Selecting the right cryptocurrency exchange can significantly impact your trading strategy and outcomes. In this comparison, we look at Bitget and MEXC, two prominent platforms known for their diverse offerings and user-centric features.

Bitget, established in 2018, has quickly risen to prominence with its comprehensive suite of trading options, including spot, futures, and copy trading. Its user-friendly interface and robust security measures make it a popular choice for traders of all levels. Bitget’s focus on social trading and its competitive fee structure further enhance its appeal.

MEXC, also founded in 2018, offers a broad range of services catering to both novice and experienced traders. Known for its high liquidity and extensive selection of supported coins, MEXC excels in providing diverse trading pairs and derivatives. The platform’s advanced trading tools and customer support are designed to facilitate seamless trading experiences.

Here’s a concise comparison:

| Feature | MEXC | Bitget |

|---|---|---|

| Fees for Trading | Competitively low | Low, under industry standard |

| Supported Coins | Wide array | Numerous |

| Leverage Options | Available | Available |

| Trading Volume | High | High |

| Deposit Methods | Multiple options | Multiple options |

| Customer Support | Moderate ticket response, fast chat | Fast response times |

Join us as we explore the key features, strengths, and potential drawbacks of Bitget and MEXC, helping you make an informed decision on which platform best suits your trading needs.

MEXC vs Bitget: Products and Services

MEXC and Bitget offer various services catered to different types of crypto traders.

MEXC stands out with its wide variety of offerings.

You have access to spot trading opportunities across a vast array of cryptocurrencies.

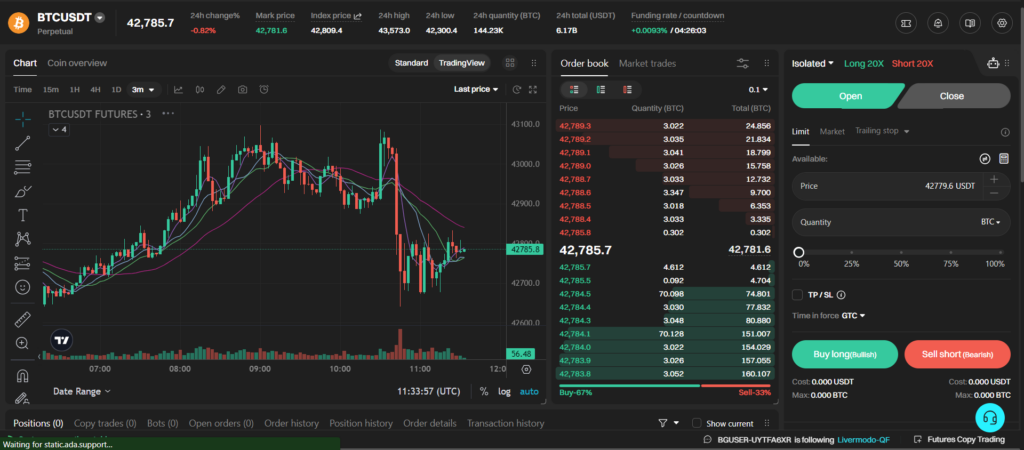

MEXC provides futures trading, including both traditional and perpetual futures, offering a more diverse set of investment tools.

Additionally, they support staking services, where you can earn rewards by holding specific cryptocurrencies.

Regarding innovative features, Bitget introduces copy trading in derivatives, appealing especially to users who prefer a more hands-off approach or are new and seeking guidance in their trading strategies.

While MEXC shines in the sheer number of crypto offerings, Bitget focuses more on derivatives trading, including futures and options markets.

This specialization can be advantageous if your interest lies in trading contracts that forecast the future prices of cryptocurrencies.

You will find that both exchanges do not support an NFT marketplace, a niche that is rapidly gaining interest within the crypto community.

However, they make up for this with the availability of leveraged tokens, which can amplify your exposure to cryptocurrency markets without the complexity of managing margin.

It’s important to note that MEXC often outpaces Bitget slightly regarding the number of available trading pairs, boasting a selection that caters to traders who appreciate diversity and less common assets.

Regarding user experience, MEXC provides a broader trading environment, while Bitget stands out with derivative products and innovative copy trading features.

| Service | MEXC | Bitget |

|---|---|---|

| Spot Trading | Extensive cryptocurrency selection | Available, less variety than MEXC |

| Futures Trading | Traditional and perpetual futures | Focus on this market segment |

| Options Trading | Not as prominent | Available with added functionality like copy trading |

| Leveraged Tokens | Available | Available |

| Staking | Supported with various options | Limited availability |

| Innovative Features | Broad trading options | Copy trading in the derivatives market |

MEXC vs Bitget: Contract Types

When evaluating MEXC and Bitget for trading contracts, comparing the specific contract types available on each platform is critical.

MEXC offers a variety of contracts:

- Inverse Perpetual Contracts: You can trade contracts where the margin and settlement are in the base cryptocurrency, typically BTC.

- Linear Perpetual Contracts: These contracts are settled in a stablecoin such as USDT, allowing straightforward calculations.

- Options: A financial derivative that provides you the choice, not the obligation, to buy or sell an asset at a predetermined price.

Bitget also presents diverse contracts, but with some differences:

- Inverse Perpetual Contracts: Similar to MEXC, Bitget allows you to use cryptocurrency as collateral, adding to your leveraging options.

- Linear Perpetual Contracts: Your profit and loss are directly tied to the underlying asset’s price movement, traded against USDT or other stablecoins.

- Inverse Futures Contracts: The settlement is based on an underlying asset, like Bitcoin, which can be complex but beneficial for specific strategies.

- COIN-M Futures: These contracts are margined and settled in the actual cryptocurrency instead of a stablecoin.

- USD-M Futures: You deal with contracts margined in a stablecoin equivalent to USD, offering simple calculations.

Each contract type brings unique benefits and potential drawbacks, such as the ease of calculation for stablecoin-based contracts versus the complexity and potential leverage opportunities for coin-margined contracts.

Understanding the nuances between these contract types is essential to align them with your trading goals and risk management strategies.

MEXC vs Bitget: Leverage and Margin

Leverage and margin trading are potent tools that amplify your investment potential on cryptocurrency exchanges.

These mechanisms allow you to open more prominent positions than your capital typically permits. However, they also increase your exposure to risk, including potential liquidation.

MEXC and Bitget both offer leverage and margin trading, but there are differences in their offerings:

MEXC Leverage & Margin

- Maximum Leverage: Offers high leverage options, potentially appealing if you want to take on more risk.

- Margin Requirements: You must commit a percentage of the total order value as collateral.

- Liquidation Risks: Higher leverage could lead to a heightened liquidation risk if the market moves against your position.

- Funding Rates: Dynamic and can vary based on market conditions.

Bitget Leverage & Margin

- Maximum Leverage: Provides leverage, though typically lower than MEXC, which might suit a conservative trading strategy.

- Margin Requirements: Like MEXC, you’ll need to provide collateral, a safeguard for the exchange.

- Liquidation Risks: The liquidation risk persists, but the lower leverage offered by Bitget may provide a cushion against rapid market movements.

- Funding Rates: Vary, as with most exchanges, and they impact the holding cost of your leveraged positions.

You must assess your risk tolerance and trading strategy before engaging with leverage.

Both MEXC and Bitget have tools and policies in place to manage risk. Still, your trading decisions should be made with a clear understanding of the possible outcomes, especially in volatile markets.

MEXC vs Bitget: Liquidity and Volume

When you’re looking to trade cryptocurrencies, liquidity and volume are critical factors you must consider. They significantly influence the ease of trade execution and the likelihood of experiencing slippage.

MEXC:

- Liquidity: You’ll find MEXC typically ranks high on liquidity score charts. Robust liquidity means you can execute large orders with minimal price impact.

- Volume: MEXC often reports substantial 24-hour trading volumes, ensuring you can trade crypto pairs efficiently.

Bitget:

- Liquidity: Bitget, while it may not always match MEXC’s liquidity, also provides sufficient market depth to support its offered trading pairs.

- Volume: The platform typically displays considerable daily trading volumes, though it varies based on market conditions.

Liquidity Sources and Metrics:

- Data from liquidity rankings and volume metrics can be sourced from multiple market aggregators and analytical platforms like CoinMarketCap or CoinGecko.

- Rankings consider order book depth, bid-ask spreads, and the percentage of orders filled without price slippage.

When comparing MEXC and Bitget, monitoring current liquidity and volume on both exchanges is essential to gauge your potential trading experience.

High liquidity and volume often lead to more favorable trading conditions due to tighter spreads and lower slippage.

Remember, these factors can fluctuate with market dynamics, so regular monitoring will serve you well.

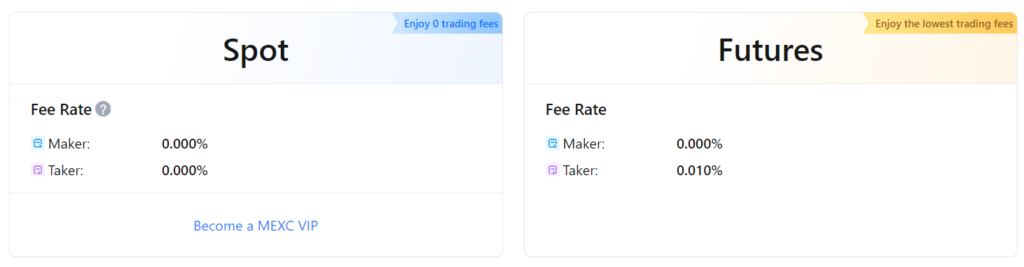

MEXC vs Bitget: Fees and Rewards

When evaluating MEXC and Bitget, understanding the fee structure is crucial since it directly impacts your trading costs.

MEXC offers a tiered fee system for spot and futures trading. You may benefit from reduced fees for spot markets if you’re a high-volume trader or hold MX tokens due to their tiered system.

MEXC Fees:

- Spot Trading: Starts at 0.2% and can be reduced based on volume or MX token holding.

- Futures Trading: Maker fees can go as low as 0%, and taker fees are at 0.03%.

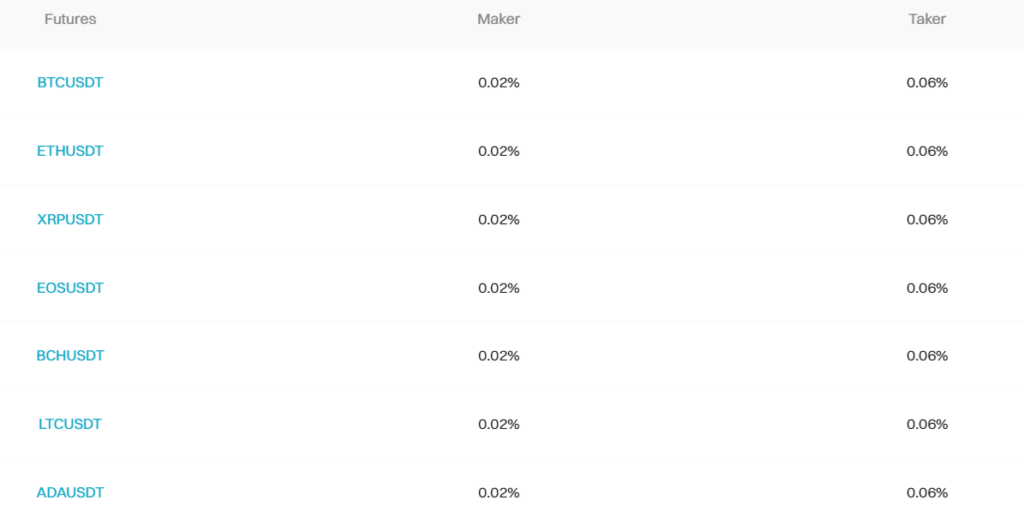

On the other hand, Bitget’s fees are straightforward. They offer a competitive fee scheme that aligns with the industry standard.

Bitget Fees:

- Spot Trading: A flat 0.1% for both makers and takers.

- Futures Trading: Maker fee of 0.02%, taker fee of 0.06%.

For rewards, both platforms offer various incentives. MEXC’s reward system is centered around their MX token, which can yield discounts.

For example, if you hold a certain amount of MX tokens, you get a 10% reduction in trading fees. This enhances your earning potential, especially in high-frequency trading scenarios.

Bitget focuses on promotional rewards such as a 10% deposit bonus, which might attract new users or those looking to transfer substantial assets onto the platform.

Additionally, both exchanges periodically introduce various campaigns with rewards that might translate into additional profit for active traders.

Remember to calculate your potential fees before trading. For instance, a $10,000 trade on the MEXC spot market at the highest fee tier of 0.2% would cost you $20.

In contrast, the same trade on Bitget would incur a fee of $10. Your specific fees and rewards will vary based on your trading volume, token holding, and participation in exchange promotions.

MEXC vs Bitget: Trading Fee & Deposit/Withdrawal Fee Compared

When trading cryptocurrencies, the fees you encounter can significantly impact your bottom line. Here’s a comparative look at the trading and deposit/withdrawal fees for both MEXC and Bitget exchanges.

Trading Fees:

- MEXC:

-

- Spot Trading: 0% for spot trading fees.

- Futures Trading: The fee is 0% for makers and 0.03% for takers.

- Discounts: Holding MX tokens grants a 10% trading fee discount.

- Bitget:

- Spot Trading: A flat rate of 0.1% for both makers and takers.

- Futures Trading: 0.02% for makers and 0.06% for takers.

Deposit and Withdrawal Fees:

- MEXC:

- Deposits are free, with no fees charged.

- Withdrawal Fees: These vary depending on the cryptocurrency’s blockchain network.

- Bitget:

- Deposit and withdrawal fee information is not specified; checking the latest details directly on their platform is advisable as it can fluctuate based on market conditions and network congestion.

Review the specific fee structure related to the payment method you choose, as this can also influence the total costs of your transactions on each exchange.

Additionally, tiered fee structures may apply depending on your trading volume or user level, potentially offering lower fees for higher-volume traders.

Always confirm the latest fee schedules on the exchanges, as they can change in response to market conditions or promotional periods.

MEXC vs Bitget: Deposits & Withdrawal Options

When evaluating MEXC and Bitget for their ability to handle your funds, consider their options for deposits and withdrawals.

- Deposit Methods:

- Both MEXC and Bitget offer cryptocurrency deposits.

- Additionally, MEXC supports diverse fiat deposit methods, including bank transfers and credit cards. On the other hand, Bitget’s options may vary by region.

- Withdrawal Methods:

- You can withdraw cryptocurrencies effortlessly on both exchanges. However, the availability of fiat withdrawal methods may also differ. Check their respective platforms for up-to-date information specific to your location.

Supported Currencies:

- MEXC supports a more extensive variety of cryptocurrencies, over 1,520, whereas Bitget provides access to around 600.

| Feature | MEXC | Bitget |

|---|---|---|

| Cryptocurrencies Supported | 1,520+ | 600+ |

Processing Times:

- Deposit processing times are typically swift on both platforms, subject to network speed.

- Withdrawal times can vary depending on network congestion, security checks, and the cryptocurrency involved.

Transfer Limits:

- The minimum and maximum amounts for deposits and withdrawals depend mainly on your currency.

- Be mindful that larger withdrawals may require additional verification processes, affecting withdrawal speed.

Costs:

- While both offer free deposits, withdrawal fees can fluctuate. Always verify the current rates to manage your costs effectively.

Stay informed about the specific deposit and withdrawal details of MEXC and Bitget, as they may update their policies or introduce new features.

MEXC vs Bitget: KYC Requirements & KYC Limits

When comparing MEXC and Bitget, you’ll find that Know Your Customer (KYC) policies play a crucial role in the functionality and security of these platforms.

Both exchanges offer trading without mandatory KYC verification, providing a level of privacy but also imposing certain limitations.

MEXC KYC Requirements:

- No KYC: You can withdraw up to 5 BTC daily.

- Primary KYC: Requires personal information and ID documentation.

- Advanced KYC: Further documentation is needed, which increases withdrawal limits significantly.

Bitget KYC Requirements:

- No KYC: Trading remains anonymous.

- Verified: Requires identity verification for increased limits and features.

Here is a basic comparison table of their KYC limits:

| Verification Level | MEXC Withdrawal Limit | Bitget Withdrawal Limit |

|---|---|---|

| Unverified | Up to 5 BTC daily | Not specified |

| Verified | Up to 30 BTC (Primary KYC) | Not specified |

| Advanced Verified | Up to 80-200 BTC (Advanced) | Not specified |

Both platforms maintain a balance between your privacy and the need for security. The absence of mandatory KYC at the initial levels offers easy access and a quick start to trading.

However, completing KYC becomes beneficial as your trading volume and withdrawal needs increase.

Bitget emphasizes anonymity, allowing you to stay unverified for trading, while MEXC encourages verification to access higher limits.

It would be best if you also considered the impact of these policies on the safety of your funds and the overall integrity of the exchange.

While less stringent KYC may be appealing for privacy reasons, it also necessitates a robust security infrastructure to safeguard against illicit activities.

MEXC vs Bitget: Order Types

Your choice of order types on a crypto exchange impacts how you trade and manage risk. Let’s compare the order types available on MEXC and Bitget to see how you can utilize them.

MEXC:

- Market Orders: Buy or sell immediately at the best available price.

- Limit Orders: Set a specific price to buy or sell.

- GTC (Good ‘Til Cancelled): Active until executed or canceled.

- IOC (Immediate or Cancel): Active for a concise span, a few seconds at most.

Bitget:

- Market Orders: Same as MEXC, for instant execution.

- Limit Orders: Execute trades at a price you set. Accompanied by advanced time conditions such as:

- GTC (Good ‘Til Cancelled): Remains active until it’s executed or you decide to cancel it.

- IOC (Immediate or Cancel): A limited window for execution; otherwise, the order is canceled.

Both platforms also offer the following additional order types:

- Stop Orders: Trigger a buy or sell when the market hits your specified price.

- Conditional Orders: Activate based on specific conditions being met.

- Post-Only Orders: Ensures the order adds liquidity and is not matched with a pre-existing order.

Unique to Bitget are:

- Trailing Stop Orders: Adjust the stop price at a distance from the market price as it moves.

- OCO (One Cancels the Other) Orders: Two orders are set simultaneously; if one executes, the other is canceled.

MEXC vs Bitget: Security and Reliability

MEXC and Bitget take your security seriously. They employ a range of measures to protect your funds and personal data. Each platform has cultivated a reputation for reliability in the fast-paced world of cryptocurrency exchanges.

MEXC:

- Cold Storage: The majority of assets are kept in offline storage.

- User Verification: Requires KYC/AML compliance to enhance security.

- Security Incidents: MEXC has not publicly reported significant security breaches, demonstrating a solid security track record.

- Regulatory Compliance: MEXC follows international regulations to ensure a secure trading environment.

- Customer Support: Offers access to customer service for issues and inquiries.

Bitget:

- Insurance Fund: Features a $300 million fund to cover potential security incidents.

- Cold Wallets: Implements multi-signature and cold storage solutions.

- Past Incidences: Actively discloses and resolves security challenges, maintaining transparency.

- Regulatory Compliance: Keeps up with global compliance standards, similar to MEXC.

- Customer Support: Provides equivalent levels of support aimed at user satisfaction and platform reliability.

| Feature | MEXC | Bitget |

|---|---|---|

| Cold Storage | Yes | Yes |

| KYC/AML | Required | Required |

| Security Breaches | None reported | Transparent resolution of incidents |

| Insurance Fund | Not specified | $300 million |

| Regulatory Compliance | Compliant | Compliant |

| Customer Support | Reliable | Reliable |

Your experience regarding security and reliability on both exchanges largely depends on the standard industry practices they both adhere to. However, elements like Bitget’s sizable insurance fund might impart additional security for your assets.

MEXC vs Bitget: User Experience

When exploring MEXC and Bitget, you’ll notice that both platforms prioritize a seamless user experience but approach it differently.

MEXC:

- Interface: The interface is designed to be intuitive, catering to beginners and seasoned traders. You’ll find clear navigation menus and customizable widgets.

- Speed: Transactions and trading operations are executed promptly, reducing lag experienced during high-volume periods.

- Design & Functionality: Features a multi-language support system and offers an accessible mobile app for trading on the go.

User Feedback:

- Pros: Widely praised for its low latency and responsive customer support.

- Cons: Some users have mentioned a learning curve when navigating advanced trading tools.

Bitget:

- Interface: The platform brings a balanced UI/UX, delivering a cohesive experience with organized tabs and simplified trading processes.

- Speed: Emphasizes stability, ensuring platform performance stays consistent even with increased traffic.

- Design & Functionality: Known for its straightforward design, Bitget provides essential trading tools without overwhelming new users.

User Feedback:

- Pros: Lauded for its user-friendly approach, especially by those new to cryptocurrency exchanges.

- Cons: Experienced traders may seek more advanced features that are found to be limited on Bitget.

MEXC and Bitget platforms are engineered to provide efficient and pleasant trading experiences.

MEXC leans slightly towards professional traders, while Bitget favors an accessible entry point for new users.

Your choice should align with your preferences regarding ease of use, design, and the specific features you require for your trading activities.

MEXC vs Bitget: Education and Community

When evaluating MEXC and Bitget, looking at how they support you in learning about cryptocurrency trading and how they foster their respective communities is essential.

MEXC has carved out a niche by creating a robust educational framework. You can access a wide range of especially beneficial materials if you’re starting to explore the crypto space. MEXC offers:

- Comprehensive Guides: Textual guides that cover the basics of cryptocurrency.

- Video Tutorials: Visual learning tools that can aid in understanding complex topics.

- FAQ Section: Quick answers to common queries.

On the community front, MEXC typically engages with its users through:

- Live Chat: For real-time assistance.

- Online Ticketing System: To submit and track support requests.

Moving to Bitget, this platform emphasizes interactive learning and community participation. Bitget puts an array of educational resources at your disposal, including:

- Detailed Guides and Video Tutorials help you navigate the platform and understand trading better.

- Knowledge Base: Covering a broad spectrum of topics.

- Community Forum: A place for users to connect, share insights, and seek help.

In terms of engagement, Bitget supports:

- Live Chat and Email Ticketing: Ensuring multiple channels for support.

- Phone Support: For more personalized assistance.

Regarding social media presence and user engagement, both MEXC and Bitget utilize platforms like Twitter and Telegram to keep you informed and involved. Regular updates, informational posts, and active community communication characterize their presence.

MEXC vs Bitget: Regulation and Compliance

When evaluating the regulatory compliance of MEXC and Bitget, you must consider the jurisdictions they operate in and the licenses they hold.

MEXC Compliance:

- As of 2024, MEXC doesn’t directly fall under the regulation of a financial authority.

- Despite this, they may conform to specific industry standards to foster a secure trading environment.

Bitget Compliance:

- Bitget’s regulatory status is similarly unanchored to a direct financial authority.

- However, Bitget has tried obtaining specific licenses and operating in regions that offer regulatory frameworks for crypto exchanges.

Compliance Challenges:

- Both platforms might face scrutiny due to the evolving regulatory landscape of cryptocurrencies.

- Staying compliant with international laws can be exceptionally intricate, given they both serve a global customer base.

Audits and Certifications:

- Audits and certifications, if any, are vital in enhancing trust and compliance. Specific information regarding these may influence your decision-making process.

The table below briefly compares key regulatory aspects:

| Aspect | MEXC | Bitget |

|---|---|---|

| Financial Authority | Not directly regulated | Not directly regulated |

| Licensing | Industry compliance measures | Obtained in several regions |

| Audits | Information not provided | Information not provided |

| Global Compliance | Industry standards adherence* | Specific regional compliance |

Note: *Adherence to industry standards is not equivalent to financial authority regulation.

Conclusion

When comparing MEXC and Bitget, each exchange has distinct features tailored to different user needs.

MEXC:

- Pros: Lower trading fees; extensive cryptocurrency offerings; appeals to various traders.

- Cons: Potentially more significant spread; less emphasis on derivative trading.

Bitget:

- Pros: Innovative copy trading feature; focused on derivatives trading; competitive fees, especially in futures.

- Cons: Higher fees than MEXC; a smaller variety of crypto assets.

MEXC is generally more affordable for the cost-conscious trader and offers a broad spectrum of tradable assets.

If your strategy involves diverse portfolio investments and spot trading, MEXC could be the preferred option.

In contrast, if you are inclined towards derivatives trading and are interested in copy trading features, Bitget is tailored to those needs despite slightly higher fees.

Your choice should align with your trading preferences and the importance of costs relative to available features.

Continuous education is vital, so consider exploring the following for deeper insights:

- MEXC Academy: Learn specifics on trading strategies and fee structures

- Bitget Blog: Gain insights on derivative products and platform updates

- Independent reviews: Analyze community experiences and feedback

Both platforms continue to evolve, so stay informed on updates and changes that may affect their offerings.

Explore how MEXC and Bitget compare to their competitors:

- MEXC vs Binance: Comparative Analysis

- MEXC vs. Phemex: Comparative Analysis

- MEXC vs Bybit: Comparative Analysis

- Bitget vs. Phemex: Comparative Analysis

- Bitget vs BingX: Comparative Analysis

- Bitget vs Bybit: Comparative Analysis