Kraken, one of the leading cryptocurrency exchanges, offers a robust platform for trading futures that is both accessible and feature-rich.

In this step-by-step guide, we’ll dive into the essentials of Kraken Futures Trading.

From setting up your account and understanding the interface to executing your first trade and managing risk, we’ll cover all the bases to help you embark on your crypto futures trading journey with Kraken.

Whether you’re looking to hedge your digital asset portfolio or capitalize on market movements, this tutorial will equip you with the knowledge to effectively start trading futures on Kraken.

Kraken Futures Trading Strategy & Basics

Trading futures contracts on Kraken allows you to speculate on the future price of a cryptocurrency asset without the need to hold the underlying asset.

Futures contracts are agreements to buy or sell an asset at a predetermined price at a specified time.

Leverage is a critical feature in futures trading. It enables you to control a prominent position with a relatively small amount of capital (the margin).

For example, with 5x leverage, a $1,000 margin allows you to open a $5,000 position. However, leverage also amplifies risks, as gains and losses are magnified.

Risk management is critical. Kraken offers tools like stop-loss orders to protect against significant losses.

You should always be aware of your liquidation price. If the market moves against your position and your margin is insufficient to cover the losses, your position may be forcibly closed.

There are two types of margin modes:

- Cross Margin Mode: Risks your entire available balance by sharing it across all open positions to prevent liquidation.

- Isolated Margin Mode: Restricts risk to the initial margin of a specific position.

Understanding these terms is crucial:

- Index Price: Average price of the cryptocurrency, derived from several spot exchanges, ensuring a fair representation of the market price.

- Fair Price: Used by Kraken to avoid price manipulation. It can differ slightly from the Index Price.

- Funding Rate: Occurs periodically and is exchanged between long and short positions. It ensures the futures price is close to the spot price.

To estimate potential profits or losses, use the Kraken order calculator to help you plan trades using your financial strategy. Always trade within your means and be mindful of the volatility of cryptocurrency instruments.

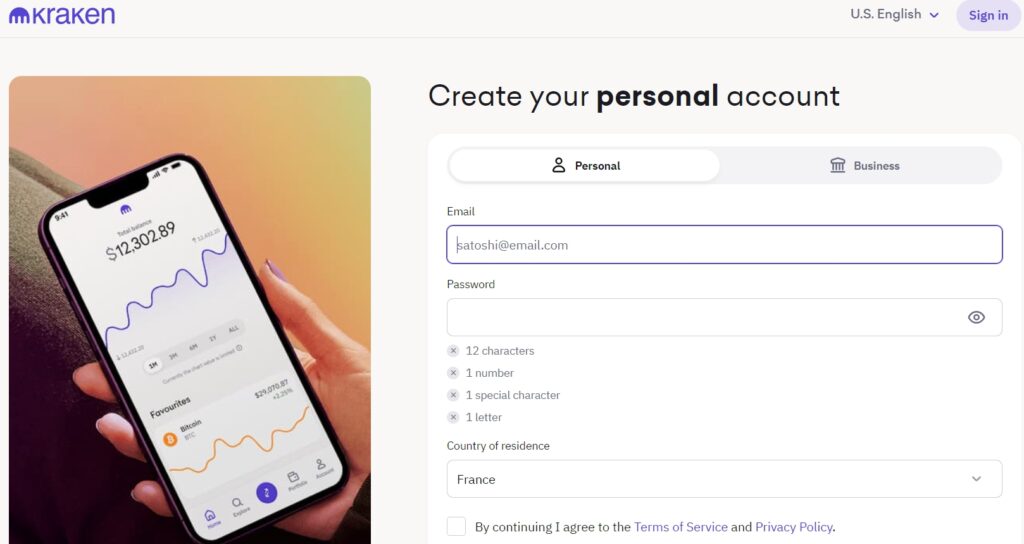

How to Create an Account on Kraken

To begin trading crypto futures on Kraken, you must create an account on their platform. Here’s a step-by-step guide to help you get started whether you use their website or mobile app.

Via Kraken Website:

- Navigate to Kraken.com: Go to the top right-hand corner and click the Sign Up button.

- Enter Required Information: Provide your email address, create a username, and set a strong password.

- Accept Terms: Read and accept the terms of service.

Via Kraken Pro Mobile App:

- Download the App: Find ‘Kraken Pro’ in your mobile app store and install it.

- Sign Up: Open the app and tap Create Account.

- Provide Details: Fill in your email, a chosen username, and a secure password.

- Verify Your Account: Complete the following verification tiers:

- Starter: Requires basic personal information.

- Intermediate: Needs a government-issued ID, proof of residence, and face verification.

- Pro: This is for advanced traders with high volume and additional perks.

Security Measures: Kraken places a premium on security. Activate two-factor authentication (2FA) for both login and withdrawal submissions to enhance the safety of your portfolio.

New User Bonus: After account verification, watch for any promotions. Kraken occasionally offers bonuses to welcome new users to their trading platform.

By following these steps, your account will be up and running, and you’ll be ready to start trading futures on Kraken confidently and securely.

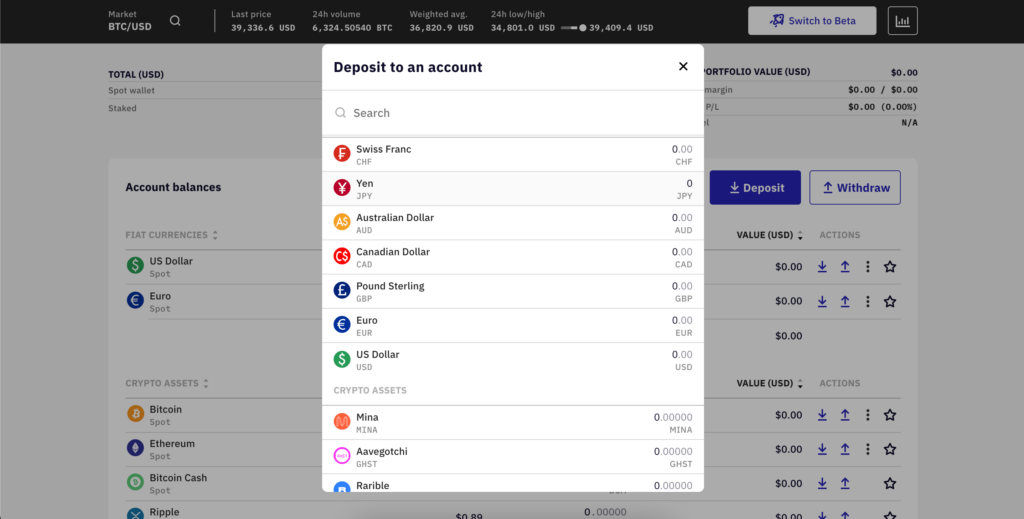

How to Deposit and Withdraw Funds on Kraken

Depositing Funds

To deposit cryptocurrencies to your Kraken account:

- Sign in to your account.

- Navigate to the “Funding” page.

- Select the currency you wish to deposit.

- Follow the instructions, which may include details beyond the address, like a tag/memo for specific coins.

- Use the QR code for convenience, ensuring all necessary details are included.

For fiat currency deposits:

- Choose the relevant fiat currency under the “Funding” page.

- Select a funding provider.

- Comply with the instructions provided.

Minimums, maximums, and fees vary depending on the currency and method of transfer and are listed on the Funding page.

Withdrawing Funds

To withdraw cryptocurrencies from your Kraken account:

- Log in and click “Withdraw” on the dashboard.

- Select the currency you’re withdrawing from the dropdown.

- Input the withdrawal information and confirm.

For fiat withdrawals:

- Access the “Withdraw” option from the Funding page.

- Choose your preferred currency.

- Select a funding provider, like Etana Custody, for certain currencies.

Fees are automatically calculated. They depend on the withdrawal type and the funding provider. Specific fee details for each currency and provider can be found on the Kraken website.

Processing times also differ, with some transfers being instant while others may take a few business days, based on the type of transfer and your funding provider.

Before initiating any transfer, ensure you know the fees and expected processing times to avoid surprises.

How to Transfer Funds to the Futures Wallet

When trading crypto futures on Kraken, it’s essential to understand the distinction between your central (spot) wallet and your futures wallet. Your main wallet is used for traditional spot trading on the exchange, holding your funds in various cryptocurrencies. In contrast, your futures wallet is dedicated solely to trading futures contracts.

To engage in futures trading, you first need to transfer funds from your main wallet to your futures wallet. Here’s a step-by-step guide:

- Log in to Kraken: Access your Kraken account using your credentials.

- Navigate to the Futures section: Look for your account interface’s ‘Futures’ tab.

- Select ‘Transfer’: Inside the Futures interface, locate and click the ‘Transfer’ option to initiate the process.

- Choose your currency: Select the one you wish to transfer to your future wallet from the list of supported currencies. Kraken Pro UI currently supports the transfer of funds to a multi-collateral futures wallet, which allows for more flexibility in the types of collateral used for futures positions.

- Enter the amount: Specify the amount you intend to move to your future wallet. Ensure you comply with the minimum and maximum transfer amounts stipulated by Kraken’s transfer policy.

It’s worth noting that only the multi-collateral futures wallet is available on the Kraken Pro UI. This means you can use a variety of cryptocurrencies as collateral for your futures positions, extending your trading capabilities on the platform.

Remember, to keep your trading efficient and risk-managed, always verify transfer details and the sufficiency of collateral before opening futures positions.

How to Choose Between USD and Crypto Futures

You can choose between USD futures and crypto futures when trading futures on Kraken. Understanding the difference is crucial for your trading strategy.

USD Futures:

These are futures contracts where the underlying asset is a cryptocurrency, but the contract is denominated in US dollars. Your profits or losses are realized in USD.

- Advantages:

- Stability: USD is not subject to the same level of volatility as cryptocurrencies.

- Familiarity: Traders may find it more intuitive to think about their local currency.

- Disadvantages:

- Currency Risk: You might incur losses due to USD value fluctuations if you convert profits to another currency.

Crypto Futures:

Alternatively, crypto futures are denominated and settled in cofptocurrency, such as Bitcoin.

- Advantages:

- Direct Exposure: You gain direct exposure to the cryptocurrency’s price movements.

- No Conversion: There is no need to convert your gains into another currency.

- Disadvantages:

- Volatility: Cryptocurrencies can be highly volatile, adding an extra layer of risk.

Trading Volume and Liquidity:

It’s also important to consider trading volume and liquidity when choosing between USD and crypto futures. Typically, Bitcoin futures have high liquidity and trading volume, which could translate to potentially lower spreads and easier entry or exit from positions.

Examples on Kraken:

- USD Futures: Bitcoin-USD, Ethereum-USD

- Crypto Futures: Bitcoin-Bitcoin, Ethereum-Ethereum

Choose the type of futures contract that aligns with your trading style, risk tolerance, and the currency you prefer for settlements.

How to Understand the Futures Trading Interface on Kraken

Before you begin trading crypto futures on Kraken, it’s essential to understand the layout and tools of the Kraken Futures interface. Familiarity with its components will enable you to navigate and utilize the platform effectively.

Navigating the Kraken Futures Interface

When you access the Kraken Futures trading platform, you will find the trading pair selector at the top of the interface, which allows you to choose the cryptocurrency pairs you wish to trade. The order book is displayed prominently, showing live orders for buys and sells with price and volume data—a real-time record of all pending trades.

- Order Book: Lists current bids and asks for your selected trading pair.

- Trading Engine: Powers the execution of trades in real-time.

- Chart: Visual representation of price movements for the chosen trading pair.

- Order Panel: Allows you to place different orders, including limit and market orders.

- Position Panel: Displays your current positions, including unrealized profit or loss.

Customizing the Trading Experience

Kraken offers various customization options to tailor the trading experience to your preferences.

- Interface Customization: Drag and personalize interface elements to craft your optimal trading dashboard.

- Trading Tools: Utilize a range of tools, such as charting features and technical analysis indicators, to inform your trades.

Bold or italicize keywords for emphasis and employ bullet points for clarity and readability, ensuring a seamless trading experience.

How to Place and Manage Orders on Kraken Futures

Trading cryptocurrency futures on Kraken requires understanding various order types and how to manage your open orders and positions effectively.

Exploring Order Types

First, select a trading pair and contract type to trade futures on Kraken, like USD/BTC. You’ll also choose your leverage level, which amplifies your buying power.

Remember that leverage increases both profit potential and risk. Limit orders allow you to buy or sell at a specific price, while market orders execute instantly at the current market price.

Stop orders become market orders once the stop price is hit. Here’s how you place an order for USD/BTC:

- Navigate to the Kraken Futures interface.

- Choose the USD/BTC pair from the list.

- Select the order type (limit, market, or stop).

- Set your price (if using a limit or stop order).

- Input the amount of BTC you want to trade.

- Decide on the leverage you wish to use.

- Review your order and confirm the execution.

Understanding Open Orders and Positions

After placing your order, it becomes an open order if it is not filled immediately. Your open positions represent active trades. Managing them requires attention to the following points:

- Open Orders: View and modify your open orders from the ‘Orders’ tab. You can cancel unfilled orders here.

- Open Positions: Monitor your positions to watch for profit or loss changes. Use a take-profit market order to set a target profit price for closing a position.

To close an open position:

- Access the open position interface.

- Decide whether to close at current market levels or set a specific exit price.

- Execute a trade in the opposite direction of your open position, equal to your position size.

And be aware:

- Leverage and Margin: Kraken will require you to have a certain percentage of the position’s value as a margin.

- Funding Rate: This periodic payment reflects the cost of holding positions open and is determined by market conditions.

- Settlement: Positions are settled either when you close them or at the contract’s expiration, according to the settlement mechanism of the futures contract.

How to Use the Kraken Order Calculator

The Kraken order calculator is a versatile tool that allows you to plan and manage your futures trades effectively.

You can leverage this feature to estimate potential profit or loss, enabling informed decision-making and robust risk management.

To access the order calculator, log into your Kraken account and navigate the futures interface. Here, the calculator symbol—typically a small calculator icon—is located within the trading dashboard.

When opening the calculator, you’ll need to input several parameters:

- Entry Price: The price at which you intend to enter a trade

- Exit Price: The anticipated price to exit the trade

- Trade Size: The size of your position

Upon setting these parameters, the calculator will display significant results that include:

- Profit/Loss: The potential outcome of the trade in terms of profit or loss

- Return on Investment (ROI): Percentage return on the trade

- Break-Even Price: The price at which the trade neither makes a profit nor a loss

For instance, if you input an entry price of $5,000 for a 1 BTC futures contract and set an exit price at $5,500, the calculator will estimate the profit should the market move in your favor, considering the size of your contract.

It’s essential to understand that all trading involves risk, and the order calculator serves as an aid for risk disclosure.

Offering a visual risk management tool helps mitigate unexpected outcomes as you can adjust the parameters to reflect different market scenarios until you find a suitable trading strategy.

Therefore, always consider the calculator’s results to be theoretical and subject to the dynamics of the futures market.

How to Use the Kraken Futures API

The Kraken Futures API is a tool that grants you automated, secure access to futures trading on the prominent cryptocurrency exchange Kraken.

By interfacing with the API, you can programmatically execute trades, manage positions, and analyze market data.

Accessing the API Documentation:

To begin using the Kraken Futures API, you’ll need to familiarize yourself with the documentation at https://docs.futures.kraken.com. This resource is a comprehensive guide detailing how to interact with the API endpoints effectively.

Benefits of Using the API:

- Automated Trading: Set up trading bots to place and cancel orders automatically based on predetermined criteria.

- Market Data Analysis: Retrieve historical trading data for analysis.

- Account Management: Check your balance, profit, loss, and margin requirements.

Understanding the Risks:

Utilizing the API involves risks, such as the potential for rapid financial loss due to leveraged trading. You must understand how margin and leverage affect your positions.

Best Practices:

- Secure your API keys and refrain from sharing them.

- Make use of the API’s rate limits to avoid being throttled.

- Test your strategies using Kraken’s futures test platform before deploying them live.

- Stay updated with the latest API changes and adapt your code accordingly.

As you integrate Kraken Futures API into your trading strategy, remember that precision in your execution and the security of your trades are paramount. Embrace the capability to enhance your trading, but proceed with cautious rationality.

Frequently Asked Questions

When you decide to trade crypto futures on Kraken, having clear information on fees, leverage, and platform accessibility is crucial for making informed decisions.

How does one calculate the fees for trading futures on Kraken?

The fees for trading futures on Kraken vary depending on the asset and your 30-day trading volume. The fee structure is designed to be competitive and rewards higher trading volumes with lower fees.

To calculate your specific trading fees, you’ll refer to the fee schedule on Kraken’s website, considering both maker and taker fees and your trade volume tier.

What levels of leverage does Kraken offer for crypto futures trading?

Kraken offers varying leverage levels for crypto futures trading, which can depend on the specific cryptocurrency pair you are trading.

The leverage can range significantly, with some products offering up to 50x leverage.

It’s essential to check the current offerings for the specific future you are interested in trading, as these levels might change in response to market conditions.

Is there a dedicated mobile app for Kraken Futures, and how does it function?

Kraken does offer a dedicated mobile app for trading futures, providing a seamless trading experience on the go.

The app includes all the functionalities you need to manage your accounts, set up trades, monitor positions, and react to market movements with the same efficiency as the desktop platform.

Conclusion

Trading crypto futures with Kraken allows you to profit from cryptocurrency price movements.

With Kraken’s robust platform, you can engage in futures trading effectively, whether you’re looking to hedge your existing digital assets or aiming to expand your trading strategies.

Kraken Pro provides an advanced trading experience with comprehensive charting tools and deeper liquidity.

- Ease of Use: Kraken’s user interface is designed for simplicity and efficiency, making it accessible even for those new to futures trading.

- Resources for Learning: Kraken offers educational materials to help you understand futures markets.

- Support: Kraken’s customer support will assist you if you face any challenges.

Remember to consider staking on Kraken as an additional method to earn revenue on your cryptocurrencies. By staking, you can earn rewards on your holdings, complementing your trading activities in the futures market.

To begin trading futures on Kraken:

- Open a Kraken account

- Complete the necessary verification steps

- Deposit funds or cryptocurrency

- Start trading futures contracts on the platform

Your journey in futures trading can start today. With tools and resources just a click away, take the opportunity to diversify your trading and potentially grow your portfolio through the Kraken platform.

Explore how Kraken compares to its competitors:

- Kraken vs. BitMEX: Head-to-Head Comparison

- Kraken vs Phemex: Head-to-Head Comparison

- Kraken vs MEXC: Head-to-Head Comparison

- Kraken vs Binance: Head-to-Head Comparison