your Options Contract:

- Identify the cryptocurrency asset for which you want to trade options.

- Choose a call or put option, depending on your market prediction and strategy.

Options trading on BitMEX allows traders to hedge positions or speculate on price movements of various cryptocurrencies.

However, it is crucial to understand the increased complexity and risk of options trading.

Options can provide leveraged exposure with potentially lower risk than futures, but they can also expire worthless if not managed correctly.

When choosing options strategies on BitMEX, consider the following:

- Assess Market Conditions: Select strategies for bullish, bearish, or neutral market outlooks.

- Manage Risk: Use options in a broader trading plan incorporating risk management techniques.

- Stay Informed: Keep up with market developments that could affect the underlying asset and the valuation of your options position.

With these points in mind, you can navigate the BitMEX options trading feature with a clear strategy and an adequately assessed risk profile.

Frequently Asked Questions

When trading crypto futures on BitMEX, understanding the fee structure and compliance with regional regulations are crucial. Here’s what you need to know.

How can I calculate the fees for trading crypto futures on BitMEX?

BitMEX uses a maker-taker fee model. As a maker (creating a market with a new limit order), you may receive a rebate, while as a taker (filling an existing order), you’ll pay a fee.

The exact percentages can vary, so check the latest fee schedule on BitMEX’s website. Fees also depend on the order type and the perpetual or futures contract you’re trading.

Are US residents allowed to trade futures on BitMEX?

No, US residents are not permitted to trade futures on BitMEX. The exchange enforces this through IP checks and requires users to verify their residence.

Attempting to bypass these restrictions violates BitMEX’s terms of service and can result in account termination.

Conclusion

Trading futures contracts on cryptocurrency exchanges like BitMEX offers a way to profit from rising and falling markets. Through strategic application, you can employ futures to invest in various crypto assets with the option of leveraging your position.

Remember:

- Spot trading refers to purchasing assets at their current market value for immediate delivery.

- Futures trading, conversely, involves a contract agreeing to buy or sell assets at pre-determined prices in the future, providing opportunities for strategic planning and hepredeterminedmarket volatility.

While engaging with futures, consider these guidance points:

- Always begin by understanding the basics of the trade and familiarize yourself with the terms and mechanisms specific to BitMEX.

- Develop a robust trading strategy to manage risks effectively; diversification and regular market analysis are critical.

- Utilize BitMEX’s support systems and educational resources to bolster your trading knowledge.

For further learning, the following can be helpful:

Explore how BitMEX compares to its competitors:

- BitMEX vs PrimeXBT: Detailed Review and Comparison

- BitMEX vs Kraken: Detailed Review and Comparison

- BitMEX vs Binance: Detailed Review and Comparison

- BitMEX vs Phemex: Detailed Review and Comparison