KuCoin and GMX are notable cryptocurrency platforms, each offering unique features to their users. KuCoin is a well-established exchange renowned for its extensive range of supported cryptocurrencies, user-friendly interface, and comprehensive trading options, including spot, margin, and futures trading. It also provides various financial services like staking, lending, and token launch platforms.

GMX, in contrast, is a decentralized exchange (DEX) known for its focus on perpetual contracts and a user-centric, non-custodial approach. GMX offers benefits such as lower fees, enhanced security through decentralized protocols, and governance via its native token.

When comparing exchanges like KuCoin and GMX, you should consider factors such as supported coins, leverage options, trading volume, deposit methods, and their foundational history.

| Feature | KuCoin | GMX |

|---|---|---|

| Founded in | 2017 | Information not available |

| Founder(s) | Michael Gan and Eric Don | Information not available |

| Supported Coins | 250+ digital assets, including BTC, ETH, KCS, SHIB, etc. | GMX token trading is available |

| Products | Spot trading, Futures, Staking, Lending, P2P marketplace, etc. | Not specified: GMX token-related services |

| Leverage | Up to 10x (spot), 100x (futures) | Not specified; typically related to the token’s use |

| Trading Volume | High volume with a global user base | Not specified in search data, often lower compared to large exchanges |

| Deposit Methods | Crypto deposits, Bank transfer, Credit & Debit cards | Data unavailable |

| Fees | Competitive trading fees with discounts for KCS holders | Fees related to GMX tokens not mentioned |

Please note that the precise features and offerings of GMX are not thoroughly detailed in the provided search data.

You may need to visit the GMX platform for the most current and comprehensive information regarding their services.

As for KuCoin, it’s an established international cryptocurrency exchange with a wide array of trading services and a significant market presence.

KuCoin vs GMX: Products and Services

When you compare KuCoin and GMX, you’re looking at two platforms with distinct offerings in the cryptocurrency space.

KuCoin, known for its extensive services, allows you to engage in various types of trading, such as spot trading, futures trading, and even margin trading. Here’s what you can expect from KuCoin:

- Spot Trading: Trade a wide array of cryptocurrencies.

- Futures Trading: Enter into contracts and trade on the future price of crypto.

- Margin Trading: Borrow funds to amplify your trading power.

- Staking: Earn rewards by holding specific cryptocurrencies.

- Leveraged Tokens: Gain leveraged exposure without the complexities of the margin market.

- NFT Marketplace: Buy, sell, or trade non-fungible tokens.

KuCoin offers a rich assortment of options propelled by its broad market access and initiatives like promotions and fee discounts for card purchases.

However, its licensing limitations in certain regions, such as the U.S., may affect your accessibility and experience.

Conversely, GMX is more focused and offers a platform that is conducive to those interested in trading cryptocurrencies via derivatives. With GMX, you have access to:

- Trading Pairs: Limited selection with a focus on derivatives and perpetual contracts.

- Leverage: Provides a mechanism to trade with increased exposure.

GMX’s services are tailored to a specific trader profile, and while it lacks the breadth of KuCoin’s product suite, it still caters proficiently to its niche.

The clarity and simplicity of GMX could be beneficial if you favor a more streamlined trading experience. However, it may fall short if you seek the diversity and depth of services offered by a more prominent platform like KuCoin.

KuCoin vs GMX: Contract Types

As you navigate the world of cryptocurrency exchanges, the variety of contract types offered is a critical aspect of your trading strategy. KuCoin and GMX provide different contract options catered to diverse trading needs.

KuCoin

KuCoin supports various derivative contracts:

- Inverse Perpetual Contracts: These contracts are settled in cryptocurrency rather than fiat. They are beneficial if you prefer to speculate directly with your digital assets without converting to a stablecoin or fiat currency first.

- Linear Perpetual Contracts: These use a stablecoin as collateral, making them ideal to avoid the volatility of using the actual cryptocurrency for trading.

- Inverse Futures Contracts: A choice for you if you’re looking to hedge future transactions at a predetermined price with cryptocurrency settlements.

- Coin-margined (COIN-M) Futures: If you’re interested in a long-term position without a set expiry date, this contract allows for holding positions with the underlying coin as a margin.

- USDT-margined (USD-M) Futures: If you prefer using a stablecoin as a margin, these contracts are settled in USDT, giving you a more stable valuation.

GMX

Compared to KuCoin, GMX has a narrower selection:

- Perpetual Contracts: GMX’s primary offering includes these contracts, which do not expire, allowing you to hold a position for as long as needed. However, they may not provide the variety of settlement options found in KuCoin.

Each platform has advantages: KuCoin’s vast array of futures contracts is helpful if you seek diversity in your trading approach.

In contrast, GMX’s perpetual contracts focus on straightforwardness and continuity.

It’s essential to weigh these features against your trading goals to determine which exchange meets your needs for contract types.

Whether you value a wide selection or straightforward perpetual contracts will guide your choice between KuCoin and GMX.

KuCoin vs GMX: Supported Cryptocurrencies

When comparing KuCoin and GMX, your choice of platform may depend on the variety of supported cryptocurrencies and trading options available.

KuCoin, established in crypto, offers an extensive range of cryptocurrencies and trading pairs.

KuCoin:

- Spot Trading: You can access a vast array of cryptocurrencies, including well-known coins and numerous altcoins.

- Futures Trading: KuCoin enables futures and leverage trading. This can include popular pairs such as BTC/USDT, ETH/USDT, and others.

- Leverage Options: Leverage varies per pair, giving you the flexibility to trade based on your risk tolerance.

On the other hand, GMX, a smaller and more specialized platform, may offer a different set of options.

GMX:

- Spot Trading: The focus is narrower, with a select range of cryptocurrencies available. You’ll have to check if GMX supports your currency of choice.

- Futures Trading: GMX might not have the breadth of futures trading pairs that an exchange like KuCoin supports.

- Leverage Options: GMX leverage offerings are typically different and may align with the platform’s more curated approach.

As you consider your trading needs, remember that accessibility and the range of available trading pairs should align with your investment goals and strategies.

The most popular futures pairs, like BTC/USDT, tend to be available across most large exchanges, including KuCoin, while niche or emerging pairs might be found on specialized platforms such as GMX.

KuCoin vs GMX: Leverage and Margin Trading

When you trade on KuCoin, you can access margin trading facilities to leverage your positions up to 10X.

In margin trading, you use your capital as collateral to open more prominent positions than your actual account balance.

This can significantly amplify both your potential gains and risks.

KuCoin requires you to maintain a certain margin account balance to keep your positions open, and you should be aware that if your trade moves against you significantly, you could face liquidation.

The exchange also offers reduced trading fees if you use their native token, KCS, to pay for transaction costs.

Leverage Options:

- KuCoin: Up to 10X leverage on various cryptocurrencies.

- GMX: Up to 30X leverage but fluctuates based on market liquidity.

Margin and Risk Management:

- KuCoin: Initial margin required; collateral is cryptocurrency in your account.

- GMX: Initial margin and maintenance margin must be monitored to avoid liquidation.

GMX, on the other hand, offers leverage up to 30X. The exact level of leverage available can change, reflecting the liquidity and volatility of the market.

Much like with KuCoin, leverage enables you to control a more prominent position with fewer funds, with a heightened chance for both profits and losses.

GMX has its margin requirements, which include an initial margin to open a position and a maintenance margin to keep it open.

Failing to maintain the maintenance margin can also lead to liquidating your position.

Be mindful that high leverage increases your buying power and the speed at which you can get liquidated during volatile market moves.

Funding Rates:

- KuCoin: Charges depending on the borrowed amount and market.

- GMX: Funding rates vary and are paid directly between traders, sometimes resulting in lower, more competitive rates.

You need to assess your risk tolerance and the terms provided by each exchange before engaging in margin trading.

KuCoin vs GMX: Trading Volume

When assessing KuCoin and GMX, it’s essential to examine trading volume, as it influences your trading efficiency, execution rates, and slippage.

Higher trading volumes typically denote more liquidity, enabling more seamless trades without significantly affecting the asset’s price.

KuCoin:

- 24h Volume: $856,328,141.73

- Most Active Pair: BTC/USDT ($231,161,765.73 in 24h volume)

- Liquidity and Ranking: High liquidity; operational since September 2017 with a substantial user base.

GMX:

- 24h Volume: Varies, last reported at $23,467,935

- Trading Pair: GMX/USDT available on KuCoin

- Liquidity and Ranking: Data on liquidity and exact rankings might be less readily available than KuCoin.

Volume Impact:

- KuCoin: You can anticipate reduced slippage due to the higher volume, translating to better price accuracy when executing orders. High volume also hints at better trading efficiency, with quicker order matching and completion.

- GMX: With a lower trading volume, there might be increased slippage. However, the exact impact depends on the asset and market conditions.

Data Source Considerations:

- The volumes and metrics are sourced from the exchanges’ public data and platforms like CoinGecko, reflecting the latest reported figures.

- Remember, these numbers can fluctuate, and checking real-time data during your trading hours is crucial.

KuCoin vs GMX: Futures Trading Fees and Rewards

KuCoin Futures Trading Fees

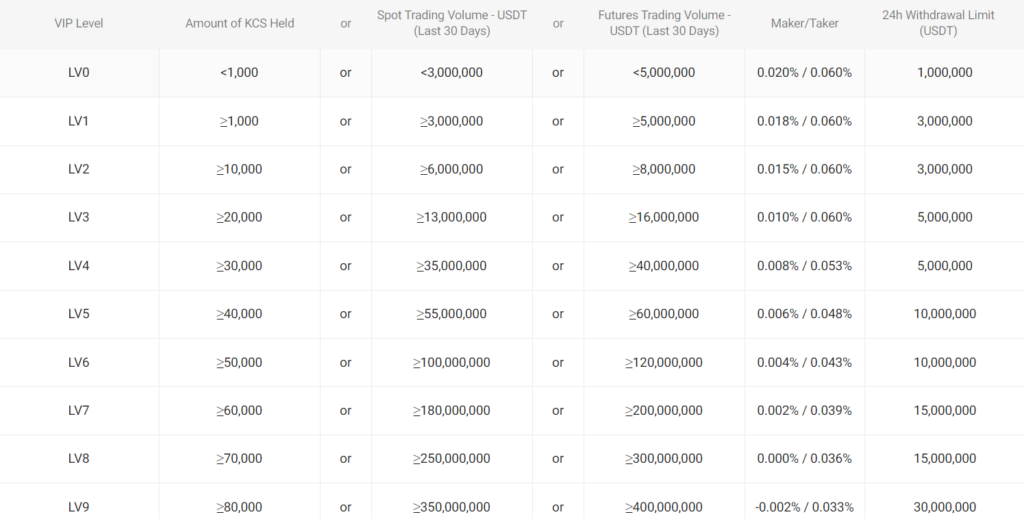

When you trade futures on KuCoin, you are charged based on your position’s total value, not just the initial margin. The fees vary according to your VIP level and trading volume:

- At the lowest VIP level, maker fees are 0.02%, while taker fees are 0.06%.

- If you reach Level 12 as a client by holding more than 150,000 KCS or trading over 80,000 BTC in 30 days, you’ll face a taker fee of 0.025% and enjoy a negative maker fee of -0.005%.

These fees can be further reduced using KCS (KuCoin’s token), potentially offering the lowest taker fee at 0.02%.

GMX Futures Trading Fees

The details on GMX’s fee structure aren’t precise in the data snippet. It’s essential to visit GMX’s official resources for up-to-date and accurate fees related to futures trading.

Deposit and Withdrawal Fees

Each platform may impose deposit and withdrawal fees, which your chosen payment method and trading product can influence. Review each exchange’s policy to understand the costs involved fully.

Reward Systems

Both platforms provide incentives to reduce fees and offer rewards. VIP levels and holding exchange tokens are common ways to receive these benefits.

Fee Calculation Examples

Imagine you execute a $10,000 futures trade on KuCoin. At the lowest level, your taker fee would be $6 (0.06%). On GMX, you’d need to check the current fees, but the cost would be in the same range if they had a similar fee structure.

Remember, trading comes with risks, and while understanding fee structures is crucial, it’s equally important to use safe trading practices and consider the rewards and discounts available to you.

KuCoin vs GMX: Deposits & Withdrawal Options

When comparing KuCoin and GMX regarding deposit and withdrawal options, they both facilitate access to various cryptocurrencies with distinct modalities to manage your funds.

KuCoin, known for its breadth of services, allows you to deposit a wide range of cryptocurrencies. To get started:

- On the KuCoin app, navigate to the “Assets” column and select “Deposit.”

- Choose your desired coin to deposit by selecting from the list or searching for the coin’s name.

Withdrawing from KuCoin is as straightforward. Bitcoin withdrawals, for example, cost you 0.0006 BTC, which is below the industry average.

The platform ensures that these transactions are processed efficiently, giving you a competitive rate and swift access to your assets.

On the other hand, GMX has a different focus and thus offers a different set of options.

While specific deposit and withdrawal methods for GMX are not detailed in the information provided, it generally operates as a decentralized exchange emphasizing derivatives. This could mean a more streamlined process, with possible influences on speed and costs relying on the blockchain used.

KuCoin’s Fees:

- Bitcoin: 0.0006 BTC

- Ethereum: 0.005 ETH

- Tether: 12 USDT

Given the focus on low fees and high liquidity at KuCoin, you will find an accommodating environment for small and large transactions, with fees designed to remain competitive.

The impact on your transfer times and costs will heavily depend on the currency in question and the current state of the network.

KuCoin vs GMX: Native Token Usage

When evaluating KuCoin and GMX, you’ll find that both exchanges have native tokens, each serving unique roles within their ecosystems.

KuCoin Token (KCS) is the native token of the KuCoin exchange. It was introduced as an ERC-20 token running on the Ethereum network.

As a KCS holder, you can benefit from trading fee discounts on the KuCoin exchange, which incentivizes its use and retention.

Additionally, KCS offers participation in the exchange’s growth as it sometimes shares revenue with token holders. As KuCoin evolves, its token is poised to play a central role, especially with plans for decentralized trading solutions.

In contrast, GMX is the native utility and governance token for the decentralized GMX exchange.

Owning GMX tokens grants you governance rights, allowing you to participate in decision-making for the platform.

Revenue sharing is also facilitated through GMX, where liquidity providers in their multi-asset pool earn fees from various services like market making, spot swaps, and leveraged trading.

Here’s a quick comparison:

| Feature | KuCoin Token (KCS) | GMX |

|---|---|---|

| Token Type | Utility | Utility and Governance |

| Network | ERC-20 on Ethereum | – |

| Trading Fee Benefits | Yes | Yes |

| Revenue Sharing | Yes | Yes |

| Governance | No | Yes |

Your participation in either of these ecosystems through these native tokens provides potential cost-saving benefits and integrates you into the growth and decision-making processes of the respective exchanges.

KuCoin vs GMX: KYC Requirements & KYC Limits

KuCoin introduced mandatory Know Your Customer (KYC) policies on July 15, 2023, significantly changing how you interact with the platform. You must complete KYC verification to continue using KuCoin’s full suite of features. This step enhances security but reduces anonymity. As part of this process, you are required to submit personal identification documents.

Verification Levels:

- KuCoin:

- Primary Verification: Provides limited access to trading and withdrawal features.

- Advanced Verification: Increases limits and unlocks full platform capabilities.

Document Requirements:

- KuCoin: Government-issued ID, proof of address, facial verification.

The KYC verification at KuCoin aligns with international regulations, curtailing activities such as fraud and money laundering. Once verified, your daily withdrawal limits are increased.

KYC Limits:

- KuCoin: Before KYC, access was severely restricted; enhanced limits were applied post-verification.

GMX, on the other hand, operates differently. GMX focuses on privacy and does not require KYC for trading on its decentralized platform.

However, this privacy-centric approach may impose inherent limitations on user protections and the capacity to recover from losses due to illicit activities.

Verification Levels:

- GMX: Not applicable, as KYC is not required.

Document Requirements:

- GMX: No documents are required due to the absence of KYC procedures.

KYC Limits:

- GMX: No limits based on verification; trading is unrestricted but less regulated.

Remember, while GMX offers freedom from KYC burdens, KuCoin provides a regulated environment with different tiers of access based on your verification status.

KuCoin vs GMX: User Experience

When evaluating KuCoin and GMX, the user experience is critical, as it directly impacts your interaction and satisfaction with the platform.

KuCoin:

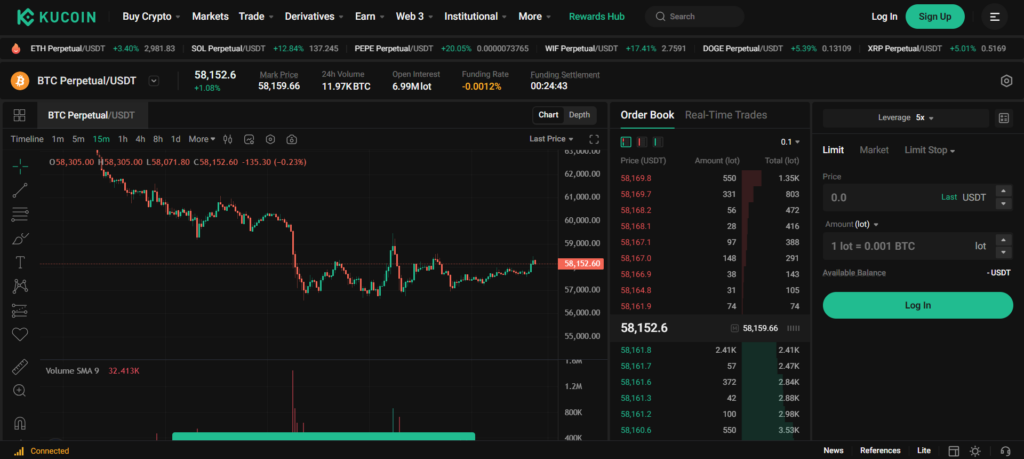

- Web Interface: KuCoin boasts a comprehensive and polished web interface designed for beginners and advanced traders. You’ll find a modern and sleek design with a dashboard that’s informative yet not overwhelming. It provides a smooth trading process with tools and charts that are easily accessible. Features such as a searchable support library help you quickly find answers to your queries.

- Mobile App: The KuCoin app mirrors the functionality of the web interface, delivering a consistent user experience on the go. It’s known for its speed and stability and provides complete access to all trading features. You can trade, deposit, and withdraw with just a few taps.

GMX:

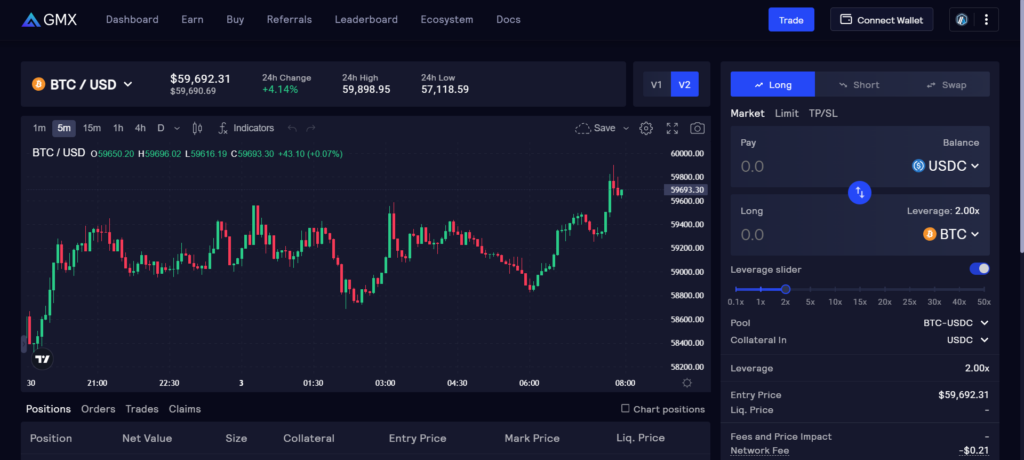

- Web Interface: The GMX interface is more focused and streamlined, with a no-frills approach that appeals to users who prefer efficiency over aesthetics. Its straightforward design offers quick access to trading functions without unnecessary distractions.

- Mobile App: GMX offers a similarly uncomplicated experience on mobile devices, emphasizing rapid execution over intricacy. While not as feature-rich as KuCoin, the app maintains functionality for essential trading tasks.

Comparison:

- KuCoin shines with its various features and advanced trading options, making it a top choice for varied user levels.

- GMX prioritizes a simplified experience, catering to users who value swift and uncluttered interactions.

KuCoin vs GMX: Order Types

When trading on either KuCoin or GMX, you have access to a range of order types designed to suit various trading strategies and risk management needs.

Here’s a comparison of standard order types available on both platforms and how they can be helpful to you.

KuCoin:

- Market Orders: This order type ensures immediate execution at the current market price. It’s the most straightforward option when you want to execute a trade quickly.

- Limit Orders: You set a specific price to buy or sell. It executes only when the asset reaches your specified price, offering you control over the price point.

- Stop Orders: Activates a market order once a specified trigger price is reached. It can help you manage risks by setting a stop loss or taking profit.

- Time in Force Orders: Good Till Canceled (GTC), Good Till Time (GTT), and Immediate or Cancel (IOC); these options dictate how long your order remains active.

GMX:

- As of the latest information, GMX supports a more limited range of order types than KuCoin. However, the exact order types provided by GMX are subject to change and may not be publicly documented as extensively.

| Order Type | KuCoin | GMX |

|---|---|---|

| Market Order | :heavy_check_mark: | :heavy_check_mark: (presumed) |

| Limit Order | :heavy_check_mark: | :heavy_check_mark: (presumed) |

| Stop Order | :heavy_check_mark: | :grey_question: |

| Time in Force | :heavy_check_mark: | :grey_question: |

Understanding these order types is pivotal to your trading.

For example, market orders provide swift trade execution, essential in a highly volatile market.

Limit orders offer you precision at the cost of immediacy. With kucoin’s advanced order types, you gain more control over your trades by setting specific conditions for the order’s longevity and execution.

GMX’s specifics regarding stop orders and time-based conditions are not as widely documented, so you may need to consult their support or platform for the latest available features.

Remember, exchange platforms frequently update their services, so always verify the most current information directly from the exchange.

KuCoin vs GMX: Security Measures & Reliability

When assessing the security measures of KuCoin, you’d note it implements multi-layer encryption, akin to bank-level security.

To protect your funds, KuCoin employs various strategies, including industry-standard encryption, two-factor authentication (2FA), and internal risk control departments that monitor transactions for suspicious activity.

KuCoin has faced criticisms regarding security in the past, but the way it has addressed issues and is continuously upgrading its security measures is significant.

The exchange has ameliorated its security protocols post-incident, building trust through resilience and commitment to user security.

In contrast, GMX offers a different set of security features as part of its operational model.

Details on specific security protocols may not be as widely publicized as KuCoin, but as a decentralized exchange (DEX), GMX leverages the inherent security features of blockchain technology.

The decentralized nature of GMX means there is no central point of failure, making it resistant to a different scope of cyber threats.

However, this does not negate the need for personal vigilance, as smart contract vulnerabilities can exist.

Issues & Resolution:

- KuCoin has proactively addressed past security incidents by engaging with cybersecurity teams and law enforcement, thereby recovering funds and enhancing overall platform protection.

- GMX, as a DEX, might not have faced specific issues related to centralized exchange, but users are responsible for managing their private keys—a critical aspect of DEX security.

Remember, while both platforms have demonstrated a dedication to safeguarding your assets, your security practices—like using strong passwords and enabling 2FA—play an essential role in the security ecosystem.

KuCoin vs GMX: Insurance Fund

In cryptocurrency exchanges, you must understand how your assets are protected, particularly from events like forced liquidations due to volatility. KuCoin and GMX employ insurance funds, but they serve different purposes depending on your chosen platform.

-

KuCoin’s Insurance Fund:

- Purpose: It is used to protect users against the risk of liquidation.

- Functioning: When a forced liquidation occurs at a price worse than the bankruptcy price, the insurance fund covers the deficit.

- Source: Surplus from liquidated positions exceeding the bankruptcy price.

-

GMX:

- As of the last update from the search snippet, there isn’t clear information regarding an insurance fund associated with GMX.

You need to consider such features when choosing an exchange. The Insurance Fund on KuCoin acts as a safety net, aiming to enhance the stability of the trading system and protect against excessive losses.

Note: Always verify the current details and terms regarding insurance funds directly with the exchange. These can change over time and may vary based on the products you use on their platforms.

KuCoin vs GMX: Customer Support

When comparing the customer support of KuCoin and GMX, you should consider the availability and reliability of the support provided.

KuCoin Customer Support:

- Accessibility: You can reach KuCoin support through various methods, such as live chat and email.

- Responsiveness: Users report timely and efficient responses from the support team.

- Services: Offers assistance for various issues, suited for novice and experienced traders.

GMX Customer Support:

- GMX’s customer support details are more intricate to find in the provided snippets, which might indicate less prominence in discussions about the platform.

- Without specific data on GMX, you cannot accurately compare its customer support with KuCoin’s.

Table summarizing kucoin’s customer support features:

| Feature | Description |

|---|---|

| Accessibility | Live chat and email. |

| Responsiveness | Prompt and efficient. |

| Suitability | Supports a wide range of user issues. |

For KuCoin, customer support is highlighted as a strong point, and it is specifically praised for its accessibility and reliability. You’re encouraged to consider that the quality of a platform’s customer support can significantly impact your trading experience.

KuCoin vs GMX: Regulatory Compliance

When examining kucoin’s regulatory compliance, you should be aware that the exchange has had a complex relationship with legal standards.

Recently, U.S. federal prosecutors charged KuCoin with violating anti-money laundering laws.

This underlines the importance of exchanges operating within regulatory frameworks.

KuCoin has been proactive on other fronts, as evidenced by its commitment to compliance in India, being one of the first to register with FIU-India.

This move sets a benchmark for operational excellence and adherence to legal standards within the country.

In contrast, GMX appears to have maintained a lower profile about regulatory challenges.

The information on GMX’s compliance status is less publicized, which may lead you to infer that they have not faced as publicized scrutiny as KuCoin.

Despite this, your understanding of their compliance status should be based on verifiable information regarding any audits, certifications, or licenses they may have obtained.

-

KuCoin:

- Regulatory Challenges: Publicly faced legal actions and accusations in the U.S.

- Compliance Actions: Registered with FIU-India for improved compliance.

-

GMX:

- Visibility of Compliance: Public information is not as apparent or detailed.

It would be best if you considered the implications of these findings. KuCoin’s proactive steps in India demonstrate a willingness to adapt to and respect local laws.

A close watch on how exchanges navigate the evolving regulatory landscape is paramount for your understanding of the industry’s future.

Conclusion

When choosing between KuCoin and GMX for your trading and investment needs, it’s essential to consider each platform’s unique offerings and limitations.

KuCoin

- Wide Asset Range: You’ll find an extensive selection of digital currencies suitable for trading less common altcoins.

- Advanced Features: Ideal if you’re an experienced trader seeking sophisticated trading tools.

- Competitive Fees: Attractive if cost-efficiency is a priority in your trading activities.

GMX

- Leverage Trading: Offers significant opportunities if you’re proficient in managing the risks associated with high leverage.

- Focused Options: This may appeal if you prefer a platform with specialized trading features.

Your Experience Level:

- If you’re a newcomer to cryptocurrency trading, you might appreciate kucoin’s user-friendly interface and educational resources.

- For traders accustomed to high-risk and high-reward strategies, GMX presents a robust environment for leverage trading.

Regulatory Considerations:

- Be mindful of KuCoin’s regulatory standing in your region to ensure it aligns with your compliance requirements.

- With GMX, ensure its leverage options are compatible with local financial regulations.

Platform Accessibility:

- KuCoin offers a comprehensive range of features that may seem overwhelming to new users but provide a rich environment for seasoned traders.

- GMX caters to a specific trading audience; if leverage trading aligns with your strategy, it could be the right choice.

By weighing the focused nature of GMX against the broader offerings of KuCoin, you can select the exchange that best fits your trading style and investment goals.

Explore how OKX and GMX compare to their competitors:

- Bybit vs KuCoin: An Extensive Review of Trading Platforms

- KuCoin vs Deribit: An Extensive Review of Trading Platforms

- KuCoin vs Bitget: An Extensive Review of Trading Platforms

- KuCoin vs BitMEX: An Extensive Review of Trading Platforms

- KuCoin vs Binance: An Extensive Review of Trading Platforms

- KuCoin vs Kraken: An Extensive Review of Trading Platforms