BingX and KuCoin are prominent cryptocurrency exchanges, each catering to different trading needs. KuCoin is known for its wide range of supported cryptocurrencies, user-friendly interface, and diverse trading options including spot, margin, and futures trading. It also offers various financial services such as staking, lending, and token launch platforms, making it suitable for both novice and experienced traders.

BingX, on the other hand, is renowned for its social trading features, allowing users to follow and replicate the trades of experienced traders. It also offers derivatives trading with competitive fees and advanced trading tools. BingX’s emphasis on community and social trading makes it a unique choice for those interested in leveraging the insights of successful traders.

When choosing a cryptocurrency exchange, you want the most reliable data to inform your decision. Below is a comparative table that highlights crucial aspects of BingX and KuCoin.

| Feature | BingX | KuCoin |

|---|---|---|

| Founded | 2018 | 2017 |

| Founder(s) | Not Publicly Disclosed | Michael Gan, Eric Don, Top Lan, Kent Li, |

| John Lee, Jack Zhu, Linda Lin | ||

| Supported Coins | Offers a wide variety | Supports an extensive list of cryptocurrencies |

| Trading Fees | Maker: as low as 0.0015%; Taker: as low as 0.035% | Maker: 0.02% – 0.03%; Taker: 0.06% – (-0.015%) |

| Withdrawal Fees | Varies per coin, typically below 1% | Depends on the cryptocurrency |

| Deposit Methods | Multiple payment methods, including bank transfer | Offers various methods, including bank transfers |

| Trading Products | Spot, Futures, Options, Copy Trading | Spot, Futures, Margin, Staking, Lending |

| Leverage | Up to 125x on certain products | Up to 100x on certain products |

This table serves as a starting point for comparing BingX and KuCoin.

Consider each exchange’s complete offerings and update yourself with the latest information before making any decisions, as the features and fees can change over time.

BingX Vs. KuCoin: Products And Services

When you compare BingX and KuCoin, you’ll find that both exchanges offer diverse trading options and services designed to cater to different kinds of traders.

BingX shines with its user-friendly approach, making it a suitable platform for both beginners and professional traders. It offers access to over 520 coins, ensuring you have a wide array of cryptocurrencies to trade. Your trading experience is further enhanced with the availability of:

- Spot Trading: Trade cryptocurrencies on the current market price.

- Futures Trading: Standard and perpetual futures are available for speculating future prices.

- Demo Trading Account: Hone your trading skills without financial risk.

- Forex and Indices: Diversify your portfolio beyond cryptocurrencies.

- Copy Trading: Follow and replicate the trades of experienced traders.

This platform is known for integrating features that cater to novices, such as the demo trading platform, and tools that appeal to seasoned traders, like copy trading.

In contrast, KuCoin is also recognized for its robust set of offerings. It provides services such as:

- Spot and Futures Trading: Both platforms allow trading in these markets.

- Options and Leveraged Tokens: For advanced trading strategies.

- Staking: Earn rewards by holding specific cryptocurrencies.

- NFT Marketplace: Engage with the growing NFT space directly through the exchange.

KuCoin’s appeal lies in its intuitive user interface and comprehensive mobile application that facilitates seamless trading.

In terms of variety, KuCoin might edge BingX slightly by offering additional products like the NFT marketplace. Innovation-wise, both platforms continuously update their services to enhance your trading experience.

As for user experience, BingX’s streamlined approach caters excellently to newcomers, while Kucoin’s extensive features will likely be preferred by users looking for a more comprehensive trading environment.

BingX Vs. KuCoin: Contract Types

When exploring the contract types on BingX and KuCoin, you need to understand the variety and characteristics of each.

Contract types are pivotal as they offer different mechanisms for trading and hedging in cryptocurrency markets.

BingX offers a range of contract types, including:

- Linear Perpetual Contracts: These are quoted in USDT, simplifying the process since you don’t have to hold the underlying asset.

- Inverse Perpetual Contracts: Your profits and losses are in the cryptocurrency on which the contract is based, requiring you to hold the underlying asset.

KuCoin, on the other hand, provides you with a broader set of options:

- Linear Perpetual Contracts (USDT-M): All settlements are in USDT, which makes it easy for you to calculate profits, losses, and margins.

- Inverse Perpetual Contracts (COIN-M): The settlement is in the native cryptocurrency, which might be suitable if you prefer holding the actual coins.

- Inverse Futures Contracts: They are settled on a specific date and require you to understand the expiry and settlement intricacies.

- COIN-M Futures: Here, contracts are denominated and settled in the coin itself, which could be beneficial or riskier depending on market volatility.

- USDⓈ-M Futures: These are settled in stablecoin, mitigating certain risks associated with coin volatility.

- Options: KuCoin offers crypto options that give you the right, but not the obligation, to buy or sell at a predetermined price, adding another layer of complexity to your trading strategy.

The benefits you glean from these contracts relate to your trading strategy and risk tolerance. For a straightforward approach, linear perpetual in USDT might suit you.

If you prefer directly handling cryptocurrencies, COIN-M or inverse contracts could align well with your preferences.

Each contract type comes with its leverage options, risk exposure, and margin requirements, which are crucial for you to consider.

BingX Vs. KuCoin: Supported Cryptocurrencies

When comparing BingX with KuCoin, your selection of available cryptocurrencies for trading, specifically in futures and leverage markets, is an essential factor. Each platform offers a range of options to meet diverse trader needs.

BingX is recognized for its selection of popular cryptocurrencies for futures trading. The exchange typically features leading digital assets like Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC), acknowledging the demand for mainstream crypto futures trading.

On the other hand, KuCoin boasts an extensive library of cryptocurrencies across its platform.

For futures trading, you find a robust lineup including but not limited to Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and more niche altcoins, providing you with an opportunity to diversify your trading strategy.

Most Popular Futures Trading Pairs

| BingX | KuCoin |

|---|---|

| BTC/USDT | BTC/USDT |

| ETH/USDT | ETH/USDT |

| LTC/USDT | XRP/USDT |

Furthermore, KuCoin often expands its offerings, adding emerging cryptocurrencies to its future markets, which may appeal to you if you’re looking for the latest tradable assets.

Leverage trading on both platforms allows for a similar scope of options, generally mirroring what’s available in their respective futures markets.

Regarding leverage, BingX and KuCoin allow you to engage with different leverage levels on specific trading pairs, catering to conservative and high-risk trader appetites.

However, always exercise caution with leverage, as it significantly increases your trades’ potential gains and losses.

Your exploration into either platform will reveal a nuanced array of supported cryptocurrencies for various trading preferences and risk profiles in futures and leverage trading.

BingX Vs. KuCoin: Leverage And Margin Trading

When trading on BingX and KuCoin, you can use leverage to enhance your trading position. Leverage is a tool that allows you to control a more prominent position with a smaller amount of capital.

It is usually represented by a ratio such as 5:1 or 10:1, meaning that for every $1 you have, you can control $5 or $10 worth of cryptocurrency.

BingX Leverage Options:

- Maximum Leverage: This can be substantial, but specific figures are updated frequently based on market conditions.

- Margin Requirements: Varies by the leverage used. Higher leverage requires less capital but increases liquidation risk.

- Liquidation Risks: You face potential liquidation if the market moves against your position and reaches a certain threshold.

- Funding Rates: Charged regularly to keep the leveraged position open.

KuCoin Leverage Options:

- Maximum Leverage: Offers different leverage levels depending on the specific cryptocurrency pair you are trading.

- Margin Requirements: As with BingX, they are contingent on the leverage and can fluctuate based on market volatility.

- Liquidation Risks: Similar to BingX, your position may be liquidated if your margin balance falls below the maintenance margin.

- Funding Rates: Funding rates apply, which might impact long-term leveraged positions due to recurrent fees.

When choosing between BingX and KuCoin for leverage and margin trading, consider the specific terms offered, as they are subject to change and can vary between platforms.

Be aware of the inherent risks of leveraged trading, such as the possibility of quick, significant losses and the potential for liquidation. Assess your risk tolerance and strategy before engaging in leveraged trades on either platform.

BingX Vs. KuCoin: Trading Volume

When comparing BingX and KuCoin, the trading volume on each platform is crucial.

The trading volume is a vital metric as it affects the liquidity within an exchange, directly influencing your trading experience.

BingX:

- Your trades on BingX may benefit from competitive liquidity in various markets.

- More minor trading pairs might have less volume, potentially reducing execution efficiency and higher slippage.

KuCoin:

- KuCoin generally boasts a higher overall trading volume.

- Higher volume can translate to better execution for your trades and less slippage, especially in significant trading pairs.

Trading Efficiency:

- On BingX, you might encounter slightly slower execution times during high volatility periods due to volume fluctuations.

- KuCoin’s substantial volume often ensures efficient trade execution, regardless of market conditions.

Slippage:

- A lower volume on BingX could mean higher slippage, affecting order fulfillment prices.

- KuCoin’s higher volume typically leads to lower slippage rates, maintaining closer alignment with your expected transaction rates.

Sources & Metrics:

- Liquidity rankings and metrics are available on various financial analytics platforms. These will provide you with real-time volume data.

- Regularly review these platforms as volumes can change, which might affect your trading strategy.

Your choice between BingX and KuCoin could depend on how much value you place on trading volume. Consider how volume integrates into your overall trading strategy, including efficiency and slippage, before choosing the platform that best fits your trading needs.

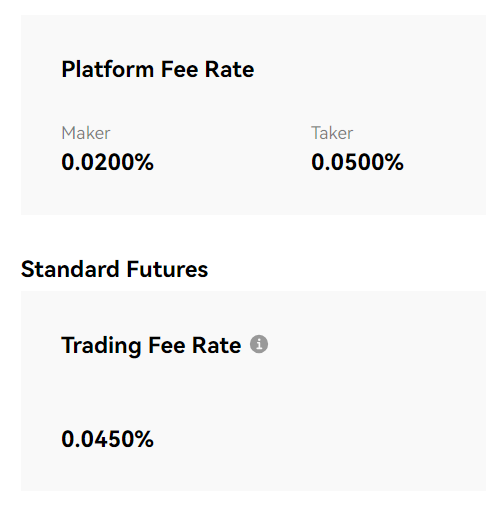

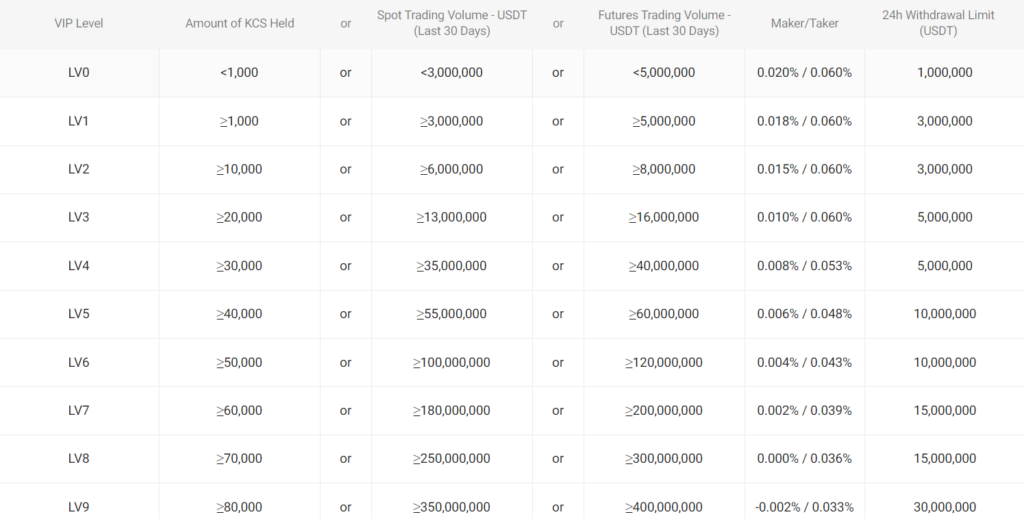

BingX Vs. KuCoin: Futures Trading Fees And Rewards

When trading futures on BingX or KuCoin, the cost structure is pivotal in affecting profitability. BingX typically offers a competitive fee with maker and taker fees that can go as low as 0.0015% and 0.035%, respectively. These are further reduced based on your 30-day trading volume, incentivizing high-frequency traders.

KuCoin’s futures trading fees are 0.02% for makers and 0.06% for takers.

However, with increased trading volume, these can decrease to 0.03% for takers and even a negative fee for makers at -0.015%, essentially rewarding users for providing liquidity to the market.

Fee Structure:

- BingX Fees:

- Maker: from 0.0015%

- Taker: from 0.035%

- KuCoin Fees:

- Maker: 0.02% to -0.015%

- Taker: 0.06% to 0.03%

Both platforms offer a tiered fee structure where your trading volume influences the fees you pay. Higher volume equals lower fees; therefore, the more you trade, the less you pay per transaction.

Rewards System:

- BingX: Offers a demo trading platform and well-integrated copy trading, which can be seen as indirect rewards fostering a learning environment and potential profitability.

- KuCoin: Provides a series of bonuses and incentives, such as fee discounts for using its native token, creating a reward ecosystem for its users.

Analyzing withdrawal and deposit fees, each platform tailors fees based on the payment method, cryptocurrency, and individual user level.

It’s essential to account for these when calculating potential profits from trading activities. Stay informed on current rates and tier qualifications, as they can change and affect your trading strategy.

BingX Vs. KuCoin: Deposits & Withdrawal Options

When deciding between BingX and KuCoin, your choice might hinge on how easily you can move your funds.

Both exchanges cater to this need with different approaches, and understanding these can help you manage your transactions more effectively.

BingX offers a broad range of withdrawal options for cryptocurrencies. You can withdraw in over 300 different types of digital assets, which provides you with tremendous flexibility.

- Supported Currencies: Over 300 cryptocurrencies

- Payment Methods: Cryptocurrency transfers

- Processing Times: Typically fast, depending on network congestion

- Transaction Limits: Varies per crypto; check BingX’s terms for specific details

In contrast, KuCoin emphasizes ease of entry into cryptocurrency, supporting fiat deposits in over 20 currencies.

KuCoin offers diverse payment options, including credit/debit cards, bank transfers, and third-party payment processors.

- Supported Currencies: Over 20 fiat currencies and a vast selection of cryptocurrencies

- Payment Methods: Credit/debit cards, bank transfers, third-party processors

- Processing Times: Can range from instant to several days, dependent on method and location

- Transaction Limits: Dependent on verification level, with higher tiers allowing more significant transaction amounts

BingX Vs. KuCoin: Native Token Usage

BingX and KuCoin, as popular cryptocurrency exchanges, offer their native tokens with various uses within their ecosystems.

Understanding how these tokens can benefit you as a trader is critical to maximizing your experience on these platforms.

BingX Native Token

BingX doesn’t currently have its native token.

KuCoin Native Token: KCS

KuCoin Shares (KCS) is the native token of KuCoin. As a holder of KCS, you can benefit from:

- Trading Fee Discounts: Your trading fees may be reduced if you pay them using KCS.

- KuCoin Bonus: Ownership of KCS entitles you to a portion of the trading fees earned by the exchange as a daily bonus.

| Utility | Description |

|---|---|

| Fee Discount | Reduced fees for trades completed using KCS. |

| Daily Bonus | Share of fees distributed to KCS holders. |

Using KCS on the KuCoin platform can decrease your trading expenses and provide a source of passive income through the KuCoin Bonus program.

These tokens’ utility makes them valuable to your trading strategy on their respective platforms.

Remember that holding tokens also comes with volatility risks associated with the cryptocurrency market.

Your diligent use of these native tokens can enhance your trading experience while managing your investment strategy according to your risk tolerance.

BingX Vs. KuCoin: KYC Requirements & KYC Limits

When comparing BingX and KuCoin, the KYC (Know Your Customer) requirements and limits are pivotal for your trading experience.

Both exchanges cater to a global audience and have developed KYC protocols to comply with regulatory standards.

BingX:

BingX operates as a non-KYC exchange in 2024, allowing you to deposit, trade, and withdraw without identity verification. However, unverified users face certain restrictions to maintain security and discourage illicit activities.

- Deposit Limits: No limitations for cryptocurrency deposits.

- Withdrawal Limits: There are specific caps for unverified accounts, subject to changes per exchange policy.

- Trading Limits: No explicit barriers on trading volumes for unverified users, but large transactions may trigger security reviews.

KuCoin:

KuCoin requires KYC verification to enhance account security and withdrawal capabilities. The exchange offers tiered levels of verification, with each level granting increased limits and services.

- Verification Levels:

- Level 1: Providing basic personal information.

- Level 2: Requires government-issued ID documents and a selfie.

- Level 3: Additional papers and proof of address.

- Withdrawal & Trading Limits: Your limits depend on the verification level, with Level 1 users facing daily and monthly caps, which increase substantially upon completing higher KYC levels.

The KYC framework of each platform directly affects privacy and security.

Your choice may depend on whether you prioritize accessibility without stringent identity checks or are inclined towards enhanced security features and higher transactional freedom through verified accounts.

Remember always to stay informed of the current limits and verification procedures, as exchanges frequently update their policies.

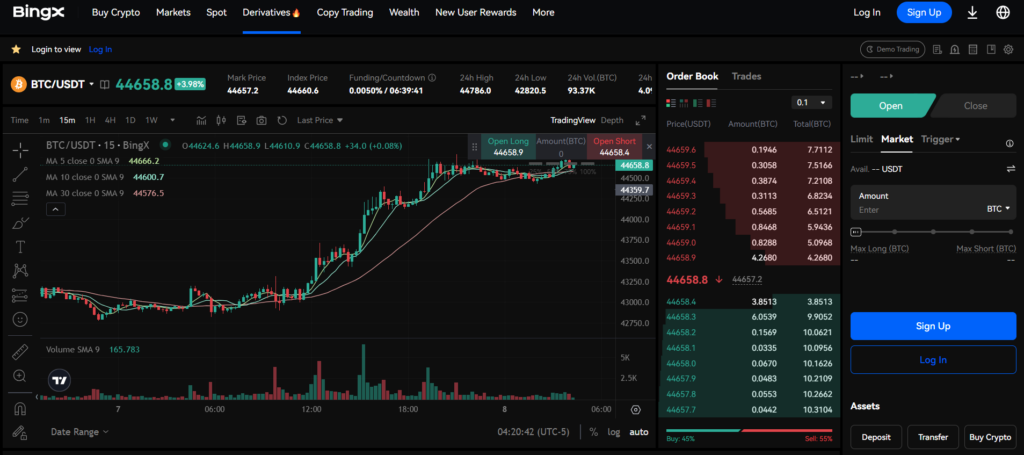

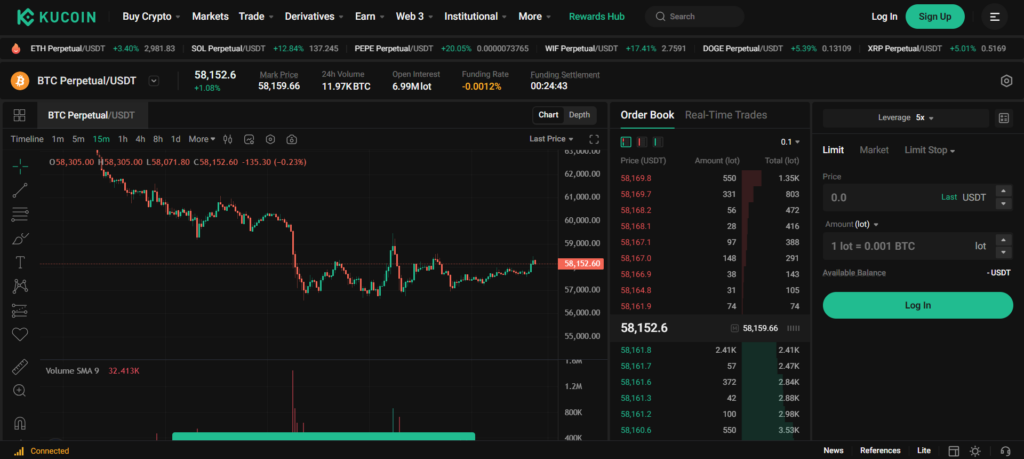

BingX Vs. KuCoin: User Experience

When you engage with BingX and KuCoin, your experience of their platforms and interfaces plays a critical role.

BingX boasts a streamlined signup process that you can complete with just an email address or a phone number paired with a strong password.

This simplicity extends to their user-friendly interface, making navigation and trading operations relatively straightforward.

KuCoin, on the other hand, has a widespread user base and has developed an interface that meets the needs of novice and experienced traders.

With support for over 800 digital assets, KuCoin presents an expansive suite of options that can be explored through its well-designed web and mobile applications.

Regarding mobile apps, both exchanges ensure that their applications are efficient and intuitive.

Frequently updated to address any usability concerns, these apps empower you with trading features that mirror those on the web interfaces.

They are designed to load quickly and give you a seamless experience, even on the go.

Regarding design and functionality, both BingX and KuCoin emphasize visual clarity and easy access to trading tools.

You’ll notice that their dashboards are organized with practicality in mind, granting you quick access to essential features like your portfolio, trade execution, and market analysis tools.

It’s also valuable to note that KuCoin has made recent updates to improve user experience, suggesting a commitment to address any navigational or operational issues promptly.

Meanwhile, BingX has focused on offering diverse trading features, intending to provide an enriching trading environment for its users.

| Feature | BingX | KuCoin |

|---|---|---|

| Signup Process | Simplified: Email/Phone | Comprehensive: Over 800 assets |

| Mobile App | Functional and intuitive | Efficient and mirrors web functionality |

| Interface Design | User-friendly and straightforward | Clean, caters to all levels of experience |

| Trading Features | Diverse | Extensive, caters to a broad market |

By comparing these aspects, you can gauge which exchange aligns most closely with your usability, speed, and overall functionality preferences.

BingX vs KuCoin: Order Types

When trading on BingX and KuCoin, you can access various order types that cater to different trading strategies and risk management approaches. It’s important to understand these to maximize the potential of your trades.

BingX Order Types:

- Market Orders: Execute immediately at the best available price.

- Limit Orders: Set a specific price to buy or sell.

- Stop Orders: Triggered when a particular price is reached; can act as stop-loss or take profit.

- Conditional Orders: Execute based on predefined conditions.

- Post-Only Orders: Ensure the order adds liquidity and is not immediately matched.

- Reduce-Only Orders: Used in margin trading to reduce a position’s size, not increase it.

KuCoin Order Types:

- Market Orders: Allow for immediate execution at current market prices.

- Limit Orders: Give you control over the price you wish to buy or sell.

- Stop-Limit Orders: Trigger a limit order when the stop price is reached.

- Stop-Market Orders: Trigger a market order once a specified price is hit.

- Iceberg Orders: Large orders are hidden and divided into smaller limit orders.

- Time in Force Instructions: Customize how long an order remains active.

Both exchanges offer advanced order types beyond the primary market and limit orders, helping you manage your trades effectively.

BingX’s conditional and reduce-only orders are helpful for sophisticated strategies and margin trading.

Meanwhile, KuCoin expands on stop orders with both limit and market triggers, and the addition of Iceberg and Time in Force options provides additional layers of discretion and control.

BingX vs KuCoin: Security Measures & Reliability

When using cryptocurrency exchanges like BingX and KuCoin, your security is paramount. Both platforms implement robust measures to ensure the safety of your funds and personal information.

BingX utilizes a multi-tier and multi-cluster system architecture to enhance stability and security. Regular security audits are essential to their safety strategy, aiming to prevent unauthorized access to your assets.

- Two-Factor Authentication (2FA): adds an extra layer of security to your BingX account.

- AdvanceEncryptionon: protects sensitive data in transit and at rest.

- Risk Management: includes real-time monitoring to detect and mitigate threats.

Meanwhile, KuCoin provides a comprehensive security infrastructure with several layers of protection for your peace of mind:

- Encryption & Authentication: employs industry-standard encryption and strict authentication processes.

- Partnership with Onchain Custodian: secures your funds through third-party custodial services.

- Insurance Policy: in the unfortunate event of a hack, an insurance policy is in place to cover affected client funds.

Both exchanges have faced challenges in the past, with KuCoin experiencing a significant cyber attack in 2020.

They have since bolstered their security measures and refunded the affected users, reinforcing their commitment to reliability and trustworthiness.

As you engage with BingX and KuCoin, remember that security is an ever-evolving domain within the crypto space, and these platforms continuously work to fortify their defenses against new threats.

Your vigilance, combined with their security measures, contributes to a more secure trading environment.

BingX vs KuCoin: Insurance Fund

When considering cryptocurrency exchanges like BingX and KuCoin, evaluating their respective insurance funds is essential. These funds are in place to protect your assets in unforeseen events, such as security breaches.

BingX:

BingX takes the security of your funds seriously. As of the information provided, BingX partners with Onchain Custodian to safeguard assets. In the event of a hack, they have an insurance policy designed to cover Client funds. This offers extra security and peace of mind for your investments in BingX.

- Partner: Onchain Custodian

- Insurance: Yes (Covers client funds in case of hack)

KuCoin:

KuCoin also places a high priority on the safety of its clients’ assets.

While specifics on KuCoin’s insurance fund in the provided content are not detailed, it is understood that significant exchanges like KuCoin typically have some form of insurance in place.

However, you should conduct further research to grasp the complete details of KuCoin’s insurance protections.

- Partner: Not specified

- Insurance: Assumed (Check for precise details)

Your choice of exchange should factor in the insurance protections offered, as they can be a testament to the platform’s dedication to asset security.

Always perform due diligence before trading to ensure you’re comfortable with the risk associated with the chosen exchange.

BingX vs. KuCoin: Customer Support

When choosing a cryptocurrency exchange, customer support is a crucial factor for you to consider. Here is how BingX and KuCoin stack up in this regard:

BingX:

- BingX prioritizes user accessibility by providing a responsive support system.

- You can expect multilingual support, allowing you to receive help in your preferred language.

- For immediate assistance, BingX offers live chat services.

KuCoin:

- KuCoin extends customer service with its 24/7 support system, ensuring that help is available no matter your time zone.

- The exchange includes a comprehensive FAQ and help center for self-service assistance.

- You can contact support via tickets, email, and social media channels.

| Feature | BingX | KuCoin |

|---|---|---|

| Live Chat | Available | Not specified |

| 24/7 Support | Not specified | Available |

| Languages | Multilingual | Multilingual |

| Self-Service | FAQ, Guides | FAQ, Help Center |

Your choice between BingX and KuCoin might hinge on whether you prefer the ease of a 24/7 service or the convenience of immediate interaction through live chat.

Each platform’s unique support offerings cater to different preferences, and your decision should align with what you value most in customer support.

BingX vs KuCoin: Regulatory Compliance

When comparing BingX and KuCoin, assessing how each platform observes regulatory frameworks is crucial. Understanding their adherence to legal standards is essential to making an informed choice.

BingX

- Jurisdiction: BingX operates under various geo-specific regulations to ensure compliance.

- KYC/AML Policies: Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures are enforced to maintain security and align with global standards.

- Licenses: Specific details regarding licenses across different regions would provide insight into the level of regulatory compliance.

- Audits: Regular audits are vital for maintaining trust and confirming adherence to legal requirements. Check for available audit information.

KuCoin

- Jurisdiction: KuCoin’s compliance varies by country, aligning with local financial regulations where it offers services.

- KYC/AML Policies: A structured KYC process reflects a commitment to security and legal compliance.

- Licenses: Investigate whether KuCoin holds any specific licenses demonstrating its regulatory adherence in active markets.

- Controversies: Any past or present legal challenges should be considered to understand KuCoin’s regulatory standing.

You should note that both exchanges strive to observe regulatory standards, but it is always your responsibility to ensure any platform you use is compliant within your jurisdiction. Staying updated with the latest compliance news regarding these exchanges provides a clearer picture of their status.

Conclusion

BingX and KuCoin hinge on your specific needs and preferences when selecting a cryptocurrency exchange.

BingX may appeal to you if you are entering the cryptocurrency trading space or prefer platforms with a more straightforward user interface and a demo trading option.

- Pros: Demo trading platform; competitive fees.

- Fees: As low as 0.0015% (maker) and 0.035% (taker).

- User-Friendly: Yes, especially for newer traders.

On the other hand, KuCoin could be a better fit if you are a more experienced trader looking for a broader range of cryptocurrencies and advanced trading features.

- Pros: Extensive range of cryptocurrencies; lower fees for higher trading volumes.

- Fees: Futures market fees can be as low as 0.03% (taker) and -0.015% (maker).

- Advanced Features: Suitable for experienced traders.

To summarize, carefully consider your trading volume, experience level, and the importance of demo functionality versus advanced trading options.

BingX serves as a vital stepping stone for novices.

At the same time, KuCoin caters well to the demands of veteran investors with its diverse offerings and potential for reduced costs at higher volumes.

Explore how BingX and KuCoin compare to their competitors:

- BingX vs Bybit: In-Depth Analysis

- BingX vs MEXC: In-Depth Analysis

- BingX vs Phemex: In-Depth Analysis

- KuCoin vs Phemex: In-Depth Analysis

- KuCoin vs Bybit: In-Depth Analysis

- KuCoin vs Gate.io: In-Depth Analysis