Phemex and PrimeXBT are two of the popular crypto exchanges catering to different needs. Phemex offers robust derivatives trading, high leverage, zero-fee spot trading for premium members, and a user-friendly interface. PrimeXBT specializes in leveraged trading across cryptocurrencies, forex, commodities, and indices, providing advanced tools for professional traders seeking sophisticated strategies.

When examining BingX and Phemex, your focus may be on the features and fees most relevant to your trading needs.

Below is a concise comparison to help you understand the distinctions between these two cryptocurrency exchanges.

| Feature | BingX | Phemex |

|---|---|---|

| Trading Fees | Competitive; varies by transaction | Low; varies based on membership level |

| Withdrawal Fees | Varied fees for different cryptos | Varied fees, often lower for VIP users |

| Supported Cryptos | Multiple, including popular ones | Extensive range, including top coins |

| Deposit Methods | Various including bank transfers, cards | Major cryptocurrencies, BTC preferred |

| Leverage | Up to 100x on certain products | Offers up to 100x leverage |

| User Rating | Generally positive; around 4.0 | Also, around 4.0, based on fewer reviews |

| Sign-up Bonus | Up to 200 USDT bonus available | Offers up to USD 180 deposit bonus |

BingX and Phemex both offer a user experience that is tailored for both novice and experienced traders. They provide various trading types to fit different strategies and goals.

Each platform updates these details regularly, meaning that the most accurate information regarding fees and features will be found on their websites.

When choosing between BingX and Phemex, consider the cost, the trading environment, available tools, and overall platform reliability.

BingX Vs. Phemex: Products And Services

When comparing BingX to Phemex, you’ll find that both cryptocurrency exchanges offer various products geared towards traders of different experience levels.

BingX:

- Spot Trading: You can trade various cryptocurrencies on the spot market.

- Derivatives Trading: Includes futures but may be less extensive than Phemex’s offerings.

- Social Trading: A standout feature where you can follow and copy the trades of experienced users.

- User Experience: Generally user-friendly with a focus on social trading features.

Phemex:

- Spot Trading: Provides a wide range of cryptocurrencies for spot trading.

- Futures Trading: Phemex is known for its crypto futures and competitive leverage options.

- Options Trading: This advanced trading feature is uncommon in many exchanges.

- Leveraged Tokens: Offers leveraged tokens for traders seeking increased exposure without managing margin.

- User Experience: Phemex offers a more traditional trading interface and is appreciated for its performance and security.

Both platforms aim to cater to users across the experience spectrum, yet each tilts towards particular strengths.

Phemex leads with more advanced trading options like futures and options trading, which could be more appealing if you seek variety and innovation in trading instruments.

On the other hand, BingX’s social trading capabilities could be a strong point for those looking to leverage community insights.

Given your trading preferences and experience, you may find one platform’s service offerings more suited to your needs than the other.

Consider what products and features align best with your trading strategies before committing to an exchange.

BingX Vs. Phemex: Contract Types

You’ll encounter various contract types when you trade on BingX or Phemex. Each platform offers specific contracts that cater to different trading strategies and preferences.

BingX primarily provides:

- Linear Perpetual Contracts: These are quoted and settled in cryptocurrencies. They allow you to speculate on the price movement of crypto pairs without an expiry date.

- Options: Options are financial instruments that give you the right, but not the obligation, to buy or sell an asset at a predetermined price within a specific time frame.

Phemex, on the other hand, offers a broader range of contracts:

- Inverse Perpetual Contracts: These contracts use cryptocurrency as the margin and are quoted in USD. Your profits or losses are also settled in cryptocurrency. This type of contract is beneficial if you wish to gain exposure to USD price movements while maintaining your margin in crypto assets.

- Linear Perpetual Contracts: Similar to BingX, these contracts are settled and quoted in cryptocurrencies and have no expiry date.

- Inverse Futures Contracts: Futures quoted and settled in cryptocurrency offer exact settlement dates.

- COIN-M Futures: These are cryptocurrency-margined futures contracts, allowing exposure to various cryptocurrencies.

- USD-M Futures: USD-margined futures offer an easy way to speculate on the future price of digital assets in USD terms.

Each contract type has its benefits and drawbacks.

For example, inverse contracts are preferable to hedge your crypto holdings against market volatility. In contrast, linear agreements may be more suitable if you trade directly with your existing crypto holdings without converting to USD.

Options available on BingX offer the flexibility to engage with the market without the obligation of a futures contract.

BingX Vs. Phemex: Leverage And Margin

When comparing BingX and Phemex, it’s essential to understand how they provide leverage and margin options for trading. These tools allow you to amplify your positions and potential returns, but they also increase the risk of liquidation.

On BingX, you can access leverage of up to 50x on specific trading pairs. This means for every $1 of your capital, you can control a position worth up to $50.

The margin requirements and liquidation thresholds vary depending on your position size and the asset you’re trading.

BingX calculates funding rates every 8 hours, which could impact the cost of holding leveraged positions.

Phemex, on the other hand, offers a maximum leverage of up to 100x on specific contracts.

Higher leverage can significantly enhance your profit potential from small price movements. However, it also increases the risks, as you could be liquidated with more minor price changes against your position.

Just like BingX, Phemex charges funding rates, but these occur every 8 hours, and the rate depends on market liquidity and the prevailing funding interval rates.

Here’s a brief comparison:

| Feature | BingX | Phemex |

|---|---|---|

| Maximum Leverage | 50x | 100x |

| Funding Interval | Every 8 hours | Every 8 hours |

| Position Amplification | Up to 50 times your initial capital | Up to 100 times your initial capital |

| Liquidation Risk | Based on position size and market volatility | Higher due to greater leverage |

Your margin maintenance and liquidation point are crucial to monitor when trading on leverage.

Your position may be liquidated if your margin balance exceeds the maintenance margin requirement.

Therefore, you must manage your risk and be aware of the leverage and margin requirements of the exchange you choose to trade on.

BingX Vs. Phemex: Liquidity And Volume

When you trade cryptocurrencies, liquidity and volume play pivotal roles in the efficiency and execution of your trades.

Higher liquidity signifies a more vibrant market where assets can be bought or sold quickly without substantial price changes.

In this context, volume refers to the number of assets traded in a particular period, reflecting market activity.

BingX Liquidity and Volume

BingX maintains a commendable level of liquidity, facilitating smoother transactions for you.

High liquidity leads to tighter spreads, meaning there’s less difference between the buy and sell prices.

Consequently, this results in lower slippage, minimizing the difference between the expected price of your trade and the actual executed price.

Metrics and Rankings:

- Spread: Tighter spreads signal higher liquidity

- Trade Volume: Indicates active trading community and stability

Phemex Liquidity and Volume

Phemex, in contrast, supports a diverse array of cryptocurrencies and demonstrates competitive liquidity.

As with BingX, Phemex’s liquidity levels are crucial for trade execution efficiency.

Sufficient liquidity ensures your trades are executed without significant price impact.

Metrics and Rankings:

- Spread: Competitive spreads attest to robust liquidity

- Trade Volume: High volume reflecting a dynamic trading environment

Each exchange’s liquidity and volume metrics can often be found on their respective websites or through industry aggregate sites that analyze and compare exchange performances.

BingX Vs. Phemex: Fees And Rewards

When considering BingX and Phemex, you’ll notice that both platforms offer competitive fee structures and rewards, which can significantly impact your trading costs and incentives.

Trading Fee & Deposit/Withdrawal Fee Compared

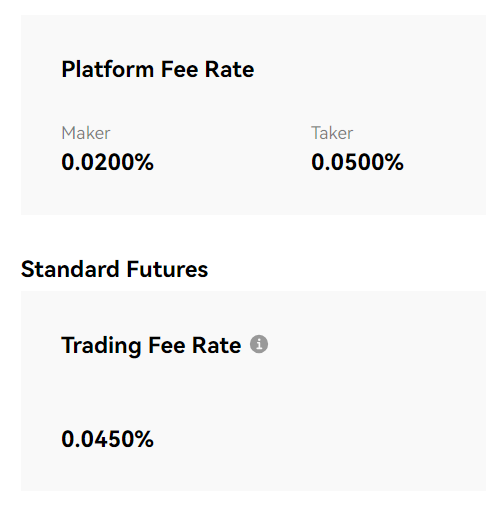

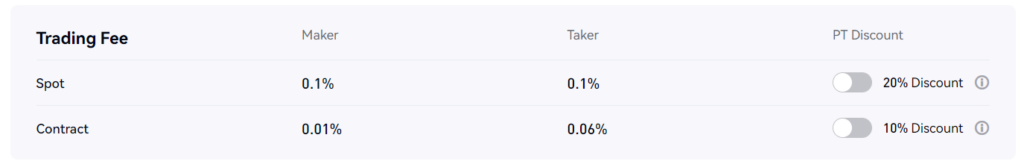

BingX:

- Trading Fees: Generally range from 0.05% to 0.2%, which is relatively low compared to many other crypto exchanges.

- Deposit Fees: Typically, there are no deposit fees for cryptocurrencies.

- Withdrawal Fees: Varies per coin; checking the specific fee for the cryptocurrency you wish to withdraw is crucial.

Reward System:

- Bonuses for sign-ups, with potential rewards up to 200 USDT.

- Monthly updates can include various promotions and fee adjustments.

Phemex:

- Trading Fees:

- Maker Fee: This can be lower than the taker fee, sometimes reaching 0% with higher trading volume or VIP levels.

- Taker Fee: Averages slightly higher than the maker fee, incentivizing liquidity provision.

- Deposit Fees: No fees are charged for cryptocurrency deposits.

- Withdrawal Fees: Depends on the asset, but there is typically a minimum network fee for withdrawals.

Reward System:

- Incentives like deposit bonuses up to USD 180.

- Periodic fee discounts or incentives may be offered for active traders or during promotional periods.

To illustrate, if you were to conduct a trade worth 10,000 USDT on BingX with a trading fee of 0.1%, your cost would be 10 USDT.

On Phemex, assuming a maker fee of 0.025%, the same trade would cost 2.5 USDT.

The difference in fees can accumulate over time, especially for frequent traders, thus affecting overall profitability.

Always verify the latest fee schedule on exchange websites, as rates and rewards can change.

BingX Vs. Phemex: Deposits & Withdrawal Options

When considering the deposit and withdrawal options on BingX and Phemex, there are a few aspects you should be aware of. These include the supported currencies, payment methods, processing times, and transaction limits.

BingX:

- Currencies: BingX supports various cryptocurrencies for both deposits and withdrawals.

- Payment Methods: BingX allows you to fund your account through multiple methods. However, specifics can depend on your region.

- Processing Times: Deposits on BingX are typically swift, with withdrawals processing within a reasonable timeframe.

- Limits: Both platforms have minimum and maximum transaction amounts to maintain security and liquidity.

Phemex:

- Currencies: Phemex also accepts a variety of cryptocurrencies for deposits and withdrawals.

- Payment Methods: Similar to BingX, Phemex offers several deposit methods. However, please verify which ones are available as they vary.

- Processing Times: On Phemex, deposits are recognized promptly, and withdrawals are processed promptly.

- Limits: Phemex enforces minimum and maximum transaction amounts for user protection and operational efficiency.

Below is a summarized comparison:

| Feature | BingX | Phemex |

|---|---|---|

| Supported Cryptos | Multiple | Multiple |

| Deposit Methods | Region-dependent | Region-dependent |

| Withdrawal Processing | Reasonable time | Timely manner |

| Transaction Limits | Minimum and maximum | Minimum and maximum |

BingX Vs. Phemex: KYC Requirements & KYC Limits

When you trade on cryptocurrency exchanges like BingX and Phemex, you must comply with their Know Your Customer (KYC) procedures. These requirements are essential to understand as they impact your privacy, security, and trading capabilities on each platform.

BingX KYC Requirements:

- Verification Levels: Typically involves a tiered system where each level grants increased liberties.

- Documents: Identification such as a passport or national ID card.

- Procedure: Upload required documents and await verification confirmation.

Phemex KYC Requirements:

- Verification Levels: Phemex also uses a similar tiered approach as BingX.

- Documents: You must submit a passport, valid ID card, or other forms of identity verification.

- Procedure: To complete your verification, you must submit your documents and follow the verification steps.

KYC Limits for BingX and Phemex:

| Verification Status | BingX Limits | Phemex Limits |

|---|---|---|

| Unverified | They limited deposits and withdrawals—restricted trading. | Similar constraints as BingX have possible variations in exact limits. |

| Verified | Increased or no limits on deposits, withdrawals, and trading capabilities. | Comparable enhancements to BingX upon completing verification. |

Your verification level determines how much you can deposit, withdraw, and trade.

A higher verification level generally means fewer restrictions, offering a broader range of financial activities.

Remember the balance between privacy and the need for higher limits when completing KYC verifications on BingX or Phemex.

BingX Vs. Phemex: Order Types

When trading on BingX or Phemex, you have access to various order types that enable you to tailor your trading strategies and manage risks effectively. Here’s a breakdown of the order types offered by each exchange:

BingX:

- Market Orders: Place an order immediately at the current market price.

- Limit Orders: Set a specific price you want to buy or sell, executing only if the market reaches your specified price.

- Stop Orders: Also known as stop-loss orders, they trigger a buy or sell when the price hits a predetermined level.

- Conditional Orders: Condition-based orders that execute when certain pre-set conditions are met.

Phemex:

- Market Orders: Enables immediate purchase or sale at the best available current price.

- Limit Orders: You can specify the price at which you wish to transact, and the order will only execute if the market price meets this price.

- Stop Orders: Automatically buy or sell assets when they reach your defined price, acting as a risk management tool.

- Conditional Orders: Set orders to execute when specific conditions are fulfilled.

- Post-Only Orders: Ensure the order is added to the order book and not executed immediately, providing liquidity.

- Reduce-Only Orders: A feature to reduce your position, not increase it. This order type ensures that an order will only execute if it decreases your position.

Both platforms provide tools for specific trading and risk management strategies.

While BingX offers the basic order types, Phemex includes additional options like post-only and reduce-only orders, offering more nuanced control over trading activities.

Use these tools to shape your trading approach and align it with your financial goals and risk tolerance.

BingX Vs. Phemex: Security And Reliability

When evaluating the security and reliability of BingX and Phemex, your priority should be how they safeguard your funds and data.

BingX:

- Implements standard industry security measures.

- Utilizes an insurance fund to cover potential losses.

- It has faced no major public security breaches, reflecting a stable security posture.

Phemex:

- It also follows robust security protocols typical within the industry.

- Employs a cold wallet system to secure user funds offline.

- Like BingX, Phemex has maintained a clean slate concerning significant security incidents.

In terms of regulatory compliance:

- Both exchanges strive to comply with international regulatory standards, which helps to ensure their reliability.

- They use KYC (Know Your Customer) practices to prevent illicit activities.

Customer Support:

- BingX provides a comprehensive support system, including live chat and email correspondence.

- Phemex also offers multiple support channels, focusing on rapid response to customer inquiries.

| Exchange | Security Features | Regulatory Compliance | Customer Support Channels |

|---|---|---|---|

| BingX | Insurance fund, Standard security | KYC, AML | Live chat, Email |

| Phemex | Cold wallet storage, Standard security | KYC, AML | Live chat, Email, Ticket system |

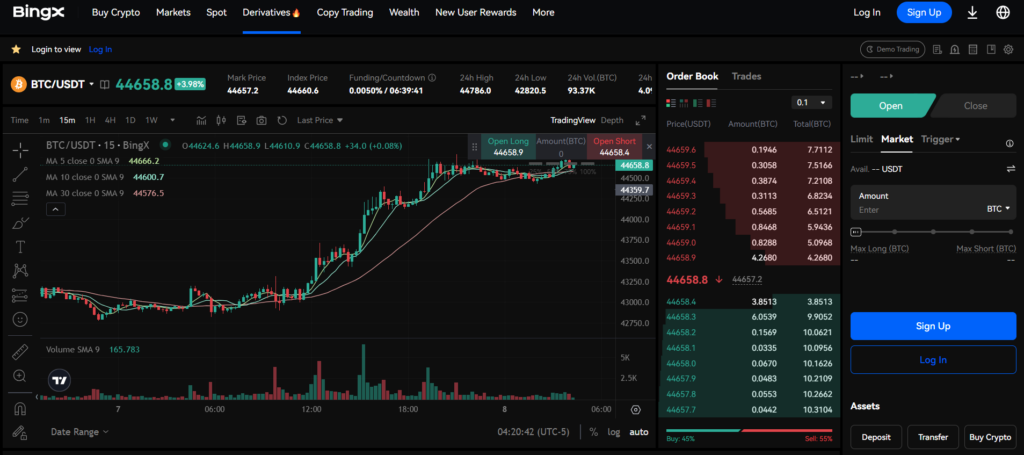

BingX Vs. Phemex: User Experience

When comparing BingX and Phemex, user experience includes aspects such as platform interface, features, ease of use, speed, and design. Your personal needs and preferences are pivotal in selecting the correct exchange.

BingX:

- Interface: Streamlined with a focus on social trading features.

- Ease of Use: Intuitive for beginners and intermediate users.

- Speed: Trades execute efficiently with minimal lag.

- Design: Clean with accessible information and features.

Users rate BingX at a 4.0, indicating a positive reception towards its usability and design. The interface allows quick market access and provides a more community-driven trading experience.

Phemex:

- Interface: Professional with advanced charting tools.

- Ease of Use: Suitable for experienced traders due to complex features.

- Speed: High performing with minimal downtime.

- Design: Functional with emphasis on technical trading tools.

Phemex also receives a rating of 4.0, showing that users find its offering satisfactory, particularly praising its robustness and advanced functionalities catered towards expert traders.

In terms of features and functionality:

- BingX leans towards a user-friendly experience with copy trading options and a social community.

- Phemex focuses on performance and advanced trading tools, including derivatives trading options.

BingX Vs. Phemex: Education And Community

When you’re exploring BingX and Phemex, you’ll notice that both platforms offer a range of educational materials and have cultivated distinct communities.

Educationally, each exchange provides learning resources, guides, and tutorials aimed at enhancing your trading knowledge and skills.

BingX

- Offers interactive tutorials and posts regular updates on cryptocurrency trends.

- Engages users on social media platforms like Twitter and Telegram, where you can connect with other traders.

- Community support is robust, with user discussions encouraged on forums and dedicated channels.

Phemex

- Focuses on comprehensive trading guides and educational articles.

- Their Phemex Academy section serves as a repository for traders to learn about crypto and trading.

- Provides a supportive community, particularly for new users, with active engagement on platforms like Discord and Reddit.

For both platforms, a strong emphasis is placed on arming you with knowledge.

- BingX aligns its resources with market trends, appealing to users who want to stay up-to-date with crypto developments.

- Phemex, on the other hand, leans towards in-depth educational content, which may benefit you if you prefer comprehensive learning.

In terms of community, each exchange offers you opportunities to engage with like-minded individuals:

- BingX’s social media presence is interactive, with frequent engagement and quick responses.

- Phemex fosters a collaborative environment with detailed responses to community questions.

BingX vs Phemex: Regulation and Compliance

When comparing BingX and Phemex regarding regulation and compliance, it’s essential to scrutinize their adherence to the legal frameworks of the jurisdictions where they operate.

Your examination should focus on their licensing status, any audits they have undergone, certifications they may hold, and their approach to navigating the ever-evolving landscape of cryptocurrency regulations.

BingX:

- It may be subject to less stringent regulations. For example, depending on its jurisdiction, a platform with derivative trading might operate without KYC (Know Your Customer) processes.

- You must confirm whether BingX has faced regulatory challenges or controversies. These could impact its reliability and the security of your funds.

Phemex:

- Consider whether Phemex has obtained specific licenses in countries where such certifications are mandatory for operation.

- Investigate any audits or compliance reviews Phemex has participated in to ensure the platform maintains high standards of security and ethical practices.

Below is a simple comparison to assist you in understanding their regulatory standing:

| Platform | Regulatory Adherence | Licenses/Certifications | Audits/Reviews |

|---|---|---|---|

| BingX | Varies by region | Check for jurisdiction-specific details | Dependent on region |

| Phemex | Compliance emphasis | Search for any public certifications | Verify audit history |

By confirming each platform’s compliance with regulatory requirements, you ensure your investment is aligned with legal norms. You’re also safeguarding your assets from legal complications or operational uncertainties associated with unregulated exchanges.

Conclusion

When comparing BingX and Phemex, it’s essential to consider your specific trading needs and preferences. Both platforms offer competitive trading fees.

Phemex has spot maker and taker fees of 0.1%. Users rate both exchanges with a score of 4.0, reflecting general satisfaction among users.

-

- BingX:

- Suitable for traders looking for a variety of deposit methods and bonuses.

- Offers a sign-up bonus of up to 200 USDT.

- Phemex:

- It is ideal for those prioritizing low trading fees and a straightforward fee structure.

- BingX:

| Feature | BingX | Phemex |

|---|---|---|

| Trading Fees | Varied depending on the platform | Spot maker/taker fee of 0.1% |

| Bonuses | Up to 200 USDT sign-up bonus | Deposit bonuses available |

| User Rating | 4.0 based on customer reviews | 4.0 based on customer reviews |

For novices, BingX might be appealing due to its user-friendly bonuses. If you’re cost-sensitive, Phemex’s low fees could be more beneficial.

To make the best decision for your cryptocurrency trading journey, conduct further research and consider staying informed through current users’ reviews and updated comparison charts.

Both Phemex and BingX update their information monthly. This could better guide your choice to align with your investment strategy.

Explore how BingX and Phemex compare to their competitors:

- BingX vs Bybit: Detailed Review and Comparison

- BingX vs MEXC: Detailed Review and Comparison

- BingX vs Binance: Detailed Review and Comparison

- Phemex vs Bybit: Detailed Review and Comparison

- Phemex vs BitMEX: Detailed Review and Comparison

- Phemex vs Binance: Detailed Review and Comparison