Kraken and Binance are major cryptocurrency exchanges offering diverse trading options. Kraken is renowned for its strong security, regulatory compliance, and extensive range of cryptocurrencies. Binance, one of the largest exchanges globally, provides high trading volumes, advanced tools, and comprehensive services including spot, margin, and futures trading, staking, and savings.

When choosing between Kraken and Binance, two leading cryptocurrency exchanges, key factors are their range of features, fee structures, and overall trading experience. Here’s how the two compare:

| Feature | Kraken | Binance |

|---|---|---|

| Supported Coins | Offers a diverse selection of cryptocurrencies. | Supports a vast array of coins. |

| Trading Volume | Has significant trading volume, ensuring liquidity. | Possesses one of the highest trading volumes in the industry. |

| User Experience | Known for its user-friendly interface and comprehensive support. | Provides a smooth experience with a user-friendly platform. |

| Fees | Charges 0% to 0.26% for most trades; some instant buy/sell/convert orders may incur higher fees. | The fee structure varies, as well as competitive rates. |

| Security | Emphasizes robust security measures. | Prioritizes a secure trading environment with advanced measures. |

| Leverage | Provides leverage options for traders. | Offers leveraged trading. |

| Deposit Methods | Accepts various deposit methods. | Multiple deposit methods are available. |

Both platforms cater well to different needs.

Kraken is recognized for its strong security stance and transparent approach. At the same time, Binance offers a higher overall score due to its extensive coin support and high trading volume, which can be particularly attractive for active traders.

Kraken vs. Binance: Products and Services

Kraken and Binance are leading cryptocurrency exchanges that provide various products and services that cater to different user needs.

- Spot and Futures Trading:

Both Kraken and Binance offer spot trading with a variety of cryptocurrencies. Binance, however, tends to provide a broader range of coins and tokens than Kraken. Regarding futures trading, Binance offers a more extensive product line, including higher leverage options.

- Margin Trading:

If margin trading is your interest, Kraken provides up to 5x leverage, presenting a more conservative offering for traders who prefer lower risk. Binance, on the other hand, allows for higher leverage, increasing both the potential reward and risk.

- Liquidity and Wallets:

Binance is known for high liquidity, diminishing the spread and slippage during significant transactions. In terms of wallets, both platforms ensure secure storage of assets, with Kraken celebrated for its transparent security measures.

- Crypto Staking:

Staking services differ slightly, with Kraken providing straightforward staking options for various coins. Binance also offers staking services, wielding a competitive range of options.

- Fiat Currencies and Payment Methods:

As for dealing with fiat currencies, Kraken supports several, complementing these with diverse payment methods. Binance has expanded its fiat support and payment options to accommodate a global user base.

- Innovation and User Experience:

Lastly, with innovation in mind, Binance often leads with features like a dedicated NFT marketplace, adding to a user’s investment experience. Both exchanges focus on user experience, providing intuitive platforms for novice and experienced traders.

Kraken vs Binance: Contract Types

Kraken and Binance provide various options when considering trading contracts on crypto exchanges. Your choice between these platforms may depend on the type of contracts you are interested in.

Kraken offers:

- Inverse Futures Contracts: These allow you to speculate on the future price of cryptocurrencies with settlement in the underlying asset.

Binance has a broader selection, including:

- Inverse Perpetual Contracts: Traded against the cryptocurrency, these contracts do not expire, allowing indefinite holding as long as you can maintain the margin.

- Linear Perpetual Contracts: Priced and settled in stablecoins like USDT or BUSD, they enable straightforward calculation of profits and losses.

- Inverse Futures Contracts: Similar to Kraken’s offering, with the added benefit of Binance’s liquidity and market depth.

- COIN-M Futures: These futures contracts are margined and settled in the cryptocurrency itself, which can be advantageous if you prefer to use your coin holdings as collateral.

- USD-M Futures: These contracts are margined with stablecoins, providing a stable valuation that can protect you from the volatility often associated with cryptocurrencies.

- Options: Binance also provides options trading, giving you the right, but not the obligation, to buy or sell at a predetermined price on or before a specified date.

Critical differences in features:

- Binance offers a more diverse array of contract types, which might suit traders looking for a wide range of trading instruments.

- Kraken’s options are more limited but might be favored if you prefer a platform with a reputation for stringent security measures and straightforward contract offerings.

It’s essential to assess your trading strategy and risk tolerance when choosing between Kraken and Binance. Consider contract types, fees, liquidity, and security in decision-making.

Kraken vs Binance: Leverage and Margin

You’ll find distinct offerings from Kraken and Binance when considering leverage and margin trading. Both platforms enable you to amplify your positions, increasing potential returns and accompanying risks.

Kraken provides you with up to 5x leverage on select currency pairs.

Your initial margin requirement starts at 20%, meaning you must commit 20% of the total position’s value to open a trade.

The maintenance margin can be lower, ensuring you keep a minimum equity percentage to avoid liquidation.

Regarding Binance, the leverage can go much higher, up to 125x, for some contracts on Binance Futures.

The initial margin requirement on Binance depends on the leverage used and the size of the position; higher leverage requires a more significant initial margin percentage.

Here is a comparison:

| Feature | Kraken | Binance |

|---|---|---|

| Maximum Leverage | 5x | Up to 125x |

| Initial Margin Requirement | Starts at 20% | Varies with leverage & position size |

| Liquidation Risk | Positions liquidated if margin falls below maintenance | Positions liquidated if the margin level reaches the maintenance amount |

| Funding Rates | Variable based on the traded asset | Dynamic, affected by market liquidity |

Remember that margin trading involves high potential returns and the possibility of significant losses, especially at higher leverage levels.

Liquidation risks become more prominent as leverage increases, and sudden market moves can affect the funding rates, impacting the cost of maintaining the position.

Continually assess your risk tolerance and strategy when engaging in leverage and margin trading.

Kraken vs Binance: Liquidity and Volume

Regarding Kraken and Binance, liquidity and volume are critical indicators of an exchange’s efficiency and reliability.

Liquidity refers to the ease with which you can buy or sell cryptocurrencies without affecting the market price.

High liquidity means less slippage, resulting in more predictable and closer-to-market price transactions.

Binance:

- Volume: Consistently ranks at the top for global trade volume.

- Liquidity: Offers high liquidity levels across a range of pairs.

Kraken:

- Volume: Lesser in comparison but still maintains substantial volume.

- Liquidity: Provides strong liquidity, especially for EUR pairs.

Your trading experience, in terms of execution and slippage, will generally be smoother on an exchange with high liquidity and volume.

Order Book Depth:

- Binance typically shows more profound order books, which means your large volume orders are absorbed with minimal impact on the market price.

- Kraken may have less depth but is preferred for specific fiat pairs.

Market Pair Availability:

- Given the more significant number of trading pairs, Binance offers more opportunities for liquidity.

- Kraken holds a respectable range of pairs, focusing on the reliability of the pairs it provides.

Data Sources and Rankings:

- Monitor rankings through aggregate sites like CoinMarketCap or CoinGecko.

- Analyze liquidity metrics using the exchange’s data or third-party tools.

When trading, check the real-time liquidity and depth for the specific pairs that interest you.

Kraken and Binance are robust platforms, and your choice may depend on the specific currencies you wish to trade and your trade volumes.

Kraken vs. Binance: Fees and Rewards

When trading cryptocurrencies, the fee structure of the exchange you choose can significantly impact your returns. Kraken and Binance offer competitive fees and rewards catering to different types of traders.

Kraken vs. Binance: Trading Fee & Deposit/Withdrawal Fee Compared

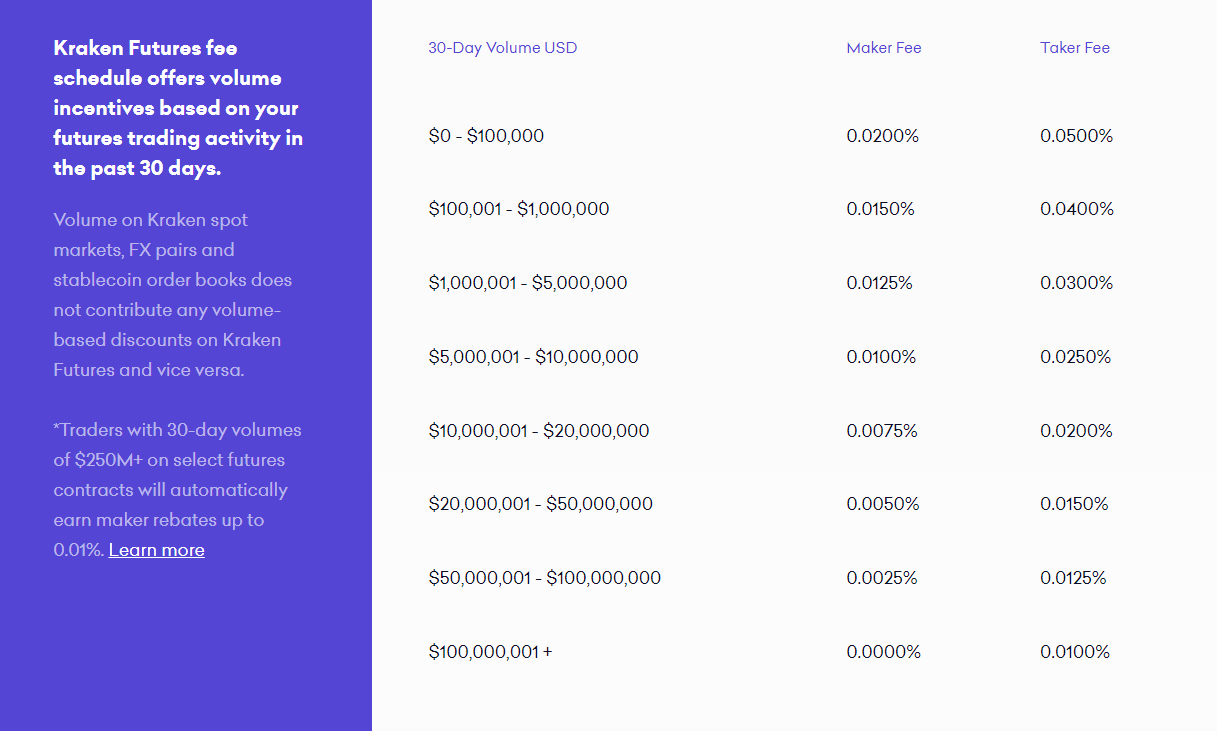

Kraken has a volume-tiered, maker-taker fee model. As your trading volume increases, your fees can be reduced.

The maker fee starts at 0.16% and can go as low as 0.00%, while the taker fee begins at 0.26% and can decrease to 0.10%.

You pay the maker fee if you place a limit order that adds liquidity to the market. If your order takes liquidity away, you pay the taker fee.

For deposits on Kraken, most cryptocurrencies are free to deposit, but some, like Ether, may include a small fee. Fiat currency deposit fees vary depending on the method and currency.

Withdrawal fees vary by currency, which can be more significant for fiat withdrawals.

Binance operates on a similar maker-taker model, with fees starting at 0.1% for both.

However, if you use Binance’s native token, BNB, you can receive a discount on trading fees, reducing them by 25%. For example, your trading fee could drop from 0.1% to 0.075% when paying with BNB.

Both platforms impose fees on deposits and withdrawals. Binance generally does not charge for cryptocurrency deposits but does have withdrawal fees that vary by coin.

The platform also provides different fiat deposit and withdrawals methods, and the fees can depend on the payment method used.

Additionally, both exchanges offer staking rewards, which allow you to earn interest on your holdings. Rates for staking rewards depend on the specific cryptocurrency and market conditions.

Kraken vs Binance: Deposits & Withdrawal Options

When you compare Kraken and Binance, you’ll find that both exchanges support various options to fund your account or withdraw your assets, which are crucial for your convenience and cost-effectiveness.

Kraken enables you to deposit funds using:

- Fiat Currencies: USD, EUR, CAD, AUD, GBP, CHF, JPY

- Payment Methods: Bank transfers (SWIFT, SEPA, domestic), wire transfers, debit and credit cards, and some country-specific options

- Processing Times: Typically 1-5 business days for fiat, a few minutes to an hour for cryptocurrencies

- Cryptocurrencies: Supports a wide range of cryptocurrencies for deposits

Withdrawal options are similar, with minimum and maximum amounts varying per currency and method.

Binance, on the other hand, offers:

- Fiat Currencies: A broader range of supported currencies due to its global reach

- Payment Methods: Bank transfers, credit/debit cards, P2P trading, third-party payment networks like Simplex

- Processing Times: Usually less than an hour for crypto withdrawals, but fiat processing can take days

- Cryptocurrencies: An extensive list of coins and tokens accepted

Withdrawals from Binance also follow varied limits, potentially offering higher thresholds for verified accounts.

Note that fees may apply differently on each platform, affecting the cost aspect of transfers. Binance typically provides a more competitive fee structure for cryptocurrency and fiat transactions.

Understanding these differences empowers you to make decisions that align with your trading efficiency and cost management needs.

Kraken vs. Binance: KYC Requirements & KYC Limits

When you sign up for Kraken or Binance, you’ll need to comply with Know Your Customer (KYC) regulations, which are in place to prevent money laundering and fraud. Each platform has a different approach to KYC, affecting how you’ll use the exchange based on your verification status.

Kraken’s KYC Procedure:

- Starter Level: You’ll start at this level by providing your full name, email address, primary address, and phone number. This level allows you to deposit, exchange, and withdraw cryptocurrencies, not fiat ones.

- Intermediate Level: Requires additional information, such as your occupation, Social Security Number (for U.S. residents), and ID verification (government-issued ID, a picture of yourself). You gain access to fiat deposits and withdrawals with a higher transaction limit.

- Pro Level: This is the highest level, demanding a completed KYC questionnaire and verification of your proof of residence. At this stage, you benefit from the highest limits available on the platform.

Binance’s KYC Procedure:

- Primary Verification: This allows you to withdraw up to 2 Bitcoin worth of cryptocurrency per day without providing any personal identification documents.

- Advanced Verification: For U.S. residents, Binance.us requires a government-issued ID, Social Security Number, and address verification, significantly increasing your withdrawal and trading limits.

Your privacy and security are central to each exchange’s KYC process, ensuring safe transactions within regulatory compliance.

Both exchanges require more information for higher limits and services, particularly fiat currency transfers.

These exchanges must follow strict regulations in the United States, making KYC an essential operation component. As you provide more personal information, you unlock more excellent capabilities within each platform.

Kraken vs Binance: Order Types

When trading on Kraken or Binance, you can access various order types that cater to different trading strategies and risk management techniques.

Kraken offers a range of order types. The primary one, market orders, allows you to buy or sell immediately at the current market price.

If you want to specify the price, you can use limit orders, setting the maximum or minimum price you are willing to trade.

There are also stop-loss and take-profit orders, automatically closing your position to minimize losses or lock in profits when the price hits a specified level.

For conditional orders, like the Stop Loss Limit or Take Profit Limit, add extra conditions to your stop orders. One advanced feature is the Settle Position order, which lets you settle your margin position at the market price.

On Binance, you’ll find similar order types with some additional features.

Besides market and limit orders, Binance offers stop-limit orders and OCO orders, which stand for “One Cancels the Other,” allowing you to place two orders simultaneously; one order’s execution cancels the other.

Binance also includes post-only orders, ensuring your order adds liquidity and earns you a maker fee discount. For traders using leverage, reduce-only orders are available to decrease or close a position.

Here is a brief comparison:

| Order Type | Kraken | Binance |

|---|---|---|

| Market | Yes | Yes |

| Limit | Yes | Yes |

| Stop Loss | Yes | Yes |

| Take Profit | Yes | Yes |

| Conditional | Yes | No |

| OCO | No | Yes |

| Post-Only | No | Yes |

| Reduce-Only | No | Yes |

| Settle Position | Yes | No |

Binance stands out in terms of variety with OCO, post-only, and reduce-only orders unavailable on Kraken.

Meanwhile, Kraken’s Settle Position is unique to that platform.

Spot trading is supported on both exchanges, allowing you to utilize these order types for immediate execution (market orders) or for executing trades at preferred price points (limit orders and others).

Understanding and effectively using these order types allows you better to manage your trades and risks on either platform.

Kraken vs. Binance: Security and Reliability

When choosing a cryptocurrency exchange, your security and reliability concerns are paramount. Kraken and Binance both employ a range of security features to protect your funds and data.

Kraken prioritizes security with features like SSL encryption, two-factor authentication (2FA), and a dedicated security team. Your deposits are kept in cold storage, reducing the risk of hacks.

Despite these measures, Kraken experienced a security incident in 2014. Still, since then, they have fortified their systems and have not suffered significant breaches, showing a commitment to learning from past experiences.

Binance also provides high-level security features, including 2FA and advanced SSL encryption, to safeguard your information.

They hold a large portion of assets in cold storage, too.

However, Binance’s security has been compromised in the past, most notably in 2019 when it suffered a hack that resulted in losing 7,000 Bitcoin. Binance addressed the situation promptly, covering the losses through their “Secure Asset Fund for Users” (SAFU).

Regulatory Compliance:

- Kraken operates with a transparent regulatory structure and generally complies with international regulations.

- Binance, while continually working to meet regulatory standards worldwide, has faced some scrutiny from various countries regarding its compliance status.

Customer support experiences vary, but both platforms strive to provide practical assistance:

- Kraken offers comprehensive support via live chat and email, with positive user feedback regarding the quality of assistance.

- Binance has an extensive help center and offers support tickets and live chat, aiming to respond efficiently to customer queries.

Regarding reliability, both exchanges have established trust with a global user base through consistent platform performance and user-centered security practices.

Kraken vs. Binance: User Experience

When comparing the user experience of Kraken and Binance, you’ll find notable differences in their interfaces and features.

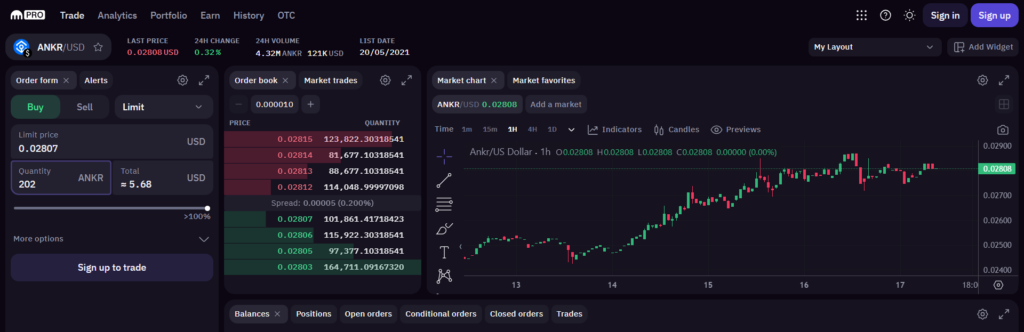

Kraken offers a simple user interface that appeals to beginners and seasoned traders.

Its ease of use and transparent security measures make it a reliable choice for trading. The exchange provides robust customer support, a comprehensive help center, and responsive service.

In contrast, Binance features a more complex interface with advanced charting tools for experienced traders. However, this might be overwhelming if you’re new to cryptocurrency trading.

Customer Support:

- Kraken: 24/7 support with a detailed help center

- Binance: Multilingual support but can be less responsive compared to Kraken

Educational Resources:

- Kraken: CryptoWatch for real-time market data and analysis tools

- Binance: Binance Academy offers an extensive library of educational content

Mobile App Experience:

- Kraken: User-friendly mobile app, suitable for on-the-go trading

- Binance: Feature-rich mobile app; some users report a steeper learning curve

Both Kraken and Binance optimize their platforms for mobile use so you can manage your account and trade directly from your phone.

As you navigate these platforms, consider your preference for simplicity versus functionality.

While Kraken may better suit novices thanks to user-friendly navigation, Binance’s comprehensive tools and resources are a powerhouse for enthusiastic traders who want depth and a broad array of features.

Kraken vs. Binance: Education and Community

When considering Kraken and Binance, the availability of educational resources and community engagement are crucial elements to examine.

Kraken prides itself on providing comprehensive educational materials accessible to novices and experienced traders. Their resources include:

- Starter Guides: Understand the basics of cryptocurrencies and trading.

- Webinars and Videos: Dive deeper into trading strategies and market analysis.

- Security Education: Ensures you know how to protect your investments.

The community interaction with Kraken tends to be more focused and offers a supportive environment, especially for those new to crypto trading.

Binance, on the other hand, boasts an extensive repository of learning materials called Binance Academy. This platform includes:

- Articles and Tutorials: A range of topics from blockchain basics to technical trading insights.

- Binance Research: In-depth analysis of different cryptocurrencies.

- Glossary: Quick access to crypto terminology.

Binance’s social media presence is notable, with a more significant following and high engagement levels, providing a lively forum for community discussion and support.

Engagement and Support:

| Platform | Social Media Activity | User Support |

|---|---|---|

| Kraken | Lower | Extensive support with a personal touch |

| Binance | Higher | Quick automated support with community help forums |

Your choice between Kraken and Binance may depend on whether you prefer a more personalized learning journey or a vast array of resources with a vibrant community.

Both platforms contribute significantly to community-building and education in the dynamic realm of cryptocurrency, ensuring you are well-equipped to navigate the crypto landscape.

Kraken vs. Binance: Regulation and Compliance

When you’re exploring cryptocurrency exchanges, understanding their regulation and compliance is crucial for a secure trading experience.

Based in the United States, Kraken adheres to a strict regulatory framework.

It complies with legal standards, holding the necessary licenses to function across numerous states. Kraken’s security measures are transparent, adding a layer of trust for its users.

Binance is a global exchange with a separate platform for United States residents—Binance. US—ensures compliance with the regulations set forth by the US government.

Binance.US is designed to meet the regulatory requirements specific to the United States, providing a compliant environment for users to trade cryptocurrencies.

Kraken Compliance Highlights:

- Holds US licenses, allowing operation in multiple states

- Adheres to anti-money laundering (AML) and know your customer (KYC) protocols

Binance Compliance Highlights:

- Binance.US operates by US regulations

- Implements rigorous AML and KYC policies, similar to Kraken

Both exchanges have faced scrutiny. Kraken, for example, has worked with regulatory bodies to ensure continued compliance.

Binance, on the other hand, has received attention from the Justice Department, which has investigated aspects of its global operations outside the US.

Despite these challenges, both exchanges continue to offer services while working to meet regulatory expectations.

Conclusion

When choosing between Kraken and Binance, your decision hinges on several critical factors.

Kraken offers:

- Robust security measures

- Competitive fees

- A long-standing reputation in the US market

It’s particularly well-suited for new and intermediate users seeking a balance between user-friendliness and comprehensive features.

On the other hand, Binance boasts:

- A vast array of cryptocurrencies

- Low trading costs

- A more diverse set of advanced trading options

This platform serves advanced traders and global users with its expansive offerings and high liquidity.

If you prioritize security and ease of use, consider Kraken. However, if you’re looking for depth of market and advanced features, Binance might be your preferred choice.

Explore how Kraken and Binance compare to their competitors:

- Kraken vs MEXC: Comparison at a Glance

- Kraken vs. Phemex: Comparison at a Glance

- Kraken vs. Bybit: Comparison at a Glance

- Binance vs Phemex: Comparison at a Glance

- Binance vs PrimeXBT: Comparison at a Glance

- Binance vs MEXC: Comparison at a Glance