MEXC and Binance are prominent cryptocurrency exchanges offering extensive cryptocurrency selections, spot, margin, and futures trading. MEXC is user-friendly with features like staking and yield farming. Binance, known for high trading volumes and advanced tools, offers staking, savings, and strong security within a broad ecosystem.

When deciding between MEXC and Binance, you’ll want to weigh each platform’s features and offerings.

Below is an organized summary designed to help you assess the key differences:

| Feature | MEXC | Binance |

|---|---|---|

| Supported Cryptocurrencies | Over 1800 | Over 800 |

| User Interface | User-friendly, suitable for various traders | Complex, caters to more advanced traders |

| KYC Policy | No mandatory KYC | Mandatory KYC for certain features |

| Spot Trading Fees | No fee for spot trading | Tiered fee structure based on trade volume |

| Futures Trading Fees | Starts at 0%/0.01% for makers/takers | Tiered reduces with higher trade volume |

| Security | Robust with a focus on user safety | Industry-leading with advanced measures |

| Payment Flexibility | Varied options tailored to user needs | Multiple payment methods, high flexibility |

| Leverage | Competitive options available | Up to 125x leverage for certain products |

| Deposit Methods | Multiple, including fiat currency | A broad range, including fiat and crypto |

| Trading Volume | High, with significant liquidity | Very high, one of the highest in the market |

MEXC excels in the number of supported cryptocurrencies and has a no-fee policy for spot trading. This attracts users who wish to diversify their portfolios with less popular coins.

On the other hand, Binance’s tiered fee structure may benefit you if you’re a high-volume trader, and it also offers an extensive range of trading products and high-leverage options.

Both platforms are fortified with security measures, though Binance’s advanced security infrastructure and more extensive user base are noteworthy.

Payment options and deposit methods are also areas where Binance shines, providing significant flexibility to manage your assets.

MEXC vs Binance: Products and Services

When considering the range of products and services offered, MEXC and Binance cater to the various needs of cryptocurrency traders and investors.

MEXC:

- Spot Trading: Offers an extensive selection with 2000+ trading pairs.

- Futures Trading: Has a flat-fee structure for futures, starting at 0%/0.01% for makers and takers.

- Options and Leveraged Tokens: Information not provided in the search results.

- NFT Marketplace: Not mentioned in the search results.

- Staking: No details are provided in the search results.

Binance:

- Spot Trading: With over 1500 trading pairs, Binance provides vast choices.

- Futures Trading: Operates a tiered fee structure that decreases with increased trading volumes.

- Options and Leveraged Tokens: Offers advanced options and leveraged trading services.

- NFT Marketplace: Binance has its NFT platform connecting creators and collectors.

- Staking: You can stake your assets to earn rewards with flexible and locked options.

Both exchanges support numerous cryptocurrencies, with MEXC leading in trading pair numbers.

For innovation, Binance stands out with its additional features, like peer-to-peer trading of over 800 options.

The user experience is subjective; however, Binance is generally favored for its sophisticated trading tools and platform reliability.

If you prefer less stringent verification processes, MEXC’s no mandatory KYC policy might be attractive.

When dealing with fees, MEXC’s straightforward fee structure is alluring for its simplicity, whereas Binance’s tiered system could be more economical for high-volume traders.

MEXC vs Binance: Contract Types

When navigating cryptocurrency derivatives, different contract types are available through exchanges like MEXC and Binance. It’s crucial to understand each one to make informed trading decisions.

MEXC offers an array of contract types, including inverse perpetual contracts and linear perpetual contracts.

Inverse perpetual contracts allow you to trade cryptocurrency as the base currency directly. This can be beneficial if you’re looking to hedge or have holdings in the contract’s underlying crypto.

On the other hand, linear perpetual contracts use stablecoins such as USDT as the base. This enables a straightforward valuation against a stable asset.

Binance, being one of the largest exchanges globally, provides a similar variety of contracts.

In addition to inverse and linear perpetual contracts, you can access inverse futures contracts, which are set for a specific date and use cryptocurrency as collateral.

There are also COIN-M futures, which are margined and priced in the underlying coin, and USD-M futures, which are margined with a stablecoin.

| Contract Type | MEXC | Binance |

|---|---|---|

| Inverse Perpetual | Available | Available |

| Linear Perpetual | Available | Available |

| Inverse Futures | Not specified | Available |

| COIN-M Futures | Not specified | Available |

| USD-M Futures | Not specified | Available |

| Options | Not specified | Available |

Finally, Binance offers options contracts, which give you the right but not the obligation to buy or sell at a predetermined price. Options can be a powerful tool for strategic trading.

Each contract type has its features and applications. Depending on your strategy, trading volume, and risk tolerance, you should consider the most suitable contract type.

Both exchanges provide educational resources for learning more before committing to trading.

MEXC vs Binance: Leverage and Margin

When trading on MEXC, you can access leverage of up to 125x for specific trading pairs.

This amplifies your trading position significantly, potentially allowing you to enhance returns on a small initial margin. However, remember that higher leverage comes with increased liquidation risks.

You must manage your trades carefully to prevent your position from being liquidated due to market volatility.

Binance, on the other hand, offers a variety of margin trading options with leverage that can reach up to 100x on certain products.

Using leverage here also enables you to increase your exposure to the market with a smaller initial capital outlay.

The funding rates on Binance are subject to change based on market liquidity and volatility.

You must monitor these rates as they can affect the cost of holding leveraged positions over time.

| Exchange | Max Leverage | Margin Requirement | Liquidation Risk |

|---|---|---|---|

| MEXC | 125x | Variable | High |

| Binance | 100x | Variable | High |

Remember, while leverage can magnify your gains, it also increases the potential for losses. Always trade cautiously and consider the risks, especially in highly volatile markets.

MEXC vs Binance: Liquidity and Volume

When you trade cryptocurrencies, liquidity, and trading volume are essential for seamless transactions.

Binance consistently ranks as one of the top exchanges for liquidity. With a high liquidity score, your orders on Binance tend to be filled quickly, reducing the likelihood of slippage.

Their daily trading volume often surpasses, evidencing a deep market that can handle large trades without significant price impacts.

In contrast, MEXC has made impressive strides in liquidity, reportedly surpassing Binance on occasion. However, checking real-time data for current standings is vital as these metrics fluctuate.

While substantial, MEXC’s daily trading volume tends to be lower than Binance’s. Their reported daily volume exceeds $10 billion, signaling healthy liquidity yet indicating variances in market depth.

| Exchange | Average Liquidity Score | Daily Trading Volume (USD) |

|---|---|---|

| Binance | 9.9 (out of 10) | >$40 billion |

| MEXC | Variable | >$10 billion |

These figures illustrate that while Binance generally offers superior liquidity, MEXC’s growing volume and competitive liquidity indicate robust trading efficiency on its platform.

MEXC vs Binance: Fees and Rewards

When you trade on MEXC and Binance, understanding the fee structures and reward systems is crucial for your profitability.

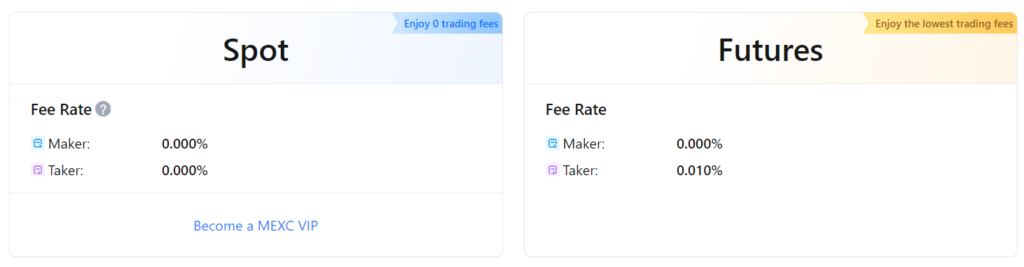

MEXC’s Fee Structure:

- Spot Trading: Charges a flat fee model. You typically don’t pay for spot trading.

- Futures Trading: The fees start at 0% for makers and 0.01% for takers.

If you trade futures, MEXC can be more competitive. For instance, if you were to open a futures position worth $10,000, you could pay as little as $1 in taker fees.

Binance’s Fee Structure:

- Spot Trading: The fee is 0.1% for both makers and takers.

- Futures Trading: Fees begin at 0.02% for makers and 0.04% for takers.

A similar trade on Binance would cost $4 for a taker, which is notably higher than MEXC’s fees.

Reward Systems:

Both exchanges use reward systems to incentivize trading:

- MEXC offers a 10% deposit bonus under certain conditions.

- Binance provides an up to USD 100 welcome bonus for new users and has a tiered reward system based on the trade volume, which might reduce fees further.

Discounts & Bonuses:

By holding exchange coins (MX Token for MEXC and BNB for Binance), you may receive discounts on trading fees.

Additionally, Binance has a tiered fee structure that may decrease costs based on your 30-day trading volume and BNB balance.

MEXC vs Binance: Trading Fee & Deposit/Withdrawal Fee Compared

When trading cryptocurrencies, selecting the exchange fee structure is critical in affecting your potential profits or losses. Here is a comparative look at the fee structures of MEXC and Binance:

MEXC:

- Trading Fees: MEXC adopts a flat fee model. For spot trading, you will incur no charges. Futures trading starts at a 0% maker fee and a 0.01% taker fee.

- Deposit Fees: You will be pleased to find that MEXC charges zero deposit fees for most payment methods.

- Withdrawal Fees: These fees vary by cryptocurrency and are subject to change based on network conditions.

Binance:

- Trading Fees: Binance operates on a tiered fee structure based on your 30-day trading volume. Spot trading fees start at 0.1% for both makers and takers. In the future, the fees will commence at 0.02% for makers and 0.04% for takers.

- Deposit Fees: There are no fees for crypto deposits, but remember that fiat transactions can come with a charge depending on your payment method.

- Withdrawal Fees: Similar to MEXC, the fees vary per coin and can fluctuate with the blockchain network traffic.

MEXC vs Binance: Deposits & Withdrawal Options

When comparing MEXC and Binance, the options for funding your account and extracting your earnings influence the trading experience significantly.

Here is a brief examination of these financial pathways:

Deposit Options:

- Currencies Supported:

- MEXC: Offers an array of cryptocurrencies to deposit.

- Binance: Supports a broader range of cryptocurrencies and fiat.

- Payment Methods:

- MEXC: Primarily crypto deposits.

- Binance: Multiple payment avenues, including bank transfers, credit/debit cards, and third-party payments.

- Processing Times:

- MEXC: Processing is usually fast but can vary based on network traffic.

- Binance: Typically offers quick processing; however, fiat transactions may take longer.

Withdrawal Options:

- Fees:

- MEXC: The platform charges a withdrawal fee. For instance, withdrawing USDT on the BNB chain network incurs a 1 USDT fee.

- Binance: The withdrawal fees differ based on cryptocurrency and network, often incorporating a layer of complexity compared to MEXC.

- Limits:

- MEXC: Has specific withdrawal limits set, which might affect your ability to move large sums.

- Binance: Provides detailed tier-based limits influencing the volume you can withdraw at various levels of verification.

MEXC vs Binance: KYC Requirements & KYC Limits

When you engage with cryptocurrency exchanges like MEXC and Binance, you will encounter the Know Your Customer (KYC) process.

This protocol is essential for your security and to ensure the exchanges comply with regulatory demands.

MEXC allows you to access their services without mandatory KYC for basic operations. This offers you a degree of privacy but comes with lower withdrawal limits. You must provide personal information and identification documents if you decide to increase your limits.

Binance, on the other hand, requires you to complete a KYC process before you can start trading. Upon completion of their basic KYC, your withdrawal limit increases significantly.

Binance uses a tiered system; you can unlock higher withdrawal and trading limits with the more detailed information provided. Here’s a comparison of what you can expect from both:

| Requirement | MEXC | Binance |

|---|---|---|

| Basic KYC | Optional, with limited access | Mandatory, with increased access |

| Advanced KYC | Provides full access | Essential for maximum withdrawal limits |

| Documents | Government ID, Proof of Residence | Government ID, Proof of Residence, and sometimes a Selfie |

| Withdrawal Limit | Varies (low without KYC) | Up to 100 BTC with advanced verification |

MEXC vs Binance: Order Types

When trading on either MEXC or Binance, understanding the range of order types available can significantly impact your strategy and risk management.

Both exchanges provide a suite of order types, each with its use case.

MEXC supports several order types:

- Market Orders: Immediate execution at the current market price.

- Limit Orders: Set your buy or sell price; the order executes when the market hits your price.

- Stop Orders: Trigger a market order when a specified price is reached.

- Conditional Orders: Execute based on predefined conditions.

- Additionally, MEXC offers advanced types such as Trailing Stop Orders and One Cancels the Other (OCO) orders, which can further help develop advanced trading strategies.

Binance, on the other hand, also has its array of order types:

- Market Orders: Instantly buy or sell at available market prices.

- Limit Orders: Specify the price you want to execute a trade.

- Stop-Limit Orders: Similar to stop orders with an added limit component.

- OCO (One Cancels the Other): A pair of orders stipulating that if one order is executed fully or partially, the other is automatically canceled.

- Post-Only Orders: Ensure the order adds liquidity to the market and pays the maker fee.

- Reduce-Only Orders: An order that can only reduce your position, not increase it.

MEXC vs Binance: Security and Reliability

When evaluating the security and reliability of MEXC and Binance, two key aspects focus on how they safeguard your funds and data and how resilient they are against potential breaches or operational issues.

MEXC emphasizes security through:

- Two-factor authentication (2FA) across web, desktop, and mobile platforms adds a layer of security whenever you access your account or conduct transactions.

Binance is renowned for:

- Advanced security features, including 2FA and an additional layer of user security protocols.

- In extreme cases, a Secure Asset Fund for Users (SAFU) was established to protect user funds.

Both exchanges have faced challenges:

- MEXC’s no mandatory KYC policy may raise concerns about vulnerabilities, but no significant breach incident is reported.

- Binance has experienced security incidents like the 2019 hack, where 7,000 Bitcoins were stolen. They have since bolstered their security measures and reimbursed impacted users through SAFU.

Regarding regulatory compliance:

- Binance has had to navigate regulatory challenges in various jurisdictions, leading to enhanced compliance measures.

- MEXC is less well-known regarding regulatory confrontations but has also followed suit in adapting to global regulatory standards.

In terms of customer support:

- Binance offers extensive customer service options, including live support.

- MEXC provides responsive support via multiple channels, addressing your concerns promptly.

MEXC vs Binance: User Experience

When comparing the user experience of MEXC and Binance, we should consider their platforms, interfaces, and provided features.

MEXC

- Interface: The trading interface is intuitive and user-friendly.

- Features: It offers a straightforward approach to trading with an extensive selection of cryptocurrencies.

- Speed: Transactions and navigation are generally fast.

- Feedback: Users praise that there is no mandatory KYC policy to enhance ease of use.

Binance

- Interface: Known for its advanced and professional-looking interface that may have a steeper learning curve.

- Features: Offers unique trading options, such as P2P trading with an 800+ cryptocurrency variety.

- Speed: Its platform is reliable, although some users report slowdowns during periods of high volatility.

- Feedback: The extensive FAQ section and automated support are beneficial, but the complexity might intimidate new traders.

Your experience on both platforms will vary based on your trading knowledge and what you prioritize in an exchange.

| Aspect | MEXC | Binance |

|---|---|---|

| Ease of Use | User-friendly | Professional |

| Speed | Fast | Generally reliable |

| Functionality | No mandatory KYC | Advanced features |

| Design | Intuitive | Professional look |

In terms of design, MEXC focuses on simplicity, while Binance caters to users seeking depth and an array of tools.

The functionality of MEXC is appreciated for its no-fuss approach, making it accessible for beginners—conversely, Binance’s depth suits seasoned traders.

Speed and reliability are everyday demands, and both exchanges strive to meet these, with Binance occasionally experiencing delays during market volatility.

Remember, each user’s perspective varies; spending time on each exchange to familiarize yourself with their offerings is the best way to determine which aligns with your trading needs.

MEXC vs Binance: Education and Community

When evaluating MEXC and Binance for educational resources and community engagement, you’ll find that both platforms have established robust efforts to support and educate their users.

MEXC:

- Educational Content: MEXC provides a variety of educational materials, including tutorials and guides, tailored for users ranging from beginners to experienced traders.

- Community Engagement: They actively engage with their community through social media platforms and have a substantial presence where traders can interact, share insights, and receive updates.

Binance:

- Binance Academy: Binance takes a proactive approach to education with its dedicated Binance Academy, offering many articles, videos, and courses on cryptocurrency and blockchain technology.

- Webinars and Workshops: Regularly scheduled webinars and workshops are provided, where users can learn directly from experts and ask questions in real time.

- Community and Social Media: Binance maintains a broad and influential social media presence, which serves as a hub for traders to connect and exchange ideas. They foster a strong community spirit through various channels, including Twitter, Telegram, and Reddit.

Both platforms understand the critical role that informed users play in cryptocurrency trading.

Therefore, investment in educational content and building vibrant communities is evident, as they each offer unique and valuable resources to empower their users.

MEXC vs Binance: Regulation and Compliance

When exploring cryptocurrency exchanges like MEXC and Binance, it’s crucial to consider how each adheres to regulations and complies with legal standards in their locations.

MEXC has adapted to regional regulatory requirements to ensure a compliant trading environment.

Historically, they have managed to operate without stringent regulatory oversight but have shifted towards aligning with global standards.

MEXC’s efforts to comply may involve acquiring necessary licenses and doing internal audits, though specific details on their compliance measures are often not publicly detailed.

On the other hand, Binance has faced a more complex regulatory environment.

As one of the largest global exchanges, Binance has operated under intense scrutiny. Despite that, the platform has worked to meet several jurisdictions’ legal and ethical standards.

For example, Binance has sought to increase its compliance protocols in various countries by applying for licenses and engaging with regulatory bodies.

In some regions, Binance has successfully obtained licenses and established formal operations, bolstering its compliance reputation.

| Exchange | Compliance Efforts |

|---|---|

| MEXC | Acquiring licenses, internal audits |

| Binance | Licenses obtained, formal operations in certain areas |

Both MEXC and Binance have tried to comply with anti-money laundering (AML) and know-your-customer (KYC) policies, which are critical in cryptocurrency.

However, your experience with either platform’s compliance may vary based on location and applicable laws. It’s your responsibility to ensure that your activities on either exchange comply with your local laws and regulations.

Conclusion

When choosing between MEXC and Binance, assess your trading needs and preferences.

For Diverse Cryptocurrency Portfolios:

MEXC stands out with its support for over 1800 crypto assets, making it ideal for building a varied portfolio.

Ease of Use and Low-Cost Trading:

Novice traders might prefer MEXC’s user-friendly interface and competitive trading fees.

Advanced Trading Features and Payment Flexibility:

If you need advanced features and various payment methods, Binance might be the better choice.

Fees Comparison:

Trading Costs:

- MEXC offers low fees, which can be appealing for cost-sensitive traders.

- Binance charges higher fees. Spot fees are at 0.1%, and futures fees start at 0.02% maker and 0.04% taker.

Reliability and Speed:

Consider MEXC for consistent performance. Binance, while generally reliable, may slow down during periods of high volatility.

For further education on cryptocurrency trading:

- Free Online Courses: Look for beginner and advanced courses on platforms like Coursera or edX.

- Community Insights: Join cryptocurrency forums and subreddits for personal experiences and strategy discussions.

- Official Resources: Visit the MEXC and Binance websites for detailed guides and support.

Remember, due diligence is critical. Review each platform’s features, fee structures, and security measures.

Your choice should align with your trading goals and comfort with the exchange’s interface and support mechanisms.

Explore how MEXC and Binance compare to their competitors:

- MEXC vs BingX: In-Depth Exchange Comparison

- MEXC vs Bybit: In-Depth Exchange Comparison

- MEXC vs Phemex: In-Depth Exchange Comparison

- Binance vs Phemex: In-Depth Exchange Comparison

- Binance vs BingX: In-Depth Exchange Comparison

- Binance vs Bybit: In-Depth Exchange Comparison