Phemex Vs Kraken: Comparison At A Glance

When comparing Phemex and Kraken, you should consider various factors to determine which platform suits your trading needs.

Key areas of comparison are the types of trading available, security measures, customer support, and fees associated with transactions.

Trading Features

| Feature | Phemex | Kraken |

|---|---|---|

| Supported Coins | Wide range of coins | Wide range, including rare altcoins |

| Leverage | Up to 100x for futures | Up to 5x |

| Products | Spot, Futures, Contracts | Spot, Futures, Margin, OTC |

| Security | Robust security protocols | State-of-the-art security |

| User Experience | Intuitive UX, easy navigation | Comprehensive UX, professional tools |

Fees & Support

| Feature | Phemex | Kraken |

|---|---|---|

| Trading Fees | Competitive fees | Varies by tier |

| Deposit Methods | Multiple options | Several methods |

| Customer Support | 24/7 support, multilingual | Live chat, limited hours |

| Trading Volume | High liquidity | High liquidity |

Phemex stands out in futures and derivatives trading with higher leverage options. Meanwhile, Kraken’s diverse offerings provide a broad range of trading types, including OTC trades for high-volume transactions.

While Phemex has a competitive edge in responsive customer support, Kraken provides tools more tailored for professional traders with their comprehensive user experience.

Both platforms take security seriously, ensuring your assets are safeguarded with advanced measures.

Regarding fees, Phemex offers a competitive structure especially appealing to frequent traders focusing on future markets.

Kraken adjusts its fees based on the user’s trading volume tier, which can be beneficial if you trade in higher volumes.

Phemex Vs. Kraken: Products And Services

Phemex and Kraken offer a range of services tailored to both novice and experienced traders.

You’ll find that Phemex specializes in futures and derivatives trading, allowing you to engage in these markets with up to 100x leverage. This is particularly beneficial if you’re looking to amplify your trading positions.

Both exchanges cater to your needs for spot trading, though Phemex has a unique offering with zero-fee spot trading for premium members.

When you evaluate their options trading capabilities, note that Kraken provides a more conservative leverage of up to 5x, positioning itself as a less risky alternative for leverage-sensitive traders.

Staking services on Kraken might align with your interests if you want to earn rewards on your cryptocurrency holdings. This provides additional ways to generate returns apart from trading.

If you areeinterestedn the burgeoning area of non-fungible tokens, Phemex and Kraken offer didifferentxperiences.

As of my last update, Kraken has not delved deeply into the NFT marketplace, whereas Phemex is progressively expanding its services in this domain.

On the customer support front, Phemex takes pride in its around-the-clock availability and multilingual support team. You can reach them through various channels, including social media.

While offering a robust live chat service, Kraken limits its availability to certain hours (6 AM to 6 PM EST).

In your search for the best user experience, both platforms endeavor to offer a user-friendly interface.

But Phemex stands out for catering extensively to traders interested in futures and high leverage. At the same time, Kraken appeals to a broader audience with its comprehensive educational resources and a more conservative trading environment.

Phemex Vs. Kraken: Contract Types

When assessing Phemex and Kraken, you’ll find differences in each platform’s contract types, crucial information for your trading strategy.

Phemex:

- Inverse Perpetual Contracts: You can trade contracts like BTC/USD, where Bitcoin is the base currency, not tied to the expiration date.

- Linear Perpetual Contracts: Contracts such as ETH/USD, with the quote currency being USD, are available for trading 24/7 on Phemex.

- Inverse Futures Contracts: These are similar to inverse perpetual but with an expiration date.

- USD-M Futures (USDT Margined): Futures contracts are margined and settled in USDT, a stablecoin tied to the value of the US dollar.

Kraken:

- Inverse Perpetual Contracts: Offers contracts for cryptocurrencies like Bitcoin with settlements in the digital asset itself.

- Options: Kraken provides European-style options, which means you can exercise them only at expiration.

Phemex features a broader range of futures products, such as COIN-M futures, which are margined and settled in the underlying cryptocurrency, and USD-M futures.

With Phemex, you benefit from high-leverage options up to 100x, which is especially attractive if you want to amplify your trading capacity. However, keep in mind the increased risk that comes with leverage.

Kraken emphasizes investor protection with a maximum leverage of up to 5x, reducing potential over-exposure to volatile markets.

While Kraken’s leverage is lower, this could decide your risk tolerance and trading style.

Each platform’s contract offerings cater to different trading needs—your choice might hinge on the degree of leverage desired or the preferred contract type.

Remember, it’s essential to understand the implications of each contract and leverage level to navigate cryptocurrency markets effectively.

Phemex Vs. Kraken: Leverage And Margin

Leverage trading amplifies your trading position beyond your initial capital, potentially increasing returns, and understanding how leverage and margin work is crucial for risk management.

Phemex offers you a significant leverage ratio, enabling positions up to 100x. This means you could control a more prominent position with relatively little capital.

Keep in mind that higher leverage also increases your liquidation risks. You could lose your entire position if the market moves against you by a small margin.

On the other hand, Kraken presents a more conservative approach, providing you with up to 5x leverage for futures contracts.

| Exchange | Max Leverage | Margin Trading |

|---|---|---|

| Phemex | 100x | Yes |

| Kraken | 5x | Yes |

Margin requirements on both platforms must be met to maintain a leveraged position.

If the market turns against your leveraged trade and your position falls below the margin requirement, the exchange will issue a margin call or proceed to liquidation to cover losses.

Furthermore, each exchange has funding rates that affect the cost of holding leveraged positions.

You’re advised to review these rates as they vary and can impact the cost-effectiveness of maintaining your position over time.

Successful leverage trading requires a keen understanding of these mechanisms and a meticulous risk management strategy.

Phemex Vs. Kraken: Liquidity And Volume

Two critical aspects to consider when trading cryptocurrencies are liquidity and trading volume. These metrics directly influence your trading experience, especially regarding order execution and slippage.

Phemex is recognized for its substantial liquidity, especially in futures and derivatives trading.

This heightened liquidity means that placing an order on Phemex is more likely to be filled quickly and closer to the price you expect, reducing slippage.

On the other hand, Kraken maintains robust liquidity across various markets. It has been a long-standing exchange with a consistent trading volume, ensuring that your trades are executed efficiently.

| Feature | Phemex | Kraken |

|---|---|---|

| Liquidity | High in futures and derivatives | Strong across various markets |

| Volume | High | Consistent |

| Execution | Quick order fill | Efficient |

| Slippage | Reduced | Minimal |

Liquidity providers play a crucial role in each exchange.

On Kraken, market makers providing liquidity are tiered based on their 30-day trading volume, with different incentives tied to each tier.

Sources for these metrics include liquidity rankings and volume data publicly provided by each exchange.

It’s essential to refer to such data to assess each platform’s capacity to handle large orders without significantly affecting the market price, allowing you to trade confidently.

Phemex Vs. Kraken: Fees And Rewards

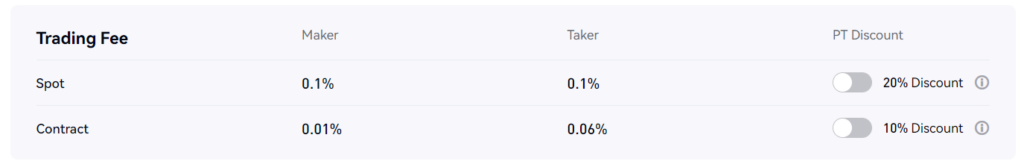

Phemex employs a flat-fee model for both market makers and takers.

As a market maker, you receive a 0.025% rebate; as a market taker, you incur a 0.075% fee.

This system encourages liquidity provision on the Phemex platform by rewarding you for adding orders to the book.

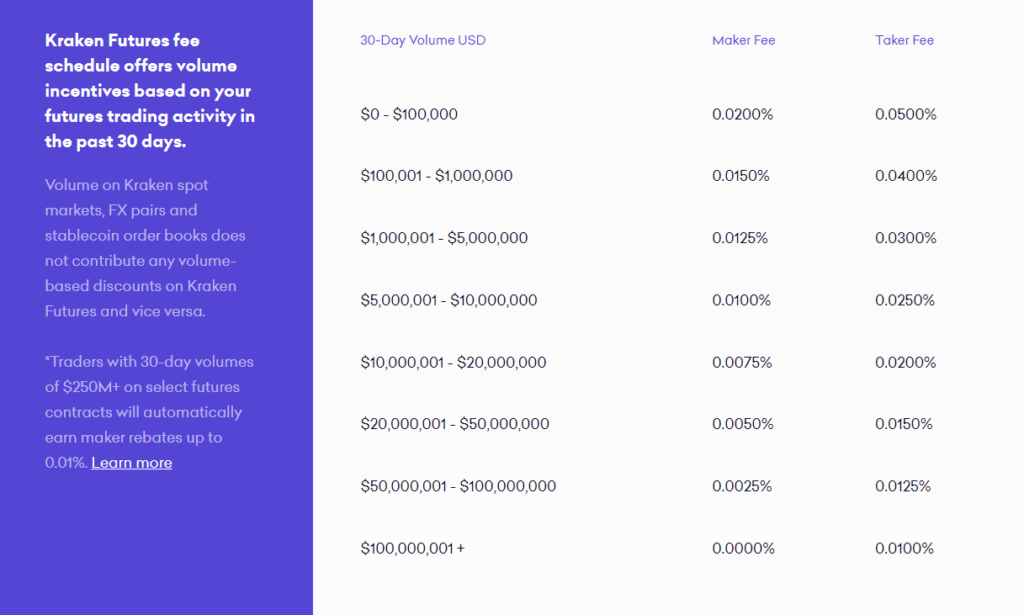

In contrast, Kraken features a tiered fee structure, which becomes more advantageous as your 30-day trading volume increases.

- At the lowest tier, for a volume less than $50,000, your taker fee is 0.26%, and the maker fee is 0.16%.

- At higher tiers, these fees can be reduced significantly, potentially reaching as low as 0% for makers and 0.10% for takers at volumes exceeding $10,000,000.

Phemenx Spot Trader Example: If you execute a $1,000 trade as a standard spot trader, you’ll pay a flat-rate fee of 0.1%, which amounts to $1. If you’re a market maker, your fee becomes a rebate, earning you $0.25 for the same trade value.

Kraken Trader Example: Conducting a $1,000 trade at the lowest tier means paying $2.60 as a taker, while it costs you $1.60 as a maker. These fees could be much lower for high-volume traders, enhancing your profitability when trading frequently.

Both exchanges offer fee discounts for various circumstances, such as using their native tokens for transaction fees or participating in specific promotions.

It’s crucial to stay updated with each platform’s latest fee schedules and reward opportunities to optimize your trading strategies.

Phemex Vs. Kraken: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Phemex and Kraken, it’s essential to understand their fee structures.

Phemex offers a competitive approach to trading fees using a maker-taker model. As a maker, you pay fewer fees than a taker, who takes liquidity away.

Phemex does not charge any fees for depositing funds, regardless of the payment method. Withdrawal fees, however, are applicable.

You’ll encounter a small Bitcoin withdrawal fee of 0.005 BTC. Note that withdrawal fees may vary based on the asset.

Kraken also implements a maker-taker fee schedule. The fees can be slightly reduced as your trading volume increases over 30 days.

Unlike Phemex, Kraken may charge fees for fiat deposits, which can vary depending on your location and the payment method.

Kraken typically has lower withdrawal fees than Phemex, which may differ based on the currency and withdrawal method.

Here’s a simplified comparison:

| Fee Type | Phemex | Kraken |

|---|---|---|

| Trading | Maker-Taker Model | Maker-Taker Model |

| Deposit | Free | Variable |

| Withdrawal | Asset-Specific Fees | Currency-Specific Fees |

The exact trading fee you pay on Kraken depends on your last 30 days of trading volume, potentially rewarding you for more activity. On the other hand, Phemex’s distinction between makers and takers prioritizes those who add to the market depth.

Phemex Vs. Kraken: Deposits & Withdrawal Options

When deciding between Phemex and Kraken, both exchanges differ in their approach to funding and taking out your assets.

Phemex:

- Deposits: You can deposit funds without any fees. The platform, however, sets a minimum deposit amount, which varies based on the asset you wish to transfer to your account.

- Withdrawals: A flat fee of 0.005 BTC applies to each Bitcoin withdrawal. For other currencies, the costs vary.

Kraken:

- Deposits: Kraken allows various funding options, including fiat and cryptocurrencies. Some options are free, while others may incur a small fee.

- Withdrawals: Fees on Kraken depend on the currency and withdrawal method. They strive to keep fees low to ensure you retain most of your funds.

| Aspect | Phemex | Kraken |

|---|---|---|

| Deposit Fee | None | Varies by method |

| Withdrawal Fee (BTC) | 0.005 BTC | Varies by currency and method |

| Supported Currencies | Multiple cryptocurrencies | Fiat and cryptocurrencies |

| Payment Methods | Cryptocurrency transfers | Bank transfers, crypto, and other methods |

| Processing Times | Immediate to a few hours for cryptocurrencies | It can vary; typically fast for crypto, slower for fiat |

Transactions on Kraken may take a few minutes to a few days, depending on your chosen method and if it involves fiat currency.

As for Phemex, crypto transactions are generally processed swiftly, which means you can expect deposits to reflect in your account within a few hours.

Phemex Vs. Kraken: KYC Requirements & KYC Limits

When choosing a cryptocurrency exchange, understanding their Know Your Customer (KYC) requirements and limits is crucial for your privacy, security, and accessibility to various services. Phemex and Kraken have differing approaches that are tailored to different user preferences.

Phemex offers a tiered system:

- Level 0: No KYC required; you can trade and withdraw a specific limit of cryptocurrencies without verification.

- Higher Levels: These require government-issued ID, proof of residence, and other personal details.

The absence of mandatory KYC for lower levels means you can maintain a degree of privacy. However, there are limits on what you can do until you complete further verification steps.

Kraken, on the other hand, has a more stringent process:

- Starter Level: Requires your name, email address, primary address, and phone number.

- Intermediate and Pro Levels: These require additional documents, including a government-issued ID, proof of residency, and, in some cases, a face photo (a selfie).

The initial requirements at Kraken’s Starter level are not excessively invasive, but more personal information is required as you advance. The additional verification unlocks higher deposit and withdrawal limits and access to advanced trading options.

| Exchange | Level 0 KYC | Higher Level KYC | Impact |

|---|---|---|---|

| Phemex | Optional | ID, Residence Proof | Limits until verified |

| Kraken | Required | ID, Residence Proof, Selfie | Higher limits post-verification |

Your comfort with these KYC requirements will depend on how much privacy you wish to maintain versus the range of trading activities you plan to undertake. The trade-off between accessibility and privacy is an essential consideration in these exchanges.

Phemex Vs Kraken: Order Types

When trading cryptocurrencies on Phemex or Kraken, understanding each platform’s different order types is key to executing your trading strategies and effectively managing your risks.

Phemex supports several order types:

- Market Orders: Buy or sell at the best available current price.

- Limit Orders: Set a specific price to buy or sell.

- Conditional Orders: Triggered upon certain conditions, like Stop orders.

- Post-Only Orders: Ensure the order adds liquidity, avoiding taker fees.

- Reduce-Only Orders: Decrease your position without increasing it.

On the other hand, Kraken provides a similar range of order types to facilitate your trading needs:

- Market Orders: To execute a trade quickly at the current market price.

- Limit Orders: To set your preferred price, providing control over the execution price.

- Stop Loss Orders: To limit potential losses by setting a sell order at a lower price than the market level.

- Take Profit Orders: To set an order that locks in profits once a certain price level is reached.

- Stop-Loss Limit: Combining stop and limit orders for precise risk management.

- Take-Profit Limit: Allowing traders to set trigger and execution prices to lock profits.

Both platforms also offer advanced order options such as Stop Loss and Take Profit orders, which can be combined with limit orders to give you more control over when your orders are filled.

Understanding how each platform’s order types work will enable you to tailor your trading approach to align with your financial goals and risk tolerance levels. Use these tools to help achieve desired outcomes while trading on Phemex and Kraken.

Phemex Vs. Kraken: Security And Reliability

When choosing a cryptocurrency exchange, the security and reliability of the platform are paramount. Phemex and Kraken deploy various measures to protect your funds and data.

Phemex underscores its security with robust systems. Your assets are held in cold storage, keeping them offline and away from potential online hacks.

Multi-signature access further secures withdrawals, ensuring multiple verifications are made before processing transactions. Despite its newer entry into the market, Phemex has maintained a robust security record.

Kraken has established itself as one of the most secure exchanges in the cryptocurrency space.

It provides comprehensive security features such as two-factor authentication (2FA), PGP/GPG encryption, and a global setting lock to prevent unauthorized changes to your account.

It’s one of the few exchanges that have never been hacked, a testament to its reliability.

Concerning regulatory compliance, Kraken prides itself on strict adherence to legal regulations, providing an additional layer of security and legitimacy.

Meanwhile, Phemex also complies with the requisite regulatory standards, giving you peace of mind when trading.

If an issue arises, both exchanges offer customer support.

Phemex is known for its responsive 24/7 support in multiple languages, while Kraken provides service via live chat during certain hours. Both strive to promptly resolve any issues, ensuring a smooth trading experience for you.

Remember, past incidents don’t necessarily dictate future reliability, but they give insight into an exchange’s track record and crisis management.

Neither Phemex nor Kraken has been immune to issues, but both have demonstrated a capacity to address and resolve them efficiently, which is critical for maintaining user trust.

Phemex Vs. Kraken: User Experience

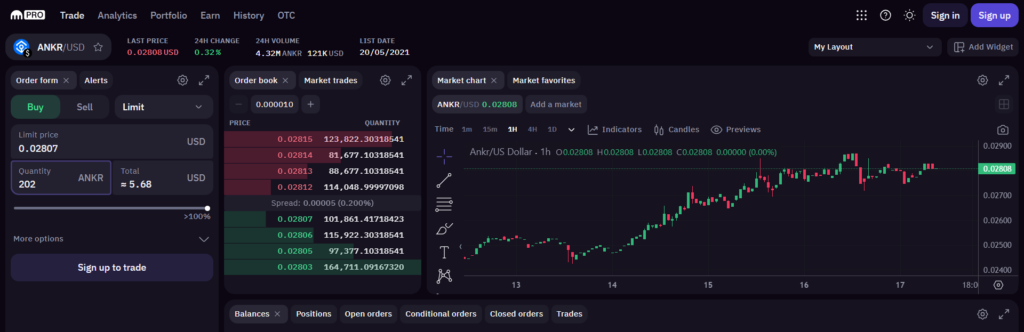

When you explore Phemex, you might notice its focus on a clean and intuitive interface designed to streamline the process for beginners and experienced traders.

Phemex offers a variety of trading options, from spot to futures, with the ability to leverage up to 100x on specific contracts, which could be attractive if you’re interested in high-risk, high-reward trading.

On the other hand, Kraken presents a robust trading experience with a strong emphasis on security and a slightly more complex interface that may appear daunting to newcomers but offers depth for the seasoned trader.

Kraken’s platform allows up to 5x leverage, which might be more suitable if you prefer a conservative approach to trading.

Features of Phemex and Kraken:

- Phemex:

- Clean interface, easy for beginners

- Up to 100x leverage on futures

- 2FA and advanced security protocols

- Kraken:

- Comprehensive security features

- Leverage up to 5x

- Rich functionality that caters to advanced users

Your trading preferences will guide your choice. If you prioritize a user-friendly interface and high leverage, Phemex might suit you.

If you value in-depth features with moderate leverage and a security track record, Kraken could be your choice.

User feedback often cites Phemex for its navigability and Kraken for its comprehensive suite of tools. Both exchanges are lauded for maintaining high-security standards and user confidence.

Phemex Vs. Kraken: Education And Community

When you explore Phemex and Kraken, you’ll find that both platforms emphasize education and community engagement.

With its well-established reputation, Kraken has developed a comprehensive range of educational content. You have access to an extensive array of articles, guides, and tutorials on cryptocurrency fundamentals and advanced trading strategies.

Phemex also invests in your education through their Phemex Academy. The academy contains articles and videos designed to cater to beginners and experienced traders. Their blog is regularly updated to inform you about the latest market trends and trading insights.

Regarding community involvement:

- Kraken interacts with its users via various social media channels and platforms, conducting webinars and live Q&A sessions. They maintain an influential presence that facilitates a strong community bond.

- Phemex counters have robust 24/7 customer support and an active presence on social media, where they engage with their community. They encourage direct communication with their team and even provide opportunities to interact with their CEO.

Here’s a comparison table to summarize their educational and community efforts:

| Feature | Phemex | Kraken |

|---|---|---|

| Education | Phemex Academy (Articles and Videos), Regularly Updated Blog | Extensive Article Base, Advanced Strategy Guides, Trading Tutorials |

| Community | Responsive 24/7 Customer Support, CEO Accessibility, Active Social Media | Webinars, Live Q&A, Strong Social Media Influence |

| Engagement | Educational Content, Interaction on Twitter and Other Networks | Educational Content, Frequent Community Events and Engagement |

In the landscape of community and educational resources, these two platforms have made remarkable efforts to support you.

Whether you prefer self-learning through guides or interactive community engagements, Phemex and Kraken have structured their resources to help you navigate the complexities of cryptocurrency trading.

Phemex Vs. Kraken: Regulation And Compliance

When assessing Phemex and Kraken, you need to consider their adherence to regulatory standards and compliance within the various jurisdictions in which they operate. Their commitment to legality shapes your trading experience and the security of your investments.

Phemex:

- Established: 2019

- Regulatory Compliance: Phemex takes measures to ensure compliance, though it’s newer in the space, and information regarding specific licenses could be less widely known. You should monitor for the latest information on their regulatory compliance.

Kraken:

- Founded: 2011

- Regulatory Compliance: Known for a solid commitment to legal compliance, Kraken is:

- Registered: As a Money Services Business (MSB) in the United States with FinCEN.

- Licenses & Certifications: Sought permits as required in jurisdictions they serve.

Regulation in cryptocurrency is an evolving landscape, and Phemex and Kraken must navigate these changes continually.

Your due diligence is essential here as you may have preferences depending on your location and the legal frameworks that matter to you.

Audits and Security:

- Phemex: Conducts security audits, though details of certifications may not be as publicized.

- Kraken: Undergoes regular audits and has a reputation for prioritizing security, which may provide you with additional assurances.

Conclusion

When deciding between Phemex and Kraken, your preferences and trading requirements take center stage.

Phemex shines with its futures and derivatives trading offerings, providing up to 100x leverage, while Kraken’s leverage peaks at 5x.

Phemex:

- Best for futures and derivatives traders.

- Notable for high-leverage opportunities.

Kraken:

- It is suited for traders looking for lower leverage and a balanced platform.

- Renowned for its customer support, it is available 24/7 in multiple languages.

If your focus lies on security and diverse customer support, Kraken emerges as a robust choice. For those seeking advanced trading features and higher leverage for futures trading, Phemex stands out.

Tips for Further Exploration:

- Always continue to research both platforms for updates.

- Consider your risk tolerance for leverage trading.

- Explore community reviews and experiences.

Resources are plentiful, with many crypto communities regularly discussing these platforms’ merits.

Engage with these communities and consult updated reviews to keep abreast of any changes.

Your due diligence will equip you to make the most informed decision tailored to your investment strategy.

Explore how Phemex vs Kraken compare to their competitors:

- Phemex vs Bybit: Detailed Review and Comparison

- Phemex vs Binance: Detailed Review and Comparison

- Phemex vs MEXC: Detailed Review and Comparison

- Kraken vs Bybit: Detailed Review and Comparison

- Kraken vs Binance: Detailed Review and Comparison

- Kraken vs MEXC: Detailed Review and Comparison