Choosing the right cryptocurrency exchange is crucial for maximizing your trading success and security. In this comparison, we delve into the features and advantages of two well-known platforms: Kraken and BitMEX. Kraken, established in 2011, is renowned for its robust security measures, wide range of supported cryptocurrencies, and user-friendly interface, appealing to both beginners and experienced traders.

BitMEX, on the other hand, has made a name for itself with its focus on Bitcoin derivatives and high leverage options, catering primarily to seasoned traders looking for advanced trading opportunities. Join us as we explore the strengths and weaknesses of Kraken and BitMEX to help you decide which platform aligns best with your trading needs and goals.

| Feature | Kraken | BitMEX |

|---|---|---|

| Founded | 2011 | 2014 |

| Headquarters | San Francisco, USA | Seychelles |

| User Interface | Clean and user-friendly | Complex, designed for pros |

| Products | Spot, Futures, and Margin | Derivatives and Perpetual Swaps |

| Supported Coins | Wide selection | Primarily Bitcoin derivatives |

| Maximum Leverage | Up to 50x | Up to 100x |

| Trading Volume | High, indicating strong liquidity | High, with substantial liquidity |

| Deposit Methods | Crypto and fiat | Crypto only |

| Regulation | Highly regulated, especially in the US | Less regulated |

| Fees | Competitive, volume-based | Low, especially for high-volume traders |

When deciding between Kraken and BitMEX, you’ll want to consider various factors like the range of supported cryptocurrencies, fee structures, security measures, and trading options. These exchanges are tailored to different types of traders, and understanding their key differences will help you choose the one that fits your trading needs best.

Kraken vs BitMEX: Comparison at a Glance

When deciding between Kraken and BitMEX, you’ll want to consider various factors like the range of supported cryptocurrencies, fee structures, security measures, and trading options. These exchanges are tailored to different types of traders, and understanding their key differences will help you choose the one that fits your trading needs best.

Supported Cryptocurrencies

- Kraken: Wide range of cryptocurrencies

- BitMEX: Focused on major cryptocurrencies with a strong emphasis on derivatives

Fees

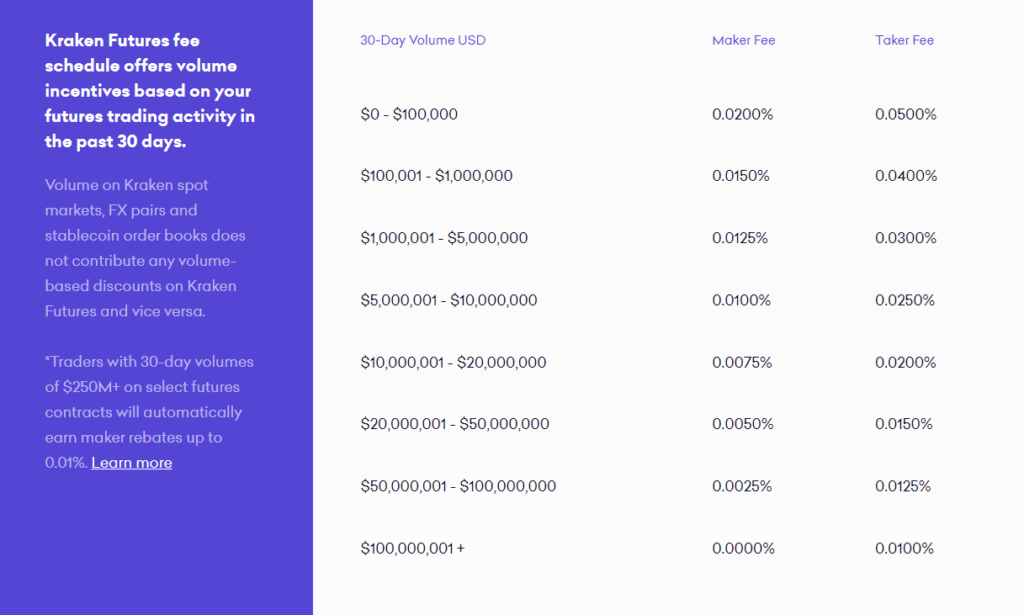

- Kraken: Tiered fee structure based on 30-day trade volume, ranging from 0.00% to 0.26%

- BitMEX: Market maker fees can be negative (rebates), and taker fees are competitive

Leverage

- Kraken: Offers up to 5x leverage

- BitMEX: Notably high leverage of up to 100x on Bitcoin contracts

Trading Volume

- Kraken: High liquidity and volume across various pairs

- BitMEX: Known for large market liquidity, especially in derivatives

Trading Options

- Kraken: Spot trading, margin trading, futures, OTC

- BitMEX: Spot trading dominated by derivative products such as perpetual contracts and futures

Deposit Methods

- Kraken: Supports fiat and cryptocurrency deposits

- BitMEX: Primarily cryptocurrency deposits

Security

- Kraken: Excellent track record, various layers of security

- BitMEX: Strong security measures in place, though regulatory issues have arisen in the past

Kraken vs BitMEX: Products and Services

Kraken offers a broad selection of products, including spot trading for numerous cryptocurrencies against various fiat currencies. It is known for its high euro volume and liquidity. Beyond spot trading, you can also engage in futures trading and use margin to leverage your positions. Kraken has a reputation for a solid security track record, enhancing your confidence in the safety of your funds.

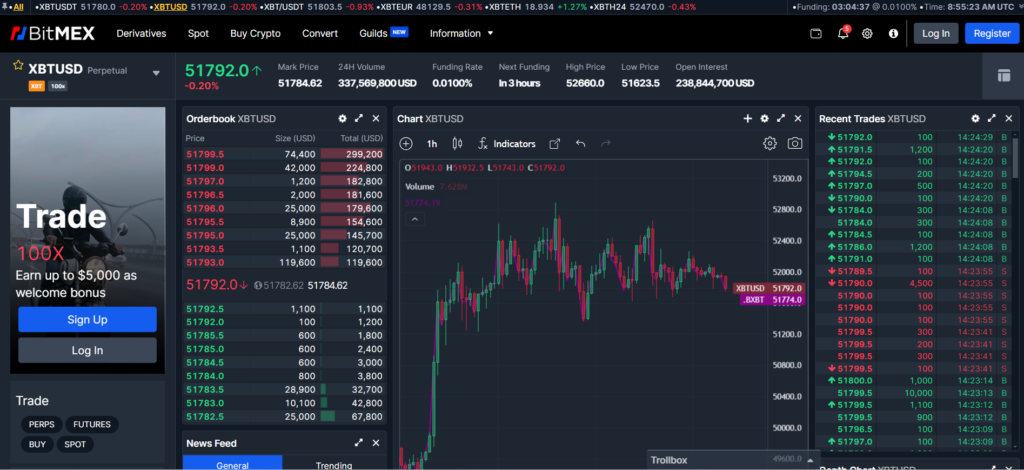

BitMEX, on the other hand, is heavily centered on the derivatives market, with products like perpetual contracts, traditional futures, and quanto futures for various cryptocurrencies. It stands out with its 100x leverage on Bitcoin which is attractive if you are looking for high leverage opportunities. However, this comes with an increased risk.

Both exchanges offer unique features:

- Kraken:

- Wide range of crypto assets for spot trading

- Staking services

- Renowned for security measures

- BitMEX:

- Specialty in crypto derivatives

- High liquidity for its trading pairs

- Provides up to 100x leverage on Bitcoin

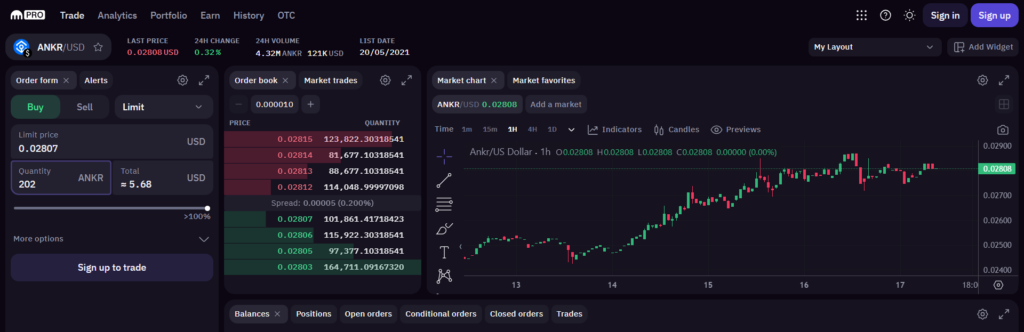

When it comes to user experience, Kraken has evolved to provide a more user-friendly interface suitable for both beginners and experienced traders. In contrast, BitMEX’s interface is heavily inclined towards traders familiar with derivatives and those who understand complex trading instruments. Your preference between the two will depend on your trading style, risk tolerance, and whether you prioritize a wide variety of assets or a specialized derivatives trading platform.

Kraken vs BitMEX: Contract Types

When you’re exploring the contract types between Kraken and BitMEX, you’ll find distinct offerings that cater to different trading strategies.

Kraken primarily features spot trading along with Options trading for more sophisticated strategies. Their platform doesn’t emphasize a wide variety of contract types but offers robust security and a diverse cryptocurrency selection.

BitMEX, on the other hand, provides a comprehensive range of contract types which include:

- Inverse Perpetual Contracts: These allow you to trade cryptocurrency pairs with Bitcoin as the quote currency. Your profits or losses are also in Bitcoin, giving you exposure to the asset’s price movements against the counterasset without the need for actual ownership.

- Linear Perpetual Contracts: These follow the same principle as inverse perpetual contracts but are typically quoted in USD, allowing for direct correlation with the fiat currency.

- Inverse Futures Contracts: Such contracts settle in Bitcoin and are for traders looking to speculate on future prices of various cryptocurrencies against Bitcoin.

- COIN-M Futures: These contracts are settled in cryptocurrency, which means your margin and settlement are in the underlying coin, not in USD or Bitcoin.

- USD-M Futures: In contrast to COIN-M, these contracts use USD as the margin and settlement currency, providing a straightforward value relationship understood against the US dollar.

Each contract type offers both benefits and disadvantages depending on your trading goals and risk profile. Perpetual Contracts on BitMEX, for example, are popular due to their high leverage options; however, with high leverage comes increased risk. Conversely, Kraken’s Options may be less risky, offering strategic trade setups with predetermined risk levels.

Your choice between Kraken and BitMEX for contract types should align with your trading preferences, risk tolerance, and the specific market exposures you are seeking to achieve.

Kraken vs BitMEX: Leverage and Margin

When trading on Kraken, you have access to a maximum leverage of up to 50x for crypto futures pairs, allowing you to amplify your trading position up to fifty times your account balance. However, bear in mind the higher the leverage, the higher the risk of liquidation if the market moves against your position. Kraken charges a rollover fee between 0.01% to 0.02%, applied every four hours for leveraged trades, varying based on the instrument.

On the other hand, BitMEX provides a more substantial leverage option, with up to 100x available on Bitcoin and other varied trading instruments. Such high leverage can greatly increase your potential gains, as well as your level of risk. BitMEX applies rollover charges once every 8 hours.

| Exchange | Maximum Leverage | Rollover Fee Timing | Notable Features |

|---|---|---|---|

| Kraken | Up to 50x | Every 4 hours | Diverse cryptocurrencies, security |

| BitMEX | Up to 100x | Every 8 hours | Perpetual Contracts, high Bitcoin leverage |

Keep in mind that while leverage can increase your potential returns, it also inflates your potential losses and can lead to rapid liquidation if the market moves unfavorably. Both platforms require traders to understand margin requirements and to manage their positions responsibly to mitigate the risks associated with trading on margin. Always assess the liquidation risks seriously, considering not just the leverage but also the volatility of the cryptocurrency market.

Kraken vs BitMEX: Liquidity and Volume

When you’re evaluating Kraken and BitMEX, considering their respective liquidity and volume is crucial for understanding how efficiently you can trade and what kind of slippage you might expect.

Kraken:

- Liquidity: Kraken is well-regarded for its high liquidity, particularly in the Bitcoin to Euro (BTC/EUR) trading pair. This deep liquidity pool can facilitate large trades with minimal price impact.

- Volume: As one of the largest exchanges in terms of trading volume, especially in the Euro market, Kraken ensures that your trades are executed promptly and at predictable prices.

BitMEX:

- Liquidity: BitMEX is notable for its substantial market liquidity, especially for cryptocurrency derivatives. This makes it a favored platform for traders looking to engage in leveraged trading without excessively moving the market.

- Volume: The high trading volume on BitMEX is primarily due to its crypto derivatives market, which includes perpetual contracts and various futures.

For traders like you, both these aspects—liquidity and volume—have direct implications:

- Trading Efficiency: High liquidity equates to high trading efficiency on both platforms, as your orders are likely to get filled faster.

- Execution: You can usually expect market orders to be executed close to the market price without significant slippage.

- Slippage: Both Kraken and BitMEX’s high liquidity levels tend to reduce slippage, resulting in trades that reflect the prices you expect.

| Exchange | Liquidity Ranking | Volume Ranking |

|---|---|---|

| Kraken | High (especially in BTC/EUR) | High |

| BitMEX | High (in derivatives market) | High |

Your choice between Kraken and BitMEX might depend on whether you prioritize spot trading in cryptos like Bitcoin, or if you’re more focused on derivatives trading. Each platform’s liquidity and volume data sourced from recent metrics and rankings, should inform your decision on where to trade.

Kraken vs BitMEX: Fees and Rewards

When you trade on Kraken, the trading fees can range up to 0.26%, which is relatively low compared to industry standards. For instance, if you execute a $10,000 trade, a maximum fee of $26 is incurred. However, fees decrease with higher trading volumes, incentivizing active traders. Kraken also rewards users through its staking services and futures trading with up to 50x leverage.

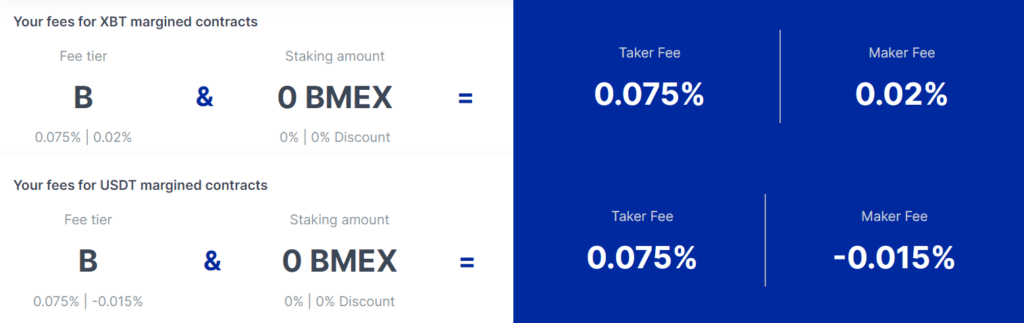

BitMEX, on the other hand, is known for its competitive fee structure, especially with a taker fee of 0.075%. Therefore, a $10,000 trade on BitMEX has a fee of $7.50. BitMEX appeals to high-volume traders by reducing fees for those holding its native BMEX tokens and for users exceeding $50,000 in 30-day trading volumes.

| Exchange | Maker Fee | Taker Fee | Additional Incentives |

|---|---|---|---|

| Kraken | Up to 0.16% | Up to 0.26% | Staking rewards, Leverage on futures |

| BitMEX | 0.025%* | 0.075% | Discounts for BMEX token holders |

*The maker fee can be negative on BitMEX, effectively offering a rebate and rewarding users who add liquidity to the market.

Kraken vs BitMEX: Trading Fee & Deposit/Withdrawal Fee Compared

When selecting a cryptocurrency exchange, understanding the fee structure is crucial for your trading ventures. Let’s compare the fees between Kraken and BitMEX.

Kraken boasts competitive trading fees, with a maker-taker model.

As a maker, your fee can be as low as 0% and can go up to 0.16%.

As a taker, fees range from 0.10% to 0.26%. Your fee percentage decreases as your trading volume increases.

Kraken does not impose fees on most deposits, yet certain payment gateways might incur charges, such as a $10 fee for SWIFT cash deposits.

BitMEX, contrastingly, has a set fee for takers at 0.075%.

Makers receive a rebate (negative fee) of -0.025%, effectively earning you money for contributing to the market liquidity. This benefit is consistent regardless of your trading volume.

Withdrawal fees on both platforms are variable. They reflect the current state of the underlying blockchain network required to process the transaction and are subject to change as network conditions fluctuate.

For deposits, Kraken does not charge fees, while BitMEX may charge depending on the method and type of currency deposited.

| Feature | Kraken | BitMEX |

|---|---|---|

| Maker Fee | 0% – 0.16% | -0.025% (rebate) |

| Taker Fee | 0.10% – 0.26% | 0.075% |

| Deposit Fee (Fiat) | $10 for SWIFT | Variable |

| Withdrawal Fee | Blockchain network fee | Blockchain network fee |

Keep in mind that specific fee reductions may apply for token holders or for reaching certain volume thresholds on the respective platforms.

Whenever trading cryptocurrencies, review the latest fee schedules on Kraken and BitMEX websites as they could be updated frequently.

Kraken vs BitMEX: Deposits and Withdrawals

When you transfer funds to or from Kraken and BitMEX, several factors come into play, including available currencies, payment methods, and transaction times.

Kraken:

- Currencies: Kraken offers a wide range of fiat currencies such as USD, EUR, CAD, AUD, GBP, CHF, and JPY, along with various cryptocurrencies.

- Payment Methods: You can use bank transfers, wire transfers, SEPA (for Europeans), SWIFT, and domestic transfers, depending on your region.

- Processing Times: Fiat deposits and withdrawals usually take 1-5 business days. Crypto transactions typically are processed within minutes to hours, depending on network congestion.

- Limits: Kraken enforces minimum deposit and withdrawal limits, varying by currency and account tier, with higher limits for more verified users.

BitMEX:

- Currencies: BitMEX focuses primarily on cryptocurrencies, not supporting fiat deposits or withdrawals.

- Payment Methods: It operates exclusively with crypto transfers.

- Processing Times: Since BitMEX is crypto-only, transactions are subject to blockchain confirmation times, generally within an hour.

- Limits: There are minimum withdrawal limits, but no maximum limits specified, giving you flexibility in managing your funds.

Your choice between Kraken and BitMEX may depend on your need for fiat currency operations — an area where Kraken has the advantage.

For crypto-exclusive traders, BitMEX’s system grants efficient and straightforward transactions with cryptos.

Remember to consider processing times, especially when trading may be time-sensitive, as these can vary significantly between exchanges and depending on the chosen method.

Kraken vs BitMEX: KYC Requirements & KYC Limits

When you sign up for Kraken, you’ll go through a tiered verification system. As a US-based exchange, Kraken adheres strictly to global KYC regulations.

Initially, you are asked for basic personal information. However, for higher tiers, be prepared to provide more detailed documents.

These tiers dictate your deposit and withdrawal limits. Here’s a quick breakdown:

- Starter: Email, full name, primary address, and phone number.

- Intermediate: Government-issued ID, proof of residence, and an uploaded ID photo.

- Pro: Completes the verification requirements and is aimed at high-volume traders with no limits on deposits and withdrawals.

In contrast, BitMEX historically had been less stringent on KYC requirements, especially known for its 100x leverage on Bitcoin without mandatory KYC checks.

Nonetheless, regulatory changes have led BitMEX to implement KYC protocols. Now, to access all features, you will need to verify your identity through the following:

- Basic: Email verification for a restricted account with minimum features.

- Verified: Government-issued ID, proof of residence, and a selfie to lift restrictions on deposits and withdrawals.

The KYC procedures impact your privacy, as more personal information is handed over.

However, they enhance security and limit fraud, laundering, and other illegal activities.

Accessibility is also affected; while Kraken’s multiple verification levels allow you to choose how much you want to disclose, BitMEX has simplified the process, with the verification setting the threshold for your activity on the platform.

Both exchanges require users to comply with KYC checks to access full services, including unlimited trading and fiat deposits or withdrawals.

Kraken vs BitMEX: Order Types

When trading on Kraken, you can utilize various order types such as market orders, limit orders, and stop-loss orders to manage trades effectively.

Market orders allow you to buy or sell immediately at the best available current price.

Limit orders enable you to set a specific price at which you want to buy or sell an asset.

Stop-loss orders help by automatically selling your asset when the price reaches a predefined level, enabling risk management.

On the other hand, BitMEX offers a similar range of order types with additions that cater to derivative traders.

You have access to market orders, limit orders, and stop orders which function much like those on Kraken.

Additionally, specialized order types like conditional orders, post-only orders, and reduce-only orders are available.

Conditional orders allow triggering of an order upon specific conditions being met, perfect for strategy execution.

Post-only orders ensure that your order will only be executed as a maker, thus avoiding taker fees.

Reduce-only orders are designed to reduce a position, not increase it, ensuring that a trade meant for position reduction won’t mistakenly add to your position.

| Order Type | Kraken | BitMEX |

|---|---|---|

| Market Orders | :white_check_mark: | :white_check_mark: |

| Limit Orders | :white_check_mark: | :white_check_mark: |

| Stop Orders | :white_check_mark: | :white_check_mark: (Stop-limit included) |

| Conditional | :x: | :white_check_mark: |

| Post-only | :white_check_mark: (Add Liquidity Only) | :white_check_mark: |

| Reduce-only | :x: | :white_check_mark: |

Your choice between Kraken and BitMEX might depend on the complexity of your trading strategy and the specific order types needed to execute it.

Kraken offers straightforward exchange features suitable for most traders, while BitMEX caters to a more niche market with advanced order types for derivative trading.

Kraken vs BitMEX: Security and Reliability

When evaluating the security and reliability of Kraken and BitMEX, your primary concern may be how these platforms safeguard user funds and personal data. Both Kraken and BitMEX implement robust security measures, but their approaches and histories are worth noting.

Kraken:

- Track Record: Established in 2011, Kraken has generally maintained a strong security record, without major incidents.

- Security Measures: Offers two-factor authentication (2FA), SSL encryption, and PGP/GPG for email.

- Regulatory Compliance: Kraken complies with legal and regulatory requirements in the regions it operates, enhancing trust.

- Customer Support: Provides comprehensive support options, including 24/7 live chat and email assistance.

BitMEX:

- Security Incidents: BitMEX has faced scrutiny and has been the subject of legal actions which have raised concerns about its operational practices.

- Security Measures: 2FA is available, and funds are stored in a multisignature wallet for added protection.

- Regulatory Compliance: BitMEX has made efforts to improve compliance, especially after legal challenges.

- Customer Support: Offers a range of support channels, though response times may vary.

Both platforms strive to offer a secure trading environment.

Kraken’s reputation for security and regulatory compliance has been relatively stable.

BitMEX, on the other hand, has been working to rebuild its reputation following legal issues.

Each platform provides customer support, but the effectiveness and speed of response can differ.

Always ensure you enable all available security features to protect your account, regardless of the platform you choose.

Kraken vs BitMEX: User Experience

When you explore Kraken and BitMEX, you’ll notice distinct differences in user experience that cater to different preferences and needs.

Kraken:

- Interface: You are greeted with an intuitive and user-friendly interface.

- Ease of Use: The platform is known for its straightforward navigation, making it approachable for beginners.

- Features: Offers a comprehensive set of tools and services, including spot trading and futures contracts.

- Performance: Fast and reliable performance with minimal downtime.

User Feedback:

Users generally report satisfaction with Kraken’s ease of use and smooth operation. The clutter-free design is appreciated for not overwhelming new users while still offering advanced features for experienced traders.

BitMEX:

- Interface: More complex and tailored towards seasoned traders.

- Ease of Use: There might be a steeper learning curve if you are unfamiliar with trading platforms.

- Features: It is notable for its extensive range of crypto derivatives and its high leverage options on Bitcoin (up to 100x).

- Performance: Known for its high liquidity, which can translate to faster execution of trades.

User Feedback:

Expert traders value the robust functionality and depth of features BitMEX provides. However, for newcomers, the complexity of the platform can present a challenge.

Kraken vs BitMEX: Education and Community

When evaluating Kraken and BitMEX on their educational resources and community engagement, you’ll find distinct approaches each takes to empower and support their users.

Kraken offers a comprehensive suite of educational materials. They aim to cater to both beginners and advanced traders.

- Guides and Tutorials: Step-by-step instructions on various crypto topics.

- Webinars and Videos: Visual aids to help further your understanding of complex concepts.

- Market Analysis: Regular updates that provide deeper insight into the crypto market.

Kraken also has a significant social media presence. They actively engage on platforms like Twitter and Reddit to offer support, share updates, and interact with the community.

On the other hand, BitMEX focuses heavily on traders interested in cryptocurrency derivatives. They provide:

- Trading Resources: Detailed articles and guides about derivatives trading.

- Research Reports: In-depth analysis on market trends and trading strategies.

- BitMEX Academy: A curated learning center for enhancing trading knowledge.

BitMEX’s online community is widespread, often engaging with users on Twitter and maintaining a presence on trading-focused forums. Their community managers actively participate in discussions and provide direct support to their users.

Kraken vs BitMEX: Regulation and Compliance

When evaluating Kraken and BitMEX on the basis of regulatory compliance, it’s crucial for you to recognize the respective jurisdictions and regulatory frameworks under which these platforms operate.

Kraken is based in the United States and adheres to a strict regulatory environment. As of the available information, Kraken is compliant with legal and regulatory requirements.

Kraken is also registered as a Money Services Business (MSB) with FinCEN in the USA and FINTRAC in Canada. This ensures that they operate under strict guidelines for financial reporting and customer protection.

- Licenses and Certifications:

- Registered as MSB with FinCEN (US)

- Registered with FINTRAC (Canada)

- Compliant with EU’s AML regulations

On the other hand, BitMEX, headquartered in the Seychelles, has had a more turbulent history with regulation.

In the past, BitMEX was known for offering high leverage on cryptocurrency derivative products, which attracted scrutiny from regulatory bodies.

- Controversies and Challenges:

- Faced charges from the US CFTC for operating an unregistered trading platform.

- Allegations: Anti-money laundering violations.

Each platform’s history with regulation should be an essential factor in your decision-making process. While Kraken seems to have a more straightforward relationship with regulatory compliance, BitMEX has faced significant hurdles and has since worked towards conforming to regulatory standards. It is advisable for you to regularly check the latest regulatory updates as this information is subject to change.

You must also consider how these compliance measures translate into the security of your assets and personal information. Both platforms implement various security protocols, but their adherence to regulations can provide you with an additional layer of reassurance about their operational integrity.

Conclusion

When comparing Kraken and BitMEX, your choice will depend on your trading preferences and requirements.

- Kraken offers a wider variety of cryptocurrencies and is known for its strong security measures. It serves well for traders seeking a diverse portfolio. It’s also suitable for those who prioritize security in their transactions.

- BitMEX caters to traders interested in crypto derivatives and offers high leverage options, such as 100x on Bitcoin. This is appealing if you’re looking for aggressive trading strategies.

For general crypto trading:

- Kraken is more suitable if you are interested in a straightforward spot trading experience with a broad selection of coins.

- BitMEX stands out if your focus is on trading highly leveraged crypto derivatives.

Further Learning:

To gain a deeper insight into trading on these platforms, consider:

- Kraken’s Official Guides: Improve your understanding of various trading features Kraken offers.

- BitMEX’s Resources: Learn about the range of derivatives products available on BitMEX.

- Cryptocurrency Trading Courses: Invest time in online courses that delve into the fundamentals of crypto trading.

Explore how Kraken and BitMEX compare to their competitors:

- Kraken vs Binance: Comprehensive Exchange Comparison

- Kraken vs Bybit: Comprehensive Exchange Comparison

- Kraken vs Phemex: Comprehensive Exchange Comparison

- BitMEX vs Bybit: Comprehensive Exchange Comparison

- BitMEX vs Binance: Comprehensive Exchange Comparison

- BitMEX vs Phemex: Comprehensive Exchange Comparison