Binance and BitMEX stand out as two prominent platforms with unique offerings and strategic advantages. Binance, established in 2017, rose quickly with its extensive range of cryptocurrencies and user-friendly features, catering to both novice and seasoned traders. It offers spot, margin, and futures trading, along with a native token, BNB, which provides trading fee discounts.

BitMEX, founded in 2014, focuses on Bitcoin derivatives and leveraged contracts, appealing to experienced traders with its high liquidity and advanced trading options.

Our analysis of Binance vs. BitMEX based on nine factors shows Binance leading with a score of 9.5, while BitMEX scores 7.5. This makes Binance more user-friendly and offers higher liquidity. The table below summarizes their main attributes for comparison.

| Feature | Binance | BitMEX |

|---|---|---|

| Supported Coins | Extensive list, including BNB | Mainly derivatives of BTC & ETH |

| Leverage | Up to 10x for margin trading | Up to 100x on specific contracts |

| Trading Volume | High; amongst the largest | Lower than Binance |

| Deposit Methods | Crypto, fiat, cards, others | Crypto only |

| Trading Fees | Lower for spot, competitive for futures | Competitive, with discounts for market makers |

| User Satisfaction | Generally high | Mixed, with a focus on experienced traders |

| Features | Spot & derivatives, staking, savings, NFTs | Derivatives with advanced trading tools |

Binance offers a broad range of services, including spot and derivatives trading, staking, and even a marketplace for NFTs. Binance also utilizes its cryptocurrency, the Binance Coin (BNB), which can further reduce your trading fees.

Conversely, BitMEX is well-respected by margin traders and offers up to 100x leverage on specific contracts. However, BitMEX focuses primarily on more experienced traders, with features tailored for advanced trading strategies.

While BitMEX might offer higher leverage options, which can seem attractive for outsized gains, they also come with increased risks. Binance’s lower leverage options might suit a wider audience, from beginners to advanced users.

Binance vs Bitmex: Products and Services

When evaluating Binance and BitMEX for their services, you’ll notice a range of offerings tailored to different trader needs.

Binance is renowned for its extensive product suite that appeals to a broad user base:

- Spot Trading: You can access many cryptocurrencies to trade on the spot market.

- Futures Trading: Binance offers futures contracts with high-leverage options.

- Options Trading and Leveraged Tokens: These are available for traders seeking sophisticated trading instruments.

- Staking and NFT Marketplace: Binance caters to various interests beyond trading, including staking options and an NFT platform for collectors and artists.

On the other hand, BitMEX primarily appeals to veteran traders due to its specialized focus:

- Derivatives Trading: It specializes in derivatives and margin trading with a significant depth of market liquidity.

- Futures Contracts: BitMEX provides a less extensive array of futures contracts with a strong emphasis on leverage.

You need to consider the user experience: Binance offers a clean and modern interface, which is often considered more user-friendly, especially for beginners. BitMEX, while reliable, features an interface that may be less intuitive for new users.

Your choice between Binance and BitMEX should align with your experience level and the type of trading products you’re interested in.

Binance vs Bitmex: Contract Types

Binance and BitMEX are two prominent cryptocurrency exchanges offering various derivative contracts. Each platform provides unique features that cater to different trading strategies.

Binance Contracts:

- Inverse Perpetual Contracts: These contracts are priced in cryptocurrency, such as Bitcoin. You can trade these without an expiry date.

- Linear Perpetual Contracts (USD-M Futures): These contracts use stablecoins like USDT for trading and are settled in the stablecoin. They are marked to market continuously.

- COIN-M Futures: These are cryptocurrency-settled futures contracts that are settled in the underlying asset, such as BTC.

- Options: Binance offers European-style options, which can only be exercised at expiration.

BitMEX Contracts:

- Inverse Perpetual Contracts: Similar to Binance, these contracts are settled in cryptocurrency and do not have an expiry date.

- Inverse Futures Contracts: These are futures contracts settled in cryptocurrency with a set expiry date.

Key Differences:

- Binance’s USD-M Futures offer a linear contract denominated in stablecoins, whereas BitMEX does not have a direct equivalent.

- Binance also provides options trading, adding flexibility in trading strategies not currently available on BitMEX.

Both platforms use a funding mechanism to ensure the last traded price is anchored to the spot market price.

Binance and BitMEX calculate the funding rate using the interest rate and premium index, which can vary for each contract type.

Binance vs Bitmex: Leverage and Margin

Binance provides you with a margin trading option that lets you leverage your trades up to 1:10 for specific pairs, giving you the ability to increase your exposure to the market. You borrow funds to increase your position size when you trade on margin.

- Initial Margin: You must deposit this amount to open a position.

- Maintenance Margin: The minimum amount to maintain a position to prevent liquidation.

Binance’s cross-margin and isolated margin features allow more control over risk management, with isolated margin allowing individual positions to be managed separately.

BitMEX, however, offers a higher leverage of up to 1:100 on some contracts, appealing to more aggressive traders who are comfortable with higher risks for potentially higher returns.

- Mark Price: BitMEX uses this unique system to prevent unfair liquidations due to market manipulation or illiquidity.

BitMEX’s approach to leverage and margin might suit you if you’re experienced and have a well-thought-out risk management strategy, as the higher leverage increases both profit potentials and risks, including liquidation.

Both platforms have their liquidation policies to manage the risks of leveraged trading. In the event market volatility works against your position, you might be subject to:

- Liquidation: If the market moves against your position and your maintenance margin is insufficient, your position may be forcefully closed at the current market price.

Furthermore, you deal with funding rates, which are periodic payments that depend on the difference between the perpetual contract market and the spot price.

- Binance Funding Rates: These can vary and are regularly exchanged between long and short position holders.

- BitMEX Funding Rates vary, are settled three times a day, and are designed to anchor contract prices to the underlying reference price.

Remember that trading with leverage is risky, and you should only utilize it if you understand and can mitigate the associated risks.

Binance vs Bitmex: Liquidity and Volume

Understanding their liquidity and volume is crucial when you evaluate cryptocurrency exchanges such as Binance and BitMEX. Your ability to trade effectively hinges on these factors, as they determine how easily you can enter and exit positions.

Binance:

Binance boasts one of the highest trading volumes in the cryptocurrency market. This high volume ensures you can execute large orders with minimal slippage, meaning the price you execute your trade remains close to your intended entry point.

- Daily Trading Volume: Over $45 billion (as per provided data)

- Liquidity Ranking: Generally within the top 3

- Markets Offered: Over 380 cryptocurrencies/pairs

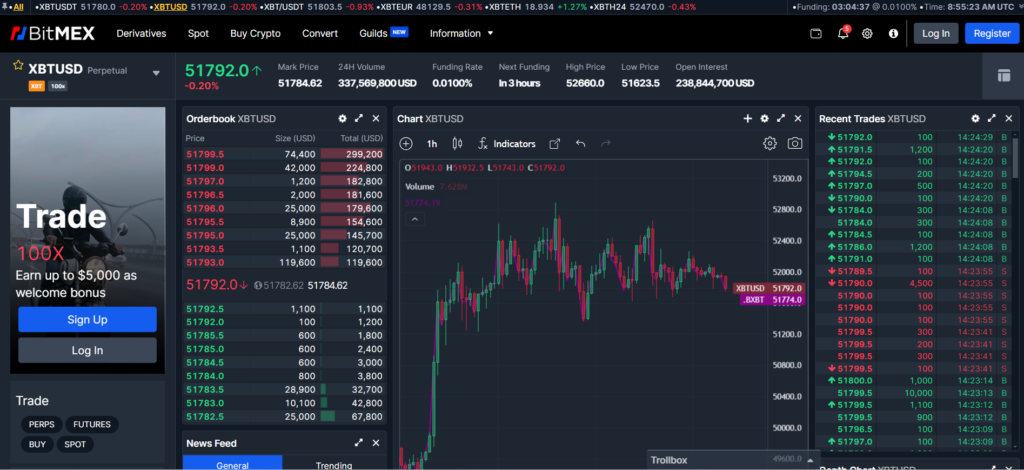

BitMEX:

BitMEX, while different in structure, also offers significant liquidity, particularly in its most liquid market, which is the XBT/USD pairing. The average daily trading volume here is a testament to its ability to facilitate large trades efficiently.

- Daily Trading Volume: Over $3.6 billion for XBT/USD

- Liquidity Ranking: Deep order book, high standing in liquidity for Bitcoin

The volume and liquidity offered by both Binance and BitMEX affect your trading by influencing the spread, which is a key consideration if you’re looking to trade at low costs.

Binance, with its broader market offerings, can provide you with more options and typically narrower spreads.

Meanwhile, BitMEX’s strength in Bitcoin trading can offer you a specialized and highly liquid market, allowing for precise execution in that market segment.

Binance vs Bitmex: Fees and Rewards

When trading on Binance, you start with an introductory fee of 0.1% for both takers and makers. However, holding Binance Coin (BNB) can reduce your trading costs significantly. If you pay BNB fees, you might benefit from a sliding scale of discounts, rewarding those who trade more.

| Binance Fee ($5000 Trade) | Without BNB | With BNB Discount |

|---|---|---|

| Taker Fee | $5.00 | $4.50* |

| Maker Fee | $5.00 | $4.50* |

*Assuming a 10% discount for using BNB

BitMEX differs by applying a maker-taker fee model designed to encourage market liquidity. Makers receive a rebate of -0.025%, essentially paid to trade, while takers pay 0.075%. BitMEX’s system can essentially reward you for adding to the order book.

| BitMEX Fee ($5000 Trade) | Maker | Taker |

|---|---|---|

| Fee (or Reward for Maker) | -$1.25 | $3.75 |

Your choice between Binance and BitMEX may hinge on how these fees impact your trading style.

High-frequency traders, for example, might find that the rebate model on BitMEX suits them. Conversely, Binance’s straightforward, low fees, with additional BNB discounts, could be more attractive for traders who prefer a simplistic fee structure.

Remember to consider how often you trade and which platform helps maximize your rewards while minimizing costs.

The reward systems and potential discounts are vital considerations that align with each exchange’s incentive structure for frequent and large-volume traders.

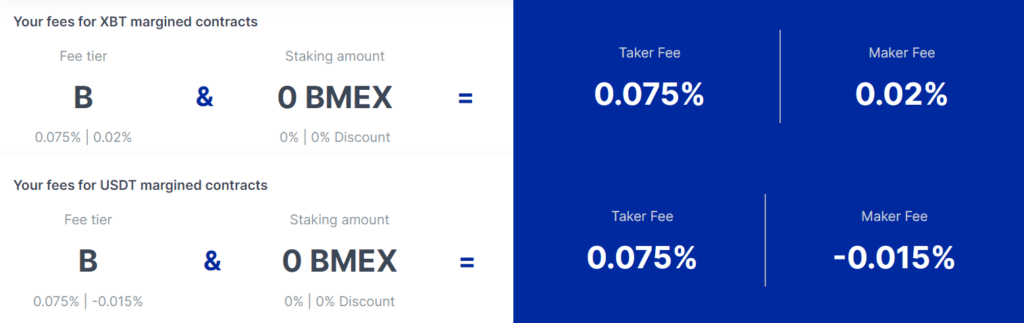

Binance vs BitMEX: Trading Fee & Deposit/Withdrawal Fee Compared

When trading cryptocurrencies, understanding the fee structure of an exchange is crucial for your investment strategy. Binance and BitMEX are prominent exchanges, each with their fee schedules.

Binance Fees:

- Trading Fees:

- Maker Fee: Typically 0.1%

- Taker Fee: Typically 0.1%

You can lower these fees by using Binance’s native BNB token to pay for them. They offer a discount depending on the amount of BNB you hold and your 30-day trading volume.

- Deposit Fees: There are usually no fees for depositing funds into your Binance account.

- Withdrawal Fees: These vary according to the cryptocurrency but tend to be low.

BitMEX Fees:

- Trading Fees:

- Maker Fee: Usually negative (this means you receive a rebate), typically -0.025%.

- Taker Fee: Typically 0.075%

BitMEX’s fee schedule is unique due to the negative maker fee, which incentivizes liquidity provision.

- Deposit Fees: BitMEX charges no deposit fees.

- Withdrawal Fees: A minimal blockchain fee varies for withdrawal transactions, not a fixed platform fee.

Both exchanges do not charge any deposit fees.

While Binance has varied withdrawal fees depending on the asset, BitMEX tends to have a universally low blockchain fee for withdrawals.

Your trading style and frequency will determine which exchange is more cost-efficient for you. Always review the latest fee information from the exchanges, as they can occasionally change.

Binance vs BitMEX: Deposits & Withdrawal Options

When you want to move funds, Binance and BitMEX offer different deposit and withdrawal methods to suit your needs.

Binance:

- Supported Currencies: Offers a wide range of cryptocurrencies and several fiat options.

- Payment Methods: You can deposit funds using bank transfers, credit/debit cards, and cryptocurrencies.

- Processing Times: Instant for cryptocurrencies; fiat transactions depend on the method and can vary from instant to a few days.

- Limits: The minimum and maximum amounts depend on your account level; higher-level accounts enjoy increased limits.

BitMEX:

- Supported Currencies: Focuses primarily on cryptocurrencies.

- Payment Methods: Deposits and withdrawals are permitted only in cryptocurrencies.

- Processing Times: Generally require blockchain confirmation; can vary but often are completed within the same day.

- Limits: There are no explicit maximum limits on deposits; withdrawal limits are linked to your trading level and past transactions.

Both platforms ensure security without compromising on processing efficiency. Binance caters to a broader audience with its support for fiat currencies, whereas BitMEX is solely crypto-oriented.

The absence of deposit and withdrawal fees on both exchanges adds to your convenience, but remember that network fees for blockchain transfers still apply.

Always check the most current information on their websites, as policies and limits can change.

Binance vs BitMEX: KYC Requirements & KYC Limits

When you choose to trade on cryptocurrency exchanges like Binance or BitMEX, understanding the Know Your Customer (KYC) requirements is critical for ensuring compliance and determining the extent of your trading capabilities.

Binance KYC Requirements:

- Verification Levels: Binance offers different tiers of verification with corresponding limits.

- Primary Verification: Requires providing your name, nationality, date of birth, and address. This level has lower withdrawal and trading limits.

- Advanced Verification: You must upload a government-issued ID and a selfie. This grants higher withdrawal and trading limits.

KYC Limits:

- Basic KYC: Allows limited deposit and withdrawal capabilities, typically suitable for low-volume traders.

- Advanced KYC: Significantly higher limits on withdrawals and deposits and full access to trading features.

BitMEX KYC Requirements:

- Verification Process: BitMEX has implemented a mandatory KYC policy.

- Identity Verification: Requires a government-issued ID, proof of address, and a selfie.

KYC Limits:

- Unverified Accounts: Before enforcingandatory KYC, BitMEX allowed trading, but now verification is required for all activities.

- Verified Accounts: Upon completing KYC, users can access deposits, withdrawals, and trading without limits.

KYC processes affect privacy, as they require the sharing of personal information. Security is enhanced by mitigating the risk of illegal activities.

The stringent verification procedures influence accessibility, potentially affecting your ability to start trading or withdraw funds quickly.

As you compare Binance and BitMEX, consider how each exchange’s approach to KYC aligns with your privacy preferences and trading needs.

Binance vs BitMEX: Order Types

Binance and BitMEX offer various order types that cater to different trading strategies and risk management preferences. Understanding the order types available can help you execute trades more effectively.

Binance Order Types

- Market Orders: These orders are executed immediately at the best market price.

- Limit Orders: You set a specific price at which you want to buy or sell an asset. The order only executes when the market price meets your limit.

- Stop-Limit Orders: A combination of stop orders and limit orders. When the stop price is reached, a limit order is placed.

- Stop Market Orders: This order type sells your asset at market price once a set price, the ‘stop price,’ is reached.

- Trailing Stop Orders: These orders allow you to set a trailing amount that adjusts the stop price as the market moves.

- Post-Only Orders: Ensures you pay the maker fee, not the taker fee. Your order won’t execute immediately against the market.

BitMEX Order Types

- Market Orders: Execute immediately against the market at the best available price.

- Limit Orders: Establish a maximum or minimum price you’re willing to buy or sell.

- Stop Orders: Triggered when the market reaches a specified stop price.

- Post-Only Orders: These orders guarantee you’ll receive the maker fee, preventing any execution as a taker.

- Hidden Orders: Large orders that don’t appear in the order book to avoid significant market impact.

- Iceberg Orders: Similar to hidden orders, they only show a small portion of the total order size in the book.

- Reduce-Only Orders: A feature that ensures an order only reduces a position, not increases.

Both exchanges provide a range of order types that can help manage risk and execute strategies.

Binance’s user-friendly interface can be more accessible for beginners, while BitMEX’s offerings cater to experienced traders looking for advanced features, such as hidden and iceberg orders.

Use these order types to your advantage to manage your trades according to your strategy, whether you’re looking to execute quickly with market orders, set specific entry points with limit orders, or secure your positions with stop orders.

Binance vs BitMEX: Security and Reliability

As you explore cryptocurrency exchanges, you’ll find that security and reliability are paramount. Binance and BitMEX incorporate several measures to protect your funds and personal data.

Binance uses two-factor authentication (2FA) and employs a SAFU (Secure Asset Fund for Users), providing added protection for your assets in extreme cases.

Binance has also faced security breaches, notably in 2019, when a significant hack resulted in losing 7,000 BTC.

However, Binance addressed the incident by covering all losses with its SAFU without affecting user funds.

BitMEX, known for its margin trading services, similarly emphasizes security. It operates a multi-signature deposit and withdrawal scheme which enhances security over your transactions.

Past events have raised concerns, including an incident in 2019 where BitMEX accidentally exposed user emails. The BitMEX team made prompt responses to mitigate the situation.

When considering reliability, note the regulatory environment around each platform:

- Binance has faced scrutiny from regulators globally, affecting its reputational reliability. However, it continues to work actively on regulatory compliance and expand its global reach with secure services.

- BitMEX has also been the subject of legal attention, particularly from the U.S. Commodity Futures Trading Commission (CFTC), and has taken steps to improve compliance with KYC and AML guidelines.

Customer support structures are an indicator of an exchange’s reliability. Both Binance and BitMEX have support tickets and help desks, with Binance providing a more comprehensive suite of support options, including live chat and a vast knowledge base.

| Exchange | Security Features | Reliability Measures |

|---|---|---|

| Binance | 2FA, SAFU, strong encryption | Regulatory efforts, robust support system |

| BitMEX | Multi-signature system, 2FA | KYC/AML compliance, responsive support team |

Always perform your due diligence when evaluating the security and reliability of cryptocurrency exchanges.

Binance vs BitMEX: User Experience

When choosing a cryptocurrency exchange, user experience (UX) is critical to ensuring smooth and successful trading. Both Binance and BitMEX offer distinct experiences tailored to their user bases.

Binance:

- Interface: Designed to be user-friendly, it accommodates beginners with a simple and intuitive layout.

- Functionality: Offers an extensive range of features, including spot and margin trading, with a responsive platform that rarely experiences downtime.

- Speed: Transactions and navigation are swift, enhancing the trading process.

BitMEX:

- Interface: Targets experienced traders and may present a steeper learning curve for newcomers. Some users find it less modern compared to newer platforms.

- Functionality: Known for its focus on margin trading and derivatives.

- Speed: The platform has been reported to handle orders effectively, though during peak trading times, it can experience delays.

Regarding community feedback, Binance users often praise its ease of use and reliable performance. However, BitMEX has historically been recommended by seasoned traders who prefer a platform centered around leveraged trading.

User reviews highlight:

- Binance’s clean interface and modern design favor those who value aesthetics and functionality.

- BitMEX has faced criticism for being intimidating to novices yet remains a staple for traders who prioritize complex instruments and options.

For user experience, your choice largely depends on your proficiency in crypto trading and whether you prioritize a wide range of features or a specialized trading environment.

Binance vs BitMEX: Education and Community

When selecting a cryptocurrency exchange, the resources available for learning and the strength of the user community are essential factors you should consider.

Binance has developed a comprehensive ecosystem for educational content through its platform, Binance Academy. Here, you have access to a multitude of resources:

- Articles and Tutorials: There is a vast range of topics, from blockchain basics to advanced trading strategies.

- Videos: Visual learning aids to enhance your understanding.

- Glossary: An extensive list of terms to get you fluent in crypto jargon.

The Binance user community spans various platforms, including:

- Binance Community: Engage with other users and participate in community events.

- Social Media: Highly active on Twitter, Telegram, and other networks.

BitMEX offers educational materials, mainly focused on trading strategies and market analysis:

- Trading Guides: Deepen your trading knowledge with detailed guides.

- Market Research: Stay informed with analyses provided by the BitMEX team.

BitMEX has community channels and is increasingly active on:

- Community Channels: Find BitMEX on Discord and Telegram.

- Social Media: Follow for the latest updates and market insights.

Each exchange offers avenues to sharpen your skills and communicate with fellow traders. Your preferences for learning format and community interaction can guide your choice between Binance and BitMEX.

Binance vs BitMEX: Regulation and Compliance

When you select a cryptocurrency exchange, understanding its approach to regulation and compliance is crucial.

Binance, one of the largest cryptocurrency exchanges by trading volume, operates with a keen awareness of regulatory compliance.

Historically, Binance has been proactive in obtaining necessary licenses and has worked to align with various international regulations, but it has also faced regulatory challenges.

For instance, it withdrew from the Canadian market in September 2023 due to regulatory uncertainties.

BitMEX, predominantly known for Bitcoin derivatives and leveraged trading, emphasizes adherence to regulatory standards by implementing robust security measures.

BitMEX has a significant focus on compliance, especially post-2020, when it ramped up its efforts to align with the legal requirements following specific legal actions taken against it.

Regulatory Highlights:

- Binance:

- Proactive in pursuing licensing and international compliance.

- Exited Canadian market due to changing regulatory landscape.

- BitMEX:

- Heightened security and compliance measures post-2020 legal scrutiny.

- Emphasis on adhering to international legal standards.

Both Binance and BitMEX have engaged in efforts to comply with the regulations of the jurisdictions in which they operate.

As you navigate your options, it’s essential to consider the dynamic nature of regulatory compliance in cryptocurrency and how each exchange adapts to these changes.

Conclusion

When deciding between Binance and BitMEX, your selection hinges on specific requirements and preferences.

Binance shines for its comprehensive offerings, including various cryptocurrencies, a user-friendly interface, and additional features such as spot and margin trading.

The platform’s native token, Binance Coin (BNB), is a significant asset that serves various utility purposes within the ecosystem.

In contrast, BitMEX is renowned among traders for its focus on derivatives and margin trading with high leverage. The platform’s long-standing reputation in the crypto derivatives market makes it a solid choice for seasoned margin traders.

For new entrants, Binance’ ‘s intuitive platform and emphasis on education may be more fitting. Advanced traders looking for sophisticated trading options and high leverage might prefer BitMEX despite its steeper learning curve.

For further learning:

- Utilize the educational resources provided by both exchanges.

- Engage with community forums and discussion groups.

- Practice trading strategies on demo accounts offered by the platforms.

Consider your trading style, risk tolerance, and the features that are most important to you. Both platforms offer distinct advantages, so your choice should align with your personal trading strategies and goals.

Explore how Binance and BitMEX compare to their competitors:

- Binance vs. Phemex: Unbiased Review

- Binance vs Kraken: Unbiased Review

- Binance vs BingX: Unbiased Review

- BitMEX vs PrimeXBT: Unbiased Review

- BitMEX vs. Phemex: Unbiased Review

- BitMEX vs Bybit: Unbiased Review