Phemex and PrimeXBT are notable cryptocurrency exchanges catering to different needs. Phemex offers robust derivatives trading, high leverage, zero-fee spot trading for premium members, and a user-friendly interface. PrimeXBT specializes in leveraged trading across cryptocurrencies, forex, commodities, and indices, providing advanced tools for professional traders seeking sophisticated strategies.

When comparing Phemex and PrimeXBT, you will notice key differences and similarities that cater to various trader needs. Below, the essential features of each platform are outlined to give you a quick overview of what each has to offer:

| Feature | Phemex | PrimeXBT |

|---|---|---|

| Leverage | Up to 100x | Up to 100x |

| Trading Pairs | Wide variety | Similar range; potentially more extensive |

| User Interface | User-friendly | Advanced features |

| Academy/Resources | Yes, including articles and tutorials | Yes, including blog and tutorials |

| Customer Support | 24/7 via live chat and email | Not specified |

| Deposits | Cryptocurrency, using an invitation code, may offer a bonus | Cryptocurrency; other methods not specified |

| Trading Types | Spot, derivatives | Spot, derivatives, forex, commodities, others |

| Availability Rate | Not specified | 99.9%, with high uptime |

Phemex emphasizes an accessible platform with straightforward navigation, supported by educational materials through their academy. They hold an advantage with their user-friendly interface, which is suitable if you’re looking for simplicity and ease of use.

PrimeXBT, on the other hand, stands out with its broad range of trading pairs and robust platform, boasting a high availability rate, which is essential if your trading strategy requires constant market access. Their educational resources can also provide valuable information, catering to traders at different levels.

Both platforms offer significant leverage options, with a maximum of up to 100x, and provide similar services such as spot and derivatives trading. However, PrimeXBT expanded its offering to include markets like forex and commodities.

Customer support in Phemex is quantified with constant availability, whereas PrimeXBT’s is not specified in the provided details.

Phemex vs PrimeXBT: Products and Services

When evaluating the services offered by Phemex and PrimeXBT, you’ll notice that both platforms have robust trading systems but varying focuses.

Phemex is known for its zero-fee spot trading and maker-taker fee model for futures trading.

It offers a significant range of cryptocurrencies for trading and additional educational resources through its Phemex Academy.

PrimeXBT, on the other hand, stands out for its flat fee structure, which can be an advantage for ease of understanding costs.

The platform provides services that include spot and futures trading, emphasizing leveraged trading options to amplify your trading power.

| Feature | Phemex | PrimeXBT |

|---|---|---|

| Spot Trading | ✓ Zero fees | ✓ Flat fee structure |

| Futures Trading | ✓ Maker-taker fees | ✓ Leverage trading with competitive fees |

| Educational Content | ✓ Phemex Academy | ✓ Extensive tutorial and blog content |

| User Experience | ✓ 24/7 Customer Support via live chat and email | ✓ Streamlined platform for beginners and experts |

Both platforms strive to innovate and improve the user experience. Phemex ensures that traders are supported with educational content and customer service.

PrimeXBT leverages a user-friendly interface to benefit both novice and seasoned traders.

Selecting between the two will depend on your specific needs—whether that involves seeking the cheapest fees, requiring powerful leveraged options, or valuing educational support highly.

Phemex vs PrimeXBT: Contract Types

When examining the range of contract types available, you’ll notice that both Phemex and PrimeXBT cater to different trading preferences with several options.

Phemex offers:

- Inverse Perpetual Contracts: These are contracts where the quote and settlement are in cryptocurrency, typically attractive if you prefer to transact in digital assets rather than fiat currency.

- Linear Perpetual Contracts: Quoted and settled in USD, these contracts can be more intuitive if you’re accustomed to fiat calculations.

- Options: Phemex also provides options contracts, which give you the flexibility to buy or sell an asset at a predetermined price within a set time frame.

PrimeXBT features:

- Inverse Perpetual Contracts: Similar to Phemex, you’ll find these contracts quoted and settled in the cryptocurrency, allowing for direct crypto market engagement.

- COIN-M Futures: These contracts are settled in the underlying cryptocurrency, which means the product’s value is derived from the base coin rather than a fiat currency.

| Feature | Phemex | PrimeXBT |

|---|---|---|

| Inverse Perpetual Contracts | Available | Available |

| Linear Perpetual Contracts | USD Settlement | Not Explicitly Offered |

| Options | Available | Not Available |

| COIN-M Futures | Not Explicitly Offered | Cryptocurrency Settlement |

| USD-M Futures | USD Settlement (Linear Contracts) | Not Available |

Each contract type has its benefits depending on your trading strategy and preferred currency for settlement.

Consider your comfort level with currency fluctuations, fees, and settlement methods when choosing between Phemex and PrimeXBT for your trading needs.

Phemex vs PrimeXBT: Leverage and Margin

Phemex and PrimeXBT notably provide leverage trading options, allowing you to amplify your positions and potential returns in the cryptocurrency market.

Phemex offers a maximum leverage of up to 100x on specific crypto pairs.

This high leverage means you can control a more prominent position with a smaller initial margin, maximizing potential profits if the market moves in your favor.

However, with higher leverage comes increased risk, including the possibility of quick liquidation if the market moves against you.

To manage this, Phemex requires sufficient margin maintenance and offers detailed risk management features.

PrimeXBT, similarly, allows up to 100x leverage on its cryptocurrency trades and even more on other trading instruments.

PrimeXBT’s leverage capabilities also allow scaling up trade sizes with relatively lower capital investment.

With augmented leverage mechanisms, the profit potential is magnified, and losses and liquidation risks are as present as on Phemex.

Both platforms operate with margin requirements that enforce trader discipline, and they keenly stress the need to understand liquidation thresholds.

Funding rates on both exchanges are mechanisms used to ensure the market’s stability, especially in perpetual contracts, and can affect the costs of holding positions.

| Exchange | Max. Crypto Leverage | Key Margin Feature |

|---|---|---|

| Phemex | Up to 100x | Risk management tools for margin |

| PrimeXBT | Up to 100x | Extended leverage on various instruments |

When engaging with leverage and margin trading, understanding liquidation risks and using appropriate stop-loss orders are vital for managing the high stakes involved in leveraged positions.

Phemex vs PrimeXBT: Liquidity and Volume

When evaluating Phemex and PrimeXBT, liquidity and trading volume are crucial factors for your trading efficiency.

Phemex:

- Liquidity: Renowned for its robust order book depth, which ensures significant liquidity.

- Volume: Features consistently high trading volumes, indicating active trading pairs and a dynamic market.

- Impact: This translates to higher efficiency in trade execution and reduced slippage for your transactions.

Liquidity Sources:

Phemex maintains strategic partnerships to pool liquidity, facilitating a smoother trading experience.

PrimeXBT:

- Liquidity: Offers deep liquidity paired with a large user base, providing accessibility to ample funds on the market.

- Volume: Known for solid trading volumes that support market stability and resilience.

- Impact: Due to strong market presence, your trades on PrimeXBT can be executed with speed, precision, and minimal slippage.

Volume Metrics:

PrimeXBT reveals its volume statistics transparently, presenting up-to-date metrics that reflect current market conditions.

Liquidity Rankings:

Both exchanges rank favorably among their peers, implying that your trades will likely face minimal adverse effects of price slippage, ensuring market orders are filled close to the expected prices.

For you, robust volume and liquidity mean more efficient trading, lower trading costs, and reliable execution. You should monitor liquidity and volume as they are dynamic and react to market developments.

Phemex vs PrimeXBT: Fees and Rewards

When examining Phemex and PrimeXBT, you’ll notice each platform has distinct fee structures that will affect your trading experience.

Phemex adopts a maker-taker fee model, benefiting you if your trades provide liquidity to the market (maker) or take liquidity away (taker).

- Maker Fee: 0.1%

- Taker Fee: 0.06%

This model can be more economical if you’re an active trader since higher volume can lead to lower fees.

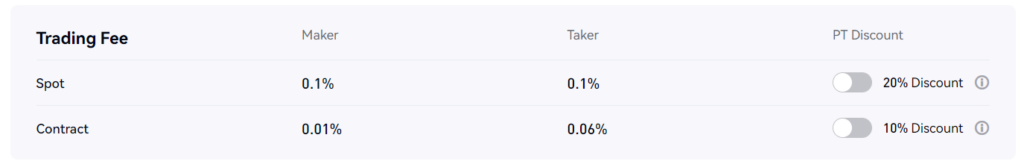

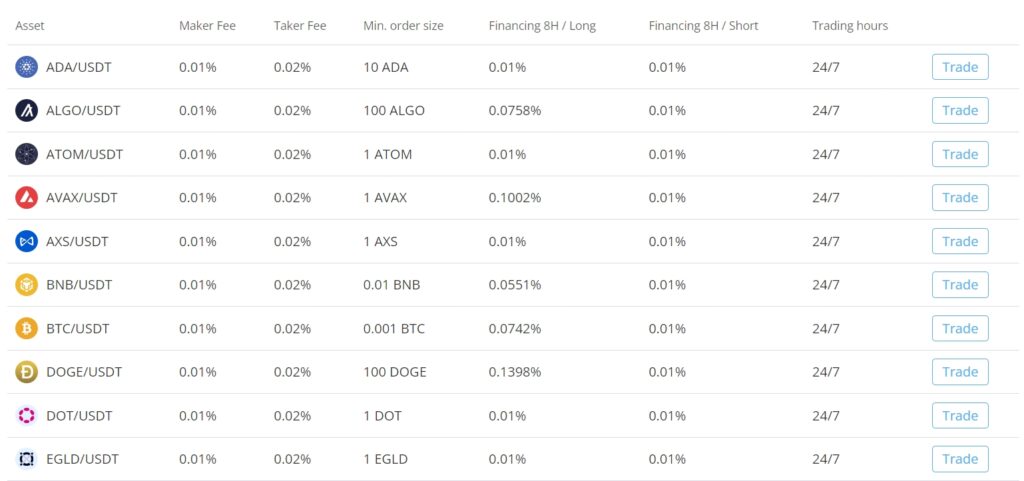

PrimeXBT, on the other hand, utilizes a flat fee model for trades.

- Flat Fee: Ranges from competitive to varying based on the instrument traded

The simplicity of a flat fee can be advantageous for you if you prefer a straightforward cost structure.

Both platforms may offer different rewards or incentives, which can sometimes offset the cost of these fees. For instance, you might benefit from:

- Phemex: A no-fee policy on deposits and withdrawals can be particularly beneficial if you frequently move funds in and out of the platform.

- PrimeXBT: A potential rewards system that can provide bonuses under certain conditions.

To calculate the cost of a trade, apply the respective fee percentage to your total trade amount. For higher volume traders, Phemex may also offer tiered discounts, reducing the fees further for larger trades.

Phemex vs PrimeXBT: Trading Fee & Deposit/Withdrawal Fee Compared

When examining the trading fee structures of Phemex and PrimeXBT, you’ll notice a distinct difference in their approaches.

Phemex operates with a maker-taker fee model:

- Maker Fee: 0.1%

- Taker Fee: 0.06%

This model incentivizes market liquidity by rewarding those who provide liquidity (makers) with lower fees than those who take liquidity (takers).

PrimeXBT, on the other hand, prefers a flat fee model. Regardless of whether you’re adding or removing liquidity, you’ll encounter:

- Flat Fee: A competitive single rate for all trades, simplifying calculations.

In terms of deposit and withdrawal fees:

- Phemex boasts a no-fee policy for both deposits and withdrawals, which can reduce your overall trading costs.

- PrimeXBT charges a withdrawal fee of 0.0005 BTC. It’s crucial to note that while the deposits might be free, the flat withdrawal fee applies regardless of the amount.

Other considerations may include the impact of your trading volume on potential discounts on trading fees with Phemex, an advantage for high-frequency traders. PrimeXBT remains transparent with a single rate, simplifying your calculation.

| Exchange | Maker Fee | Taker Fee | Deposit Fee | Withdrawal Fee |

|---|---|---|---|---|

| Phemex | 0.1% | 0.06% | None | None |

| PrimeXBT | – | Flat Rate | None | 0.0005 BTC |

Remember that fee structures are subject to change, and it’s wise to always confirm the current fees directly from the exchanges’ official resources before initiating your trades.

Phemex vs PrimeXBT: Deposits & Withdrawal Options

Phemex provides a range of deposit methods, including cryptocurrency and traditional banking options like credit card payments.

Your deposits enable leverage trading up to 100x your initial investment. Furthermore, Phemex has a no-fee policy on deposits and most withdrawals, contributing to cost efficiency.

PrimeXBT, on the other hand, focuses more on crypto-based transactions. Starting from $10, you can deposit fiat currencies via AdvCash. The flexibility PrimeXBT offers for purchasing cryptocurrency can be a significant convenience.

PrimeXBT is known for its flat fee model, which simplifies your trades’ cost structure.

| Feature | Phemex | PrimeXBT |

|---|---|---|

| Fee Policy | No fees on most deposits and withdrawals | Simple flat fee model |

| Deposits | Cryptocurrencies, Credit Cards | Cryptocurrencies, Fiat via AdvCash |

| Withdrawals | Mostly no-fee, but some options might incur a charge | It might include fees depending on the withdrawal method |

| Currencies Supported | Multiple cryptocurrencies | Primarily crypto, with some fiat options |

| Minimum Deposit | Varies by method; some options have no minimum | There is no minimum for crypto; fiat starts at $10 |

Phemex vs PrimeXBT: KYC Requirements & KYC Limits

When you compare the KYC requirements for Phemex and PrimeXBT, you’ll notice distinct differences that may influence your choice of platform based on your preference for privacy and compliance.

Phemex

KYC Policies:

- KYC: Optional for essential account functions but required for certain features and jurisdictions

- Documents: A form of identification such as a passport or valid ID card

Limits Based on KYC:

- Withdrawals: Phemex has set specific limits for withdrawals that vary depending on your KYC status

PrimeXBT

KYC Policies:

- KYC: No mandatory requirement for typical services, prioritizing user privacy

- Documents: Not required for standard account operations

Limits Based on KYC:

- Withdrawals: PrimeXBT offers more freedom with fewer restrictions tied to KYC status, encouraging ease of access

KYC processes are crucial for user security and ensuring that the exchanges comply with regulations.

In your case, your preference for privacy against the need for higher transaction limits will determine the suitable platform.

Phemex might limit certain functions without KYC, whereas PrimeXBT enables more access without stringent KYC checks, balancing privacy with service accessibility.

Phemex vs PrimeXBT: Order Types

When trading on Phemex and PrimeXBT, you can access various order types, which are crucial for implementing your trading strategies and managing risks efficiently.

Each platform offers several common types of orders and unique options catering to different trading styles.

Phemex

- Market Orders: Allows you to buy or sell instantly at the current market price.

- Limit Orders: You set the price you want to buy or sell, providing better control over the entry or exit points.

- Stop Loss/Take Profit: Automatically close a position when the market hits a predefined price level to either lock in profits or limit losses.

- Conditional Orders: Trigger a market or limit order when you meet certain conditions.

- Post-Only Orders: Ensure that the order is added to the order book and does not match a pre-existing order, allowing you to always pay the maker fee.

- Reduce-Only Orders: A feature in position management that ensures an order will only reduce your position, not increase it.

PrimeXBT

- Market Orders: Buy or sell immediately at the best available current price.

- Limit Orders: Set your desired entry or exit price, giving you control over the price at which the order will be executed.

- Stop Orders*: Place a stop loss or take profit as part of your risk management strategy.

- OCO (One-Cancels-the-Other) Orders: Combine a stop order with a limit order. When one is triggered and executed, the other is automatically canceled.

Selecting and using the correct order types can significantly impact your trading efficacy. Choose the platform that best fits your trading needs based on these features.

Phemex vs PrimeXBT: Security and Reliability

When comparing the security and reliability of Phemex and PrimeXBT, it’s essential to consider how these platforms safeguard your investments and personal information.

Former Morgan Stanley veterans founded Phemex and have built a reputation on robust security features.

Your digital assets are protected through cold wallet storage, which keeps funds offline and away from potential online threats, and a multi-signature withdrawal process for additional checks.

| Feature | Phemex | PrimeXBT |

|---|---|---|

| Fund Security | Cold wallet storage, 2FA | 2FA, Hardware security modules |

| Platform Security | Multi-signature withdrawals | Cloudflare DDoS protection |

| Past Incidents | None publicly reported | None publicly reported |

| Regulatory Compliance | Know Your Customer (KYC) | KYC efforts to meet regulations |

PrimeXBT, established in 2018, prides itself on its high availability rate of 99.9%. This rate implies that it offers near-constant market access, critical for a market that never sleeps.

Security-wise, PrimeXBT enforces two-factor authentication (2FA) and uses hardware security modules with a rating of FIPS PUB 140-2 Level 3 or higher.

Both platforms have reportedly had no major security breaches publicly disclosed. This suggests diligence in maintaining security infrastructure and responding rapidly to potential vulnerabilities.

Regarding regulatory compliance, both exchanges operate with KYC procedures to verify the identity of their users, aligning with international anti-money laundering standards.

Customer support is a linchpin for trust between you and an exchange.

Phemex and PrimeXBT offer support through multiple channels, including live support on their sites, showing a commitment to promptly addressing your queries and concerns.

Phemex vs PrimeXBT: User Experience

When analyzing the user experience on Phemex and PrimeXBT, you’ll find that both platforms prioritize accessibility and streamlined design.

Phemex:

- Interface: Offers a clean and intuitive design for novice and experienced traders.

- Mobile App: Provides a comprehensive mobile application replicating the web platform’s functionality.

- Support: Delivers robust 24/7 customer service via live chat and email.

PrimeXBT:

- Interface: Equipped with a customizable and straightforward interface, the platform appeals to various traders.

- Tools: Includes over 50 indicators and advanced charting to support various trading strategies.

- Support: Like Phemex, it offers 24/7 live chat support, ensuring timely assistance.

Both platforms are built with speed and functionality at the core, but they cater to different preferences in trading styles and experience levels. Here’s how they differ in specifics:

| Feature | Phemex | PrimeXBT |

|---|---|---|

| Interface | Intuitive and user-friendly | Highly customizable and user-friendly |

| Trading | Maker-taker fee model; no deposit fees | Flat fee structure; simple fee model |

| Support | Live chat, email, responsive customer care | Live chat; noted for timely user support |

| Mobile | Seamless trading on the go | N/A (no specific mobile app data available) |

Phemex vs PrimeXBT: Education and Community

When choosing a cryptocurrency exchange platform, the education and community resources can significantly enhance your trading experience.

Both Phemex and PrimeXBT recognize the importance of these aspects and have tried to cultivate them.

Phemex offers a dedicated ‘Learn & Earn’ program, an educational initiative that rewards you for expanding your crypto knowledge. This program consists of tutorials and quizzes that help you understand cryptocurrency concepts.

Moreover, their commitment to user education extends to comprehensive guides and articles accessible through their blog.

On the community front, Phemex maintains an active presence across social platforms like Twitter and Telegram. Here, you can find updates and market insights and interact with fellow traders.

PrimeXBT, on the other hand, provides an extensive range of educational materials. This includes a frequently updated blog with informative content covering market analysis, trading tips, and the latest industry news.

- Trading Academy is another facet where PrimeXBT shines. They offer video tutorials and step-by-step guides designed to cater to novice and seasoned traders.

Regarding community engagement, PrimeXBT also has an active Twitter presence alongside other social media channels. They foster a space where you can join discussions, gain insight, and stay updated with the latest platform developments.

Phemex vs PrimeXBT: Regulation and Compliance

When you trade with Phemex, you engage with a platform that places a significant emphasis on regulation and compliance.

Phemex has established itself as a trustworthy platform by maintaining rigid security protocols and focusing on adhering to the legal standards of the regions in which it operates.

Though specific licenses and audits were not detailed in the information provided, their commitment to security can strongly indicate their dedication to compliance.

In contrast, PrimeXBT operates its trading services globally. To maintain a high standard of trust, they must also comply with diverse regulatory requirements.

While detailed compliance information is not explicitly covered here, PrimeXBT’s high availability rate and commitment to a stable trading ecosystem suggest an awareness of the importance of meeting industry standards for operational integrity.

- Phemex:

- Emphasis on layered security protocols

- Advances regulation and compliance efforts

- Focus on adherence to local legal requirements

- PrimeXBT:

- Global operational standards

- Presumed compliance through platform reliability and uptime

For you as a trader, understanding these platforms’ regulation and compliance aspects is crucial.

While Phemex and PrimeXBT strive to offer services aligned with regulatory standards, always verify their standing with relevant financial authorities in your jurisdiction before trading.

Conclusion

When comparing Phemex and PrimeXBT, you’ll find that each platform offers unique features tailored to different trader profiles.

Phemex operates on a maker-taker fee model. Maker fees are at 0.1%, and taker fees are at 0.06%. These rates could benefit active traders who can take advantage of them. Moreover, Phemex’s no-fee policy on deposits and withdrawals adds to its appeal.

On the other hand, PrimeXBT stands out with its flat fee structure. This could be more advantageous for traders preferring a straightforward cost model.

Moreover, PrimeXBT’s provisions for copy trading and its capabilities in leveraged trading might offer more to those with a higher risk appetite and more experience in trading.

For new traders:

- Phemex’s educational resources and more straightforward fee structure may reduce entry barriers.

- PrimeXBT’s high-leverage options and advanced features might be challenging to navigate without prior experience.

For experienced traders:

- Phemex could potentially offer cost savings through its maker-taker model.

- PrimeXBT’s advanced trading options and copy trading could amplify trading strategies.

If you want to learn more or explore these platforms further:

- Consider Phemex Academy for comprehensive articles and tutorials.

- Explore PrimeXBT’s blogs and tutorials to deepen your understanding.

Remember to conduct due diligence and ensure your platform aligns with your trading needs and financial goals.

Explore how Phemex and PrimeXBT compare to their competitors:

- Phemex vs Binance: An Objective Comparison

- Phemex vs Bybit: An Objective Comparison

- Phemex vs MEXC: An Objective Comparison

- PrimeXBT vs BingX: An Objective Comparison

- PrimeXBT vs MEXC: An Objective Comparison

- PrimeXBT vs Bybit: An Objective Comparison