Kraken and PrimeXBT are leading cryptocurrency exchanges with unique offerings. Kraken is renowned for its strong security measures, regulatory compliance, and extensive range of cryptocurrencies and trading options. PrimeXBT focuses on high-leverage trading across cryptocurrencies, forex, commodities, and indices, catering to professional traders with advanced tools and strategies.

When choosing between Kraken and PrimeXBT for your trading needs, you’ll want to consider the unique features, fee structures, and trading options that each platform offers.

Below is a summarized comparison to guide your decision.

| Feature | Kraken | PrimeXBT |

|---|---|---|

| Supported Coins | Over 220 crypto tokens | Over 30+ assets including Crypto, FX, Commodities |

| Leverage | Up to 1:5 on spot crypto | Up to 500x for various assets |

| Trading Platform | Proprietary trading terminal | Customizable trading platform |

| Trading Volume | High volume, liquidity | – |

| Deposit Methods | Multiple, including fiat | Deposits in BTC only |

| User Accessibility | Traders from US accepted | US traders may have restrictions |

| Fees | Stable rollover fees on spot transactions | – |

This table should give you a clear starting point to further investigate which platform suits your trading strategy best.

Remember to consider the type of assets you want to trade, the level of leverage you’re comfortable with, and the liquidity which can impact your trades.

Take note that while Kraken provides a sizable list of crypto tokens and relatively moderate leverage, PrimeXBT offers a wider range of assets including non-crypto options, along with significantly higher leverage opportunities.

Your choice between Kraken and PrimeXBT should align with your trading preferences and the individual features you value most in a cryptocurrency exchange.

Kraken vs PrimeXBT: Products and Services

When comparing the products and services of Kraken and PrimeXBT, you’ll notice both platforms cater to traders with different needs.

Kraken, established in 2011, is well recognized for its wide range of services. It offers:

- Spot trading: A robust platform with a variety of cryptocurrency pairs.

- Futures trading: Provides leverage for those looking to trade on future price movements.

- Margin trading: Allows trading with borrowed funds to increase potential returns.

- Staking: Enables you to earn rewards by staking certain cryptocurrencies.

- NFT marketplace: A newer addition facilitating the trade of digital collectibles.

PrimeXBT, a Bitcoin-based trading platform, focuses more on leveraged trading options. Its services include:

- Leveraged trading: Up to 100x leverage on various assets, including cryptocurrencies.

- Covesting: A copy-trading feature allowing you to follow the trades of seasoned users.

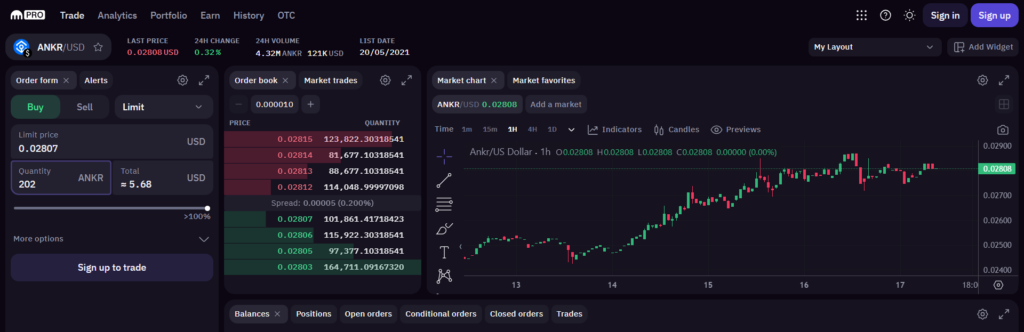

- Customizable interface: Tailor the trading environment to your preferences with multiple charting and analysis tools.

Kraken shines with its broader service range, fluid user experience, and additional features like staking and an NFT marketplace. PrimeXBT, on the other hand, is tailored toward users looking for high leverage and unique features such as covesting, which can be particularly attractive for less experienced traders seeking guidance from veterans.

Each platform offers a particular niche; your choice depends on whether you prioritize a comprehensive service range or specialized leveraged trading tools.

Both have their own user-friendly interfaces, but Kraken takes a slight edge with its commitment to security and regulatory compliance.

Kraken vs PrimeXBT: Contract Types

When exploring Kraken and PrimeXBT to understand the variety of contracts they offer, you’ll find that both platforms have a range of options suited to different trading strategies.

On Kraken, you have access to:

- Inverse Perpetual Contracts: These contracts allow you to hedge or speculate on the price movements of cryptocurrencies without the need to own the underlying asset. Your profits or losses are realized in the base cryptocurrency.

- Options: Options contracts give you the right, but not the obligation, to buy or sell a cryptocurrency at a predetermined price. They offer the flexibility to execute varied trading strategies.

PrimeXBT offers a different set of contract types, including:

- Linear Perpetual Contracts: Your trading here is straightforward, as these contracts are quoted and settled in USD, making them easy to understand if you’re accustomed to fiat transactions.

- Inverse Futures Contracts: These are traditional types of futures contracts that involve the delivery of a specific amount of cryptocurrency at a predetermined price at a future date.

Neither Kraken nor PrimeXBT prominently feature COIN-M Futures (settled in the base cryptocurrency) and USD-M Futures (settled in US dollars). This suggests that you may want to consider other platforms if these are integral to your trading strategy.

Each platform inherently has its benefits and drawbacks. The choice between Kraken and PrimeXBT should be made based on your preference for the type of contract that aligns with your investment approach, the currency of settlement you’re comfortable with, and the platform’s user interface that best suits your trading style.

Kraken vs PrimeXBT: Leverage and Margin

When you’re considering Kraken and PrimeXBT for your trading needs, understanding their leverage and margin options is crucial. These tools can amplify your trading positions, allowing you to potentially increase your returns.

Kraken offers you leverage of up to 1:5 for spot crypto trading, which means you can trade five times the value of your deposit.

For futures, Kraken extends the leverage up to 1:50. Their margin requirements are designed to protect you from the possibility of a negative balance, ensuring that you cannot lose more than your account equity.

The exchange implements a tiered margin system and liquidation can occur if your positions move against the market. This safeguards against the risk of negative balance.

PrimeXBT, on the other hand, stands out with a much higher leverage, offering you up to 500x on various assets including cryptocurrencies, FX, commodities, and indices.

This high leverage can significantly augment your trading position, but it comes with increased risk.

With a 100x leverage on cryptocurrencies, the margin requirements vary based on the position size, and you should be aware that with higher leverage comes a closer liquidation threshold.

PrimeXBT follows a margin system that liquidates positions once they reach a certain threshold to prevent your balance from falling below the maintenance margin level.

Be mindful of the funding rates, which apply on both platforms, as they can affect the cost of holding leveraged positions. Kraken’s rollover fees tend to be stable, while PrimeXBT’s may vary depending on market conditions.

Remember, while leverage can magnify your gains, it also increases the potential for losses. Therefore, it is vital to understand the correlation between leverage, margin requirements, and liquidation risks before engaging in leveraged trading.

Kraken vs PrimeXBT: Liquidity and Volume

When you’re trading cryptocurrencies, understanding the liquidity and volume of an exchange is crucial to your ability to execute trades efficiently.

High liquidity typically results in tighter spreads and less slippage, leading to better execution of trades.

Kraken, founded in 2011, is renowned for its high liquidity, especially when it comes to the Euro (EUR) markets.

As of the latest data, Kraken is one of the largest exchanges in terms of Bitcoin trading volume denominated in EUR. This substantial volume indicates that you are more likely to have your orders filled quickly and at predictable prices, reducing the cost of trading in terms of both time and money.

PrimeXBT, on the other hand, although newer and less established than Kraken, offers competitive liquidity.

However, the exact volume and liquidity rankings for PrimeXBT might not match those of Kraken.

For you, this can mean that while PrimeXBT can still offer efficient trade execution, it may, at times, experience more slippage than Kraken, especially during volatile market conditions or for large order sizes.

| Exchange | Volume Ranking | Noted Market |

|---|---|---|

| Kraken | Top for EUR | High Bitcoin liquidity |

| PrimeXBT | – | Competitive liquidity |

Your choice of exchange may depend on the specific cryptocurrencies you wish to trade and the volume of trade you plan to execute.

Kraken’s established reputation and large volume could be reassuring, but remember that both exchanges are subject to fluctuating market conditions that can affect liquidity at any time.

Kraken vs PrimeXBT: Fees and Rewards

When trading cryptocurrencies, you should consider the fees and rewards that exchanges like Kraken and PrimeXBT offer.

Each platform has a distinct fee structure and incentives that can impact your trading profitability.

Kraken

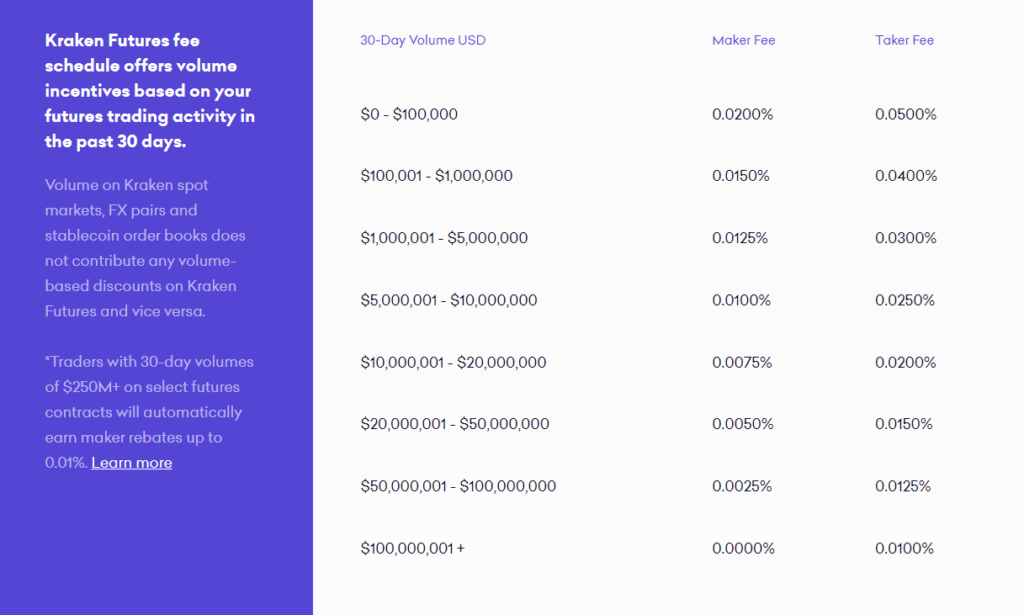

- Trading Fees: Kraken’s fees are based on a maker-taker model with the costs varying depending on your 30-day trading volume.

- Makers (those who add liquidity to the market by placing limit orders) usually pay lower fees than takers (those who remove liquidity by filling orders).

- Fees can start as low as 0.16% for makers and 0.26% for takers, decreasing with increased volume.

- Staking Rewards: Kraken also offers staking services where you can earn rewards, enhancing your potential returns. Staking different cryptocurrencies may yield different reward rates.

PrimeXBT

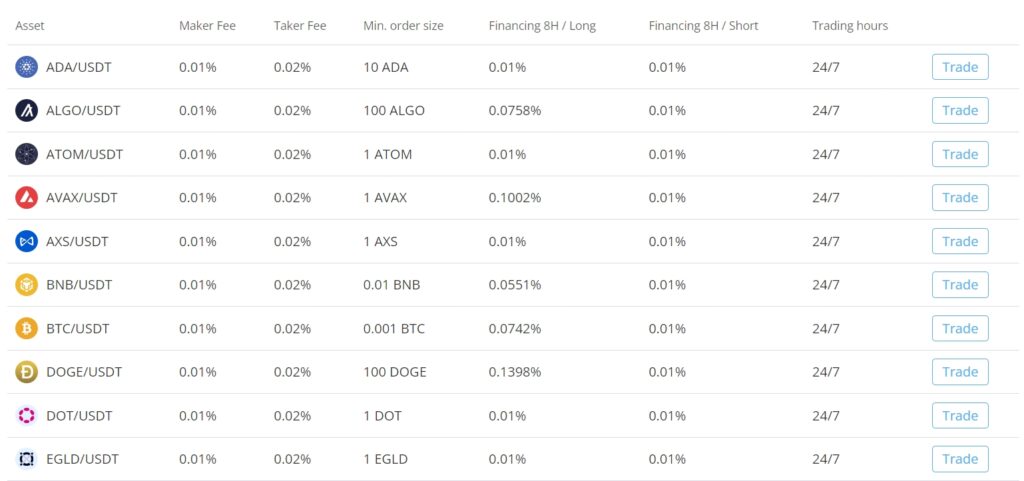

- Trading Fees: PrimeXBT operates on a flat-rate fee structure for trades, typically charging a 0.05% fee on all trades, regardless of whether you’re a maker or taker. It differentiates itself by focusing on Bitcoin-based margin trading.

- Leverage Costs: With leverage up to 500x available, be aware of the overnight financing cost which can affect your profitability.

- Bonuses: PrimeXBT may offer deposit bonuses like a $100 bonus when certain conditions, such as a minimum deposit or trading volume, are met.

When comparing the two, look out for volume-based discounts which may apply after surpassing certain thresholds.

Kraken, for example, reduces trading fees after $50,000 in 30-day volume, while PrimeXBT might offer lower fees based on promotional offers.

Remember, your individual profitability and incentives will be affected by how these platforms align with your trading style and volume.

Discounts and bonuses are subject to change, so it’s vital to stay updated with each exchange’s policies and offerings.

Kraken vs PrimeXBT: Trading Fee & Deposit/Withdrawal Fee Compared

When examining the fee structures of Kraken and PrimeXBT, you’ll notice some key differences that could influence your decision on which platform to use.

Kraken utilizes a maker-taker fee model that is volume-based. This means the more you trade, the lower the fees you incur. To give you a clearer picture:

- Maker fees range from 0.00% to 0.16%.

- Taker fees are slightly higher, varying from 0.10% to 0.26%.

Kraken rewards users who provide liquidity to their market, which is reflected in the lower maker fees. Additionally, the exchange typically does not charge for deposits but does include a fee for withdrawals, which varies by asset.

In contrast, PrimeXBT charges a flat fee for trades, which allows for easy calculation of trading costs, regardless of the trading volume:

- Trading fee is consistently pegged at 0.05% for all trades.

However, unlike Kraken, PrimeXBT only accepts deposits in Bitcoin. They also offer leveraged trading, which might carry additional costs in terms of rollover fees for positions held open over a certain period.

When considering deposit and withdrawal fees:

- PrimeXBT does not have deposit fees but does charge for withdrawals.

- For both platforms, withdrawal fees depend on the network fee of the particular cryptocurrency you are withdrawing.

Kraken vs PrimeXBT: Deposits & Withdrawal Options

When selecting a cryptocurrency exchange, the ease of moving your funds is a pivotal factor. With Kraken and PrimeXBT, you have distinct options to consider.

Kraken:

- Currencies: Supports a wide array of fiat currencies including USD, EUR, CAD, among others.

- Payment Methods: Offers bank transfers, wire transfers, and crypto deposits.

- Processing Times: Typically, bank and wire transfers can take 1-5 business days. Crypto transactions depend on network speed.

- Limits: Minimum and maximum limits vary by currency and method; these details are obtainable on Kraken’s official website.

PrimeXBT:

- Currencies: While mainly a crypto platform, it allows transactions in several major cryptocurrencies.

- Payment Methods: Crypto deposits are the standard, with the option to use third-party services for fiat transactions.

- Processing Times: Crypto deposits and withdrawals can be relatively swift, depending on the network traffic.

- Limits: No minimum deposits, but withdrawal limits are typically bound by the cryptocurrency’s network.

Your choice will depend on your preference for trading with fiat currencies or strictly cryptocurrencies. Kraken provides more diversity with fiat options, which might be a convenience if you deal in traditional currencies. On the other hand, PrimeXBT’s crypto-focused platform means direct crypto transactions without mandatory conversion processes, which can be faster. Always consider transaction fees, as these could influence the cost-effectiveness of moving funds, especially if you plan frequent transfers or trade in high volumes.

Kraken vs PrimeXBT: KYC Requirements & KYC Limits

When comparing Kraken and PrimeXBT, it’s important for you to consider the Know Your Customer (KYC) requirements and associated limits for each platform, as these affect your privacy, security, and accessibility.

Kraken emphasizes regulatory compliance and requires KYC verification for all users. You’ll encounter several verification levels ranging from Starter to Pro. To reach the Starter level, you must provide personal information, whereas Pro level demands government-issued ID, proof of residence, and a verified occupation. The higher your level, the less restrictive the limits:

- Starter: Deposit and trade cryptocurrencies; no fiat or withdrawals.

- Intermediate: Deposit and withdraw fiat; increased crypto limits.

- Pro: Highest fiat and crypto limits; access to OTC markets.

PrimeXBT, on the other hand, traditionally offers a more privacy-focused experience with no rigorous KYC procedures for account creation. You can register using just an email and begin trading almost immediately. PrimeXBT requires deposits in BTC only, which allows for a level of anonymity. However, absence of KYC can have implications for the platform’s security and might affect deposit or withdrawal limits imposed by regulatory bodies in the future. Understand that trading without KYC comes with potential risks, such as limited legal recourse in case of disputes.

Kraken vs PrimeXBT: Order Types

When comparing the order types available on Kraken and PrimeXBT, you’ll find that both platforms cater to your strategic trading needs by offering a variety of order types to manage risk and enter the market at desired price points. Here’s a breakdown to guide your understanding:

Kraken:

- Market Orders: Allows you to buy or sell instantly at the current market price.

- Limit Orders: Lets you set a specific price at which you want to buy or sell.

- Stop Orders: Triggers a market order when the market reaches your set stop price.

- Conditional Orders: Include stop-loss and take-profit conditions to help automate your trading.

- Post-Only Orders: Ensures the order is added to the order book and not matched with a pre-existing order, benefiting from maker fees.

- Reduce-Only Orders: This order type is for reducing your position and not for increasing it.

PrimeXBT:

- Market Orders: Execute immediately at the best available market price.

- Limit Orders: You can specify the price at which you’re willing to buy or sell.

- Stop Orders: An order placed that becomes executable once a set price has been reached and is then treated as a market order.

- OCO (One-Cancels-the-Other): A pair of orders stipulating that if one order is executed fully or partially, then the other is automatically canceled.

Both platforms support these fundamental order types, assisting you in executing strategies like chasing the breakout with a stop order or managing risk with a stop-loss. However, the OCO option is unique to PrimeXBT, providing a distinct tool to simultaneously set a stop-loss and take-profit point, and automatically cancel the one that isn’t triggered. On the other hand, Kraken provides reduce-only and post-only options, giving you finer control over your existing positions and order book impact.

Kraken vs PrimeXBT: Security and Reliability

When evaluating Kraken and PrimeXBT in terms of security and reliability, your funds’ and data’s safety are paramount.

Kraken has maintained a very good security track record, with no incidents of hacks reported in over a decade of operation. As a platform, it supports a diverse list of cryptocurrencies and offers features like crypto staking and an NFT marketplace. Kraken emphasizes continuous security measures, such as two-factor authentication (2FA), encrypted email communications, and global settings lock, to prevent unauthorized changes to your account.

PrimeXBT, on the other hand, is a Bitcoin-based margin trading platform known for allowing users to trade a range of assets with high leverage. Deposits are BTC only, indicating a streamlined approach to funding. PrimeXBT has not broadcasted any major security breaches to date. They also employ industry-standard practices, including cold storage of assets to mitigate risks from online threats.

In terms of reliability, both platforms strive to offer continuous uptime and effective customer support. Kraken is recognized for its 24/7 live chat support, a valuable asset in quickly resolving your issues. PrimeXBT’s support is less publicized, but like most platforms, it provides a support system to assist you.

Both exchanges adhere to regulatory requirements. Kraken is known for its high regulatory compliance in multiple jurisdictions, adding to its trust profile. Regulatory information about PrimeXBT is less detailed in public domain; however, it functions in a competitive space necessitating adherence to financial regulations.

Kraken vs PrimeXBT: User Experience

When exploring Kraken, you’ll encounter a user interface that highlights a balance between functionality and aesthetics. Kraken’s design is recognized for being both sleek and minimalistic, enabling you to focus on trading without distraction. You’ll appreciate the speed of the platform, which is designed to facilitate prompt trade execution, an essential feature for high-frequency traders.

In contrast, PrimeXBT operates with a Bitcoin-based margin trading platform where you can trade various assets. Despite the power of trading with up to 500x leverage, PrimeXBT’s design may sometimes feel less intuitive, especially if you’re new to cryptocurrency trading. That said, it offers a customizable trading platform, which can be a significant advantage once you get accustomed to the system.

Ease of Use:

- Kraken: Known for a smooth user experience.

- PrimeXBT: Requires some familiarity for optimal use.

| Feature | Kraken | PrimeXBT |

|---|---|---|

| Interface Clutter | Minimal | Some Clutter |

| Customizability | Limited | High |

| Ease for Beginners | Better | Moderate |

Feedback from Users and Experts:

Users often favor Kraken for its user-friendly approach, which can be less intimidating for beginners. Expert reviews typically highlight Kraken’s emphasis on a focused trading experience without compromising the availability of advanced trading tools.

On the other hand, PrimeXBT might require a steeper learning curve, but once mastered, offers powerful tools for trading crypto, FX, commodities, and indices CFDs. As you progress, the value of being able to tailor the platform to your trading style may become more apparent.

Kraken vs PrimeXBT: Education and Community

When you’re navigating the world of cryptocurrency exchanges, the resources and community interaction offered by platforms like Kraken and PrimeXBT can be invaluable.

Kraken puts a strong emphasis on education for both novice and experienced traders. Their website hosts a comprehensive suite of guides and tutorials. You’ll find an array of topics ranging from the basics of blockchain technology to advanced trading strategies.

Additionally, Kraken provides a knowledge base and a support center that can help resolve your queries. Their commitment to educating their user base is reflected in the quality and depth of the provided materials.

On the other hand, PrimeXBT maintains a focus on supporting its users through educational blogs and market analysis.

In terms of community, both Kraken and PrimeXBT understand the importance of social media.

Kraken boasts a considerable presence with active profiles on platforms like Twitter and Facebook. They engage with their audience and share updates, market insights, and educational content.

PrimeXBT also uses social media to connect with users, publishing trading tips and platform updates.

| Feature | Kraken | PrimeXBT |

|---|---|---|

| Guides | Comprehensive variety | Focused on trading strategies |

| Tutorials | Available for all levels | – |

| Knowledge Base | Extensive with support center | Blogs and market analysis |

| Social Media | Twitter, Facebook, and more | Actively engaging on major platforms |

Your choice between these exchanges should consider not just the trading features but also how each platform empowers you with knowledge and a sense of community.

Each exchange provides a distinct approach to education and community building.

Kraken vs PrimeXBT: Regulation and Compliance

When choosing a cryptocurrency exchange, understanding their regulation and compliance is crucial for your security and peace of mind.

Kraken, based in the United States, is known for its strong stance on regulatory compliance. It operates in accordance with the legal requirements of the jurisdiction it serves.

You can trust that Kraken adheres to rigorous standards since it is registered as a Money Services Business (MSB) with FinCEN in the USA and FINTRAC in Canada. This underscores its commitment to following anti-money laundering (AML) and know your customer (KYC) guidelines.

- Licenses and Registrations:

- FinCEN (USA)

- FINTRAC (Canada)

On the other hand, PrimeXBT may not offer the same level of regulatory compliance as Kraken. While PrimeXBT provides margin trading on a variety of assets, the clarity regarding its regulatory status is typically less transparent than that of Kraken.

The platform does emphasize its security measures but may lack explicit regulatory licenses from known financial authorities.

Concerning certifications and audits, exchanges frequently undergo security audits to demonstrate their systems’ robustness.

Kraken has made it a point to pass such audits to assure you of its platform’s security, though specific details might vary with time. Meanwhile, PrimeXBT’s approach to compliance may focus more on securing trades and ensuring user security through robust internal measures.

- Each exchange faces its own set of challenges and controversies.

- Kraken is seen navigating the regulatory landscapes proactively.

- PrimeXBT must ensure it satisfies traders’ needs while dealing with the complexities of international financial compliance.

Your choice should align with your comfort level regarding each platform’s adherence to legal and ethical standards. Understanding these nuances helps you trade with confidence.

Conclusion

When comparing Kraken to PrimeXBT, your choice hinges on specific trading needs and preferences.

Kraken boasts a broader selection of over 220 cryptocurrencies. It’s known for its euro liquidity, making it ideal for traders focused on spot trading with moderate leverage of up to 1:5. Its user-friendly platform is well-suited if you prefer a blend of accessibility and in-depth trading features.

PrimeXBT, on the other hand, caters to traders seeking higher leverage, boasting ratios up to 1:500 on certain assets. If your interest lies in a diverse trading portfolio, PrimeXBT’s expansive offerings and customizable platform may be your better choice.

For those of you in the United States, you’ll find that Kraken’s services are available, while PrimeXBT may have certain restrictions.

In terms of security and reputation, Kraken’s longstanding presence since 2011 offers a level of trustworthiness. However, it’s crucial for you to conduct thorough due diligence, as security is paramount in all trading activities.

Your individual trading style and risk tolerance are critical factors when picking between these platforms.

Beginner traders might lean towards Kraken for its straightforward interface and comprehensive support. Experienced traders looking to leverage positions substantially may value what PrimeXBT offers.

Remember to consider fees, available assets, platform capabilities, and geographic availability in your decision. Your choice should align with your investment strategy and desired trading experience.

Explore how Kraken and PrimeXBT compare to their competitors:

- Kraken vs BitMEX: Choosing the Right Platform

- Kraken vs Binance: Choosing the Right Platform

- Kraken vs Bybit: Choosing the Right Platform

- PrimeXBT vs Bybit: Choosing the Right Platform

- PrimeXBT vs MEXC: Choosing the Right Platform

- PrimeXBT vs Bitget: Choosing the Right Platform