Mexc Vs Kraken: Comparison At A Glance

When deciding between MEXC and Kraken as your go-to trading platform, several factors come into play.

Both are well-known crypto exchanges, but they cater to different user preferences and requirements. Below is a table contrasting their key features to aid your decision-making process.

| Feature | MEXC | Kraken |

|---|---|---|

| Supported Cryptocurrencies | Offers a wide variety of altcoins and tokens | Provides a well-curated selection of popular cryptocurrencies |

| User Interface | Intuitive and suitable for all levels of traders | Clean design with advanced trading tools |

| Trading Volume | High, with substantial liquidity | Also high, one of the leading exchanges by volume |

| Trading Fees | Competitive rates with a tiered structure | Typically, low fees with volume-based discounts |

| Leverage | Provides options for margin trading | Offers margin trading and futures contracts |

| Deposit Methods | Supports multiple methods, including bank transfers and credit cards | Accepts various funding options, including fiat and cryptocurrencies |

| Security Measures | Implements strong security protocols | Known for its robust security features and practices |

You’ll find that both MEXC and Kraken have their unique advantages. MEXC may appeal to you if you want a broader range of coins and a user-friendly interface.

On the other hand, Kraken could be your preference for its high-security measures and advanced trading features. Consider what’s most important for your trading needs while making your choice.

Mexc Vs. Kraken: Products And Services

In choosing between MEXC and Kraken for your crypto trading needs, you should consider each offer’s range of products and services, including assets available for trade and additional financial products like staking and futures.

Available Cryptocurrency Assets

MEXC:

- Offers a wide selection of cryptocurrencies for spot trading, with hundreds of altcoins available.

- Derivatives Trading: MEXC provides several futures contracts and options for traders seeking leverage and more sophisticated trading products.

Kraken:

- It lists a variety of cryptocurrencies, including popular coins and some altcoins, for spot trading.

- Derivatives Trading: Futures trading is also supported on Kraken, although the list of futures contracts is not as extensive as that of MEXC.

Additional Financial Products

MEXC:

- Staking: Available, allowing you to earn rewards on your cryptocurrency holdings.

- ETFs: Offers exchange-traded funds for crypto, enabling exposure to various coins through a single investment.

- Features: Includes innovative trading features and tools for novice and experienced traders.

Kraken:

- Staking: Provides staking services with competitive rewards.

- Features: Known for its robust security measures and user-friendly platform, Kraken’s features are designed to enhance trading experience while prioritizing safety.

Mexc Vs Kraken: Contract Types

When exploring the contract types between MEXC and Kraken, you’ll find various options tailored to different trading strategies involving futures, options, and other crypto assets.

MEXC offers a broad spectrum of contract types, including:

- Inverse Perpetual Contracts allow you to trade crypto assets as the quote currency with other cryptocurrencies.

- Linear Perpetual Contracts: Unlike the inverse contracts, you trade with USDT as the quote.

- Inverse Futures Contracts: These contracts are similar to inverse perpetual but with an expiration date.

Furthermore, MEXC provides COIN-M Futures, where the margin is denominated in the cryptocurrency that is the base asset of the contract, and USD-M Futures, where margins and settlements are in USDT.

On the other hand, Kraken is known for its:

- Futures Trading: Offering both fixed-expiration futures contracts and perpetual contracts, Kraken enables you to trade with leverage and settle in the underlying currency.

- Trading Options: These derivative contracts provide the flexibility to speculate on the price movement of crypto assets without the obligation to purchase the underlying asset.

Both platforms furnish these derivatives to augment your trading capabilities, but they come with their intricacies:

- With inverse contracts, your account balance is in the base currency, which could introduce complexity to those more accustomed to the fiat systems.

- Linear contracts denominated in USDT offer a more straightforward approach, which is appealing if you prefer stablecoin settlements.

- Futures contracts carry the element of time, necessitating close attention to expiry dates and potential rollover costs.

Your choice between MEXC and Kraken may hinge on your comfort level with specific contract mechanics and the range of available crypto assets for trading.

Mexc Vs Kraken: Leverage And Margin

When evaluating MEXC and Kraken’s leverage and margin trading offerings, you’ll find distinct differences catering to varying trader needs, especially in leveraged exposure to cryptocurrencies such as Bitcoin.

MEXC typically stands out for offering higher leverage limits. It allows you to engage in margin trading with leverage up to 125x, which significantly amplifies your potential return and liquidation risk.

With such high leverage, small market movements can lead to substantial profits or losses, so managing your positions and understanding liquidation risks is essential.

On the other hand, Kraken offers a more moderated leverage option, with a maximum of 5x for margin trading.

This reduced leverage might be more suited to your needs if you’re seeking lower-risk exposure. Additionally, Kraken’s focus on regulatory compliance provides you with a secure and trustworthy platform for margin trading.

Here’s a quick comparison:

| Feature | MEXC | Kraken |

|---|---|---|

| Maximum Leverage | 125x | 5x |

| Margin Trading Available | Yes | Yes |

| Regulatory Compliance | It is less stringent compared to the Kraken | More stringent |

| Liquidation Risk | High with increased leverage | Lower with reduced leverage |

While deciding, consider the funding rates on both platforms, as they can affect the cost of holding leveraged positions.

High leverage on MEXC might attract higher funding rates than Kraken, impacting your trading costs.

Remember that the margin required to maintain a position is less with higher leverage, but the liquidation risk is more significant.

Your trading strategy should align with how much risk you’re willing to take and whether the trade-offs between potential gains and losses meet your investment goals.

Mexc Vs. Kraken: Liquidity And Volume

When selecting a cryptocurrency exchange, liquidity and trading volume are critical factors.

Liquidity impacts your ability to execute trades quickly and at desirable prices, while volume indicates an asset’s market activity and visibility.

With its established market presence, Kraken typically provides strong liquidity, which is particularly beneficial when trading significant cryptocurrencies.

This ensures minimal slippage, making prices stable even during significant transactions. Kraken’s volume and liquidity are highly regarded in the industry, often ranking high in global metrics.

In contrast, MEXC offers a different scenario. It has a reputation for better liquidity in altcoins, serving many global users.

This is not to say that MEXC lags in liquidity; it specializes in providing a marketplace for various cryptocurrencies, including less prevalent altcoins.

This allows for enhanced trading opportunities across a broad spectrum of assets.

Here’s a comparison table to outline the differences:

| Exchange | Liquidity Rank | 24h Trading Volume | Altcoins Availability |

|---|---|---|---|

| Kraken | High | Very High | Moderate |

| MEXC | Moderate | High | High |

Your trading experience can be significantly affected by these factors. If your strategy includes trading popular digital assets with the intent of quick execution and price stability, Kraken may suit your needs.

However, if you’re interested in a broader range of altcoins and are prepared for variations in liquidity, MEXC could provide the diversity you’re looking for.

Remember, trade execution and the potential for slippage largely depend on the liquidity and volume of the exchange you choose.

Mexc Vs Kraken: Fees And Rewards

Understanding the fee structures and reward systems of exchanges like MEXC and Kraken becomes imperative as you navigate the intricacies of trading cryptocurrencies.

These can significantly influence your trading costs and potential benefits.

Comparing Trading And Withdrawal Fees

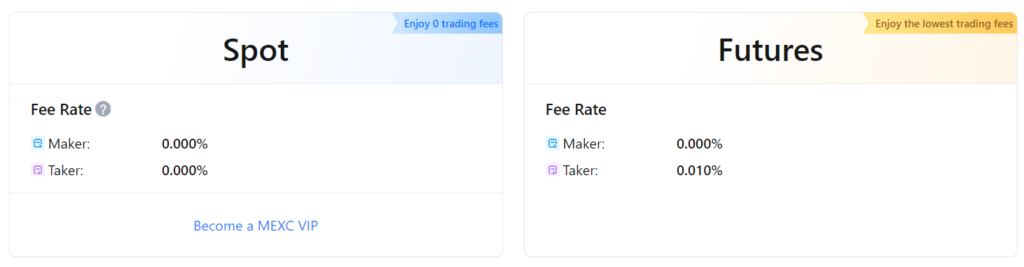

MEXC:

- Trading Fees: MEXC offers competitive trading fees with a recent initiative to eliminate fees for spot trading pairs. However, confirming the latest fee schedule is essential as these policies can change.

- Withdrawal Fees: These fees vary depending on the currency, and it is essential to check the fee schedule for the latest rates.

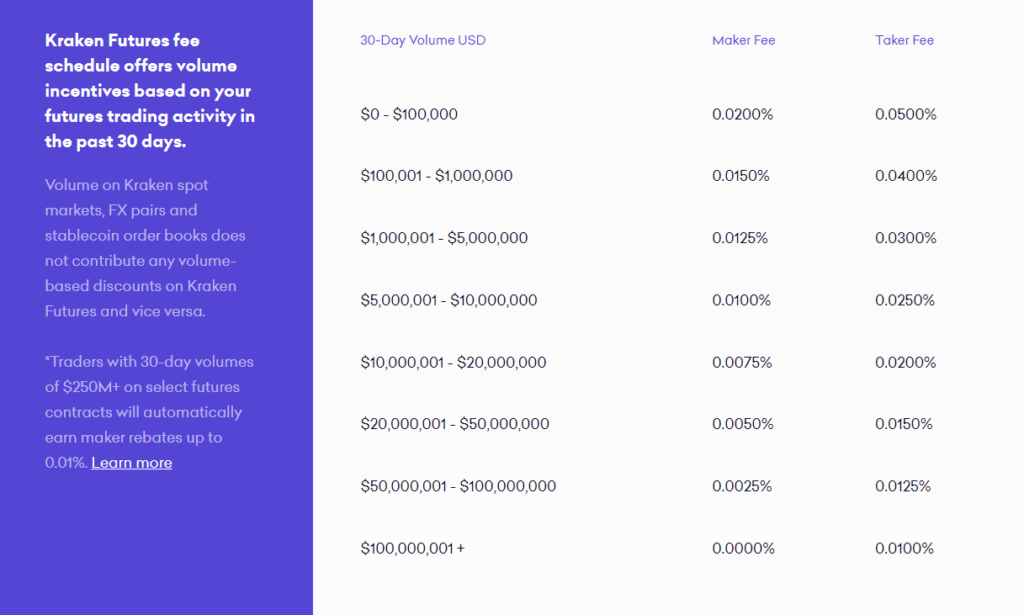

Kraken:

- Trading Fees:

- Maker fees start at 0.16%, and taker fees start at 0.26%.

- These fees can decrease for traders with higher monthly trade volumes.

- Withdrawal Fees: Charged per transaction and can differ based on currency type.

To calculate the impact of these fees on your trades, use each exchange’s fee calculator with your planned trade volume.

Both platforms offer fee discounts based on volume and other factors, such as staking or using the exchange’s tokens.

For rewards, while Kraken does not have a loyalty program, it operates an affiliate program providing monetary compensation for referring new users.

MEXC, on the other hand, may offer different reward incentives, though specifics should be confirmed on their website as offerings can change.

Consider these fees and rewards when deciding on an exchange, as they directly affect your trading costs and potential earnings from referrals or loyalty programs.

MEXC vs Kraken: Deposits & Withdrawal Options

MEXC and Kraken provide distinct methods to suit your needs when considering deposit and withdrawal options.

MEXC:

- Currencies Supported: MEXC offers a vast range of cryptocurrencies for your transactions.

- Deposit Methods: Cryptocurrency transfers are standard, with support for several coins.

- Withdrawal Methods: Similar to deposits, you can withdraw in various cryptocurrencies.

- Processing Times: Transfer speeds can vary but are generally swift for deposits and withdrawals.

- Limits: You’ll notice minimum and maximum thresholds that are crypto-specific.

Kraken:

- Currencies Supported: Besides supporting many cryptocurrencies, Kraken allows FIAT currencies, including USD, EUR, and GBP.

- Deposit Methods:

- Crypto transfers

- Bank transfers (FIAT)

- Other methods like credit/debit card (in some regions)

- Withdrawal Methods:

- Crypto withdrawals

- FIAT via bank transfers

- Processing Times: Crypto transfers are rapid; FIAT transactions may take several business days, depending on the method.

- Limits: Ranges for deposit and withdrawal limits are clearly defined and tend to vary based on verification level and type of currency.

Your choice between MEXC and Kraken will depend on whether you need only crypto transactions or prefer the additional option of FIAT currencies.

Kraken’s ability to handle USD, EUR, and GBP alongside crypto can broaden your options for fund management.

However, if cost is a primary concern, MEXC’s lower fees for trading could be a deciding factor in your preference.

By understanding the nuances of deposit and withdrawal mechanisms, you can make a more informed decision tailored to your trading habits and financial preferences.

MEXC vs Kraken: KYC Requirements & KYC Limits

Knowing the Know Your Customer (KYC) requirements and limits of the exchange you choose is crucial for your security and operational capacity when trading cryptocurrencies.

MEXC and Kraken have distinct KYC protocols influencing privacy, security, and trading accessibility.

MEXC requires a set of KYC verifications to enhance your account’s functions. Initially, you can start trading with primary verification, providing personal information.

Advancing to higher KYC levels, such as completing advanced KYC, offers higher privileges, like increasing your 24-hour withdrawal limit to 200 BTC and unlocking unlimited OTC transactions.

| MEXC KYC Level | Benefits |

|---|---|

| Basic | Trading with limits |

| Advanced | Higher withdrawal limits, full OTC access |

On the other hand, Kraken’s verification levels are primarily determined by your residency and the assets you deal with.

Each verification tier enhances deposit and withdrawal capabilities, ensuring a secure transaction environment.

| Kraken Verification Level | Requirements | Benefits |

|---|---|---|

| Starter | Basic personal information | Deposit and trade cryptocurrencies |

| Intermediate | Address verification | Higher deposit and withdrawal limits |

| Pro | KYC questionnaire and ID verification | Highest limits, access to Kraken futures |

Both exchanges maintain a balance between user privacy and regulatory compliance. Robust KYC procedures are in place to prevent fraud and ensure the platforms’ integrity.

Your deposit and withdrawal capabilities will significantly depend on the level of verification you complete on the respective exchanges.

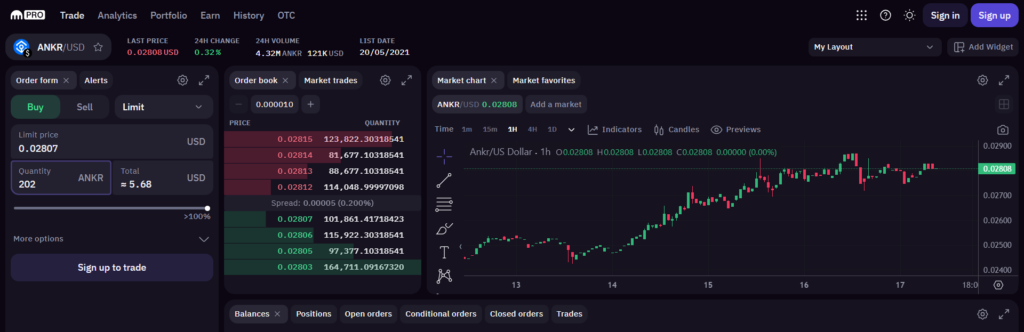

MEXC vs Kraken: Order Types

When trading on MEXC or Kraken, understanding the order types available is crucial for executing your strategies and managing risks effectively.

MEXC primarily offers these order types:

- Market Orders: Executes immediately at the current market price.

- Limit Orders: Sets a specific price to execute your trade.

- Stop Orders: Triggers a market order when a specified price is reached.

- Conditional Orders: Executes when certain conditions are met.

On the other hand, Kraken expands on these with additional order types, providing you with a more diverse set of tools:

- Market Orders: Filled at the best available price.

- Limit Orders: You can specify the price you wish to buy or sell.

- Stop Loss and Take Profit Orders: Automatically close your position when your specified price is hit.

- Conditional Close Orders: Set conditions for closing a position when you place your initial order.

- Stop Loss Limit and Take Profit Limit Orders: Similar to stop-loss and take-profit orders but with a limit price set.

- Settle Position Orders: These are used to settle a future position.

- Post-Only Orders: Ensure the order is added to the order book and not filled immediately.

Both platforms also support advanced orders, such as reduce-only orders, which ensure that an order reduces your position and does not increase it.

| Feature | MEXC | Kraken |

|---|---|---|

| Market Order | ✓ | ✓ |

| Limit Order | ✓ | ✓ |

| Stop Order | ✓ | ✓ |

| Conditional Order | ✓ | – |

| Post-Only Order | – | ✓ |

| Reduce-Only Order | ✓ | ✓ |

| Advanced Stop Orders | – | ✓ |

| Settle Position Order | – | ✓ |

Use these order types to manage your trading, as they can provide precise control over your entry and exit strategies and help safeguard your investments against sudden market movements.

Mexc Vs. Kraken: Security Features

Your assets and personal information security are paramount when considering a cryptocurrency exchange. MEXC and Kraken are committed to providing secure platforms for their users.

Kraken takes security seriously, and its reputation underscores a robust system. Notable features include two-factor authentication (2FA), SSL encryption, and a strict verification process to mitigate the risk of unauthorized account access.

Kraken also has proof of reserves, which provides transparency and trust, ensuring customer funds are accurately represented on the exchange.

On the other hand, MEXC also dedicates significant resources to security. It provides 2FA and multi-signature wallets to enhance the safeguarding of your funds.

Additionally, MEXC uses an SSL-encrypted system, which protects your personal information during transmission.

Both exchanges have faced challenges in the past. For instance, Kraken has experienced DDoS attacks, but they responded promptly to resolve such issues without users experiencing loss of funds. Similarly, MEXC stays vigilant and often updates its security measures to address emerging threats.

As for regulatory compliance, Kraken is known for its adherence to international regulations, transparency, and compliance with legal requirements.

MEXC, while based in Seychelles, also complies with regulations and educates its community about security practices.

Regarding customer support, both platforms have mechanisms to assist users with security concerns. Kraken boasts a comprehensive support center and a 24/7 live chat feature. MEXC also provides support through various channels, ensuring users can seek help.

By remaining neutral, one can appreciate that both MEXC and Kraken take user security seriously, each employing distinct strategies to ensure peace of mind for their customers.

Mexc Vs. Kraken: User Experience And Support

When you pit MEXC against Kraken, it becomes evident that both platforms strive to provide a seamless user experience complemented by robust customer support.

This section will delve into the specifics of their platform accessibility, usage experience, and the quality of customer support services.

Platform Accessibility And Usage

MEXC: Your interactions with MEXC’s platform will likely be straightforward since they maintain an updated interface geared towards novice and seasoned traders.

A particular strength worth noting is the monthly updates to ensure trading fees, withdrawal fees, and supported cryptocurrencies are aligned with user needs.

- Interface: Users typically find MEXC’s interface to be user-friendly.

- Mobile App: MEXC’s mobile app is designed to provide a comprehensive trading experience on the go and is well-received for its functionality.

Kraken: On the other hand, Kraken’s platform is known for its ease of use and robust security measures. Kraken has consistently received high scores for its user-friendly design and operational speed on various devices.

- Interface: Kraken’s interface delivers advanced functionality with simple navigation.

- Mobile App: The Kraken crypto trading app is acknowledged for its smooth performance on mobile devices, enhancing trading accessibility.

Customer Support Services

MEXC: The platform provides customer support, emphasizing education within the crypto community. MEXC has various channels for support, including:

- Immediate Assistance: A live chat feature for real-time problem-solving.

- Educational Resources: A focus on informative content to assist user decision-making.

Kraken: Kraken’s commitment to support aims for a comprehensive service, including:

- Multi-Layered Support: Offers 24/7 customer service, often praised in user reviews.

- User Education: Provides extensive learning materials to help you navigate the complexities of crypto trading.

Mexc Vs. Kraken: Compliance And Regulation

When considering MEXC and Kraken, you are looking at two cryptocurrency exchanges with different approaches to compliance and regulation.

Kraken has faced challenges with regulatory authorities, notably the SEC, which charged it for operating as an unregistered securities exchange.

This highlights Kraken’s importance on compliance, as it adjusted its operations to meet regulators’ demands.

On the other hand, MEXC has focused on transparency with its proof-of-reserve, which it declared in 2023, reflecting its commitment to user trust and financial integrity.

This move aligns with industry calls for exchanges to assure users of the safety of their assets against potential insolvency issues.

| Aspect | MEXC | Kraken |

|---|---|---|

| Proof of Reserve | Declared in 2023 | Not specified in the search results |

| Regulatory Issues | No recent controversy has been reported | Faced SEC charges and was required to adjust operations |

| Compliance Efforts | Commits to aligning with regulatory standards and transparency | Actively works to comply with global regulatory bodies despite challenges |

Regulation is crucial as it indicates the level of oversight and standards an exchange is held to.

Although the details about MEXC’s licenses or certifications weren’t provided, their proactive approach to declaring proof of reserves implies a dedication to relevant compliance standards.

Despite its regulatory hurdles, Kraken has also demonstrated its capacity to realign its offerings to remain in legal standing with regulatory institutions.

Conclusion

In comparing MEXC and Kraken, your choice hinges on specific trading needs and preferences.

MEXC offers more tradable assets and generally higher leverage, which might attract you if you’re seeking variety and advanced trading options.

The exchange also boasts deep liquidity and a user-friendly interface, catering well to novice and seasoned crypto traders.

On the other hand, Kraken is known for its robust security measures and solid regulatory standing, possibly making it the preferred option for traders prioritizing safety and compliance.

For professional traders, MEXC’s low trading fees and extensive asset offerings provide an attractive trading environment with a higher potential for diversified strategies.

In contrast, Kraken’s reputation and regulatory compliance may offer more peace of mind for risk-averse traders and investors.

| Feature | MEXC | Kraken |

|---|---|---|

| Tradable Assets | More | Less |

| Leverage | Higher | Lower |

| Fees | Lower | Higher |

| Security | Standard | Robust |

| User Interface | User-Friendly | Complex |

Before deciding, consider your trading style, whether you’re more driven by a wide selection of assets and cost-efficiency or by security and regulatory assurances.

Each platform has unique benefits; your final choice should align with your trading goals and risk tolerance.

Explore how MEXC and Kraken compare to their competitors:

- MEXC vs BingX: A Comprehensive Comparison

- MEXC vs Bybit: A Comprehensive Comparison

- MEXC vs Phemex: A Comprehensive Comparison

- Kraken vs. Binance: A Comprehensive Comparison

- Kraken vs. Phemex: A Comprehensive Comparison

- Kraken vs. Bybit: A Comprehensive Comparison