MEXC and PrimeXBT are distinct cryptocurrency exchanges. MEXC offers a wide range of cryptocurrencies, user-friendly interface, and diverse trading options including spot, margin, and futures. PrimeXBT specializes in high-leverage trading across cryptocurrencies, forex, commodities, and indices, providing advanced tools for professional traders seeking sophisticated strategies.

When evaluating MEXC and PrimeXBT for your trading needs, consider the variety of features each platform offers. The table below provides a summarized comparison of essential aspects such as trading fees, withdrawal fees, deposit methods, supported cryptocurrencies, trading types, and user accessibility:

| Feature | MEXC | PrimeXBT |

|---|---|---|

| Trading Fees | Varies for different pairs | 0.05% for cryptocurrency assets |

| Withdrawal Fees | Varies based on currency | Not explicitly detailed |

| Deposit Methods | Multiple, including fiat and crypto | Mainly crypto |

| Supported Coins | Extensive list of cryptocurrencies | Selection includes popular cryptocurrencies |

| Trading Types | Spot, futures, and others | CFDs, commodities, indices, forex |

| User Accessibility | Information not detailed | Services available in 150+ countries |

MEXC’s platform may cater to a broader spectrum of cryptocurrencies and offers multiple deposit methods involving both fiat and digital currencies.

You will find your trading costs might differ per transaction, hence it’s crucial to check the latest fees for specific trading pairs on their site.

On the other hand, PrimeXBT standardizes its trading fees across cryptocurrency assets and is known for its focus on a wider array of markets including CFDs, and traditional financial instruments like commodities and indices in addition to forex trading. It stands out with user accessibility spanning over 150 nations globally.

Remember to verify this information on the respective platforms for the latest updates, as fees and features can change.

Mexc Vs Primexbt: Products And Services

When evaluating MEXC and PrimeXBT, the variety of products and services available for your trading journey is a critical consideration.

MEXC offers an extensive range of options, including spot trading, futures, and options trading. You can also engage with leveraged tokens and explore an NFT marketplace, catering to diverse crypto interests.

For your assets, MEXC presents staking services, allowing you to earn returns on your holdings.

On the other side, PrimeXBT is known for its margin trading platform, facilitating trading on crypto CFDs, commodities, indices, and forex. This exchange is tailored more towards users with an interest in trading beyond the cryptocurrency sphere.

Here’s a brisk comparison to help you weigh your options:

| Feature | MEXC | PrimeXBT |

|---|---|---|

| Spot Trading | Yes | No (CFD Trading only) |

| Futures Trading | Yes | Yes (Via CFDs) |

| Options Trading | Yes | No |

| Leveraged Tokens | Yes | No |

| NFT Marketplace | Yes | No |

| Staking | Yes | No |

| Forex & Commodities | No | Yes (CFDs) |

MEXC stands out for its broader scope of crypto-specific services such as options trading and an NFT marketplace, positioning itself as a versatile platform for various cryptocurrency activities.

In contrast, PrimeXBT offers strength in its diversified trading options, including traditional markets accessible through crypto-based accounts.

Both platforms implement a trade fee structure; however, PrimeXBT adds an overnight financing fee, which is a cost to consider if you hold leveraged positions after market close.

Your choice should align with your trading preferences—whether that be a focus on a wide array of cryptocurrencies with MEXC or broader market access with PrimeXBT’s CFDs on multiple asset classes.

Mexc Vs Primexbt: Contract Types

When you’re comparing MEXC and PrimeXBT, you’ll find a range of contract types available that cater to different trading strategies and preferences.

Each platform has its own set of offerings that can influence your trading approach.

MEXC

- Inverse Perpetual Contracts: You can trade contracts pegged to cryptocurrency rather than fiat. This means your profits and losses are in the underlying cryptocoin itself.

- Linear Perpetual Contracts: Such contracts are quoted and settled in USDT, making calculations and values easier to understand if you think in terms of fiat currency.

- USD-M Futures: These USD-margined futures allow you to speculate on the future value of cryptocurrencies with settlements in USD.

- Options: They are not commonly found on MEXC, focusing more on the futures and perpetual contracts.

PrimeXBT

- Inverse Perpetual Contracts: These contracts also exist on PrimeXBT, mirroring similar characteristics to those on MEXC, with your margin and PnL denominated in cryptocurrency.

- COIN-M Futures: Unlike MEXC, PrimeXBT features COIN-M futures, which means they are margined and settled in the underlying cryptocurrency itself.

- USD-M Futures: PrimeXBT does not commonly offer USD-margined futures, focusing more on crypto-margined products.

Both platforms don’t traditionally focus on options trading in the cryptocurrency space.

Whether you choose MEXC or PrimeXBT depends highly on your preference for margin and settlement currencies (crypto or USD) and the type of contracts you’re looking to trade.

Clearly understanding the contract structures will ensure you manage risk and strategy effectively on the respective platforms.

Mexc Vs Primexbt: Leverage And Margin

When exploring the leverage and margin offerings between MEXC and PrimeXBT, you will find key differences that cater to varying trader requirements.

Leverage trading on these platforms enables you to amplify your trading positions beyond your initial capital, thus potentially increasing your returns as well as your risk of capital loss.

PrimeXBT offers maximum leverage on cryptocurrencies up to 1:200 for BTC and ETH, with lower leverage on altcoins, typically up to 1:100.

This extends to a high leverage maximum of 1:1000 for forex pairs, with indices and commodities up to 1:100.

The margin interest fee at PrimeXBT is another consideration, as it applies to all leveraged trades and is calculated based on your position’s size and the prevailing market rates.

- Cryptocurrencies: up to 1:200

- Altcoins: up to 1:100

- Forex: up to 1:1000

- Indices/Commodities: up to 1:100

MEXC does not present exact numbers in the provided snippets, but as a competing exchange, you can expect a range of leverage options as well.

It is important for you to examine the specific numbers directly from MEXC to make accurate comparisons.

When you engage in leverage trading, always be mindful of the liquidation risks.

If the market moves against your position, you can quickly deplete your margin and potentially face liquidation.

Carefully consider the funding rates for holding leveraged positions, as these can impact the cost of your trades over time.

Both platforms require understanding of margin and leverage mechanics to manage trades effectively and to protect against the volatility inherent in cryptocurrency markets.

Before taking a leveraged position, it’s crucial to have a clear grasp of these concepts and the specific details of the exchange you choose to trade on.

Mexc Vs Primexbt: Liquidity And Volume

Liquidity and trading volume are crucial aspects that determine your trading efficiency on cryptocurrency exchanges. Both MEXC and PrimeXBT equip you with diverse trading environments, but they differ significantly in these metrics.

MEXC:

- Liquidity: MEXC ensures a robust market with continuous liquidity. This is crucial for executing your trades at close to your desired price, minimizing slippage.

- Volume: The exchange reports substantial daily trading volumes, reflecting active participation and a high number of transactions.

PrimeXBT:

- Liquidity: PrimeXBT works with 12+ liquidity providers. The integrated system ensures efficient trade execution, often essential for your trading strategies.

- Volume: An average daily trading volume of over $123,000,000 is evident on PrimeXBT. This signifies a high level of trading activity that is advantageous for market entry and exit.

Trading Efficiency: With MEXC’s updated monthly information on liquidity, you can make informed decisions.

Similarly, PrimeXBT’s ability to execute up to 12,000 orders per second significantly reduces the risk of slippage, with an average order execution speed of less than 7.12 ms.

Execution and Slippage: You’re likely to experience rapid trade execution on PrimeXBT, directly influencing the precision of order fulfillment.

Conversely, MEXC’s stable liquidity can aid in maintaining market order without considerable price changes.

Metrics and rankings from MEXC are updated monthly, ensuring up-to-date market information.

PrimeXBT reportedly aligns with high liquidity levels, sourced from a multitude of liquidity providers, presenting you with competitive data for effective trading.

Mexc Vs Primexbt: Fees And Rewards

When trading on MEXC and PrimeXBT, it’s essential to understand the fee structures and rewards to optimize your trading strategy.

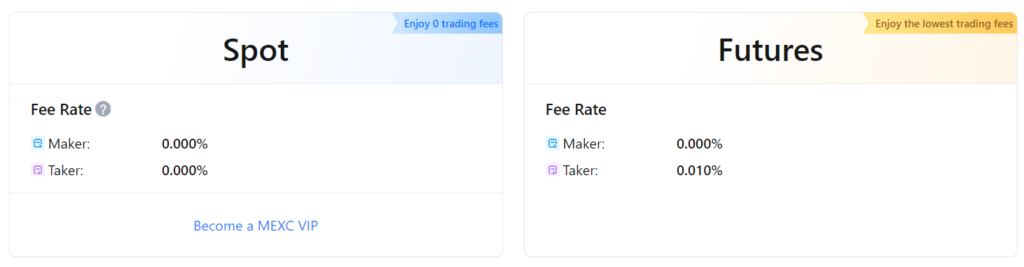

MEXC Trading Fees:

MEXC implements a tiered fee system based on your 30-day trading volume. As your volume increases, the fees you incur can decrease.

The typical maker fee starts at 0.20%, while the taker fee also begins at 0.20%. These fees can be reduced for high-volume traders.

Also, if you use the platform’s native token for transactions, you might benefit from discounted fees.

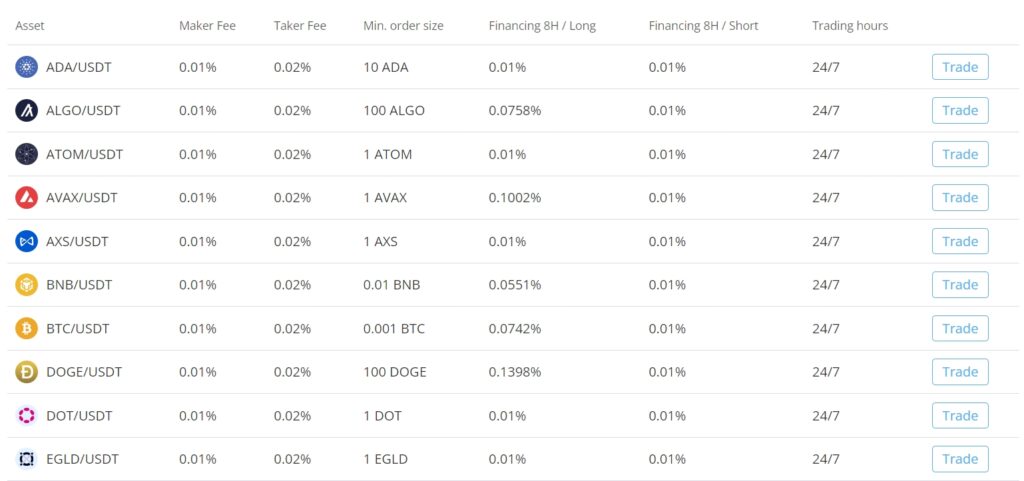

PrimeXBT Trading Fees:

PrimeXBT features a flat fee structure for its trading services. The platform charges a 0.05% fee on trades for its global markets, while the fees for crypto futures are 0.01% for makers and 0.02% for takers.

By offering a fixed rate, PrimeXBT simplifies the fee calculation process for you.

Reward Systems:

MEXC offers several ways for you to earn rewards, including a MX-DeFi hub, which allows you to join liquidity pools and possibly earn incentives, as well as potential airdrops through events such as M-Day.

These avenues serve to enhance the value of your trading experience and provide additional incentives.

Calculating Fees and Rewards:

Let’s assume you execute a trade worth $10,000 on MEXC. Your maker or taker fee (assuming the starting rate) would be $20.

On PrimeXBT, the same trade in global markets would incur a $5 fee, while crypto futures trading would cost you $1 as a maker or $2 as a taker.

Keep an eye out for any promotional periods or loyalty discounts, as these can offer significant savings on your trading activities.

Thoroughly understanding each platform’s fee and reward structure can be pivotal in your trading profitability.

Mexc Vs Primexbt: Trading Fee & Deposit/Withdrawal Fee Compared

When you trade on MEXC and PrimeXBT, you’ll encounter different fee structures. Here’s a breakdown to guide you through their trading and transaction fees:

MEXC Trading Fees:

- Maker Fee: This is the cost you incur for adding liquidity to the market. Usually, maker fees are lower than taker fees.

- Taker Fee: This fee applies when you remove liquidity from the market. Typically, taker fees are higher than maker fees.

PrimeXBT Trading Fees:

- Trading Fee: A flat rate charged on trades. This might be higher compared to others, affecting profitability.

Deposit and Withdrawal Fees:

- MEXC: Often offers various deposit methods with no associated fee. However, you must stay alert as withdrawal fees are regularly updated to reflect network conditions.

- PrimeXBT: No deposit fee is charged, but withdrawals are subject to fees. For example, withdrawing Bitcoin costs 0.0005 BTC, and Ethereum costs 0.002 ETH. Note that fees can vary with the network used, like ERC-20 or BEP-20 tokens for USDT withdrawals.

Mexc Vs Primexbt: Deposits & Withdrawal Options

When comparing MEXC and PrimeXBT, you’ll find distinctions in their deposit and withdrawal options that impact your trading experience.

MEXC and PrimeXBT differ in supported cryptocurrencies, user accessibility, processing times, and transaction costs.

Deposits

MEXC offers a variety of deposit methods, supporting a range of cryptocurrencies for funding your account. Each deposit option might involve different processing times, but typically, cryptocurrency deposits are credited after the network confirms the transaction.

- Supported Cryptos: Multiple

- Processing Time: Varies by network speed

- Minimum Deposit: Depends on the cryptocurrency

- Deposit Fees: Varies

In contrast, PrimeXBT does not define a fixed minimum deposit amount; it is determined by the trades you intend to make and the required margin. This means deposit limits can be variable.

- Supported Cryptos: Multiple, including BTC

- Processing Time: Dependent on the network

- Minimum Deposit: Trade-dependent

- Deposit Fees: May apply

Withdrawals

When withdrawing from MEXC, you’re subject to withdrawal fees, which can vary based on the blockchain network utilized. These fees can influence your overall trading cost.

- Withdrawal Fees: Yes, varies by network

- Minimum Withdrawal: Crypto-specific

- Processing Time: Dependent on network confirmation

PrimeXBT similarly charges withdrawal fees that are contingent on the blockchain network. This could potentially inflate the cost of trading on their platform.

- Withdrawal Fees: Yes, network-specific

- Minimum Withdrawal: Not specified

- Processing Time: Contingent on blockchain confirmation

Mexc Vs Primexbt: Kyc Requirements & Kyc Limits

MEXC and PrimeXBT have different approaches when it comes to Know Your Customer (KYC) policies and associated limits.

MEXC KYC Requirements:

- Primary KYC: You’re required to log in and click on [Identification] to verify.

- Documents: You’ll select your nationality of ID and ID type.

- Deposits: The platform might offer a deposit bonus upon completion of certain KYC procedures.

MEXC KYC Limits:

- Trading: Details about specific limits tied to KYC status are not provided in the snippet.

- Withdrawals: It’s unclear what the withdrawal limits are based on KYC level from the snippet.

PrimeXBT KYC Requirements:

- Account Verification: Registering and depositing funds allows you to begin trading with certain limits.

- Extended Limits: Completing the verification process increases withdrawal limits and grants access to additional rewards.

- CDD Review: May be triggered if account activity seems inconsistent with margin trading.

PrimeXBT KYC Limits:

- Withdrawal Limit without KYC: $20,000 within a 24-hour period for unverified users.

Mexc Vs Primexbt: Order Types

When trading cryptocurrencies, understanding the order types each exchange offers is crucial for executing your strategies and managing risk.

At MEXC, you have access to a range of order types including:

- Limit Orders: Set a specific price to buy or sell, offering you control over pricing.

- Market Orders: Execute immediately at the best available market price.

- Trigger Orders: Activated upon reaching a defined condition, useful for entering or exiting positions.

- Trailing Stop Orders: These adjust the stop price at a fixed percentage distance from the market price as it moves.

- Post-Only Orders: Guarantee you pay the maker fee and not the taker fee.

PrimeXBT, alternatively, streamlines the order types available to:

- Limit Orders: You can specify the price at which you want to buy or sell an asset.

- Market Orders: These orders will be filled at the best available current price.

- Stop Orders: This includes stop losses, which automatically sell your asset at a predefined price to limit potential losses.

- Conditional Orders: Triggered only when certain conditions are met, similar to MEXC’s trigger orders.

While MEXC offers a broader variety of orders such as post-only and trailing stop orders which can assist in more nuanced trading strategies, PrimeXBT focuses on the most utilized order types, catering to traders who prefer a more streamlined approach.

Using limit orders, you can mitigate slippage by setting precise entry or exit points. Market orders are your go-to for quick executions. With stop and conditional orders, you can automate trades to help protect against significant losses or to take profits at predetermined levels.

Remember to choose an exchange that aligns with your trading style and the complexity of strategies you wish to deploy. Each order type serves a unique purpose that, when used effectively, can play a pivotal role in the success of your trading outcomes.

Mexc Vs Primexbt: Security And Reliability

When assessing the security of MEXC and PrimeXBT, it’s crucial for you to consider the various measures each platform implements to safeguard your funds and personal information. Here’s what you need to know:

MEXC:

- Regulation: Operates with regulatory compliance in mind, although specifics depend on your jurisdiction.

- User Security Features: Includes options like 2-factor authentication (2FA), and anti-phishing codes.

- Past Incidents: The platform maintains a strong track record with no major security breaches reported.

PrimeXBT:

- Regulation: Registered in Seychelles; adheres to the legal standards required in their jurisdictions.

- User Security Features: Offers 2FA, withdrawal whitelist, and hardware security keys.

- Past Incidents: Also known for maintaining a high level of security without significant historical breaches.

Both platforms have made customer support accessibility a priority, providing you with a resource for addressing any concerns quickly. You’ll find support through various channels including live chat and support tickets.

As you navigate either platform, you benefit from a range of security protocols designed to protect your trading activities.

Reliability is also a shared strength, with both exchanges offering high uptime statistics, meaning you are less likely to encounter unexpected downtimes that could impact your trading.

Keep in mind: Staying informed about the current security features and past incidents is essential for making the most secure choices in your crypto trading activities.

Mexc Vs Primexbt: User Experience

When you compare MEXC and PrimeXBT, it’s evident that both platforms aim to provide seamless trading experiences tailored to various user needs.

MEXC is designed with a feature-rich environment in mind, catering to experienced traders with tools for spot and futures trading, margin support, and quantitative trading features.

Its interface might be overwhelming for beginners, but if you’re an advanced trader, you’ll appreciate the depth of analysis and trading options available. According to user feedback, MEXC maintains a healthy performance in trust with its proof-of-reserves status listed, and frequent updates reflect an improvement in the overall trading experience.

On the other hand, PrimeXBT offers a clean and intuitive design. It’s particularly noted for its user-friendly mobile app that replicates the functionality of its desktop platform.

This means that even on the go, you have full access to trading features, including 100+ markets. For newcomers, PrimeXBT allows a minimum of $5 to start trading, making it accessible for those looking to enter the market with less capital.

- Ease of Use:

- MEXC: Complex with various tools for experienced users.

- PrimeXBT: Simplified, user-friendly for beginners and advanced traders alike.

- Features:

- MEXC: Extensive trading options, advanced features.

- PrimeXBT: Concise feature set with innovative options like PrimeXBT Turbo.

Mexc Vs Primexbt: Education And Community

When comparing MEXC and PrimeXBT, you’ll notice distinct approaches to education and community.

MEXC focuses on providing a diverse set of learning materials that cater to traders at different expertise levels.

You can access a variety of tutorials, how-to guides, and trading strategies through their platform, which are designed to help you understand both the basics of cryptocurrency and more complex trading concepts.

On the other hand, PrimeXBT prides itself on an extensive Education Center.

It serves as a repository where you can find articles, video tutorials, and webinars. Not only do they offer insights into using their platform effectively, but they also delve into general trading strategies and market analysis.

Community Engagement:

- MEXC:

- Active social media channels providing updates and support

- Regular community events and AMAs (Ask Me Anything)

- Responsive customer support

- PrimeXBT:

- Social Trading feature to engage with other traders

- Blogs and market updates for educational content

- Collaborative atmosphere through trading communities like Telegram groups

In terms of social media presence, both platforms engage their communities with regular updates, educational content, and interactive discussions. MEXC and PrimeXBT engage their users on platforms such as Twitter and Reddit. This allows them to provide timely market information and foster a sense of community among users. They also utilize these channels for customer service inquiries and to keep the dialog open with their user base.

Each exchange has built a respectable presence within the crypto community, though the way they educate and engage with their users differs slightly. Whether you prefer an exchange with more structured learning resources or one with an interactive community may influence your choice between MEXC and PrimeXBT.

MEXC vs PrimeXBT: Regulation and Compliance

When considering MEXC and PrimeXBT, understanding their regulatory framework is crucial for your peace of mind. As a trader, you want to ensure you’re operating on platforms that adhere to legal and ethical standards.

MEXC, recognized for a broad scope of trading pairs and services, operates under a framework that includes monthly updates on their compliance. However, the search results do not specify the exact licenses or audits that MEXC has undertaken. It’s recommended to directly review MEXC’s disclosures to ascertain their current compliance status.

On the other hand, PrimeXBT is registered in Seychelles and has offices in St. Vincent and the Grenadines. Although registration does not equate to being licensed by a financial regulatory body, it indicates a level of commitment to compliance. The platform does not explicitly state the possession of any financial licenses in the search results, making it essential to conduct further research into their disclosures or any third-party audits they may have undergone.

Both platforms, based on the snippets provided, do not readily advertise certifications or licenses. As a user, you are encouraged to probe the platforms for their respective Terms of Service and Privacy Policies to better understand their commitment to regulation and compliance.

Be aware of the regulatory environment as it can impact your trading activities. While controversies and challenges are not highlighted in the search results, it is prudent to stay informed about any ongoing or past issues that may affect the platform’s operation and your trading experience.

Conclusion

When considering MEXC versus PrimeXBT, your choice hinges on distinct preferences and requirements.

MEXC generally offers a more comprehensive range of deposit methods and competitive fees, which may appeal to a broader audience. It updates its information monthly, ensuring you have access to the latest data for your trading decisions.

PrimeXBT, on the other hand, stands out for its advanced features like copy trading and a variety of markets, including cryptocurrencies, forex, and more. It is favored by experienced traders who are familiar with high leverage and can navigate the complexities of an unregulated platform.

MEXC:

- Better for: Beginners to intermediate traders

- Standout Feature: Diverse deposit options

- User Experience: Regular updates on trading conditions

PrimeXBT:

- Better for: Experienced traders

- Standout Feature: Advanced trading tools like copy trading

- User Experience: High leverage trading

For ongoing learning, consider following industry websites and forums, enrolling in online courses on trading, and attending webinars hosted by trading platforms.

These will equip you with the knowledge to make informed decisions tailored to your trading style.

Remember, both platforms have specific strengths, and your decision should align with your experience level and investment goals. Always continue to do thorough research before committing to any trading platform.

Explore how MEXC and PrimeXBT compare to their competitors:

- MEXC vs Bybit: Comparison at a Glance

- MEXC vs Bitget: Comparison at a Glance

- MEXC vs Kraken: Comparison at a Glance

- PrimeXBT vs Bybit: Comparison at a Glance

- PrimeXBT vs Phemex: Comparison at a Glance

- PrimeXBT vs Bitmex: Comparison at a Glance